List of currency transaction codes

- 10100 — Currency transaction code

These are settlement transactions of non-residents for prepayment to a resident for goods exported from Russia.

- 10200 — Currency transaction code

Designates payments made by a non-resident to a resident in the event of a deferred payment for products exported from the Russian Federation.

- 11100 — Currency transaction code

These are settlement transactions of a resident for prepayment to a non-resident for goods imported into Russia.

- 11200 — Currency transaction code

Indicates settlements by a resident if a non-resident has given a deferred payment for products imported into Russia.

- 12060 — Currency transaction code

This operation is the fact of payment by a resident to a non-resident for goods sold abroad without their import into Russia.

Tax agent 06 For a participant in foreign economic activity (legal entity) 08 The payer transfers funds as payment for insurance premiums or other payments to the country's budget 09 The tax payer is a private entrepreneur 14 Payments are made to individuals 16 A participant in foreign economic activity is an individual 17 Foreign trade participant - private entrepreneur 19 Enterprises and their branches that issued an order on the transfer of finances For data about the payer, field codes 8-12 are allocated, which indicate:

- name of the payer;

- Bank account number;

- name and address of the bank;

- Bank code;

- bank account number.

Income The accountant is required to prepare income statements.

It turns out that the FSS department can consider your application for as long as desired.

What to do if you can’t pay with a bank card in an online store

I didn't know what the reason was. I couldn't find the error in my personal account.

Now I will try to talk about the main reasons why an error occurs when paying with a bank card. The main reasons for errors when paying with a bank card. The first reason, which is the most common, is the lack of the required amount on the card. It is recommended to check your balance - to do this you need to call the bank or log into the Internet bank. Sometimes a card has a monthly or daily spending limit.

To check this, you need to call the bank.

This reason may not be immediately clear—if your payment is declined, your balance may not be displayed. The 3D secure authentication error may also be due to incorrectly entering card details in the previous step. In this case, simply repeat the payment and provide the correct information. The second reason is on the side of the payment system.

For example, the Russian Railways payment terminal does not allow payments with MasterCard cards.

General provisions on payment orders

The payment form was developed and approved by the Central Bank of Russia on June 19, 2012 by regulation No. 383-P. Filling out this form must be based on the methodology approved by the Central Bank in the same regulatory document.

Following what is written in Appendix No. 3 of this act, in the 2021 payment order, along with other details, there is field 110.

In addition, based on the composition and description of the payment details, which are attached to the mentioned Regulation No. 383-P, this column is considered a detail indicating an order to the bank or credit institution to make a payment.

Initially, field 110 should reflect the corresponding type of payment in the payment form. This column continues to appear in the 2021 instruction form (see figure above).

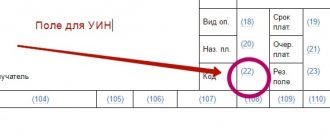

UIP code in the payment

The numbers in this code indicate the payment administrator, the type of payment and the document that obliges it to be made. Therefore, each payment is assigned an individual identifier. But not always. Unfortunately, the current legislation does not clearly explain where to get the UIP in a payment order starting from 2021.

Although in certain cases, affixing this code to the payment document is formally mandatory.

Therefore, it is necessary to have an idea of how to find out the UIP. At the same time, the legislation does not establish the obligation of the payer to independently determine the meaning of the UIP. This code is assigned to the payment by the recipient of the funds and then communicates it to the payer on the basis of the agreement. The bank in which the obligated person has an account opens, when servicing it, checks the presence and correctness of the UIP value in the payment order.

In some situations, if this information is filled out incorrectly, the payment may be rejected by the bank.

What should I enter in field 110 of the payment slip?

Field 110 is intended to indicate the type of payment. It is located at the top of the payment card, where the recipient's information is indicated.

Changes in the order of filling out this detail occurred quite often. So, on April 30, 2014, the Ministry of Finance allowed not to fill it out starting in 2015 (Order of the Ministry of Finance No. 126n). In December 2014, the Bank of Russia recommended indicating the type of payment “0” (letter of the Central Bank of the Russian Federation dated December 30, 2014 No. 234-T), and a year later canceled this recommendation (directive of the Central Bank of the Russian Federation dated November 6, 2015 No. 3844-U).

The Bank of Russia made further changes to the payment type indicator in the payment order on July 5, 2021 by Directive No. 4449-U. For field 110, a special attribute “1” was set. This is the code for payments of budget funds in the form:

- monetary allowance or maintenance for civil servants, including lifelong maintenance for judges;

- salaries to employees of state and municipal institutions, as well as state extra-budgetary funds;

- state-established scholarships;

- pensions and other social payments from the Pension Fund.

Thus, commercial companies and individual entrepreneurs are not required to fill out payment type 110 when paying taxes and insurance premiums. They leave this field blank. Tax authorities and extra-budgetary funds will establish the type of payment according to the BCC (Order of the Ministry of Finance dated October 30, 2014 No. 126).

