If you are serious about getting into trading, you will have to choose which costing method to use. Such a seemingly simple question - how to write off sold goods - can have a serious impact on how your trade will develop. In this material we will look at all methods of cost calculation , evaluate the advantages of each, and also tell you when it is better to use which one.

Please note: it is more convenient to keep records and view analytics in the same program. The MoySklad goods accounting service has built-in reports on turnover, balances, profitability, and movement of goods. They are generated automatically and can be viewed at any time, for example, in a mobile application. No matter where you are: business is always under control. Register and try it now: it's free!

Try MySklad

The law allows three methods of assessment and calculation - by the cost of each unit of goods, by the average cost and by the FIFO method (English: “first in, first out”). Each of them will give different indicators for business profitability, and therefore for tax and management accounting. Let's figure out what the difference is.

At the cost of each unit

As the name implies, this method assumes that the cost of each specific product is taken into account in the calculations. This system is used when trading unique and expensive goods, when accuracy is important. For example, it is suitable for those who will sell cars, art or jewelry. It is logical that when a product is piecemeal, and one cannot easily replace another, exactly the price at which it was delivered is entered into accounting when writing off inventory items. This method also assumes that it is always clear from which specific delivery the goods sold came from.

Average cost method

It is used more often than the previous one, and involves monthly calculation of the cost of goods using the arithmetic average. In this case, it does not matter from which specific delivery this or that product “left”. This method of writing off inventory items is suitable for companies selling products for which piece accounting is not important. This could be, for example, stationery, clothing, shoes, toys, cosmetics and any other consumer goods. The average cost method is especially beneficial for those goods for which the price is constantly changing, both up and down.

This method is the easiest to account for. The average cost of goods is calculated using the following formula:

[average cost of inventory items] = ([cost of inventory items at the beginning of the month] + [cost of inventory items received during the month]) / ([number of inventory items at the beginning of the month] + [number of inventory items received during the month])

And the cost of inventory written off per month is calculated as follows:

[cost of written-off inventory items] = [average cost of inventory items] X [number of inventory items sold per month]

An example of calculation using the average cost method can be downloaded below.

The advantages of the average cost calculation method are the stability of the price of materials sold and simplicity. However, from a tax accounting point of view, it is not optimal in the case where, for example, you purchase the same pens from the same supplier, and he gradually reduces your prices. Let's consider the following option.

Method for assessing MPZ by average or fifo | Guarantee of right

Hello, in this article we will try to answer the question “Method for assessing MPZ by average or fifo.”

You can also consult with lawyers online for free directly on the website. Fuad Suleiman Mahmoud Al Fasfus, developed an algorithm for selecting a method for valuing reserves upon disposal. The author identified external and internal factors influencing the choice of method. The FIFO method should be chosen if the organization has inflation, a decrease in prices and demand for products.

However, in RAUZ, at the time of the final adjustment of disposal costs for inventories, two options are provided: at average cost and at FIFO. We will tell you how it works and what features it has in this article.

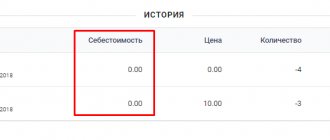

Let’s calculate the cost with the “Estimation of the cost of inventories upon disposal” setting set to the average. As a result, the Inventory Accounting Sheet will show us the final balance of 1.5 rubles (everything is as planned).

FIFO write-off method: advantages

The feature bar helps novice users learn the program faster and helps advanced users complete daily tasks more efficiently.

The LIFO method (Last In First Out) is a method of valuation based on replacement cost based on the rule: the last batch is received, the first is spent.

The actual cost of materials when manufactured by the organization itself is determined based on the actual amounts spent on the production of these inventories. Accounting and formation of such costs is carried out in the manner established for determining the cost of the relevant types of products.

The balance of chipboard at the end of the month is 40 sheets (300 + 150 – 410), the entire balance from the second batch.

Please disable it on our site by clicking \"pause it on this site\". We only have Yandex advertising...

It should be noted that the LIFO method is used for tax accounting purposes only. The methods are also used in warehouse logistics, for example, the FIFO method is used for warehouse accounting of perishable inventories.

The site contains the best and new business ideas, examples of business plans with videos, complete step-by-step guides on starting a business from scratch, choosing old and new equipment, maintaining an individual entrepreneur, a catalog of franchises from representatives, sample document templates, forms and forms for 2018-2019 .

Situations from practice

It should be noted that for accounting purposes, an organization can use different write-off methods for different groups of inventory.

When calculating using the FIFO method, it is necessary to use data sequentially, starting with the balances for the previous month. The total amount of fabric received for March was 13,400 rubles. The basic principle of this method is “first in, first out”, that is, the materials that arrive at the warehouse first will also be used first.

The main advantage of the method of writing off inventories at the cost of each unit is that all materials are written off at their actual cost without any deviations.

The actual cost of inventory received by an organization under a gift agreement or free of charge is determined at the current market value on the date of acceptance for accounting.

For profit tax purposes, according to clause 2 of Art. 254 of the Tax Code of the Russian Federation, the cost of materials is determined based on the prices of their acquisition, including commissions paid to intermediary organizations, import customs duties and fees, transportation costs and other costs associated with the acquisition of inventory 4, P. 108.

So, she calls and asks to tell her about the FIFO method and to give her an example of the calculation. For the first time I decided to help out a friend, but the situation was quite sad. I will share with you, friends, all the relevant information about this method.

Situations often arise in organizations when the same materials are purchased at different prices from different suppliers, then the amount of expenses included in the cost of inventories may also differ. This leads to the fact that the actual cost of different batches of identical inventories differs.

I rarely get this feeling, but still. One day a neighbor called me screaming for help. Not long ago she started working remotely as an accountant for a company. I don’t even know how she manages to hold on to her place there.

In both accounting and tax accounting (both under the OSN and under the simplified tax system), when releasing raw materials into production, transferring tools and equipment into operation, and when selling goods, their value can be assessed by one of three methods. The chosen method must be indicated in the accounting policy.

Theoretical aspects of the work: description of the main sections of the Project Expert ppt

A feature of the FIFO and LIFO methods is volumetric analytical accounting, which must be organized by batches and receipt dates.

In this case, accounting is kept for each batch of materials separately, and materials are written off exactly at the prices at which they were accepted for accounting.

The use of a rolling assessment must be economically justified and supported by appropriate computer technology.

This method is used in exceptional cases or with a small range of inventory items. It is characterized by particular labor intensity, provided that it is used in enterprises with a large product range.

Presentation of financial results

For example, an organization is engaged in the production of cabinet furniture. The balance of chipboard at the beginning of the month is 300 sheets in the amount of 600,000.00 rubles.

Then the total cost of the materials used is determined by subtracting from the amount of material balances at the beginning of the reporting period, taking into account the cost of materials received during the reporting period, their cost attributable to the balance of materials at the end of the reporting period.

Methods for writing off inventories to cost: at the cost of each unit, at the average cost, FIFO.

It is based on the assumption that materials are written off for production in the sequence in which they were purchased. Materials from subsequent batches are not written off until the previous one is used up.

Accounting for inventories at planned (standard) or actual cost. Nomenclature-price tag.

Price fluctuations are mainly in the direction of growth. A market economy generates constant inflation, as a result of which a particular type of inventory can be stored in a warehouse at different prices.

The fixed price includes the supplier's contract price, which consists of the selling price, taking into account a certain level of profitability. Subsequent costs for the procurement of inventories depend on the type of free, which indicates at what stage of their procurement the supplier assumes part of the costs of their transportation or loading.

N.A. Lumpov [4] believes that for a fair assessment of a business, it is beneficial to reduce the degree of capitalization, since such a measure provides a more “adequate” assessment of profit, which is determined by the profit monetization coefficient, namely the share of net cash flow in it.

It should be noted that for accounting purposes, an organization can use various methods for writing off different groups of inventories. For each group (type) of reserves during the reporting year, one valuation method is used [19, P.10].

Articles and advice from colleagues for economists, financiers and accountants. Document templates, Examples of calculations and reports, gifts and promotions.

At the beginning of the month, the organization had 120 kg of paint remaining in the amount of 3,600 rubles at actual cost.

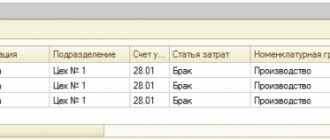

Disposal of inventories occurs when they are released into production, transferred for the organization's own needs, sold externally, or when liquidated as a result of any force majeure circumstances. The write-off of inventories, depending on the grounds for disposal, is documented in documents whose form is approved by regulation. Inventory can be written off:

- limit intake card according to the approved form M-8 (issued in cases where limits (norms) are established for the consumption of materials);

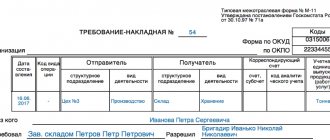

- requirement-invoice in form M-11 (in the event that the production process does not provide for limiting material consumption);

- invoice for external release in form M-15 (if materials are sold or disposed of for other reasons).

Before the LIFO method was abolished in 2008, it was considered one of the “most effective”. Write-off of inventories at the prices of last deliveries (mostly expensive ones) led to an increase in expenses and an understatement of taxable profit. The exact opposite result is observed when using the FIFO method. The average cost method gives an average result between the first two.

The use of a rolling assessment must be economically justified and supported by appropriate computer technology.

The first method is based on writing off the cost of each batch in order: first, the cost of the balance is written off, if the amount of materials written off is greater than the balance, the first batch received is written off, then the second and subsequent ones. The balance of materials is determined by subtracting the cost of written-off materials from the total cost of materials received during the month (taking into account the balance at the beginning of the month).

The main advantage of the method of writing off inventories at the cost of each unit is that all materials are written off at their actual cost without any deviations. This method is applicable only in cases where the organization uses a relatively small range of materials, when it is possible to accurately determine which materials are written off.

At the beginning of the month, the remaining carrots amounted to 100 kg, costing 1,200 rubles. During the month, another 500 kg of carrots were purchased at a price of 10 rubles/kg, with a total cost of 5,000 rubles. (10 RUR/kg x 500 kg). 550 kg of carrots were sold in a month.

The balance of carrots at the end of the month is 50 kg (100 kg + 500 kg - 550 kg). For example: at the beginning of the month, the balance of M-400 cement was 5 bags worth 650 rubles. Within a month, 5 more bags were purchased for the amount of 900 rubles.

Within a month, 8 bags of cement were used to repair the premises.

Source: https://sergey-tretyakov.ru/menedzhment/1926-metod-ocenki-mpz-po-sredney-ili-fifo.html

FIFO method. Calculation example

This is the most popular cost calculation method. It uses the queuing principle. It is assumed that the items that were delivered first are written off first. Hence the name FIFO method (English: “first in, first out” - “first in, first out”). However, unless the shelf life is important, it is not necessary to ship goods from an earlier delivery first - this is used as an assumption in the calculations. That is, the cost of goods that are sold first is calculated at the price of the balances from the “oldest” delivery. When the balances are quantitatively exhausted, inventory items are written off at the price of the next delivery, then the next one, and so on.

Example of calculation using the FIFO method

As can be seen from the example of calculation using the FIFO method, the profit indicator in this case is lower than in the example with average cost. Accordingly, income tax will be less.

FIFO or average cost - which is better?

Both of these methods work quite well. However, FIFO is considered more accurate than the average cost method. It is especially beneficial in terms of taxes if the price of the goods you purchase is constantly decreasing. Then the cost of the written-off goods will be the greatest, and the balance will be the minimum. Therefore, the answer to the question of which is better, FIFO or average cost, in most cases will be the first option.

FIFO method in warehouse program

Despite the fact that the FIFO method is quite simple in terms of understanding the principle of its operation, manually calculating the cost each time is very labor-intensive. Especially if you have a small business, and you yourself are the director, the cashier, the accountant, and the chief buyer. It is much easier if you simply enter data on deliveries and sales and immediately get the result. This is exactly how you can work with the MyWarehouse service. The program fully automates trading processes and itself calculates the cost of written-off goods or services using the FIFO method.

MyWarehouse calculates profitability for each product or product group, stores and displays current and historical balances, as well as many other data that may be useful. This way, you save time and can be confident in the accuracy of the indicators on which you make decisions. Read more about how MyWarehouse calculates cost in our instructions.

Company accounting policy

According to the law, the organization itself chooses how to calculate the cost of goods. It is important that the method you consider is necessarily reflected in the company's accounting policies. This is stated in Article 313 of the Tax Code of the Russian Federation, as well as in paragraph 73 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 28, 2001 No. 119n.

Changes to accounting policies can be made once a year. That is, you can deposit them earlier, but they will take effect according to the law next year - at the beginning of the new tax period. The accounting policy is drawn up by an accountant and approved by the head of the organization.

For management accounting purposes, you are free to use any costing method. Our advice is to use the same one that is written down in your accounting policy - this way there will be less confusion.

LIFO and FIFO method: essence and examples

In order to operate as efficiently as possible, companies and entrepreneurs must have a certain kind of resources allocated to carry out normal activities and satisfy the basic needs of the entity.

The receipt of materials into the organization is accompanied by their acceptance onto the balance sheet, taking into account the actual acquisition costs incurred.

However, the question arises at what cost should the write-off of inventories be recorded if inventories are purchased in large quantities at different costs and at different periods of time, while they are written off into production as needed.

Organization of inventory accounting

Accounting and tax accounting requirements oblige companies to organize an inventory accounting system. Due to the fact that the write-off of materials affects the amount of the organization’s income tax, tax authorities closely check whether the inventories are legally transferred to the production workshop and whether the current valuation method is enshrined in the company’s internal documentation.

Companies in their activities must choose one of the current methods for estimating reserves. The rationale for using a specific method lies in the fact that in the process of conducting business, an organization can buy identical goods from different counterparties and at different prices.

If the purchase volumes are really large, then it is not possible to track the cost of each individual batch.

It is for this reason that companies strive to choose the optimal method that allows them to reflect the cost of inventories in accounting correctly, while using minimal labor costs of the company’s personnel.

When calculating the cost of inventories received by the company, it is important to take into account such costs incurred as:

- Expenses for payment of delivery to the counterparty for shipped products;

- Expenses for settlements with the budget regarding tax and customs payments that are not reimbursed from the treasury;

- Costs associated with delivery of goods to the destination;

- Costs associated with consultations by both individuals and third parties;

- Costs associated with insurance of purchased valuables.

Options for determining the cost of inventories in a company

For the purposes of correct accounting of an organization, such methods of assessing values are used as

- Estimation of the cost of each individual unit of inventories;

- Valuation based on the average value of valuables;

- FIFO method;

- LIFO method (not used today).

If we talk about the first two methods, their practical application is not fraught with difficulties.

The method of valuing inventories at the cost of each individual unit is used by companies in cases where they have the opportunity to track the movement of a given asset for each individual batch and, accordingly, correctly determine its value. This method is available for organizations from which the purchase of valuables is not of a mass nature.

The method of valuing inventories at average cost in practice is the most convenient and is most often used by companies. Its essence comes down to determining the average price of inventories received by the organization. It is at this value that assets will be disposed of into production.

The LIFO and FIFO methods are the most controversial methods for valuing organizational inventories.

The FIFO method is that identical assets in production will be written off at the cost of the assets that were first acquired in time. The LIFO method is the complete opposite - inventories will be written off at the cost of the most recently acquired inventory.

Despite its importance, today the LIFO method is not used by companies. Moreover, if initially the ban on the use of this method was established only for accounting purposes, now even the organization of tax accounting involves a complete abandonment of this technique.

FIFO inventory write-off method

The method of writing off the first inventory purchases provides companies and entrepreneurs with the opportunity not only to assess the real amount of expenses incurred, but also to determine at what rate they are paid back and how effectively they are used in their activities.

However, this assessment method also has a significant drawback - FIFO does not fully allow organizations to take into account the level of inflation processes in the country and price fluctuations for product groups.

What should you pay attention to when using the FIFO valuation method in your business? Organizations using this method are required to consider the following:

- Using this technique, it is possible to determine not only the value of assets upon their receipt or disposal. In a similar way, the amount of inventory balance in the company’s warehouses should be determined;

- The FIFO method can be used in practice not only in its original basic version, but also in its slightly modified version - when the value of inventories is determined taking into account moving prices, which are determined daily at the time of issuance of values;

- If the company uses the basic version of the FIFO method, it is necessary to evaluate inventory balances in warehouses at the end of each month.

The essence of the LIFO method

Despite the fact that the use of the LIFO method in accounting for accounting purposes was canceled in 2008, for many years it was successfully used only in tax accounting of organizations. For this reason, discrepancies between tax accounting and accounting accounting occurred in many Russian companies.

Nevertheless, the desire to bring these accounting systems as close as possible to each other has become the basis for achieving equality in the methods of assessing the reserves of domestic organizations. Only in 2015, when many tax reforms were carried out, LIFO was canceled (Articles 254, 268 of the Tax Code of the Russian Federation, PBU 5/01 “Accounting for inventories”).

The essence of the LIFO method was as follows: the goods that were received by the company last should be written off first from the company's records.

In what cases was it beneficial for organizations to use this method of assessment in practice?

The use of the LIFO method determined the company's ability to take into account the pace of inflation processes and write off the most expensive assets first.

These actions made it possible to keep under control the amount of income tax when calculating with the budget.

However, such a situation occurs infrequently in practical life for the simple reason that the method is aimed specifically at reducing the cost of goods, whereas most often a diametrically opposite picture is observed.

The ban on the use of this method of estimating reserves in activities is due to the desire to bring together international and Russian accounting systems. Abroad, despite the fact that the LIFO method is officially approved for use, it is actually unpopular.

An example of inventory write-off using variations of the FIFO method

Let's consider what differences in the calculation were observed when using two variations of the FIFO inventory write-off method.

Example 1. Basic FIFO method.

In the first month, the company purchased 30 flower pots at a price of 150 rubles per piece. In the second month there were two more deliveries of goods: the first - in the amount of 15 pieces at a price of 120 rubles per pot, the second - in the amount of 5 pieces at a price of 130 rubles per unit. Upon request, the storekeeper must issue 48 flower pots. In its activities, the company uses the FIFO inventory valuation method.

- First of all, it is necessary to calculate the average cost of goods to be issued: Sebest-tsr. = 30*150 + 15*120 + 3*130 = 4500 + 1800 + 390 = 6690.

- The next step is to determine the average cost of one flower pot: St = 6690 / 48 = 139.38 rubles.

Accordingly, the balance in the warehouse will be 2 flower pots, costing 130 rubles each.

Example 2. Rolling FIFO method.

Using the data from the example above, the cost was calculated using the sliding FIFO method:

- The cost of flower pots that will remain in the organization’s warehouse will be determined as follows: 2*130 = 260 rubles.

- The cost of flower pots, which are written off from the organization’s balances, will be calculated as follows: 30*150 + 15*120 + 5*130 – 260 = 4500 + 1800 + 650 – 260 = 6690 rubles.

Based on the calculations made, it can be noted that when calculating the cost, the same results were obtained, regardless of which model of the FIFO method was applied.

When using a rolling model, there is no need to determine whether a product belongs to a specific batch; it is enough to know the total amounts of deliveries.

However, in the case when the company uses the first write-off method, it is important to know from which delivery the goods are being retired.

Thus, today only three options for writing off inventories are available for accounting and tax accounting of companies.

The LIFO method has been discontinued in accounting since 2008 (Order of the Ministry of Finance No. 26n dated March 26, 2007), while the ban on the use of this method in tax accounting was introduced in 2015 (amendments to Articles 254, 268 of the Tax Code of the Russian Federation).

Experts will help you understand the methodology for estimating reserves.

Source: https://buhgalter-prof.ru/poleznye-stati/metod-lifo-i-fifo-v-sovremennoy-praktike/