A bill received from a counterparty may generate additional income in the form of interest or a discount. It must be taken into account in accounting and taxation.

This follows from articles 5, 77 of the Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341, paragraph 22 PBU 19/02, paragraph 7 PBU 9/99, paragraph 11 PBU 10/99, paragraph 3 Article 43 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

To learn how to calculate the amount of interest (discount) on a bill of exchange for the reporting period, see How to calculate interest (discount) on a bill of exchange received.

Accounting

Calculate the amount of interest or discount on a bill of exchange using an accounting certificate (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011, Clause 4, Article 328 of the Tax Code of the Russian Federation).

Situation: is it possible to reflect interest on a fixed-term bill of exchange (the maturity date of the bill of exchange is clearly defined) in accounting and taxation?

No you can not.

The drawer can provide for the accrual and payment of interest only on a perpetual bill (i.e., a bill that is payable upon sight or after a certain time after presentation).

If an interest clause is written into a term bill (i.e., a promissory note or bill of exchange that is payable within a specified period), it is considered unwritten.

This follows from Articles 5 and 77 of the Regulations, approved by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR of August 7, 1937 No. 104/1341.

Since in this case, due to the violation by the drawer of the procedure for drawing up the bill, the holder of the bill does not have any economic benefits, it is not necessary to reflect the accrual of interest in accounting and taxation (Article 5 of the Law of December 6, 2011 No. 402-FZ, Art. 38, 41 of the Tax Code of the Russian Federation).

Accounting for income on a bill depends on what is reflected: interest or discount.

Approximate mathematics

A Sberbank bill gives a yield of 5% per annum after six months, and 6% after a year. Annual deposits at the same time have a return of about 9%. Bonds of VTB and Gazprombank provide a yield of about 6% per annum. By the way, Sberbank also offers a discount bill as an income product.

Only bills with low reliability can compete with deposits and bonds of banks with government participation. But this is a big risk; here the investor himself decides whether to invest his funds in banks and financial companies or not.

Accounting: interest bill

The procedure for accounting for interest on a bill of exchange does not depend on which bill of exchange the interest is reflected on (a third party’s bill of exchange or the counterparty’s own bill of exchange) and how it was received (as security for payment, under a purchase and sale agreement, etc.).

Include interest on the bill monthly as part of other income. Account the amount of interest in account 76, to which open a sub-account “Interest on bills received”:

Debit 76 subaccount “Interest on bills received” Credit 91-1 – interest on the bill has been accrued.

Reflect the receipt of money to pay interest as follows:

Debit 50 (51) Credit 76 subaccount “Interest on bills received” - interest on the bill is received.

This follows from the Instructions for the chart of accounts (accounts 91, 76) and paragraphs 7 and 16 of PBU 9/99.

Accounting: discount bill

Reflect the discount on a bill in accounting depending on the bill for which it is provided:

- on a bill of exchange, which is accounted for as a financial investment (in particular, a bill of exchange of a third party);

- on a bill of exchange, which is taken into account as a guarantee of payment of debt by the counterparty (in particular, the counterparty’s own bill of exchange, which the organization received as security for goods (works, services)).

To account for financial investments in the form of discount bills, an organization has the right to use the following options:

- Accounting for bills of exchange at acquisition cost (initial cost) adjusted for discount. In this case, the discount amount is applied evenly to the financial result of the organization’s activities;

- accounting of bills at the cost of acquisition (initial cost) without taking into account the discount.

Fix the selected option in the accounting policy for accounting purposes.

Such rules follow from paragraphs 21–22 of PBU 19/02, paragraph 7 of PBU 1/2008.

When evenly distributing the discount amount (first method), monthly increase the book value (initial) value of the bill and the financial result by the amount of the discount relating to the reporting period. Reflect it like this:

Debit 58-2 Credit 91-1 – income is recognized in the form of part of the discount on the bill.

Thus, with this accounting option, at the time the bill is repaid (on time and in full), its book value will become equal to its nominal value. And the financial result from this operation is zero, since the entire discount amount will already be taken into account in the income of previous reporting periods (clause 22 of PBU 19/02, clause 16 of PBU 9/99).

