How to write off materials that have become unusable, accounting for goods and materials in accounting.

Accounting for tools and devices in factory warehouses and distribution warehouses is organized similarly to accounting in material warehouses.

Accounting for instruments in the CIS is carried out in an accounting group using graded turnover cards, filled out daily on the basis of primary receipt and expenditure documentation, or in a document-copy form by laying out primary documents in a card index with the output of the current balance and monthly recording of the turnover results in a monthly graded turnover card .

Instrument accounting should be concentrated in the OGM. Each instance of a flat tool is assigned an individual number. The book of registration of flat tools indicates the workshop in which the tool is operated and the frequency of its inspection. Planar tools are repaired only in a special area. The quality control department systematically monitors the condition of flat tools in the workshops according to a schedule. A tool that has lost its accuracy is removed from service and sent for repair to the RMC. If the instrument being tested turns out to be suitable, a note is made about this in its passport.

Accounting for tools, fixtures and low-value equipment is kept in a separate sub-account. Accounting is organized in the same way as accounting for materials in a warehouse. Accounting for tools, devices and equipment in use is organized in different ways in workshops.

To account for tools (devices) issued to a worker from the shop storeroom for short-term use, a tool mark is used, which is returned to the worker when the tools are handed over to the storekeeper.

To account for tools (devices) issued to a worker from the shop storeroom for short-term use, tool marks are used.

The stamps are made of metal; on each of them, as a rule, the number of the workshop, storeroom, and also the personnel number of the worker is stamped. The required number of tool marks is prepared for each worker. They are issued to storeroom workers against signature in a special book (face cards) upon their entry to work. The storekeeper issues only one tool for each tool brand.

Used to account for tools (devices) sent for sharpening or repair. It is used in those enterprises where sharpening and repair of tools (devices) are carried out in a centralized manner. The order is issued in duplicate by the distribution pantry storekeeper. After sharpening or repairing tools (devices), the storekeeper makes a note in his copy about the return of the tool (devices) and signs the copy of the performing workshop.

Proper organization of instrument accounting requires providing conditions for their storage in accordance with the established procedure and for determining and checking their suitability. The enterprise has a circle of employees who are responsible for technical acceptance, storage, delivery to workplaces and proper operation of tools. The write-off of worn-out tools as scrap is approved by the head of the enterprise. Tools are not assigned inventory numbers, but they are marked with a mark indicating that they belong to a given enterprise. Instruments are accounted for by item numbers.

Used to account for tools (devices) sent for sharpening or repair. It is used in those enterprises where sharpening and repair of tools (devices) are carried out in a centralized manner. The order is issued in duplicate by the distribution pantry storekeeper. After sharpening or repairing tools (devices), the storekeeper makes a note in his copy about the return of the tool (devices) and signs the copy of the performing workshop.

The most difficult thing is to account for tools in use. In order to bring their storage places closer to production, tool-distributing storerooms (IDS) are organized at the corresponding workshops, in which tools are stored, tools are received and issued to workers and other categories of personnel. Tools are issued to employees, depending on their purpose, for a short or long term.

The situation is different with regard to the instrument after it has been put into operation. The storage and movement of tools in use are usually highly specialized.

The second option should be used to account for expensive tools, since the correct distribution of their wear and tear by month significantly affects the cost of production. The same option is usually used to account for inventory with long service lives. The second option is recommended to account for short-life tools used in mass production.

In machine shops, the most common way to record tools of permanent use is to record the issued tool in a special tool book kept by the worker, and at the same time in a front card for recording a given type and size of tools. Personal cards are kept in the workshop tool storeroom. Accounting for the issue of temporary instruments is usually carried out using special instrument marks (for more details, see Chapter.

Analytical accounting of low-value inventory in operation differs from accounting of tools and fixtures. There is no need for grading cards and balance books here, since inventory records of household equipment are analytical accounting registers. To reconcile analytical and synthetic accounting data, a turnover sheet is drawn up. When there is a small movement of low-value household equipment in operation, turnover sheets are compiled quarterly.

Pages: 1 2 3

Types of defects in the chopping edge of an ax

// . — P. 85-87. (chief - ) link to this page For investigative practice in the examination of chopped injuries, in addition to the fact of the impact of a chopping object, the identification of a specific instance of a chopping tool. Identification of a chopping tool is made by general (based on the action of a sharp object), group (based on the chopping effect) and narrow group characteristics (individual characteristics of the blade). The blade of a chopping weapon acquires individual characteristics with the appearance of various defects on it.

