Home / Legal articles / Details for paying the fee for extract from the Unified State Register 2021

As always, we will try to answer the question “Details for paying the fee for an extract from the Unified State Register 2021”. You can also consult with lawyers for free online directly on the website without leaving your home.

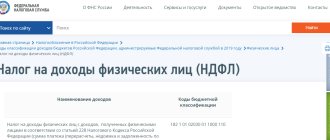

KBK - 182 11300 130 - fee for extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs - Recipient's bank - Branch 1 Moscow, Moscow 705 - account 40101810800000010041 - BIC 044583001 - INN and KPP of the recipient of funds - MIFTS of Russia No. 46 for Moscow

Now all you need to do is select the payment type and fill in all the required fields. A receipt for payment will be generated for you, according to the details of which the payment will be received exactly as intended. The receipt is paid at the bank and is attached to all documents.

New KBK codes - Budget classification codes

You just need to select the type of payment required and fill in the details of the payer who pays the state duty. The system itself will generate a receipt for you and all that remains for you is to make the payment in a convenient way.

KBK – 182 10800 110 – state duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

Extract from the Unified State Register urgent details 2021

Details for transferring the fee for the extract can be found on the official tax website by selecting the item “Fee for providing information from the Unified State Register of Legal Entities”, and then select the desired type of extract: regular or urgent extract. Afterwards you will be asked to fill in the necessary information (TIN, full name, address and region), click on “Pay”. This way you can see all the necessary details. Payment can also be made online.

A receipt for payment of the fee is one of the documents that is required to obtain an extract from the Unified State Register of Legal Entities, in addition to the application. The form of this document can be obtained from a savings bank, after which you can fill it out and pay. In addition, the receipt can be found in electronic form on the Federal Tax Service website. Typically, such forms already contain the details for transferring the fee, so the taxpayer will only have to enter information about himself. Of course, coming to the bank with a ready-made receipt will be more convenient, since in this case you can fill out the form in advance and check all the details.

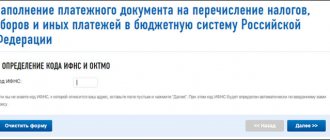

A payment document for payment of the duty can be generated on the Federal Tax Service website using the “Fill out payment order” service. In this case, a receipt for payment will be generated, in which all the details will be automatically entered according to the address specified by the taxpayer. After this, the receipt can be printed and paid at any bank.

One of the ways to transfer the fee for obtaining an urgent extract from the Unified State Register of Legal Entities is through electronic terminals presented at the MIFTS. On the terminal screen, the applicant will be asked to select the name of the payment, and the remaining details will be generated automatically. After an electronic receipt is generated, you will need to deposit funds. Next, a payment receipt will be printed.

Nowadays, consulting agencies have also begun to appear, through which you can obtain an extract urgently and without contacting the tax office. In this case, in addition to the discharge fee, you will also need to pay the cost of the services provided. Therefore, before agreeing, you need to find out the final cost of such a service. Sometimes the cost of an urgent discharge through agencies can reach 1,500 rubles.

Details for paying state duty

Currently, the Federal Tax Service website provides the opportunity to obtain an extract from the Unified State Register of Legal Entities (USRIP) using the service “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs”. In this case, the statement will be generated in PDF format and provided absolutely free of charge as an electronic document.

Extract from the Unified State Register of Legal Entities in electronic form

Thus, in order to receive an extract from the Unified State Register of Legal Entities, the taxpayer will need to pay a fee of 200 rubles. In this case, the statement will be ready in 5 days. If the document is required urgently, the fee will be 400 rubles. But the finished extract can be picked up within a day.

State duty for extract from the Unified State Register of Legal Entities: detailed instructions

You no longer need to look for a receipt form and tax details to pay the state fee for an urgent extract. The Federal Tax Service for payment of state duties will help you in generating a receipt for payment of the state fee for an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. We print it out and pay without commission at any bank (fee for the urgent provision of information and documents from the Unified State Register of Legal Entities). We attach the paid receipt to the top edge of the application with a stapler. Using this service, you can also pay the state duty online through one of the partner banks of the Federal Tax Service of Russia.

