A payment order (hereinafter referred to as PP) is a type of payment form documentation that is generated by the payer. Its purpose is to convey information about the fact of transfer of a certain amount of money to the person who is the recipient. This paper is used as part of settlement transactions of commodity and non-commodity form, and advance payments. The check is filled out independently by the sender or the bank. Registration can be carried out in two key forms - paper (on A4 sheet) and electronic (using a specialized program). When drawing up a payment order, it is important to ensure that all columns are filled out correctly, especially for the UIP. What is this in a payment order - we will consider in the framework of the material.

General information about the UIP

Knowing and understanding the difference between UIP and UIN is very important, especially for citizens living on the territory of the Russian Federation, since in some cases it is necessary to indicate only zeros in the payment document.

To display complete and reliable data on the payment slip, you must fill it out with knowledge of all legal norms and rules. In the current situation, the following points are mandatory:

- UIP and UIP.

- Taxes that will be paid.

- Mandatory contributions.

- Indicate the number that was assigned to the document based on the payment.

- The name of the person making the payment.

To correctly fill out the documentation, you need to clearly understand what the UIP is and what it represents, as well as what the UIN is and what it represents.

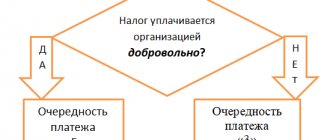

Field 101 (01): Tax and contribution payer

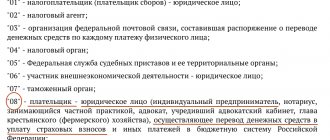

In field 101 you must indicate an identifier that shows who pays the tax or contribution - individual entrepreneur or LLC, tax agent, lawyer, member of a consolidated group, notary.

Before filling out the “payment form”, you need to select one of 26 values in field 101 (before 2014 there were 20). This rule also applies to tax and insurance payments.

If individual entrepreneurs and LLCs act as tax agents, then the status of the field will not be 01, but 02. 01 - taxpayer, that is, the payer of fees is a legal entity. 02 – tax agent.

Since 2014, the Ministry of Finance has clarified the status of code 08 - now it applies to all tax payers, individual entrepreneurs and LLCs that transfer insurance contributions to the budget system of the Russian Federation. In field 101 you must indicate code 08 in payment slips not only for contributions to the Social Insurance Fund, but also to the Pension Fund. This change will avoid numerous disputes arising between taxpayers and employees of the Pension Fund.

UIP

UIP is an abbreviation that stands for unique payment identifier . This identifier consists of twenty specific characters. At the time of making the payment, the payer may not know the identifier, however, this is not a problem. The field specifically designated for UIP in the documentation may remain empty, but after the code is received, the necessary symbols will still need to be entered into the document as quickly as possible.

WIN

UIN is also an abbreviation that stands for a unique identifier for accrual . This identifier is used for those transfers of funds that will be transferred to the state budget of the country in the future.

If the UIP code is incorrectly indicated in the documentation, the payment made may not end up in the structure for which it was intended. The same thing will happen if the identifier is specified in the wrong column. As a result of such a transaction, the incorrectly sent funds will be required to be returned, and the payment that should have been paid will be overdue.

- In order to carry out such an operation, it will be necessary to spend a large amount of additional time and additional material resources.

- To avoid getting into such a situation, you must fill out all the fields in the payment documentation very accurately and correctly.

For what purpose is the UIP indicated in the payment?

Filling out payment receipts is simple and quite simple, but you need to be very careful when entering a unique payment identifier (UPI). In some cases, it will also be necessary to enter the UIN if required by the documentation.

The purpose of the UIP in payment documentation:

- Helps organize documentation when making various types of contributions;

- This identifier is used by the state to maintain various statistics;

- Making a contribution specifically with the amount that was previously indicated in the payment documentation.

Registration of this identifier in violation of legal norms and rules can lead the payer to serious problems and difficulties in the future.

Difficulties and troubles arise due to the fact that documentation completed with violations leads to the fact that the state may not receive the required amount of material resources, or may receive them late, or receive them completely in another financial structure

All this leads to the fact that the state will impose a fine on the careless payer, the material amount of which will depend on the degree of guilt of the person.

Public services payment for another person

The performance of these works is coordinated with the state traffic inspectorate and the village housing and communal services authority. For example, you bought sneakers in a store, came home and realized that you don’t like them, they don’t fit, the color isn’t what you wanted, etc.

Therefore, the landlord needs to use this method of expressing consent to sublease carefully and thoughtfully. If the manager has changed his last name, you will need to issue a new bank card

Granting special statuses to individuals. An album of unified forms of primary accounting documentation for recording work in capital construction and repair and construction work, approved by Resolution of the State Statistics Committee of Russia dated 11.

Various additional information

Currently, in the current legislation, there is certain information that relates to the introduction of UIP, which is subsequently entered into a person’s payment papers.

Because of these additional nuances assigned by law, each payer is recommended to initially read all the rules and regulations for filling out papers, as well as familiarize himself with all the information about introducing UIP into his payment papers.

Compliance with this simple requirement will avoid many bad situations that could result in penalties.

There are examples of the preparation of this type of documentation, which can be easily accessed if there is a lack of knowledge, experience or understanding in this kind of paperwork issues.

Finding these samples will not be difficult. To do this, you just need to visit special sites. The following points are considered the most important points:

- The place where you can get the UIP.

- What to do if an incorrect UIP was entered.

- Please see a sample order for this payment.

Legislative justification

Regulation 383-P (which contains general rules for money transfers) obliges banks to make payments based on customer orders. These include receipts, notices, and collection requirements. However, among all this diversity, the main means of settlement with both counterparties and the state budget is the payment order.

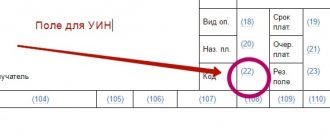

The form and content of such a document must comply with the requirements of banking records management and Russian legislation. A unified payment order form with all the necessary details was approved in the same Regulation 383-P. Among other things, it establishes the mandatory completion of Section 22 “Code”. What's in the "payment"? UIP we are talking about.

Thus, there are the following necessary information in the payment order:

- number assigned to the document;

- UIP;

- WIN;

- payer data;

- amount of contribution, tax.

Explanatory and regulatory information regarding the device of the UIP can also be found in the following acts:

- Order of the Ministry of Finance No. 107n (Appendix No. 2).

- Letter of the FSS of Russia N 17-03-11/14-2337.

- Explanation of the FSS of the Russian Federation “On the procedure for indicating the UIN...”

- Directive of the Bank of Russia No. 3025-U (clause 1.1).

Where to get UIP

This code must be received before the first payment is made. The code must also be purchased by the person who will be in charge and will subsequently pay the payments. You can obtain such an identifier from various government agencies that monitor and control various types of payments and payments.

These structures are:

- FNI;

- FSS;

- Customs or Pension Fund of Russia.

The best option would be to acquire such an identifier before making the first payment and completing all documents. This will help avoid a lot of difficulties.

You can take the code from a specific reference book, which you can download from the Internet. But with this method of obtaining a code, you need to remember that almost every year some changes are made and such identifiers may change

This must be monitored very carefully, since if you enter even one incorrect number, a situation may arise in which the payer will have to pay a penalty for the fact that the payment did not reach the structure on time due to an incorrectly specified identifier.

Who generates the ID?

What is the UIP on the receipt? Code generated by the recipient. But not all recipients of funds assign this code to certain payments. The following have the right to form it for their payers:

- Addressees to whom payment is a revenue item of the state budget of the Russian Federation.

- Recipients in whose name funds are redistributed to the Federal Treasury account.

- Budgetary institutions that provided their services to the sender.

In particular, UIS must provide senders with the following structures:

- Social Insurance Fund.

- The Federal Tax Service. Be careful, in the notice from the Federal Tax Service, the UIP is the document index.

- Pension Fund of the Russian Federation.

- Customs structure.

What needs to be done if the UIP was entered incorrectly

When making a payment, it may be discovered that the UIP code was not entered in the required column. In this case, you can carry out the payment transaction further, and leave the space for the code either empty or fill all fields with zeros.

However, there are situations such that the UIP code indicated in the column was initially entered incorrectly, and this happened due to the negligence and inexperience of the financial employee of the structure. In such a situation, the following steps must be taken:

- Re-enter the correct code and repeat the payment;

- It is necessary to draw up and send a statement that it is necessary to return the funds sent by mistake in order to transfer them to another financial institution. It is also necessary to write an application to a government agency;

- Indicate the card number or other bank details where the funds sent by mistake will need to be returned.

However, this refund formula is not universal. Most often, you have to start from what the payment was and for what financial structure it was originally intended.

Types and purpose of payment orders

The classification of orders can be extensive, so documents are often one-time and periodic in nature. In the first case, their power is lost after a single transfer is made. In the second situation, you can count on systematic payments. Thanks to the possession of this documentation, you can count on performing certain types of operations:

- transfer operations on funds as settlements;

- transfers to various funds;

- payment actions to repay loans, replenish deposits;

- making regular payments.

Government agencies involved in accepting payments carefully monitor the process of filling out documentation. And this is not surprising, because subsequently these papers are sent to the tax authorities and reflect certain insurance premiums. Every year, government agencies introduce various innovations for filling out payment documents, and these rules are valid for all types of papers.

What should be present in a correctly completed document?

In order to clearly see what should be indicated in a correctly drawn up document, you can visit the website. But here it is worth noting that you can only trust a site that has reviews about itself only from a positive point of view. Such documentation has several standard forms that have been approved by the state. The correctly completed form must display the following:

- Number assigned to the payment.

- The number of its registration.

- Type of document execution – electronic or paper.

- Name of the authority where the payment is made, TIN.

- Full name of the person making the payment.

- Financial institutions of the payer and recipient.

- Purpose of payment.

- The signature of the person responsible for the document, as well as the seal of the financial structure.

How to check a payment using data from a check

Checking the receipt with the help of the support service is one of the most common ways by which a Qiwi payment is verified. The terminal will provide a receipt when depositing cash or performing any transaction. If the document is saved, you can take the necessary data from it to track the status of the payment.

The Qiwi payment by check is checked in the “Help” section of the payment system website. Here you need to select “Check payment”. A special window will immediately open in which the user will have to enter the details.

The following data will be required: terminal number, phone number of the wallet owner, date of transaction, special transaction code, which is always indicated on the check.

After filling out all the fields, you need to click the “Check” button and immediately familiarize yourself with the details.