Definition

Manufacturing overhead costs (POC) are a set of costs incurred during the production process that cannot be directly attributed to the cost of a particular type of product. In other words, there is no criterion that would allow us to directly establish the dependence of the magnitude of such costs on the level of business activity. For this reason, a business's manufacturing overhead costs can also be classified as indirect (indirect) costs.

The most common examples of manufacturing overhead are:

- cost of auxiliary raw materials and materials;

- labor costs for auxiliary and administrative production personnel;

- depreciation costs of industrial buildings and equipment;

- expenses for maintenance, maintenance and repair of industrial buildings and equipment;

- expenses for renting production premises and equipment;

- costs for labor protection and quality control.

Results

To collect overhead expenses, accounting provides special accounts from which the accumulated amounts are written off monthly.

Manufacturing costs are always included in the cost of production. General business expenses can either be taken into account in the cost price or not be included in it, but be attributed to the accounting of financial results from sales. Selling expenses are not taken into account in the cost of production, they are always immediately attributed to the financial result and may have amounts remaining at the end of the month. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Manufacturing overhead allocation

The attribution of commissioning and commissioning to the cost of manufactured products is determined not only by the requirements of financial accounting standards. Also, their inclusion in the cost is necessary to solve the problem of correct pricing.

Important!

The purpose of allocating manufacturing overhead is to determine unit costs and work in process.

As mentioned above, we cannot choose a criterion that would allow us to write off these expenses directly to the cost of a specific type of product. The solution to this problem is to select a cost factor (allocation base) that most closely matches the nature of the overhead costs of the production unit. For example, if the production process is dominated by the labor of workers, then it is advisable to use the man-hours of the main workers as the distribution base. If the manufacturing process is machine-dominated, then the machine hours of the production equipment should be used as the basis for allocating manufacturing overhead costs. In practice, the amount of direct labor costs or the number of units of production is also quite often used as the distribution base.

The commission distribution rate is calculated using the following formula:

| PNR distribution rate = | Manufacturing overhead |

| Distribution base |

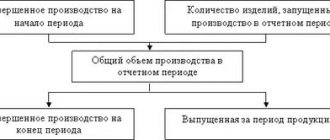

Collection of direct production costs

For the accumulation of direct expenses in accounting, accounts 20, 23, 29 are intended, selected depending on the purpose of the production corresponding to these accounts:

- basic,

- auxiliary

- serving.

On the same accounts, the final cost of the created products will be formed by adding the required share of overhead costs to the direct costs.

Analytics on accounts 20, 23, 29 is organized by:

- by department;

- types of products created;

- cost items, among which, in addition to those directly related to direct ones, there will also be corresponding types of overhead costs included in the cost.

The list of items of direct production costs is, as a rule, very limited and most often involves a breakdown:

- for materials,

- workers' salaries,

- salary accruals.

Planned and actual commissioning distribution rates

In its accounting policy, a company can choose to distribute commissions at the actual or planned (standard) rate. Both of these approaches have their advantages and disadvantages, so we will dwell on each of them in detail.

To calculate the actual rate of distribution of commissions, the following formula is used:

| Actual PNR distribution rate = | Actual commissioning |

| Actual distribution base |

Important!

A critical disadvantage of this approach is that the distribution rate can only be calculated after the closing of the reporting period, when the actual amount of overhead costs and the distribution base becomes known. Until this point, it is impossible to determine the full cost of production.

Since during the reporting period it is necessary to repeatedly evaluate the cost of inventory and justify the selling price, the use of this approach in practice is quite rare.

Due to the shortcomings of the approach to distributing production overhead costs at the actual rate, in practice, as a rule, the approach to distribution at the planned (standard) rate is used. The following formula is used to calculate it.

| Planned PNR distribution rate = | Budgetary commissioning |

| Budget distribution base |

Important!

When determining the planned rate of distribution of commissions, it is advisable to use data from the quarterly or annual budget. Longer periods allow better identification of relationships between costs and output.

The problem with this approach is that, in practice, actual manufacturing overhead costs will always differ from those budgeted, with very few exceptions. This leads to the appearance of over- or under-distributed PNR.

If the company's accounting policy assumes normal calculation of the cost of manufactured products, then the following formula is used to determine the amount of distributed commissioning.

Distributed commissions = Planned rate × Actual distribution base

MDS standards 81 33.2004

For overhead costs associated with contractors carrying out major repairs of production facilities, the application of standards is provided in accordance with the sizes established for construction work.

