All primary documents of an organization can be divided into two groups: tax documents (documents necessary for calculating taxes and insurance premiums) and accounting documents (including personnel), they make up the entire document flow of the organization. Storage and timely destruction of documents is a pressing task for many managers and accountants. Most often, special attention is paid to legal requirements regarding the procedure and periods for storing documentation. We will address these questions in the article.

Legislation on accounting and tax accounting and archiving establishes various requirements for the storage periods of accounting and tax accounting and reporting documents. The difference in the storage periods for documents is due to the importance of the document, its necessity for accounting, for calculating and paying taxes.

Retention period for tax documents

The Tax Code has established a maximum period of 4 (four) 5 (five) years (the period has been changed from 03/17/21) for storing accounting and tax accounting documents that are necessary for the calculation and payment of taxes and contributions (Article 23 of the Tax Code of the Russian Federation). For documents received or generated on or after February 18, 2021, the updated retention periods apply. The order of the Russian Federal Archive does not contain transitional provisions. Therefore, for “old” documents, the storage periods established by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558 apply.

This period also applies to documents confirming:

- receiving income,

- carrying out expenses,

- as well as payment (withholding) of taxes.

A corresponding requirement has been established for tax agents who are obliged to ensure the safety of documents necessary for the calculation, withholding and transfer of taxes for 5 (five) years. In addition to paying VAT and income tax for foreign legal entities, tax agents, in particular, are employers who calculate and pay personal income tax.

When carrying forward losses for profit tax purposes, taxpayers are required to keep documents confirming the amount of the received loss for the entire period when it reduces the tax base of the current tax period by the amounts of previously received losses - no more than 10 (ten) years.

Storage period for accounting documents

The accounting legislation establishes a minimum 5 (five) year storage period for accounting and reporting data.

Other storage periods, depending on the type of document, are established by the legislation on archiving. Organizations are required to store primary accounting documents, accounting registers and financial statements for periods established in accordance with the rules for organizing state archival affairs, but not less than five years.

Eg:

- annual forms of accounting (financial) reporting (balance sheets, financial performance reports, reports on the targeted expenditure of funds and appendices to them) must be stored PERMANENTLY;

- documents on receipt of salaries and other payments in the presence of personal accounts must be kept for 6 years;

- calculations of insurance premiums (annual and quarterly) – 50/75 years;

How to take it

There are three ways to submit reports:

- Personally on paper, if the company has up to 25 employees. If more, then only via the Internet.

- By registered mail with a list of attachments.

- Through the Internet. To do this, you will need an electronic signature, an agreement on electronic document management and a service for sending reports.

To send reports electronically, provide the following documents to the Pension Fund:

- One copy of the application for connection to electronic document management.

- Two copies of the agreement on the exchange of electronic documents. It is signed by the manager or employee with a power of attorney and the inspector of the Pension Fund.

In order for the fund to accept the agreement and application signed by the employee, indicate the full name and position of the trusted employee and attach the power of attorney itself. Download document templates from the website or pick them up at the Pension Fund branch.

The Pension Fund will review the application and issue a signed agreement. Only after this can you send reports electronically.

Then select a program for sending reports electronically. For example, Kontur.Accounting generates and sends reports via the Internet. Keeping records in the service is not difficult. And an electronic signature will be issued for you free of charge.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

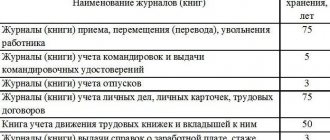

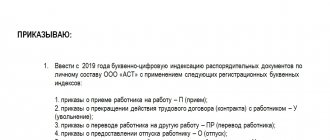

Retention periods for personnel documents

Federal Law No. 127-FZ dated June 18, 2017 “On Amendments...” introduced a new Article 22.1 on the retention periods for personnel documents into the Law “On Archival Affairs in the Russian Federation” dated October 22, 2004 No. 125-FZ. Now documents reflecting labor relations in organizations between employees and employers must be kept for 75 or 50 years:

- 50 years – storage period for documents created after January 1, 2003,

- 75 years is the storage period for documents created before January 1, 2003.

