Payment order and its details

A payment order is a document whose purpose is to transfer funds from the sender's bank account to the recipient's account.

It is the most frequently circulated document in the financial sector. For budgetary institutions, the form of the document is approved by the Bank of Russia in the rules for transferring funds (Regulations of the Central Bank of the Russian Federation dated June 19, 2012 N 383-P). Payment order details must include all the necessary identifiers of the payer and recipient.

For transfers in favor of tax agents, funds or other budget payments, you must fill in fields numbered 106 and 107.

What design errors lead to and how to avoid them

If one of the fields of the tax payment document is filled in incorrectly, there is a risk of non-fulfillment of the tax obligation. Even if all bank details are filled out correctly, the funds will not be credited as intended within the prescribed period. This entails the accrual of penalties, but not fines.

To ensure that the payment order is filled out correctly, it is recommended to use specialized accounting programs. Creating new documents using the correct source is highly likely to eliminate errors. An additional check to ensure that the payment form is filled out correctly will take place in the remote banking system. If fields 106 and 107 contain errors, the settlement documents will be rejected until all comments are corrected.

Legal documents

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

- Letter from the Federal Tax Service of Russia dated 10/08/2020 N KCh-4-8/ [email protected]

What to write in field 106

These details contain information about the basis and tax period for which the payment is made.

Field 106 in the 2021 payment order is filled in with two characters and can take values from the list approved by the Central Bank.

So, to help you figure out how to correctly fill out field 106 (basis of payment) in a payment order, we have compiled a special table with explanations. It will help you understand the designations that can be indicated in the basis of payment 106; the decoding for 2021 is given in the left column.

| Props name | Payment basis 106: decryption of details |

| TP | Indicates payments for the current year for debts and accruals |

| ZD | Indicates that you yourself found an arrears or a payment error and, without waiting for the tax authorities, contributed the missing amount to the budget |

| BF | Set when the payer is an individual and funds are debited from his bank account |

| TR | It is necessary to put when the debt was discovered and presented for payment by the tax authority |

| RS | Denotes the repayment of a debt that can be paid in installments |

| FROM | Must be applied in case of repayment of debt that has been deferred |

| RT | Repayment of restructured debt |

| PB | Indicated in case of debt repayment by bankrupt organizations |

| ETC | Filled out when repaying a debt that has been suspended for collection |

| AP | Indicates that it is necessary to repay the debt after checking the organization and issuing an inspection report |

| AR | Placed in case of repayment of debt under a writ of execution |

| IN | Applicable for repayment of investment tax credit |

| TL | Used in bankruptcy cases where the debt is paid by a third party |

| ST | Indicated for repayment of current debt by bankrupt organizations |

If you put "0"

Sometimes, out of ignorance, an accountant enters a zero value in field 106. If tax authorities cannot accurately identify a payment, they will assign it to one of the codes given in the table based on the general rules of tax law.

Finally, let’s say that, although the payment order detail 106 in question is mandatory to fill out, putting a zero does not affect the receipt of the transferred amounts into the budget. They won't freeze anyway. It is only possible that the payment will have to be clarified.

What to write in field 107

Field 107 in the payment order has 10 required characters. Eight of them are semantic, and two more characters are dividing points. For example, MS.06.2019.

According to the instructions of the Bank of Russia, the first two characters in detail 107 are filled in depending on the payment period and, accordingly, indicate it:

- MS - per month;

- KV - per quarter;

- PL - for half a year;

- GD - for a year.

The next two semantic characters (4th and 5th) of detail 107 are filled in according to the payment period and, accordingly, according to the previously selected first two parameters. That is, if the payment is monthly, the indicator can be selected from 01 to 12 depending on the month for which it is made. Quarterly - from 01 to 04. Semi-annual - 01 or 02. When transferring funds once a year, “00” is indicated in the 4th and 5th digits.

The last 4 characters are filled in in accordance with the year for which payment is made.

In cases where the legislation provides for a specific tax payment date, field 107 in the payment slip should be filled out indicating this date, for example:

- MS.06.2019;

- KV.02.2019;

- PL.01.2019;

- GD.00.2019;

- 15.07.2019.

