Home — Articles

If you have a “simplified” approach with the “income” object. The article was written for “simplified people” on the subject of “income minus expenses”. And the information provided in it will be needed if you want to change the object of taxation.

Even those who do nothing buy raw materials and materials. Every company and entrepreneur needs paper, stationery, and cartridges to submit reports. What can we say about those who conduct production activities? For them, the expense item “cost of inventories” is one of the most significant. And although the rules for writing off materials as expenses under the simplified tax system have not changed for several years, they remain not entirely clear to many “simplified people.” This is confirmed by both the questions received by our editorial office and the explanations from the Ministry of Finance, which are issued with enviable consistency. We offer a commentary on this topic to the next Letter of the Ministry of Finance of Russia dated July 31, 2013 N 03-11-11/30607.

Accounting for the simplified tax system Income - Expenses

Comprehensive accounting for the simplified tax system Income minus turnkey expenses for small and medium-sized businesses at a price of 7,000 ₽.

Find out details

All expenses of individual entrepreneurs on the simplified tax system can be viewed in Article 346.16 of the Tax Code of the Russian Federation. However, it is not enough to be aware of these costs; you also need to take into account some of the complexities of cost accounting. Situations often occur when businessmen have to pay fines, increased taxes, and interest on penalties due to errors in calculating costs made due to incorrect and unclear wording set out in the articles of the code. In this article, we will help you understand what the costs of the simplified tax system are and how to correctly take into account all the costs and avoid common mistakes.

What expenses can be accepted under the simplified tax system (USN) income minus expenses, and what not?

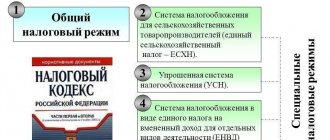

For small businesses, minimizing the tax burden is of great importance, especially if it is regulated by the law itself. We are talking about the right choice of tax regime. In particular, about the simplified taxation system, or “simplified”.

Therefore, most small businesses prefer it. Moreover, it is possible to choose not just a given tax regime, but also a more profitable object of taxation. (Read more about this here>>

It is often advisable to choose “Income minus expenses” as the object of taxation. This is beneficial for companies whose expenses account for more than 60% of revenue.

And, if everything is more or less clear with income, then expenses raise a lot of questions, despite the fact that their entire list is spelled out in the Tax Code of the Russian Federation. Not to mention the fact that expenses are the favorite object of inspection by tax authorities.

As a result, there is a need to create a clear, simple cheat sheet-recommendation: which expenses can be accepted under the simplified tax system, income minus expenses, and which cannot. Follow these rules to avoid possible mistakes!

Rule #1

At the same time, the procedure for recognizing VAT has its own subtleties, which you can learn about in the course “STS for LLC + Practice 1C 8.3”

By the way, who are tax agents, what is the procedure for accounting and calculating VAT for this category of taxpayers, learn from the course “Taxation of foreign trade and transport class=”aligncenter” width=”801″ height=”365″[/img] Rule No. 2

After making sure that this the type of expense is among those permitted by law, let’s proceed to rule No. 2.

Rule #3

The course “Simplified taxation system for LLCs and individual entrepreneurs + Practice 1C 8.3” will help you study all the most difficult aspects using practical examples and apply them immediately in your work.

Rule #4

In conclusion, let’s move on to rule No. 4, in which we simply outline the most common costs in practice, including my professional one, that are IMPOSSIBLE

taken into account when calculating the tax base. Even if they are paid and documented, even if they are needed to generate income, and you can justify them.

Rule No. 5

Fundamental knowledge and practical experience are the main foundations that help to confidently overcome all the difficulties of accounting and tax accounting in any area and under any taxation system.

Therefore, in order to gain confidence in your knowledge, as well as invaluable experience, you just need to choose any course that suits you!