An example of reflecting in accounting a discount on a third party’s bill of exchange received in payment for services rendered. The accounting policy of the organization for accounting purposes provides for the uniform attribution of the discount to financial results during the circulation period of the bill

On February 24, Alpha LLC received, in payment for the consulting services previously provided to Proizvodstvennaya LLC, an interest-free promissory note from a third party with a nominal value of 100,000 rubles.

The cost of services provided, paid by bill of exchange, is 59,000 rubles. (including VAT – 9000 rubles). The payment deadline for the bill is August 2.

On February 24, Alpha’s accountant made the following accounting entries:

Debit 58-2 Credit 62 – 59,000 rub. – a third party’s bill of exchange was received as payment for services rendered.

The accounting policy for accounting purposes provides for uniform accounting of the discount on the bill. The Alpha accountant determined the discount amount for February as follows: (100,000 rubles - 59,000 rubles): 159 days. × 4 days = 1031 rub.

At the end of February, the following entry was made in accounting:

Debit 58-2 Credit 91-1 – 1031 rub. – an adjustment to the book value of the bill by the discount amount for February is reflected.

When accounting for bills of exchange without uniform distribution of the discount amount (second option), the bill of exchange is reflected at its original cost for the entire time that it is owned by the organization. At the same time, the discount does not in any way affect the value of the asset and the financial results of the organization.

With this accounting option, the discount on the bill must be taken into account when the bill is disposed of, in particular, at the time of its redemption as a financial result from the transaction.

This follows from paragraphs 21, 25, 26 of PBU 19/02, paragraphs 7, 10.6, 16 of PBU 9/99 and paragraphs 11, 14.1 of PBU 10/99.

Advice: in order to avoid the occurrence of differences under PBU 18/02 when choosing one of the indicated options for reflecting the discount in accounting, you should proceed from the order of its accounting when calculating income tax (accrual method or cash method).

For organizations that calculate income tax using the accrual method, it is more profitable to use the first option of discount accounting (with a uniform distribution of income). This is due to the fact that under the accrual method, the discount is also recognized in income evenly.

Organizations that calculate income tax using the cash method, on the contrary, are better off using the second option for accounting for the discount on a bill (without uniform distribution of income). This is because under the cash method, the discount is recognized in income when it is received.

This conclusion can be made by the provisions of paragraphs 3, 22 of PBU 19/02, paragraph 6 of Article 271, paragraph 4 of Article 328 and paragraph 2 of Article 273 of the Tax Code of the Russian Federation.

The discount on the counterparty's own bill of exchange received as security for payment for goods (works, services) should be taken into account as other income (expenses) of the organization at the time of their formation. That is, upon disposal of the bill (for example, at the time of its repayment). This procedure follows from clauses 7, 10.6, 16 of PBU 9/99 and clause 11 of PBU 10/99. This is due to the fact that such a security is not a financial investment, but represents a security for obligations to pay for goods (works, services) sold to a counterparty (clause 3 of PBU 19/02, art. 815, 823 of the Civil Code of the Russian Federation).

If necessary, at the time of repayment of an interest-bearing or discount bill received as payment or security for payment for goods (work, services), charge VAT. Record it in your accounts like this:

Debit 91-2 Credit 68 subaccount “Calculations for VAT” - VAT is charged on interest (discount) on a repaid bill.

This follows from the Instructions for the chart of accounts (accounts 91, 68).

An example of how a discount is reflected in accounting on a third party bill of exchange received as payment for services rendered and repaid on time. The accounting policy of the organization for accounting purposes does not provide for uniform attribution of the discount to financial results during the circulation period of the bill

On January 11, Alpha LLC received, in payment for the consulting services previously provided to Master LLC, an interest-free promissory note from a third party with a nominal value of 100,000 rubles.

The cost of services provided, paid by bill of exchange, is 59,000 rubles. (including VAT – 9000 rubles). The payment deadline for the bill is February 14.