If it is impossible to specify the required values, the payment order may not be saved and will generate an error stating that the “payment basis 106” field is not filled in. In this case, it is possible to enter the value “0” in fields 106 and 107 of the payment slip.

From 2021, INSURANCE PREMIUMS will be received by the IRS

Note: In addition to contributions for “injury”

From 01/01/2017, the Federal Tax Service will administer the procedure for calculating and paying insurance premiums to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund.

You can do it another way:

- first re-transmit the tax amount, correctly indicating all the details in the payment order;

- then offset or refund the overpaid tax according to the rules established by Article 78 of the Tax Code of the Russian Federation.

However, in this case, the organization (entrepreneur) will only avoid fines. Penalties will be charged for each day of delay in tax payment based on 1/300 of the refinancing rate of the unpaid tax amount (clauses 2, 3, 7).

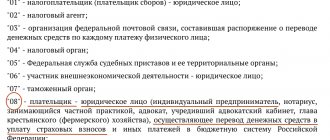

The error in code 101 is critical in two cases: 1) when transferring VAT and 2) when transferring personal income tax by an entrepreneur. In other cases, the error code 101 does not matter! The main thing is to correctly indicate the BCC and write in detail in field 24 “Purpose of payment” so that it is clear where to assign the payment.

An example of clarifying field 101 of a payment order for the transfer of tax amounts

The organization, as a tax agent for VAT, transferred the tax amount of 5,000 rubles to the budget on April 18. The payer status in the payment order was indicated incorrectly: instead of code 02 (tax agent), code 01 (taxpayer) was indicated.

The error was discovered on May 16 when reconciling calculations with the tax office. To correct the error, the accountant prepared and sent an application to the tax office with a request to clarify the details of the payment order.

To the head of the Federal Tax Service of Russia No. 120 for Moscow N.T. Petrov

from LLC Gazprom INN 4308123456 KPP 430801001 OGRN 10244567890123

Address (legal and actual):

610008, Kirov, st. Shvetsova, 20

Samples of filling out fields 106 and 107 in a payment order

Let's look at examples of filling out the fields for payment basis 106 and tax period 107 of the payment order for the most common situations.

Payment of income tax by the organization in the second quarter of 2020

Payment to the organization at the request of the tax authority (penalties on insurance premiums for compulsory health insurance for December 2021)

Innovations

Any organization or individual entrepreneur becomes a taxpayer from the moment of state registration and assignment of a TIN. From that moment on, they have the obligation to pay taxes and submit returns to the Federal Tax Service. The new procedure for processing payments includes the following changes:

- The exact number of characters in lines “60” (TIN) and “103” (KPP) is clearly stated. The TIN of individuals consists of 12 digits, and of legal entities - of 10. The checkpoint consists of 9 characters. Both codes cannot start with "00".

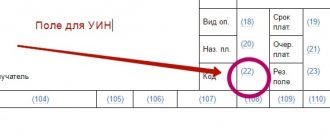

- The new UIN details may include 20 or 25 characters. KBK - 20 digits, OKTMO - 8 or 11. Moreover, none of the listed codes can contain only “0”.

- A new mandatory payment detail has appeared - “Basis of payment” (106). State duty, fine, penalty and regular debt repayment are listed under different codes.

A number of changes affected the rules for filling out the “Payment Type” field (110). When paying taxes and fees, you do not need to fill in this information. But the code for the subtype of income should be reflected in the KBK. This will be used to identify the payment:

- 2100 - transfer of penalties;

- 2200 – interest payment.

Let's take a closer look at all these changes.

OKTMO

The payment order contains a mandatory field “Basis of payment” (106), the explanation of which will be presented below. Also, according to the new rules, you need to indicate OKTMO instead of OKATO. You can find out the code on the website of the territorial department of state statistics or through the Federal Tax Service service of the same name. To obtain information, you need to select a region, indicate OKATO or municipality. The results may be presented in an abbreviated version. If OKTMO ends with “000”, then the first 8 characters will appear as a result of processing. If OKTMO is 46534426636 (contains 11 characters), then the code will be reflected in full.

Taxable period

Let us separately consider how the “107” detail is filled in when making payments. In all of the above transactions, the tax period is reflected as follows:

- transfer of insurance premiums – “0”;

- tax transfer – 10-digit code of the Federal Tax Service in the format “SS.UU.YYYY”.

