Financial assistance 4000 income code and deduction code 2021

Financial assistance and 2-NDFL certificate codes - what is it 2. Income codes for material assistance up to 4,000 rubles and above 3.

Deduction codes for material assistance in the 2-NDFL certificate Material assistance and codes for the 2-NDFL certificate - what is it? Material assistance in the labor practice of enterprises of the Russian Federation means specific payments made by employers to their employees, as well as to third parties in connection with the occurrence of any unfavorable circumstances in their lives, as well as other forms of support other than cash. At the same time, financial assistance is considered a payment that is not directly tied to the results of work and is not of an incentive, but a compensatory nature, designed in one way or another to correct and compensate for the damage received by a person.

Accordingly, the special nature of such payments presupposes the use of other tax standards reflected in individual articles of the Tax Code of the Russian Federation, namely: Article 217 of the Tax Code of the Russian Federation.

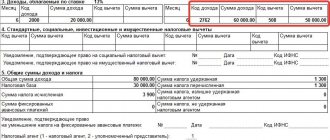

Income codes for the 2-NDFL certificate in 2021

2201 Author's fees (rewards) for the creation of literary works, including for the theater, cinema, stage and circus 2202 Author's fees (rewards) for the creation of artistic and graphic works, photographic works for printing, works of architecture and design 2203 Author's fees (rewards) for creation of works of sculpture, monumental decorative painting, decorative and applied and design art, easel painting, theatrical and film decorative art and graphics, made in various techniques 2204 Author's fees (rewards) for the creation of audiovisual works (video, television and cinema films) 2205 Author's fees (rewards) for the creation of musical works: musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for cinema, television and video films and theatrical productions

What is the income code for financial assistance up to 4000 rubles and the deduction code?

Next, we’ll figure out what the income codes are. assistance, and by what regulatory act they are established.

Income codes for material assistance are reflected in Order of the Federal Tax Service of Russia dated September 10, 2015 No. Income code for material assistance of 4,000 rubles or less is entered in certificate 2-NDFL.

The codes are indicated in Appendix No. 1 to the above Order of the Federal Tax Service. This section presents a significant number of codes, of which 3 are suitable: Type of financial assistance Income code Any financial assistance, except for that paid by the employer in favor of employees and former employees, as well as except for the amount of financial assistance paid at the birth of children.

2710 Any financial assistance provided to employees or former employees from the employer 2760 Financial assistance for workers, or who adopted them or took them under guardianship 2762

Material assistance income code

P.

As for the income code for financial assistance in the 2-NDFL certificate, it must be selected from the income codes given in Appendix No. 1 to the order of the Federal Tax Service dated September 10.

2015 No. It contains the following options for income codes: 2760 - income code for financial assistance to employees, including former employees who retired due to disability or age; 2761 - income code for material assistance to disabled people from public organizations of disabled people; 2762 - income code for one-time financial assistance to employees - parents (guardians, adoptive parents)

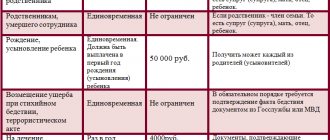

Personal income tax on financial assistance in 2021 is not withheld if its amount does not exceed 4,000 rubles per year for any reason, with the exception of special cases. 1. Completely tax-free, these include:

- emergency circumstances, incl. disaster;

- prevention, suppression and other actions to prevent the commission of a terrorist act.

- death of a close relative of an employee, death of a former employee;

2.

Non-taxable within the limit of 50,000 rubles:

- employees at the birth (adoption, establishment of guardianship) of a child.

According to paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, such one-time financial assistance is excluded from the tax base for personal income tax; with regard to insurance contributions, the position of the Ministry of Finance is identical. The income code (material assistance up to 4,000 rubles) is indicated in the Federal Tax Service order No. ММВ-7-11 / [email protected] dated 09/10/2015.

This includes:

- income code 2760 (material for employees, former employees who left upon retirement)

Financial assistance: taxation and insurance contributions

The only exceptions are:

- natural disasters and terrorist attacks.

- birth of a child;

- death of an employee or his relative;

When a subordinate becomes a parent, he can be paid up to 50,000 rubles without calculating insurance premiums.

Financial assistance in connection with the death of a family member, compensation for damage due to injury, terrorist attack, emergency or accident are not included in the base for calculating insurance premiums and personal income tax.

