Russian citizens who have dependent disabled children under the age of 18, as well as supporting adult disabled children of groups 1 or 2 under the age of 24 who are full-time students, have the right to take advantage of an income tax deduction.

In this case, the amount of taxable income will be reduced by the amount of the fixed deduction established at the federal level. The accrued income tax will also be reduced in the corresponding proportion.

This mechanism was introduced in order to provide additional state support to families raising disabled children and, according to Article 218 of the Tax Code of Russia, applies to:

- each parent of a disabled child, even if they are divorced, never married or live together without registering a civil marriage;

- adoptive parents;

- spouses of the natural parent (stepfather or stepmother).

All of the above categories of citizens must be tax residents of Russia. These are persons who stay in the country for at least 183 days a year.

How to get a 2-NDFL certificate?

If you need to issue a 2-NDFL certificate to provide to bailiffs, then in theory this should not pose any difficulties. If you believe Article 62 of the Labor Code, then after submitting an application to the accounting department, the document must be prepared within three working days. Moreover, it will be legal only when the manager certifies it with the personal signature and seal of the company.

In practice, obtaining a 2-NDFL certificate to provide to bailiffs is not always as easy as it seems. Accounting often misses deadlines, and the director may find himself on a business trip at the most inopportune moment.

What to do if you need this document urgently? After all, even if your workplace issued you a certificate in a timely manner, small inaccuracies made during its execution can lead to the legal nullity of such a document.

Common mistakes when issuing a 2-NDFL certificate

- The date of issue of the certificate must be indicated only in this way: day, month, year (for example, 03/17/2016). Any other format is considered invalid.

- If there is no signature (necessarily with a transcript) of the accounting employee who issued the certificate, it is also considered invalid. You should also pay attention to the fact that the signature is placed only in the “tax agent” column and only in blue ink. An important point is that there cannot be a print on top of it.

- The stamp on the 2-NDFL certificate is placed strictly in the lower left corner of the sheet, in the designated place.

It should also be remembered that inaccuracies made during the preparation of the certificate cannot be corrected. If an error is discovered, you will again have to contact the accounting department with a request to issue a new document, and this is an extra time investment.

All reference books on income and deduction codes can be found on the Internet. Try to use exclusively modern and verified documents, since in 2012 certain changes were made to the code books. Is there a deduction code for alimony in personal income tax certificate 2? It is necessary to immediately place all aspects on this issue:

- Alimony is not taxed, therefore, it is not reflected in the income certificate;

- Alimony is calculated from the total amount of wages, and is indicated in the certificate with code 2000. A tax of 13% is required to be deducted from this amount.

Also on the topic: How does the alimony court proceed, how to behave and what will happen if the defendant does not appear at the hearing

Who is responsible for deducting child support?

The next important step in the alimony withholding procedure is to understand who should make the calculation and who is responsible for withholding the alimony. Article 109 of the Family Code of the Russian Federation tells us this, according to which the obligation to withhold alimony is assigned to the organization in which the person paying alimony works. In particular, the accountant of the organization where the person works will calculate alimony.

A writ of execution received by an organization is subject to mandatory registration in a special journal, after which it is handed over to the accountant of this organization against signature. The accountant is obliged to notify the bailiffs in writing of the receipt of the writ of execution, after which the writ of execution itself is transferred for storage until:

- dismissal of an employee from his place of work;

- a judicial act canceling the writ of execution;

- in the event of the death of the person for whom the alimony was intended.

It should be remembered that a mandatory condition for deducting alimony is the presence of the original document of execution or a notarized agreement. But you shouldn’t be happy about someone whose original writ of execution was lost; in order to get a duplicate, it’s enough to contact the court that made the decision in this case.

You may also be interested in:

- The amount and procedure for paying child support from a non-working parent in Ukraine

- Where and how to apply for alimony?

- What is the state fee for collecting alimony? (All conditions and examples)

- What to do if the court refuses alimony?

Watch also the video about deducting alimony from “non-salary” income:

Alimony deduction code in certificate 2 personal income tax

In other words, there is no such thing as an alimony deduction code.

At the same time, you need to be very careful when issuing a certificate. Please note that only 25% of alimony is deducted per child.

