General provisions for accounting for the release of defects in the software "1C:Manufacturing Enterprise Management 8"

To account for the costs of producing defective products, the configuration uses:

Movements on account 28 “Defects in production”:

For tax accounting:

Movements in the accumulation register “Defects in production”:

Note! Account 28 is a cost account, so it does not provide quantitative accounting. This account is intended to accumulate costs associated with the production of defective products.

The invoice itself does not provide for the “Nomenclature” sub-conto, that is, we do not see which specific defective products were produced.

The program provides the possibility of object-by-object accounting of released defective products in the “Defects in Production” register.

At the end of the month, the account balance is 28 is recognized as a final defect and is written off in full to the account. 20 for distribution to the cost of manufactured good products.

Whatever option you choose for keeping records of defects, it is important to remember that the release of defects (D 28) is brought to the fact by the program, and the write-off of the account. 28 (K 28) – no.

Accounting for losses from defects

Defects in production are considered to be products, products, semi-finished products, parts, work that, in terms of their quality, do not meet established standards or technical conditions and cannot be used for their intended purpose or can be used after eliminating detected defects.

Depending on the nature of the defects, a distinction is made between correctable and irreparable (final) defects.

Correctable defects are products, semi-finished products (parts and assemblies) and work that can be used for their intended purpose after correction of defects, and their correction is technically possible and economically feasible.

Final (irreparable) defects are considered to be products, semi-finished products, parts and work that cannot be used for their intended purpose and the correction of which is technically impossible or economically impractical, that is, in cases where correcting the defect will require costs exceeding the costs of manufacturing new products instead defective.

In accordance with the Chart of Accounts, accounting for losses from defects is carried out using account 28 “Defects in production”. The debit of account 28 takes into account the cost of irreparable defects, as well as the costs of correcting defects. The credit of account 28 reflects amounts that reduce losses from defects, in particular, the cost of defective products capitalized at the price of possible use, amounts recovered from those responsible for the defects, amounts recovered from suppliers of substandard materials, the use of which was defective.

Non-refundable amounts of losses from defects are included in the cost of those types of products for which defects are detected. If in the period in which a defect was detected, this type of product was not produced, then the amount of losses from defects is distributed by type of product as general production expenses.

Internal marriage

If a defect is detected directly at the enterprise, at certain stages of the technological process, or directly in finished products before they are transferred to customers, the defect is considered internal.

Losses from internal defects are reflected in the costs of the month in which the defect was detected.

The cost of internal irreparable defects, to be reflected on account 28, is determined by the amount of costs for the manufacture of defective products, which includes the cost of raw materials used, labor costs and the corresponding amounts of unified social tax, costs of maintaining and operating equipment, and part of general production expenses.

Accounting for irreparable internal defects is documented by accounting entries:

- Dt 28

“Defects in production”

Kt 20

“Main production”,

21

“Semi-finished products of own production”,

43

“Finished products” - the cost of defective products is written off; - Dt 10

“Materials”,

21

“Semi-finished products of own production”,

41

“Goods”

Kt 28

“Defects in production” - defective products are capitalized at the price of possible use; - Dt 73

“Settlements from personnel for other operations”

Kt 28

“Defects in production” - amounts to be recovered from those responsible for the defect have been accrued; - Dt 76

subaccount “Calculations for claims”

Kt 28

“Defects in production” - amounts to be recovered from suppliers of defective materials have been accrued; - Dt 20, 23 Kt 28

“Defects in production” - losses from defects are included in the cost of production

Example

The company discovered an irreparable defect in a batch of products, the cause of which was the use of low-quality materials.

The costs of manufacturing defective products were: Cost of materials consumed - 25,000 rubles; Salary - 15,000 rubles; The amount of unified social tax is 5,340 rubles; The share of general production expenses is RUB 7,500. The possible sale price of defective products is 20,000 rubles. A claim has been filed against the supplier of low-quality materials; the amount to be recovered is 10,000 rubles.