Currency transaction codes in 2021

— the payer is a non-resident.

Currency transaction code Description of the currency transaction code 10100 These are settlement transactions of non-residents for prepayment to a resident for goods exported from Russia (advance payments), including under an agency agreement, a contract of agency 10200 Indicates payments made by a non-resident to a resident in the event of a deferred payment for products exported from the Russian Federation (deferment payment) 11100 These are settlement transactions of a resident for prepayment to a non-resident for goods imported into Russia (advance payments), including under an agency agreement, a mandate agreement 11200 Indicates settlements by a resident if a non-resident has given a deferred payment for goods imported into Russia (deferred payment) 12050 Payment non-resident in favor of a resident for goods sold abroad without their import into Russia 12060 Payment by a resident to a non-resident for goods sold abroad without their import into Russia 13010 Payment

Errors in tax payment orders

This type of code is indicated in the following cases: When filling out a certificate of foreign exchange transactions - If the payer is a non-resident - If the payer is a resident And the recipient - no Approximate list of some codes: 10100 Settlement transaction of a non-resident for an advance payment to a resident for the export of goods from the Russian Federation 10200 Settlement of a resident and a non-resident if there is a deferred payment 11100 Settlement transaction of a resident for prepayment to a non-resident for the import of goods into Russia In 2015, changes occurred, as a result of which some codes were changed.

Order; Letter of the Treasury No. 42-7.4-05/5.4-53, PFR No. KA-30-24/1165 dated 02.02.2012.

What does the currency transaction type code mean?

The first indicates the class of the transaction, the second – its essence.

Let's look at an example. Operation code – 10100.

Its components:

- 100 – indicates that the buyer made an advance payment.

- 10 – indicates the export of products from the territory of Russia.

The very presence of this code means that this is a transaction with a foreign counterparty.

FOR YOUR INFORMATION! Sometimes an accountant encounters problems when choosing a KVBO. There are a lot of codes in the Central Bank instructions. It is not always easy to decide which one is suitable for a particular operation.

If an accountant is afraid of making a mistake, he can ask a representative of the servicing bank for advice. KVVO is needed for these operations:

- Ruble money transfer from a non-resident.

- Payment for services or products in foreign currency. Money is transferred from a resident to a non-resident.

- Debiting currency to the account.

- Settlements with a non-resident banking institution.

Typically, the code is required when filling out an application for a currency transfer, order, or certificate.

We recommend reading: If the husband takes out a mortgage on himself, ownership

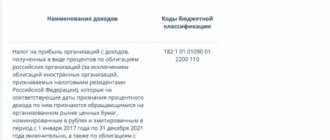

Budget Classification Codes (BCC) for 2021

Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds.

Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt. This code consists of 20 characters - numbers, separated by hyphens into groups, it has the following form XX - X XX XX XXX XX - XXXX - XXX. Each group of characters corresponds to an encrypted meaning determined by the Ministry of Finance.

Let's consider the structure of the profitable BCC, since they are the ones that entrepreneurs mainly have to use (expense codes can be found mainly when returning funds under any government program).

"Administrator". The first three signs show who will receive the funds and is responsible for replenishing this or that part of the budget with them, and manages the received money. The most common codes for businessmen begin with 182 - tax authority, 392 - Pension Fund, 393 - Social Insurance Fund and others. “Type of income” includes characters 4 to 13.

Decision of September 28, 2015 in case No. A49-7641/2015

In the case materials, the Company received an application to clarify the stated requirements, motivated by a typo made in the pleading part of the application submitted to the court, indicating the norm of the Code of Administrative Offenses of the Russian Federation, according to which the Company was brought to administrative liability under the contested resolution. Taking into account that the clarification of the stated requirements was not contradicts the law and does not violate the rights and interests of other persons, the arbitration court, on the basis of an article of the Arbitration Procedural Code of the Russian Federation, accepts it and determines the subject of the claims as challenging the resolution of the Technical Supervision Authority of Rosfinnadzor in the Penza region dated June 16, 2015 No. 55-04-04/15-24 o bringing the Company to administrative liability, provided for in Part 6 of Article RF, in the form of a fine in the amount of 40,000 rubles. In support of the stated requirements, the Company referred to the absence of an administrative offense, considering,

Errors in payment slips for payment of contributions: what are they and how to correct them

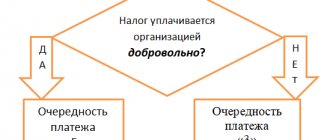

The fact is that all errors made when filling out a payment order can be divided into critical and non-critical. The first are those due to which the amounts did not reach the required Treasury accounts.

