Federal Law No. 402-FZ of December 6, 2011, in Article 9, provides for commercial enterprises a free choice of forms of primary documentation, starting in 2014. To record the actions of employees in the workplace, forms T-12 and T-13 are used (approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004).

Article 91 of the Labor Code of the Russian Federation (Part 3 of Article 91) indicates that a budgetary organization is obliged to record the length of time employees work at the workplace. For this purpose, a mandatory form has been developed (OKUD code 0504421), on the basis of which wages are calculated. When filling out, you must use the symbols in the time sheet in 2021.

Time sheet: about the obligation to maintain

The obligation to take into account the time worked by employees is defined in Article 91 of the Labor Code of the Russian Federation. It applies to all employers, regardless of the form of business organization and its size. Microenterprises that have refused to draw up internal regulations on the basis of the provisions of Article 309.2 must also keep a timesheet. The reason is that the time sheet is not a labor law document, since it does not establish any standards. This is the primary accounting document, and it is mandatory for everyone.

It does not matter what wage system the employer has adopted – time-based or piece-rate. Maintaining employee time sheets is mandatory in any case. After all, recording hours worked is necessary not only for calculating wages, but also for monitoring the implementation of the work and rest regime.

The absence of a work time sheet may result in a fine under Part 1 of Article 5.27 of the Code of Administrative Offenses, as it is a violation of labor legislation.

Truancy

Absenteeism may become one of the grounds for terminating an employment agreement at the request of the employer.

Absenteeism is the absence of an employee from his assigned place without a satisfactory reason for 4 or more hours in a row during one day (shift). Nothing depends on the length of the shift (the employee skipped working hours). The boss can define the following points as absenteeism:

- When an employee who has signed an employment contract (term unspecified) leaves his workplace without satisfactory reason, without notifying the employer of termination of the agreement, before the expiration of the 2 week notice period;

- When an employee who has signed a contract (fixed term) leaves the position without any valid reason before the expiration of the contract or before the expiration of the warning period for early termination;

- Self-management of days off, as well as arbitrary assignment of vacation.

These norms may seem to be clearly defined and extremely transparent. However, employers, and often the courts, even today find themselves at a dead end when studying such cases and determining whether a particular situation constitutes truancy. As a result, judges' verdicts often turn out to be incorrect and hasty.

Who fills out the time sheet?

Large organizations sometimes introduce a separate position for a timekeeper. His responsibility is to keep track of his colleagues’ working hours. He enters data daily, sums up the results at the end of the accounting period, signs the document himself and with the manager (or head of a structural unit), and then passes it on to the payroll specialist.

The main thing in the work of a timekeeper is keeping a record of the hours actually worked by each employee, recording absences and entering this data into the working time sheet with the appropriate codes. The accuracy of wage calculations will depend on this.

However, not all organizations can afford an independent staff unit for keeping time sheets. These functions can be assigned to any member of the team or to several. If the employment contract or job description of a particular employee does not specify the responsibilities for maintaining this document, an appropriate order must be issued.

Actions of the employer after the dismissal of the employee is declared illegal

Article 396 of the Labor Code of the Russian Federation establishes a requirement for the immediate execution of a court decision to reinstate an illegally dismissed employee.

Based on the court decision, the employer must:

- issue an order to reinstate the employee at work with the mandatory cancellation of the dismissal order;

- make an entry in the work book declaring the previous dismissal entry invalid;

- issue an order indicating for what period and what payments need to be made (for accounting, it will be the basis for calculating and paying compensation for the period of forced absence);

- pay the average earnings for the period of forced absence: a pre-calculated amount for the court that is not disputed by the company, if it is indicated in the decision, or an amount calculated after the order is issued;

- pay monetary compensation for moral damage if it is awarded by the court;

- take into account the time of forced absenteeism in the employee’s work experience (Article 121 of the Labor Code of the Russian Federation).

It is important to remember that the requirement for reinstatement at work is considered fulfilled from the moment when two actions are carried out: the returning employee has begun to perform his previous job duties and the order for his dismissal is canceled (decrees of the Constitutional Court of the Russian Federation dated July 15, 2008 No. 421-О-О, dated November 15 .2007 No. 795-О-О).

note

The employer’s obligation to pay wages during forced absence occurs simultaneously with the cancellation of the dismissal order and the reinstatement of the employee in his previous position, being an integral part of the process of reinstatement at work (Determination of the Armed Forces of the Russian Federation dated April 23, 2010 No. 5-B09-159).

