Nowadays, many enterprises practice organizing meals for employees. Accountants in this case have to understand the intricacies of accounting for related business transactions and tax rules. It should be borne in mind that the accounting of the company's costs for employee lunches will depend on whether the company has its own catering division, or whether ready-made sets of products are purchased from third-party companies. As for paying taxes, it all depends on whether the staff’s meals are provided for in the collective (labor) agreement or not. You will learn about all the features from the article “Food for wiring employees.”

Meals for postage employees - canteen on the balance sheet of the enterprise

To summarize the available information about the expenses of the canteen, which is listed on the balance sheet of the enterprise, the accountant must use account 29 “Service industries and farms”. This procedure is provided for in the Chart of Accounts (approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

| DEBIT account 29 | CREDIT account 29 |

| Reflection of direct costs for preparing lunches in the enterprise canteen. In correspondence with the CREDIT accounts for accounting of settlements with personnel for salaries, inventories, etc. | Reflection of the actual cost of ready-made lunches prepared in the canteen. Amounts are subject to debiting from the account. 29 in DEBIT of sales accounts, accounting of finished products, etc. |

Postings for crediting the amount of deduction from wages to budget income

Good afternoon When you ask a question, please do not forget about the forum rules. Let me remind you: we strive to create a friendly atmosphere on our forum. Therefore, it is customary for us to say hello and also say “thank you” and “please.” Respectful attitude towards forum members, experts and moderators is a requirement of the forum rules.

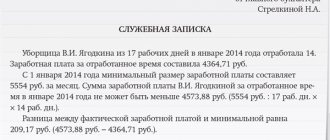

I think the overpayment was due to an accountant’s mistake? I have a friend who is an assistant prosecutor and she knows that if the mistake was made due to the accountant’s fault (even an overpayment!), then you have no right to deduct from the employee. The courts in this case support the employees. Withholding is possible only by decision of the Court, if the employee writes a statement (i.e. agrees to be deducted from him, but what fool would agree?!) or as a result of a counting error (and then no more than 20% per month and it is also necessary to prove that the error was countable). That is, if the mistake was the fault of the accountant, then this is his fault and the following entries must be withheld from him and the following entries must be made in the accounting records (this is what the Courts believe). 1) Debit 205 31 560 Credit 401 10 130 - accrual of budget revenues in the amount of overpayment (improper payment) of previous years, subject to compensation by the guilty party; 2) Debit 201 34 510 Credit 205 31 660 - funds were deposited by the guilty person into the cash register; 3) Debit 210 03 560 Credit 201 34 610 - funds were deposited from the cash register to the personal account (based on a cash receipt order and an announcement for a cash contribution); 4) Debit 304 05 211 Credit 210 03 660 - funds were credited to the personal account (based on an extract from the personal account).

Meals for posting employees - buffet lunches

When staff meals are organized in the form of a buffet, it is impossible to determine exactly how much food consumed per subordinate. In this regard, the costs incurred by the company for preparing lunches are subject to a single social tax and personal income tax according to a non-standard scheme for this situation.

As is known, UST and personal income tax are targeted taxes (contributions), since they are calculated separately based on the earnings of each of the company’s employees. A prepared meal at the expense of the organization is the employee’s income in kind, on which taxes must be paid, as on wages.

And when organizing lunches according to the buffet system, when everyone puts dishes in any quantity and assortment on their plate, it is impossible to determine with accuracy exactly how much each of the subordinates received this income (in other words, how much each employee had lunch for). ). For this reason, the amount of payment by the company for food provided to employees free of charge cannot be considered as staff income.

This rule is confirmed by judicial practice; it is enough to read paragraph 8 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 21, 1999 No. 42. A similar conclusion can be drawn after reading the text of the Federal Law dated December 15, 2001 No. 167-FZ and Chapters 23–24 of the Tax Code - in These regulations do not provide guidance on the procedure for determining an employee’s income in such a case.