The storage period for civil contracts on the performance of work, provision of services by individuals, acceptance certificates for completed work and services is also 50/75 years.

Retention periods for documents for government agencies

Previously, the requirements of state archival affairs for the storage of documents were contained in the List of standard management documents generated in the activities of organizations with an indication of their storage period, approved by the Federal Archive Service of Russia on October 6, 2000. In accordance with the order of the Federal Archives of August 26, 2010 No. 63, the specified List lost its power.

Currently there is a List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods. In general, documents according to storage period are divided into the following groups:

- documents with a limited storage period (1 year, 3 years, 5 years, etc.),

- permanent storage documents;

- storage until no longer needed;

- storage until replacement with new documents.

Thus, analytical documents (tables, reports) for annual financial statements must be stored for 5 years. Transfer, separation, liquidation balance sheets, appendices, explanatory notes to them, certificates of registration must be stored permanently. Workers' writs of execution - until the need has passed.

Document storage location

Place of storage of documents in the LLC

The company is obliged to store documents provided for by federal laws and other regulatory legal acts of the Russian Federation, the company's charter, internal documents of the company, decisions of the general meeting of the company's participants, the board of directors (supervisory board) of the company and the executive bodies of the company (Article 50 14-FZ). Until December 2021, this article contained an indication of the location of the executive body, but it was removed.

Place of storage of documents in the joint-stock company

Federal Law of December 26, 1995 N 208-FZ (as amended on July 31, 2020) “On Joint Stock Companies”

The company is obliged to store documents provided for by this Federal Law, the company's charter, internal documents of the company, decisions of the general meeting of shareholders, the board of directors (supervisory board) of the company, the management bodies of the company, as well as documents provided for by regulatory legal acts of the Russian Federation. The company stores documents at the location of its executive body in the manner and within the “time limits” established by the Bank of Russia (Article 89 208-FZ). In the law on joint-stock companies there is still an indication of the place; in fact, it works poorly. Therefore, a bill on amendments with the following text is ready: “The place of storage of documents must be determined in the charter or internal documents of the company.”

What happens if you don't send reports?

If you do not submit the SZV-M or SZV-STAZH on time, you will be charged a fine of 500 rubles for each employee. For late submission of a report or sending incomplete and unreliable information to SZV-TD, you are subject to a warning or a fine - from 300 ₽ to 500 ₽. There are no fines for failure to submit SZV-ISKH and SZV-KORR on time.

To send reports on time and without errors, work in Kontur.Accounting. The system has a salary block and reporting for employees, as well as simple accounting, reporting to all regulatory authorities, financial accounting and other tools for the director and accountant. The first 14 days of using the service are free.

Document storage procedure

The organization must ensure safe storage conditions for accounting and tax records and their protection from changes (Article 29 of Law No. 402-FZ).

Organizations and citizens have the right to create archives for the purpose of storing archival documents generated in the process of their activities (Article 13 of Law No. 125-FZ).

To organize the archive, a separate room must be allocated, equipped with special shelves (racks) or closed cabinets. If there are windows in the archive room, they should be curtained or blinds installed, otherwise it will not be possible to protect documents from exposure to light, and therefore they may fade. It is advisable to equip the windows of the first or basement floor with metal bars; in addition, it is better to install a metal door in the archive. Such measures will help to avoid unauthorized entry into the archive premises.

In the archive, case inventories are compiled:

- permanent storage;

- temporary (over 10 years) storage;

- by personnel;

- as well as acts on the allocation for destruction of files that are not subject to storage.

Cases with expired storage periods according to the List are included in the act of allocation for destruction and are subject to destruction.

The processed primary documents of the current month are compiled in chronological order and accompanied by an inventory for the archive. Cash orders, advance reports, bank statements with related documents must be collected in chronological order and bound. Certain types of documents may be stored unbound, but filed in folders to prevent loss or misuse.