Construction work as part of the economic method is subject to inclusion in overhead costs in accordance with an individually assigned rate. The estimated standards for this work plan provide for the use of a coefficient of 0.6.

When determining the cost of semi-finished products and blanks for production, overhead costs are subject to calculation according to an individually assigned norm, or in the established amount of 0.66 of the payroll amount for workers engaged in construction and mechanization.

Starting from 2011, the provisions of MDS 81-33.2004 (clause 4.7) and MDS 81-34.2004 (clause 3.7) are terminated, and a new coefficient applied to overhead costs is introduced in the amount of 0.85.

The exceptions are standards financed from the state budget for:

- piling works;

- construction of bridges;

- pipeline;

- soil stabilization measures;

- laying tunnels and subways.

In addition, when determining the cost of a construction or reconstruction product, performing major repairs, routine repairs, it is provided for the use of reduction factors at the level of 0.85 for overhead costs, as well as 0.8 for estimated profit at current prices in the following cases:

- assignment to overhead costs according to aggregated standards (main types of construction, according to MDS 81-33.2004 and MDS 81-34.2004);

- allocation according to general industry standards of estimated profit as part of the amount of construction and installation activities in the amount of 0.65 or 0.6 of the cost of repair and construction work (MDS 81-25.2001);

- according to the recommended standards of estimated profit (construction and installation work) according to letter No. AP-5536-06 of Rosstroi of the Russian Federation dated November 18, 2004.

Under-allocated and over-allocated PNR

In practice, we may encounter two situations that require adjustments to financial accounting data.

- If in the reporting period the amount of distributed commissions is greater than the actual ones, then the resulting difference is redistributed commissions.

- If in the reporting period the actual commissions turned out to be more than the allocated ones, then the resulting difference is underdistributed commissions.

The resulting difference is written off in financial accounting using one of two methods.

- The adjustment amount is written off in full to cost of goods sold.

- The adjustment amount is written off to the following accounts in proportion to their balances: “Cost of goods sold,” “Finished goods,” and “Work in progress.”

Important!

This problem is discussed in more detail in the next section.

Shop and general plant commissioning distribution rates

In practice, a situation quite often occurs when the production process has a workshop structure. Provided that separate accounting of production costs is maintained by each separate production unit, the distribution of production overhead costs can be carried out at shop rates.

Important!

Since the basis for the distribution of commissioning work among production divisions can be different cost factors, the use of shop rates makes it possible to take into account as fully as possible the nature of the production overhead costs of each of them. Due to this, a more accurate estimate of the cost per unit of production and inventory is achieved.

An alternative to using shop floor rates is to use a plant-wide commission distribution rate. This approach does not require the organization of separate accounting of overhead costs by each production department. However, the cost estimate obtained as a result of its application will be less accurate, since one cost factor is selected to distribute the production overhead costs of all departments, which does not allow them to fully take into account their nature.

Calculation procedure

Enterprises do not always understand how to calculate overhead costs; more precisely, the difficulties are largely due to the fact that it is impossible to immediately attribute them to a certain type of finished product or service. However, you cannot turn a blind eye to them, because this can cause the formation of an underestimated cost, which will ultimately negatively affect the amount of profit and profitability of production.

To correctly determine the amount of overhead costs when calculating costs per unit of production, the following methods of their distribution are used:

- proportional to the price of materials and raw materials used;

- in proportion to the remuneration of key workers;

- in proportion to revenue received, sales volume or other performance indicators.

There is no unified method. For example, if a company employs a large number of production workers, then it would be most logical to calculate overhead costs based on the wage fund. Only in this case will we be talking about the wages of production workers, excluding the wages of the management sector.

Example . The enterprise has 2 workshops: for the production of milk and cheese. In a month they produce 5,000 liters and 2,000 kg respectively. 150 and 200 thousand rubles are spent on paying workers, respectively. The cost must take into account overhead costs in the total amount of 100,000 rubles. How to distribute them? If we use the method of calculation proportional to wages, it turns out that overhead costs need to be distributed in the proportion of 150:200, that is, the cost of 1 liter of milk will include: (100,000 * 150/(150+250)/5,000) = 8, 57 rubles. And the cost of 1 kilogram of cheese: (100,000 * 200/(150+250)/2,000) = 28.57 rubles.

Some industries have their own overhead cost standards that businesses need to apply. For example, such exist in the chemical and mining industries, construction. The standards are established by the relevant regulations.

Similar articles

- What is included in overhead costs in the estimate?

- What can be classified as indirect costs?

- Direct costs

- Direct and indirect costs

- Production cost

Variable and fixed manufacturing overheads

A very important aspect of preparing information for the needs of management accounting is the classification of commissioning projects in relation to their relation to production volume.

Variable production overhead costs change in direct proportion to the volume of activity, and fixed manufacturing overhead costs remain unchanged (within the relevant range) as activity volumes change.

In practice, the behavior of quite a few manufacturing overhead items does not fall into any of the cases described above. Such PRPs are called conditionally variable, since although they depend on the volume of production, this dependence is not directly proportional. For further analysis of expenses in such items, their variable and constant components must be distinguished; for example, this can be done using the method of maximum and minimum values.

Important!

Classification of production overhead costs into variable and fixed is one of the stages in preparing information for the analysis of “costs - production volume - profit”.

Existing types

All overhead costs can be divided into the following types:

| General production | These include:

|

| General economic | Includes costs for:

|

| Sales costs | This includes costs for:

|

Example

has a workshop production structure. Pre-processing of products takes place in the machining workshop, and then the resulting semi-finished products are transferred to the assembly workshop, where the products are completed by processing.

The table below shows some budgetary indicators for the reporting quarter.

At the end of the reporting quarter, the following actual indicators were achieved.

The management accountant is tasked with the following tasks.

- Calculate the shop floor and general plant standard (planned) commissioning rate distribution.

- Calculate the shop floor and general plant actual commissioning rate distribution.

- Determine the amount of under- or redistributed PNR.

Additionally, the following information is known:

- the basis for the distribution of overhead costs of the machining shop is the machine-hours of equipment operation;

- the basis for the distribution of overhead costs of the assembly shop is the man-hours of work of the main workers;

- the accounting policy establishes the man-hours of work of the main workers as the basis for the distribution of production overhead costs at the general plant level;

- The company uses normal costing of manufactured products.

The most difficult nuances

Cost items for construction

The full list of all overhead items in 2021 is extremely broad and can be classified into one group or another.

Administrative and economic costs include:

- costs for salaries of administrative and economic personnel;

- expenses for administrative staff, including employees and specialists;

- expenses for line and maintenance personnel;

- payments under the Unified Social Tax for employees from AHP, employees of servicing vehicles;

- postal services, telegraph, long-distance calls, use of cellular communications, other means of communication, the Internet;

- payment for computer upgrades, installation of new programs, PC maintenance;

- payment for printing works;

- payments for the maintenance/operation of buildings, areas for agricultural production;

- payment for the services of lawyers, notaries, auditors, information services;

- purchase of stationery;

- business trips, traveling expenses of employees;

- maintenance of the company's vehicle fleet and garages for it;

- employee relocation expenses;

- various types of fees for employees and delivered products or raw materials;

- Banking services;

- depreciation as part of the maintenance of the management apparatus;

- entertainment expenses;

- payment for services to conduct market research in order to stimulate the process of product sales;

- other expenses related to the functioning of the administrative and economic part.

The second large group of items are expenses for:

- personnel training, education, training;

- unified social tax for employees involved in construction work performed as overhead costs;

- sanitation and hygiene measures;

- depreciation, rental, repair of mobile structures used for sanitary or domestic purposes;

- remuneration of service personnel working in the field of production maintenance;

- expenses for creating working conditions;

- services of outside legal entities persons organizing the process of nutrition and provision of medical services for employees;

- safety measures;

- expenses for workwear for workers;

- social insurance contributions;

- Carrying out medical examinations and workplace certification.

Separately, other groups of overhead cost items are distinguished:

- for all construction work and related activities at construction sites;

- other overhead costs associated with intangible assets, bank payments, loans, advertising costs;

- cost items not taken into account in the standards, but attributable to overhead costs (payments of insurance premiums, contributions to insurance funds, tax, deductions by law, certification, commission fees, etc.).

Transport share of costs

It is especially important to take into account transportation costs in transactions when planning estimates.

This group includes many process-related indicators:

- purchase of vehicles for production purposes;

- rental of vehicles for production needs;

- operation and repair of production vehicles;

- payment of expenses for fuel and lubricants;

- similar costs of transport used for business purposes.

An estimate must be drawn up that includes all needs regarding transportation costs, taking into account likely changes in current prices or the cost of services. It is quite difficult to determine the exact value of transportation costs, which entails the use of short periods of time in calculations. The degree of accuracy of calculations also depends on production volumes and current and ongoing needs for transport and other equipment.