In this case, you will have to make the payment again. And non-critical errors can be considered those that do not lead to the non-receipt of money to the budget of the Pension Fund of the Russian Federation or the Social Insurance Fund, so they are corrected by simply clarifying the payment. Using the example of a payment order for the payment of contributions to the insurance part of a labor pension for February 2012, we will show in which columns of the payment order the errors will be critical (they are highlighted in red), and in which - not (they are highlighted in blue).

PAYMENT ORDER No. 3 03/06/2012 Date Type of payment 01 Payer status Amount in words Sixteen thousand rubles 00 kopecks INN 7723045954 KPP 772301001 Amount 16000-00 Marathon LLC Payer Account. No. 40702810838110104803 Moscow Bank of Sberbank of Russia (OJSC) MoscowBank payer BIC 044525225 Account.

Where in the document

Let us say right away that the popularity of payment orders does not eliminate all questions regarding filling out lines and individual details in this form. In addition, every few years, new changes occur in this area that affect the rules for filling out any details. Thus, one of the fields of the payment slip that was often affected by new requirements is line 110.

The figure below shows the legally approved form of payment. The payment type is allocated to the bottom right corner. This is field 110.

Also see “Payment order for the payment of taxes and insurance premiums in 2021: decoding of the fields.”

When is a protection code needed, and how to use it?

Also, its use will help if the sender doubts whether the recipient's account number has been entered correctly. How to set a protection code and transfer funds? In order for the payment to be additionally protected by a code, you need to perform a number of actions.

Users often use the quick transfer form, then, usually, the “Transfer” option is clicked, but in this case the protection code will not be installed, therefore, there will be no additional payment protection.

You can install the code by clicking on the “More features“ option. A page appears and in the “To” field the recipient’s number is entered, then the transfer amount and payment are entered, taking into account the 0.5% commission.

A check mark is placed in front of the column “Protection with a protection code”, for how long it is entered (from 1 to 365 days). If the protection code has not been entered within the period specified in the column, the money is returned to the sender.

Also, money will be returned if you enter the code incorrectly three times.

plbarber.ru

This opportunity is provided by p.

3.6 instructions No. 138-I. All types of such operations are described and systematized in Appendix No. 2 to Instruction No. 138-I of the Bank of Russia dated 06/04/2012.

Important Each type is assigned a specific code consisting of numbers.

In which field of the payment order should I fill in the code?

We recommend reading: What percentage of couples get back together after a divorce?

The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. But in this form there is no explicit field for entering the operation type code. Therefore, it is entered in the “Purpose of payment” field, and there are clear instructions about this in paragraph Info Other errors in the payment order Other errors in the payment order, such as incorrectly indicated KBK, OKATO, INN, KPP and the name of the tax authority, do not prevent receipt tax to the budget (sub.

4 p. 4 art. 45 Tax Code of the Russian Federation). If such errors are made, then the tax is considered paid, but, in accordance with the norm of paragraph.

2 clause 7 art. 45 NK

Invalid beneficiary payment code must be 7

All types of such operations are described and systematized in Appendix No. 2 to Instruction No. 138-I of the Bank of Russia dated 06/04/2012.

Important

Each type is assigned a specific code consisting of numbers.

In which field of the payment order should I fill in the code? The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. But in this form there is no explicit field for entering the operation type code.

Therefore, it is entered in the “Purpose of payment” field, and there are clear instructions about this in paragraph.

Info

Other errors in the payment order Other errors in the payment order, such as incorrectly indicated KBK, OKATO, INN, KPP and the name of the tax authority, do not prevent the receipt of tax to the budget (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). If such errors are made, then the tax is considered paid, but, in accordance with the norm of paragraph.

2 clause 7 art. 45

Tax Code of the Russian Federation, it is required to submit an application to clarify the payment (letters of the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145, dated July 16, 2012 No. 03-02-07/1-176, dated March 29, 2012 No. 03- 02-08/31, Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125, dated December 24, 2013 No. SA-4-7/23263). For information on how to draw up such an application, read the material “Sample application for clarification of tax payment (error in the KBK).”

How to correctly indicate information about the body or person involved in drawing up transfer orders Another important law is Federal Law No. 161 “On the National Payment System”, adopted on June 27, 2011.

How to indicate a currency transaction code in a payment order?

It is for them that the transaction type code is provided for filling in the payment order.

All types of such operations are described and systematized in Appendix No. 2 to Instruction No. 138-I of the Bank of Russia dated 06/04/2012. Each type is assigned a specific code consisting of numbers.

The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012.

But in this form there is no explicit field for entering the operation type code. Therefore, it is entered in the “Purpose of payment” field, and there are clear instructions about this in clause 3.2 of Chapter 3 of Instruction No. 138-I, both for residents and non-residents.

Before the text in the “Purpose of payment” field we write VO in Latin letters, followed by the transaction code from Appendix 2 of instruction No. 138-I, and we enclose all this in curly brackets.