The standard tax deduction is the amount of earnings on which personal income tax will not be withheld at the rate of 13%. This benefit allows you to increase the parent's monthly income, as it reduces the tax base.

If parents do not work, they are not payers of personal income tax, so they are not entitled to a tax deduction. The benefit is provided for each child in the family to parents who work.

It does not matter whether the child is a native child, adopted or under guardianship. The size of the tax benefit depends on the income of the parents, the number of children in the family and their health. The general procedure for providing and the amount of benefits is provided for in Article 218 of the Tax Code of the Russian Federation:

- The tax base decreases from the month in which the child is born until the end of the year in which he turns 18 years old.

Adverse consequences

Mention should also be made of arrears of alimony, which arise only if the court establishes the fact of evasion of obligations, provided that the other party has made attempts to obtain alimony from the defendant. In this case, the court has the right to collect arrears of alimony, but only for the last three years.

In the matter of paying alimony, it should be remembered that this issue provides for a number of different responsibilities - administrative and criminal. Malicious evasion of alimony payments can lead to both correctional labor and imprisonment for up to 1 year. Administrative penalties are limited to various types of fines, both for responsible persons and for legal entities. The size of fines varies from 500 to 200,000 rubles. The maximum fines are imposed specifically on legal entities, while a number of penalties also include deprivation of the right to hold a certain position.

Alimony certificate 2-NDFL

For full-time education, the period can be extended to the month in which the child turns 24 years old.

- Each parent has the right to the deduction, and if they have new spouses in a registered marriage, then so do they. Factors such as divorce, non-payment of alimony, deprivation of parental rights do not deprive the second parent of the opportunity to apply for a personal income tax deduction for the child.

- The standard child deduction can be combined with other tax benefits.

- The personal income tax benefit is provided for the current period, is registered with the employer and is provided every month. To apply for it, the following conditions must be met:

- presence of at least one child in the family;

- the parent works and is a personal income tax payer.

If an employee pays alimony, he is also given a personal income tax benefit, since he takes part in providing for the child.

Is alimony displayed in the 2NDFL certificate?

In this case, you must provide the employer with the following documents:

- an application for a double deduction and an application from the other parent to waive the child deduction;

- and what is also new is that it is necessary to provide a certificate of income in Form 2-NDFL of the refusing parent every month since 2013.

In standard situations, to receive a deduction, the employer must provide:

- child’s birth certificate, certificate in form 2-NDFL from the previous place of work for the current year;

- application for the standard child tax credit;

- for children aged 18 to 24 years - a certificate from the educational institution.

The deduction for children is valid until the month in which the taxpayer’s income, calculated on an accrual basis from the beginning of the tax period (new year), exceeded 280,000 rubles.

Deduction codes for 2021: table

Each personal income tax deduction is determined in the amount established by the Tax Code of the Russian Federation. In this case, each deduction has its own code. The following table shows the codes for 2-NDFL certificates for 2021. The table has been generated taking into account the new deduction code.

| Deduction code | Name of deduction |

| Standard tax deductions provided for in Article 218 of the Tax Code of the Russian Federation | |

| 126 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child |

| 127 | For the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child |

| 128 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is providing for the child |

| 129 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to the parent, spouse of the parent, adoptive parent who is providing for the child |

| 130 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the guardian, trustee, adoptive parent, spouse of the adoptive parent, who is supported by child |

| 131 | For the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the guardian, trustee, adoptive parent, spouse of the adoptive parent, who is supported by child |

| 132 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24, a guardian, trustee, foster parent, spouse of a foster parent, for providing for which the child is |

| 133 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to a guardian, trustee, foster parent, spouse of the foster parent, supported where the child is located |

| 134 | Double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent, guardian, trustee |

| 135 | Double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 136 | Double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent |

| 137 | Double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 138 | Double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent |

| 139 | Double the amount for the third child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 140 | In double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II to the only parent, adoptive parent |

| 141 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II to the sole guardian, trustee, foster parent |

| 142 | In double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice based on an application for refusal of one of the parents receiving a tax deduction |

| 143 | In double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents parents from receiving a tax deduction |

| 144 | In double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice on the basis of an application for refusal of one of the parents receiving a tax deduction |