It should be noted that according to Part 4 of Art. 394 of the Labor Code of the Russian Federation, if the dismissal is declared illegal, the court, at the request of the employee, may decide to change the wording of the grounds for dismissal to dismissal at one’s own request. By virtue of Part 7 of the same article, if, in the cases provided for by this article, after declaring the dismissal illegal, the court makes a decision not to reinstate the employee, but to change the wording of the grounds for dismissal, the date of dismissal must be changed to the date the court makes the decision. If, by the time the said decision is made, the employee, after a contested dismissal, has entered into an employment relationship with another employer, the date of dismissal must be changed to the date preceding the day of commencement of work for this employer.

If the employer intends to challenge the court's decision, the preparation of the relevant documents and the direct application to the court should be carried out after the employee is reinstated at work.

Sample order to appoint a person in charge

The order is drawn up in free form, it includes a preamble and an administrative part. The preamble states the basis and/or purpose of the order. In this case, you can, for example, write “For the purpose of recording working time,” “Guided by Article 91 of the Labor Code of the Russian Federation,” or include both of these wordings.

The administrative part indicates the responsible person. In a large organization, it is advisable to appoint several people and assign a specific structural unit to each. The director can also indicate the person responsible for executing the order, or assign control to himself. The order ends with the signature of the manager, as well as the responsible persons - they must be familiar with it.

Unified report forms

Resolution of the State Statistics Committee dated January 5, 2004 No. 1 for commercial organizations approved report card forms T-12 and T-13. Nowadays, keeping time sheets for employees on standard forms is not necessary - you can develop them yourself. However, traditional forms are convenient, so many people still use them. You can download a blank form of both forms at the end of the article.

Forms T-12 and T-13 are equivalent in the sense that you can choose either one. However, T-12 is intended not only for recording working hours, but also for calculating wages. Currently, all calculations are carried out automatically using computers - there is no need to count manually. Therefore, in practice, the T-12 is used extremely rarely. T-13 is more compact due to the lack of a section for calculating payments, so employers usually use it.

Before getting acquainted with filling out these forms, we will talk about the points common to them.

In the T-12 form, codes are given on the first page - these are designations in the timesheet of the type of working time or the reasons for the employee’s absence. There are two types of codes - alphabetic and numeric. The employer decides for himself what type of code he will use. In practice, alphabetic ones are more convenient because they are more understandable. For example, “I” is attendance, “B” is absence due to disability (sick leave), “OT” is vacation.

The designations from the T-12 form are also used to fill out the T-13 report card. If standard codes are not enough, their list can be expanded. It is only important to ensure that the additional designations introduced by the employer are unique and do not repeat existing ones.

In addition, you should choose the method for displaying information in the timesheet. There are two options:

- Complete registration. In the process of filling out the timesheet, the code and number of hours are entered daily, that is, each of its cells is filled in.

- Registration of deviations. The employer sets the normal working time - usually 8 hours of attendance. This value will correspond to an empty cell. The report card will record only the difference from this value. If the cell is empty, it means the employee worked his standard 8 hours that day. If the cell contains, for example, code “B”, he was on sick leave that day.

The document can be filled out on paper or on a computer (in Excel, Word or accounting programs). If entries about work time are entered into the timesheet manually, then it is more convenient to use the method of recording deviations - it is less labor-intensive.

The electronic format requires printing. But the document does not need to be printed if all signatories use a qualified electronic signature. If after signing it is necessary to correct the work time data, a corrective document is drawn up.

And now about how to fill out the timesheet in practice.

Change data in a timely manner

Until the reason for the employee’s failure to appear at his place has been determined, do not mark the time sheet with the coding “PR” or “24”. First, you should make sure that there are no positive justifying factors for all days. In the beginning, it is worth demanding an explanatory statement from the employee, then the boss can draw up a decree imposing a penalty. Although the employee will not challenge termination due to absenteeism, if the employer immediately leaves the mark “PR” instead of “NN”. In court, the evidence base (failure to appear) is important, and not this moment of registration.

When the fact of absenteeism becomes undeniable, write an adjustment document for this person. This is an additional document issued with the code “NN”. It is compiled for the current day, but for the entire period of absenteeism. In this report card, the encoding “PR” will be correct.” If on some days the employee is able to bring documents justifying absenteeism, then it is worth entering this data into the accounting document under the necessary codes. For example, you can leave the notes “B” or “T” if the reason for failure to appear was disability.

You cannot make adjustments to a timesheet that has already been taken into account by the accounting department. The first reason is that the document will be unreadable due to the large number of corrections. The boss will need to cross out the notes, add new ones, indicate the date of the adjustments, and certify them. Also, at the time of filling out the report card corresponded to the real situation. And it will clearly demonstrate that the person was not at his workplace. The last reason is that for accounting there is no difference between the designations “NN” or “PR”. All that matters to them is that the employee does not have the right to receive money for these hours. It turns out that everything will be correct with the calculations.

Instructions for filling out a working time sheet in form T-13

As we have already noted, the T-13 is more frequently used in practice, so let’s start our acquaintance with it.

The form consists of a header and a table and usually fits on one sheet. The company name is included in the header. If the time sheet is compiled for a structural unit, its name must also be entered. In addition, the OKPO code, date, document number and reporting period are indicated. Next follows two sheets of tabular part.

In column 2 of the work time sheet in the T-13 form, broken down by structural divisions, the surnames and initials of all company employees, as well as their positions, are entered. The data is taken from the staffing table. Column 1 contains the serial numbers of the persons on the list, and column 3 – their personnel numbers.

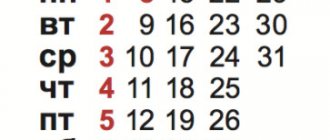

Column 4 contains cells corresponding to calendar days - from the 1st to the 31st. They are placed in 2 rows: the top row is from 1 to 15, the bottom row is from 16 to 31. For each day there are 2 cells located one above the other. The code is entered at the top, and the number of hours at the bottom.

Filling out a timesheet is not always easy, because there are sometimes incomprehensible moments. Let's consider a couple of situations that cause difficulties for employers:

- Working overtime. The cells are entered using a fraction. The codes “Y/S” are written in the upper cell, and the values “8/2” are written in the lower cell. This means that on a particular day a person worked 8 hours and worked overtime for another 2 hours.

- Long absence. For example, a woman went on maternity leave. Should it be included in the timesheet? Yes, it's necessary. The list includes everyone who works in the organization on the day it is compiled. In the case of parental leave, the code “OZH” is entered, and the cell with the number of hours remains empty.

Column 5 summarizes the results for the 1st-15th day of the month: in the top cell - the number of working days, in the bottom - hours worked. Similarly, the results for the month are reflected in column 6.

Columns 7-9 reflect the data for calculating wages. Column 7 is intended to indicate the payment type code. It is needed for an accountant who will calculate salaries based on the timesheet in order to understand the type of accrual. Resolution No. 1 does not specify where exactly to get these codes, so the employer can develop his own coding. But they traditionally use the List of codes for types of income for tax purposes, approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

There are not many most used codes. For example, 2000 – basic salary, excluding bonuses, 2012 – vacation pay, 2300 – sick leave, 2002 – bonuses paid not at the expense of profits (reduce the income tax base), 2003 – bonuses at the expense of profits.

Column 8 indicates the accounting account on which the costs for a specific payment are reflected. It depends on how the accountant will post this accrual. For example:

- Dt 20 Kt 70 – accrual of wages to employees engaged in production (main activity). In column 8 enter “20”;

- Dt 23 Kt 70 - accrual of salary to support service employees (for example, an accountant). “23” is entered in column 8;

- Dt 69 Kt 70 – accrual of sick leave to employees. “69” is entered in column 8.

In column 9 indicate the total number of days for 2 weeks, and in brackets - the hours that need to be paid according to the corresponding code.

If the document is filled out for a department with a small number of employees, it is very likely that the wage type code and invoice may be the same for everyone. In this case, they can be indicated once - for this, lines are left in the header of the table, above columns 7-9.

In columns 10-13 you need to duplicate all no-shows for the month. The entry occupies 2 cells horizontally. First, enter the code, and next to it - the number of days (hours) of absence from work. For example, the entry “FROM 3 (24)” will mean that during the month the employee missed 3 full working days (24 hours) due to the main vacation.

This completes filling out the time sheet. The finished form is signed by the timekeeper, the head of the organization or structural unit.

If reflecting the data in the timesheet is difficult, we recommend that you look at the sample filling at the end of the article.

Can I use my own abbreviations and decodings?

Many specialists are interested in whether it is possible to add their own codes for the 2021 working time sheet. If necessary, the enterprise has the right to independently supplement the adopted abbreviations (according to article of the Order of the Ministry of Finance dated March 30, 2015 No. 52n).

For example, to designate a vacation period, “O” must be entered - regular and additional leaves or “OR” - for child care. For convenience and to differentiate between types of leave, specialists enter “DO” into the designation, which means leave at their own expense; the designation is quite often used in the time sheet. Or “KR” - a break to feed the baby.

When introducing additional values, it is necessary to issue an order to approve the designations, thus securing new codes and decoding of employee movements in the workplace in local regulatory documents.

Form T-12: differences and rules for filling out

T-12 is a slightly more complex form, since it also calculates wages. Sheets 3 and 4 are intended for this - they are filled out by the accounting department. Sheet 1 lists the codes (designations in the report card) for both forms. Working hours in T-12 are noted on sheet 2. The data is also entered into the table, but it has more columns.

Columns 1-3 in the T-12 report card are the same as in the T-13 form. Next, there is a slight difference in the presentation of data - in T-12 all calendar days are placed on one line. Working hours for the period from the 1st to the 15th are reflected in column 4, for the period from the 16th to the 31st - in column 6. Columns 5 and 7 are intended to indicate the total data for the first and second half of the month.

Columns 8-13 reflect data for the month:

- 8 – number of days worked;

- 9 – total number of hours, including overtime (column 10), night (column 11), weekends/holidays (12), others (column 13).

In column 14 you need to make a calculation of the missed days and hours for the month, and next to this you need to detail these data: in column 15 indicate the reason for each absence in the form of a code, in column 16 - the number of days and hours. Column 17 reflects weekends and holidays.

What are the rules for calculating average earnings during forced absence?

The provisions of Art.

234 of the Labor Code of the Russian Federation stipulates that if a court or a labor dispute commission recognizes the dismissal of an employee as illegal, he must be paid the average salary for the entire period of forced absence. According to the legal position set out in paragraph 62 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 2[1], the average earnings to pay for the time of forced absence are determined in the manner prescribed by Art. 139 Labor Code of the Russian Federation. Since the Labor Code establishes a uniform procedure for calculating the average salary for all cases of determining its size, the same rules should be used to determine the average earnings when collecting sums of money:

- during forced absenteeism caused by a delay in issuing a work book to a dismissed employee (Article 234 of the Labor Code of the Russian Federation);

- in case of forced absenteeism due to incorrect formulation of the reason for dismissal (Part 8 of Article 394 of the Labor Code of the Russian Federation).

Features of the procedure for calculating average wages established by Art.

139 of the Labor Code of the Russian Federation, are determined by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations. This procedure is defined in the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average salary” (hereinafter referred to as the Regulation). According to this resolution, the average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment. Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with clause 15 of the Regulations, by the number of days actually worked during this period (clause 9 of the Regulations). In practice, legal proceedings on issues of reinstatement and recovery of wages for forced absence can drag on, and during this time the organization most often increases wages.

In this regard, clause 17 of the Regulations provides for a special calculation procedure. The average earnings determined to pay for the time of forced absence are increased by a special coefficient.

So, if during forced absence in an organization (branch, structural unit) tariff rates, salaries (official salaries), and monetary remuneration increased, the coefficient is determined by the following formula:

| Coefficient | = | Tariff rate, salary (official salary), monetary remuneration established for the employee from the date of actual start of work after his reinstatement to his previous job |

| Tariff rate, salary (official salary), monetary remuneration established in the billing period |

At the same time, in relation to payments established in a fixed amount and in an absolute amount, the rules of clause 16 of the Regulations apply: when average earnings increase, payments taken into account when determining average earnings, established in absolute amounts, do not increase.

note

When recovering average earnings in favor of an employee reinstated in his previous job, the severance pay paid to him is subject to offset (Resolution of the Plenum of the Armed Forces of the Russian Federation No. 2, Appeal ruling of the Sverdlovsk Regional Court dated April 1, 2015 No. 33-4234/2015).