To receive an urgent extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the stamp of the tax office, you must submit an application for an urgent extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs in free form, to which a document confirming payment must be attached.

On our website we now have the ability to generate a receipt for payment of state duty. Now you don’t need to delve into various KBK codes, check the correctness and relevance of the details, because in case of an error, it will be very difficult to return an incorrectly made payment. As a rule, payers find out that they made a payment using incorrect details only at the tax office when the tax inspector does not accept your documents.

The final stage of registering a company as a newly created legal entity is making a record of this event in the Unified State Register of Legal Entities. For an enterprise, especially if it carries out multilateral activities, an extract from the Unified State Register of Legal Entities is often necessary. Usually it complements the package of vital documents of the company (constituent, statutory main provisions of the company), so you should request it by paying a fee, which is the legally established state duty for issuing an extract from the Unified State Register of Legal Entities. The features of the procedure for obtaining a certificate and the amount of payment for services for its preparation will be discussed in the article.

Moscow BIC: 044525000 KBK: 18211301020016000130 OKATO: 46218501000 Payment of state duty for urgent extracts from the Unified State Register of Legal Entities IFTS No. 46 for Moscow Payment according to KBK: Fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register individual entrepreneurs (federal state bodies, Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) Moscow region → Districts of the Moscow region → Istra → Cities of district subordination of the Istra district → IstraTransfer OKATO 46218501000 to OKTMO Clear form Print receipt Register and get the opportunity to save forms (for auto-filling them ) receipts you created. After registering and saving the form, a list of forms you have saved will appear in this place.

Next, you will need to fill in your personal data (TIN, full name, region, address) and by clicking the “pay” button, the necessary details will be visible. You can pay online. Urgent extract from the Unified State Register of Legal Entities - state duty in 2021 (cost) Not everyone knows, but an extract from the unified register of legal entities can be obtained as soon as possible - no later than the day following the submission of the application to the Federal Tax Service or the MFC. However, not everything is so simple, since in order to receive the document as quickly as possible you will have to pay an additional amount. The cost of obtaining an extract from the Unified State Register of Legal Entities urgently is 400 rubles. Choosing a BCC when paying for an extract from the Unified State Register of Legal Entities in 2021 It is important to note that the BCC when paying a fee will differ depending on whether you submit an application to the MFC or to the Federal Tax Service.

Details for paying the cost of the extract can be found by entering the phrase “Federal Tax Service payment of state duty” into any search engine. The first link will show you the page of the official website of the Federal Tax Service, on which you should click on the item “Fee for providing information from the Unified State Register of Legal Entities”, and then select the type of extract you are interested in (urgent or not).

By force of habit, we call any fee in favor of the state a state duty. However, according to the above Resolution No. 462, for issuing an extract from the Unified State Register of Legal Entities, not a fee, but a fee is charged. The state duty is fixed exclusively in Chapter 25.3 of the Tax Code of the Russian Federation, and the fee for issuing extracts from the Unified State Register of Legal Entities is not given in this chapter. For simplicity, in this article we equate these concepts.

How to pay the state fee for the Unified State Register of Real Estate

The cheapest way to order an extract is on the portal egrnka.ru. In addition, there is no need to find out the details; the money is automatically sent to the desired account. And receiving a certificate does not take much time (up to two hours), unlike ordering through the MFC and Rosreestr (2-5 working days).

Step-by-step instruction

- Before applying for a certificate. A receipt for payment of the state fee must be provided to an employee of the MFC or Rosreestr when ordering a service from these government agencies.

- After submitting your application. This method is used when ordering certificates through special services. The service is paid only after the customer verifies that the property is actually included in the real estate registry database.