Thus, taxes on financial assistance and the maximum amount in 2021 remain unchanged for now.

Please note that one-time financial assistance is considered a payment for certain purposes, accrued no more than once a year on one basis, that is, on one order (Letter of the Federal Tax Service of Russia No. AS-4-3/13508).

How a person receives the money - all at once or in parts throughout the year - does not matter (Letter of the Ministry of Finance of Russia No. 03-04-05/6-1006).

Is material taxable?

So, it must immediately be said that financial assistance involves the payment of a sum of money to employees by decision of the employer:

- Due to the emergence of a difficult life situation;

- When a certain negative event occurs.

The tax calculation for assistance is taken into account depending on the amount, as well as the funds from which it is paid.

For example, certain assistance may be paid during the vacation process, which, in principle, is taken into account in expenses as wages; accordingly, it is determined for income under code 2000, and personal income tax funds are fully deducted from this assistance. Info What are the codes for income and deductions for personal income tax in 2021:?

A table with codes and explanations is given in this article. In different tables there are codes of income and deductions for personal income tax for 2021. All organizations and individual entrepreneurs that pay income to individuals must submit 2-NDFL certificates to the tax office (clause

1 tbsp. 226, paragraph 2 of Art. 230 Tax Code of the Russian Federation)

2-NDFL and financial assistance

For example, in 2-NDFL, financial assistance up to 4,000 rubles paid to an employee () must be shown with income code 2760 and at the same time with deduction code 503.

Similarly, the certificate indicates a lump sum payment accrued to the employee in connection with the birth of his child. As you know, it is not subject to personal income tax up to 50 thousand rubles. for each child, but for both parents, and provided that it is paid within a year from the date of birth. For this financial assistance, income code 2762 and at the same time deduction code 504 () are used.

But financial assistance, which is not subject to personal income tax regardless of its size, is not indicated at all in 2-personal income tax. For example, there is no need to reflect in the certificate the payment of one-time assistance to an employee whose apartment burned down for reasons beyond his control.

After all, it was paid due to an emergency, which means it is completely not subject to personal income tax (). If you paid tax-free

Material assistance codes in 2021

This article regulates the procedure for accounting for material assistance in the expenditure portion of the tax base of an enterprise. • Article 422 of the Tax Code of the Russian Federation. The standards of this article regulate the procedure for calculating insurance premiums accrued for financial assistance.

Financial assistance is regulated only by the provisions of tax legislation. The Labor Code does not contain this definition and does not provide for any specific regimes for its settlement.

Based on this, the nature of the payment of financial assistance is initially purely voluntary for employers - it is they who decide whether the possibility of receiving the said compensation should be reflected in the regulations of the enterprise.

Considering that material assistance refers to special means that cannot be directly attributed to the income of the recipient

Financial Assistance 2021 Personal Income Tax Codes

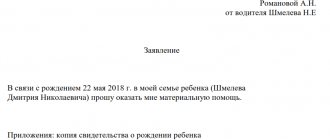

If a force majeure situation occurs, the employee must contact the institution with an application for financial assistance.

It can be written in free form, however, if the organization has a described procedure for providing financial assistance, you should be guided by it.

2710 - financial assistance (except for that provided by employers to their employees, as well as former employees who resigned due to retirement due to disability or age, disabled people, public organizations of disabled people and one-time financial assistance to employees (parents, adoptive parents, guardians) upon the birth or adoption of a child) ; 2760 - financial assistance provided to employees, including former employees who resigned due to retirement due to disability or age; 2770 - compensation (payment) by employers to employees, their spouses, parents and children, their former employees (age pensioners), as well as disabled people for the cost of medications purchased by them (for them), which were prescribed to them by their attending physician.

Income and deduction codes for personal income tax in 2021: table

We present the deadlines for submitting 2-NDFL for 2021 in 2021 in the table: Certificate Deadline for submitting 2-NDFL with sign 1 April 1, 2021 2-NDFL with sign 2 March 1, 2021 The Appendix to the 2-NDFL certificate must be filled out separately for each rate tax (clause 1.19 of the Procedure for filling out the 2-NDFL certificate).