| 145 | In double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents parents from receiving a tax deduction |

| 146 | In double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice based on an application for refusal of one from parents from receiving a tax deduction |

| 147 | In double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal one of the adoptive parents from receiving a tax deduction |

| 148 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II, to one of the parents of their choice based on an application for refusal of one from parents from receiving a tax deduction |

| 149 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to one of the adoptive parents of their choice on the basis of an application for refusal one of the adoptive parents from receiving a tax deduction |

| Amounts reducing the tax base in accordance with Article 214.1 of the Tax Code of the Russian Federation | |

| 201 | Expenses on transactions with securities traded on the organized securities market |

| 202 | Expenses on transactions with securities not traded on the organized securities market |

| 203 | Expenses on transactions with securities not traded on the organized securities market, which at the time of their acquisition were related to securities traded on the organized securities market |

| 205 | The amount of loss on transactions with securities traded on the organized securities market, reducing the tax base for transactions with derivative financial instruments traded on the organized market and the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 206 | Expenses on transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 207 | Expenses on transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 208 | The amount of loss on transactions with derivative financial instruments traded on an organized market, the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which are securities or stock indices, obtained as a result of the specified transactions performed in the tax period, after reducing the tax base for transactions with derivative financial instruments traded on the organized market, reducing the tax base for transactions with securities traded on the organized securities market |

| 209 | The amount of loss on transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices, reducing the tax base for transactions with derivative financial instruments that are traded on the organized market |

| 210 | The amount of loss on transactions with derivative financial instruments traded on an organized market and the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which are securities or stock indices, reducing the tax base for transactions with derivative financial instruments that traded on the organized market |

| Amounts reducing the tax base in accordance with Article 214.3 of the Tax Code of the Russian Federation | |

| 211 | Expenses in the form of interest on a loan incurred under a set of repo transactions |

| 213 | Expenses on operations associated with closing a short position and costs associated with the acquisition and sale of securities that are the subject of repo transactions |

| Amounts reducing the tax base in accordance with Article 214.4 of the Tax Code of the Russian Federation | |

| 215 | Expenses in the form of interest paid in the tax period under a set of loan agreements |

| 216 | The amount of excess expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities traded on the organized securities market, calculated in accordance with the proportion, taking into account the provisions of paragraph 6 of clause 5 Article 214.4 of the Tax Code of the Russian Federation |

| 217 | The amount of excess expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities not traded on the organized securities market, calculated in accordance with the proportion, taking into account the provisions of paragraph 6 of paragraph 5 Article 214.4 of the Tax Code of the Russian Federation |

| 218 | Interest (coupon) expense recognized by the taxpayer in the event of opening a short position on securities traded on the organized securities market, for which interest (coupon) income is accrued |

| 219 | Interest (coupon) expense recognized by the taxpayer in the event of opening a short position on securities not traded on the organized securities market, for which interest (coupon) income is accrued |

| 220 | The amount of expenses for transactions with derivative financial instruments not traded on an organized market |

| 222 | The amount of loss on REPO transactions accepted as a reduction in income from transactions with securities traded on the organized securities market, in a proportion calculated as the ratio of the cost of securities that are the object of REPO transactions traded on the organized securities market to the total value of securities , which are the object of repo transactions |

| 223 | The amount of loss on REPO transactions taken to reduce income from transactions with securities not traded on the organized securities market, in the proportion calculated as the ratio of the cost of securities that are the object of REPO transactions not traded on the organized securities market to the total cost securities that are the subject of repo transactions |

| 224 | The amount of a negative financial result obtained in the tax period on transactions with securities traded on the organized securities market, which reduces the financial result obtained in the tax period on individual transactions with securities not traded on the organized securities market, which at the time of their acquisition belonged to securities traded on the organized securities market |

| 225 | Expenses on transactions with securities traded on the organized securities market, accounted for in an individual investment account |

| 226 | Expenses on transactions with securities not traded on the organized securities market, accounted for on an individual investment account |

| 227 | Expenses on transactions with securities not traded on the organized securities market, which at the time of their acquisition were related to securities traded on the organized securities market accounted for on an individual investment account |

