What is KBC and why is it needed?

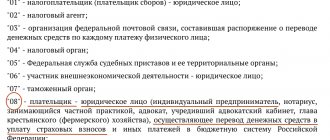

KBK is a budget classification code. In other words, this is a special series of 20 numbers by which you can determine what kind of payment it is, who the recipient and sender of the payment are, the type of income, the origin of the payment, etc. This code was first established in 1999. Since then, the codes have changed many times. There is no point in memorizing the KBK. There are special KBK directories for payers, which are changed annually by the Ministry of Finance depending on changes in legislation. The codes were developed based on the Budget Code of the Russian Federation. A complete current list of all BCCs can be found in the order of the Ministry of Finance of the Russian Federation dated 06.06.2019 No. 85n. The KBK directory is also posted on the official portal of the Federal Tax Service. The BCC is needed in the financial system of the state so that every ruble of tax, fee, duty, fine, and penalty received is taken into account and analyzed in the financial flow.

The tax under the simplified tax system is not transferred to the required KBK. How to fix the situation

Individual entrepreneur on the simplified tax system (income) since 2009. For 2009, when submitting a declaration under the simplified tax system “income”, the KBK “income reduced by expenses” was indicated. Taxes were also transferred to this KBK. How to fix this situation? Do you need to submit a corrective declaration and write a letter about offset of payments to the desired CBC? Will penalties be assessed?

According to paragraphs 1 clause 3 art. 45 Tax Code of the Russian Federation

the obligation to pay tax

is considered fulfilled

by the taxpayer from the moment of presentation to the bank

of an order

to transfer funds from the taxpayer’s bank account to the budget system of the Russian Federation to the appropriate account of the Federal Treasury if there is a sufficient cash balance on it on the day of payment.

The obligation to pay tax is not considered fulfilled

in strictly stipulated in

paragraph 4 of Art.

45 of the Tax Code of the Russian Federation in cases:

– review

the taxpayer or the bank returning to the taxpayer an unexecuted order to transfer the relevant funds to the budget system of the Russian Federation;

– incorrect indication

the taxpayer in the order to transfer the tax amount,

the account number of the Federal Treasury and the name of the recipient's bank

, which resulted in the non-transfer of this amount to the budget system of the Russian Federation to the corresponding account of the Federal Treasury;

– if on the day the taxpayer submits to the bank (Federal Treasury body, other authorized body that opens and maintains personal accounts) an order to transfer funds to pay tax, this taxpayer has other unfulfilled requirements

, which are presented to his account (personal account) and in accordance with the civil legislation of the Russian Federation are executed as a matter of priority, and if there is not a sufficient balance on this account (personal account) to satisfy all requirements.

Thus, the fulfillment of the obligation to pay tax has nothing to do

with the correct (incorrect) indication of the budget classification code

in the payment order for the payment of tax.

In addition, Art. 45 Tax Code of the Russian Federation

prescribes that the tax should be transferred to the budget system,

without specifying

that the tax should be transferred to the appropriate budget.

According to paragraph 7 of Art. 45 Tax Code of the Russian Federation

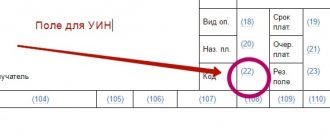

an order to transfer tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury is filled out by the taxpayer in accordance with the rules for filling out orders.

If the taxpayer discovers an error in filling out an order to transfer tax, which does not result in non-transfer of this tax to the budget system of the Russian Federation

to the appropriate account of the Federal Treasury, the taxpayer has the right to submit to the tax authority at the place of his registration

a statement of an error

, attaching documents confirming his payment of the specified tax and its transfer to the budget system of the Russian Federation to the appropriate account of the Federal Treasury,

with a request to clarify the basis, type and affiliation payment

, tax period or payer status.

a joint reconciliation may be carried out

taxes paid by the taxpayer.

The results of the reconciliation are documented in a document

, which is signed by the taxpayer and an authorized official of the tax authority.

The tax authority has the right to demand from the bank a copy of the taxpayer’s order to transfer tax

to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, registered by the taxpayer on paper.

