If the account is seized by bailiffs, what is the order of payments?

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

Your voice is important in the discussion on corporate bankruptcy. persons Lecturers: V. V. Vitryansky, V. V. Batsiev, E. D. Suvorov, O. R. Zaitsev, A. V. Yukhnin.

Compliance with the order of debits when seizing a bank account

© NPP GARANT-SERVICE LLC, 2021. The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

All rights to the materials on the GARANT.RU website belong to NPP GARANT-SERVICE LLC. Full or partial reproduction of materials is possible only with the written permission of the copyright holder. Rules for using the portal.

The GARANT.RU portal is registered as an online publication by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor), El No. FS77-58365 dated June 18, 2014.

LLC "NPP "GARANT-SERVICE", 107392, Moscow, st. Khalturinskaya, 6A,

8-800-200-88-88 (free long-distance call)

Editorial office (ext. 3145),

Advertising department (ext. 3161), Advertising on the portal. Media kit

If you notice a typo in the text, highlight it and press Ctrl+Enter

What payments can be made when an account is frozen?

In this case, the account is completely seized, since the taxpayer does not have any arrears (penalties, fines). If all funds are blocked in accordance with paragraph. 3 p. 1 art. 76 of the Tax Code of the Russian Federation, if all funds in the account are blocked, then only the following payments can be made:

- Write-off of funds to pay taxes, fees, insurance premiums, penalties and fines to the budget system of the Russian Federation;

- Payments, the order of execution of which in accordance with the Civil Code of the Russian Federation (clause 2 of Article 855 of the Civil Code of the Russian Federation) precedes the execution of the obligation to pay taxes and fees in the following order:

- first of all - according to writs of execution on compensation for damage and collection of alimony (writs of execution, court orders, orders of the bailiff and other documents specified in Part 1 of Art.

Bailiffs seized the account - what to do? how to unfreeze an account

How do bailiffs seize funds? In accordance with Article 81 of Federal Law No. 229 “On Enforcement Proceedings,” seizure of an account is carried out as follows:

- The decision on collection falls into the hands of the bailiff.

- He, in turn, draws up a resolution to seize the citizen’s funds placed in accounts and sends this document to the relevant banks.

- If the account details are unknown, then the bailiff sends a resolution to search for them to the financial organization.

- The bank employee immediately seizes the funds in the amount of the existing debt. In addition, he informs the bailiff about taking appropriate measures.

- If there is enough money, it is written off and the account is blocked.

Sender Notifications

If the order is correctly executed and there are sufficient funds in the account for electronic settlements, the financial institution accepts the document for execution. In this case, the bank notifies the sender of the paper about the start of the procedure. If the order is issued on paper, the employee of the financial institution puts the date of receipt, signature and stamp.

The copy containing the marks is returned to the sender no later than the next day (working day). If the order is executed incorrectly, the bank sends an electronic notification about the cancellation of the transaction. In this case, the notice must indicate the reason for cancellation. If the order is executed on paper, appropriate marks are placed on it. The document is certified by the signature of the responsible employee and a stamp.

How to pay wages to employees when the tax account is seized?

Add to favoritesSend by email According to paragraph. 2 p. 1 art. 76 of the Tax Code of the Russian Federation, the suspension by the tax authority of operations on an account entails the termination by the bank of all debit transactions on it. However, this measure does not prevent the taxpayer from spending funds from the current account in certain cases provided for by law. If only part of the funds is blocked. If only part of the funds in the account is blocked, then for part of the balance the taxpayer can carry out any expense transactions, as well as electronic money transfers (paragraph 4, 6, clause 2, article 76 of the Tax Code of the Russian Federation). To unblock the account, the taxpayer can send an application to the tax authority in accordance with clause 9 of Art. 76 Tax Code of the Russian Federation. It should be noted that this rule does not apply when an account is blocked due to failure to submit a declaration.

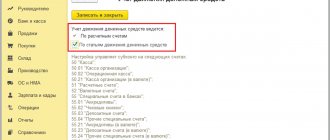

Accounting

How is the procedure for debiting funds from a current account reflected? On loan account 51 go through all expense transactions. The postings will be like this:

- db sch. 60 (66, 91.2, 76, etc.) CD count. 51 – payment of obligations under the terms of the agreement.

- db sch. 68 CD count. 51 – deduction of budget payments.

- db sch. 69 CD count. 51 – payment of contributions. At the same time, separate sub-accounts are opened for settlements with the Social Insurance Fund, the Federal Compulsory Medical Insurance Fund, and the Pension Fund.

- db sch. 70 (71, 73) CD count. 51 – repayment of obligations to employees.

- db sch. 75.1 CD count. 51 – payment of dividends to participants.

When the account is frozen, salary payment

The bailiff sends the decision to both the collector and the debtor. If the debtor does not repay the debt on his own within 5 days, the bailiffs take measures to forcibly collect the debt. After this, the bailiffs issue a collection order, which is sent to those banks in which current accounts of the debtor company are opened. The procedure for writing off seized funds Based on the explanations contained in the letter of the Presidium of the Supreme Arbitration Court, it can be concluded that the amount that must be withdrawn in accordance with the arrest order is not subject to priority collection.

This means that the established queue for debiting funds from the account should not be violated. For example, the debtor has other creditors who, before the arrest, received the right to collect funds from his current account.

A taxpayer can apply to cancel the suspension of operations if the tax inspectorate has blocked the organization’s accounts completely, while the total amount of funds on them exceeds the amount specified in the decision to block the account (Clause 9 of Article 76 of the Tax Code of the Russian Federation). In the application to unblock an account, you must indicate the details of the accounts that have sufficient funds to collect the tax.

Within two days from the date of receipt of the application, the inspectorate will make a decision to cancel the blocking in part of the amount in excess of that specified in the blocking decision. The same can be done if the company has only one account open, and the amount of blocked funds is less than the amount of funds remaining in this account.

If the tax authority has violated the deadline for unblocking the account, then it must pay the company interest for each calendar day of delay (clause 9.2 of Article 76 of the Tax Code of the Russian Federation).

If there are no amounts in the debtor's account other than those that have been seized, the creditor may apply to the court to obtain permission to write off the required amounts in the order of priority established by law. If there is a larger amount in the account than is subject to arrest, the debit occurs as usual.

The required amounts are debited until the seized amount remains in the account. This procedure also applies to account suspensions.

Neither arrest nor suspension should violate the order of write-off established by the legislation of the Russian Federation. If funds related to one queue are to be written off, the write-off must be carried out in calendar order, in accordance with the dates of receipt of documents (

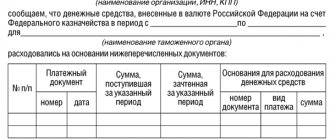

Partial transfer

For its implementation, a form f. 0401060. On the front side of the paper in the upper right corner, the bank employee puts down the corresponding o). On the back of the order you must indicate:

- Serial number of payment.

- Date and order number.

- Payment amount and account balance.

- Signature.

This information may be included in an appendix to the order. It is compiled in any form. The corresponding rules are present in paragraphs 4.4 and 2.10 of the Central Bank Regulation No. 383.

What payments can be made when an account is frozen?

Compliance with the order of payments Requirements for writing off funds are fulfilled depending on the calendar order of receipt of payment documents (Letters of the Ministry of Finance of Russia dated 03/06/2014 N 03-02-07/1/9689, dated 03/05/2014 N 03-02-07/1/9544 , dated 03/05/2014 N 03-02-07/1/9538, dated 03/05/2014 N 03-02-07/1/9536, dated 03/05/2014 N 03-02-07/1/9530, dated 03/05/2014 N 03-02-07/1/9526). According to the Ministry of Finance of Russia, expense transactions for claims related to the third priority in terms of wages with persons working under an employment agreement (contract) received later than the order of the tax authority related to the fourth and fifth priority, provided for in paragraph 2 of Art. Violations were discovered during a tax audit. Tax inspectors have the right to suspend transactions on an organization's bank accounts if violations of the law are detected during a tax audit. In this case, the suspension of operations is an interim measure, which is aimed at collecting the debt identified during the inspection (subclause 2, clause 10, article 101 of the Tax Code of the Russian Federation). How to find out about account blocking Restriction in the disposal of funds in accounts is an unpleasant event. However, it is not unexpected, since the Tax Code of the Russian Federation provides for a procedure for documenting the suspension of transactions on a bank account.

If the bailiffs seized the account, what should you do when it suddenly turns out that the card is blocked or the money from the deposit was written off based on a court decision? First, it is necessary to determine whether the actions of the FSSP are legal. If enforcement proceedings were actually initiated, the bailiffs seized the account and there is an outstanding debt, the best solution would be to pay it as soon as possible.

But this is not enough. It is imperative to submit payment receipts to the bailiffs, only after this the arrest will be lifted. If the actions of the FSSP are unlawful, it is necessary to file a complaint. It is advisable to write a statement addressed to the senior bailiff, not forgetting to attach a document confirming the illegality of the seizure of funds in the account. If these actions do not help, you need to go to court to appeal the illegal arrest.

What is the order of priority when making a decision from the bailiffs in favor of the tax office?

The debtor's property shall be seized no later than one month from the date of delivery to the debtor of the decision to initiate enforcement proceedings, and, in necessary cases, simultaneously with its delivery. When making a decision to seize the debtor’s property, the bailiff, no later than three days before the date of seizure, notifies the tax authority that sent the resolution to collect the tax (fee), as well as penalties, from the property of the taxpayer-organization (tax agent-organization), about the upcoming seizure of the debtor's property (Appendix No. 5). The bailiff may reflect in the notice the mandatory (taking into account the territoriality of the execution of enforcement actions) presence of a representative of the relevant tax authority when carrying out enforcement actions to seize the following wording: “I ask you to ensure the presence of the representative.”

What should a bank do when executing a seizure order?

Legislative framework Legislative act Contents Law No. 118-FZ of July 21, 1997 “On Bailiffs” Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings” Article 855 of the Civil Code of the Russian Federation “Sequence of writing off funds from the account” Answers to common questions Question : If the bailiffs seize a current account, is it possible to open a new one? Answer: The bank should not open a new account if there is a decision to suspend operations on the debtor's account. But only if the decision on suspension is made by the tax authorities. If the account is seized by bailiffs, then you can open a new account; the law does not prevent this. Question: How to pay salaries to employees if the organization’s current account is frozen. Answer: If there are not enough funds in the account to pay off all the requirements of the organization.

Additional group

There is currently debate about the existence of a fourth phase of payments. Accordingly, the ambiguity of this point gives rise to ambiguity of opinions on the issue of the number of groups themselves. According to most experts, the additional queue is present, but in a somewhat truncated form. Taking into account the wording of Article 5 of Federal Law No. 308, we can conclude that budget payments and contributions to extra-budgetary funds are classified in the 3rd group.

But as a result of “exclusion” from the fourth stage, a category of payments arises that does not fall into other groups, including the third. These are contributions to off-budget non-state funds. Thus, an additional group appears - in practice it is the fourth. The 5th and 6th stages are determined by article 855 without changes.

What to do when accounts are seized by bailiffs. procedure for lifting arrest

Law No. 229-FZ provides for other grounds for ending enforcement proceedings. In particular: – return by the bailiff of the order to collect debt at the expense of the taxpayer’s property, for example, in connection with its withdrawal by the tax authority when granting a deferment or installment plan to the taxpayer (clause 3.17 of the Methodological Recommendations); – declaring the taxpayer bankrupt; – liquidation of the taxpayer. The end of enforcement proceedings is formalized by a resolution of the bailiff (Part.

3 tbsp. 47 Law No. 229-FZ). The bailiff sends a copy of the resolution no later than the next working day to the tax authority and the taxpayer (Part 2 of Article 15, Part 6 of Article 47 of Law No. 229-FZ). No votes yet. Please wait…

Seizure of current account by bailiffs

If there are no amounts in the debtor's account other than those that have been seized, the creditor may apply to the court to obtain permission to write off the required amounts in the order of priority established by law. If there is a larger amount in the account than is subject to arrest, the debit occurs as usual. The required amounts are debited until the seized amount remains in the account.

This procedure also applies to account suspensions. Neither arrest nor suspension should violate the order of write-off established by the legislation of the Russian Federation. If funds related to one queue are to be written off, the write-off must be carried out in calendar order, in accordance with the dates of receipt of documents (

Important point

Another question that often arises in practice is whether the bank should postpone the execution of payment orders belonging to groups 1-3 until the required amount has accumulated on the account? If you answer this question positively, it turns out that the procedure for writing off funds from a current account during arrest will be violated.

This is due to the fact that in this case, payment documents of group 5 will receive priority over orders related to compensation for harm to health, payment of benefits, earnings, royalties under copyright agreements, as well as tax deductions. The arrest must not violate the order established by Article 855. If it is imposed by an employee of the FSSP on the amounts provided for payment in group 5, payment documents related to 1-3 gr. are first executed.