The first characters of the code will decipher the payment period:

- "MS" - month.

- "KV" - quarter.

- "PL" - half a year.

- "GD" - year.

The fourth and fifth characters after the dot indicate the period number. If the tax is paid for January, “01” is entered, if for the second quarter – “02”. The last four signs indicate the year. These three groups are separated by dots. This scheme allows you to quickly decrypt payments. For example, VAT is transferred for February 2021, then in detail “107” you need to write “MS.01.2015”. If there are several deadlines for the annual fee, and separate payment dates are set for each, then these dates are indicated in the period.

If funds are transferred not for the full reporting period, but only for several days, then the first two characters will look like “D1” (2,3). Depending on what figure is indicated, the tax is transferred for the 1st, 2nd or 3rd decade. If payment is made at the request of the Federal Tax Service, then a clear date of the act must be indicated. The specific period must also be indicated in the payment document if an error was discovered in a previously submitted declaration, and the taxpayer tries to independently charge additional fees for the expired period. In this case, in the fourth and fifth digits you need to indicate for what specific period the additional fee is charged.

Individual data identifier (108)

Depending on what document was provided to identify the payer, this detail is filled in. For example, if a citizen provided a passport with the number 4311124366, in the “108” field it is indicated: “01; 4311124366.” The table below shows the main identifiers:

| 1 | Russian passport |

| 2 | Certificate of birth from the civil registry office, executive authority |

| 3 (4) | Seaman's (military) identity card |

| 5 | Military ID |

| 6 | Temporary certificate of a Russian citizen |

| 7 | Certificate of release from prison |

| 8 | Foreigner's passport |

| 9 | Resident card |

| 10 | Residence permit |

| 11 | Refugee document |

| 12 | Migration card |

| 13 | USSR passport |

| 14 | SNILS |

| 22 | Driver's license |

| 24 | Vehicle registration certificate |

Required details

The same form number of the form is always indicated in the upper right corner - 0401060. Next, the serial number of the document is written. It is assigned by the bank and consists of 6 digits. Identification is carried out using the last three digits.

The date is entered in the format DD.MM.YYYY. If a document is sent via Internet banking, the system assigns the required format independently. If the document is drawn up on paper, then it is important not to confuse the first two indicators.

The type of payment is specified in the form of a code approved by the bank. The amount in words is indicated only in paper payments. The same information is duplicated separately in numbers. Rubles are separated from small change by a sign (“”). If the amount is indicated without kopecks, then you can put the “=” sign (7575=).

In the “Payer” field, the legal entity indicates its abbreviated name. If the payment is sent abroad, the address of the location is additionally indicated. Individual entrepreneurs and individuals indicate their full names. (in full) and legal status. In the case of an international payment, the address of residence is additionally indicated. Payment can be made without opening an account. In this case, the document contains the name of the bank and information about the payer: his full name, tax identification number, address. The payer's account must consist of 20 digits.

The document contains the name of the sender and recipient's bank, its address, BIC, correspondent account numbers, and the abbreviated name of the recipient. If the transfer is made through an account opened with another financial institution, then the client’s account number is additionally indicated.

In the “Type of transaction” field the payment code is entered, in the “Payment purpose” - what exactly the payment is for. If we are talking about budget payments, then the information from this field should complement the “Base of payment” (106). Penalties and fines are paid with a unique code, but goods and services are paid without it. After filling out all the fields, the stamp and signature of the bank’s responsible person is affixed.

These are standard details that must be present in any payment document. Now let's look at the additional fields that are filled in when transferring taxes.

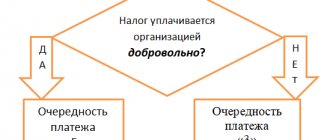

Sequence

Art. 855 of the Civil Code of the Russian Federation provides for 5 orders of payments. For clarity, we present the information in the form of a table.

| 1 | Execution documents for harm caused to human health and life; for alimony. |

| 2 | Executive documents for severance pay, wages; remuneration to authors. |

| 3 | Documents on wages, taxes, fees, transfers to extra-budgetary funds. |

| 4 | Other executive documents. |

| 5 | Other payment documents. |