When adjustment is required

Be sure to submit an amendment if an error led to an underestimation of the amount of tax paid. There are two options for this error:

- the tax base is underestimated, for example, if you forgot to reflect sales in the sales book;

- the amount of tax deductions is inflated, for example, when deducting VAT on incorrectly executed invoices or when deducting VAT on expenses not related to activities subject to VAT.

The law says that if the amount of tax payable is underestimated, filing an amendment is the responsibility of the taxpayer (Clause 1 of Article 81 of the Tax Code of the Russian Federation).

An amendment must also be submitted if the parties have retroactively reduced the price of goods or services sold. This leads to the fact that the buyer’s expenses decrease, which means the amount of VAT payable increases. Such a price change is possible by providing a retrospective discount, which we discussed in the article “VAT on discounts and premiums.”

The form is submitted not only by taxpayers, but also by tax agents. But adjustments are only needed for those payers for whom an error was made.

How to fill out a payment order for additional VAT payment

- sells products, provides services or performs work subject to VAT;

- donates products, provides work or services free of charge. The tax base for VAT in this case is the market price of products or services;

- transfers products (works, services) to our country for its own needs. These transactions are subject to VAT if the company did not take into account the costs of them when calculating income tax;

- performs construction and installation work for its own needs;

- imports the product.

The phrase about the purpose of the payment ends with a mention of the amount of VAT included in the amount paid, or the absence of tax. The requirement to highlight VAT in settlement documents as a separate line is contained in clause 4 of Article 168 of the Tax Code of the Russian Federation. An exception is made for transfers for taxes and insurance fees, where VAT information is not indicated.

When it is not necessary to submit a clarification

The clarification may not be submitted in two cases: the error does not affect the amount of VAT payable, or the error leads to an overstatement of tax. Then submitting an update is your right, not your obligation (Clause 1, Article 81 of the Tax Code of the Russian Federation).

Due to an error, the VAT amount has not changed

Not all errors lead to VAT distortion. Some of them do not affect the tax amount in any way. For example, an error in the number or date of the invoice, in the customs declaration number, in the details of the counterparty, and so on. In this case, it is not necessary to submit a clarification.

During a desk audit, a declaration with such an error will not pass formal logistics control, and the Federal Tax Service will ask you for clarification. In your response, indicate the correct information that should be in the declaration and send it to the Federal Tax Service within 5 working days.

The Federal Tax Service, in its letters dated December 3, 2018 No. ED-4-15/23367 and dated November 6, 2015 No. ED-4-15/19395, asks in such cases to submit an update along with explanations, even if the error did not lead to an understatement of the tax. The letter does not have legislative force; submitting an amendment is still your right.

An error resulted in an overpayment of taxes.

If an error has led to an overpayment of VAT, use any of three ways to eliminate it (clause 1 of Article 54 and clause 1 of Article 81 of the Tax Code of the Russian Federation):

- submit an updated declaration in the period in which the error was discovered;

- correct the error by reducing the tax base in the period in which the error was found;

- do nothing if the amount of overpayment is not significant for the company.

The tax base of the current period can be reduced not only due to errors in past declarations, but also due to changes in tax legislation, if they have retroactive effect. For example, you expanded the list of income that can be excluded from the tax base, or changed the list of expenses that you took into account when calculating VAT.

The period for eliminating an error related to an overpayment is limited to a three-year period for VAT refund. It starts from the day when the organization or individual entrepreneur learned about the fact of overpayment.

Important! For tax authorities, filing an adjustment may serve as the basis for conducting an on-site tax audit for the period being adjusted (clause 4 of Article 89 of the Tax Code of the Russian Federation).

Results

If errors are discovered in the original VAT return that result in an overstatement of tax, an amended return may be required.

It will allow sellers to provide actual data on sales, and counterparties to avoid problems with deductions. When reducing VAT in the declaration, tax authorities may request clarifications, which must be submitted within five days in electronic form. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for filling out an updated VAT return

When filling out the clarification, follow the same rules as when preparing the initial declaration. The filling procedure is fixed in the Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/ [email protected]

Include in the updated declaration:

- all sections completed previously in the initial report, no matter with or without corrections;

- all sections that were not completed in the initial report, but have been completed now;

- Appendix No. 1 to Section 8, if you filled out an additional sheet of the purchase book;

- Appendix No. 1 to Section 9, if you filled out an additional sheet of the sales book.

For clarification on the title page, be sure to fill in the “Correction number” field. Enter the number “1” if this is the first adjustment for the period, “2” if it is the second, and so on. Quantity is not limited.

Also, do not forget about the signs of relevance in sections 8 and 9. On line 001, indicate the sign of relevance of the previous information:

- “1” — section data is current, no changes;

- “0”—there are corrections in the section.

When making changes to the book of purchases or sales after the expiration of the tax period, fill out additional sheets from Appendix No. 1 to Section 8 or 9, respectively.