On January 11, Alpha's accountant made the following entries:

Debit 58-2 Credit 62 – 59,000 rub. – a third party’s bill of exchange was received as payment for services rendered.

The accounting policy for accounting purposes provides for the reflection of bills of exchange of third parties at the cost of their acquisition and does not provide for an even distribution of the discount amount. Therefore, during the entire time that the bill was in the ownership of Alpha, the organization’s accountant took it into account at the cost of acquisition - 59,000 rubles. At the same time, the discount amount is 41,000 rubles. (100,000 rubles - 59,000 rubles) was not reflected in the accounting records.

On February 14 (not a leap year), the bill was presented for payment and repaid by the “Master” in full. The refinancing rate is 11 percent per annum.

Alpha's accountant reflected this in accounting as follows:

Debit 76 Credit 91-1 – 100,000 rub. – a bill of exchange is presented for redemption;

Debit 51 Credit 76 – 100,000 rub. – the bill is repaid in full;

Debit 91-2 Credit 58-2 – 59,000 rub. – the original cost of the bill is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 6162 rubles. (((100,000 rub. – 59,000 rub.) – (59,000 rub. × 11%: 365 days × 34 days)) × 18/118) – VAT is charged on the amount of the discount (generated upon repayment of the bill), exceeding the amount of interest calculated based on the refinancing rate.

The financial result from the operation to repay the bill (discount) in accounting amounted to 34,838 rubles. (RUB 100,000 – RUB 59,000 – RUB 6,162).

What to pay attention to when drawing up an act of acceptance and transfer of a bill of exchange

The purpose of registration is to document the receipt and transfer of securities. It is important to carefully fill out the details (header, then the main part, signatures, as well as links to primary documents).

The act of accepting the transfer helps:

- prevent disputes between the parties;

- if there is a disagreement regarding the content of the bill, establish what it was originally;

- minimize the risk of non-shipment of goods.

There is no single approved form that must be filled out. But it is important to identify the bill.

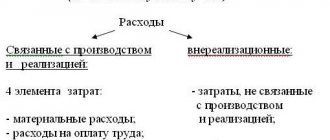

BASIC: income tax

For tax purposes, there is no difference between the treatment of interest and discount. This is explained by the fact that, according to tax law, any previously declared (previously known) income, including a discount, is recognized as interest. This follows from paragraph 3 of Article 43 of the Tax Code of the Russian Federation and is confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated February 8, 2008 No. A05-8613/2007 and the West Siberian District dated July 25, 2006 No. F04-4649/2006(24854-A46-37)). It also does not matter the type of bill of exchange (a bill of exchange of a third party or the counterparty’s own bill of exchange) and the method of receiving it (as security for payment, under a purchase and sale agreement, etc.).

When calculating income tax, include interest (discount) on a bill of exchange as part of non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

If an organization calculates income tax using the accrual method, take into account the amount of interest (discount) on the bill of exchange in income every month in the amount attributable to it (clause 6 of Article 271 of the Tax Code of the Russian Federation).

When repaying a bill of exchange, do not include interest (discount) received from the debtor, on which the organization previously paid income tax, into income if their amounts have already been taken into account for taxation (clause 3 of Article 248 and clause 2 of Article 280 of the Tax Code of the Russian Federation) .

If an organization reflects a bill of exchange in accounting as a financial investment at its original cost without adjusting for the discount amount, in accordance with PBU 18/02, a deductible temporary difference arises and a corresponding deferred tax asset arises. It will be repaid upon receipt of payment for the bill. This follows from paragraphs 11 and 14 of PBU 18/02.

Situation: does the organization have the right to reflect in expenses the interest on a bill of exchange that it previously took into account in income if this bill was presented for redemption ahead of schedule? In this case, it provides that no interest is charged.

Yes, you have the right.

