Since the beginning of the year, tax agents have been required to report quarterly on the amounts of calculated and withheld income tax.

Until July 31, individuals and legal entities making payments under various types of employment and civil contracts must submit a report in Form 6-NDFL for the first half of the year.

Let's take a closer look at how to fill out section 2 of form 6-NDFL, in particular, lines 100, 110 and 120, so that the inspectors have no complaints.

Section 2 of form 6-NDFL is filled out according to certain rules. Read the article about what tax authorities suggest you pay attention to when submitting your half-year report.

Standards by law

According to the Tax Code, each legal entity must provide conclusions on the amount of taxes based on the income of individuals to whom bonuses, dividends and salaries are paid.

Form 6 personal income tax is divided into two sections, the first indicates the total for all periods on an increasing basis. The second reflects transactions for the reporting period that were carried out in the last three months.

Referring to the tax code of the Russian Federation, the tax agent is obliged to deduct the amount of the required payment from the income of the payer himself. The very fact of payment must also satisfy all the special requirements established by this paragraph.

Due to these features, if the employer paid the salary for March at the beginning of August, then the tax will also be calculated for the date when the money arrived in the individual’s account. It follows from this that the operation will be reflected in the first section, but the agent may forget about it in the second section, since the operation will ultimately be taken into account in the calculation in Form 6-NDFL for the direct payment of wages.

Date of actual receipt of income in kind

Income in kind is considered received on the day of actual transfer of such income (for example, the date of delivery of a gift or debiting the amount transferred from the account to pay for the employee’s education). This date is reflected in line 100 “Date of actual receipt of income” of form 6-NDFL.

The date of actual receipt of income in 6-NDFL depends on the conditions for receiving wages:

- If the income was received in cash, then the day of payment of such amount will be the day it is credited to the bank account. This includes the transfer of money to third party accounts, according to the taxpayer’s instructions.

- If the production supports payment for working time in kind, then the date for the 6-NDFL certificate is the day of their transfer.

- For organizations that have a system of subsidizing housing loans, the day the mortgage payment is received will be the retention period for the loan.

- Determining the date of 6-NDFL income received will be determined using receipts from stores.

- It is possible to find out when securities were received using shareholder statements.

- The number that needs to be included in the summary statement of income from the company is the end of the tax period, according to personal income tax.

- The amount that was received by the entrepreneur with financial assistance must be taken into account in the 6-NDFL certificate for all three tax periods.

- According to tax accounting, the amount of 6-NDFL income received will be indicated for two tax periods. If the amount of assistance exceeds the amount of expenses, the difference is also taken into account for tax purposes.

- The amount of 6-NDFL income received on wages is calculated on the last day of the month in which the accrual was made. If an employee is dismissed, the information for filling out the certificate will be the last day of work in production. This also applies to the date of receipt of vacation pay that was received upon dismissal of the employee.

If representatives of the tax authorities accuse the employer of providing data that does not correspond to each other, he will become a violator of the law. A discrepancy between the information from line 120 and the deadline for transferring personal income tax in the budget settlement card is unacceptable. It means that the taxpayer knowingly or inadvertently provides distorted reporting and tries to disguise non-payment of taxes to the budget.

To dispel the suspicions of regulatory authorities, the accountant will have a maximum of five days from the moment the violation is detected. During this time he must:

- Correctly correct the mistake.

- Provide an explanation of the reasons why inaccuracies were included in the document.

Let's check the data

Lines 100, 110, 120 and 140 have their own characteristics - this manifests itself at the filling out stage and requires the accountant to be careful.

The first error concerns line 100 and is associated both with ignorance of the instructions and with the use of accounting programs. One way or another, before submitting reports, it is necessary to check that the date of receipt of income is indicated in accordance with the requirements of the Code. Otherwise, if the dates of actual payments are indicated for all income, the organization will be asked to present an updated calculation form.

Also, if in line 120 the date of the tax payment was indicated, and not the one required by law, then this may be due to a delay in the transfer of funds to the budget. Tax authorities are well aware of this and always check whether it is time to assess penalties and fines for the debtor organization. If violations are detected, they will send a request for “clarification.” Payment documents have nothing to do with personal income tax reporting - information from them does not fall into Form 6.

In line 140, the amount of personal income tax withheld should not depend on how much money was later transferred to the budget.

Video - 6-NDFL. Dates of receipt of income

Key Notes

Design details

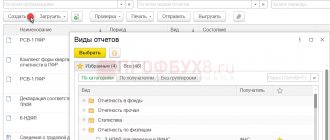

The form for calculating the amounts that were determined by the tax agent has already been approved by the Federal Tax Service. According to it, the procedure for filling out the form is also precisely spelled out so that any company that is a tax agent can correctly draw up 6-NDFL.

If the payment transfer date and the accrual period differ, the information will be filled out in two stages. In the first section, data on the actual transfer is filled in, and in the second - for the next reporting period.

Tax payment deadline

The date on which the tax agent transfers personal income tax to the budget is no later than the day following the day the income is issued. However, if we turn to vacation pay and temporary disability benefits, then personal income tax is transferred to the budget no later than the last day of the month in which this payment was made. It should also be remembered that page 120 only indicates working days. This means that if the day that follows the day of payment of income (the last day of the month) is a weekend, then the next working day will be indicated as the tax payment date (Read also the article ⇒ How the tax office checks 6-NDFL).

Priority and latest changes

| Title page | Consists of basic information and deadlines for submitting the form. |

| First section | Contains stacked indicators. An advance is indicated here, the amount of which is predetermined in 6 personal income taxes for both residents of the Russian Federation and foreigners living in the country for less than six months. |

| Second section | Implies information on income received by individuals, according to 2-NDFL. |

There are two main differences that must always be remembered: the second form is filled in with personalized data, taking into account each employee individually, the sixth form is filled in with consolidated values for all employees.

| Income type | How to determine the date of actual receipt |

| Salary | The last day of the month when funds were transferred. For example, if the money is transferred on the fifteenth of April, then the date is considered to be the thirtieth of April. |

| Cash (salary not included) | The day the funds are received or received into the account. |

| Business trips | The last day of the month when the employee approved the amount of expenses. For example, if confirmation is provided on December seventh, then the date of receipt is December thirty-first. |

| Receipts transferred in any form other than cash | The day on which the income was transferred. |

| Profit received from the purchase of securities, goods and services | The immediate day of the transaction. |

| Profit from loans with a rate lower than that established by refinancing | The last day of each month while the money was set aside. |

6-NDFL on paper

is submitted only in cases where the local Federal Tax Service accepts reports in this form.

Read in this article how to reflect the tax deduction in 6-NDFL.

If the tax was not withheld

If the tax agent was unable to withhold tax on income in kind during the calendar year, then in the annual Calculation he fills out line 080 “Amount of tax not withheld by the tax agent” (clause 5 of Article 226 of the Tax Code of the Russian Federation).

In Section 2 of Form 6-NDFL, income in kind and the tax not withheld from it should be shown as follows (Letter of the Federal Tax Service of Russia dated 01.08.2016 No. BS-4-11/):

- on line 100 – the date of actual receipt of income;

- on lines 110 and 120, the date in the format “00.00.0000”;

- on line 130 – the amount of income received in kind;

- on line 140 – “0”.

Other conditions

Reflection methods

According to the rules, the actual income received, indicated in line 100 of the second section, is shown in line 130 in a combined form. But there are conditions under which this value needs to be divided into different sheets or rows for the convenience of maintaining and checking the report. The purpose is to show the amount of the amount before and after deduction from the income received.

In addition to the title page, form 6-NDFL includes two sections. Section 1 “Generalized indicators” - is filled out on an accrual basis for the first quarter, half a year, nine months and a year. Section 2 “Dates and amounts of income actually received and withheld personal income tax” implies transactions performed over the last three months of a given reporting period. In order to begin studying the nuances when filling out the calculation, let’s find out who should provide it.

According to officials, if a person has provided zero, the tax authority will accept it in the prescribed manner. Such a document is submitted in order to notify the Federal Tax Service of a temporary or complete cessation of activity. This method allows you to avoid unnecessary proceedings and eliminate misunderstandings.

It is important to note that such an excuse was not invented just like that. For example, your company submitted a 2-NDFL certificate, which indicates taxable earnings and the personal income tax itself.

Differences in reports

There cannot be any differences in the first section of the report in 2021; the entire form has already been strictly approved; all actions for the reporting period are indicated here. But the second section may bring surprises. We have already talked above about the lines that can be added while filling out a section, but these are not all the possible differences in the forms.

And in order to know what data is included in calculations based on 6-NDFL, you need to take into account the following variables:

- Date of transfer of income to the account of individuals.

- The date on which taxes are withheld from the income received.

- The period for which the income must be transferred.

An interesting fact is that the amount spent on paying the employee’s vacation pay is not taxable. The fact is that, according to the Tax Code of the Russian Federation, money received in this way is of a different nature from the real salary.

It is always worth remembering: if the deadline for transferring taxes falls on a non-working day, then the end is postponed to the next working day.

Check the accuracy of filling

For the column where tax withholding dates are entered, the ascending principle applies. Therefore, the outer columns contain earlier dates and vice versa. If the tax authorities note violations in the document, the organization will be fined for the unreliability of the information provided. She will have to pay an administrative fine of 500 rubles. In general, it should be noted that the Federal Tax Service very carefully monitors the procedure for filling out 6-NDFL and, at the slightest error or inaccuracy, returns the reporting forms for revision.

Fill out the form carefully

What is section 2 of the 6-NDFL declaration

The second section of form 6-NDFL, provided for by the Order of the Federal Tax Service of the Russian Federation, is intended to correctly record the timing of the distribution of income and taxes.

Filling out the terms and amounts of income in section 2 of form 6-NDFL is a very important procedure

The section contains a list of three dates that are important to be able to fill out correctly:

- date of actual receipt of income (line 100);

- tax withholding date (line 110);

- tax payment deadline (line 120).

The list is compiled to accurately reflect in the reporting of all income received by date.

Paragraph 2 of Article 223 of the Tax Code of the Russian Federation establishes that the actual date of payment of wages is the very last day of the month.

Thus, line 100 indicates the 31st, 30th, or last day of February. If this calendar day falls on a weekend or holiday, the entry in the line remains unchanged.

The approved salary payment date is considered to be the very last day of the month.

According to the law (clause 6 of Article 226 of the Tax Code of the Russian Federation), all necessary amounts of taxes must be withheld at the time of actual distribution of income to an individual. Transfers are made on the next business day.

Fixing the tax withholding period in 6-NDFL depends on the time of its accrual. The retention date for different situations will be as follows:

- for “salary” income - the day of payment of earnings;

- for “severance” payment - the day of settlement with the dismissed employee;

- for “interest savings” - the day of the nearest cash payment after the day of receipt of income.

In the 6-NDFL calculation, the tax withholding date is one of the required parameters.

Subtleties of calculation

When in doubt whether the tax withholding column is filled out correctly, you need to refer to the Letter of the Federal Tax Service dated February 25, 2021. You can also consider all the difficult issues with examples.

Example. Suppose the salary for February was received on March 15 of the same year, and the tax was transferred on March 16. To the question of what needs to be entered in line 110, there is a clear answer - March 15. We will indicate this date in the certificate, which is submitted to the tax office based on the results of the 1st quarter.

When filling out a document in Form 6-NDFL, Section 2 is not subject to the cumulative total rule. This half-year part will contain the dates of the last three reporting months. The February date indicated above will be present in the quarterly report, but not in the semi-annual report.

Another question that employees authorized to enter information into the personal income tax report often encounter concerns the case when they received their salary a few days before the end of the month.

Example. Due to the May holidays, employees received their salaries at the end of April, and not on May 3, as required by the contract. The difficulty is that the tax must be withheld on the day the salary was received, and this date is the last day of the month. Tax officials, in response to a question, explained that an individual’s income cannot be recognized until the end of the month. Therefore, you need to set the day of payment of the May advance as the withholding date.