Catalog of distance courses>>

Catalog of full-time courses>>

| Author of the article: Tatyana Valerievna Matasova - expert on tax and accounting issues |

Accounting for Covid-19 expenses under the simplified tax system

In connection with the current situation in the world, a new expense item has appeared related to safety measures that must be observed to prevent coronavirus infection. The subclause on newly introduced costs can be found in the first clause 346.16 of the article of the Tax Code. There you can find a list of costs listed:

- 1. For the purchase of various types of personal protective equipment for workers;

- 2. For the purchase of antiseptic agents, thermometers, special equipment for sterilization;

- 2. For quartz treatment and disinfection of premises.

Testing workers for the presence of coronavirus and antibodies to it at company expense is not included in the list of costs under the simplified tax system (based on the notice of the Ministry of Finance dated November 23, 2021 No. 03-11-06/2/101770).

Training and retraining of full-time employees

Expenses under the simplified tax system in 2021 include expenses for training and advanced training of employee personnel. However, they must meet certain criteria, which are described in subparagraph 33 of Article 346.16 of the Tax Code:

- The employee sent for training is on the taxpayer’s staff (Appeal of the Ministry of Finance dated August 9, 2013 No. 03-11-11/167);

- Availability of a license from the institution where the training will take place;

- Availability of a concluded agreement between the taxpayer and the educational institution. It is worth considering that a paid contract issued for an employee will not be taken into account in the simplified tax system for taxes minus expenses (letter of the Ministry of Finance dated January 19, 2021 No. 03-03-06/1/2614)

In addition, the costs of employee training must be justified economically. Therefore, the employee who has completed the training is required to demonstrate the acquired skills in his or her job. For example, a company pays for a course in a foreign school. The tax office may request an explanation for what purposes employees are taught this knowledge. The employer will be able to explain that the acquired skills, for example, will be useful in preparing and concluding contracts with foreign companies, which means the costs will be justified. However, if the courses were purchased to improve the company’s image, then the costs will not be justified.

Write-off of materials under the simplified tax system

We install plastic windows and safe doors for legal entities. We apply the simplified tax system (income - expenses). We order products (windows) to organizations based on our sketches and measurements, which we took from the customer at his facility. We do not maintain accounting records. How to properly organize tax accounting (documented)?

For example, for commercial organizations we issue an invoice and indicate: 1. PVC products (windows, doors), 2. under one name “consumables” we set the total amount, which includes everything that is needed to install the window. Then we write out a certificate of completion of work, write “installation” and the established amount, which is stated in the contract with the client. What document should I use to document the write-off of consumables for installation? How to use such forms as KS-2, KS-3?

In accordance with Art. 704 Civil Code of the Russian Federation

unless otherwise provided by the contract, the work is performed

at the expense of the contractor

- from his materials, with his forces and means.

Price in the contract

includes compensation for the contractor’s costs and the remuneration due to him (

Article 709 of the Civil Code of the Russian Federation

).

According to paragraphs 5 p. 1 art. 346.16 Tax Code of the Russian Federation

when determining the object of taxation under the simplified tax system,

the taxpayer reduces the income received by material expenses

.

Expenses are accepted subject to their compliance with the criteria specified in paragraph 1 of Art. 252 Tax Code of the Russian Federation

.

That is, in particular, they must be documented

.

P.p. 1 item 2 art. 346.17 Tax Code of the Russian Federation

It has been established that

material expenses

(including expenses for the purchase of raw materials and materials), as well as labor costs,

are taken into account as expenses at the time of debt repayment by

writing off funds from the taxpayer’s current account, payments from the cash register, and in case of another method of debt repayment - at the time of such repayment.

That is, you write off material expenses without waiting for them to be released into production

.

Taxpayers are required to keep records of income and expenses for the purpose of calculating the tax base for the tax paid in connection with the application of the simplified taxation system in the Book of Accounting of Income and Expenses of organizations and individual entrepreneurs applying the simplified taxation system.

The form and procedure for filling out the Book were approved by order of the Ministry of Finance of the Russian Federation dated December 31, 2008 No. 154n.