Storage of primary documents, accounting and tax accounting documents can be carried out in electronic form, unless otherwise provided by regulatory legal acts of the Russian Federation. At the same time, their storage on computer storage media should be carried out in accordance with the Federal Law “On Electronic Signatures” dated 04/06/2011 N 63-FZ using an electronic digital signature equivalent to a handwritten signature in a document on a paper medium.

The safety of primary documents, accounting and tax reporting, their execution and transfer to the archive is ensured by the chief accountant. The issuance of documents from the accounting department and from the archives of the organization to employees or other persons, as a rule, is not allowed, and in some cases can only be done by order of the chief accountant.

Seizure of documents can only be carried out by the bodies of inquiry, preliminary investigation, prosecutor's office and courts on the basis of a decision of these bodies in accordance with the current criminal procedural legislation. The seizure is documented in a protocol, a copy of which is handed over to an official of the organization against receipt. With the permission and in the presence of representatives of the authorities making the seizure, the accountant can make copies of the seized documents indicating the grounds and date of their seizure.

The procedure for storing personnel documentation is regulated by separate provisions of labor legislation in relation to various types of documentation. So, for example, in Art. 87 of the Labor Code of the Russian Federation establishes the employer’s obligation to ensure the safety of the employee’s personal data. Employee personal data is information required by the employer in connection with employment relations and relating to a specific employee. Personal data includes information contained in a personal file.

The procedure for storing personal data of employees is established by the employer in compliance with the requirements of the Labor Code of the Russian Federation and other federal laws. The employer must control the storage and use of personal data, as well as ensure its protection from misuse or loss.

Separate requirements apply to the storage of work record forms. Forms of the work book and its insert, as strict reporting forms, must be stored in safes, metal cabinets or special rooms to ensure their safety.

What to send

The Pension Fund is waiting for three report forms:

- SZV-M - contains a list of employees, their INN and SNILS. Submit a report even if the company only employs a director with whom an employment contract has not been concluded and wages are not paid. The SZV-M form was approved by Decree No. 83P dated 02/01/2016.

- SZV-STAZH - contains information about the length of service of each employee under an employment or civil contract: full names of employees, date of hire, dismissal and other data for calculating pensions. The SZV-STAZH form was approved by Resolution No. 507p dated December 6, 2018.

- SZV-TD - contains information about changes in work activity. It indicates the full name, position and dates of personnel events: admission, transfer, dismissal and the rest. The Pension Fund takes them into account when filling out electronic work books. If there were no personnel events during the month, you do not need to send a report. The SZV-TD form was approved by Resolution No. 730P dated December 25, 2019.

Three more forms are submitted if necessary:

- SZV-ISH - contains income and contributions of employees, as well as insurance experience. It is submitted by policyholders who have not submitted information about the insured persons until 2021 in the reports: RSV-1, SZV-1, SZV-3, SZV-4-1(2), SZV-6-1(2), SZV-6 -4. The form was approved by Resolution No. 507p dated December 6, 2018.

- SZV-KORR - contains clarifications according to employee data. By submitting the SZV-KORR, the policyholder adjusts the data on the individual personal accounts of the employees that he indicated in the SZV-STAZH. The form was approved by Resolution No. 507p dated December 6, 2018.

- EDV-1—contains summary data about the insurer organization. It is not submitted separately, but together with the forms SZV-STAZH, SZV-KORR and SZV-ISKH. The form was approved by Resolution No. 507p dated December 6, 2018.

Responsibility for violation of document storage rules

Tax liability

If the tax authorities, during an audit, discover that there are no primary documents, invoices or accounting (tax) registers, they have the right to fine the organization.

The fine for such a violation (Article 120 of the Tax Code of the Russian Federation) is:

- 10,000 rubles, if there are no accounting or tax documents relating to the same tax period;

- 30,000 rubles, if there are no accounting or tax documents for several tax periods;

- 20% of the amount of unpaid tax, but not less than 40,000 rubles, if the lack of documents resulted in an underestimation of the tax base.

