Will sick leave be paid after dismissal?

It all depends on exactly when the person went on sick leave relative to the moment of dismissal.

Payment of sick leave after the dismissal of an employee in the same amount as if he had continued to work in the organization is carried out by the employer only if the person fell ill no later than the last day of work in the organization (Clause 2 of Article 5 of the Law “On Social Insurance” dated December 29, 2006 No. 255-FZ). Thus, the employer must compensate sick leave to an employee in an amount calculated on the basis of 100% of the average salary if his insurance experience is 8 years or more, 80% of earnings if the person’s insurance experience is 5–8 years, 60% if the employee’s insurance experience is less than 5 years.

Is it necessary to pay sick leave for caring for a sick child to an employee after his dismissal, ConsultantPlus experts explained. You can find out the opinion of experts by getting free trial access to the system.

In turn, if a person falls ill within 30 days from the date of dismissal, then his former employer also has an obligation to pay sick leave, but not in full, but in the amount of 60% of the average salary of the former employee (clause 2 of Art. 7 of Law No. 255-FZ).

We remind you that starting from 2021, the employer accrues and pays benefits only for the first 3 days of sick leave due to illness or domestic injury. The rest of the benefit amount is calculated and paid to the Social Insurance Fund employee, and some benefits are paid by the fund 100%. For more information, see our guide to direct benefit payments.

The scenarios we have considered are relevant if, by the time the illness occurs, the person has already written a letter of resignation (or the process of releasing him from his position for other reasons has begun). It’s another matter if a person initially did not plan to leave the company, but during an illness he still decided to quit.

Let's look at how sick leave is paid in this case.

Refusal to pay

The organization where the employee previously worked has the right to refuse to pay sick leave if it was not properly completed or the deadline for provision has expired. So, if the insured event occurred later than 30 calendar days from the date of dismissal, then the employer is not obliged to pay for it.

The law also lists cases when the amount of payments is reduced. These include, in particular:

- non-compliance with doctor's instructions,

- failure to appear for a medical examination,

- injuries, illnesses caused by alcohol, drugs, or toxic conditions.

If the sick leave was issued properly and on time, but the organization did not accept it for payment or violated the payment deadlines, then the former employee has the right to file a complaint with the Labor Inspectorate or the court.

In this case, the organization is subject to a fine for failure to fulfill insurance obligations.

How is voluntary dismissal processed while on sick leave?

Regardless of whether the employee is on sick leave or working, he can exercise his right to dismissal in accordance with the provisions of Art. 80 of the Labor Code of the Russian Federation, that is, on one’s own initiative. Therefore, if a person’s desire to quit arose while he was on sick leave, from a legal point of view this is considered in the same way as if he had done it while he was at work.

Having received a letter of resignation from an employee on sick leave under Art. 80 of the Labor Code of the Russian Federation, the employer can agree with him on the immediate termination of the contract or wait 2 weeks, during which the employee can still have time to go to work, and only after that formalize the termination of the employment relationship.

If the sick leave lasts more than 2 weeks or the date of termination of the contract by agreement has already arrived, the employee will continue to receive compensation for sick leave, while being in the status of dismissed. Thus, in this interpretation, the 2-week period after the employee submits a letter of resignation cannot always be considered as mandatory for working off. In this case, it is a formality, the observance of which is dictated by the norms of the Labor Code of the Russian Federation.

The official termination of an employment contract with an employee generally requires his or her appearance at the employer’s office. But what if a person, for example, has a high temperature and cannot come to work?

Read about the rules for filling out a resignation letter in the material “How to write a resignation letter correctly - sample?”

Can an employee be fired while he is on sick leave?

The Labor Code prohibits employers from firing employees while they are incapacitated . This is expressly enshrined in Art. 81 Labor Code of the Russian Federation. In this case, dismissal is, in principle, possible only on certain grounds listed in this article:

- insufficient qualifications of the employee;

- systematic failure to fulfill labor duties without significant reasons;

- disclosure of secrets protected by law, etc.

Frequent sick days are not listed in this series (can they be fired for frequent sick days?).

Dismissal of an employee who is on vacation or sick leave will be legal only in one case - liquidation of the enterprise or termination of the activities of an individual entrepreneur.

The ban on dismissal during illness does not apply if the employee wants to leave work himself. That is, it is possible to terminate the employment relationship with a sick employee only with his consent . That is, the basis must be a statement of resignation of one’s own free will or a written agreement of the parties. The same applies to those who have a sick child.

If the employer initiated the termination of the relationship, and the employee brought sick leave, opened by the date of dismissal, then there is no such basis for restoring the employment relationship.

But the date of dismissal must be moved to the first day after sick leave. If a notice of dismissal has already been entered into the employment record, it will need to be corrected.

How to terminate an employment contract with a sick employee?