The holder of the bill independently, based on the conditions specified in the bill, determines the amount of interest that must be taken into account when calculating income tax (paragraph 2, paragraph 1, article 328 of the Tax Code of the Russian Federation). In this case, the bill stipulates that in case of early repayment, interest will not be accrued or paid. That is, previously accrued non-operating income is not such. Due to newly discovered circumstances, the bill holder organization has no basis for its accrual and no economic benefit (clause 1 of Article 328 and Article 41 of the Tax Code of the Russian Federation). This is indirectly confirmed by paragraph 3 of paragraph 4 of Article 328 of the Tax Code of the Russian Federation. In this regard, the amount of interest excessively accrued as income in tax accounting should be taken into account in non-operating expenses (subclause 20, clause 1, article 265 of the Tax Code of the Russian Federation).

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/117 and dated March 5, 2005 No. 03-03-01-04/1/96.

If the organization uses the cash method, reflect the income on the day of actual receipt of interest or discount in the amount received (clause 2 of Article 273 of the Tax Code of the Russian Federation).

In this case, a taxable temporary difference and a corresponding deferred tax liability arise in accounting until payment is received on the bill. They are formed when interest is calculated on a bill or the discount is distributed evenly. After receiving payment, pay off the accrued tax liability. This follows from paragraphs 12 and 15 of PBU 18/02.

An example of how a third party’s bill of exchange received in payment for services rendered is reflected in accounting and taxation. The organization's accounting policy for accounting purposes does not provide for uniform attribution of the discount to financial results during the circulation period of the bill. The organization pays income tax monthly, uses the accrual method

On January 28, Alpha LLC received, in payment for the consulting services previously provided to Proizvodstvennaya LLC, an interest-free promissory note from a third party (Torgovaya LLC) with a nominal value of 100,000 rubles. The payment deadline for the bill is February 8 (not a leap year).

The cost of services provided, paid by bill of exchange, is 59,000 rubles. (including VAT – 9000 rubles).

On January 28, Alpha’s accountant made the following accounting entries:

Debit 58-2 Credit 62 – 59,000 rub. – a third party’s bill of exchange was received as payment for services rendered.

The accounting policy for accounting purposes provides for the reflection of bills of exchange of third parties at the cost of their acquisition and does not provide for an even distribution of the discount amount. Therefore, during the entire time that the bill was owned by Alpha, the organization’s accountant took it into account at the cost of acquisition - 59,000 rubles. At the same time, the discount amount is 41,000 rubles. (100,000 rubles - 59,000 rubles) was not reflected in the accounting records.

Alpha pays income tax monthly and uses the accrual method.

In January, the accountant calculated part of the discount on the bill, which he took into account when calculating income tax for this month, as follows: (100,000 rubles - 59,000 rubles): 11 days. × 3 days = 11,182 rub.

At the same time, the accountant made the following entry in accounting:

Debit 09 Credit 68 subaccount “Calculations for income tax” – 2236 rubles. (RUB 11,182 × 20%) – a deferred tax asset is reflected in the amount of the discount taken into account when calculating income tax and not included in income in accounting.

On February 8, Alpha presented the bill for payment. Hermes repaid the bill on the same day, transferring the money to Alpha's bank account. The refinancing rate is 11 percent per annum.

Alpha's accountant reflected the accounting transactions as follows:

Debit 76 Credit 91-1 – 100,000 rub. – a bill of exchange is presented for redemption;

Debit 91-2 Credit 58-2 – 59,000 rub. – the original cost of the bill is written off;

Debit 51 Credit 76 – 100,000 rub. – the bill is repaid in full;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 6224 rubles. (((RUB 100,000 – RUB 59,000) – (RUB 59,000 × 11%: 365 days × 11 days)) × 18/118) – VAT is charged on the amount of the discount (generated upon repayment of the bill), exceeding the amount of interest calculated based on the refinancing rate.

In February, the accountant calculated part of the discount on the bill, which he took into account when calculating income tax for this month, as follows: (100,000 rubles - 59,000 rubles): 11 days. × 8 days = 29,818 rub.

Debit 68 subaccount “Calculations for income tax” Credit 09 – 2236 rub. ((41,000 rubles – 29,818 rubles) × 20%) – the deferred tax asset is repaid according to the discount amount.

Subtleties of design

Reception and transfer of a document can be formalized through representatives by providing a notarized power of attorney. A copy of it must be attached to the act, having previously indicated its presence in it.