As the Ministry of Finance of the Russian Federation indicated in letter dated October 27, 2010 No. 03-11-11/284, since expenses associated with the purchase of raw materials and materials are taken into account as expenses at the time of their actual payment, the details of the corresponding payment order

.

For tax purposes, according to the Ministry of Finance, the obligation to maintain primary documents to record the write-off of raw materials and supplies into production

A taxpayer using a simplified taxation system

does not have

.

Therefore, for tax purposes, you have the right not to draw up primary accounting documents for the write-off of materials for production

.

Including not using standardized forms No. KS-2 and No. KS-3.

For internal accounting purposes, you can use any forms, both unified and independently developed.

Compensation costs when using personal transport

To take into account this position in the simplified tax system, income minus expenses from 2021, it is necessary to correctly complete the documentation. If payments are processed incorrectly, serious problems may subsequently arise with accounting for expenses under the simplified tax system, as well as with personal income tax and insurance payments. To avoid incorrect document preparation and reduce the number of errors, the following instructions must be observed:

- Drawing up an agreement in addition to the employment contract with all employees who use personal vehicles at work (Article 188 of the Labor Code of the Russian Federation);

- Written confirmation of the procedure for payment of compensation, taking into account the full amount of costs that were spent on all fuels and lubricants;

- It is necessary to draw up a plan for the accounting system to ensure that it is possible to understand the mileage that the employee drove during working hours in a personal car. Dates, times, distance traveled should be documented in writing;

- All receipts for fuels and lubricants must be kept for some time until compensation payments are made.

If the documentation is completed correctly, personal income tax and insurance contributions will not be charged on compensation payments (based on subparagraph 2 of Article 422 of the Tax Code, as well as the appeal of the Ministry of Finance dated December 6, 2021 No. 03-04-06/94977).

There are limits on the payment of compensation for the use of a personal car (subclause 12 of clause 1 of Article 346.16 of the Tax Code, Decree of the Government of the Russian Federation of February 8, 2002 No. 92), namely:

- 1. 1,200 rubles monthly for vehicles with a full engine capacity of up to 2 thousand cubic meters. cm.;

- 2. 1,500 rubles monthly for vehicles with an engine of more than 2 thousand cubic meters. cm.

This spending limit, according to the Ministry of Finance, should include all related expenses: fuels and lubricants, parking costs, car repairs, as well as all other expenses. Therefore, it is worth considering in advance that even if the amount of expenses is large, then only expenses within the established amount can be taken into account in expenses under the simplified tax system for 2021.

OS costs

The procedure for including fixed assets costs in expenses depends on when they were purchased:

- At the moment when the taxpayer was already on the simplified tax system.

- Before switching to the simplified tax system.

“Simplified”, which applies the simplified tax system for the difference in income and expenses, writes off investments in the purchase of OS from the moment the OS is put into operation on the last day of the reporting period in which this commissioning took place, in the amount of actual payment.

IMPORTANT! OS can be taken into account only on the condition that they are used in the entrepreneurial activity of a “simplified person” (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation). OS purchased for other purposes cannot reduce the base under the simplified tax system.

Similarly, VAT, included in the initial cost of the operating system and paid upon its purchase, is also accepted as expenses.

When a taxpayer purchases an asset before it switches to the simplified tax system, recognition of expenses is determined by the useful life of the asset. This period is established in accordance with Art. 258 of the Tax Code of the Russian Federation and classification of OS.

When determining the period as lasting 3 years or less, the residual value of the fixed assets is written off on the last day of each quarter during the first year of application of the regime.

When setting a period of 3 to 15 years inclusive, the residual value of the fixed assets is written off as expenses in the following order: in the first year of application of the described regime, 50% of the residual value of the fixed assets is written off, in the second - 30%, in the third - the remaining 20%.