May 05, 2021 semeiadvo 247

Share this post

- Related Posts

- Child benefit for a low-income family, Chelyabinsk region

- How many sq.m. is a disabled person of group 2 living alone allowed in the Chernobyl area of an apartment to pay for utilities. Chernobyl?

- Living wage per child in St. Petersburg in 2021

- From 2021, veterans in what amount in Lyubertsy

Budget classification codes for 2021. Government duty

The legal entity receiving the extract transfers to the authorized person the right to represent interests. The power of attorney is issued in any order with the obligatory indication of the rights to submit an application and receive an extract.

Attention!

In accordance with Article 45 of the Tax Code of the Russian Federation, the taxpayer is obliged to fulfill the obligation to pay tax independently, that is, on his own behalf and at his own expense. When funds are written off from your bank account to pay taxes and fees for other individuals, their obligation will not be considered fulfilled.

- On the main page, in the “Electronic services” section, find the “Pay taxes” item.

- Select "Payment of duties".

- Check the box next to the fee for providing information.

- Click "Next".

- In the window that appears, fill in information about the payer. Required items to be filled out: TIN, first and last name, region of receipt of the service and payer’s residential address. Select "Next".

- Check the data again and click the “Pay” button.

- In the window that appears, select the payment method: cash or card. In the first option, the “Generate payment document” button will appear. A receipt with the index and details will appear. When choosing the second method, options for banks and electronic systems will appear through which you can pay the fee. Having selected a logo, you go to the credit institution’s page, where you will need to make a transfer.

If an interested person needs to make amendments to the Unified State Register of Legal Entities, he only needs to fill out an application on form P14001 and provide a set of documents confirming the fact of the changes made. In this case, you do not need to pay a fee - the service is provided free of charge.

If there are several state duty payers, then there are different opinions about who should pay it and how. First, let's turn to the law, namely, paragraph. 2 hours 2 tbsp. 333.18 Tax Code of the Russian Federation:

“If several payers who are not entitled to the benefits established by this chapter simultaneously apply for a legally significant action, the state duty is paid by the payers in equal shares.”

Letter of the Ministry of Finance of the Russian Federation dated 08.08.13 No. 03-05-06-03/32177 confirms this position of the Tax Code of the Russian Federation, giving rise to the curious case of an attempt to pay the amount of 4,000 rubles, 1/3 for each applicant.

After this, a practice developed, at least in Moscow - even if there are several applicants, it is enough for one of them to pay the state fee. The main thing is that he is indicated on the receipt as the payer.

You can order an urgent extract from the Unified State Register of Real Estate in the shortest possible time for a property, including an apartment in a new building under an agreement for participation in shared construction, using the Internet.

When requesting an extract online, the applicant will receive a link to his email, as well as an access key. You must follow the link and fill out the required fields. As a result, an archive with 2 files will be downloaded (the extract itself and the electronic digital signature).

To urgently receive an extract from the USRN on the day of application, see here.

Details for paying state tax duties can be found on the Federal Tax Service website. Better yet, use a special service to generate a payment document. Since the Federal Tax Service website automatically displays its data for each region, it will be quite difficult to make a mistake when filling it out.

The “universal” requisite for the entire country is the budget classification code (BCC), although sometimes, for some regions, they may differ.

Payment of state duty according to details

There are several ways to pay the state fee.

- Directly at any bank. When paying a state fee, no commission is charged (but not in all cases, so it’s better to check).

- Through a payment terminal of any bank. There may be a commission here.

- Through the mobile application of any bank. True, in the Sberbank application there is no special option for state tax duties, but you can enter the details and pay:

- You can pay the state duty through the Federal Tax Service website. Moreover, this service will allow you not only to pay online, but also to simply generate a payment document and print it in order to pay later in another way. At the same time, the problem with finding details is solved.

- If a government service is provided to an organization (ordering an extract from the Unified State Register of Legal Entities, for example), then the state duty can be paid from its current account.