| 228 | Expenses on transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 229 | Expenses on transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 230 | Expenses in the form of interest on a loan incurred on a set of repo transactions accounted for in an individual investment account |

| 231 | Expenses on operations associated with closing a short position, and expenses associated with the acquisition and sale of securities that are the object of repo transactions accounted for in an individual investment account |

| 232 | Expenses in the form of interest paid in the tax period on a set of loan agreements accounted for on an individual investment account |

| 233 | Interest (coupon) expense recognized by the taxpayer in the event of opening a short position on securities traded on the organized securities market, for which the accrual of interest (coupon) income is provided, accounted for in an individual investment account |

| 234 | Interest (coupon) expense recognized by the taxpayer in the event of opening a short position on securities not traded on the organized securities market, for which the accrual of interest (coupon) income is provided, recorded on an individual investment account |

| 235 | Amounts of expenses for transactions with derivative financial instruments not traded on an organized market, accounted for in an individual investment account |

| 236 | The amount of a negative financial result obtained in the tax period on transactions with securities traded on the organized securities market, which reduces the financial result obtained in the tax period on individual transactions with securities not traded on the organized securities market, which at the time of their acquisition related to securities traded on the organized securities market, accounted for on an individual investment account |

| 237 | The amount of excess expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities accounted for in an individual investment account, traded on the organized securities market, calculated in accordance with the proportion, with taking into account the provisions of paragraph six of paragraph 5 of Article 214.4 of the Tax Code of the Russian Federation |

| 238 | The amount of excess expenses in the form of interest paid under the aggregate of loan agreements over income received under the aggregate of loan agreements, reducing the tax base for transactions with securities accounted for in an individual investment account that are not traded on the organized securities market, calculated in accordance with the proportion, taking into account the provisions of paragraph six of clause 5 of article 214.4 of the Tax Code of the Russian Federation |

| 239 | The amount of loss on REPO transactions accounted for on an individual investment account, taken as a reduction in income on transactions with securities accounted for on an individual investment account, traded on the organized securities market, in a proportion calculated as the ratio of the cost of securities that are the object of REPO transactions, traded on the organized securities market to the total value of securities that are the subject of repo transactions |

| 240 | The amount of loss on REPO transactions accounted for on an individual investment account, taken as a reduction in income on transactions with securities accounted for on an individual investment account that are not traded on the organized securities market, in a proportion calculated as the ratio of the cost of securities that are the object of REPO transactions not traded on the organized securities market to the total value of securities that are the subject of repo transactions |

| 241 | The amount of loss on transactions with derivative financial instruments traded on an organized market, the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which are securities or stock indices, obtained as a result of the specified transactions performed in the tax period and accounted for in an individual investment account, which reduces the tax base for transactions with derivative financial instruments that are traded on the organized securities market, accounted for in an individual investment account |

| Amounts reducing the tax base in accordance with Article 214.9 of the Tax Code of the Russian Federation | |

| 250 | The amount of loss on transactions with securities traded on the organized securities market, received as a result of the specified transactions made in the tax period and accounted for in an individual investment account, reducing the financial result on transactions with derivative financial instruments traded on the organized market, the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 251 | The amount of loss on transactions with derivative financial instruments traded on an organized market, the underlying asset of which are securities, stock indices or other derivative financial instruments, the underlying asset of which are securities or stock indices, obtained as a result of the specified transactions performed in the tax period and accounted for on an individual investment account, after reducing the financial result on transactions with derivative financial instruments traded on the organized market, reducing the financial result on transactions with securities traded on the organized securities market accounted for on the individual investment account |

| 252 | The amount of loss on transactions with derivative financial instruments traded on an organized market, the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices, obtained as a result of the specified transactions performed in the tax period and accounted for in an individual investment account, reducing the financial result of transactions with derivative financial instruments traded on an organized market, accounted for in an individual investment account |

| Property tax deductions provided for in Article 220 of the Tax Code of the Russian Federation | |

| 311 | The amount spent by the taxpayer on new construction or the acquisition on the territory of the Russian Federation of residential houses, apartments, rooms or shares (shares) in them, the acquisition of land plots or shares (shares) in them provided for individual housing construction, and land plots or shares ( shares) in them, on which the purchased residential buildings or share(s) in them are located |

| 312 | The amount aimed at repaying interest on targeted loans (credits) actually spent on new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, the acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or shares (shares) in them on which the purchased residential buildings or share (shares) in them are located, as well as for repayment of interest on loans received from banks for the purpose of refinancing (on-lending) loans for a new construction or acquisition of the specified objects on the territory of the Russian Federation |

| Social tax deductions provided for in subparagraph 2 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation | |

| 320 | The amount paid by the taxpayer in the tax period for his education in educational institutions, for the education of a brother (sister) under the age of 24 for full-time study in educational institutions - in the amount of actual educational expenses incurred, taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code RF |

| 321 | The amount paid by a taxpayer-parent for the education of his children under the age of 24, by a taxpayer-guardian (taxpayer-trustee) for the education of his wards under the age of 18 in full-time education in educational institutions, by a taxpayer performing the duties of a guardian or trustee over citizens , their former wards, after the termination of guardianship or trusteeship in cases where the taxpayer pays for full-time education of citizens under 24 years of age in educational institutions - in the amount of actual educational expenses incurred, but taking into account the limitation established by subparagraph 2 of paragraph 1 of Article 219 of the Tax Code RF |

| Social tax deductions provided for in subparagraph 3 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation | |

| 324 | The amount paid by a taxpayer in the tax period for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to him, his spouse, parents, children (including adopted children) under the age of 18, wards under the age of 18 years (in accordance with the list of medical services approved by the Government of the Russian Federation), as well as in the amount of the cost of medicines for medical use (in accordance with the list of medicines approved by the Government of the Russian Federation), prescribed by the attending physician and purchased by the taxpayer at his own expense - in the amount of expenses actually incurred, but taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 325 | Amounts of insurance premiums paid by the taxpayer in the tax period under voluntary personal insurance contracts, as well as under voluntary insurance contracts for their spouse, parents, children (including adopted children) under the age of 18, wards under the age of 18, concluded them with insurance organizations that have licenses to conduct the relevant type of activity, providing for payment by such insurance organizations exclusively of medical services in the amount of actual expenses incurred, but taking into account the restrictions established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 326 | The amount of expenses for expensive treatment in medical organizations and individual entrepreneurs engaged in medical activities - in the amount of actual expenses incurred |

| Social tax deductions provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation | |

| 327 | The amount of pension contributions paid by a taxpayer during the tax period under a non-state pension agreement (agreements) concluded by the taxpayer with a non-state pension fund in his own favor and (or) in favor of family members and (or) close relatives in accordance with the Family Code of the Russian Federation ( spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half-siblings (having a common father or mother) brothers and sisters), disabled children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer during the tax period under a voluntary pension insurance agreement (agreements) concluded with an insurance organization in his own favor and (or) in favor of a spouse (including a widow, widower), parents (including adoptive parents) , disabled children (including adopted children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under a voluntary life insurance agreement (agreements), if such agreements are concluded for a period of at least five years, concluded (concluded) with an insurance organization in his own favor and (or) in favor of a spouse (including a widow, widower), parents (including adoptive parents), children (including adopted children under guardianship (trusteeship) - in the amount of expenses actually incurred, taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| Social tax deductions provided for in subparagraph 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation | |

| 328 | The amount of additional insurance contributions paid by the taxpayer during the tax period for a funded pension in accordance with Federal Law dated April 30, 2008 N 56-FZ “On additional insurance contributions for a funded pension and state support for the formation of pension savings” - in the amount of actual expenses incurred, taking into account the limitation, established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| Professional tax deductions provided for in Article 221 of the Tax Code of the Russian Federation | |

| 403 | The amount of actually incurred and documented expenses directly related to the performance of work (provision of services) under civil contracts |

| 404 | The amount of actually incurred and documented expenses associated with the receipt of royalties or remunerations for the creation, execution or other use of works of science, literature and art, remuneration to the authors of discoveries, inventions, utility models and industrial designs |

| 405 | The amount within the limits of the standard costs associated with receiving royalties and remunerations for the creation, performance or other use of works of science, literature and art, rewards to the authors of discoveries, inventions, utility models and industrial designs (as a percentage of the amount of accrued income) |

| Deductions in the amounts provided for in Article 217 of the Tax Code of the Russian Federation | |

| 501 | Deduction from the value of gifts received from organizations and individual entrepreneurs |

| 502 | Deduction from the cost of prizes in cash and in kind received at competitions and competitions held in accordance with decisions of the Government of the Russian Federation, legislative (representative) bodies of state power or representative bodies of local self-government |

| 503 | Deduction from the amount of financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age |

| 504 | Deduction from the amount of compensation (payment) by employers to their employees, their spouses, parents and children, their former employees (age pensioners), as well as to disabled people, the cost of medications purchased by them (for them), prescribed to them by their attending physician |

| 505 | Deduction from the value of winnings and prizes received at competitions, games and other events for the purpose of advertising goods (works, services) |

| 506 | Deduction from the amount of financial assistance provided to disabled people by public organizations of disabled people |

| 507 | Deduction from the amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled people of the Great Patriotic War Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War |

| 508 | Deduction from the amount of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child |

| 509 | Deduction from the amount of income received by employees in kind as wages from organizations of agricultural producers, determined in accordance with paragraph 2 of Article 346.2 of the Tax Code of the Russian Federation, peasant (farm) farms in the form of agricultural products of their own production and (or) works (services) , performed (rendered) by such organizations and peasant (farm) farms in the interests of the employee, property rights transferred by these organizations and peasant (farm) farms to the employee |

| 510 | Deduction in the amount of insurance premiums paid by the employer for the employee in accordance with Federal Law No. 56-FZ of April 30, 2008 “On additional insurance contributions for funded pensions and state support for the formation of pension savings”, but not more than 12,000 rubles per year |

| Amounts that reduce the tax base in accordance with Article 214 of the Tax Code of the Russian Federation | |

| 601 | Amount that reduces the tax base for dividend income |

| Investment tax deductions provided for in Article 219.1 of the Tax Code of the Russian Federation | |

| 618 | A deduction in the amount of the positive financial result received by the taxpayer in the tax period from the sale (redemption) of securities traded on the organized securities market, specified in subparagraphs 1 and 2 of paragraph 3 of Article 214.1 of the Tax Code of the Russian Federation and owned by the taxpayer for more than three years |

| 619 | Positive results from operations on an individual investment account |

| 620 | Other amounts that reduce the tax base in accordance with the provisions of Chapter 23 of the Tax Code of the Russian Federation |

Alimony deduction code

But to start transferring funds, you need to have documents with a court decision. Registration of personal income tax certificate 2 Today, these certificates are issued exclusively on the basis of the use of specialized programs.

All types of income are included in the program. At the same time, each type of income has its own specific code. A lot depends on this aspect.

The thing is that the program algorithm is created in such a way that, by specifying the code and amount of income, the tax deduction procedure is carried out.

We should also not forget about tax deductions, which allow us to reduce the income base in relation to taxes. All deductions are also issued in code format. Income codes are displayed as a four-digit number. Deduction codes are a three-digit number. Please note that only those people who work officially can apply for deductions.

Also on topic: Judicial practice on alimony

Grounds for deduction

According to labor laws, no one has the right to withhold any part of your income from you, including alimony, without reason. Therefore, the first thing you need to find out is what are the grounds for withholding alimony from income. This raises the question: what is the basis for their deduction?

It could be:

- writ of execution issued on the basis of judicial acts;

- court order;

- agreement on payment of alimony, or a notarized copy.

It is important to understand that the agreement itself is legal only if it is notarized.

The first two cases clearly indicate a judicial process preceding the appearance of executive documents, while the third case implies the voluntary consent of a person to pay alimony. In any case, without one of the listed documents, any deductions from income received are illegal. The difference between a court order and a writ of execution lies in the defendant’s agreement with the demand presented to him. If he agrees, then a court order is immediately issued; if not, a trial is scheduled.

The executive document contains all the necessary information. In addition to identifying data, the details, amount, procedure and conditions for payment of alimony are indicated.

If a person voluntarily signed an agreement to pay alimony and notarized it, then by law he is obliged to pay, and in case of non-payment, coercive measures may be applied to him.

If there is a lawsuit, a person can challenge the court's decision, but for this he will need compelling reasons. In any case, until a higher court overturns the current decision, alimony will be calculated in the proper manner.

