Calculation and deduction of personal income tax

Not only companies, but also individuals share income with the state.

This is done by withholding income tax - personal income tax on the income of individuals. The tax rate is generally 13%. If an individual is an employee or contractor of a company, then the employer or customer becomes the tax agent of this individual. She must calculate, withhold and transfer the tax on the employee’s salary to the Federal Tax Service.

Note: a contractor with the status of an individual entrepreneur himself must calculate and pay personal income tax on income for a contract that is paid for by the customer, be it another individual entrepreneur or organization.

But let's get back to our dumplings. Evgeny spends 80,000 rubles on salaries, including tax: he pays 50,000 to Ibragim, 30,000 to apprentice Nikita. He transfers his salary twice a month, in accordance with Art. 136 Labor Code of the Russian Federation.

Personal income tax is calculated on the full amount of the salary, but is transferred only once a month - no later than the next day after the payment of salaries for the month. If this day falls on a weekend or official holiday, the payment is postponed to the next business day.

Personal income tax on vacation pay and sick leave must be transferred to the budget no later than the last day of the month in which the income was paid.

So how much money will Evgeniy’s employees receive in their hands for a full month?

Let's calculate Nikita's salary: 30,000 – 30,000 * 13% = 26,100 rubles

And now Ibrahim’s salary: 50,000 – 50,000 * 13% = 43,500 rubles

Both replenish the budget monthly by the amount:

3,900 + 6,500 = 10,400 rubles

Evgeniy also pays 6% on the individual entrepreneur’s income minus expenses, because he uses the “Income minus expenses” tax regime. Last month he paid 7,080 rubles.

Where do these 17,480 rubles go every month? For the work of kindergartens, schools, police and courts, for road repairs and social programs, support for the poor. Taxes go mainly to the budget of the region where the company is registered.

Ibrahim explained all this to Evgeny and Nikita. And Evgeniy promised that soon Ibrahim would receive 50,000 rubles in his hands, and Nikita - 30,000 rubles. How to calculate personal income tax based on a given salary value? Ibrahim will explain with his own example.

To do this, you need to divide the amount of salary that you plan to pay in person by the difference between 100% and 13%:

50,000: 87% = 57,470 rubles

So, the tax was calculated and transferred to the treasury. What's next? Ibrahim will report on the performance of this duty to the Federal Tax Service.

Generalized calculation of 6-NDFL

Ibrahim needs to submit Form 6-NDFL to the Federal Tax Service on a quarterly basis. This is a generalized calculation in which you need to reflect income and personal income tax amounts accrued and withheld for all employees in total.

Note: 6-NDFL is submitted by organizations and individual entrepreneurs with employees. If the individual entrepreneur does not have employees, there is no need to submit a calculation.

The document must be submitted in electronic format if the company paid salaries to less than 25 employees during the reporting quarter. Ibrahim can submit a report drawn up on paper.

Form 6-NDFL must be sent to the Federal Tax Service no later than the last day of the month following the reporting quarter.

For each month of delay in submitting a report, the company can be fined 1,000 rubles under clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. Ibrahim can be fined up to 500 rubles under Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation as a responsible person.

Help 2-NDFL

At the end of the year, information about the withholding and payment of personal income tax from employees must be submitted to the Federal Tax Service in certificate 2-NDFL. The certificate form was approved by Order of the Federal Tax Service No. ММВ-7-11/566 dated 10/02/2018.

Form 2-NDFL is a certificate for each employee about how much the tax agent paid him and how much tax he withheld for the past year. Ibrahim must submit this document no later than April 1.

However, if for some reason the tax agent could not withhold personal income tax, he must report this no later than March 1.

An employee or contractor of a company may need a 2-NDFL certificate. And the employer must issue it:

- to an employee - upon oral or written request - within three days from the date of application;

- an individual who received a payment subject to personal income tax from the company - within 30 days from the date of application.

Also, an income certificate is provided to an individual on the day of dismissal from the company.

If Ibrahim is late in submitting 2-personal income tax to the tax office, Evgeniy’s company may be fined under Art. 126 of the Tax Code of the Russian Federation for 200 rubles for each document that was not submitted on time. That is, Evgeniy will have to pay a fine of 600 rubles (200 * 3). Not much, but if the staff grows, so will the fine.

Note: Individual entrepreneurs without employees do not need to submit a 2-NDFL certificate. If the company employs 25 people or more, the report is submitted in the form of an electronic document and signed by a qualified electronic signature.

Supreme Court on fines for non-payment of insurance premiums

Recently, the findings of the Supreme Court of the Russian Federation regarding late payment of insurance premiums have become very popular in the accounting community.