In the literature available to us, there is no classification and morphological description of defects in the chopping edge, their metric characteristics and frequency of occurrence. Since among chopping objects in everyday life the most common is the ax, and accordingly, it has the greatest forensic significance among chopping objects, which determined it as the main object

Describe the defects of plastic products

If the content is low, the filler does not have the proper reinforcing effect; if it is in excess, it is not completely wetted by the polymer; increased water absorption is the result of an excess amount of hygroscopic fillers. Molding defects arise due to deficiencies in the design of the mold and molding machines, incorrect selection or violation of the plastic processing regime.

Particularly important is compliance with the temperature regime and duration of the molding operation.

With deviations from the optimal molding temperature, uneven heating of molds, rapid or slow cooling, destructive processes can occur, significant internal stresses may arise, causing deformation of products, appearance of defects in appearance, and also reducing mechanical strength. The most common molding defects include the following: warping - distortion of the shape of products,

We recommend reading: Who can file a missing persons report?

Shovel Life - Protecting Citizens' Rights

Documentation and accounting of operations related to the receipt and disposal of inventory and household supplies, as well as their stocks in the warehouse, are carried out in accordance with the procedure set out in the relevant sections of these Recommendations.

Such a complex consists of several objects with common fixtures and accessories, mounted on the same foundation. They may have the same or different purposes.

The first condition is that the object is intended for use in production, when performing work or providing services; for management needs, or for rental.

Estimated standards are based on the assumption that the work is performed under normal conditions, not complicated by external factors.

Can bailiffs seize a house for debts from another bank if it is mortgaged?

The value of the instrument is transferred monthly until it is completely written off. The amount of annual deductions is determined by the product of the cost of the instrument and the annual depreciation rate. The amount included in the monthly cost is calculated by dividing the annual depreciation amount by 12 - the number of months.

This group of industrial goods includes household supplies and equipment with a useful life of up to 12 months, regardless of cost.

The service life can be calculated in units of time, as well as other units of measurement - kilometers, meters, etc. based on the functional purpose of the product.

Cause of snow shovel damage

- However, an unpleasant pungent odor occurs - you should know about this in advance.

It is recommended to work with open windows. Using a lamp, the edges of the chip or crack are heated.

They are further connected and compacted with their hands.

As a result, a seam is formed on the blade of the shovel.

The product itself may be slightly deformed. However, this will not significantly affect the functionality of the tool. Making a new cloth If a plastic shovel breaks, you can make a new cloth for it. For this you will need a sheet of plywood. To improve the working qualities, a metal edging should be strengthened on the lower part of the plywood: it will extend the service life of the tool. As a handle for a new shovel, you can take the remaining part of a broken one or select a new one of the required length.

The panel is fixed to the handle using self-tapping screws. Unlike regular nails, they will not come loose.

A plastic snow shovel is broken: what to do?

A plastic snow shovel is a reliable snow removal tool that almost everyone has. However, it requires remarkable strength and a certain dexterity.

Today, varieties of snow removal equipment are becoming more common. It may vary in appearance, cost, design and functionality. If you decide to purchase such a device, read it first here.

In it you will find a lot of useful and interesting information about modern snow removal equipment. If you don’t want to bother and decide to buy a new similar shovel, then you must fulfill a number of conditions.

They will allow you to choose the most suitable shovel option and help extend its service life.

KOSGU 343 transcript in 2020

KOSGU 343 in 2021 states - “Increasing the cost of fuels and lubricants” - in terms of payment for contracts for the supply (purchase) of all types of fuel, fuels and lubricants used to ensure the functioning of fuel systems.

Example: Which KOSGU should include the purchase of coal: 343 or 223. The institution enters into employment contracts with stokers (i.e. independently without the involvement of a third-party organization).

Transactions for payment of utilities for the provision of solid fuel in the presence of stove heating and payment for contracts for the supply of solid fuel:

- KOSGU 223 “Utilities” - in terms of payment for contracts for the provision of utility services, including services for the provision of solid fuel in the presence of stove heating;

- KOSGU 343 “Increasing the cost of fuels and lubricants” - in terms of payment for contracts for the supply (purchase) of all types of fuel, fuels and lubricants used to ensure the functioning of fuel systems.

