Reflecting transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on their type and traditionally raises many questions among accountants.

No time to read? Cheat sheet on the contents of the article:

- What is the difference between the concepts of “forfeit”, “fine” and “penalty”

- What legislation regulates the payment of penalties?

- 3 ways to collect penalties

- What transactions should be used to charge penalties to state-owned, budgetary and autonomous institutions?

- What indicators are reflected in the reporting forms?

What is a penalty

In accordance with the Civil Code of the Russian Federation, a penalty is a sum of money that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular, for its delay (Article 330). Moreover, the agreement on the penalty must be made in writing, regardless of the form of the main obligation, otherwise it is declared invalid (Article 331).

There are two types of penalties: a fine or a penalty. The fine is a fixed payment and can either be specified as a fixed amount or calculated as a percentage of a particular amount. The penalty is a variable value, its size depends on the duration of the period of violation. The amount of the penalty is determined as a percentage of the amount of the obligation, the fulfillment of which it ensures.

The rules for calculating penalties are also determined by the Civil Code of the Russian Federation. The first day of delay is the date following the day of fulfillment of the obligation in accordance with the contract. Last day is the date preceding the day of actual fulfillment of the obligation.

Example.

According to the terms of the contract, the deadline for fulfillment of obligations by the supplier (contractor) is defined as follows: “no later than June 20, 2021.” The goods were actually delivered on July 20, 2021. The period of delay lasted from June 21 to July 19 and amounted to 29 days.

Penalties: postings

In case of late payment of any budget payment, the company or entrepreneur is assessed penalties. The formula for calculating them is standard, regardless of what particular obligation of the tax or fee payer is violated: the amount of penalties is determined as 1/300 of the key rate of the amount owed for each day of delay. In tax accounting, paid penalties are not recognized as expenses that reduce tax deductions, which is actually logical, since the payer himself is to blame for the fact that the deadlines for settlements with the budget are violated, that is, such expenses are not considered justified. However, the task of accounting for penalties in accounting remains relevant one way or another.

We recommend reading: Is it possible to withdraw all the money from a social card to a minor?

Paying tax under the simplified tax system involves an advance system, that is, a company or individual entrepreneur is required to make settlements with the budget based on their own data, and quarterly, before April 25, July 25 and October 25. The final calculation for the year is made on the reporting deadline: for companies it is March 31, for individual entrepreneurs it is April 30. There is an opinion that such a situation makes it possible not to pay advances at all under the simplified tax system. But that's not true. They must be transferred within a strictly specified time frame, and delay, in turn, will lead to the accrual of penalties. Another question is that these sanctions will be imposed only after filing the annual declaration, that is, after the tax office learns about the amounts of accrued quarterly advance payments.

Penalty when purchasing services

In addition to the Civil Code of the Russian Federation, the concept of a penalty, the procedures for its calculation and collection when purchasing services for state (municipal) needs are defined in Art. 34 “Contract” of Federal Law No. 44-FZ (hereinafter referred to as the Law). According to clause 4, securing the responsibility of the customer and supplier (contractor, performer) for non-fulfillment or improper fulfillment of obligations under the contract is a mandatory condition of the contract. Clause 6 contains requirements for the payment of penalties in case of delay in fulfilling obligations and in other cases of non-fulfillment (improper fulfillment) of obligations.

However, the Law also provides for a number of exceptions when the above requirements may not apply (Clause 15, Article 34). Exceptions include purchases from a single source, for example, for an amount not exceeding 100,000 rubles, or goods, works or services related to the scope of activity of natural monopolies.

According to the Law, in certain cases, in the manner prescribed by the Government of the Russian Federation, it is possible to grant a deferment in the payment of accrued amounts of penalties or to write them off. One of the criteria required for write-off is the size of the total amount of unpaid penalties. It should not exceed 5% of the contract price.

Which postings should be used to reflect penalties?

Collections can also be carried out using account 91. However, when accounting through account 91 “Other income and expenses”, the enterprise will have tax obligations, since such expenses are not accepted for taxation (clauses 4, 7 of PBU 18/02).

Penalties may be accrued (accounted for later in the article) for each calendar day of late payment. The starting point is the day following the legally established transfer deadline. The calculation is carried out for the entire period of delay, including the repayment date. Penalties may also arise for violation of the payment procedure for goods supplied, work performed or services provided, as provided for in contractual relations.

Methods for collecting penalties

In the terms of the contract (agreement), it is recommended to immediately specify the method of collecting the penalty. There are three ways:

- Request payment of the penalty from the contractor.