If a fixed asset has a useful life of more than 15 years, then the residual value is written off during the first 10 years of application of the simplified tax system.

NOTE! When switching to the simplified tax system, the VAT paid when purchasing an operating system should be restored taking into account the residual value of the operating system and paid to the budget. This must be done in the last tax period before using the special regime.

The amount of the residual value of fixed assets, which can be taken into account in expenses for the purposes of calculating the simplified tax system, is determined according to the rules specified in clause 2.1 of Art. 346.25 of the Tax Code of the Russian Federation, and depends on the tax regime in which the taxpayer was before the transition to the simplified tax system with the object “income minus expenses”.

Example

If, before the transition to the simplified tax system with the object “income minus expenses,” the taxpayer applied the simplified tax system with the object “income,” then the residual value of fixed assets is not determined. If, before the transition to the simplified tax system with the object “income minus expenses,” the taxpayer used the general taxation system, then the residual value of paid fixed assets is determined on the date of transition to the simplified tax system as the difference between the purchase price (construction, manufacture, creation) of the fixed asset and the amount of accrued depreciation according to the rules Ch. 25 “Profit Tax” of the Tax Code of the Russian Federation.

If before the transition to the simplified tax system with the object “income minus expenses” the taxpayer used UTII, then the residual value as of the date of transition to the simplified tax system is formed as the difference between the price of acquisition (construction, production, creation) of a fixed asset and the amount of accrued depreciation according to accounting rules for the entire period application of UTII.

Costs for the results of intellectual activity

A complete list of objects is presented in Article 1225 of the Civil Code of the Russian Federation. In particular, this includes: brand names, programs for electronic computers, databases, phonograms, etc. The method for calculating the amount of costs is determined by which of the articles of the Tax Code of the Russian Federation falls under one or another final result of the mental process.

- Non-monetary assets, the duration of which is more than 1 year (subparagraph 2 of paragraph 1 of Article 346.16 of the Tax Code). Having paid for such an object, you can subsequently take it into account in the income and expenses of the individual entrepreneur on the simplified tax system, broken down by reporting periods, throughout the entire year in which it was purchased (clause 3 of Article 346.16, subclause 4 of clause 2 of Article 346.17 of the Tax Code);

- The results of intellectual activity, which are mentioned in subclause 2.1 of clause 1 of Article 346.16 of the Tax Code, and these are, for example, patents, databases, utility models, samples from production, computer programs. These costs can be taken into account under the simplified tax system in the full amount of their cost.

It also happens that the final product obtained as a result of mental processes meets two accounting criteria at once. In this case, it is advisable to choose a more profitable accounting option that will be convenient for your company.

Separately, subparagraph 19 of paragraph 1 of Article 346.16 notes the costs of purchasing non-exclusive rights to use computer programs and databases, including their re-flashing and updating.

How to write off material expenses using the simplified tax system

Organizations that apply the simplification and pay a single tax on the difference between income and expenses can include paid material expenses in the calculation of the tax base (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Material expenses are taken into account in the manner prescribed by Article 254 of the Tax Code of the Russian Federation, taking into account the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

One of the items of material costs is the cost of purchasing raw materials and supplies used in the process of producing goods (performing work, providing services). When calculating the single tax, expenses for the purchase of raw materials and supplies (intended for use in production) are recognized provided that these expenses are economically justified and documented (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation).

When determining the tax base for a single tax, it is necessary to separately take into account: - the cost of material assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation); — amounts of input VAT paid to suppliers upon their acquisition (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Estimation of the cost of raw materials and supplies

Estimate the cost of raw materials and materials at the actual cost, which includes:

— purchase price under the contract; — commissions paid to intermediaries; — import customs duties and fees; — transportation costs; — other costs associated with the acquisition of inventories.

This is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Situation: at what point can the cost of inventories (raw materials, inventory, components, etc.) be written off as expenses? The organization applies the simplification and pays a single tax on the difference between income and expenses

Write off material expenses immediately after actual payment.