Contents of operation Dt CT Amount, rub The cost of defective products is reflected (25,000 + 15,000 + 5,340 + 7,500) 28 20 52 840 Defective products are capitalized at the price of possible sale 43 28 20 000 The amount to be collected from the supplier has been accrued 76 28 10 000 Losses from defects are included in the cost of production (52,840 – 20,000 – 10,000) 20 28 22 840

The cost of internal correctable defects includes the cost of raw materials and supplies spent in correcting defects, the wages of employees directly involved in correcting defects, the corresponding amounts of accrued unified social tax, the share of costs for the maintenance and operation of equipment and general production costs attributable to operations to correct defects.

Accounting for correctable internal defects is documented using the following accounting entries:

- Dt 29

“Defects in production”

Kt 10

“Materials” - the cost of raw materials and supplies used to correct the defect has been written off; - Dt 28

“Defects in production”

Kt 70

- calculation of wages for workers involved in correcting defects; - Dt 28

“Defects in production”

Kt 69

- accrual of unified social tax for the wages of workers engaged in correcting defects; - Dt 28

“Defects in production”

Kt 25

- the corresponding share of general production costs is written off; - Dt 73

“Settlements with personnel for other operations”

Kt 28

“Defects in production” - amounts to be recovered from those responsible for the defect have been accrued; - Dt 76

subaccount “Calculations for claims”

Kt 28

“Defects in production” - amounts to be recovered from suppliers of defective materials have been accrued; - Dt 20, 23 Kt 28

“Defects in production” - the costs of correcting defects are included in the cost of production

Example

A defective batch of products was detected at the enterprise.

The costs of manufacturing defective products were: Cost of materials consumed - 25,000 rubles; Salary - 15,000 rubles; The amount of unified social tax is 5,340 rubles; The share of general production expenses is RUB 7,500. Total - 52,840 rubles. The costs for correcting the defect were: Cost of materials used - 8,000 rubles; Salary - 7,000 rubles; The amount of UST is RUB 2,492; The share of general production expenses is 1,500 rubles. Total - 18,992 rubles 5,000 rubles were recovered from those responsible for the marriage.

Contents of operation Dt CT Amount, rub The cost of materials for correcting defects was written off 28 10 8 000 Wages accrued for correcting defects 28 70 7 000 UST accrued 28 69 2 492 General production costs incurred to correct defects have been written off 28 25 1 500 The amount to be recovered from those responsible for the marriage has been accrued 73 28 5 000 The amount collected is withheld from the employees' salaries 70 73 5 000 The amount of losses from defects is included in the cost of production (8,000 + 7,000 + 2,492 - 5,000) 20 28 13 992 The production cost of finished products is reflected (52,840 + 13,992) 43 20 66 832

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |

Possibilities of the program for recording marriages

The typical mechanism of the program offers the following options for recording the release of defects.

Simplified scheme for recording defect release

This scheme is suitable for you if:

- the enterprise does not need to account for the release of defects in quantitative terms;

- Only final rejects are issued;

- there are no flow movements on the account. 28 (transfer to the guilty unit, transfer to the guilty person).

In this case, we release defective products directly to the account. 28, without coming to the warehouse. On this account we also accumulate other expenses associated with the release of defects and increasing the cost of production.

- D 28 K 20 – release of defective products at book value.

- D 28 K 10, 70, 69, 60 - collection of other costs for producing defects.

- D 20 K 28 - write-off of defective costs to the cost of production.

The release of defects in the program (D count 28) is identical to the release of finished products (D count 43). The release is made according to the same specifications at the accounting (planned) release price. At the end of the month, the release of the marriage is brought to the surface. The amount of collected costs is distributed to the production of suitable products.

Let's consider how the mechanism of this scheme for recording the release of defects is implemented in the program.

How are production defects taken into account?

A manufacturing defect should be considered a product that was processed during the production process, but does not meet the established criteria. At the same time, products that, according to their characteristics, have higher values of the criteria provided for by the relevant documentation cannot be considered defective. This product will be considered better than standard.

Downgrading of products from a high grade to a lower grade is not considered a defect. For example, premium flour and 1st grade flour.

The decision to recognize a product as defective is made by the technical control department. At the same time, an act is drawn up. The technical control department identifies and determines whether the defect can be corrected, or whether it should be written off as an enterprise expense. Hence it is divided into correctable and incorrigible.