- There are various payment systems (Qiwi, Elexnet, etc.), through the terminals of which you can also pay state tax duties. There will also most likely be a commission.

In this case with the Federal Tax Service, it is possible to return the paid state duty only in two cases. This is when you pay a larger amount than necessary, as well as if you change your mind about applying for the service (Part 1 of Article 333.40 of the Tax Code of the Russian Federation).

Refunds are made on the basis of an application through the Federal Treasury. Be prepared, they will get to the bottom of every comma.

From October 1, 2021, a one-time re-use of the state fee is possible in case of refusal of the initial registration of a company, if the reason for the refusal was incorrect filling out or failure to submit documents.

More recently, if it was necessary to obtain information regarding its own company, a legal entity had the opportunity not to pay for the service. Now, under no circumstances will it be possible to request personal data and other information from the General Database of the Federal Tax Service for free:

- The state fee for obtaining information in the standard manner is 200 rubles.

- The fee for urgent discharge is set at 400 rubles.

You can pay for the service in cash or by bank transfer. In the first case, terminals located at the Federal Tax Service (usually at the entrance) are used. The commission is 50-100 rubles. Another option involves using Sberbank ATMs. Here, a fee of 2 rubles is charged for the operation.

From the Unified State Register of Legal Entities you can obtain the following information and documents about a legal entity:

- Full and abbreviated name and legal form - LLC, PJSC, JSC, etc.

- Address.

- Method of formation - creation or reorganization.

- Information about the founders and participants.

- Original or notarized copy of the constituent document.

- Information about legal succession, if the legal entity was created as a result of reorganization.

- Method of termination.

- Information that the legal entity is in the process of liquidation, or that bankruptcy proceedings have been initiated for the legal entity.

- Amount of authorized capital.

- Full name, position and passport details of persons who have the right to act on behalf of a legal entity without a power of attorney.

- Information about licenses.

- Information about branches and representative offices.

- TIN, KPP and date of registration with the tax authority.

- OKVED codes.

- Number and date of registration as an insurer in the territorial body of the Pension Fund of the Russian Federation and in the executive body of the Social Insurance Fund.

- Information that the legal entity is in the process of reorganization or reduction of the authorized capital.

Let's start with the fact that the amount paid for providing information about the organization from the Unified State Register of Legal Entities is not correctly called a state duty. After all, this kind of state duty Ch. 25.3 of the Tax Code of the Russian Federation is not provided for. However, many people call the fee for extracting from the Unified State Register of Legal Entities a fee. We will adhere to this common approach in our material.

Summing up the results of the BCC for payment of state duty

For individuals, the state duty has a fixed value established at the state level. Legal entities often have to calculate the duty, since it depends on “floating” factors. To calculate the state duty, you can use a variety of online calculators: the developers claim that they are regularly updated due to changes in the Tax Code.

Current BCC for payment of state duty

When contacting state authorities, self-government or any officials with a request for any action that is significant from the point of view of the law, an individual or legal entity must pay a special fee - state duty . Unfortunately, in 2021, these fees have increased significantly for almost all types of services.

When you need a government service, very often these services are not provided free of charge, and require payment of a state fee for their implementation. In rare cases, no state duty is charged. Let's look at situations where state duty is required when providing government services by the Tax Service.

Details of the Department of the Federal Tax Service of Moscow for MIFTS No. 46 payment of the state fee for an extract from the Unified State Register of Legal Entities

- for providing information about a specific legal entity on paper - 200 rubles;

- for urgent provision of information about a specific legal entity on paper (no later than the working day following the day the request was received by the registering tax office) - 400 rubles.

State duty is a federal tax established by the Tax Code of the Russian Federation (Chapter 25.3 of the Tax Code of the Russian Federation). It is paid in case of contacting various bodies (state, municipal, etc.) for the commission of certain legally significant actions.

