The transfer of administration of insurance premiums to the Federal Tax Service has raised many questions. One of the most relevant: what payer status for payment of insurance premiums from 2021 should be indicated in field 101 of the payment order? Previously, we published material on the issues of filling out payment orders for insurance premiums in 2017. And here we will only touch on changes in filling out field 101.

It is known that the rules for filling out field 101 in a payment order are regulated by Appendix No. 5 to Order No. 107n of the Ministry of Finance of the Russian Federation. But the currently valid version of this application does not contain a status that could undoubtedly be applied to the policyholder transferring contributions to the Federal Tax Service. Let us remind you that before the transfer of administration of insurance premiums to the Federal Tax Service, it was necessary to indicate code “08” in all cases in the payment order for payment of insurance premiums.

In turn, in 2021, the Ministry of Finance of the Russian Federation published a draft order “On amendments to the order of the Ministry of Finance of the Russian Federation No. 107n.” This document states that when transferring insurance premiums by legal entities, code “01” must be indicated in field 101. Individual entrepreneurs paying insurance premiums “for themselves” must indicate payer code “09”, individual entrepreneurs paying insurance premiums for employees must indicate payer status “14”.

But this draft Order has not yet entered into force. Therefore, what the payer’s status should be in a payment order in 2021 is not entirely clear.

However, there is still no official clarification on this topic. In this regard, you can only rely on your own logical thinking, in the hope that it coincides with the thinking of the people who will administer these payments.

Meanwhile, on thematic forums on the Internet, accountants express three points of view on what status should be indicated in field 101. We bring each of them to the attention of readers.

Payment order form in 2017

Since 2021, there have been a huge number of tax and accounting changes. See “What will change in 2021: taxes, insurance premiums, benefits, reporting, accounting and online cash registers.”

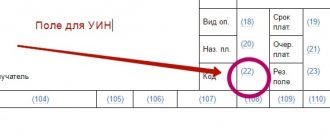

However, in order to pay taxes and insurance premiums in 2021, you should, as before, use the payment order forms familiar to all accountants. The payment form, numbers and names of its fields are given in Appendix 3 to the Regulations approved by the Bank of Russia dated June 19, 2012 383-P. The form of the payment order stipulates that it must indicate the status of the payer.

Payer status is field 101 of the payment slip. A special code is written into this field, which consists of two digits. This code indicates who exactly is making what payment.

The payer status is indicated in the payment order if taxes, insurance premiums or other obligatory payments are transferred. If the payment is made in favor of the counterparty, then field 101 is not filled in.

Rules for filling out payment orders in 2017

The rules for filling out payment orders for the payment of taxes and insurance contributions were approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. These rules continue to apply in 2021.

However, from 2021, instead of taxpayers and payers of insurance premiums, taxes and contributions can be paid by third parties: organizations, individual entrepreneurs or ordinary individuals (Clause 1 of Article 45 of the Tax Code of the Russian Federation). When filling out payment slips, third parties are also required to follow the rules approved by the Order of the Ministry of Finance of Russia dated November 12. 2013 No. 107n. See “Third parties now have the right to pay taxes, fees and insurance premiums for others.”

Unified calculation of insurance premiums: other codes reflected in reporting

In addition to the above information, the calculation of insurance premiums reflects the following information in encoded form:

| Code type | Where to indicate the code in the calculation of insurance premiums | Comments |

| Tax authority code | Title page | You can find your Federal Tax Service code in our Accounting Directory |

| Code of type of economic activity according to the OKVED2 classifier | Title page | You must specify the code corresponding to your type of activity. The code is taken from the Classifier OK 029-2014 (NACE Rev. 2), approved. By Order of Rosstandart dated January 31, 2014 No. 14-st |

| Country code of citizenship/Citizenship (country code) | p.070 Appendix 9 to section 1 | You will find the country code in OKSM, approved. Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st |

| p.120 section 3 | ||

| OKTMO code | p.010 section 1 | The code of the municipality/inter-settlement territory/settlement that is part of the municipality on the territory of which the payer pays insurance premiums is reflected. OKTMO are contained in the Classifier, approved. By Order of Rosstandart dated June 14, 2013 No. 159-st |

| p.010 section 2 | ||

| KBK | p.020 section 1 | You must indicate the budget classification code to which the following are credited: - contributions to compulsory pension insurance |

| p.020 section 2 | ||

| p.040 section 1 | — contributions to compulsory medical insurance | |

| p.040 section 2 | ||

| p.060 section 1 | — contributions to compulsory health insurance at additional rates | |

| p.080 section 1 | — contributions for additional social security | |

| page 100 section 1 | — contributions to compulsory social insurance in case of temporary disability due to maternity (contributions to VNiM) | |

| Sign of the basis for calculating insurance premiums at additional rates | p.001 subsection 1.3.1 | This line indicates: - “1”, if contributions in the amount of 9% are charged on payments to employees engaged in work with hazardous working conditions (clause 1 of article 428 of the Tax Code of the Russian Federation, clause 1 of part 1 of article 30 of the Law of 28.12 .2013 No. 400-FZ); - “2”, if contributions in the amount of 6% are charged on payments to employees engaged in work with difficult working conditions (clause 2 of Article 428 of the Tax Code of the Russian Federation, clauses 2-18, part 1, article 30 of the Law of December 28, 2013 No. 400-FZ) |

| Base code | p.001 subsection 1.3.2 | The choice of code depends on the basis for calculating contributions for additional tariffs established by clause 3 of Art. 428 of the Tax Code of the Russian Federation: - “1”, if the contributions established by clause 3 of Art. 428 of the Tax Code of the Russian Federation, are accrued for payments to employees engaged in work with hazardous working conditions (clause 1 of article 428 of the Tax Code of the Russian Federation, clause 1 of part 1 of article 30 of the Law of December 28, 2013 No. 400-FZ); - “2”, if the fees established by clause 3 of Art. 428 of the Tax Code of the Russian Federation, are accrued for payments to employees engaged in work with difficult working conditions (clause 2 of Article 428 of the Tax Code of the Russian Federation, clauses 2-18 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ) |

| Filling base | p.002 subsection 1.3.2 | The code corresponding to the basis for establishing the additional tariff is reflected: - “1” - based on the results of the special assessment; — “2” — based on the results of certification of workplaces; — “3” — based on the results of a special assessment and the results of workplace certification |

| Working conditions class code | p.003 subsection 1.3.2 | You must indicate one of the codes corresponding to the working conditions: - “1” - dangerous, subclass of working conditions - 4; — “2” — harmful, subclass of working conditions — 3.4; — “3” — harmful, subclass of working conditions — 3.3; — “4” — harmful, subclass of working conditions — 3.2; — “5” — harmful, subclass of working conditions — 3.1; |

| Code of basis for calculating insurance contributions for additional social security | p.001 subsection 1.4 | Reflected: - “1” when calculating the amounts of contributions for additional social security for members of flight crews of aircraft and civil aviation; — “2” — when calculating the amounts of contributions for additional social security for certain categories of employees of coal industry organizations |

| Payout sign | p.001 Appendix 2 to section 1 | It is necessary to indicate the sign of insurance payments for compulsory social insurance at VNiM: - “1” - for direct payments by the territorial body of the Social Insurance Fund to the insured person; — “2” — credit system of payments by the territorial body of the Social Insurance Fund to the payer of contributions |

| Sign | p.090 Appendix 2 to section 1 | Indicate: - “1”, if line 090 reflects the amounts of contributions to VNiM subject to payment to the budget; — “2”, if line 090 reflects the excess of expenses incurred over calculated contributions to VNiM |

| Code of the type of business activity established by the legislation of the constituent entity of the Russian Federation, specified in the application for a patent | p.030 Appendix 8 to section 1 | This code is taken from the patent application |

| Identification of the insured person | p.160 section 3 | The code depends on whether the person for whom the information is submitted is insured in the OPS system: - “1” - yes; - “2” - no |

| p.170 section 3 | The code depends on whether the person for whom the information is submitted is insured in the compulsory medical insurance system: - “1” - yes; - “2” - no | |

| p.180 section 3 | The code depends on whether the person for whom the information is submitted is insured in the compulsory social insurance system: - “1” - yes; - “2” - no |

Payer status: what to indicate in 2017

Payer status codes were approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (Appendix 5 to this order). According to this order, until 2021, when paying all types of insurance premiums, code 08 had to be indicated in field 101 of the payment order.

At the same time, in 2021, the Ministry of Finance of Russia published a draft order “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n” “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation " This document was developed, in particular, in connection with the fact that from 2021, the tax authorities have been transferred powers to administer insurance contributions for compulsory pension, social and health insurance. See "Insurance premiums from 2021: overview of changes."

The mentioned draft order of the Ministry of Finance, among other things, stipulates that when transferring insurance contributions for compulsory pension (social, medical) insurance for employees in 2021, code 01 must be shown instead of code 08. That is, payments for insurance premiums from 2021 must be issued the same as for taxes. The only difference is in the BCC and the purpose of payment.

Also, from 2021, new payer statuses have appeared, which must be used by organizations or individuals paying taxes and insurance premiums “for others”: statuses 29 and 30. Here is an updated table of payer statuses from 2021, based on the draft order of the Ministry of Finance:

Payer status when filling out a payment order in 2017.xlsx

| Field number | Field code | Field code value |

| 101 | 1 | Taxpayer (payer of fees) – legal entity |

| 2 | Tax agent | |

| 6 | Participant in foreign economic activity – legal entity | |

| 8 | An organization (individual entrepreneur) that transfers other obligatory payments to the budget | |

| 9 | Taxpayer (payer of fees) – individual entrepreneur | |

| 10 | Taxpayer (payer of fees) – notary engaged in private practice | |

| 11 | Taxpayer (payer of fees) – a lawyer who has established a law office | |

| 12 | Taxpayer (payer of fees) – head of a peasant (farm) enterprise | |

| 13 | Taxpayer (payer of fees) - another individual - bank client (account holder) | |

| 14 | Taxpayer making payments to individuals | |

| 16 | Participant in foreign economic activity – individual | |

| 17 | Participant in foreign economic activity - individual entrepreneur | |

| 18 | A payer of customs duties who is not a declarant, who is obligated by Russian legislation to pay customs duties | |

| 19 | Organizations and their branches that withheld funds from the salary (income) of a debtor - an individual to repay debts on payments to the budget on the basis of a writ of execution | |

| 21 | Responsible participant of a consolidated group of taxpayers | |

| 22 | Member of a consolidated group of taxpayers | |

| 24 | Payer – an individual who transfers other obligatory payments to the budget | |

| 26 | Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | |

| 27 | Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system | |

| 28 | Legal or authorized representative of the taxpayer | |

| 29 | Other organizations | |

| 30 | Other individuals |

Payer status for individual entrepreneurs

As can be seen from the table above, individual entrepreneurs in 2021, in order to pay insurance premiums as for hired personnel, must indicate the payer status code “14”. If the individual entrepreneur pays insurance premiums “for himself,” the payer status code should be indicated – 09.

If an organization or individual entrepreneur acts as a tax agent and pays, for example, personal income tax for employees, then code 02 is indicated in the payer status in field 101 in 2021. It has not changed. This code was also used in 2021.

Legal entity – “01”, individual entrepreneur – “09”, “14”

According to one opinion, individual entrepreneurs, when paying contributions for themselves, should put code “09” in field 101, and when paying contributions for employees, code “14”; organizations - code “01”. This opinion is based on the fact that the administration of insurance premiums has been transferred to the tax authorities, which, according to supporters of this point of view, makes it possible to put an equal sign between policyholders and taxpayers. The problem with this decision is that the current version of the Tax Code separates the concepts of “payer of insurance premiums” and “taxpayer”.

Sample payment order: new status

Official confirmation from the Federal Tax Service

When filling out field 101 “Payer status” of the payment order for the transfer of insurance premiums, organizations must enter the value “01”, and individual entrepreneurs - “09”. This is confirmed by the letter of the Federal Tax Service dated 02/03/17 No. ZN-4-1/1931.

Tax officials learned that bank software does not allow accepting “payments” from organizations for the payment of insurance premiums with status “14.” Therefore, banks simply refuse to accept payment orders with this status and return them as erroneous. Processing banking software products may require some time from the Central Bank of the Russian Federation (more than six months). Therefore, the Federal Tax Service recommends indicating in field 101 of payment orders, in particular, for the payment of insurance premiums, the following statuses:

- “01” - for legal entities making payments to individuals;

- “09” - for individual entrepreneurs;

- “10” - for notaries engaged in private practice;

- “11” - for lawyers who have established a law office;

- “12” - for heads of peasant (farm) households;

- “13” - for individuals.

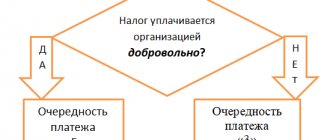

From 2021, in field 101 of the payment order when transferring insurance contributions, you must indicate code 01. In other words, payment orders for the payment of insurance contributions for compulsory pension, medical and social insurance must be filled out as for tax payments. Here is a sample payment order for 2021 for the payment of pension contributions, which indicates the new payer status.

As you can see, the payment order for the transfer of pension contributions indicates a new payer status (code 01 is indicated instead of 08). Besides:

- in the TIN and KPP field of the recipient of the funds - the TIN and KPP of the tax inspectorate administering the payment of contributions are indicated;

- in the “Recipient” field – the abbreviated name of the Federal Treasury authority is indicated and in brackets – the abbreviated name of the Federal Tax Service Inspectorate administering the payment;

- in the KBK field - the budget classification code is indicated, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service. See “How the main BCCs for paying insurance premiums will change from 2021.”

Also see “Payment order for the payment of taxes and insurance premiums in 2021: decoding of the fields.”

Status "08"

This status was applied when transferring insurance premiums in past years, and, according to a number of experts, should be applied now. In particular, payment orders with this particular payer status are accepted by Sberbank Online, rejecting payment orders that indicate other statuses. Let us remind you that status “08” is intended for individual entrepreneurs and organizations that transfer insurance contributions to the budget of the Russian Federation. The problem is that several regional branches of the Federal Tax Service of the Russian Federation gave official answers to policyholders the day before with a recommendation to indicate a different payer status, which is discussed below.

Controversial point

Now let's touch on the main controversial issue related to changes in payer status codes from January 1, 2021. So, as we have already said, the indicated changes are based on the draft order of the Ministry of Finance “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n. However, according to our information, as of January 1, 2021, this draft has not been approved, officially published and, accordingly, has not entered into force. And if so, then no changes have occurred in filling out field 101 of payment orders “Payer Status” and the following conclusions can be drawn:

- even after January 1, 2021, when paying all types of insurance premiums, code 08 must still be indicated as payer status;

- when paying insurance premiums for December 2021, as well as for months related to 2021 (January, February, March, etc.), the payer status must be indicated as 08;

- indicating code 08 when transferring insurance premiums does not entail the occurrence of arrears in contributions;

- banks do not have the right to demand that when paying insurance premiums to organizations from January 1, 2021, code 01 is indicated as the payer status.

If there is an error in the payer status

Let’s assume that changes in filling out the “Payer Status” have nevertheless occurred. If so, then at the beginning of 2021, confusion is possible: some accountants, when paying insurance premiums in the status of a payer, will, as before, indicate 08, others - 01. It is possible that tax authorities will regard one of these options as erroneous. And then there may be arrears in insurance premiums. The fact is that payments under payment orders, which indicate different payer statuses, are posted by the Federal Tax Service to different personal accounts. That is, tax authorities can accept a payment with status 08 as “other obligatory payments” and not insurance premiums. It may turn out that there will be an overpayment for “other payments”, and a debt for insurance premiums. And the tax inspectorate, as is known, can charge penalties and fines for the amount of arrears (Articles 75, 122, 123 of the Tax Code of the Russian Federation). To avoid this, you should submit an application to the inspectorate to clarify the payment (letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125). Please attach a copy of the payment order to your application. Such a statement will be the basis for transferring the transferred amount to insurance premiums. Here is an example of an application to clarify payer status in 2021.

If the commented draft order of the Ministry of Finance was never approved and did not enter into force as of January 1, 2021, then nothing needs to be clarified. After all, then code 08 is the correct code in the payment slip for payment of insurance premiums.

What do the Federal Tax Service say?

In 2021, in field 101 of the payment order for insurance premiums for employees for organizations and individual entrepreneurs, the Federal Tax Service advises entering code 14. Such information can be found on the official website of the Federal Tax Service. If an individual entrepreneur pays insurance premiums “for himself,” then code 09 should be shown. Such information appeared on the official website of the Federal Tax Service in January 2017. Then a joint letter was issued by the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund with the same position. At the same time, according to our information, if organizations and entrepreneurs previously transferred insurance premiums with code 01, then the inspectorate considers such payment to be correct and there will be no arrears. Moreover, in later clarifications in the letter of the Federal Tax Service dated 02/03/17 No. ZN-4-1/1931 it is said that when paying insurance premiums, organizations need to use code 01, and entrepreneurs – 09

What should I do if an error was made when specifying the status code?

If an error was made when specifying the code, the fact that the payment was not transferred to the budget will be recorded. That is, even if money is debited from the sender’s account, it will not be credited to the recipient’s account. In accordance with tax legislation, the tax will be considered unpaid, and this may result in penalties for the payer.

To avoid disputes with the tax service, you should proceed in the following order:

- Check your payment for errors.

- If errors are found, submit an application to the tax office, which will clarify the payer’s status in the payment invoice.

- It is best to reconcile with the tax office on previously paid taxes and contributions. Based on the results of this process, an act will be generated, which is signed by both parties - the taxpayer and the tax service employee.