According to the executive documents, alimony can be calculated not only from the father or mother, but also from the children.

Is alimony considered before or after personal income tax withholding?

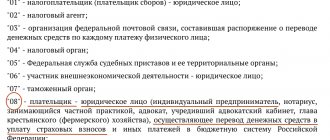

Code for deducting alimony in personal income tax certificate 2. To the question whether alimony is indicated in personal income tax certificate 2, there is a clear answer - it is not indicated. This is explained by the fact that this certificate is considered a certificate of income. It should be borne in mind that if we are talking about receiving income in the form of alimony payments, then the amount is not subject to taxes, which means it is not reflected in the documents. By law, all income must be reflected in certificate 2 of the personal income tax. This document is filled out by the tax agent; the employer plays his role. He must reflect all income in the certificate, not just salary. Help 2 contains all data exclusively in code form. The amounts of deductions are indicated in code format. It is necessary to understand in detail whether there is a code for deducting alimony in certificate 2 of the personal income tax.

How to check authenticity

To check the authenticity of a document, it must comply with certain factors:

- the paper is filled out according to a standard template and does not contain errors or errors;

- the document has a clear signature of the responsible person, not covered by a “wet” seal;

- The employer's TIN matches the stamp;

- there is no suspiciously high or low monthly income.

The status of the citizen in the tax service and the financial viability of the organization are also checked. The request is made through the Pension Fund.

Is it possible to challenge Form 2-NDFL in an alimony dispute?

If the alimony payer files a claim in court, he provides documents, which also indicate the income code for alimony in the 2-NDFL certificate. The only condition is that the document must be genuine.

Subsidies

Withholding alimony and transferring it to the claimant If the writ of execution does not indicate the amount of alimony or its fixed amount, which is determined in accordance with the subsistence level, then they are calculated as follows:

- For 1 child - ¼ of the payer’s income.

- For 2 children - 1/3 of income.

- For 3 children or more - ½ income.

The total amount of alimony payments should not exceed 70% of the payer’s income minus personal income tax. In accordance with the law, the employer is obliged to transfer alimony to the recipient within three working days from the date of payment to the employee of wages or other amount from which they can be withheld.

For example, bonuses, vacation pay, temporary disability benefits. Withheld alimony and personal income tax must be reflected on the payslip so that the employee can understand how the amount paid to him is determined.

Child support Place of registration What is the validity period of the 2nd personal income tax certificate when submitted to the court for calculating alimony. read answers (1) Tags: Validity period of the certificate Statutory period Validity period I took the 2nd personal income tax certificate with a salary of 15,000 for alimony I received a letter from the bailiff to work for alimony and the accountant declares that he will pay alimony not from 15,000, but from 18,000, is this legal? read answers (2) Tags: Salary Get a certificate I owe a lot for alimony, the bailiff said to bring a certificate of 2 personal income taxes and we will recalculate the debt! The company where I worked no longerread the answers (1) Tags: Bailiffs Make a request Do you need a certificate 2 personal income tax from your ex-spouse to apply for alimony through the court?read the answers (1) Tags: Do you need a certificate Former spouses Filing for alimony My son and the cohabitant have a common child, she applies for alimony and requires a certificate of 2 personal income tax.

Family law Is alimony considered before or after personal income tax withholding? The legislation of the Russian Federation obliges each parent to provide for their children until they reach adulthood. If a child lives only with his mother or only with his father, then the other must provide financial assistance for his maintenance. In reality, children most often stay with their mother, so the father pays child support. Recipients of alimony often wonder whether the alimony they receive is income; alimony is withheld before the calculation of personal income tax or after.

Personal income tax is a tax levied on the income of individuals. Its value is 13% and is withheld from the official income of the tax payer.

Also on the topic: How does alimony court work?

Payments that are alimony in accordance with the Family Code of the Russian Federation are not subject to personal income tax. Despite this, in unusual situations, accountants are puzzled by the problem.

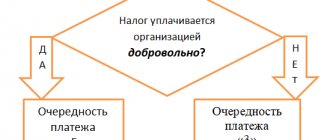

In accordance with the legislation of the Russian Federation 2021, amounts are first withheld to repay first-priority debts. These include alimony and the following requirements:

- For compensation for damage caused to health.