When indicating the number “1” in section 8, you do not need to fill out lines 005, 010 - 190 of section 8, and when indicating the number “1” in section 9, you do not need to fill out lines 005, 010 - 280 of section 9. (Letter of the Federal Tax Service of Russia dated 21.03 .2016 No. SD-4-3/ [email protected] ). That is, if you put the number “0” in line 001 in section 8 or 9, then the information from the primary declaration is transferred to these sections without changes.

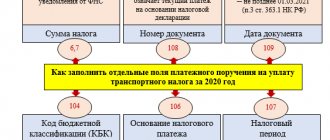

Sample of filling out a payment order for VAT payment

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Deadline for filing an updated VAT return

There is no deadline for submitting clarifications. However, penalties and fines depend on the date the adjustment is submitted if the adjustment increases the amount of VAT. Whether sanctions will be applied to you or not depends on the filing deadline.

Submitted the updated declaration before the expiration date of the primary report . In this case, there will be no fines or penalties.

The clarification was submitted after the deadline for submitting the primary declaration, but before the tax payment date . Liability can be avoided if you submit an adjustment before the tax authorities find the error or schedule an on-site audit.

The adjustment was submitted after the deadline for filing the primary report and after the deadline for paying the tax . Liability can be avoided if the conditions are met (clause 4 of Article 81 of the Tax Code of the Russian Federation):

- you submitted an amendment before the tax authorities noticed the error or scheduled an on-site audit, and transferred the arrears and VAT penalties before submitting the adjustment;

- The tax authorities did not find any errors during an on-site inspection of the declaration for which the adjustment was submitted.

Payment Order Upon Payment of VAT Before Submitting the Clarification

thanks for answers! One more question regarding payments. You need to pay a fine for late filing of your UTII return for the 4th quarter of 2021. The tax office sent a decision to prosecute And I again have questions about the same fields:

I am concerned about the question of how to correctly fill out a payment order, namely: field 106

“Payment basis code”,

I think, you need to indicate

the PO

- voluntary repayment of debt for expired tax periods, if the tax office has not issued a demand for payment of taxes;

Main errors in the VAT return and ways to eliminate them

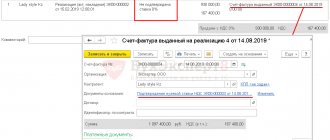

The sales invoice was not reflected in the sales book

Be sure to submit an amendment, as you have underestimated the amount of tax payable. We register the forgotten invoice on an additional sheet of the sales book in the quarter when the sale occurred.

In the clarification, we fill out Appendix No. 1 to Section 9. In term 001 of the Appendix we write “0” and transfer the data from the additional sheet of the sales book.

Before submitting the declaration, we pay additional VAT and penalties, otherwise the tax authorities will issue a fine.

Understatement of VAT due to a technical error in the invoice

We ask the seller to issue a corrected invoice. In the additional sheet we cancel the incorrect invoice and register a new one. We write the amount for the canceled invoice with a minus sign, and for the corrected invoice with a plus sign.

The indicator of relevance in sections 8 and 9 is “1”, and in Appendix No. 1 to section 9 – “0”.

Duplicate invoice in sales book

On an additional sheet we write down the “double” invoice with a minus sign, that is, we cancel it. In sections 8 and 9 we indicate the relevance indicator “1”, and in Appendix No. 1 to section 9 - “0”.

Samples of payment orders for VAT 2021

The company transfers in August the current VAT payment and the amount that it should have paid no later than July 25. For the current VAT, write down the TP in field 106, KV.02.2021 in field 107, and the date when the company signed the declaration for the second quarter in field 109. For a late payment, write ZD in field 106, KV.02.2021 in field 107, and 0 in field 109.

Current VAT and tax on demand. It is necessary to issue two payment orders for VAT if the current payment and the tax on demand for the same quarter are transferred on the same day. For example, the company did not pay 1/3 of the VAT on time in July for the 2nd quarter. The inspection made a requirement. It is necessary to draw up a separate order for the payment of VAT upon request and another payment slip for the current VAT.

We recommend reading: Free Consultations on Labor Disputes 2021

What should I include?

When submitting, the same declaration form is filled out, including the data that was not entered in the first version or was entered with errors. The difference between the data provided and the updated data is not indicated.

The clear structure of the cover letter provided has not been established, so it can be provided on the organization’s regular letterhead with all the necessary points included. The form must include :

- Details of the tax office accepting the declaration.

- Organization details.

- Name of the tax being adjusted.

- An indication of the article regulating the right to submit clarification (clause 81 of Article TC).

- The covering letter must indicate the reason for filing the clarifying declaration.

The more serious the mistake made in filling out the declaration, the more detailed the reason why this happened must be indicated. If the defect is not serious, then it is enough to indicate the reason as an error in arithmetic calculations. - The period for which errors were made in the report.

- Names of the fields to which changes have been made.

- New values of incorrect indicators from the primary declaration.

- Confirmation of additional payment of the missing amount from the penny and payment details.

- List of attached documentation.

- Signature of responsible persons.