Witnesses may be present. Their data is entered into the act, and they endorse it.

The act is printed on letterhead or on a white sheet. But it is allowed to fill in the details by hand.

BASIS: VAT

If a bill of exchange (of a third party, your own) is received as payment for goods (work, services) that are subject to VAT, the interest (discount) on the bill increases the tax base for VAT. However, the tax must be charged not on the entire amount of interest (discount), but only on that part of it that exceeds the amount of interest calculated at the refinancing rates in force in the periods for which the calculation is made. Moreover, tax must be calculated only at the time of receiving interest (discount). This procedure follows from subparagraph 3 of paragraph 1 of Article 162 of the Tax Code of the Russian Federation.

For more information on calculating VAT on interest and discount on a bill of exchange, see How to pay VAT when paying by bill of exchange.

Situation: when repaying a bill of exchange, can the holder of a bill of exchange take into account, when calculating income tax, the amount of VAT accrued on the difference between the amount of interest (discount) on the bill of exchange and interest calculated based on the refinancing rate?

Yes maybe.

The organization has the right to take into account as other expenses the amounts of taxes accrued as required by law (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). An exception is the mandatory payments listed in Article 270 of the Tax Code of the Russian Federation.

Clause 19 of Article 270 of the Tax Code of the Russian Federation establishes that when calculating income tax, taxes imposed on the buyer (acquirer) of goods (work, services, property rights) are not taken into account. However, the holder of the bill presenting the bill for redemption is not the buyer of goods (work, services, property rights) under the transaction concluded by the parties (Article 815 and paragraph 1 of Article 807 of the Civil Code of the Russian Federation). Consequently, the provisions of paragraph 19 of Article 270 of the Tax Code of the Russian Federation do not apply to relations regarding the repayment of a bill of exchange.

Since the Tax Code of the Russian Federation does not contain any other restrictions, the amount of VAT accrued upon repayment of a bill can be taken into account in reducing taxable profit (subclause 1, clause 1, article 264, clause 1, article 252 of the Tax Code of the Russian Federation). When applying the accrual method, this can be done immediately after VAT is accrued to the budget (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). When using the cash method - after payment (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

Document structure

The form of a promissory note is a guarantor of the property rights of the person to whom it belongs (Article 815 of the Civil Code of the Russian Federation). The form is a structured list characterizing a debt obligation. In simple terms, it is written down on a piece of paper how much one participant in the transaction borrowed from another. The possibility of repayment and fulfillment of a property obligation appears only upon presentation by the holder of the original bill of exchange.

The bill of exchange has a certain structure that should be followed when drawing up the document

A blank promissory note can be purchased from specialized companies, banks, and printing houses. The paper form must contain special security elements to minimize the risk of falsification. We list the basic details, the contents of which are mandatory for the sample bill of exchange:

- Name of the form (the phrase or word is written in the national language of the compiler).

- Series and number of the form in the registration inventory.

- The amount of monetary obligation in numbers.

- Address for compiling the form.

- The name of the executor who accepts the obligation to transfer money on time.

- Explanation of the amount of debt in words indicating the amount of interest.

- Name of the bearer for whom this document is issued (link to likelihood of representation).

- The deadline for fulfilling a bill of exchange upon presentation.

- The place where the debt is planned to be repaid (details to the apartment, intercom, premises or a link to the region, location of stay).

- Signatures of authorized representatives of the compiler (citizen, manager, chief accountant for enterprises).

- Printing for organizations.

On the left border it is allowed to print fields for filling out the aval. Three standard lines are enough:

- Addressee of the guarantee.

- Personal signature of the avalist with transcript.

- Stamp and date of inscription.