The bank, in turn, is obliged to submit a copy of this order to the tax authority within five days from the date of receipt of the tax authority’s request.

Based on the application

taxpayer and the act of joint reconciliation of calculations for taxes, fees, penalties and fines, if such a joint reconciliation was carried out,

the tax authority makes a decision to clarify the payment on the day the taxpayer actually pays the tax

to the budget system of the Russian Federation to the appropriate account of the Federal Treasury.

In this case, the tax authority recalculates penalties

, accrued on the amount of tax, for the period from the date of its actual payment to the budget system of the Russian Federation to the appropriate account of the Federal Treasury until the day the tax authority makes a decision to clarify the payment.

Both the taxpayer and the tax authority carry out the above actions in case of any error by the taxpayer in filling out the payment order.

The main thing is that the Federal Treasury account is indicated correctly

.

On the incorrectness of the BCC in Article 45 of the Tax Code of the Russian Federation

- not a word.

In letters dated August 14, 2007 No. 03-02-07/1-377, dated June 17, 2008 No. 03-02-07/1-288, the Ministry of Finance of the Russian Federation explained that if the tax amount was credited to the proper budget

in the absence of losses to the state treasury,

it is possible to take into account the payment made in the prescribed manner without charging penalties

.

That is, if the tax authority makes a decision to clarify the payment, no penalties will be charged.

.

And in a letter dated September 13, 2006 No. 03-02-07/1-249, the Ministry of Finance of the Russian Federation directly stated that the error that arose in connection with the taxpayer’s instructions in the order to transfer the single tax levied on taxpayers who chose income as the object of taxation , reduced by the amount of expenses, the budget classification code for a single tax levied on taxpayers who have chosen income as an object of taxation can be eliminated in accordance

from

paragraph 7 of Art.

45 Tax Code of the Russian Federation .

Payment clarification application form

is not approved, therefore it can be compiled

in any form

.

Example.

Application for clarification of certain details in the payment order

Individual entrepreneur Gvozdikin I.I. On April 28, 2010, he transferred tax to the budget under the simplified taxation system for 2009 in the amount of ___ rubles. 00 kop.

An error was made in the KBK when filling out the payment order.

In accordance with paragraph 7 of Art. 45 of the Tax Code of the Russian Federation, I ask you to clarify the relevance of the payment under the payment order dated 04/28/2010 on the day of its actual payment (as of 04/28/2010) and recalculate the tax penalties.

Please include the payment according to the following indicator values (indicate all information identifying the payment, including the correct BCC).

Attached to the application

a copy of the payment order and a bank statement for the entrepreneur’s current account.

Let us note that arbitration practice on this issue has developed and is completely on the side of taxpayers.

So, according to the FAS Moscow District

(resolution dated February 10, 2010 No. KA-A40/344-10),

the taxpayer’s erroneous indication of the budget classification code

in the payment order

did not affect the fulfillment of his obligations to pay tax

and did not result in non-transfer of tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury , and therefore

the accrual of penalties is unfounded

.

FAS Ural District

indicates that the legislation on taxes and fees

does not link the fact of payment of tax payments with the correctness

of the taxpayer (tax agent)

the KBK

in the appropriate payment destination field of settlement documents for the transfer of taxes to accounts for accounting for income and budget funds of all levels of the budget system of the Russian Federation.

Tax legislation does not contain such a basis for declaring a tax unpaid as incorrect indication of the budget classification code

(decrees dated December 12, 2006 No. F09-9925/06-S2, dated March 11, 2009 No. F09-1198/09-S2).

Therefore, write a statement specifying the payment.

The tax authority must recalculate penalties, that is, reverse those accrued earlier.

Why is an error in the KBK dangerous?

When filling out a payment slip or receipt for payment of taxes, duties and other non-tax fees, you need to be very careful when specifying the BCC. If an error is made in the KBK, then your payment will end up in unidentified receipts and will “hang” there until you sort it out. But the worst thing is that for the tax or fee that you paid with an erroneous payment or receipt, arrears will appear and penalties will be charged. And if it was a state duty for performing legally significant actions or issuing documents, then you will simply be denied this action. For example, they will not accept a statement of claim in court, or issue a driver’s license or a duplicate of the required document.

Unpaid taxes, fees and contributions may also be recovered through legal action. However, if the payment order correctly indicates the account number (settlement and correspondent account) and the details of the recipient's bank, the obligation to pay tax is considered fulfilled from the moment the payment order is presented to the bank for the transfer of funds (subclause 1, clause 3, article 45 of the NKRF) when provided that there are sufficient funds in the business entity’s current account. The tax service also agrees with this opinion, having issued a corresponding letter dated October 10, 2016 No. SA-4-7/ [email protected] The Ministry of Finance also has a similar letter dated January 19, 2017 No. 03-02-07/1/2145.

We wrote about the fine for failure to pay personal income tax on time in the article.

Accounting entries to reflect transactions on insurance premiums

To display the accounting department's transfers of insurance premiums to funds, as well as transfers from funds, account 69 is used:

- DT 69 CT 51 - crediting money to the budget;

- DT 99 CT 69 - sanctions (fine, penalty);

- DT 51 (52) CT 69 - return of money on insurance payments overpaid to the funds;

- DT 20 (91 and other expense accounts) CT 69 - additional calculation of insurance premiums.

This account is used by organizations and private enterprises to record information about all mutual settlements for insurance payments. If necessary, subaccounts are used. For example, 69.06 - for transfers of fixed contributions to the state of emergency.

Example 1. Miscalculation when a legal entity paid mandatory insurance fees for 2021

The organization is obliged to pay the January OPS (insurance line) contributions for 2021. When preparing the settlement document, the responsible accountant of the organization incorrectly entered the coding: instead of 182 1 0210 160, 182 1 02 02010 06 1000 160 was written down (until January 1, 2017). Payment transactions were carried out on time, but using the wrong code.

As a result, the transferred money was displayed according to the code specified in the payment document (period until January 1, 2017). At this time, the payer had no debts regarding insurance, so there was an overpayment.

Due to the described error, there were no enrollments for the required code 182 1 02 02010 06 1010 160. Here arrears arise and a penalty is charged.

To rectify the situation, the obligated person must contact the tax authorities. He needs to prepare an application to clarify the payment transaction and to adjust the BCC (Tax Code of the Russian Federation, Article 45, paragraph 7). The applicant has no arrears in contributions, insurance payments were made according to the details of the Federal Tax Service in 2021 on time, so the tax office will clarify the payment, and the penalty will be reversed.

Example 2. Application of budget classification when paying insurance fees in 2021 (private income exceeded the maximum limit of 300 thousand rubles)

A private entrepreneur is obliged to pay a quarterly mandatory fee for 2021 for compulsory insurance (for the insurance part) on profits exceeding the limited limit of 300 thousand rubles.

The new budget qualification rules do not provide a special code for calculating fees on private enterprise profits greater than the limited threshold of 300 thousand rubles. Current codes that are written in the payment document:

- 182 1 0200 160 - fixed (hereinafter referred to as fixed) generally mandatory PS fees for payment of insurance pension (hereinafter referred to as SP) until January 1, 2017 (the income of the obligated person did not exceed the established limit);

- 182 1 0200 160 - fixed general mandatory fees for payment of joint ventures until July 1, 2017 (the income of the obligated person is more than the established limit);

- 182 1 0210 160 - fixed general mandatory fees for payment of joint ventures from January 1, 2017.

In the emergency settlement document, you need to specify a coding that reflects the fixed amount of mandatory fees starting from 2017.

What to do if the BCC is indicated incorrectly

The legislation does not directly stipulate what a business entity should do if it made a mistake in indicating the tax payment to the KBK. However, organizations and individuals can be guided by paragraph. 2 clause 7 art. 45 of the Tax Code of the Russian Federation, which establishes the procedure in case of detection of an error in a payment order that does not lead to the payment of tax. So, if you incorrectly indicated the KBK when transferring the tax payment, then you need to write an application as quickly as possible to the Federal Tax Service at the place of registration to clarify the payment. After all, due to an incorrect KBK, your payment will not be received as intended and the payment will be incorrectly reflected in your personal card. This means that you will have an arrears and penalties will be charged.

If the business entity made a mistake in the State Duty Code, then the application is also written to the Federal Tax Service, but this document must also be accompanied by confirmation from the Federal Treasury about the receipt of money into the budget. Applications for clarification of payment are always submitted to the tax office, if it is necessary to clarify the BCC of a tax, fee and other obligatory payments administered by the tax authorities, to the budget system of the Russian Federation. In this case, it does not matter whether, as a result of the error, the tax or fee was credited to the same budget or not. There is no official form for this application, so you can compose it arbitrarily. The application must indicate:

- name of the organization, individual entrepreneur or full name of the taxpayer - an individual;

- TIN, OGRN or OGRNIP;

- legal and actual address;

- contact phone number for communication.

Further in the text of the application it is necessary to explain in detail what exactly needs to be clarified and what the error is. A copy of the payment slip for which the “erroneous” payment was transferred must be attached to the application.

The completed application must be sent to the tax office in one of the following ways:

- submit an application to the Federal Tax Service in person or by proxy;

- send by registered mail or courier service;

- send via telecommunication channels or through the taxpayer’s personal account.

In our article you can apply for clarification of tax payment.

If you forgot to indicate the KBK in the payment order, then in this case an application is submitted to search and return the erroneously transferred funds.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Despite the fact that the recipient of the funds is the Federal Treasury, it does not work directly with payers, therefore applications for clarification or refund of payments are submitted to the administrator of the Federal Treasury, indicated in the payment as the recipient.

What to do if, when transferring a tax payment, you made a mistake in other details of the payment order, read the ready-made solution “ConsultantPlus”. If you don’t have K+ yet, take advantage of a free trial access to the system.

Common mistakes when paying insurance premiums

| Common errors | Outcome and options for correcting mistakes made |

| December insurance premiums for 2021 were credited in January 2017 to the Pension Fund (the details of the fund are indicated, not the tax service, the BCC is inaccurate) | The obligation to pay contributions has not been fulfilled. To rectify the situation, the obligated person has the right to write an application to the fund for the return of the erroneously transferred money. The appeal indicates the details of the organization (tax office) where the money should be returned |

| Contributions were credited correctly to the required tax service account, but the wrong BCC is indicated (a code is needed for the period from 01/1/2017, but instead the code used before 01/1/2017 is written down) | There is no need to re-pay contributions; no penalties will be charged. The payer must request clarification of the BCC to the tax authorities |

| Excess amount for insurance payments transferred | The payer has the right to use one of the options: · return the overpayment; · offset the excess against future payments. To do this, he must submit an appropriate application (for a credit or refund of the excess amount) to the tax authorities |

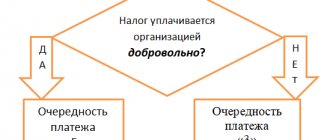

Decision to clarify payment

The tax office will review your application within 5 working days. Before a decision is made, penalties are accrued, and until a decision is made, the tax authority may require their payment. The Federal Tax Service can also reconcile settlements with the payer or request a payment order from the bank to transfer the tax.

If the outcome is favorable, the Federal Tax Service will decide to clarify the payment. The form of the decision was approved by the order of the Federal Tax Service of Russia “On approval of the form of the decision to clarify the payment and the procedure for filling it out” dated December 29, 2016 No. ММВ-7-1/ [email protected] In addition, the tax authority will have to recalculate accrued penalties from the date of actual payment of the tax or collection (i.e. this is the date of your “erroneous” payment) until the day the decision is made to clarify the payment. It would be useful to subsequently request from the tax office a certificate of absence of debt or a statement of reconciliation of calculations, in which you will see that your erroneous payment has been corrected, there are no arrears and penalties have been recalculated.

We wrote about the reconciliation act in the article.

Documents required for correcting miscalculations when paying insurance fees

The key document that appears in correcting such errors is the statement of the obligated person. This may be an application for clarification of payment or offset of the excess amount that was paid.

Sample application for offset of excess amount of fines collected

Sample free form application for clarification of payment