In this case, defects detected at the manufacturer are called internal. If it was found by consumers, then it should be classified as external.

If technical control recognizes the product as defective, its cost from account 20 should be written off to account 28 manufacturing defects.

After making a decision about the possibility of correcting the defect, the same account reflects information about all the costs incurred by the enterprise to correct it - the cost of materials, wages with deductions, services of third-party companies, etc. These costs are reduced by amounts reimbursed by the guilty parties.

Attention! When a defect is recognized as irreparable, its cost is written off to the appropriate accounts of other costs, minus the amounts of materials that can be used after disassembling the product, taking into account the reimbursement of costs by the guilty parties.

In this case, an act for writing off defective products is drawn up. Typically, those parts of the original product that have retained their usefulness come into stock and can be separated from the main product without loss of properties and reused in the production of new products. The cost of such materials is determined based on the price of their possible use.

If a company produces products for which it sets a strictly defined warranty period, then it is obliged to create a reserve for warranty repairs on account 96. In this situation, losses from external defects are compensated for by it.

The perpetrators of defects can be both internal (employees) and external (suppliers of low-quality material). If the supplier is to blame for the defect, then a claim is made to him, and the amount of compensation received is counted towards reducing the cost of correcting the defect.

Attention! If an employee is found guilty of committing marriage, then the amount of expenses that must be covered from his salary is established. The law establishes that it is allowed to withhold no more than 20% of the salary each month.

Conditions of the problem

Product output - Shop 1 (Table 1):

| № | Products | Issue volume | Quality | Planned price | Planned cost |

| 1 | Closet | 10 | Good products | 10 000 | 100 000 |

| 2 | Coffee table | 20 | Good products | 2500 | 50 000 |

| 3 | Closet | 1 | Marriage | 10 000 | 10 000 |

We will set specifications (material consumption standards) for manufactured products. Specifications are set in the item card on the “Specifications” tab:

Note. This tab is available only if the value “Production” is specified in the “Type of reproduction” field (the “Advanced” tab):

During the production process in Workshop 1, the following costs were collected:

Release of defective products

The release of defects is reflected in the document “Production Report for the Shift”.

Attention. Before reflecting product output, planned output prices must be set (document “Setting item prices”):

To reflect the release of defects in the document, you need to set the “Use release direction” flag in the additional settings:

According to the conditions of the example, we will reflect the production of both suitable and defective products.

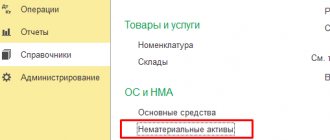

Menu: Tab “Products and Services”

- When releasing suitable products, in the “Direction of release” column, indicate “To warehouse”.

- When releasing defective products - “At costs”.

Note. The “Specification” field must be filled in for both acceptable and defective products.

Menu: Tab “Recipients”

Important . To account for marriage according to the account. 28 as analytics it is necessary to use a cost item with the nature of costs “Defects in production”:

In the “Analytics” field for the “Products” Analytics Type, you can indicate which specific defective products were produced. This information will be recorded in the accumulation register “Defects in production” and accordingly will be displayed in the standard report “Statement of defects in production”.

Characteristics of 28 accounts in accounting

To account for defective production products in the Chart of Accounts, account 28 is used. It is active, as it reflects the cost of defective products and the cost of correcting them at the beginning of the period.

You might be interested in:

Fixed assets in accounting and tax accounting, main changes in [year]

The debit of account 28 reflects the cost of defects identified in production, as well as all costs incurred by the company to bring products to the standards required by regulations.

The credit of the account reflects the cost of the corrected finished product, or the cost of defects written off as costs due to the impossibility of correction, as well as the cost of material assets that can be used, amounts attributed to the guilty parties, etc.

The debit balance of account 28 is determined by adding the initial balance to the debit turnover of the account and subtracting from it the loan amounts for the period under review. Subaccounts 28 accounts

Analytical accounting for account 28 is built in accordance with the characteristics of the activities carried out by the enterprise.