You can download a ready-made sample of a bill of exchange

A sample of a standard bill of exchange does not differ significantly from the form described above. This document is supplemented with lines about the location of the drawer. On the right margin of the paper, lines are entered to indicate acceptance and consent to payment processing. The executor enters the amount to be paid and the maturity date of the promissory note. The obligation is certified by the signature of the acceptor, and important notes are allowed. To eliminate errors, you can use an example of filling out a promissory note issued by a legal entity.

simplified tax system

For tax purposes, there is no difference between the treatment of interest and discount. This is explained by the fact that, according to tax law, any previously declared (previously known) income, including a discount, is recognized as interest. This follows from paragraph 3 of Article 43 of the Tax Code of the Russian Federation and is confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated February 8, 2008 No. A05-8613/2007 and the West Siberian District dated July 25, 2006 No. F04-4649/2006(24854-A46-37)). It also does not matter the type of bill of exchange (a bill of exchange of a third party or the counterparty’s own bill of exchange) and the method of receiving it (as security for payment, under a purchase and sale agreement, etc.).

When the bill of exchange is presented for redemption, the loan obligation is terminated. Funds received to repay a loan obligation do not count as income taken into account for tax purposes (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). Therefore, not the entire amount received must be recognized as income, but only interest (discount) (Clause 6, Article 250 of the Tax Code of the Russian Federation). This procedure does not depend on what object of taxation the organization applies - income or income minus expenses.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated November 25, 2008 No. 03-11-04/2/177 and dated October 10, 2006 No. 03-11-04/2/202.

For information on how a simplified organization can account for income from a bill of exchange that was purchased for resale, see How to record the sale and other disposal of a bill of exchange of a third party.

General definition

A valuable form issued to certify a debt obligation is called a promissory note. This document does not confirm the validity of a specific agreement; it is a general receipt, a loan. Under a simple order, the manager undertakes to pay the holder the agreed amount. If the form is of a transferable nature (draft), then the demand for payment of funds is made by the last citizen or enterprise that owns the asset.

A bill of exchange obligation is abstract; the issuer undertakes to unconditionally fulfill the legal financial requirements of the holder no later than the date specified on the form. Early execution of the settlement is allowed if the parties reach such an agreement by mutual decision. You can sell, buy, assign debt. In fact, the obligation on a bill of exchange is strict, formal, and represents an analogue of an order.

The issuer is the person who issued the form and is recognized as the payer. If the form is simple, then the executor of the obligation is also considered the drawer; according to transfer requirements, the document is issued by the previous owner. Individuals and legal entities who have received a bill of exchange are called bill holders.

To issue a bill of exchange, the payer does not require the permission of other persons, that is, the obligation is formed on the private initiative of the executor, unilaterally. The main feature of the debt form is formality. The debt will be invalid if there is a significant defect on the paper. Only judicial proceedings can resolve the dispute, since in fact the borrowed obligation continues to exist.

Nuances of form circulation

The procedural side of bill of exchange legal relations is a complex of specific features, characteristics, and regulations for resolving controversial issues. For example, according to procedural rules, it is possible to file a protest about the early execution of a bill of exchange before the compilation of a single list by the arbitration tribunal.

A bill of exchange is a security and a guarantee that the debtor will fulfill his obligations to the creditor.

The substantive and legal side of the relationship between the parties using bill forms is a set of nuances of its application that are not used in other situations. According to the terms of the form, the debtor is obliged to timely transfer funds to the bearer, despite the fact that up to this point the creditor has not fulfilled any obligations. Therefore, the form holder is relieved of the need to challenge and prove the validity of the claims.

To protect its interests, the payer has the right to operate only with those norms of legislation that are applicable to bill law. For example, presenter objections to the execution of a promissory note are allowed if significant defects are identified on it. Based on general rules and regulations, it is prohibited to object on the grounds of issuing a bill of exchange.

General civil obligations are transferred to other persons on the basis of assignment or assignment. For bill legal relations, an individual procedure is provided for replacing persons in the legal relationship - endorsement. The current holder (endorser) transfers the rights and obligations to own the bill form to another user by making a special inscription on the front or back side of the form. If there is no mark on the template, responsibility remains with the previous owner.