It indicates (clauses 6.1, 6.4 of the Procedure for filling out the 2-NDFL certificate):

- income that you paid to an individual in cash and in kind, as well as in the form of material benefits;

- tax deductions from these incomes provided to individuals (except for standard, social and property ones).

The fields of the Appendix to the certificate are filled in as follows:

- in the “Amount of Income” field – the entire amount of income accrued and actually received by an individual this month;

- in the “Month” field – the serial number of the month;

- in the “Income code” field – a code depending on the type of income of an individual (for example, the code for salary is 2000, the code for vacation pay is 2012);

Financial assistance 4000 rubles: taxes, contributions in 2021

28 Art. 217 of the Tax Code of the Russian Federation states that material assistance is not included in the taxable base for income tax, but only that which does not exceed 4,000 rubles. for one individual in one tax period.

What does it mean? The tax period for personal income tax is one year.

And the limit is 4,000 rubles. established for the total amount of financial assistance received from one or more employers. That is, if for a calendar year an employee has already received financial assistance in the amount of 4,000 rubles from one of the employers, then from another employer similar financial support for the employee should already be taxed.

True, if the employee did not notify the employer of such a fact, and the 2-NDFL certificate was not provided, no sanctions will follow against the employer.

But the employee will receive a notification from the tax authorities about the need to pay additional personal income tax on the amount of “excess” financial assistance.

Source: https://GarantR.ru/materialnaja-pomosch-4000-kod-dohoda-i-kod-vycheta-2021-50016/

Financial assistance up to 4000 income code in 2021

These include financial assistance for vacations, weddings, etc.

Such material assistance is not subject to personal income tax and insurance contributions in the amount of 4,000 rubles.

for the calendar year (, ,). Personal income tax and contributions must be charged on the excess amount. Keep in mind that the limit is set for financial assistance on all such grounds. Let’s say that during 2021, an employee was paid financial assistance for vacation in the amount of 2,000 rubles, as well as financial assistance in connection with his marriage in the amount of 3,000 rubles.

That is, the employee was provided with financial assistance totaling 5,000 rubles. (2000 rub. + 3000 rub.). Financial assistance, tax-free in 2021, as we said above, is 4,000 rubles.

Accordingly, from 1000 rubles. (5000 rubles – 4000 rubles) you need to calculate personal income tax and contributions. The specified limit is 4000 rubles. also valid in 2021.

In order to avoid problems with the Federal Tax Service and the Social Insurance Fund, in some cases, when paying financial assistance, it is necessary to stock up on supporting documents.

Under what code should financial assistance be reflected in the 2-NDFL certificate?

In the latter case, the limit of financial assistance increases to 50 thousand rubles. Regardless of exceeding the limit, financial assistance is indicated on the form and recorded with the serial code 2710.

They are also assigned deduction codes:

- 504 – assistance that is accrued upon the birth of an employee’s newborn.

- the minimum payment is indicated by the number 503;

It is important to indicate the payment amount and enter the appropriate code.

Next, write down the deduction number and the amount that is subject to taxation.

Income code financial assistance

217 hours

2 Tax Code of the Russian Federation. These include certain categories of financial support payments. Let's look at clear examples of what base for personal income tax should be taken subject to the payment of financial assistance and how this will be reflected in the 2-NDFL certificate.

This type of financial assistance will not be subject to personal income tax.

8 tbsp. 217 NK). Therefore, the tax amount (13% of the amount of 15,000 rubles) will be 1,950 rubles. The cash that the employee will receive is 63,050 rubles. In the 2-NDFL certificate they should be reflected with codes: income - 2762 and deduction - 508.

Such financial assistance will not be subject to personal income tax, regardless of the amount.

Source: https://econsalting.ru/materialnaja-pomosch-do-4000-kod-dohoda-v-2021-godu-62471/

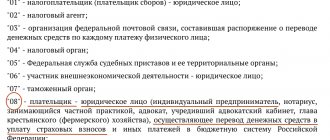

Sample payment order

Basic requirements when filling out a payment order:

- Payer status – the person making the payment (01 – legal entity; 02 – tax agent, etc.).

- When indicating tax payments in the fields provided, you should carefully fill in the account numbers and bank names.

- Priority of payment (for tax contributions - 5).

- BCC (104) must be indicated as valid at the time of payment.

- OKTMO code – indicated at the location of the legal entity.

- The period for which the insurance or tax contribution is paid.

The form of the payment order does not change; the only thing that differs when transferring insurance premiums in case of disability due to maternity is the KBC.

Insurance premiums in case of disability due to maternity are paid according to KBC 182 1 02 02090 07 1010 160 from January 2021.

Can both parents receive financial assistance?

According to current legislation, both parents can receive financial assistance from the employer, but it is important not to forget that the non-taxable amount of 50,000 rubles consists of total birth benefits.

What to do if management refuses to pay financial assistance?

The fact is that a financial payment from an employer is voluntary assistance from an organization. This payment is not regulated by the Labor Code, so the employer has every right not to pay it.

Is it possible to receive payment before the birth of the child?

No, the payment is made only after the birth of the child, and the basis is a document confirming the birth.

Financial assistance 4000 income code

How should financial assistance be reflected in 2-NDFL? Let us help you navigate this issue.

Reasons

One of the main responsibilities of an accountant in an organization is to correctly enter information into documents, taking into account all changes in legislation. After the publication of the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485, it is necessary to reflect financial assistance in a new way in the certificate in form 2-NDFL.

Financial assistance is money that is paid to an employee of an organization after an appropriate decision has been made by management. Most often, money is given out when a difficult life situation arises for an employee or when an important event occurs. These include registration of marriage, birth of a child, death of a family member.

The only exception for tax calculation is material support provided to parents at the birth of a child or to adoptive parents or guardians. During the first 12 months, they can receive personal income tax-free support in the amount of up to 50,000 rubles.

Some types of financial assistance are not taxed, regardless of the amount they were accrued. In this case, there is no need to reflect financial assistance in the amount of 4,000 rubles in 2-NDFL

or even more. These include funds paid in connection with:

- the results of a natural disaster;

- the onset of an emergency - accident, flood, fire. In this case, the employee should provide the manager with a certificate issued by the competent authority;

- departure of a family member to another world.

Payments made on these grounds do not need to be shown in 2-NDFL at all. The law allows this.

What happens in practice

By law, tax agents are required to annually prepare reports and submit data on the income of their subordinates to the inspectorate. Tax agents are employers who pay wages and any other income to their staff. The certificate contains information for the calendar year:

- – the amount of calculated tax;

- – amount of tax withheld;

- – the amount of tax paid.

The form of the 2-NDFL certificate and the procedure for filling it out are approved by the relevant order of the Federal Tax Service. When filling out the document, financial assistance should be correctly reflected in the appropriate lines. You can download the 2-NDFL certificate form to fill out using this link “”.

Let's look at a specific example

After registering a new family as an employee, the head of the company decided to give him a financial benefit in the amount of 15,000 rubles. Income tax was withheld from taxable income in the amount of 11,000 rubles (15,000 – 4,000). Its amount was 1,430 rubles. The accountant needs to decide on the advisability of reflecting the payment in the 2-NDFL certificate.

Since part of the financial assistance in the amount of 4,000 rubles is not subject to personal income tax, the amount must be entered in several lines of form 2-NDFL.

So, in the column “Amount of income” the entire amount that was accrued to the employee as material support is entered. In this case, the amount of the deduction is not taken into account.

To fill out the “Income Code” column, you must use the reference book and select the most appropriate value. To fill in the “Deduction Amount” field, use the amount of income from which tax cannot be withheld.

In this case, this amount is 4000 rubles. The line “Deduction code” is also filled in based on data from the directory.

Be sure to reflect in which month the income was accrued and when the payment was made.

If the income is not taxed

Sometimes they purposefully pay financial assistance in an amount that is not subject to personal income tax. For example, a manager decided to reward an employee with 3,000 rubles. However, there were no other similar payments during the year.

In the event that part of the income is completely exempt from personal income tax, the accountant must still indicate it in the certificate in Form 2-NDFL.

Payment to a third party

It may happen that the head of the company decided to pay financial assistance to a person who is not an employee of this organization. For example, this could be either a person who previously worked in this organization or a close relative of one of the employees. In this case, there is no need to fill out form 2-NDFL and submit information to the tax authorities.

In accordance with the explanations given in the letter of the Federal Tax Service, the employer does not act as a tax agent for such income of third parties.

Thus, when filling out form 2-NDFL, financial assistance for 4000

rubles (more or less) should be reflected in accordance with the specifics of the legislation. This approach will help to avoid inaccuracies when reconciling with tax authorities and fines.

, please select a piece of text and press Ctrl+Enter

.

What is financial assistance and how can it be correctly taken into account in the 2-NDFL certificate? What financial assistance code should be reflected in the certificate? First, let’s define what financial assistance is and for what purposes it is given, since this is the main criterion for determining the operation code.

So, financial assistance is amounts paid to employees by decision of the employer for certain purposes: - in connection with the emergence of a difficult life situation (for example, difficult financial situation, death of a family member, long-term illness); - in connection with the occurrence of a certain event.

Accounting for financial assistance is the same for all taxation regimes.

Financial assistance paid for vacation is taken into account in wage costs, provided that this payment is provided for by an employment (collective) agreement or local regulations and is related to the employee’s performance of his job duties.

When paying financial assistance for other reasons, it is taken into account at the expense of the enterprise’s net profit and is not taken into account in the company’s expenses.

Let's look at the main reasons for paying financial aid. 1. Financial assistance is paid to parents in connection with the birth of a child during the first year of his life. Not subject to personal income tax up to 50,000 rubles. per child based on both parents.

Moreover, from the place of work of the second parent, a 2-NDFL certificate is provided or a statement is written stating that financial assistance was not paid at the place of work of the second parent. Such assistance is not subject to insurance contributions to the Pension Fund, Compulsory Medical Insurance, Social Insurance Fund up to 50,000 rubles.

per child per parent.

2. Financial assistance in connection with the death of a family member. This assistance is not subject to any taxes or contributions.

3. Financial assistance in connection with a natural disaster or other emergency circumstances (for example, an accident, a fire) in the presence of a certificate from the competent government agency (for example, the Ministry of Emergency Situations) about the fact of the emergency event. This type of assistance is not subject to personal income tax. Contributions are not assessed if assistance is paid to compensate for material damage or harm to health caused by these events.

4. Maternity assistance for other reasons is not subject to personal income tax and contributions up to 4,000 rubles. per calendar year per employee.

How is financial assistance reflected in the 2-NDFL certificate? What codes does it apply to?

1. In the 2-NDFL certificate, financial assistance is not reflected: - in connection with the death of a family member; - in connection with a natural disaster or other emergency circumstances (for example, an accident, fire); - in connection with the birth of a child during the first year of his life, if the amount of financial assistance does not exceed 50,000 rubles. based on both parents;

– for other reasons, including those related to vacation, if the total amount of such financial assistance does not exceed 4,000 rubles. in a year.

2. Financial assistance is reflected in the 2-NDFL certificate: - in connection with the birth of a child during the first year of his life, if the amount of financial assistance is more than 50,000 rubles. based on both parents (income code 2762, deduction code 508);

– for other reasons, including those related to vacation, if the total amount of such financial assistance is more than 4,000 rubles. for the year (income code 2760, deduction code 503).

Accounting for financial assistance.

If financial assistance is paid for vacation, it is taken into account in the same way as wages.

D-t 20 (23, 25, 26, 44) D-t 70 – accrual of financial aid for vacation

D-t 70 K-t 51 (50) – payment of financial assistance

Dt 70 Dt 68 – personal income tax withholding from the amount of financial assistance

Dt 20 (23, 25, 26, 44) Dt 69 – calculation of insurance premiums for the amount of financial assistance

Accounting for financial assistance on other grounds.

D-t 91 D-t 73 – calculation of financial aid

D-t 73 K-t 51 (50) – payment of financial assistance

Dt 73 Kt 68 - personal income tax withholding from the amount of financial assistance

Dt 91 Kt 69 - calculation of insurance premiums for the amount of financial assistance

How to take into account the overpaid amount of personal income tax in the certificate, see.

Free book

Go on vacation soon!

To receive a free book, enter your information in the form below and click the “Get Book” button.

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

Information on the income of employees, as well as calculated, withheld and transferred personal income tax from this income is indicated in a certificate in form 2-NDFL (Appendix No. 1 to the Order of the Federal Tax Service dated October 30.

2015 No. ММВ-7-11/). It should also reflect the financial assistance paid to the employee. But not every one.

By the way, in the list of income codes noted in the 2-NDFL certificate, not every financial aid has its own code.

So which financial assistance should be reflected in the form, and which not?

Rules for reflecting financial aid in 2-NDFL

The Tax Code establishes different procedures for taxing financial aid with personal income tax depending on the reason for which it is paid or what “type” this financial aid is. Conventionally, all financial assistance can be divided into 2 groups: limited by the amount not subject to personal income tax and unlimited.

So, any financial assistance that is not subject to personal income tax in a certain amount must be reflected in the 2-personal income tax certificate. It is necessary to show the entire amount of income in the form of financial assistance and the deduction applied to it (in the amount not subject to personal income tax).

For example, in 2-NDFL, financial assistance of up to 4,000 rubles paid to an employee (clause 28 of Article 217 of the Tax Code of the Russian Federation) must be shown with income code 2760 and simultaneously with deduction code 503.

Similarly, the certificate indicates a lump sum payment accrued to the employee in connection with the birth of his child. As you know, it is not subject to personal income tax up to 50 thousand rubles.

for each child, but for both parents, and provided that it is paid within a year from the date of birth. For this financial assistance, income code 2762 and at the same time deduction code 504 are used (

You may also like…

Source: https://small-businessrf.ru/mortgage/material-assistance-4000-income-code.html

Payment classification

All required benefits are conditionally divided into mandatory and optional. Mandatory payments contain all types of assistance that are paid by the state. Optional - paid by the organization where the expectant mother works, in other words, this is financial assistance paid by the company to its employee on a voluntary basis.

There is also a difference: one-time payments and benefits that are paid monthly.

In addition, cash benefits are:

- federal (received by all citizens of the Russian Federation from the country’s budget);

- regional (the region has the right to issue additional benefits from its budget).

From the state

A lump sum payment upon the birth of a child is due once. It is possible for both the father and mother of a newborn to receive it. Every woman receives the payment, regardless of her employment before maternity leave. An unemployed woman can also receive this money.

The following documents are needed:

- statement;

- child's birth certificate;

- parents' passports;

- certificate from the other parent’s place of work;

- child's birth certificate and copy.

Documents for download (free)

- Sample application from an employee for financial assistance

The law allows 10 days for the calculation and issuance of money from the moment the package of documents is transferred to the accounting department at the address of work or study of a family member.

For child care

This subsidy is available to those who plan to take parental leave for up to 1.5 years. This could be any of the spouses. If an unemployed parent plans to provide care, you can do everything necessary to receive funds at the nearest branch of the Federal Social Insurance Fund of the Russian Federation.

For a working citizen, the benefit is calculated in the amount of 40% of the average monthly salary, 2 years before the birth of the child are taken into account, the amount is paid every month.

According to the law, the amount should not be less than 4,465.20 rubles if this is the first child, and 6,284.65 rubles for subsequent children.

A woman who has never worked before the birth of a child has the right to a minimum level payment, for which she needs to visit the Social Insurance Fund office at her place of residence. If a woman, while on leave to care for her first child, goes on leave to care for her next child, she becomes entitled to a subsidy, which will consist of the amount of benefits for caring for the first child and the second.

The maximum amount should not be more than 100% of the average salary for the last 2 years and be less than the minimum amount.

It is important that in this case the woman has the right to count on either payment of benefits or maternity benefits.

The following documents are required:

- parents' passports;

- child's birth certificate;

- parents' work records;

- a certificate from the employment service stating that no payment was made (for the mother);

- certificate from place of work (study);

- personal account number in the Security Council of the Russian Federation;

- certificate of family composition.

Maternal capital

Maternity capital is paid once in the event of the birth of a second and/or next child in the family. If there is more than one child in a family, and they did not use the capital, then when the next one appears, the family can issue a payment.

In addition to the child’s mother, the father can also receive state payments if he remains the sole adoptive parent of the second or subsequent children.

It is important to understand that current legislation allows the use of this capital exclusively for the following purposes:

- Elimination of housing problems (buying an apartment or a larger house).

- Children's education. Capital is allowed to pay for the education of any of the children in the family. You can pay with the amount of maternity capital to study at the desired accredited educational institution in the Russian Federation.

- Compensation for expenses for disabled children.

- To pay for the pension of the child’s mother, its funded part.

The use of capital for other needs is punishable by Russian law and is criminally punishable.

Maternity capital is registered at the Pension Fund branch. You are allowed to submit a package of documents at any convenient time. To receive capital, a personal certificate is required.

Basic documents for receiving funds:

- statement;

- parents' passports;

- children's birth certificate.

From the employer

An employer can pay financial assistance to employees upon the arrival of a child in the family; to do this, you need to write an application, to which you must attach the documents required by company regulations. But this payment is not mandatory and is paid solely at the request of the company. Therefore, the application will not necessarily receive a positive response.

The Labor Code does not provide for regulation of this payment. The conditions must be specified in the employment and collective agreement, and it must also indicate what documents must be attached to the application. As a rule, these should be:

- child's birth certificate;

- certificate of income of the second parent.

Income code for financial assistance over 4000 in 2021

In this case, the corresponding tax deduction is used. Income codes and deduction codes are enshrined in the order of the Federal Tax Service of the Russian Federation “On approval of codes...” dated September 10, 2015 No. ММВ-7-11/387.

Guided by the requirements of this order, specific income codes - financial assistance, as well as deduction codes for financial assistance of 4,000 rubles or less, entered in the 2-NDFL certificate, depend on the amount of payment and the purpose of such support (i.e.

e. type of financial assistance). Applies 4 digital

Financial assistance 4,000 rubles: taxation and insurance contributions in 2021

As a result, personal income tax on financial assistance that does not exceed 4,000 rubles is not withheld and is not transferred to the budget.

Experts spoke in more detail about this.

In such a situation, no tax is paid on one-time financial assistance up to 50,000 rubles per child.

It is important that the money is paid within the first year; the money was paid in connection with a natural disaster or other emergency on the territory of Russia.

It doesn't matter if it's one time or not; One-time financial assistance was paid to family members of the deceased employee.

Personal income tax with financial assistance in 2021

In addition, such accrual is one-time in nature. The legislation does not establish the amount of assistance provided in a particular case, so the amount of payment is determined by management based on emotional need. Often such a payment is specified in the employment contract and is an additional guarantee that protects the employee from unexpected expenses.

It is very important that the wording of additional assistance be extremely clear, since vague definitions may arouse suspicion among the tax inspectorate, and the company’s management will be suspected of understating the tax base.

Assistance is accrued based on the employee’s application and documents confirming the situation.

Articles Due to the fact that most types of financial assistance are exempt from personal income tax, the accountant must formalize this type of payment as accurately as possible.

Source: https://yu-pegas.ru/kod-dohoda-dlja-materialnoj-pomoschi-svyshe-4000-v-2021-godu-31855/

Accounting entries

When paying out financial assistance, the postings may differ; it depends only on the source of the payment.

In the case when these payments are made from retained earnings from previous years:

Dt 87 Kt 73 (76) It must be remembered that retained earnings can be transferred to provide financial assistance to employees only with the consent of the founders or shareholders of the company.

If the current year’s profit is used for financial assistance:

Dt 91.2 Kt 73 (76)

The founders' permission is not required. Such a decision can be made by the management of the organization.

Financial assistance issued:

Dt 73 (76) Kt 50 (51)

At the birth of a child, a woman has the right to financial assistance both from the organization in which she works and from the state. Even if a woman has never worked before having a child, she can count on financial support from the state.

Of course, these cash receipts will not solve the financial issue once and for all, but, nevertheless, they will serve as a good help. After all, right after birth it is necessary to purchase a lot of things necessary for the child. Therefore, it is important to know your rights and timely collect and submit the necessary documents for each payment location.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

Income code financial assistance over 4000 in 2021

It is reflected in the certificate if the employee received the amount from transactions on an individual investment account.

See all income and deduction codes in the 2-NDFL certificate for 2021 and the explanation for them below.

Experts talk in detail about the current income and expense codes for personal income tax in 2021.

- Now you can fill out 2-NDFL, RSV, 6-NDFL, 4-FSS and any other reporting online in our new program. If you don’t want to fill out reports, try calculating salaries, vacation pay, sick leave and any other payments, or draw up and print personnel documents. The program can do all this too.

Employers are annually required to submit 2-NDFL certificates to the inspectorate. In Form 2-NDFL, you must include all income that is taxed.