Tax officials can request documents only for the last three years, and are required to store them for four years. This means that tax inspectors do not have the right to fine an organization for the lack of tax documents for the last (fourth) year.

Administrative responsibility

Gross violation of accounting requirements, including accounting (financial) reporting (Article 15.11 of the Code of Administrative Offenses of the Russian Federation):

- shall entail the imposition of an administrative fine on officials in the amount of 5 (five) thousand to 10 (ten) thousand rubles;

- Repeated commission of an administrative offense shall entail the imposition of an administrative fine on officials in the amount of 10 (ten) thousand to 20 (twenty) thousand rubles or disqualification for a period of one to two years.

Gross violation of accounting requirements:

- understatement of taxes and fees by at least 10 percent due to distortion of accounting data;

- distortion of any indicator of accounting (financial) statements expressed in monetary terms by at least 10 percent;

- registration in the accounting registers of an imaginary accounting object (including unrealized expenses, non-existent obligations, non-existent facts of economic life) or a pretended accounting object;

- maintaining accounting accounts outside the applicable accounting registers;

- preparation of accounting (financial) statements not based on data contained in accounting registers;

- the economic entity lacks primary accounting documents , and (or) accounting registers, and (or) accounting (financial) statements, and (or) an audit report on the accounting (financial) statements (if the audit of the accounting (financial) statements is mandatory) during the established storage periods for such documents.

The administrative liability provided for in this article for distortion of accounting (financial) reporting indicators does not apply to the person entrusted with accounting, and the person with whom an agreement has been concluded for the provision of accounting services, if such a distortion was made as a result of inconsistency primary accounting documents compiled by other persons to accomplished facts of economic life and (or) non-transfer or untimely transfer of primary accounting documents for registration of the data contained in them in the accounting registers.

If the rules for storing accounting documents are violated , a protocol on this violation can be drawn up and sent to the magistrate, who will decide whether to impose a fine on the head of the organization or not. The magistrate can punish for violation of the terms of storage of documents and at the initiative of archival service employees.

Punishment can be in the form of a warning or a fine. Amount of the fine (Article 13.20 of the Code of Administrative Offenses of the Russian Federation):

- for citizens, ranges from 1,000 to 3,000 rubles;

- for officials - from 3,000 to 5,000 rubles,

- for legal entities – from 5,000 to 10,000 rubles.

Criminal liability

Theft, destruction, damage or concealment of official documents, stamps or seals committed out of selfish or other personal interest (Article 325 of the Criminal Code of the Russian Federation):

- fine up to 200,000 rubles,

- or in the amount of wages (other income) of the convicted person for a period of up to 18 months,

- or compulsory work for up to 480 hours,

- or correctional labor for up to 2 years,

- or forced labor for up to 1 year,

- or arrest for up to 4 months,

- or imprisonment for up to 1 year.

Firmmaker, 2014 (we monitor the relevance) Irina Semchenkova (Zhuravleva) When using the material, a link to the article is required

When to send

- SZV-M - monthly, until the 15th of the current month for the previous one.

- SZV-STAZH - once a year, until March 1 of the following year. Another report is submitted upon the employee’s retirement within three days.

- SZV-TD - the day after the hiring or dismissal of an employee. For other personnel events - until the 15th of the next month.

- SZV-ISKH, SZV-KORR - sent immediately when errors are detected.

- EDV-1 - the deadline is tied to the deadline for submitting SZV-STAZH, SZV-KORR and SZV-ISKH.

If the date falls on a weekend or holiday, the due date is moved to the next working day.

After sending the report, you will receive a delivery receipt from the Pension Fund within 4 days. Control protocol - within 6 days. The response time for the report will take a total of 10 working days. The rules for accepting reports from the tax office and the Pension Fund are different: the Pension Fund considers the date of acceptance of the report to be the day on which the positive report was received. Therefore, it is worth sending reports in advance in order to meet the deadline.