The dismissal of a sick person is formalized in accordance with the general procedure. There is no need to postpone your dismissal date due to illness.

However, in this case, the employer may not be able to obtain the necessary signatures from the resigning employee and give him the work book. Therefore, an order should be issued to terminate the contract with the employee and an entry should be made in it stating that due to the absence of the employee, it is impossible to convey information to him under the order (paragraph 2 of Article 84.1 of the Labor Code of the Russian Federation).

Important! Recommendation from ConsultantPlus Do not forget to make a special note on the order and send the employee a notice of the need to appear for a work record book (if it is kept) or agree to send it by mail. If the work record is not kept... For more details, see K+. Trial access to the system is free.

Payment of sick leave after voluntary dismissal is carried out according to the same scheme as in the case of compensation for an existing employee. That is, the employee must bring to the accounting department all documents confirming the illness, after which, within 10 days, he will be assigned the appropriate compensation, which will be transferred on the day of salary payment (Clause 1, Article 15 of Law No. 255-FZ).

How is sick leave paid if a person gets sick on the last working day?

According to Art. 84 of the Labor Code of the Russian Federation, the day of dismissal is considered the last working day. The person resigning on this day is subject to all guarantees provided for by law. Therefore, if a person wrote an application to resign from work of his own free will, brought it to his superiors and fell ill on the same day, the calculation of the employee’s disability benefits will be made according to the insurance period.

It does not matter for what reason the sick leave was opened : whether the employee himself fell ill, or his child or another incapacitated family member needed care - in any case, payment for the leave taken by the employee will be made in full for all days.

Accrual rules

If an employee notifies of his intention to resign while on sick leave, or falls ill within 14 days after writing the application, then the benefit should be calculated according to the length of service according to the rules of Art. 7 of the Federal Law of December 29, 2006 No. 255-FZ:

- 8 years and more - 100% of average earnings;

- from 5 to 8 years - 80%;

- less than 5 years - 60%;

- less than 6 months - 60%, but not more than 11,280 rubles, that is, the minimum wage.

For sick leave opened within a month from the date of dismissal, the employer will pay only 60% of average earnings.

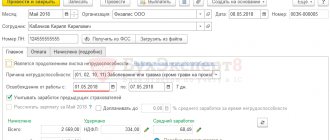

For the calculation, two years are taken (from January 1 to December 31) before the year in which the employee fell ill or needed to care for a child. All income received from the employer during this time in connection with work is divided by 730. The amount received must be multiplied by the number of sick days - it does not matter whether before or after termination of the employment contract. This will be the amount of the benefit.

Payment period

All payments due must be given to the employee on the day of payment . The following must be paid: salary for the period worked, compensation for unused vacation, etc. On the same day, the employee must pick up a fully completed work book. But these rules do not apply to sick leave.

The certificate of incapacity for work should be submitted to the accounting department immediately after closure, even if at that moment the employee is no longer in an employment relationship with the employer. After receiving sick leave from a former employee, the administration is obliged to accrue disability benefits to him within 10 days. But the payment itself may come later - with the next salary (advance).

Calculation of sick leave: nuances

There are a number of nuances that characterize the calculation and payment of sick leave.

The maximum amount of average daily earnings that can be taken into account when determining the amount of sick leave in 2021 is 2,434 rubles. 25 kopecks This indicator is calculated based on the maximum base for insurance contributions to the Social Insurance Fund for 2 calendar years preceding the one in which the employee went on sick leave:

- 865,000 rub. — in 2021;

- 912,000 rub. - in 2021.

For an example of calculating sick leave, see the article “Maximum amount of sick leave in 2021 - 2021” .

In 2021, the benefit cannot be less than the minimum wage per full month (in 2021, the minimum wage is 12,792 rubles).

In what cases and how the minimum wage benefit is calculated, read in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

As we said above, an employee has the right to receive sick leave compensation from his former employer after dismissal within 30 days. But if during this time a person found another job (that is, a new employment contract was signed during this period) and fell ill after applying for it, then the obligation to pay sick leave rests with the new employer (Clause 2 of Article 5 of Law No. 255-FZ) .

It can also be noted that an employee has the right to apply for accrual of sick leave only within 6 months after recovery. If he misses this deadline, then sick leave, if there are good reasons for this absence, can be paid by the Social Insurance Fund (clauses 1, 3, article 12 of Law No. 255-FZ).

Results

Payment of sick leave after dismissal is provided for by law in 3 cases:

- if a person fell ill while he was on the payroll (in this case, compensation is assigned to him according to the general scheme);

- if his child fell ill while he was still an employee of this organization;

- if illness occurs within 30 days after dismissal (in the latter case, the employer pays the former employee sick leave in the amount of 60% of the average salary).

The fact that an employee is on sick leave is not a legal obstacle to filing a voluntary dismissal.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.