In this case, the obligations under the contract are paid in full and the security amounts (funds at temporary disposal) are returned. The counterparty can either transfer the amount of the penalty to the personal or current account of the institution, or deposit cash into the cash desk within the limit established by the Central Bank of the Russian Federation - 100,000 rubles. - Transfer payment under the contract in the amount reduced by the amount of the penalty.

- Withhold the penalty from the amount of security for the execution of the contract (funds at temporary disposal).

Separately, it should be said about the right to dispose of received funds, which depends on the type of institution.

In paragraph 3 of Art. 41 of the Budget Code of the Russian Federation, a penalty is included in non-tax budget revenues from liability measures for violating the terms of a civil transaction. Amounts received by a government institution are accordingly subject to inclusion in budget revenues.

Budgetary or autonomous institutions have the right to spend the amounts received in accordance with the FCD Plan, since such receipts are their non-operating income. It is only necessary to make timely changes in the prescribed manner to the FCD Plan, increasing the total amounts of receipts and disposals and determining the directions of expenditure.

Rules for accounting for fines on taxes and agreements

The organization will have to independently choose the accounting option and consolidate the corresponding rules in its accounting policies. Please note that penalties are similar in economic essence to fines. And account 99 is intended for accounting for fines. But if the company accounts for penalties in account 91, then it is necessary to reflect a permanent tax liability (according to the requirements of PBU 18/02).

The company may be fined by the tax authorities, for example, for late submission of reports. Counterparties may impose fines for violating the terms of contracts. The opposite may also happen - the organization itself will receive monetary compensation from a supplier who did not ship the goods on time. Accounting for sanctions in each specific case has its own characteristics. Let's look at them in more detail.

Reflection of transactions in accounting

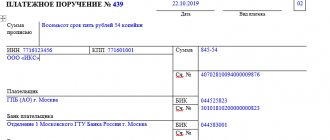

The accrual of the presented amounts of penalties (fines, penalties) is documented by posting

D-t (KDB) X. 209.40. (560) or

(KDB) X. 205.41. (560)

Kit (KDB) X. 401.10. (140)

Where X is the source of financial support depending on the type of institution (1 – state-owned, 2 – budgetary, autonomous).

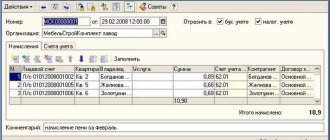

The program uses the document “Accounting operation (manual)”

.

Correspondence regarding the receipt of the collected penalty in accordance with Instructions No. 162n, No. 174n and No. 183n should be reflected in accounting depending on the type of institution.

Correspondence in a government agency

Upon receipt of payment of the penalty from the supplier of correspondence in a government institution, the following will occur:

- Depositing cash.

1.1cash was credited to the institution's cash desk.

D-t (KIF) 1. 201.34. (510) / 17.34 (140) Kt (KDB) 1. 209.40. (560) or

(KDB) 1. 205.41. (560)

In “1C”: document “Cash receipt order” with the type of operation “Receipt of funds for compensation of damage (209)” or “Other cash receipts d/s”.

1.2

cash issued for crediting to budget revenue:

D-t (KIF) 1. 210.03. (510) / 17.30 (510) Kt (KIF) 1. 201.34. (610) / 17.34 (610)

In “1C”: document “Cash outflow order” with the type of operation “Cash transfer to account No. 40116 (210 03)” or “Other cash withdrawals”.

- Crediting funds to budget income.

The set of transactions and accounting entries depends on whether the institution is vested with the authority of a revenue administrator or not.Option 1

: The institution has administrator powers.

2.1.1.

crediting funds directly to the administrator's account (04).- cash from the cash register: D-t (KDB) 1. 210.02 (140) K-t (KIF) 1. 210.03. (610) / 17.30 (610) or

non-cash from the supplier (contractor): D-t (KDB) 1. 210.02 (140) K-t (KDB) 1. 209.40. (560) or

(KDB) 1. 205.41.

(560) In “1C”: document “Cash Receipt”.

2.1.2.

crediting funds to income with a “transit” reflection in the PBS account (03) as a restoration of cash expenses.

In fact, the “transit” of non-tax income (penalty) contradicts paragraph 3 of Art. 41 of the Budget Code of the Russian Federation, since receipts to the personal account of the recipient of budgetary funds are reflected according to the Budget Code of Expenses.

- crediting cash from the cash register: D-t (KRB) 1. 304.05 (ХХХ)

K-t (KIF) 1. 210.03.