- will indicate the payer status - 01;

- recipient - the Federal Tax Service for Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

You just need to select the type of payment required and fill in the details of the payer who pays the state duty. The system itself will generate a receipt for you and all that remains for you is to make the payment in a convenient way.

First of all, a receipt for payment of the state fee is a mandatory document for obtaining an extract from the Unified State Register of Legal Entities along with an application. You can pick up a receipt form at any Sberbank branch, fill it out and pay. It is also possible to find a receipt in electronic form on the Internet. As a rule, such forms already contain the necessary details for paying the state fee for an extract from the Unified State Register of Legal Entities; you just need to enter information about the payer. This form of receipt is undoubtedly more convenient - you just need to print it out and pay, avoiding errors when filling it out. However, before printing and further payment, it is important to make sure that the details indicated in such a receipt are correct, otherwise, when you submit an application, you will simply be refused, and along with time you will lose money.

KBK – 182 10800 110 – state duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions;

Information contained in the state register about a specific legal entity or individual entrepreneur is provided upon request, drawn up in any form, indicating the necessary information in accordance with the “Rules for maintaining the unified state register of legal entities and providing the information contained therein”, in the form of an extract from the state register in the established form these Rules.

- for providing information about a specific legal entity on paper - 200 rubles;

- for urgent provision of information about a specific legal entity on paper (no later than the working day following the day the request was received by the registering tax office) - 400 rubles.

Let's consider two options - download an extract from the Unified State Register of Legal Entities from the tax website or contact the Federal Tax Service directly. In the first case, you can quickly receive an extract in electronic form. To obtain a regular information extract from the tax office with publicly available information, you need to go to the official website of the Federal Tax Service in the Unified State Register of Legal Entities category.

You must fill out an application, indicate the number of copies and the method of receipt (by hand or by mail). The completed application must be accompanied by a power of attorney from an authorized person or an order granting authority to receive organizational documents and a passport. You must add a receipt for payment of the state duty to the documents. You can pay the tax through a bank or by electronic payment.

Payment details

- KBK - 182 11300 130 (fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs).

- The recipient's account number is 40101810045250010041.

- Recipient bank - Main Directorate of the Bank of Russia for the Central Federal District of Moscow (abbreviated name - Main Directorate of the Bank of Russia for the Central Federal District).

- BIC of the recipient's bank - 044525000.

- Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow).

- INN and KPP of the recipient - 7733506810/773301001 (MIFTS of Russia No. 46 for Moscow).

- OKTMO code - 45373000.

Please note that the KBK is of particular importance when paying the state fee for obtaining an extract from the Unified State Register of Legal Entities. It is its numbers that are responsible for the implementation of which procedure the payment is directed to. And if the procedure code does not coincide with its purpose, this leads to an official refusal.

Details of the state duty for extract from the Unified State Register for legal entities in 2021

In the case of state tax duties, the timing of payment does not play a special role - but, of course, you need to pay before applying.

Again, there are no exact regulations on the expiration dates of the state duty, but we tried to submit for initial registration a month after payment - everything was registered. In any case, there is no need to delay it for more than a year.

Now there is no need to look for tax details to pay the state duty; the state duty details are entered automatically when generating the state duty using the Payment of State Duty service.

Now you also don’t need to look for a state duty form and a sample of filling out the state duty to fill out yourself. The Payment of state duty service allows you to generate a receipt for the state duty automatically; all you have to do is print it and pay for it.

You can pay the state duty receipt at any bank. State duty is not subject to commission.

Attention!

In accordance with Article 45 of the Tax Code of the Russian Federation, the taxpayer is obliged to fulfill the obligation to pay tax independently, that is, on his own behalf and at his own expense. When funds are written off from your bank account to pay taxes and fees for other individuals, their obligation will not be considered fulfilled.

The Payment of state duty service also allows you to use the non-cash electronic payment service. From March 11, 2014 Order of the Ministry of Finance of Russia dated December 26, 2013 N 139n came into force, from which it follows that failure to provide a document on payment of state duty is not grounds for refusal of registration; the tax authority can request it in the information system on state and municipal payments independently. Thus, you can avoid going to the bank by paying the state fee, for example, through a Qiwi wallet.

Read more: Monthly waybill for a passenger car form

Attention!

Non-cash electronic payments can only be made by clients of partner banks who have current accounts with them.

There is no state fee for the TIN.

The state fee for re-issuing a TIN is 300 rubles.

The state fee for an extract from the Unified State Register of Legal Entities for a legal entity about itself is 200 rubles.

The state fee for an extract from the Unified State Register of Legal Entities is 200 rubles.

The state fee for an urgent extract from the Unified State Register of Legal Entities is 400 rubles.

Attention!

How to order an extract from the Unified State Register of Legal Entities yourself, read the article Obtaining an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

Cost of state duty for legal entities

Then, following the instructions, complete the 4 steps described and create a request. In response to a request to the specified email, you will receive all the necessary data for payment with details, purpose of payment, BCC, UIN code and amount.

Easy ordering of an extract from the Unified State Register of Real Estate

After specifying all the details, a receipt is generated. It can be filled out and paid at any bank branch. A sample form can be found on the “Payment of state duty” website. The MFC can also provide information.

- registration of an individual entrepreneur or organization;

- making changes to registration documentation;

- liquidation of the organization;

- registration of an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- drawing up a pricing agreement and making changes to it;

- consideration of disputes in courts of various instances;

- vehicle registration, etc.

State Duty Details for Extract from the Unified State Register of Legal Entities 2021

A state duty is a kind of payment by an organization or an individual of an amount established by law for the provision of a certain service by a government agency. Providing an extract from the Unified State Register of Legal Entities (USRLE) is a clear example of this, because business cannot do without this document. Every day, MIFNS No. 46 in Moscow is visited by hundreds of people who want to receive an extract from the Unified State Register of Legal Entities. So let's figure out how to do this and how to correctly pay the state fee for providing an extract from the Unified State Register of Legal Entities.

To obtain an extract from the register directly from the registration authority, you must submit a written request and pay a fee.

The request must be accompanied by the original receipt or payment, and a power of attorney from the head of the legal entity is also required if the request is not submitted personally by the applicant.

An extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs can be obtained from MIFNS No. 46 in Moscow for any organization or entrepreneur in the Russian Federation.

An extract from the register can be obtained in the usual manner within 5 working days only “for yourself” or urgently on the next working day after submitting a request “for yourself” or “for third parties”.

The state fee for an extract from the Unified State Register of Legal Entities is not always a mandatory payment. It all depends on the timing of the statement and who submits the application. If a legal entity wants to order an extract for itself and does not insist on urgency, the provision of such an extract is not subject to state duty. But if you need an urgent extract from the Unified State Register of Legal Entities, that is, the day after submitting the application, then you cannot do without payment. The state duty in this case is 400 rubles.

There is also a non-urgent extract from the Unified State Register of Legal Entities. It takes five working days to prepare and will cost the customer 200 rubles (if you need an extract from a third-party organization).

The information list of the registry is regulated by Federal Law N159.

| The extract contains information: | Explanation |

| about the company's full and abbreviated name in Russian and other languages | there may not be a foreign name |

| about the legal address of the enterprise | this information, it would seem, can be found out from other sources, but the address specified during registration may not coincide with either the actual or legal addresses disclosed by the company |

| about the organizational and legal form | Limited liability company, closed joint stock company, open joint stock company... |

| on the formation of a legal entity | by creating or reorganizing |

| on official data on the size of the authorized capital | accordingly, the minimum amount of property of the enterprise will become known |

| about the day of company formation | if a legal entity was created before 2002, the extract will indicate the day the entry was included in the register |

| about the members of the company or its founders | their number, full name, size of shares, etc. |