- For compensation for damage in connection with the death of the breadwinner.

- To compensate for the damage caused by the crime.

- On compensation for moral damage.

In the background are requirements related to payments to the budget. Then all other deductions are made. It is important to take into account that when collecting alimony for minor children and other first-priority claims, the total amount of withholding cannot exceed 70% of the debtor’s salary and other income. In other cases, you can retain no more than 50%.

Amount of alimony deductions and sources of income

If alimony is transferred by postal order or by transfer to a card with a commission, then, according to Russian legislation, the costs of sending funds are borne by the alimony payer.

The amount of transfers is indicated in the executive documents. And it can be expressed both in a fixed amount of money and as a percentage of the salary, as well as in the amount of the minimum wage (minimum wage). Depending on the situation, the amount of deductions cannot exceed 50% of income, but nevertheless, in some cases, the law provides for an allowance of up to 50% in the case of paying alimony in favor of minor children. The amount of payments is also directly related to the number of children:

- 1 child – 25% of earnings

- 2 children – 33% of earnings

- 3 or more – 50% of earnings.

Alimony is withheld from net salary, that is, after deduction of personal income tax; Article 210 of the Tax Code of the Russian Federation directly tells us this.

Alimony is withheld from various types of income:

- main place of work

- part-time job

- various types of remuneration, bonuses

- scholarships

- income of an individual entrepreneur

- fees

- unemployment benefits

- other sources of income

This list contains many different positions, the edge of which is the official confirmation of any type of income, that is, the income that is known to the state. A complete list of income subject to deductions can be found in Decree of the Government of the Russian Federation No. 841 of July 18, 1996. However, there are also types of income from which alimony is not deductible, according to the law. These include disability pensions, disability benefits, etc. In addition, alimony is not withheld from income received through one-time transactions, for example, the sale of an apartment or car. It is also impossible to withhold alimony from compensation payments, such as travel allowances, wear and tear of work tools, etc.

If a person’s income is received in kind, then when determining the amount of alimony, the accountant is guided by its current market value at the time of calculation.

The amount of alimony collected may be reduced or increased depending on changes in income level. In other words, if the defendant’s income has increased, then the applicant can file an application with the court to review the amount of alimony. The alimony payer can do the same if he has lost his job or his income has decreased.

In the case where the alimony payer is serving a sentence in correctional institutions or is in the departments of medical dispensaries, a deduction is made from all earnings, with the exception of deductions for those funds that are spent on their maintenance in these institutions.

If the court sets a fixed amount, then the organization responsible for withholding it must index it relative to the cost of living in the region. Alimony has priority over other types of deductions, therefore, when an organization receives several types of writs of execution, alimony is deducted first.

How much to transfer alimony from and whether it is necessary to withhold personal income tax from it

It is easier to consider the calculation using an example.

The ex-spouse’s earnings are 40,000 rubles; the accounting department received a writ of execution to withhold 25% of the total income for the maintenance of one child.

The calculation will be performed by the accountant as follows:

- Personal income tax on earnings amounted to: 40,000 * 13% = 5,200 rubles;

- income that is accepted for calculating alimony: 40,000 – 5,200 = 34,800 rubles;

- therefore, the employee must pay alimony in the amount of: 34,800 * 25% = 8,700 rubles;

- The employee’s net income will be: 40,000 – 5,200 – 8,700 = 26,100 rubles.

Within three days, the accountant is obliged to transfer alimony to the ex-wife in the amount of 8,700 rubles.

Personal income tax benefit if the employee pays alimony

An employee may be given a double deduction; it can be officially issued for only one parent.

To do this, the following package of documents is submitted to the accounting department:

- An application indicating the possibility of providing double benefits;

- an application from the second spouse of the parent, where he refuses to apply the child benefit at his place of employment;

- declaration from the place of work of the refused parent in Form 2 personal income tax for the last year;

- the child’s birth certificate, which confirms the parentage of the former spouses;

- if the son or daughter has already reached the age of majority, they are from 18 to 24 years old, they are studying at an educational institution, a certificate from the dean’s office confirming the status of the student will be required.