Subaccounts to this account can be opened:

- By structural divisions where product defects occurred.

- In types of defective products.

- According to cost items for correcting defective products.

- Due to the reasons for the occurrence of defects in production.

- For the guilty persons, as a result of whose activities or inaction a defect occurred in production.

Object-by-object accounting of defects

If object-by-object accounting of defects is maintained (that is, the “Analytics” field is filled in), then the costs of producing this defective product (cabinet, 1 piece) will be included in the cost of producing the same good product (producing cabinets in the amount of 10 pieces).

If object-by-object accounting is not maintained, then the costs of releasing defects will be included in the cost of all good products produced during the period.

When posting the document, the following transactions will be generated:

- in accounting:

- for tax accounting:

A fixable marriage

Let's look at the situation using an example.

Example 1

The buyer returned the defective product. This product must be corrected and returned to the buyer. To correct the defect, materials were spent and piecework wages were accrued to employees. Part of the cost of correcting the defect was attributed to the person at fault.

Sequence of reflection in accounting (see Fig. 1):

- We prepare the document “Return from the buyer”. In the document, in the “Quality” column, indicate the value “Defect”.

- Using the document “Transfer to Warehouses” we formalize the transfer of defective products to the warehouse of the workshop where the defects will be corrected.

- We carry out operations to correct defects:

- We enter the document “Transfer for correction of defects”. The document indicates the materials necessary to correct the manufacturing defect. The cost of materials will be reflected on account 28 “Defects in production”.

- Enter the document “Piece work order”. In the document we indicate the direction of expenses “To correct the defect”. The amount of piecework payment will be reflected on account 28 “Defects in production”.

- We enter the document “Write-off of losses from defects”. In the document we indicate the amount that should be attributed to the guilty person. We indicate the account of settlements with the guilty party, for example, 73.2 “Settlements for compensation of material damage.” The amount of the document will be debited from account 28 “Defects in production” to the account of settlements with the guilty person.

- After the defect has been corrected, we draw up the document “Change in the quality of inventories”. In the “Initial quality” field, select “Defect”. In the “New quality” field, select “New.”

- We draw up the document “Sales (sale)” and transfer the corrected products to the buyer.

Rice. 1

When carrying out the document “Closing the month”, the cost of correcting the defect minus the amounts attributed to the guilty party will be taken into account in the cost of manufactured products for the current month.

The following entries will be made in accounting:

Debit 28 “Defects in production” Credit 10.1 “Raw materials” - 500 rubles. - transfer of materials to correct defects Debit 28 “Defects in production” Credit 70 “Settlements with personnel for wages” - 1000 rubles. - calculation of piecework payment Debit 73.2 “Calculations for compensation of material damage” Credit 28 “Defects in production” - 800 rubles. - assignment of the amount to the guilty person Debit 20 “Main production” Credit 28 “Defects in production” - 700 rubles. - end of the month.

After all operations have been completed, account 28 “Defects in production” is closed.

Calculation of the cost of manufactured defects. Closing the account 28

If at the end of the period the costs of releasing defects should remain in work in progress and should not be included in the cost of production, then at the end of the month it is necessary to enter the document “Inventory of defects in production”.

This document is entered once at the end of the month for each production unit. Filling occurs automatically by clicking the “Fill” button - with balances from the “Production Defects” register:

For our example, we will assume that defects should not remain in the WIP. And the entire amount of costs for producing defective products should go towards increasing the cost of producing suitable products.

Distribution of material costs (document “Distribution of materials for production”)

Important. Material costs in 1C:UPP can be included in the production cost either by the boiler method (distribution of costs according to a given distribution base), or distributed according to the share of each material according to the specification in the production cost.

In our example, consider the distribution of material costs according to specifications.

We will make a manual calculation of material costs included in the cost of manufactured products.

For example, 50 boards were written off in Workshop 1. To produce 1 cabinet according to specification, 10 boards are required. For the entire production of cabinets (including defective ones), the requirement is 10 * 11 = 110 pieces. According to the standard, 4 boards are required to produce one coffee table. Total planned requirement 4 * 20 = 80 pcs.

Let's assume that there was no work in progress at the end of the month.

When distributing, we find that 50 units were used to produce 11 cabinets. * (110/190) = 28,947 pcs.

The cost of 1 board is 300 rubles. Accordingly, the material costs for spent boards for the production of all cabinets (including defective ones) amount to 300 * 28.947 = 8684.10 rubles.

| № | Products | Mat. costs (pcs.) | Mat. costs (rub.) | ||||||

| Board | Plywood | Glue | Dye | Board | Plywood | Glue | Dye | ||

| 1. | Closet | 28,947 | 17,368 | 5,238 | 10,645 | 8684,1 | 2 605,2 | 261.90 | 745,15 |

| 2. | Coffee table | 21,053 | 12,632 | 4,762 | 19,355 | 6 315,9 | 1 894,8 | 238,1 | 1 354,85 |

| Total: | 50 | 30 | 10 | 30 | 15000 | 4500 | 500 | 2100 | |

Total material costs:

- Wardrobe (11 pieces) – RUB 12,296.35.

- Coffee table (20 pcs.) – RUB 9,803.65.

In the program, material costs can be distributed to a specific output directly in the release document (“Production report for a shift”) or in a specialized document “Distribution of materials per output.”

The “Products” tab is automatically filled with the list of released finished products, including defective ones, using the “Fill” button. If necessary, the data can be edited:

The “Materials” tab is filled in with all material costs written off for the specified period for the department selected in the document header:

On the “Distribution of Materials” tab, the automatic distribution of material inventories to manufactured products occurs according to the specifications:

Thus, we see that the material component of the cost of defective products is calculated in exactly the same way as for suitable products.

Distribution of other costs

Other costs in the program are included in the cost of production according to the methods of distribution of cost items.

Menu: information register “Methods of distribution of cost items of an organization”

In our example, we will set the distribution method for other costs “By volume of output” (in quantity).

Calculation example. Costs for labor costs included in the cost of manufactured cabinets = 10,000 rubles. (ZPL) / (11 (production of cabinets) / 31 (entire volume of production) = 3,548.39.

| № | Products | PPL (rub.) | Social fear (rub.) | Services (RUB) | Total (RUB) |

| 1. | Closet | 3 548,39 | 709,68 | 1 774,19 | 6032,26 |

| 2. | Coffee table | 6 451,61 | 1 290,32 | 3 225,81 | 10967,74 |

| Total: | 10 000 | 2000 | 5000 | 17 000 |

Calculation of production costs

Let's manually calculate the cost of each unit of production (before including the costs of defects in the cost of producing cabinets):

| Products | Production volume (pcs.) | Material costs (rub.) | Other costs (RUB) | Production cost (RUB) | Unit cost (RUB) |

| Closet | 11 | 12 296,35 | 6032,26 | 18 328,61 | 1666,24 |

| Coffee table | 20 | 9 803,65 | 10 967,74 | 20 771,39 | 1038,57 |

Let's manually calculate the cost of manufactured good products:

| Products | Production volume (pcs.) | Material costs (rub.) | Other costs (RUB) | Increase in price for defective production (rub.) | Production cost (RUB) | Unit cost (RUB) |

| Closet | 10 | 12 296,35 | 6032,26 | 1666,24 | 19 994,85 | 1999,49 |

| Coffee table | 20 | 9 803,65 | 10 967,74 | 20 771,39 | 1038,57 |

The formation of the cost of all manufactured products (including defective ones) in the program is carried out using the document “Cost Cost Calculation”:

When carrying out this regulatory document, entries will be generated to generate the actual cost of production (including defective products):

The cost of producing defective products is included in the cost of producing suitable products:

As a result, when carrying out the document “Calculation of cost”, we will obtain the cost of each type of manufactured product. This information can be analyzed using the “Output Costs” report:

The “Quantity” column indicates the amount of inventory written off as expenses.

In the “Cost” column we can see the cost of the entire production of suitable products received into the warehouse.

Note. The calculated cost of the defective cabinet (RUB 1,666.24) is included in the cost of production of products of the same name (cabinets).