Organizations on a simplified basis with the object of taxation “income minus expenses” have the right to reduce the tax base for material expenses (clause 1 of Article 346.14, subclause 5 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Such expenses (if economically justified) are recognized immediately upon actual payment. This follows from the provisions of subparagraph 1 of paragraph 2 of Article 346.17, paragraph 2 of Article 346.16 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Based on the literal interpretation of the provisions of paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation, material expenses must be recognized according to the rules of Article 254 of the Tax Code of the Russian Federation. However, clarifications from the Russian Ministry of Finance allow us to conclude that such expenses can be included in the calculation of the single tax if two conditions are simultaneously met:

– goods and materials (raw materials, materials, inventory, components) are received and entered into the warehouse; – expenses have been paid, that is, the debt to the supplier has been repaid.

This rule also applies to customer-supplied raw materials transferred for processing to another organization (letter of the Ministry of Finance of Russia dated May 21, 2013 No. 03-11-11/17871).

Additional conditions provided for in Article 254 of the Tax Code of the Russian Federation are not required to recognize material expenses. In particular, there is no need to wait for raw materials to be transferred to production. And there will be no need to adjust the amount of material expenses to the cost of unused balances (letter of the Ministry of Finance of Russia dated July 31, 2013 No. 03-11-11/30607).

In relation to tools, devices, inventory, instruments, workwear and other property, the initial cost of which does not exceed 40,000 rubles, it is not necessary to comply with the norms of subparagraph 3 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. That is, the costs of purchasing such objects can be written off as a reduction in the tax base, regardless of whether they were put into operation or not. The main thing is that material assets are paid for and entered into the warehouse. This is stated in letters of the Ministry of Finance of Russia dated July 5, 2013 No. 03-11-06/2/26056 and dated July 29, 2009 No. 03-11-06/2/137.

In the book of income and expenses, costs for the purchase of raw materials (materials) are reflected on the basis of the payment order that was used to pay for the received resources. At the same time, the organization is not obliged to keep records of raw materials and materials written off for production. This follows from the provisions of subparagraph 1 of paragraph 2 of Article 346.17 and subparagraph 1 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 27, 2010 No. 03-11-11/284 and dated January 23, 2009 No. 03-11-06/2/4.

The same procedure is used to recognize expenses for raw materials and materials that the organization acquired and paid for during the period of application of the simplified tax system, and used in production after the transition to the general taxation system. The amount of expenses in such a situation is fully taken into account when calculating the single tax. This was stated in the letter of the Ministry of Finance of Russia dated October 21, 2011 No. 03-11-11/259.

An example of reflecting in the book of income and expenses the costs of purchasing raw materials and household equipment. The organization applies the simplification and pays tax on the difference between income and expenses

CJSC "Alfa" is engaged in the production of food products, applies a simplified tax system and pays a single tax on the difference between income and expenses.

In March, Alpha acquired:

— raw materials for use in the main production for a total amount of 118,000 rubles. (including VAT RUB 18,000); — inventory for use in production activities for a total amount of 11,800 rubles. (including VAT 1800 rub.).

The raw materials were paid for on March 25, entered into the warehouse on March 28, and written off for production on April 4. The accountant included the cost of raw materials, as well as the amount of “input” VAT, as expenses in March (Q1), without waiting for them to be written off for production.

The inventory was paid for on March 29 and put into operation on April 2. The accountant decided to reflect the cost of inventory in expenses after its commissioning, that is, in April (Q2).

The listed transactions were reflected in the book of income and expenses.

Situation: is it possible to reduce the tax base for a single tax on the cost of raw materials received as a contribution to the authorized capital? The organization applies the simplification and pays a single tax on the difference between income and expenses

Answer: no, you can't.

When receiving property as a contribution to the authorized capital, the organization does not incur any expenses (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Therefore, the organization does not have the right to take into account the value of such property when calculating the single tax. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 3, 2010 No. 03-11-06/2/14 and dated January 29, 2010 No. 03-11-06/2/09.