(610) / 17.30 (610) or - crediting non-cash payments from the supplier (contractor): D-t (KRB) 1. 304.05 (ХХХ)*

K-t (KDB) 1. 209.40.

(560) or

(KDB) 1. 205.41.

(560) In “1C”: document “Cash Receipt”. - transfer of funds to budget revenue to your personal administrator account: D-t (KDB) 1. 210.02 (140) K-t (KRB) 1. 304.05 (ХХХ)* In “1C”: document “Application for cash expenses” or “ Cash receipts."

Where XXX depends on the codes by which payment is made under the contract.

Option 2

: The institution is not vested with the powers of a revenue administrator.

2.2.1.

crediting funds from the supplier directly to the administrator's account (04).

- notification to the cash receipts administrator about the expected receipt of income. The basis is the Notice f. 0504805, sent to the revenue administrator: D-t (KDB) 1. 304.04 (140) K-t (KDB) 1. 303.05. (730)

- receipt of income to the budget. The basis is the Notice received from the cash receipts administrator: D-t (KDB) 1. 303.05. (830) Kit (KDB) 1. 209.40. (560) or

(KDB) 1. 205.41. (560)

2.2.2.

crediting funds from the personal account of the recipient of budget funds.

- crediting to the institution's personal account from the supplier (contractor): D-t (KRB) 1. 304.05 (ХХХ) K-t (KDB) 1. 209.40. (560) or

(KDB) 1. 205.41.

(560) In “1C”: document “Cash Receipt”. - transfer of received amounts from the personal account of the recipient of budget funds to the account of the income administrator: D-t (KDB) 1.303.05 (830) K-t (KRB) 1.304.05 (ХХХ) In “1C”: document “Application for cash expenses” .

- notification to the cash receipts administrator about the expected receipt of income. Reason – Notification f. 0504805, sent to the revenue administrator: D-t (KDB) 1. 304.04 (140) K-t (KDB) 1. 303.05. (730)

Correspondence in a budgetary (autonomous) institution

- Receipt of cash.

1.1.to the institution's cash desk:

D-t (KIF) 2. 201.34. (510) / 17.34 (140) Kit (KDB) 2. 209.40. (560) or

(KDB) 2. 205.41.

(560) In “1C”: document “Cash receipt order”.

1.2.cash deposited to the personal account:

D-t (KIF) 1. 210.03.

(510) / 17.30 (510) Kt (KIF) 1. 201.34. (610) / 17.34 (610) In “1C”: document “Cash expenditure order”. - Receipt of amounts to the personal account in OFK.

2.1cash:

D-t (KIF) 2. 201.11 (510) / 17.01 (KOSGU 510) K-t (KIF) 2. 210.03.

(610) / 17.30 (610) In “1C”: document “Cash receipt”.

2.2.transfer from the supplier (contractor) to the institution’s account:

Dt (KIF) 2.201.11 (510) / 17.01 (KOSGU 140) Kt (KDB) 2. 209.40. (560) or

(KDB) 2. 205.41.

(560) In “1C”: document “Cash Receipt”.

Penalty 18 million for failure to withhold tax from the income of a foreign organization

Penalty of 18 million rubles for failure to withhold tax from the income of a foreign organization

Cassation Resolution of the Court of Justice of the West Siberian District dated October 30, 2021 in case No. A03-21974/2017:

| “As follows from the case materials and established by the courts of first and appellate instances, the inspectorate conducted an on-site tax audit, as a result of which a decision was made dated 09/08/2017 No. RA-003-08 to hold the company liable, in particular, under Art. 123 of the Tax Code for failure to fulfill the duty of a tax agent to calculate, withhold and transfer to the budget tax on income received by a foreign organization. By the same decision, the company was asked to pay 57,929,406 rubles to the budget. not withheld tax on income of foreign organizations and penalties accrued on it in the amount of 18,007,355.86 rubles. ... The cassation court, leaving the decision of the appellate court unchanged, proceeds from the arguments of the cassation appeal and the specific circumstances of the case. By virtue of subparagraph 3 of Article 247 of the Tax Code, for foreign organizations that do not operate in the Russian Federation through permanent representative offices , the object of taxation for corporate income tax is income received from sources in the Russian Federation, which is determined in accordance with Article 309 of the Tax Code. The tax in this case , in accordance with paragraph 1.1 of Article 309, paragraph 1 of Article 310 of the Tax Code, is levied by withholding it by the tax agent - the Russian organization paying the income ." |

When paying in favor of a foreign organization, it is necessary to check whether there is documentary evidence of the registration of this foreign organization with the Federal Tax Service of the Russian Federation as a “permanent representative office”.

If there are documents about a “permanent establishment”, then the permanent establishment independently calculates, withholds and transfers tax to the budget of the Russian Federation (like an ordinary Russian organization).

And if there are no documents about a “permanent establishment,” then the tax agent’s responsibilities for calculating and withholding tax from the payment amount are assigned to the Russian organization that pays income to this foreign organization.

For foreign organizations that do not carry out business activities on the territory of the Russian Federation through permanent representative offices,

There is no obligation to withhold tax.

See about this “Letter” of the Federal Tax Service of Russia dated June 11, 2014 No. GD-4-3/11305 “On the performance of duties for the calculation, withholding and transfer to the budget of tax on income from sources in the Russian Federation”:

| “Thus, Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation on individuals and foreign organizations, not implementing entrepreneurial activity on the territory of the Russian Federation through permanent missions, when paying income from sources in the Russian Federation, no duty assigned to determine the amount of tax, withhold this amount from the taxpayer’s income and transfer the tax to the budget.” |

/* That is, if there are no documents on a “permanent establishment”, then the duties of the tax agent to calculate and withhold tax from the payment amount are assigned by law only to the Russian organization that pays income to such a foreign organization.*/

In principle, there is nothing new in the above, since all this is even in ordinary textbooks for students

For example, see “Civil Law: Textbook” - Alekseev S.S., Gongalo B.M., Murzin D.V. and others (under the general editorship of Corresponding Member of the RAS S.S. Alekseev). — 3rd ed., revised. and additional — M.: “Prospekt”, 2011.” (Addendum. Tax rights and obligations in connection with civil legal relations):

| Section VI. International private law To Article 1186 of the Civil Code of the Russian Federation (“Definition of the law to be applied to civil relations involving foreign persons or civil relations complicated by another foreign element”). The provisions of this article, as well as the provisions of other articles of Section VI of the Civil Code, interact with the requirements, in particular, Art. 7, 11, 154, 160, 165, 185, 208, 311, 312 of the Tax Code of the Russian Federation, etc.). Conducting transactions with a foreign element (foreign economic transactions) entails the emergence of tax legal relations relating, in particular, to the taxation of foreign organizations: a) operating through a permanent representative office on the territory of the Russian Federation (Articles 306, 307 of the Tax Code of the Russian Federation); b) not operating through a permanent representative office in the Russian Federation and receiving income from sources in the Russian Federation (Articles 309, 310 of the Tax Code of the Russian Federation). |

If there are no documents confirming the registration of a foreign organization with the Federal Tax Service of the Russian Federation as a “permanent representative office,” then

To be exempt from withholding tax when applying the provisions of international treaties on the avoidance of double taxation, it is necessary to:

1) providing proof of location (tax residency);

2) documentary evidence that this foreign organization has the actual right to receive the corresponding income;

3) assess who will be the actual recipient of the income;

4) documentary evidence of whether the person has declared and paid taxes on such income.

In addition, for the purposes of due diligence and caution to avoid tax risks, it is necessary to:

5) check the legal capacity (establish the legal status) of a foreign organization;

6) documentary evidence of the authority of the head of the foreign organization and a copy of his identity document;

7) documentary evidence of the authority of the representative of the foreign organization and a copy of his identity document;

eliminate transactions through intermediaries;

eliminate transactions through intermediaries;

9) exclude payments through third parties.

See the following topics on Law Ru about this

Tax on income of a foreign organization (Legal position of the Federal Tax Service of the Russian Federation)

Tax on income of foreign organizations (legal position of the Constitutional Court, Supreme Court, Supreme Arbitration Court, Ministry of Finance and Federal Tax Service of the Russian Federation)

To pay under the contract

In the case under consideration, the resulting counterclaim (penalty) presented to the supplier (contractor) is counted towards payment of the institution’s obligations under the contract.

When choosing this calculation method, a government institution must take into account several factors:

- It is advisable to include in the contract a condition that the fulfillment of obligations to transfer the penalty to budget revenue is assigned to the state customer;

- transfer the penalty yourself to budget revenue (the name of the counterparty for whom the penalty is transferred should be indicated in the payment document);

- make changes to the indicators of the budget obligation taken into account by the FC body.

It should be noted that the Budget Code of the Russian Federation does not provide for the execution of the budget by income by offsetting expenditure obligations (Article 218 of the Budget Code of the Russian Federation).

Correspondence in a government agency

- Reflection of amounts of obligations under the contract:

D-t (KRB) 1. 401.20 (ХХХ) or1.106.ХХ (310) Kit (KRB) 1. 302.ХХ (730)

- Reducing the amount of obligations by the amount of the penalty:

D-t (KRB) 1. 302.ХХ (830) K-t (KDB) 1. 209.40. (560) or(KDB)1. 205.41. (560)

- Transfer of withheld amounts of penalties to budget revenue:

D-t (KDB) 1. 210.02 (140) or(KDB) 1.303.05 (830) K-t (KRB) 1.304.05 (ХХХ) – code according to which execution is provided.

Correspondence in a budgetary (autonomous) institution

Let's consider a separate case when the contract is executed at the expense of subsidies allocated for other purposes (capital investments) and located in a separate personal account of the institution.

- Transfer of funds under the contract (minus the amount of the penalty):

D-t (KRB) 5 (6). 302.ХХ (830) Kt (KIF) 5 (6). 201.11 (610) / 18 (code KOSGU XXX) - Termination of counterclaim:

D-t (KRB) 5 (6). 302.ХХ (830) Kt (KRB) 5 (6). 304.06 (730) - Termination of counterclaim in the amount of the fulfilled claim under sanctions:

D-t (KRB) 2. 304.06 (830) K-t (KDB) 2. 209.40. (560) or(KDB) 2. 205.41. (560)

- Transfer of the amount of the penalty from a separate personal account to an account for accounting for transactions with institutional funds:

Dt (KRB) 5(6). 304.06 (830) K-t (KIF) 5(6). 201.11 (610) / 18 (KOSGU code XXX expenses) – disposal of funds from a separate personal account 21 (31).D-t (KDB) 2. 201.11 (510) / 17 (KOSGU code 140) – receipt of funds to the funds transactions account 20 (30). Kit (KRB) 2. 304.06 (730)

Correspondence regarding the termination of the counterclaim is reflected (based on certificate f. 0504833).

How to take into account fines and penalties for taxes and contributions in accounting and when calculating tax in a simplified manner

Tax legislation and legislation on the payment of insurance premiums separate the concepts of “penalty” and “fine”. Penalties are the amount that an organization must transfer to the budget if it fails to pay a tax or contribution on time (Article 75 of the Tax Code of the Russian Federation). A fine is a sanction imposed by regulatory agencies for tax offenses (Article 114 of the Tax Code of the Russian Federation). The amounts of tax penalties are shown in the table.

For accounting purposes, fines and penalties can be combined into one category of accounting objects - tax sanctions. This approach does not contradict the objectives of accounting. In particular, it provides complete and reliable information about the activities of the organization and complies with the principles of rationality and the priority of content over form (clause 1, article 13 of the Law of December 6, 2021 No. 402-FZ, clause 10 of the Regulations on Accounting and Reporting).

Deduction from contract security amounts

Correspondence in a government agency.

- Receipt of funds at temporary disposal (security under the contract):

D-t (KIF) 3. 201.11 (510) K-t (KBC) 3. 304.01 (730) - Transfer of penalties from a personal account to account for funds in temporary disposal to budget revenue:

D-t (KBC) 3. 304.01 (830) K-t (KIF) 3. 201.11 (610) - Receipt of penalty amounts to the administrator's personal account:

D-t (KDB) 1. 210.02 (140) K-t (KDB) 1. 209.40. (560) or (KDB) 1. 205.41. (560)

Correspondence in a budgetary (autonomous) institution.

Writing off in accounting the amounts of penalties from funds in temporary disposal and reflecting them as income:

D-t (KBC) 3. 304.01 (830)

Kit (KIF) 3. 201.11 (610)

D-t (KIF) 2. 201.11. (510) / D-t 17.01 (KOSGU 140)

Kit (KDB) 2. 209.40. (560) or

(KDB) 2. 205.41.

(560) The basis for transactions are documents confirming that the security remains with the institution:

- notification of clarification of client operations (f. 0531852) sent to OFC

- accounting certificate (f.0503833)

Topic: penalties under the contract, postings

Good afternoon I meant charges for state fees, legal services and penalties by court decision. I wanted to clarify how to do it correctly. I spent it like this: D 71.1—K 50—money received in the account for payment of lawyer’s services. D 91.3.—K71.1 paid for the services of a lawyer; D 91.3—K68.6—state duty charged; D 68.6—K 51—state duty paid; D 76.2—K 91.1—reflects the defendant’s debt for lawyer’s services; D 76.2—K 91.1—state duty for return by court decision; D 76.2—K 91.1—penalties to be returned by court decision. D 51——K 76.2—receipt of funds to the account from the defendant.