Posting deductions from wages in a budgetary institution

When hiring an individual, the employer enters into an employment contract with him. Consequently, relations arise between the parties to such an agreement, regulated by labor legislation. If one of the parties causes damage to the other, then it is obliged to compensate it. This is established by Article 232 of the Labor Code of the Russian Federation. Let us note that the employee is obliged to compensate the employer only for direct actual damage (Article 238 of the Labor Code of the Russian Federation). This means:

By credit, the entries in account 70 display the amount of debt of the enterprise/organization to the employee, by debit - the reduction of such debt due to the payment of wages or other amounts due to employees in accordance with the law, or the occurrence of debt by the employee to the enterprise.

Meals for posting employees - compensation for the cost of meals for employees

Often, an enterprise does not provide free lunches to staff, but simply compensates them for the cost of food. The chart of accounts provides for the use of:

- account 73 “Settlements with personnel for other operations” - it reflects the implementation of payments to personnel not related to wages and compensation of expenses of accountable persons (payment of compensation for the cost of food from funds taken at the cash desk will be reflected in the DEBIT of account 73 in correspondence with the account 50 "Cashier");

- sch. 91 “Other income and expenses” subaccount 91-2 “Other expenses” - to reflect non-operating expenses.

Let's look at an example of how an accountant records the company's expenses associated with paying employees compensation for the cost of lunches. Let’s imagine that employees of Oblaka LLC receive monthly compensation for the cost of food in the amount of 1,500 rubles:

| DEBIT | CREDIT |

| 91-2 | 73 |

| 99-2 | 68 |

| 73 | 68 |

| 73 | 50 |

Withholding from the dismissed amount, accounting entries in a budgetary institution

- limits on budgetary obligations (budgetary allocations) - if the cash expenditure was made by an institution in the status of a recipient of budgetary funds before changing the type of institution;

- targeted subsidies. At the same time, federal institutions may not transfer the funds received to budget revenue if there is a decision of the founder to do so;

- budget investments.*

If the notification is accepted, salary deduction transactions are reflected in column 5 “Assignments completed through personal accounts” of the Report (f. 0503737). When maintaining accounting in accounting automation programs, such operations, as a rule, are generated automatically.

Posting meals for employees - the company buys lunches for employees from a third-party company

Important!

If the provision of lunches to the company's employees is stipulated by a collective or labor agreement, their cost is part of the salary expressed in kind, that is, accountants should reflect the cost of meals in the same manner as accruals and payment of salaries are reflected.

For the purpose of reflecting payments related to the remuneration of employees, account 70 “Settlements with personnel for remuneration” is used (maintained separately for each employee). Since the cost of staff meals is not charged to employees, it is a type of wages, which means it is also reflected in account 70. According to DEBIT account. 70 must reflect the amounts of wages issued (pensions to working pensioners, wages, bonus payments, additional payments, allowances, benefits), amounts of taxes, various deductions and payments under executive documents. By LOAN account 70, wage payments will be reflected in correspondence with the accounts of production expenses (sales costs).

It is also necessary to pay attention to the following points regarding tax and accounting in an organization that provides meals to its employees:

- The accrual of UST must be reflected on the LOAN account. 69 “Calculations for social insurance and security” in correspondence with DEBIT of accounts for recording production expenses. The amount of UST is recognized as expenses for ordinary activities.

- If the provision of lunches to employees is not stipulated in labor and collective agreements, the company's costs for employee lunches are recognized as non-operating expenses. They are reflected in DEBIT account. 91 “Other income and expenses” subaccount 91-2 “Other expenses” in correspondence with CREDIT account. 60 “Settlements with suppliers and contractors.”

- Payment for the services of the company from which ready-made meals are purchased, in accordance with the concluded agreement, will be reflected in the DEBIT account. 60 and LOAN account. 51 "Current accounts".