| about a person who has the right to perform actions on behalf of a legal entity without issuing a power of attorney | Full name, position |

| about what the company does | it can carry out several types of economic activities at once |

| about succession | if the company was formed as a result of reorganization |

| about received licenses | for each type of activity |

| about the presence of representative offices and branches | or lack thereof |

| about OKVED codes | for each type of employment |

| on the value of the net assets of the joint-stock company on the last day of the reporting period | if we are talking about a joint stock company |

| on reducing the authorized capital of JSC | |

| about whether the process of liquidation or reorganization of the legal entity has begun | if a statement has been received that a legal entity is going to carry out these actions |

| on termination of a legal entity | due to liquidation, disposal from the Unified State Register of Legal Entities or reorganization |

| about the company’s TIN and the time of registration with the Federal Tax Service | date of filing the application for registration |

| about the contact details of the legal entity, if they were found out during registration | Individuals cannot obtain information about bank accounts and passport details of the manager |

| about the time of making changes to the Unified State Register of Legal Entities | if they took place |

from 01/01/2021 the details for paying state duty will change

Budget classification code for filling out a payment document:

| KBK | Name |

| 18211301020016000130 | Fee for obtaining information and documents from the Unified State Register of Legal Entities (and Unified State Register of Legal Entities) |

Legislative acts are represented by the following documents:

| Federal Law No. 129-FZ of 08.08.2001 “On state registration of legal entities and individual entrepreneurs” | On the procedure for registering legal entities and individual entrepreneurs, the last stage of which is making an entry in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, respectively |

| Order of the Ministry of Finance of the Russian Federation dated November 23, 2011 No. 158n “On approval of the procedure for maintaining the Unified State Register of Legal Entities and the provision of information and documents contained therein” | On the procedure for maintaining the Unified State Register of Legal Entities and providing data on organizations from the register |

| Government Decree No. 438 of June 19, 2002 “On the Unified State Register of Legal Entities” (repealed) | On the procedure for maintaining the Unified State Register of Legal Entities and providing the information contained therein |

| clause 1 art. 7 of the Law of August 8, 2001 No. 129-FZ, p.p.p. 18, 38, 109 of the Administrative Regulations (approved by Order of the Ministry of Finance of the Russian Federation dated January 15, 2015 No. 5n), clause 1 of the Decree of the Government of the Russian Federation of May 19, 2014. No. 462 | On receiving (free of charge) information in electronic form from the Unified State Register of Legal Entities |

Error No. 1 : Indication in the payment order for payment of information from the Unified State Register of Legal Entities details of an arbitrary tax service.

Comment : If you need to obtain information from the Unified State Register of Legal Entities about a company that is not registered in Moscow, the payment order for the service must include the details of the Federal Tax Service that accepted the application for issuing an extract.

Error No. 2 : Transferring a state fee in the amount of 400 rubles for obtaining an extract from the Unified State Register of Individual Entrepreneurs when it is not urgently required.

Comment : A state fee of 400 rubles is assigned for the service of providing a paper extract from the Unified State Register of Legal Entities within up to 1 day, i.e. urgently. If the person who submitted the request can wait 5 working days or is ready to receive an extract only in electronic form, he pays 200 rubles or nothing, respectively.

Error No. 3 : Information about companies and extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs can only be requested by legal entities and individual entrepreneurs.

Comment : This is not true, information from the register is publicly available and can also be obtained by an individual. The only thing is that an individual cannot find out the passport details of company managers and their contact information.

Question No. 1 : Can a physical. does a person request an extract from the register of legal entities? Or is information about enterprises available only to individual entrepreneurs and LLCs?

Answer : Information from the register is publicly available; all citizens can apply for information: individuals, entrepreneurs, company founders.

Question No. 2 : How soon can I receive an extract from the Unified State Register of Legal Entities through the electronic service of the Federal Tax Service, and how much will it cost?