An invoice is not an accounting document at all and cannot be the basis for entering data accepted for accounting. An invoice may also be missing; this is a document for VAT accounting, and not for accounting. accounting. To post goods/work/services, you need an invoice or act. When providing services by a lawyer, you also need a certificate, because payment may be in advance, and the act confirms that the lawyer has completed his work.

Write-off of penalty amounts

A decrease in the amount of accrued income when a penalty is written off on the grounds provided by the Government of the Russian Federation in accordance with the Instructions is reflected:

D-t (KDB) X

. 401.10 (174)

Kit (KDB) X

.

209.40. (560) or

(KDB)

X*

. 205.41. (560)

Where X is the source of financial support depending on the type of institution (1 – state-owned, 2 – budgetary, autonomous).

Account 401.10.174 “Lost income” was included in the Accounting Instructions by Order of the Ministry of Finance of the Russian Federation dated November 16, 2016 No. 209n (came into force on December 5, 2016).

Calculation of penalties for taxes: accounting entries

The company undertakes to promptly pay bills presented by the state (tax office in particular). Everything that a legal entity owns and from the use of which it receives income is taxed. VAT, income tax, excise taxes - such amounts “go” to the federal budget. Payments for the use of land, property and natural resources usually go to the local or regional treasury of the state.

The “Profit and Loss” account is used to collect information and display the final result about the financial activities of the enterprise. It has an active-passive structure. The debit indicates the amount of losses, and the credit indicates the amount of income. The account is closed before preparing annual reports. The ending balance on one side is written off to “Retained earnings (uncovered loss).” Analytical accounting on the account is created in such a way that all the necessary data is then transferred to the financial statements.

Reflection of indicators in reporting forms

The composition of the data and the list of reporting forms for reflecting settlements with the counterparty for penalties, including the status of settlements, the amounts of accrued income and their cash execution are given in Table 1.

Table 1

| Reflected indicator | Reporting forms | |

| budgetary and autonomous institutions | government institutions | |

| Amounts of debt at the beginning and end of the period and indicators of its change - increase/decrease (according to settlement accounts - 209.40 or 205.41) | “Information on accounts receivable and payable” Columns 2-14 (except for columns 6 and  | |

| "Balance…" | ||

| Lines 580 or 590, columns 5, 9 | Lines 580 or 590, columns 3, 6 | |

| “Report on the financial results of the institution” | ||

| Lines 481, 482, column 6 | Lines 481, 482, column 4 | |

| Amounts of accrued income (account 401.10) | “Report on the financial results of the institution” | |

| Column 6 line 050 | Column 4 line 050 | |

| “Certificate on the conclusion by an institution of accounting accounts for the reporting financial year” | “Certificate on the conclusion of budget accounts for the reporting financial year” | |

| Counts: 5, 18, 13 | Counts: 3, 4, 7 | |

| Amounts of income received to the cash desk, to the personal or current account of the institution (according to the relevant accounting accounts) | “Report on the institution’s implementation of its financial and economic activity plan” | “Report on budget execution...” |

| Line 010, columns 5, 6, 7 | Line 010, columns 5 (6) | |

| "Cash Flow Statement" | ||

| Line 060 column 4 | ||

If transactions are correctly reflected in accounting in “1C: Public Institution Accounting 8”, the above indicators in the reporting forms are filled out automatically using the “Fill”

.

A budgetary institution should pay special attention when carrying out operations to fulfill planned income assignments without cash flow. An example is the transfer of payment under the contract in an amount reduced by the amount of the penalty. In accordance with the requirements of Instruction No. 33n, in this case, the amount of income must also be reflected in the Income section of the “Report on the institution’s implementation of its financial and economic activity plan (form 0503737)” in column 8.

Penalties for business contracts

This is basic mathematics, there is nothing complicated here. The penalty is calculated as follows: the amount of the penalty is equal to = the amount of delay. Example: NBU discount rate 7.7. Amount of penalty for one day = 7.7. If you want to know the percentage of a specific. The fine is double. NBU (validity period of NBU discount rate 7.7.

Calculation of penalties - ADVISER law firm. Calculation of penalties. Contents: Introduction. This article contains practical recommendations for calculating penalties. Legal and nuances. Ukrainian legislation. If you want to find out or update.