- Costs for the transfer of goods (works, services) for one’s own needs, according to paragraphs. 2 p. 1 art. 146 of the Tax Code of the Russian Federation cannot be taken for deduction for the purpose of calculating income tax. These expenses are subject to VAT, which is necessarily allocated to the account. 19 for subsequent offset from tax amounts transferred to the budget.

- Costs that form the accounting profit of the reporting period and are not taken into account when calculating the taxable base for profit tax of the current and subsequent reporting periods should be recognized as a permanent difference. Permanent differences between reporting periods should be reflected separately in the accounts. They are subject to reflection in the analytical accounting of the corresponding account of assets and liabilities, in the assessment of which a permanent difference has arisen. In the case of providing lunches to staff, this will be analytical accounting for account 91 subaccount 91-2.

- The appearance of a permanent difference means the emergence of a permanent tax liability (a tax amount that increases the amount of tax payments for income tax in the reporting period). The amount of the permanent liability can be calculated by multiplying the permanent difference identified in the reporting period by the income tax rate (according to clause 1 of Article 284 of the Tax Code of the Russian Federation - 24%). Permanent tax liabilities should be reflected in DEBIT account. 99 “Profits and losses” in correspondence with CREDIT account. 68 “Calculations for taxes and fees.”

Budget accounting entries in 2019

• 27 “Material assets issued for personal use to employees (employees)”; • 30 “Settlements for the fulfillment of monetary obligations through third parties”; • 31 “Shares at par value.” Order of the Ministry of Finance of Russia No. 16n “On amending the order of the Ministry of Finance of the Russian Federation No. 157n” (the order is being registered with the Ministry of Justice of Russia) provides for the introduction of a new off-balance sheet account 40 “Assets in management companies”, intended for accounting for assets held in trust in management companies reflected in account 0 204 51 000 “Assets in management companies”; • according to the order of recording the increase in the initial cost of fixed assets as a result of completion, modernization, reconstruction; • on the capitalization of unaccounted for objects identified during the inventory; • to accept for accounting fixed assets received as compensation in kind for damage caused by the perpetrator. The accounting of non-financial assets as part of the movement between the parent institution and (or) separate divisions is no longer limited to the type of activity code “4”.

• transfer of special equipment from the warehouse to the scientific department to perform R&D under the contract; • transfer of material reserves to employees (employees) of the institution for personal use for the performance of their official (official) duties; • transfer of young animals to the main herd; • capitalization of material reserves formed as a result of the authorized body making a decision on the sale, gratuitous transfer of movable property that has been put out of service.

Meals for posting employees - meals for employees are provided for in the labor (collective) agreement

A different situation with taxation of the cost of free meals at an enterprise arises when the provision of meals to employees is regulated by a labor or collective agreement.

Income tax

The costs incurred by the enterprise for organizing meals for employees are not taken into account when calculating the taxable base for income tax, since lunches are provided free of charge (or at a reduced cost) and are not provided for the purpose of providing special meals to certain categories of employees (clause 25 of Article 270 of the Tax Code of the Russian Federation ).

Unified social tax

Payments to employees are not subject to UST if the taxpayer company does not have these payments as expenses taken into account when calculating income tax. Since free meals are not issued on the basis of an employment contract, the cost of meals cannot be subject to a single social tax. That is, insurance contributions to the Pension Fund should not be paid from the cost of food. However, according to Art. 255 of the Tax Code of the Russian Federation, the expenses of a taxpayer company may include any labor costs, including accruals in kind. Therefore, it is possible to reduce the size of the income tax base on the cost of food only if it is provided for by labor or collective agreements.

If a manufacturing company, or a firm provides services or performs paid work, the cost of food for tax purposes is taken into account separately for production personnel and administrative and management specialists. This is done because the provision of food is related to wages, and it can be attributed to direct or indirect expenses of the company.

The enterprise's expenses for remuneration of production personnel are direct expenses, part of which is not written off at the end of the period, but relates to work in progress. The costs of paying managers are indirect and are written off in full at the end of the tax period to form the income tax base.

Deduction for training from salary upon dismissal in 2021

“To calculate average earnings, it is necessary to take into account the last 12 calendar months of the employee’s labor activity, as well as the average monthly number of calendar days,” says Yu.P., head of the department of labor law at the Higher School of Economics. Orlovsky.

It is important to remember that, in accordance with Part 1 of Art. 248 of the Labor Code of the Russian Federation, by order of the employer, compensation may be collected, the amount of which does not exceed the employee’s average monthly earnings. No more than 20% of the salary can be withheld one-time (Article 138 of the Labor Code of the Russian Federation).

Common mistakes

Error:

The accountant does not withhold personal income tax from the cost of food provided to the employee at the enterprise free of charge, at the expense of the employer.

A comment:

Free food is an employee's income in kind, related to wages. And personal income tax is withheld from wages and other payments related to wages.

Error:

A company that provides buffet meals for employees takes into account the cost of meals as part of the employee's remuneration.

A comment:

In the event that meals are organized according to a buffet system, it is impossible to determine how much lunch a particular employee spent. Accordingly, the cost of food cannot be taken into account as part of remuneration in kind.

Accounting for deductions from wages: postings and examples

- If the amount of mandatory deductions exceeds the limit (70%), then the amount of deductions is distributed in proportion to the mandatory deductions. No other deductions are made;

- The amount of limitation on deductions initiated by the employer is 20%;

- At the request of the employee, the amount of deductions is not limited.

In the name of employee Vasilkov A.A. 2 writs of execution were received: alimony for the maintenance of 3 minor children - 50% of earnings and compensation for damage to health in the amount of 5,000.00 rubles. The salary amount was 15,000.00 rubles. The personal income tax deduction for 3 children amounted to RUB 5,800.00.

Answers to common questions about employee power supply

Question #1:

The accountant of a company that organizes meals for employees does not take into account separately the cost of free meals for production and management personnel. Are such actions legal?

Answer:

The fact is that the company’s expenses for food for production personnel are considered direct expenses, and the costs for lunches for the administrative and managerial staff are considered indirect. In the first case, part of the expenses will be attributed to work in progress, and in the second case, the expenses are written off completely at the end of the tax period. Therefore, separate accounting should be carried out.

Question #2:

What is the most profitable thing to do: provide meals to employees on the basis of a collective agreement or not provide for lunches in the collective agreement?

Answer:

In the event that catering is provided for by an employment or collective agreement, the company’s expenses for catering can be taken into account when calculating income tax.

Postings in budget accounting withholding for unworked vacation days

And part of the vacation pay paid to him will be an advance for his upcoming work in the organization. BUKH.1S is now in the Telegram messenger! You can join the channel using the link: (or type @buhru in the search bar in Telegram).

Take fully worked months into account. Round the remaining days in months not fully worked to full months according to the rounding rules. Discard the remainder up to 14 calendar days inclusive, and round the remainder from 15 calendar days or more to a full month. This procedure is provided for in paragraph 35 of the Rules approved by the CNT of the USSR on April 30, 1930.

We recommend reading: Tax For Real Estate Owned Less Than 3 Years

Accounting for deductions from wages

The actual value of the lost property is subject to recovery. However, it may differ from the book value of the lost assets. That is, the amounts attributed to settlements with the perpetrators and the amount of the value of the missing property may not coincide or correspond.

When hiring an individual, the employer enters into an employment contract with him. Consequently, relations arise between the parties to such an agreement, regulated by labor legislation. If one of the parties causes damage to the other, then it is obliged to compensate it. This is established by Article 232 of the Labor Code of the Russian Federation. Let us note that the employee is obliged to compensate the employer only for direct actual damage (Article 238 of the Labor Code of the Russian Federation). This means: