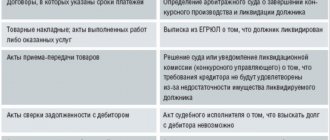

Knowing the receipts, expenses of fuel, combustible materials, it is necessary to maintain primary documentation. This will simplify the task of tracking raw materials, as well as facilitate checks on the fact of direct use of materials.

Primary documents

Combustible materials include: gasoline, diesel fuel (DF), gas of any fractions (liquefied, compressed, petroleum). Also, the following primary documentation is monitored: motor oil, lubricants, anti-freeze.

Typically, organizations and institutions whose vehicles carry out transportation activities: cargo, transportation of passengers, etc., use primary documentation for the settlement system. Leaving point A, the car’s tank is filled with a certain amount of fuel, the calculation of which is made depending on the brand of the vehicle and the organization’s standards. The allocated liters of fuel are entered into the protocol or voucher. The amount of fuel and mileage are checked at the time of departure. At the end of the route, the remaining fuel and mileage are checked. All this represents documentation that controls the flow of raw materials within the organization.

What is fuel and lubricants

Fuel and lubricants is a generally accepted abbreviated name for a group of fuels and lubricants. These include:

- various types of fuel (diesel, gasoline, gas);

- special fluids for vehicles (brake, cooling);

- oils and lubricants (motor oils, transmission oils, various lubricants, etc.).

Fuel and lubricants can be used by both specialized transport enterprises and ordinary companies that have vehicles used for various needs.

In what cases is a waybill not needed?

Fuel, fuels and lubricants can be used for organizations involved in the transportation or trading of such materials. For example, an organization that uses a lawn mower to maintain its territory does not require a travel document; this is an extra document for accounting for the costs of raw materials. In such cases, use the technical documentation for the unit, which indicates gasoline consumption rates per hour of operation.

Organizations not engaged in transportation, having official or industrial transport, can do accounting work without waybills, according to (Ministry of Finance, document No. 03-03-06/1/354 dated 16/06/11):

- When using the GLONASS system, which allows you to make copies of receipts and other primary documentation - reports that track all movements of the vehicle.

- If the route does not change, the vehicle is intended for daily transportation of workers. The number of trips, mileage, gasoline consumption is constant, therefore, the use of write-offs according to approved fuel consumption standards is logical.

How to write off fuel and lubricants using waybills

A waybill (PL) is a primary accounting document that reflects the mileage of vehicles. With its help you can calculate the consumption of fuel materials.

Specialized transport organizations that use vehicles to carry out their main activities are required to use the PL with the details that are specified in the order of the Ministry of Transport of Russia “On the procedure for filling out the PL” dated September 18, 2008 No. 152.

Attention! Changes have been made to Order No. 152 and from March 1, 2019, you will need to fill out travel forms in a new way. We talked in more detail here.

Enterprises for which the use of vehicles is not the main activity can independently develop a form of PL and consolidate it in their accounting policies. However, it is important not to forget about the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. And yet, most often, enterprises prefer to use the PL form from the Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78. For a sample of filling out a waybill, see here.

Each DP must be noted in a special registration log. In practice, the question often arises with what regularity it is necessary to issue a PL. Clause 10 of Order 152 states that the PL can be drawn up for 1 day or for a period of no more than 1 month.

Specialized transport enterprises are recommended to draw up PLs daily in order to confirm their expenses and record the time worked by drivers. An exception is the case when the driver was sent on a business trip for a period exceeding 1 day (shift).

Companies that use vehicles for their needs and are not specialized can issue a license as needed, for example, once every 2 weeks or once a month (Resolution of the Federal Antimonopoly Service of the North-Western District dated February 11, 2009 No. A56-10236/2007).

The Ministry of Finance notes that PLs must be issued with such regularity that on their basis one can confidently judge the need for spent fuel and lubricants and the accounting of time worked by drivers (letter of the Ministry of Finance of the Russian Federation dated 04/07/2006 No. 03-03-04/1/327, dated 16.03 .2009 No. 03-03-04/2/77).

Rules for writing off fuel and lubricants based on waybills

The procedure for writing off fuel and lubricants according to waybills involves 2 methods of writing off: according to the standard or according to the fact. In order to figure out when and what method to use, let’s turn to the PL form itself.

Let's assume that the enterprise uses the PL from Resolution 78. The forms of this document contain a column for indicating fuel consumption. The columns of this column reflect how much fuel was in the tank when the vehicle left, how much was issued, and how much was left in the tank when the vehicle returned. In this case, it is possible to calculate the actual fuel consumption for the submarine. Non-specialized transport enterprises, when independently developing their own plans, can also include these columns in the document. Then there will be no difficulties in actually calculating the spent fuel and lubricants.

Section II of Order 152 does not indicate the reflection of turnover in the movement of fuel resources as mandatory details. At the same time, in paragraph 6 of this document you can see the requirement to indicate the odometer readings when leaving and returning the vehicle, that is, mileage in kilometers.

How to write off fuel and lubricants according to waybills in cases where the fuel turnover is not indicated in the PL? You can use the write-off of fuel and lubricants according to the standard - the rules for such write-off are given in the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. The document contains standard fuel costs for various brands of cars and the procedure for calculating fuel costs according to the distance traveled by vehicles.

The resulting data is the basis for reflecting spent fuel and lubricants in accounting. For tax accounting purposes, you can use either method. The Tax Code of the Russian Federation does not directly stipulate that fuel and lubricants expenses are accepted for tax accounting only based on actual expenses incurred.

A ready-made solution from ConsultantPlus will help you calculate fuel consumption according to standards. Sign up for a free trial to learn the material.

Calculation of waybills for the write-off of fuel and lubricants

Let's consider a practical example of calculating waybills for writing off fuel and lubricants.

Example

In August 2021, Zarnitsa Plus LLC purchased 200 liters of gasoline for a total amount of 8,000 rubles. in view of VAT. At the same time, as of August 1, 2019, there were 80 liters of gasoline in stock at a price of 38 rubles. per liter A VAZ-21214-20 Chevrolet Niva car was filled with gasoline. This car is used for business trips by employees of the Zarnitsa Plus accounting department. The accounting policy at the enterprise has adopted the method of accounting for fuels and lubricants at average cost.

The company operates in the Chelyabinsk region.

Let's determine the average cost of writing off fuel and lubricants in March and calculate fuel consumption in the current month in two ways: according to fact and according to the standard.

| Dt | CT | ∑, rub. | Content |

| 10 | 60 | 6 666,67 | Receipt of gasoline from the supplier |

| 19 | 60 | 1 333,33 | VAT |

Let's calculate the average cost of gasoline in August 2021:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

(80 l × 38 rub. + 6,666.67 rub.) / (80 l + 200 l) = 34.67 rub.

- Write-off of gasoline after the fact.

In August 2021, 1 vehicle departure was made for official purposes. The PL states that when leaving, there were 40 liters of gasoline in the Niva’s tank, 20 liters were issued, and when returning back to the enterprise, the remainder in the tank was 30 liters.

Let's determine the actual fuel consumption:

40 l + 20 l − 30 l = 30 l.

The amount of gasoline write-off in March will be:

30 l × 34.67 rub. = 1040.10 rub.

| Dt | CT | ∑, rub. | Content |

| 26 | 10 | 1 040,10 | Gasoline written off for general business needs |

- Write-off of gasoline according to the standard.

Let's assume that the submarine does not reflect the fuel speed. The company uses PL with odometer readings.

The submarine produced about: at the beginning of the trip 5000 km, after returning to the enterprise - 5070 km. Let us turn to order No. AM-23-r.

In paragraph 7 of the document you can see the formula for calculating fuel consumption:

Qн = 0.01 × Hs × S × (1 + 0.01 × D),

Where:

Qn — standard fuel consumption, l;

Hs—basic fuel consumption rate for vehicle mileage, l/100 km;

S—vehicle mileage, km;

D — correction factor (total relative increase or decrease) to the norm, %.

In sub. 7.1 of the document we find Hs for our car - 10.9 liters.

Coefficient D is found in Appendix No. 2 to the document - 10% (for the Chelyabinsk region).

Let's determine gasoline consumption in March:

0.01 × 10.9 l × 70 km × (1 + 0.01 × 10%) = 8.4 l.

The amount of gasoline write-off in March will be:

8.4 l × 34.67 rub. = 291.23 rub.

| Dt | CT | ∑, rub. | Content |

| 26 | 10 | 291,23 | Gasoline written off for general business needs |

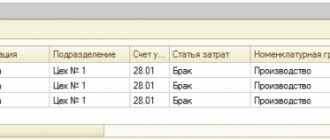

Accountant's procedure

The organization's materials are taken into account by the accountant and calculated based on their cost. These expenses and receipts are elements of the PBU 5/01 system. Acceptance of any raw materials into the accounting system is carried out taking into account the following documents:

- If fuel is purchased in cash, these are gas station receipts;

- Fuel coupons, if raw materials were purchased by bank transfer, taking into account the agreement between the supplier of raw materials and the receiving company.

There are situations when a driver refills his tank while on the road using a special card. Afterwards, the accountant needs to write off not only the gasoline poured at point A, but also calculate the amount of additional spent, knowing its cost and volumes on the map.

But, in general, adding additional fuel rarely occurs, and accountants work exclusively with waybills and write off specific volumes. Receipt balances are summed up and divided by the total balance on the day of registration.

Accounting

The entire accounting system consists of two important sections:

- Debit is income;

- Credit - Write-off (expense).

What is the calculation? To begin, calculate the amount of raw materials by multiplying this indicator by the cost of a unit of fuel from reserves. The result is written off according to the calculated values of each type of raw material.

Tax accounting

Generating waybills is not an easy task. It is necessary to determine the type of expenses and material costs. Inventory assets regulated by basic documents include: fuel, lubricants, oils, antifreeze. The rest, the movement of vehicles, are considered other expenses and are regulated by other documents.

Do I need to take expenses into account for tax purposes? The legislation does not say that 100% are recognized as mandatory and their actual use. The Ministry of Finance confirms that the amount of raw materials is calculated based on mathematical formulas in accordance with order No. AM-23-r.

All incoming raw materials, together with consumables, are calculated according to standard and actual values of consumption indicators. The order indicated above allows subjects and organizations to independently establish standards for the consumption of raw materials and a calculation system. For example, an organization that has independently developed expense norms and correctly documented them will not raise questions from the tax authorities, and the latter will not consider these values as expenses of the reporting period.

***

Accounting for the write-off of fuel and lubricants must be organized at each enterprise where vehicles are used and fuel and lubricants are consumed. It does not matter whether the organization is a specialized transport company.

Fuel resources are written off on the basis of the main primary document - PL. There are certain rules for writing off fuel and lubricants based on waybills. The costs of fuel and lubricants can be determined by fact or by standard. The cost of writing off fuel and lubricants in accounting is calculated using the FIFO method or the average cost method. For tax accounting purposes, you can use either method.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical mistakes of accountants

Technical errors are common when working with documentation. These are typos, omissions, arithmetic errors, and numerical errors. If you make such a mistake, you can identify it by drawing up final reports when income and expenses do not match the balance.

Methodological errors are rarely discovered. This is due to the competent form of drawing up and processing documents. Typically, forms for writing off fuel and lubricants, waybills are quite simple, employees of the economic departments of the organization do not have problems with their preparation. It is enough to know the receipt, consumption and cost of fuel. Waybills will help you determine the mileage and display the exact balance.

Write-off of fuel and lubricants is now the main part of the activity of any enterprise. It is important to competently and clearly maintain primary documentation and correctly justify the expenses of the enterprise.