Answer : If it is enough for you to receive an extract from the Unified State Register of Legal Entities in electronic (not paper) form, the online service will allow you to receive it the very next day after sending the request. There is no state fee for electronic services.

Question No. 3 : I need to prove that I am not an individual entrepreneur, what document should I present at the place of request, since the Unified State Register of Legal Entities contains only records of registered entrepreneurs?

Answer : You can fill out an application at the nearest branch of the Federal Tax Service to receive information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, additionally indicating that you need a certificate stating that you are not on the list of individual entrepreneurs.

The list of accounting data is established in Appendix No. 2 to the Rules for Maintaining the Unified State Register of Legal Entities. The information includes:

- Name of the legal entity in full and abbreviated versions.

- Location (outdated name - legal address) of the organization.

- Main registration numbers – TIN, KPP, OGRN.

- Date of registration of the enterprise and entry into the Unified State Register.

- Information about the registration authority and its location.

- Information about the founders, their shares, and the director.

- Availability of branches and separate divisions.

- Issued licenses and their validity period.

The document contains data on all changes made to the constituent forms of the company. The full form of the statement is available only to the organization itself and government agencies.

The maximum option includes passport data of the founders, manager, and company current account data.

State tax duty: Federal Tax Service details, receipt, payment in 2021

The extract can be obtained from any tax office. For legal entities and individual entrepreneurs, this document is most often needed when making various transactions, opening bank accounts, when certifying documents at notarial authorities, when obtaining permission to conduct certain types of activities, etc.

- The first three digits indicate the government agency code.

- The fourth digit is the income code.

- 5-7 digits – code of tax or duty, other payment.

- The next five figures show the income item.

- Then there are 5 numbers that allow you to analyze the budget level (for example, federal or local budget).

- Next are the values that show the reason for the payment.

- The last three are a classifier of the type of deductions.

We recommend reading: Is Landmarking Required When Obtaining a Construction Permit in 2021

Unified State Register is a database where information about real estate is collected, data about owners is systematized, etc. After the property is registered in the state register, they are included in the Unified State Register database. If you need to get an extract from this database, you should also write an application and send it to the tax office. Most often, such information is needed when:

- When purchasing real estate.

- When drawing up a contract for the sale and purchase of apartments, etc.

- Upon entering into inheritance.

- In case of divorce, taking into account the division of real estate.

- When using government programs that are aimed at improving living conditions.

If you need an extract urgently without visiting the tax office, it makes sense to contact a consulting agency. In this case, the cost of the service provided by the company’s employees will also be added to the amount of the state fee for an extract from the Unified State Register of Legal Entities. Therefore, before placing an order, you should clarify whether the state duty for an extract from the Unified State Register of Legal Entities is included in the final cost of the order. Most agencies take this into account and indicate it in the information about the service provided. If there is no such confirmation, you should be careful, lest you have to pay more than expected.

The Federal Tax Service Inspectorate generates and issues an extract from the Unified State Register of Legal Entities (USRLE).

The latest news from the Ministry of Labor says that a new bill will be approved, according to which it is planned to index social pensions and benefits. We will tell you more about this project, and also determine how much payments will increase and what the size of pensions will be for socially vulnerable categories of Russians.

Motorists purchasing vehicles outside the Russian Federation undergo customs clearance. They have to pay a certain amount for importing cars. Let’s consider what the fee will consist of and how much it will cost to clear a car through customs in Russia in 2020.

You just need to select the type of payment required and fill in the details of the payer who pays the state duty. The system itself will generate a receipt for you and all that remains for you is to make the payment in a convenient way.

On our website we now have the ability to generate a receipt for payment of state duty. Now you don’t need to delve into various KBK codes, check the correctness and relevance of the details, because in case of an error, it will be very difficult to return an incorrectly made payment. As a rule, payers find out that they made a payment using incorrect details only at the tax office when the tax inspector does not accept your documents.

KBK – 182 10800 110 – state duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

KBK – 182 10800 110 – state duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions;