What does field 101 mean in a payment order?

The document for non-cash payments with the budget and other counterparties has its own rules for filling out.

Each of its cells (fields) is drawn up in accordance with current regulations, depending on the category of payment, the owner of the current account and the direct recipient of the funds. The main points are stated in the Bank of Russia regulation “On the rules for transferring funds” dated June 19, 2012 No. 383-P. Read more about the procedure for issuing a payment document in the article “How to fill out a payment order in 2021 - sample?” .

Field 101 is reserved for a coded 2-digit designation of the status of the payer - the sender of funds. It can be an organization, an individual entrepreneur, a lawyer, the head of a peasant farm, or another individual. Also, the completed field is intended to indicate a tax agent, a participant in foreign economic transactions.

The funds received are credited to different personal accounts depending on the payer’s status.

ATTENTION! From 05/01/2021, be sure to fill out field 15, which indicates the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). From this date, the details of the Treasury accounts and the name of the recipient bank also change. The period from 01/01/2021 to 04/30/2021 is transitional. Those. The bank will accept payments with both old and new details. This follows from the letter of the Federal Tax Service of Russia dated October 8, 2020 No. KCh-4-8/16504. See here for details.

ConsultantPlus experts explained in detail how to correctly fill out a payment order to pay taxes. If you do not have access to the K+ system, get a trial online access for free.

Payment of taxes and contributions through the banking portal

Not all payments require filling out field 101. If payment for preschool services is expected, then an individual’s account is used and the column is filled in automatically.

To complete the payment procedure you need to perform a number of steps:

- Log in to the portal using your username and password.

- Go to the “Payments and Transfers” tab.

- Open “Transfer to organizations”, select the desired institution from the list or enter details to identify the organization.

- Specify the account from which payment will be made.

- Fill in the payer information (name and address). Leave field 101 blank.

- Specify the payment amount.

- Confirm the operation by entering the code from the SMS notification.

Options for filling out field 101

The rules for filling out the payer status in field 101 are contained in Appendix 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

Read about what problems with choosing a status occurred when making payments for insurance premiums in the material “Main payer statuses in a payment order .

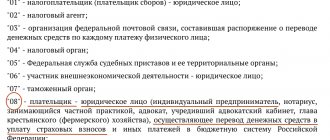

The following codes can be considered the main operating details:

- 01 - taxpayer-organization, any legal entity.

- 02 - tax agent. This status is most often found when paying personal income tax for employees, VAT for lease agreements concluded with municipal organizations.

- 08 - this code is used by enterprises and other individuals who pay insurance premiums for employees.

- 09, 10, 11, 12 - self-employed persons (individual entrepreneurs, notaries, lawyers, farmers) paying taxes for themselves.

- 13 - taxpayers - other individuals.

Note! From 10/01/2021, individual entrepreneurs, lawyers, notaries and heads of peasant farms, when transferring money to the tax office, will indicate payer status code 13, which is currently used by individuals. We described all changes in the details for filling out a payment order here.

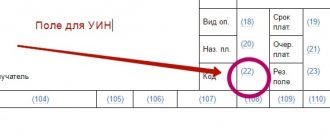

Field 101 of the payment order in 2021 does not have to be filled out in every case of transfer of funds. The presence of payer status indicates the recipient of the payment as the entity in whose accounts taxes, contributions and other revenues are accumulated. In such cases, banks are obliged to ensure that subsequent cells 102–110 are also filled out. If the required data is missing, 0 is entered. An empty field is not allowed. The exception here is field 110, which does not need to be filled in at all.

For more information about the situation with the 110th field, read the article “The issue of the 110th field of the payment card has been finally resolved.”

Codes 15 and 20 are used by credit organizations or their branches, payment agents who transfer funds for individuals on the basis of a general register or individually.

Code 24 is indicated by individuals making payments of insurance premiums or other payments to the budget.

Thus, if a business entity transfers insurance premiums for injuries to the Social Insurance Fund for its employees, the payer’s status is indicated with code 08, regardless of whether it is an organization or an individual entrepreneur.

Example 1

What code should be entered in field 101 when transferring personal income tax? It is incorrect to use status 01, which indicates the payer is a legal entity. In this case, when transferring funds by tax agents for their employees, it is necessary to enter 02. Entrepreneurs paying income tax use code value 09. Notaries transferring personal income tax - code 10, lawyers - code 11. Other individuals who pay tax resulting from the provision of one-time services, enter code 13 in the status field.

However, from 10/01/2021, individual entrepreneurs, lawyers, notaries and heads of peasant farms, when transferring money to the tax office, will indicate payer status code 13, which is currently used by individuals. We described all changes in the details for filling out a payment order here.

Example 2

What payer status is indicated when paying land tax?

Field 101 is filled in depending on the owner of the land plot. For organizations, the payer status is 01. Entrepreneurs who use land in their activities related to making a profit enter code 09. Land tax in cases where the owners are other individuals is paid with code 13.