According to the Supreme Court and the Supreme Arbitration Court of the Russian Federation, if the amounts of insurance premiums are correctly reflected in the calculation, but advance payments are transferred late, only late fees will be collected from the organization, but not a fine (determination of the judicial panel for economic disputes of the Supreme Court of the Russian Federation dated April 18, 2021. No. 305-KG17-20241, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Violation of the procedure for calculating and (or) paying advance payments cannot be considered as a basis for holding a person accountable for violating the legislation on taxes and fees. Paragraph 7 of Article 58 of the Tax Code of the Russian Federation establishes that the rules provided for in this article also apply to the procedure for paying fees, insurance premiums (penalties and fines)

- the judges said.

As we can see, late payment of advance payments, correctly calculated and displayed in the reporting, does not constitute an offense under Article 122 of the Tax Code. It is important that reporting on contributions is submitted to the Federal Tax Service on time.

Insurance premiums

Evgeniy withholds personal income tax from employee salaries, that is, he reduces payments by the amount of tax. But he must pay insurance premiums himself. From business money or personal funds, he must fulfill his obligations to the team he hired.

Insurance contributions must be made monthly. Money is transferred to the Federal Tax Service and Social Insurance Fund every month. What are these payments?

- 22% - for compulsory pension insurance. Reduced to 10% if the total amount of payments to the employee during the year exceeds the limit. For 2021, the limit of 1,150,000 rubles was established by Government Decree No. 1426 of November 28, 2018.

- 5.1% - for compulsory health insurance.

- 2.9% - for compulsory social insurance in case of temporary disability and in connection with maternity. Just like pension contributions have a base limit. As soon as payments in 2019 reach 865,000 rubles, contributions are no longer accrued until the end of the year.

- From 0.2 to 8.5% - contributions for injuries. They pay for employees signed under an employment contract, as well as for contractors whose contract contains such a condition. The amount of the contribution depends on the professional risk group of the enterprise.

Ibrahim will transfer contributions for injuries to the Social Insurance Fund, the rest - to the Federal Tax Service. Then the tax office will distribute the money among the funds.

The occupational risk group and the amount of contributions are indicated in the “Notice on the amount of insurance contributions for compulsory social insurance against accidents at work and occupational diseases” from the Social Insurance Fund. It is issued upon registration, and then upon annual confirmation of the main type of activity. True, the individual entrepreneur confirms the type of activity only when it changes.

Contributions must be remitted monthly. The last day is the 15th of the next month. If it falls on a weekend or non-working holiday, then the end of the period is considered to be the next working day following it.

Payments to individual entrepreneurs according to GPA

An individual entrepreneur performs the functions of the executive body of a limited liability company under a civil contract, the subject of which is the performance of work and the provision of services.

Remuneration under such an agreement is not considered subject to insurance premiums for the organization. Since here the individual entrepreneur is an independent payer of insurance premiums for himself based on his income.

Read in the berator “Practical Encyclopedia of an Accountant”

Payment under various types of civil contracts

Information about the insured persons

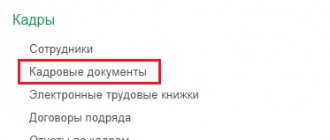

Ibrahim needs not only to transfer the contributions, but also to report on them. Moreover, although he transfers pension contributions to the Federal Tax Service, he must report them to the Pension Fund.

Every month, Ibrahim will submit the SZV-M form, or “Information about insured persons,” to the Pension Fund. It must be submitted no later than the 15th day of the month following the reporting month. The form was approved by Resolution of the Pension Fund Board No. 83p dated February 1, 2016.

SZV-M is a report on insured persons, that is, employees. It includes information about employees, even if they are on maternity leave or vacation. If the contract is terminated during the reporting period, the data for such an employee is also reflected in the SZV-M.

The report includes employees with whom the following agreements are concluded:

- GPA;

- employment contract;

- author's order agreement;

- publishing license agreement;

- licensing agreement on granting the right to use works of science, literature, art;

- agreement on the alienation of the exclusive right to works of science, literature, and art.

It is necessary to submit SZV-M even when the company has suspended its activities, if it has registered employees.

If Ibrahim forgets to report on time, Evgeniy will have to pay a fine of 500 rubles for each employee in accordance with Part 4 of Art. 17 of Law No. 27-FZ.

What accountants don't take into account

While this finding is positive, accountants need to consider one important point. Payments for insurance premiums are submitted to the Federal Tax Service on a quarterly basis, no later than the 30th day of the month following the reporting period. Thanks to this calculation, tax authorities may notice a later period for paying insurance premiums. It’s good if the company manages to pay them before the reporting date. And if not?

In this case, the Federal Tax Service will send her a demand for payment of the resulting arrears with accrued penalties and fines. The arrears will need to be paid within eight working days from the date of receipt of the request. Unless, of course, it specifies a longer period of time to pay the tax.

If the debt is not repaid within the established period, the Federal Tax Service will begin the procedure for collecting the arrears. This means that the tax authorities will write off the required amount from the company’s account. And the same amount will be blocked to ensure payment of the arrears.