The volume and cost of production, including defective products, can be analyzed using the “Product Output (Cost Estimation)” report:

Accounting for defective products

Almost all companies encounter defects. You will learn more about accounting and tax accounting for such products from our article.

T.A. Shubnikova, expert editor of AG "RADA"

Defective products are products, semi-finished products, parts, assemblies that do not meet the established standards or technical specifications in quality. They can only be used after correction.

There are several types of marriage. According to the nature of the defects, it is divided into correctable and irreparable. Depending on the location of detection, defects can be internal or external.

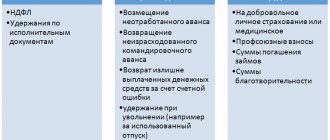

All types of defects are taken into account on account 28 “Defects in production”. The debit of this account reflects the costs associated with detected defects (cost of defective products, costs of correcting defects). The credit of account 28 reflects amounts that reduce losses from defects (cost of returnable waste, amounts withheld from guilty persons, etc.), as well as losses from defects.

The amount of losses from defects is equal to the difference between the debit and credit turnover of account 28. This can be represented in the diagram.

| Losses from marriage | = | Cost of final defects + Costs of correcting partial defects | – | Recovery from those responsible for the defect + Cost of returnable waste at the price of possible use |

In tax accounting, marriage losses reduce taxable income as other expenses. This is stated in subparagraph 47 of paragraph 1 of Article 264 of the Tax Code.

Internal defects are detected at the enterprise, that is, before the products are sent to consumers. It can be correctable (also called partial) and incorrigible (that is, final).

A defect is considered correctable if it is possible and economically feasible to eliminate it. If the cost of correction is higher than the cost of producing a new product, then the defect is considered final.

The cost of internal correctable defects includes:

– costs of raw materials, materials and semi-finished products, parts that are used to correct product defects;

– wages of workers involved in repairing marriages;

– UST and contributions to the Pension Fund of the Russian Federation accrued from the wages of these employees;

– other expenses associated with correcting the defect.

The costs of correcting the defect may be deducted from the salary of the employee who committed the defect. However, the total amount of deduction cannot exceed the average monthly salary, and the amount of monthly deduction cannot exceed 20 percent of the employee’s salary due for payment.

Example

On one of the working days in December, employee M.I. Isaev produced 20 parts, 2 of which were found to be 70 percent suitable. The cost for manufacturing one part is 70 rubles.Isaev’s salary for this day should be calculated as follows:

(20 pcs. - 2 pcs.) 70 rub./pc. + 2 pcs. 70 RUR/pcs. 0.7 = 1358 rub.

– end of example –

If the defect is corrected by other employees, their wages do not change.

The cost of internal final defects consists of the costs of materials, labor, etc., as well as the costs of maintaining and operating equipment and shop expenses (utilities costs, etc.).

Please note that to calculate the cost of the final defect, you should:

– calculate the costs of manufacturing defective products;

– calculate the amount of penalties from those responsible for the defect and the cost of returnable waste at the price of possible use;

– determine the amount of losses from the final marriage.

Example

Employee R.B. Tarasov made a defective part in the ninth technological operation. He turned out to be incorrigible. According to the calculation, the actual cost of the final defect was the following costs:– raw materials and materials – 15,000 rubles;

– worker’s salary (including the last operation) – 10,000 rubles;

– UST and social insurance contributions against industrial accidents and occupational diseases accrued on a worker’s salary – 3,600 rubles.

Total actual cost of the final defect is 28,600 rubles. (15,000 + 10,000 + 3600)

Based on the calculation, the accountant made the following entry:

Debit 28 Credit 20

– 28,600 rubles – reflects the actual cost of the final defect.

RUB 2,000 was withheld from the person responsible for the marriage. This is reflected by the wiring:

Debit 73-2 Credit 28

– 2000 rubles – reflects the amount due to be withheld from Tarasov.

The cost of capitalized returnable waste amounted to 12,000 rubles. The accountant made a note:

Debit 10 Credit 28

– 12,000 rubles – returnable waste is taken into account.

Thus, the amount of losses from the final marriage amounted to 14,600 rubles. (28,600 – 2000 – 12,000). This amount is included in the costs of main production.