Situation: is it possible to reduce the tax base for a single tax on the cost of materials purchased in cash, but without a cash receipt? When purchasing materials, the seller issued an invoice, invoice and receipt for the cash receipt order

Answer: yes, you can.

In order to take into account expenses when calculating the single tax, they must be paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). For cash payments, payment is confirmed by a cash receipt, which the seller must issue. If for some reason he did not do this, you can prove the fact of payment using a receipt for the cash receipt order, which must be issued by the seller. This follows from paragraph 5.1. Instructions of the Bank of Russia dated March 11, 2014 No. 3210-U.

Thus, the cost of materials purchased for cash can be taken into account when calculating the single tax, even if the seller did not issue a cash receipt. To confirm payment of such expenses, it is enough to have a receipt for the cash receipt issued by the seller.

This conclusion is also confirmed by arbitration practice (see, for example, decisions of the FAS of the East Siberian District dated July 14, 2005 No. A19-22317/04-52-Ф02-3320/05-С1 and the North-Western District dated September 15, 2005 A66-13879/2004).

Situation: how to write off the costs of paying for raw material processing services? The organization applies the simplification and pays a single tax on the difference between income and expenses

For organizations using the simplified system, the costs of paying for services for processing raw materials are material (subclause 5, clause 1, article 346.16, clause 2, article 346.16, subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). Their cost can be included in the calculation of the tax base if two conditions are simultaneously met: services for processing raw materials must be accepted from the contractor and paid for (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). At the same time, the costs of purchasing customer-supplied raw materials reduce the tax base, regardless of the provision of these services. The cost of raw materials transferred for processing is recognized as an expense immediately after these raw materials have been capitalized and paid to the supplier. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated May 21, 2013 No. 03-11-11/17871.

Costs of employee vacations and trips around Russia

The costs of paying for tour packages for employees are classified as labor costs, which are listed in Article 255 of the Tax Code. This system also applies to the simplified tax system “income minus expenses” in 2021, due to which company owners have the opportunity to reduce the tax base by taking into account the costs of domestic tourism and employee vacations. However, there are some important points to consider:

- 1. A limit has been set for cost accounting—RUB 50,000. per person, according to paragraph 24.2 of Article 255 of the Tax Code. This means that the cost of the trip is 70,000 rubles. Only 50,000 will be taken into account in expenses.

- 2. An important point is that you can take into account the costs of vacation not only for the employee, but also for his relatives. The limit will remain the same.

- 3. This offer is only available for trips within Russia.

- 4. It is also necessary to take into account that the trip must be purchased with a full package, including flights, meals, hotel payment, life insurance, entertainment program, etc. All this must be documented in the contract with the travel agency providing the packages.

Note!

In Art.

255 of the Tax Code, paragraph 16, specifies a certain limit for accounting for these expenses in the tax base. General social costs, in particular, the cost of medical insurance for employees and expenses for tour packages in Russia, should amount to no more than 6% of the company’s wage fund. From the beginning of 2022, adjustments will be made to the Tax Code of the Russian Federation, thanks to which the employer will be able to take into account the costs of treatment of employees in sanatoriums under an agreement concluded with a health institution, including receiving compensation for the expenses of employees and members of their families.

Do you need help with accounting for the simplified tax system?

Don’t waste time, we will provide a free consultation and help you with accounting for the simplified tax system Income - Expenses.

“Simplified”: bought materials and immediately wrote them off

The newly created organization switched to “simplified”. Production has not yet been fully established, but materials have already been purchased. Is it possible to write off their cost as expenses without waiting for production to start? Our expert will give you the answer to this question.

L.V. Klimenkova, UNP expert

The issue of when material expenses are recognized in the simplified taxation system has been resolved in favor of taxpayers. Material expenses are recognized on the day they are actually paid. This is directly stated in the letter of the Ministry of Finance of Russia dated July 14, 2004 No. 03-03-05/1/76.

The problem of recognizing expenses in the “simplified” system is the most acute. This is due to the fact that Chapter 26.2 “Simplified Taxation System” of the Tax Code of the Russian Federation establishes a special procedure for recognizing income and expenses. But at the same time, some expenses are taken into account according to the rules of Chapter 25 “Income Tax of Organizations” of the Tax Code of the Russian Federation, and for them, tax accounting for income tax provides for its own recognition procedure.

A clear example of this situation is material costs. In the simplified taxation system, they are taken into account in the same way as when calculating income tax, namely according to the rules of Article 254 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). When using the cash method of determining income and expenses for income tax, costs for the purchase of raw materials and supplies are recognized as expenses only as they are written off for production (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation). At the same time, in the simplified taxation system, expenses are recognized as expenses after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

It turns out that if you follow the simplified procedure for recognizing expenses, then material expenses can be written off immediately after they are paid. And if, when accounting for material costs, we use the rules of Chapter 25 of the Tax Code of the Russian Federation, then raw materials and supplies can be classified as expenses only after they are transferred to production.

The tax authorities immediately took advantage of the ambiguity of the issue and demand that when recognizing material expenses, one must be guided by the norms of Chapter 25 of the Tax Code of the Russian Federation (letter of the Ministry of Taxes and Taxes of Russia dated June 11, 2003 No. SA-6-22/657)*. That is, the cost of raw materials and supplies, in their opinion, is expensed only after they are released into production.

But wait a minute! This rule applies only to income tax. Firstly, such a requirement is not contained in Chapter 26.2 of the Tax Code of the Russian Federation. Secondly, in the chapter on the simplified system there is no direct reference to Article 273 of the Tax Code of the Russian Federation. Therefore, the cash method of determining income and expenses for income tax cannot be equated with the cash method in the simplified taxation system.

The main financial department of the country adheres to a similar position. Its experts also believe that material costs, including the cost of raw materials and materials, are recognized as expenses on the day of their actual payment.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2021

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

How and who to keep a cash book in 2021

The cash book in 2021, as before, is drawn up by business owners who have cash turnover.

Moreover, it is carried out alone, even when using several types of activities and different tax regimes. Let's consider how to correctly fill out the cash book in 2021 and what data is reflected in it. Accounting for the simplified tax system Comprehensive accounting for the simplified tax system Turnkey income for small and medium-sized businesses... 337 Find out more

New fines for working with markings

The State Duma has developed bill No. 972623-7, which provides for new fines for mandatory labeling of goods.

The document was adopted in the first reading, but at the moment the draft has not yet been signed. Let's look at the changes introduced by the bill, and also discuss how to properly prepare for them in this article. Registration in the Honest Sign labeling We provide assistance with registration in the labeling system for consignment stores from 1 day…. 413 Find out more

How to register in the Argus Rosselkhoznadzor system

Registration with Argus is necessary for those involved in the transportation of agricultural goods to the territory of the Russian Federation and beyond its borders, and transit transportation.

It is part of FSIS VetIS. Operator: Rosselkhoznadzor. Registration in the Argus system Registration in the Argus Rosselkhoznadzor system for LLCs and individual entrepreneurs in the shortest possible time at a competitive price. Read more about the proposal Why the Argus System is needed The goals of creating the Argus system... 315 Find out more

Registration of VSD in Mercury: rules and errors

Registration of VSD in Mercury is carried out for the purpose of electronic certification and tracking of goods subject to veterinary control. The previous owner draws up documents upon shipment of goods, and the new owner confirms at the time of acceptance or refuses partially or completely if discrepancies are identified. Let's consider the design features of different types of VSD. Support with extinguishing of eVSD. Extinguishing of eVSD at a special price - only 2500 rubles. per month for...774 Find out more