To protect the rights and interests of participants in the bill of exchange relationship, a guarantee system is provided - aval. Any citizen or organization has the right to vouch for the debtor, that is, assumes full or partial debt obligations. Collateral may be provided: real estate, house, equipment, etc. If the payer is unable to transfer the money on the appointed day, the guarantor will transfer it at the first request of the creditor.

UTII

Only certain types of activities are transferred to the payment of UTII (clause 2 of Article 346.26 of the Tax Code of the Russian Federation).

Situation: is it necessary to pay income tax when receiving income in the form of interest (discount) on a bill of exchange received? All activities of the organization have been transferred to UTII.

Yes need.

Only certain types of activities are transferred to the payment of UTII (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). The operation to generate income in the form of interest and discount on a bill of exchange is not named in this list. Accordingly, the financial result from such an operation does not relate to activities on UTII.

Taxes must be calculated on the amount of income received on the bill in accordance with the general taxation system (clauses 9, 10 of Article 274 of the Tax Code of the Russian Federation).

Advice: there are arguments that allow organizations using UTII not to pay income tax on interest (discount) on bills received as payment (security for payment) for goods (work, services). They are as follows.

Income on a bill of exchange received in payment (security of payment) of the counterparty's debt is directly related to the organization's activities on UTII (sale of goods (work, services)). In addition, as a rule, transactions involving settlements with bills of exchange:

- are of a one-time nature;

- are not initially aimed at extracting additional economic benefits (since the bill in this case is a means of payment or a guarantee of payment).

That is, in this case they cannot be interpreted as an independent entrepreneurial activity aimed at generating income (Clause 1, Article 2 of the Civil Code of the Russian Federation).

This point of view is indirectly confirmed by letters from the Ministry of Finance of Russia dated March 7, 2008 No. 03-11-04/3/109, dated December 18, 2007 No. 03-11-05/300, dated December 1, 2006 No. 03-11 -04/3/520 and letters from the Federal Tax Service of Russia in Moscow dated November 6, 2007 No. 20-12/105713 and dated September 8, 2005 No. 20-12/64161. They expressed a similar opinion regarding the accounting of other non-operating income of the organization on UTII (amount of insurance compensation, supplier bonuses for purchases, bank interest on the current account, exchange rate differences).

However, it is possible that such a point of view will lead to a dispute with tax inspectors. Particularly if the third party's note is subsequently realized rather than repaid. In this case, it will have to be defended in court (Article 138 of the Tax Code of the Russian Federation). Arbitration practice on this issue has not yet developed.

Types of stock instruments

One of the most important markets in the economic system of any country is the securities market. It performs a number of functions that have a direct impact on the stability of the economy, as well as its potential for growth.

The most important functions of the stock market include:

- obtaining income from assets and free cash flows;

- formation of market prices for stock instruments, impact on the balance of supply and demand;

- creation of a single information field accessible to all participants;

- regulation of relations within the market between participants in transactions;

- distribution of financial risks;

- creating conditions for the movement of money and capital assets between sectors of the economy;

- attracting citizens to investment activities by transferring savings into investments;

- additional financing of the budget without additional emission of money supply.

All market relations are carried out using securities. The economic essence of the stock market comes down to production and transactions with them.

About fifteen types of securities are used in Russia. An investor who wants to receive additional financing or income from his free funds, as a rule, resorts to the formation of a package of stock documents. This approach is called an investment portfolio. It allows its owner to create a flexible instrument for generating income on their assets at different times and with varying degrees of risk. The use of securities with varying degrees of liquidity, maturities and riskiness makes it possible to reduce losses across the entire package of documents that form the investment portfolio.

Currently, electronic types of documents are increasingly used. However, there are securities that must be issued only in paper form. One of these is a bill.

OSNO and UTII

If an organization applies the general system and pays UTII, then the taxation of income on the bill does not depend on the activity within which it was received. From the income received, calculate taxes in accordance with the general taxation system (clause 2 of article 346.26, clauses 9 and 10 of article 274 of the Tax Code of the Russian Federation).

At the same time, keep in mind that there are arguments that allow you not to pay income tax on interest (discount) on bills received in payment (security of payment) for goods (work, services) sold within the framework of activities transferred to UTII.