Debit 20 Credit 28

– 14,600 rubles – losses from final defects are taken into account in the costs of main production.

– end of example –

External defects are those identified by the buyer during use of the product.

A feature of accounting for external defects is that they can be detected some time after the production and sale of products. Therefore, external defects are valued at full cost, that is, taking into account selling costs. In addition, the cost of external defects includes transportation costs associated with the return of rejected products.

The write-off of external defects depends on whether the company creates a reserve for warranty repairs or not.

In accounting, the creation of a reserve for warranty repairs is provided for in paragraph 72 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n. The reserve helps to evenly include in the cost price the costs of correcting external defects. The decision to create it must be reflected in the company's accounting policies.

When creating a reserve, the following entries are made:

Debit 20 Credit 96 subaccount “Reserve for warranty repairs”

– a reserve has been created for warranty repairs.

In this case, the amount of losses from defects is written off from the created reserve:

Debit 96 subaccount “Reserve for warranty repairs” Credit 28

– losses from defects are written off at the expense of the created reserve.

In tax accounting, the creation of a reserve for warranty repairs is regulated by Article 267 of the Tax Code. Please note that a reserve can be created only for those products for which, according to the contract with the buyer, there is an obligation to repair during the warranty period.

If the organization has not previously sold products subject to warranty repair, then the amount of the reserve cannot exceed the expected repair costs reflected in the plan for fulfilling warranty obligations.

Please note: the amount of the reserve cannot exceed the limit. It is defined as the product of the share of actually incurred expenses for warranty repairs in the volume of revenue from the sale of the specified products over the last three years and the amount of revenue (from the sale of the same products) in the current year.

If the company does not create a reserve, then the costs associated with defective products are included in the cost of production. In this case the following wiring is done:

Debit 20 Credit 28

– losses from defective products sold this year are reflected;

Debit 91-2 Credit 28

– losses from defective products sold in previous years are reflected.

Example

In September 2003, Vityaz LLC sold a machine for 840,000 rubles, including VAT - 140,000 rubles. The cost of the machine is 400,000 rubles. The guaranteed service life of the machine is 1 year. The organization does not create a reserve for warranty repairs.These transactions will be reflected in accounting with the following entries:

Debit 62 Credit 90-1

– 840,000 rubles – revenue from the sale of the machine is reflected;

Debit 90-3 Credit 68 subaccount “Calculations with the budget for VAT”

– 140,000 rubles – VAT accrued for payment to the budget;

Debit 90-2 Credit 40

– 400,000 rubles – the cost of the machine sold was written off;

Debit 90-9 Credit 99

– 300,000 rubles (840,000 – 140,000 – 400,000) – the financial result from the sale of the machine has been determined;

Debit 51 Credit 62

– 840,000 rubles – money received from the buyer for the purchased machine.

2 months after the start of operation the machine broke down. The defect was considered irreparable and the buyer returned the machine. At the same time, he demanded the return of the money paid for the machine, as well as reimbursement of expenses associated with its return (8,000 rubles).

Vityaz LLC agreed to fulfill the buyer’s requirements. The following entries were made in accounting:

Debit 62 Credit 90-1

– 840,000 rubles – proceeds from the sale of the machine were reversed;

Debit 90-3 Credit 68 subaccount “Calculations with the budget for VAT”

– 140,000 rubles – accrued VAT reversed;

Debit 90-2 Credit 40

– 400,000 rubles – the cost of the machine sold was reversed;

Debit 28 Credit 40

– 400,000 rubles – the cost of external defects is reflected;

Debit 28 Credit 62

– 8,000 rubles – reflects the buyer’s expenses for returning the defective machine;

Debit 62 Credit 51

– 848,000 rubles (840,000 + 8000) – money transferred to the buyer.

The cost of returnable waste obtained from dismantling a defective machine is 150,000 rubles. The following entries were made in accounting:

Debit 10 Credit 28

– 150,000 rubles – returnable materials were credited to the warehouse;

Debit 20 Credit 28

– 258,000 rubles (400,000 + 8000 – 150,000) – losses from external defects are reflected.

–end of example –