Under what conditions is it possible to transfer customer-supplied materials?

A contract agreement is concluded between the organization that uses the materials and their supplier. This agreement must take into account the interests of both parties. The following fundamentally important points are usually stated:

- Name of materials.

- Their number.

- Transfer deadlines.

- Specific transportation option. If the transfer process involves third parties in the form of transport companies, then these conditions may also be mentioned.

- If the equipment or structure is complex, then technical or design documentation must be transferred along with it. This fundamentally important point is specially discussed. The owner of the materials can either make correct copies or transfer the originals of these documents. Everything will depend on the positions of counterparties on this issue.

- When or under what conditions are customer-supplied materials returned?

- What happens to the remainder of the toll material, actions are prescribed in the event of shortages, failure of one of the parties to comply with the terms of the agreement, etc. When concluding such contracts, it is recommended to use the services of a professional lawyer, especially if we are talking about materials with a significant market value.

The procedure for filling out the invoice f. M-15

The first table of the invoice indicates the number and date of the document. If the company uses product coding, then the product code is entered. In the “Bases” line, indicate the contract number and make a note that the operations were carried out on a toll basis.

In the “To” line indicate the details of the contractor’s enterprise; surname and initials of the responsible person; details of the power of attorney to receive resources.

Column 1 and column 2 reflect information about the accounting accounts. accounting. Column 3 reveals information about the material: name, grade, brand, size. Column 4 – indicates the item number of the resource. It is assigned for each type of material asset. If such numbers are not used at the enterprise, then a dash is placed in the column. Column 5 – unit of measurement code. Column 6 – name of the unit of measurement. Column 7 – the amount of required supply of resources. Column 8 – actual amount of allocated resources. Column 9 – price per unit excluding VAT. Column 10 – the amount of allocated resources excluding VAT. Columns 11 and 12 are marked with a dash, since the transfer of resources on a toll basis does not provide for the accrual of VAT. Columns 13,14 - indicate the inventory and passport number of the raw materials, if any. Column 15 is the serial number of the entry in the warehouse card file.

The quantity of allocated resources and their cost are indicated in words at the end. The document is signed by the recipient, the accountant and the person who released the resources.

Reflection in accounting

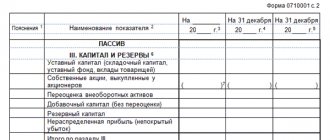

In this case, the described property will be listed in the accounting records of the tolling organization in the line “Materials” as fixed assets. And the company that accepts them must issue an off-balance sheet account for the equipment (or other property) with the corresponding listing of items.

As for the accounting of this issue, it is also necessary to divide customer-supplied raw materials into different accounts on a territorial basis, as well as post raw materials from different contractors into separate accounts.

The legislative framework

When concluding agreements regarding the transfer of customer-supplied raw materials (and the act of transfer of customer-supplied materials will be an appendix to such an agreement), one should be guided by the Rules for accounting for customer-supplied raw materials, which are clearly stated in Methodological Instructions No. 119n (clause 156), which were approved by a separate order of the Ministry of Finance dated December 28, 2001 . In particular, it describes the transfer mechanism, the conditions that counterparties must follow, and other fundamentally important points.

Document elements

The act is an annex to the drawn up agreement and is signed by the parties immediately after the transfer. If not, then the body of the paper must contain a reference to the agreement under which the transfer is made.

An important point: the information in the agreement signed between the parties must correspond to the data in the act. If you change at least one item in the list of tolling materials or revise the deadlines after signing, you must re-enter the agreement (of course, if such changes are not provided for in it).

At the very top of the act of acceptance and transfer of customer-supplied materials there are official data: name of the document, city of signing, date. Then comes the main part. The body of the main part indicates the parties who entered into the agreement and provides a link to the invoice with its number and date. In addition, the act must contain a list of customer-supplied materials. It can be in the form of a list, but the attached sample contains a table with the necessary data.

Table contents

Each line of the act table must contain a single name of the material. It is unacceptable to list multiple items on one line. When filled out, the columns also describe information about:

- The serial number of the line.

- Type, size, brand of supplied materials.

- Unit of measurement.

- The amount of material transferred.

- The amount of material received.

- What part of what is received is suitable for further processing within the framework of a pre-concluded contract.

- The cost of accepted materials is in rubles.

The act ends with the signatures of representatives of both parties. Judicial practice especially emphasizes that this document must be signed after the transfer. This will eliminate possible misunderstandings between counterparties.

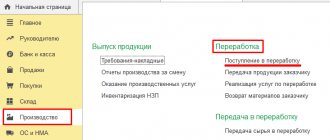

Toll scheme of work. Documents for registration according to the tolling scheme.

ACCOUNTING SERVICES FOR YOUR COMPANY >>

Here you will find a set of documents that will allow you to correctly prepare documents both on behalf of the Provider (Customer) and on behalf of the Processor (Contractor) *). We highly recommend using them in your document flow to avoid sanctions from the tax authorities.

Contact us >> Cost of accounting services for your company >> Why do you need us to service your company >>

Invoice for the transfer of raw materials to the Processor (M-15) - with this accompanying document drawn up by Davalets, the material (raw materials) is transferred to the Processor for processing. The document is required to be drawn up.

Certificate of acceptance and transfer of materials to the Processor for processing.doc - this document, together with the M-15 form, must be transferred by the seller when transferring materials for processing. The document is required to be drawn up.

Receipt order for materials, goods, etc. (M-4) - this document formalizes the receipt of materials at the Processor's warehouse on the basis of the M-15 invoice received from the Provider and the materials acceptance and transfer certificate.

Invoice for the transfer of finished products to the warehouse (MX-18) - with this document, the Processor registers the receipt of finished products received from processing from HIS production at its warehouse.

Processor's report - this document is drawn up monthly when working under a tolling scheme. The document is required to be drawn up.

Act on excess consumption of materials and waste.doc - this document is drawn up if, during processing for the production of a certain amount of finished products, it was discovered that more materials were consumed than was established in the calculation (annex to the contract), which, among other things, indicates consumption standards for the production of a unit of product, as well as defect rates and the amount of acceptable waste. . The document is required to be drawn up if the specified standards are exceeded.

Certificate of acceptance and transfer of finished products to Davalts.doc - this act is drawn up each time the finished product is transferred from the Processor to Davalts. The finished products are transferred to the Provider along with an invoice in form M-15, drawn up by the Processor (similar to how this is done when the Processor receives materials - the invoice has the same form, and the act has its own form for the transfer of finished products). The document is required to be drawn up.

*) The documents presented on our website are only samples and cannot be used without detailed study and adjustments taking into account the activities of each specific company. The owners of the site www.profitgroup.ru do not bear any responsibility for the use and consequences of the use of any files (documents) obtained from this site

What to pay attention to besides filling out

In order to avoid problems with interaction with regulatory organizations, in particular with the tax authorities, you must strictly adhere to the following principles:

- In the processor's accounting, customer-supplied materials should not be listed on the processor's balance sheet. The accountant must create separate, off-balance sheet accounts for them.

- If the product was manufactured by the seller, then selling identical product names to him is prohibited.

- Ownership of the home and business waste must be assigned to one of the parties in the contract so that there are no questions about the possible gratuitous transfer of materials.

Definition of tolling operations

When carrying out tolling operations, the supplier (customer) transfers inventories to the processor (performer). This is done in order to carry out certain work on the conversion of raw materials. Upon completion of the work, the customer receives the finished product.

Differences between a dealer and a processor

| Provider (customer) | Processor (performer) |

| Owns raw materials or has available funds to purchase them | Possesses the necessary production capacity |

| Has its own trademark, patented technologies, etc. | Processes raw materials |

| Has its own sales channels for finished products | Returns processed products to the seller |

| Pays for processing services | |

| Has ownership rights to raw materials and waste | |

| Possesses processed products |

To carry out operations for processing raw materials, two organizations enter into an agreement with each other for the processing of customer-supplied products. Such contractual relations between the parties are carried out on the basis of Chapter 37 “Contracting” of the Civil Code of the Russian Federation.

Nuances

When registering receipt and transfer, it is recommended to use the M-15 invoice form. It is also necessary to prepare at least two copies of the act, one for each party. The storage period for documentation depends on the storage period of the main agreement between the counterparties.

The proposed form of document preparation is only a recommended form. Since 2013, its use, as well as strict compliance with the listed columns, is not mandatory. But it is recommended. Details on forms are subject to change. In most cases, they are restructured in accordance with the specific specifics of the organization's work.

Use of customer-supplied materials.

Use of customer supplied materials.pdf

This method of providing material resources is common in construction. When used in accordance with Art. 713 of the Civil Code of the Russian Federation, part 1 (1), the contractor is obliged to use the materials provided by the customer economically and prudently, and after completion of the work, provide him with a report on the consumption of the materials received. The contractor must return the materials remaining after completing the work to the customer or, with his consent, reduce the price of the work taking into account the cost of the remaining unused materials. In this case, the estimated (contractual) cost of construction of the facility for the contractor is formed from the cost of construction and installation work without the cost of materials, which must be appropriately taken into account in the design and estimate documentation.

Current accounting rules qualify a business transaction involving the use of customer materials by a contractor as construction using customer-supplied raw materials and supplies. Article 220 of the Civil Code of the Russian Federation, part 1. (1) retains the customer's ownership of the materials transferred for processing.

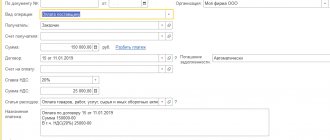

In the customer's accounting, transactions for the purchase of materials and their sale to the contractor are reflected as follows:

| № | Contents of a business transaction | Invoice correspondence | |

| debit | credit | ||

| 1. | Construction materials accepted for accounting | 10 s/sch "Build materials" | 60 |

| 2. | VAT is reflected on construction materials accepted for accounting | 19 s/account “VAT on purchased material resources” | 60 |

| 3. | Paid the supplier's invoice for construction materials, incl. tea VAT | 60 | 51 |

| 4. | The cost of materials transferred to the contractor for use in construction work is reflected, according to the transfer documents (act, invoice) | 10 s/ch "Materials transferred for processing" | 10 s/sch "Build materials" |

| 5. | The work performed by the contractor was accepted in accordance with the certificate of form No. KS-3 at the estimated (negotiable) cost of the work, including N With {without the cost of customer-supplied materials) | 08 s/sch "Construction of fixed assets" | 60 |

| 6. | The materials used during construction were written off in accordance with the write-off certificates submitted by the contractor in comparison with the consumption determined according to production standards | 08 s/sch "Construction of fixed assets" | 10 s/ch "Materials transferred for processing" |

In the contractor's accounting, transactions are reflected as follows:

Receipt on off-balance sheet account 003 “Materials accepted for processing” - raw materials and materials accepted from the developer (customer) at the prices stipulated in the contract;

Dt 62 “Settlements with buyers and customers” Kt 90-1 “Other income and expenses” - the completed volumes of work were handed over to the customer in accordance with the certificate of form No. KS-3 at the estimated (contractual) cost of the work without taking into account the cost of customer-supplied materials;

Expense on off-balance sheet account 003 “Materials accepted for processing” - customer-supplied materials are written off when they are used in the production of work.

Considering the above business transactions, it should be noted that:

• amounts of value added tax paid to suppliers on goods purchased and transferred to contractors on toll-to-pay basis for construction and installation work are subject to deduction from the taxpayer after the registration of a production facility completed with capital construction in accordance with clause 5 of Art. 172 Tax Code of the Russian Federation, part 2. (2);

• for the contractor, the turnover subject to VAT is the cost of work on processing customer-supplied raw materials and materials.

Documents for registration according to the tolling scheme.

Invoice for the transfer of raw materials to the Processor (M-15) - with this accompanying document drawn up by Davalets, the material (raw materials) is transferred to the Processor for processing. The document is required to be drawn up.

Certificate of acceptance and transfer of materials to the Processor for processing. — this document, together with form M-15, must be handed over by the seller when transferring materials for processing. The document is required to be drawn up.

Receipt order for materials, goods, etc. (M-4) - this document formalizes the receipt of materials at the Processor's warehouse on the basis of the M-15 invoice received from the Provider and the materials acceptance and transfer certificate.

Invoice for the transfer of finished products to the warehouse (MX-18) - with this document, the Processor registers the receipt of finished products received from processing from HIS production at its warehouse.

Processor's report - this document is drawn up monthly when working under a tolling scheme. The document is required to be drawn up.

Act on excess consumption of materials and waste. - this document is drawn up if, during processing for the production of a certain amount of finished products, it was discovered that more materials were consumed than was established in the calculation (annex to the contract), which, among other things, indicates the consumption rates for the manufacture of a unit of product, and also the norms of defects and the amount of acceptable waste. . The document is required to be drawn up if the specified standards are exceeded.

Certificate of acceptance and transfer of finished products to Davalets . — this act is drawn up each time the finished product is transferred from the Processor to the Provider. The finished products are transferred to the Provider along with an invoice in form M-15, drawn up by the Processor (similar to how this is done when the Processor receives materials - the invoice has the same form, and the act has its own form for the transfer of finished products). The document is required to be drawn up.

BARGAINING 12 PRODUCT CONTRACT.xls

Processor's report on the consumption of materials and manufactured finished products.doc

Act-Report on overuse and waste of materials.doc

Certificate of provision of services and acceptance and transfer of finished products.doc

Certificate of acceptance and transfer of materials for processing.doc

MX-18 CONTENT FOR TRANSFER OF FINISHED PRODUCTS TO STORAGE LOCATIONS.xls

M-15 CONTENT.docx

M-4 RECEIPT ORDER.docx