Since November 2021, the rule has come into force that payment of tax is possible by a third party. Filling out a payment document in this case has its own characteristics.

more about preparing a document for tax payment by a third party in the following materials:

- “The rules for filling out payment orders when paying taxes by third parties have been approved”;

- “The nuances of payment when paying tax for a third party.”

Results

The payer status is filled in field 101 of the payment order, code from 01 to 26 is used when making payments to the state budget. Depending on the code, payments are classified as taxes and fees from individuals, individual entrepreneurs, organizations acting as tax agents, parties to foreign trade transactions and participants in the procedure for forced debt collection.

Lifehack . We tell you how to quickly get money. We fill out an online application for a card, make purchases and do not pay interest for up to 55 days. The decision will be known immediately, the card will be delivered to your home free of charge.

Sources

Errors when filling out field 101 in a payment order

An incorrectly specified payer status code leads to possible arrears of taxes and contributions, accrual of penalties, fines, and disagreements with regulatory authorities.

The most common mistake in using payer status can be considered the transfer of personal income tax for employees with code 01 indicated in field 101 - as an organization. This is incorrect, since in this case the subject acts as a tax agent. The correct payer status would be code 02. The same applies to cases of VAT transfer when renting for municipal institutions, when the organization acts as a tax agent.

For examples of indicating the payer’s status, see the material “Correctly indicate the status in payment orders in 2021” .

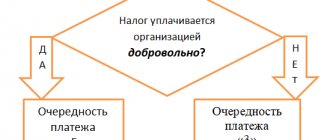

Invalid payer status: procedure

If field 101 in the 2021 payment order is filled out incorrectly, the organization may experience arrears. This is due to the fact that for different payer statuses, tax authorities indicate the amount in different personal accounts. For example, one organization can be both a VAT payer and a tax agent for this tax. In this situation, if you indicate the wrong status, there may be an underpayment for one type of tax and an overpayment for another.

Tax authorities will charge penalties and fines, since the amount of tax was not actually paid on time. To prevent this from happening, submit an application to the tax office to clarify the payment (letter of the Federal Tax Service of Russia dated October 10, 2021 No. SA-4-7/19125). In the application, indicate the number and date of the payment, and also attach a copy of it. Upon receipt of the application, tax officials will reconcile the calculations and make a decision. If it is positive, then the penalties are canceled. The inspection must notify of its decision within 5 days.

There is a second option to fix the error:

- transfer the required amount using the correct details;

- refund the excess amount paid.

In the second case, you will not face a fine, but the tax authorities will not remove the penalty. Since the payment date will be later with the correct details.

What to do if the payer status is incorrect?

If you fill out field 101 incorrectly in the 2021 PP, the organization that made the mistake may experience arrears. It is formed due to the fact that the Federal Tax Service, depending on the status of the payer, indicates the amount in different personal accounts. For example, one company is both a VAT payer and an agent for it. In this case, an arrear is formed, for which the tax service may impose fines and penalties.

To avoid such a situation, it is necessary to fill out an application for correction of payment and take it to the Federal Tax Service (letter dated October 10, 2021 No. SA-4-7/19125). It is necessary to indicate the date and number of the PP and offer a copy of it.

Based on the application, the Federal Tax Service will conduct an inspection and make a decision. If the outcome is positive, the pennies will be cancelled. Notification from the Federal Tax Service must be received within 5 days.

There is also a second option: the arrears are paid off by receiving the missing amount paid using the correct details. In this case, fines from the Federal Tax Service cannot be assessed, but pennies are not cancelled. This is due to a late payment date using the correct details.

Application form for payment clarification : download the form

Consequences of incorrect execution of payment orders

An incorrectly completed payment order indicating erroneous details may result in liability for late payment. In sub. 4 p. 4 art. 45 of the Tax Code of the Russian Federation provides examples in which cases errors in payment documents do not allow the taxpayer’s obligation to independently calculate payments to be considered fulfilled:

- incorrect account number;

- There is an error in the name of the recipient's bank.

Other cases of erroneous filling out of payment slips are not grounds for refusal to credit payments. In such cases, a business entity has the right to contact the tax office to clarify payments.

Judicial practice also indicates that a decision in such situations will most likely be made in favor of the taxpayer (Resolution of the Federal Antimonopoly Service of the Moscow District dated 08/07/2009 No. KA-A41/7564-09 in the case under consideration No. A-41-10152/08) .

Periodic reconciliation with the tax inspectorate and extra-budgetary funds will allow you to identify possible errors in the preparation of payment documents, credit the required amounts on time and avoid further conflicts and misunderstandings with inspectors regarding the amount of arrears.

More codes

As you can see, for insurance premiums, the status of the compiler can generally take the values “01”, “08”, “09” or “13”.

As for personal income tax, the status of the compiler should matter:

- “02” – tax agent preparer status;

- “13” is an ordinary individual.

In relation to the state duty, the status of the preparer in most cases will be “08”.

Please note that the status of the compiler of a fine depends on which authority administers this sanction - tax authorities, Social Insurance Fund, customs, etc.

Also see “Deciphering the abbreviations of payment basis codes in a payment order.”