Please note: if the demand was not made, the tax authorities do not have the right to write off the collection debt from the company’s account.

It turns out that on the one hand, it seems that you can pay later. But on the other hand, as soon as a company has an underpayment, other mechanisms begin to work: a demand is automatically raised, a deadline for payment is set, and a decision is sent to the bank to block the account.

Calculation of insurance premiums

The RSV form (calculation of insurance premiums) is submitted quarterly to the Federal Tax Service by all policyholders. It was approved by order of the Federal Tax Service No. ММВ-7-11/ [email protected]

This is reporting on the amounts of remuneration to individuals who are subject to contributions for compulsory health insurance, compulsory medical insurance and compulsory social insurance for sick leave and maternity leave. Ibrahim must also reflect in it the amount of contributions that the company has accrued and paid with the taxable base for the quarter, half a year, nine months and a year.

Let's calculate what numbers Ibrahim will get when calculating pension contributions if Evgeniy increases employee salaries from the third month of cooperation.

80,000 (first month's salary) * 22% = 17,600 rubles

160,000 (salaries for two months) * 22% – 17,600 = 17,600 rubles

251,952 (salaries for three months) * 22% – 35,200 = 20,229 rubles

The deadline for submitting the calculation is established by clause 7 of Art. 431 Tax Code of the Russian Federation. The DAM must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting quarter.

Note: if the individual entrepreneur does not have employees, there is no need to submit a report. If the policyholder has an average number of employees of more than 26 people, the Federal Tax Service will accept the report only in electronic form.

“Zero” reporting for organizations

The Tax Code does not exempt organizations from submitting reports on insurance premiums even if it does not operate and does not pay wages to employees or remuneration to performers under civil contracts.

Therefore, in this case, the organization must submit a Calculation with zero indicators.

Having received such a calculation, the tax office learns that the organization declares that in a specific reporting period it did not have:

- payments and rewards in favor of individuals;

- amounts of insurance premiums payable for the same reporting period.

In addition, Calculation of contributions with zero indicators will allow the organization to avoid:

- a fine for failure to submit reports in the amount of 1 thousand rubles in accordance with Article 119 of the Tax Code;

- consequences that are applied by the Federal Tax Service to unscrupulous payers. For example, in the form of suspension of transactions on bank accounts.

The Ministry of Finance drew attention to these consequences of failure to submit “zero” reporting in a letter dated January 26, 2021 No. 03-15-05/4460.

Previously on the topic:

How to fill out the DAM if payments are made only to the entrepreneur-manager?

Information about experience

Information about length of service is provided in the form SZV-STAZH, which was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 3p dated January 11, 2017. It contains information about the insurance length of all employees and is submitted to the Pension Fund once a year. The form must also be given to the employee upon dismissal along with the SZV-M.

Along with this report, the accountant must send to the Pension Fund an inventory of the transmitted information in the EDV-1 form. The report is submitted to the district Pension Fund by March 1 of the year following the reporting year.

When one of the employees retires, a separate SZV-STAZH report with the “assignment of pension” type is submitted for him. This report must be submitted within 3 calendar days from the date on which the employer received the application with a request to provide information about the length of service.

Note: if the individual entrepreneur does not have employees, there is no need to submit this report.

Calculation 4-FSS

Calculation of accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as the costs of paying insurance coverage, is submitted to the Social Insurance Fund.

They submit a report based on the results of each quarter in Form 4-FSS; it reflects only contributions for injuries. The form was approved by order of the Social Insurance Fund No. 381 dated September 26, 2016.

Additionally, it is indicated whether sick leave was paid for work-related injuries, whether there were industrial accidents, how many workers must undergo mandatory medical examinations and when the medical examinations were carried out.

The paper report is submitted no later than the 20th day of the month following the quarter. In electronic form - no later than the 25th. An individual entrepreneur without employees does not submit this form.

Call yourself an employer - pay and report. If you don’t want to get involved, hire an accountant, pay, and he will report. This is the only way to work calmly, without penalties.

How to fill out the “zero” contribution calculation

In such a Calculation of insurance premiums with zero indicators, you must fill in:

- title page;

- Section 1, no appendices.

In this case, in line 001 “Payer Type” you must indicate code “2”, which means that in the last 3 months you have not paid any salaries or benefits.

In this case, in all lines where total values are reflected, you must enter “0”;

- section 3.

In subsection 3.1, provide information about each individual, put dashes in line 010, as well as in lines 120 - 210 of subsection 3.2.

The Ministry of Finance recommended this procedure for filling out the “zero” Contribution Calculation in letters dated January 26, 2021 No. 03-15-05/4460, dated December 31, 2020 No. 03-15-03/116923.

Also on topic:

Companies blocked accounts for lack of zero RSV for the founding director