Based on this, in the case of our example, we need to use KOSGU 343, because Coal is purchased independently as a solid fuel, rather than purchased as a utility service from a third party.

Reasons for writing off a galvanized bucket

Appears during breaks in pouring metals.

Chill (a defect in cast iron cookware) is the formation of free cementite in the surface layer in the form of a light crust.

Mechanical damage - dents, nicks, damage to the integrity of the casting (formed when the mold is knocked out). Defects of stamping are observed in all types of steel utensils, utensils made of copper alloys, and sheet aluminum: Fractures - rupture of metals during deformation.

Nicks are the introduction into the surface of a product of pieces of metal that have fallen into the stamp. Dents are local deformation of goods due to mechanical stress. Corrugations are wavy folds on the surface of a product. Burrs are sharp, uneven edges of products. Drawing is the spiral-shaped and concentric marks of a press when processed on pressing machines.

Side waviness is the deviation of the edge of the pan from the specified shape.

Thickening or thinning is observed in individual parts of goods. Defects of the protective and decorative coating include:

OKOF: code 330.25.92.1

- OKOF - All-Russian Classifier of Fixed Assets

- 300.00.00.00.000 - Machinery and equipment, including household equipment, and other objects

- 330.00.00.00.000 - Other machinery and equipment, including household equipment, and other objects

- 330.25.92.1 — Light metal containers

330.25.92.1 — Light metal containers

Classifier: OKOF OK 013-2014 Code: 330.25.92.1 Name: Light metal containers Subsidiary elements: 2 Shock absorption groups: 0 Direct adapter keys: 4

Subgroups

Group 330.25.92.1 in OKOF contains 2 subgroups.

- 330.25.92.11 - Tin cans made of ferrous metals, closed by soldering or flanging, with a capacity of less than 50 liters

- 330.25.92.12 - Barrels, drums, cans, boxes and similar aluminum containers for any substances (except gases) with a capacity of not more than 300 liters

Shock absorption groups

Code 330.25.92.1 does not belong to any depreciation group (based on the appendix to the Decree of the Government of the Russian Federation “On the Classification of fixed assets included in depreciation groups”).

Transition keys

To move from the old OKOF to the new OKOF, use a direct transition key:

| OKOF OK 013-94 | OKOF OK 013-2014 | ||

| Code | Name | Code | Name |

| 162945000 | Functional containers for trade and catering establishments | 330.25.92.1 | Light metal container |

| 162945116 | Functional containers for catering establishments | ||

| 162945122 | Functional containers for fruit and vegetable stores and procurement enterprises | ||

| 162945134 | Functional containers for trade enterprises |

Weak nozzle.

The simplest way, it would seem, is to immerse the hammer in water for several hours and the swollen handle will again firmly hold the hammer. It is possible, of course, this way, but after a while the nozzle will weaken again and again - “to whom will God send”?

A weakened handle must be wedged in the area of the hammer itself. To do this, you need to remove the hammer from the handle, knock out the old wedge and install a new one that is slightly thicker than the old one. The wedge should be driven in diagonally - this way it will work in two planes and will more securely hold the hammer on the handle.

You can use another nozzle method: one wooden wedge is driven in as usual, and another metal wedge is driven perpendicular to it.

REPORT ABOUT THE SHOVEL. naval humor.

“Secret.

To the commander of SS-4138, Lieutenant V.V. Konetsky, from Lieutenant-Commander Dudarkin-Krylov N.D. REPORT I hereby bring to your attention regarding fire shovel No. 5.

When examining fire shovel No. 5, I identified the following deviations from the Order of the Commander-in-Chief of the USSR Navy.1. The shovel handle is shorter than the standard one.2.

It is mounted poorly, it wobbles.3. There is no bulb at the end of the cutting.4.

Shovel tracker is clogged with grease.5. The cheeks of the shovel are rusty and not sealed.6. The shovel is not a shovel type.7. The shovel handle does not fit into the holders on the fire board.8. As a result, the shovel on the fire stand is not secured, but holds on like hell.9. The shovel is not painted red.10. The shovel does not have a last inspection tag.11.

There is no inventory number on the shovel.12. The shovel is not included in the receipt and expenditure book.13.

The shovel is not included in the fire board inventory.14. The shovel is not hanging in its normal place. Far from the site of the future fire.15.

gold4

April 9th, 2012, 12:06 pm How to write off property (1)? Have you ever had to write off property in an enterprise or organization?

Poring over the act, coming up with a reason for the write-off? (We know that sometimes what was written off wandered to someone’s dacha). Or maybe this problem is facing you today? Then below, an excerpt from the story by the Soviet writer Viktor Konetsky “How I am” will help commanded a ship for the first time.” The excerpt shows a document that, according to the author of the story, he happened to see during his service in the Navy - in the form of a Report, but in fact an Act for the decommissioning of the most primitive shovel located on a fire shield . I think this passage will inspire anyone to come up with an adequate reason to justify the write-off of any property. So, the passage: “Secret. To the commander of “SS-4138” Lieutenant Konetsky V.

V. Lieutenant-Captain Dudarkin-Krylov N.D. RAPORT I hereby bring to your attention regarding fire shovel No. 5.

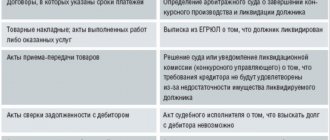

Reasons and grounds for writing off material assets

And accordingly, the entire distortion will affect the evenness of the cut of the product and its quality.

Units susceptible to breakage in guillotine shears

Mechanics who repair guillotine shears classify breakdowns depending on the design and type of equipment:

- with mechanical drive;

- with hydraulic drive.

In addition, there is also a basic division of scissors into manual, semi-automatic and automatic.

However, there are a number of basic faults that are typical for guillotines of any type:

ü first of all and most quickly, the sliding bearings of the drive shaft of the knife beam or, as they are commonly called, bronze bushings wear out;

ü wear of the knife beam guides. Subsequently, this leads to uneven metal cutting;

ü wear of the edges of the knives, which also affects the quality and evenness of the metal cut. It can also be eliminated on site by grinding the edges;

ü wear of rubber bushings (most typical for pneumatically driven scissors);

ü damage to the pneumatic distributor and/or coupling;

ü the mechanism for switching on the stroke or rotation of the knife beam often fails, which is typical for mechanically driven scissors;

ü wear of the limit switches of mechanically driven scissors leads to untimely stopping of the equipment or even work without stopping.

Of course, there are also more specific and less common breakdowns, which, unfortunately, are sometimes not easy to insure against. For example, pneumatic powered shears may suffer from sudden voltage surges. And the mechanics - from a sharp blow as a result of illiterate operation.

If you need guillotine shears repaired, call us. Our on-site specialists will most accurately determine the cause of the breakdown and take all measures to eliminate it as quickly as possible.

Other Economics Finance Marketing Astronomy Geography Tourism Biology History Computer Science Culture Mathematics Physics Philosophy Chemistry Bank Law Military Accounting Journalism Sports Psychology Literature Music Medicine

| home | page 1 "APPROVED" Director of the firm ________________________________________________________________INSTRUCTIONSon the procedure for writing off low-value items, equipment and workwear. Financially responsible persons who are responsible for low-value and wear-out items, equipment, special clothing, tools that have become unsuitable for further use are required to notify the chairman of the commission - chief engineer _______________ _______________ of the need to write off. sets the time for the write-off - collects a commission and goes to the site where the material assets to be written off are located. The commission checks the presence of valuables presented for write-off, determines their condition, the reasons for write-off and, if they are not suitable for further use, draws up an act in the established form. The act reflects the name of the assets, how many years they have been in operation, their quantity, price, amount, reason for write-off. In addition, the commission determines what materials can be obtained from dismantling valuables subject to write-off (rags, scrap metal, spare parts, etc.) and reflects this in the act, indicating the name of the received valuables, their quantity and price (the price is determined conditionally in relation to the further use of the received valuables, rags for wiping, washing, scrap metal at the price of delivery, etc.). The commission signs the act and submits it to the director of the company for approval. After approval of the act, the accounting department issues an invoice for the transfer of the valuables received from the write-off of the IBP and transfers it to the materially responsible person, from whose account the values are written off, who, in turn, transfers the materials received from the write-off to the warehouse according to the invoice. Head the warehouse or storekeeper signs for the acceptance of the valuables received from the write-off of the IBP in the invoice and in the act. The write-off act together with the invoice are transferred to the accounting department for making entries in the accounting registers. Financially responsible persons who are in charge of equipment, tools, workwear and shoes are obliged to take care of their operation and safety. Masters and foremen hand over equipment and tools to workers against signature and mark their delivery. |

Material write-off act

35421 Drawing up an act for writing off materials is required in cases where the material assets and inventories on the organization’s balance sheet have become unusable for some reason. Write-offs occur in a strictly established manner and are recorded in the appropriate act. FILES To write off material assets, the creation of a special commission is required.

It consists of financially responsible persons, as a rule, from different structural divisions of the enterprise.

It is their responsibility to identify and examine damage, defects or malfunctions of equipment, machinery, furniture, household equipment, tools and other valuables contained on the organization’s balance sheet. After recording such facts, they are authorized to draw up an act of write-off of materials.

As a rule, in large organizations there are specially developed clear instructions for such actions.

Useful life of a bayonet shovel

Only the language has undergone changes - the term “IBE” has been removed from the professional accounting lexicon. And is it worth considering the removal of account 13 “Depreciation of IBP” from the Chart of Accounts as a change, if there is account 10.11 that completely satisfies us in this regard? About this in particular, and in general - about the modern methodology for accounting for low value - here and now.

The use of tools and equipment in the production process requires the transfer of their value to the manufactured product, work performed or services provided. Instrument depreciation allows you to transfer the cost of assets belonging to fixed assets (PP) to cost.

As a self-tapping screw, it is necessary to select a thick version that is suitable for the diameter of the hole for fastening, and also 1 - 1.5 cm shorter than the diameter of the handle.

The rate of deductions is determined for the instrument for the entire period without changes, except in cases of modernization with an increase in the period of operation.

In this regard, I advise you to lay the following principle as the basis for your accounting policy regarding the accounting of low-value resources.

The organization is obliged to monitor the safety of inventory included in the materials if its useful life exceeds 12 months. This is stated in paragraph 4 of clause 5 of PBU 6/01.

Let us add that the production focus of such expenses can also be confirmed by documents that indicate the purposes for using assets - memos, orders, acts. This is stated in paragraph 58 of the Regulations on Accounting and Reporting and in paragraph 16 of PBU 5/01.

Conditions for classifying an instrument as a fixed asset

The secret of a true master is not only in the perfectly trained ability to perform his work, but also in the tool with which this work is performed.

Raw materials and materials are written off at the enterprise according to reporting periods (daily, ten-day, monthly, quarterly).

If materials were received as surplus or during disassembly, repair, or disposal of other property, take them into account at the estimated cost.

Working tank for mastic 6 10 0–70 0–14 Scoop for mastic 6 10 0-50 0–10 Steel brush 24 20 0-53 0–05 Metal square 60 20 1-72 0–07 Workbench 48 20 7-50 0 -38 Total – – – 3-85 Painters – – – – Scissors 20 30 1-00 0-18 Steel spatula 18 100 0-34 0–23 Wooden spatula 3 100 0-15 0-60 Ruler 6 20 0-30 0 –12 Compass 36 10 1-00 0-03 Wooden square 24 10 0-30 0–03 Plumb line 24 40 0-60 0–12 Block 12 10 0–30 0-03 Spray gun 84 10 27-90 0-40 Gun 84 10 20-50 0-29 Flying brush 12 50 2–53 1-27 Hand brush 6 100 0-95 1–80 Stencil brush 6 100 0-36 0-72 Flute brush 12 100 0-95 0-95 End brush 30 3 48-07 – Electric glue cooker.

- This is stated in paragraph 102 of the Instructions to the Unified Chart of Accounts No. 157n.

Why do electric kettles break?

Only in individual cases can these spare parts be replaced.

In all other cases, you will need to come up with something yourself, or make cable connections without using these spare parts. In this case, the electric kettle will heat up until it is turned off manually. There will be no temperature control here and it will be able to turn off on its own.

This solution is also acceptable, since many of us, after turning on the electric kettle, are in the kitchen and pour coffee or tea into a mug, and the kettle itself heats the water faster than a gas stove, so you can turn it off yourself...

Answer: Fixed assets worth up to 3,000 rubles. inclusive, when they are issued for operation, they are written off from the balance sheet of the institution on the basis of the statement of issuance of material assets for the needs of the institution (f.

Accounting for inventory and household supplies in accounting

Author of the article Olga Evseeva 7 minutes to read 1,987 views Contents In this article we will look at accounting for inventory and household supplies. Let's learn about accounting as part of the inventory. Let's understand tax accounting on OSNO. An enterprise cannot do without inventory and household supplies.

Just like any other property, this type of property is subject to accounting. They are used for the manufacture of a variety of products. Molds and similar items used for the production of certain types of products or to fulfill a single individual order. Containers that are used

The document is the basis for writing off materials (Obukhova T.)

Question: In an organization, all materials are issued on the basis of the Statement of Issue of Material Assets for the Needs of the Institution (f.

Features of accounting operations with household supplies, the nuances of tax accounting are described below. Accounting for inventory and household supplies (IHP) is carried out at the place of their storage and location. As a rule, the following groups are used: Tools and devices that have universal use.

0504210) (hereinafter referred to as the statement), and then the financially responsible person transfers these statements to the accounting department. The write-off of materials is carried out on the basis of a statement or is it necessary to additionally draw up an Act on the write-off of inventories (f. 0504230) (hereinafter referred to as the act)? Which materials are written off according to a statement, and which ones - according to an act or a Request-invoice (f.

0315006)?Such questions are not uncommon.

Instructions NN 157n, 174n do not indicate the range of materials that can be issued according to a statement and upon request-invoice. Let's try to understand these and other issues related to the registration of transactions for the movement and write-off of materials. ——————————— Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n “On approval of the Unified Chart of Accounts

Tool life

At the same time, according to paragraph 4 of Art. 346.16 of the Tax Code of the Russian Federation, only fixed assets are included in the fixed assets, which are recognized as depreciable property in accordance with Chapter. 25 Tax Code of the Russian Federation.

If inventory is released from a warehouse to an intermediate division of the organization (for example, to the administration department), then at the time of transfer it is not known how much each division of the organization will consume (for example, accounting, purchasing department). In this case, as each department spends it, it is necessary to draw up acts (reports) in any form. Accordingly, the contractual to the subaccount of account 01 defined for this purpose will, as expected, be the corresponding subaccount of account 02. And the contractual to account 10.10 will be the account 10.11 specially designated for this purpose by the Chart of Accounts.

Enter the site

How would everything be interchangeable and in case of breakdown/wear you can buy a separate part to replace it - when replacing it in the future, then we immediately write it off as a cost? — Do I need to do a completion certificate?

I want to draw the moderator's attention to this message because:

A notification is being sent.

[e-mail hidden] Minsk Posted by 262 Reputation: December 4, 2013, 5:01 pm Finski, the cost of transferring inventory into operation is debited from account 10.9. Is the quantity written off at the time of knockout due to a breakdown, for example?

no further suitability. I would not complete the mop, but would write everything off separately, because...

If, for example, a pen or holder breaks, you simply write it off and buy new ones.

And so, complete the mop (a complete set certificate is needed), and then when

Write-off of business equipment

Contents Manufacturing, purpose and scope of application of galvanized buckets As you know, a galvanized bucket is a container used for storing and transporting liquid and bulk materials and substances over short distances.

In addition, galvanized buckets can be used for storing various small parts, when loading garbage and during cleaning. The range of use of all buckets, including galvanized ones, is very wide. Galvanized buckets will serve well when loading solutions, wood and metal shavings and sawdust, gravel, sand: their high strength makes it possible to quickly scoop up materials without using shovels, directly, without scattering them, which is not always possible to do using fragile plastic buckets.

They are often used to extinguish fires or as a container for garbage. Galvanized buckets are the most popular in Ukraine.

We recommend reading: If the owner of the first room buys the third room, documents

The main reasons for the breakdown of microwave ovens

If your microwave oven suffers such a problem as a breakdown, it does not work properly or does not turn on at all, you can try to fix the problem on your own.

There is a checklist of faults that helps you quickly and easily determine the type of breakdown, as well as the best way to repair it.

The very first thing to do is to find out what the main problem is. This is already half the success in solving it. Analyze whether the microwave oven produces heat, whether the equipment turns on, or whether there are any other malfunctions?

Each malfunction has certain symptoms. We will look at them below. You will need to compare the symptoms of your microwave oven breakdown with the symptoms that will be described. The fact is that all microwave ovens have a similar device, regardless of the brand and model, so they are characterized by common malfunctions. If the problem is not complicated, then you can solve it yourself without any special effort. True, you may need to find the necessary parts to replace those that have failed. If everything is more serious, then the help of a specialist will be required.

Remember: when deciding to carry out repairs yourself, adhere to safety rules.

Microwave oven does not turn on

First of all, make sure that the microwave oven is properly connected to the electrical outlet. Check that the outlet the appliance is plugged into is working. There are times when the problem is not in the technology, but in the lack of power supply. To eliminate this option, connect the microwave oven to a different outlet.

If the device still does not turn on, you need to check the fuses located in it. In total, the microwave oven has two fuses. The temperature sensor is located on the outer surface of the camera, and there is also a high-voltage fuse. Both need to be checked.

Another fairly common reason why a furnace won't start is due to the door latch microswitch. If it fails, a signal about an open door will be sent to the electronic module. To protect both the appliance and the user from hazardous operation, the microwave oven will not start.

The microwave oven is humming and not heating

The situation when the oven stops heating and starts making a humming or buzzing noise can greatly frighten the user of the device. Let's find out why this problem most often occurs.

The high voltage diode is an important electronic component. Its function is to pass current in one direction and block its passage in the opposite direction. When the diode does not function properly, a characteristic buzzing sound occurs and the oven stops heating. If it is faulty, you can replace it.

A high-voltage capacitor is a device designed to accumulate an electric field and generate microwaves. Due to its breakdown, the oven may not function. Check the condition of the capacitor. If this is the problem, replacing it will bring your microwave back to life.

Magnetron. Its defect can also cause a strange hum or buzzing and the fact that the microwave oven stops heating. If the magnetron is faulty, it can be replaced.

Microwave oven “sparks”

There may be several reasons for this phenomenon:

• Using metal utensils to heat food. In addition, periodic contact of the metal with the walls of the furnace can cause this effect. You cannot use such utensils in a microwave oven (except for those cases that are clearly stated in the instructions for the device).

• The mica diffuser plate has burnt out.

• The enamel that covers the inner walls of the oven is damaged. If this happens, the coating will need to be restored. For this, only special enamel is used. Under no circumstances should you paint with products not intended for microwave ovens. Otherwise, the fumes from this paint will affect the quality and safety of the food.

• Using ceramic dishes decorated with silver or gold powder to heat food in the microwave.

If you reheat fatty foods, also be extremely careful. It is better if you cover the food with a paper napkin or a special cap. Thanks to this, splashes of grease will not be able to get onto the mica plate. Most often it is placed on the right and is designed to protect the waveguide. If it starts to spark after some time, this may damage the magnetron. And this, by the way, is the most expensive part in a microwave oven. In addition, if the sparking is not eliminated, the housing may even burn through.

Microwave oven plate does not rotate

The vast majority of microwave oven models have a glass tray rotating along its axis, on which a container with heated food is placed. Under this stand there are plastic wheels. If the plate has stopped rotating or is rotating incorrectly, then the problem may be in these wheels. Sometimes food remains get stuck in them, preventing free movement. If you have cleaned the wheels, but they still do not rotate, then the drive motor of the tray plate has become faulty.

Shovel life in accounting

Contents The service life of a shovel is the period of time during which the manufacturer undertakes to provide the consumer with the opportunity to use the shovel for its intended purpose and is responsible for significant deficiencies that may arise in the shovel.

All situations are individual in nature, so you can get free legal advice at the phone numbers listed on the website or from the online consultant at the bottom of the page.

It's fast and free!

( 1 rating, average 4 out of 5 )

What are the defects of carpets, dry cleaners and laundries?

As a result of use, carpet products significantly lose their original properties and acquire:

a) fatal or difficult to remove defects, which include:

- yellowing or browning of the pile surface of white and light-colored carpets. This defect can occur due to the destruction of optical brighteners over time, as well as “aging” processes (oxidative processes under the influence of light, atmospheric oxygen, etc.), as well as when moisture gets on the carpet, which is accompanied by washing out of the soil of the carpet, tannins and pectin substances (natural dyes) and their migration to the ends of the pile yarn. The defect cannot be repaired;

- the formation of pellets that appear in the initial stage of abrasion of the material.