What is a code in a payment order in 2021

To compose it correctly, you need to know the basic codes. Revenue code is a 4-digit number.

By Order of the Social Insurance Fund dated October 31, 2011 No. 434) on the date of payment of contributions;

- recalculates penalties (if everything was paid on time, resets them to zero);

- within 5 working days from the moment the decision is made, notifies you of the German

6 tbsp. 4, part 11, 12 art. 18 of Law No. 212-FZ. But it is not stated anywhere how long it takes to make a decision. We turned to an FSS specialist with this question.

FROM AUTHORITATIVE SOURCES ILYUKHINA Tatyana Mitrofanovna Head of the Department of Legal Support of Insurance in Case of Temporary Disability and in Connection with Maternity of the Legal Department of the Federal Social Insurance Fund of the Russian Federation “Such a period is not established by law.

Chairman's blog

- The period field for medical deductions/contributions cannot be earlier than 072017

- The consumer has reached retirement age

- The amount of medical deduction is greater than the limit

- The month or year for the PERIOD field is incorrect

- Invalid contribution code*

- IIN does not match the specified full name

- The message format must be MT 102

- The amount of medical deduction is less than the limit* *

* When generating payment orders in the SWIFT-file format, when specifying the payment purpose code (PCC) 121, the symbol R must be reflected, and when PCC 122 - M.

Example. {VO01030} is a resident’s purchase of foreign currency for rubles. Important! Latin letters are in capital letters only; spaces cannot be placed inside parentheses.

** The amount of medical deduction is less than the limit - the minimum threshold values for deductions and contributions (245 tenge for employers, 1,223 tenge for individual entrepreneurs, notaries, lawyers, etc.) were canceled by the Ministry of Health of the Republic of Kazakhstan from August 23, 2021.

UIN in payment orders: sample

There is no single UIN for taxes or contributions.

In each specific case the code is unique.

Fill in field 22 of the payment order as follows:

- if the request does not contain UIN – “0”.

- if the request contains a UIN – the value of the UIN;

If you indicate the UIN number in field 22, then the recipients of the funds (for example, tax authorities), upon receiving the payment, will immediately identify that it is an arrear, penalty or fine upon request. And they will take it into account correctly. Using the UIN number, taxes, insurance contributions and other payments to the budget are automatically recorded. Information about payments to the budget is transmitted to the GIS GMP.

This is the State Information System about State and Municipal Payments. If you specify the wrong code, the system will not identify the payment. And the obligation to pay will be considered unfulfilled.

And as a consequence of this:

- the company will incur debt to the budget and funds;

Why is field 22 needed?

Let's figure it out, code 22 in the payment card - what is it and how is it used?

Each payment order consists of many fields that must be filled in with relevant information. For example, in area 3 the number of the payment document is entered, in the fourth - the date, and the name of the payer is indicated in cell No. 8. The payment with field numbers for 2021 is available for download at the end of the article. Since March 31, 2014, an innovation has been introduced in the payment order form - cipher number 22. Payment with fields for 2021 already includes an identifier. The obligation to indicate it is fixed by Order of the Ministry of Finance of the Russian Federation No. 107 of November 12, 2013.

When filling out field 22 in the payment slip, assign a code to those payments that are sent to regulatory authorities and state extra-budgetary funds - the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund.

Many employees responsible for filling out documents are wondering: what is (payment) code 22, what should I write in this cell? This cell is reserved for a unique digital cipher known as UIN (unique accrual identifier) or UIP (unique payment identifier). Each payment is assigned its own special digital value, according to which one or another budget transfer will be carried out.

A special code is necessary for operators processing receipts to speed up the process of crediting payments. Previously, each operation took much longer: it was necessary to check the details of the paying organization, the purpose of the payment order, the cash register, and only after that the transfer was credited. After the appearance of unique codes, the process of processing and entering payments into the database became much easier. If the payer makes a mistake when entering the UIN, then the funds paid will go to unexplained payments, and then a lengthy procedure will follow to clarify or return the money transferred to the budget authorities.

More detailed information about what a UIN is is presented in the article “Instructions: how to correctly indicate the UIN code in a payment.”

Appendix 3. Response codes - decoding actionCode

Contact your store representative to clarify the reasons. -2101 -2101 Blocking by e-mail Blocking by e-mail Payment failed.

Contact your store representative to clarify the reasons. -2021 -2021 Invalid ECI received Invalid ECI received. The code is set if the ECI received in PaRes does not correspond to the acceptable value for a given MPS.

The rule works only for MasterCard (01.02) and Visa (05.06), where the values in brackets are acceptable for the IPS. Payment failed. Please try again later.

-2021 -2021 Rejected by iReq in PARes PARes from the issuer contains iReq, as a result of which the payment was rejected Payment error. Please try again later. If this error occurs again, contact your bank to clarify the reasons.