Tax Code >> Chapter 23

Article 207 Taxpayers

Article 208 Income from sources in the Russian Federation and income from sources outside the Russian Federation

Article 209 Object of taxation

Article 210 Tax base

Article 211 Features of determining the tax base when receiving income in kind

Article 212 Features of determining the tax base when receiving income in the form of material benefits

Article 213 Features of determining the tax base for insurance contracts

Article 213.1 Features of determining the tax base for non-state pension agreements and compulsory pension insurance agreements concluded with non-state pension funds

Article 214 Peculiarities of paying personal income tax in relation to income from equity participation in an organization

Article 214.1 Peculiarities of determining the tax base, calculation and payment of income tax on transactions with securities and on transactions with financial instruments of futures transactions

Article 214.2 Features of determining the tax base when receiving income in the form of interest received on deposits of individuals in banks located on the territory of the Russian Federation

Article 214.2.1 Features of determining the tax base when receiving income in the form of fees for the use of funds of members of a credit consumer cooperative (shareholders), interest for the use by an agricultural credit consumer cooperative of funds raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative

Article 214.3 Peculiarities of determining the tax base for repo transactions, the object of which are securities

Article 214.4 Peculiarities of determining the tax base for securities lending transactions

Article 214.5 Peculiarities of determining the tax base for income received by participants of an investment partnership

Article 214.6 Peculiarities of calculation and payment of tax in relation to income on government securities, municipal securities, as well as equity securities issued by Russian organizations, paid to foreign organizations acting in the interests of third parties

Article 214.7 Peculiarities of determining the tax base for income in the form of winnings received in a bookmaker's office and totalizator

Article 214.8 Request for documents related to the calculation and payment of tax when paying income on government securities, municipal securities, as well as equity securities issued by Russian organizations, paid to foreign organizations acting in the interests of third parties

Article 214.9 Peculiarities of determining the tax base, accounting for losses, calculating and paying tax on transactions accounted for on an individual investment account

Article 215 Features of determining the income of certain categories of foreign citizens

Article 216 Tax period

Article 217 Income not subject to taxation (exempt from taxation)

Article 217.1 Features of exemption from taxation of income from the sale of real estate

Article 218 Standard tax deductions

Article 219 Social tax deductions

Article 219.1 Investment tax deductions

Article 220 Property tax deductions

Article 220.1 Tax deductions when carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions

Article 220.2 Tax deductions when carrying forward losses from participation in an investment partnership

Article 221 Professional tax deductions

Article 222 Powers of legislative (representative) bodies of the constituent entities of the Russian Federation to establish social and property deductions

Article 223 Date of actual receipt of income

Article 224 Tax rates

Article 225 Procedure for calculating tax

Article 226 Peculiarities of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents

Article 226.1 Peculiarities of calculation and payment of tax by tax agents when carrying out transactions with securities, transactions with financial instruments of futures transactions, as well as when making payments on securities of Russian issuers

Article 227 Peculiarities of calculation of tax amounts by certain categories of individuals. The procedure and terms for payment of tax, the procedure and terms for payment of advance payments by specified persons

Article 227.1 Peculiarities of calculating the amount of tax and filing a tax return by certain categories of foreign citizens engaged in paid labor activities in the Russian Federation. Tax payment procedure

Article 228 Peculiarities of tax calculation in relation to certain types of income. Tax payment procedure

Article 229 Tax return

Article 230 Enforcement of the provisions of this chapter

Article 231 Procedure for collection and refund of tax

Article 231.1 Features of the refund of tax withheld by a tax agent from certain types of income

Article 232 Elimination of double taxation

Article 233 Repealed

Chapter 23 of the Tax Code of the Russian Federation Personal income tax

| Chapter 22 | Chapter 24 |

Comments on Chapter 23 of the Tax Code of the Russian Federation - Personal Income Tax

Who should pay personal income tax

According to the Tax Code of the Russian Federation, personal income tax, payers of this tax are both citizens of the Russian Federation and foreigners receiving income in Russia. If a citizen of any state receiving income is in our country for more than 183 days within 12 consecutive months, he automatically becomes a tax resident who is obliged to pay personal income tax. Separately, it is worth pointing out that under the described temporary conditions, stateless persons must also pay this tax.

When do you need to pay income tax?

The deadline for paying personal income tax directly depends on the entity that makes deductions and submits reports to the tax authorities. This can be either an individual who directly received the income or an employer who is responsible for withholding and remitting this tax from employee salaries. If we are talking about employees, then the tax must be paid within the next day following the day of payment. The deadline for self-filing of a declaration for the past tax period is until May 2. An individual can pay personal income tax for himself or herself until July 15 of the current year. You can pay this tax online on the official website of the Federal Tax Service of Russia.

How is personal income tax calculated?

According to Article 224 of the Tax Code of the Russian Federation, personal income tax of working persons is calculated at a rate of 13%, which is deducted from the basic income (wages). A separate rate of 35% has been introduced for the following types of income of citizens:

- lottery winnings (winning bets at bookmakers) over 4,000 rubles per calendar year;

- accrual of bank interest on personal deposits;

- profit received through the temporary use of cooperative funds;

- indirect income resulting from lower mortgage interest rates;

- income of the founder (shareholder, shareholder) of any societies and companies

Personal income tax is not charged for the following transactions:

- sale of real estate that has been owned for more than 3 years;

- inheritance or gift transactions;

- sale of a car owned for more than three years;

- when selling property whose sales value is equal to or less than the amount received from the sale (documentary evidence)

Personal income tax for foreign citizens selling any real estate in Russia is 30% of the estimated value of the property.

Deductions from personal income tax

A property deduction from personal income tax can be applied in the case of the sale of real estate worth up to 1 million rubles, if it has been owned for less than 3 years. The period is calculated from the date of state registration of the immovable object indicated in the certificate. When selling other property owned for less than 3 years, a tax deduction of 250,000 rubles is applied. Individuals also have the right to apply so-called “children’s” deductions for citizens with children, professional and social deductions.

According to the latest changes in the Tax Code of the Russian Federation, personal income tax in 2021 will be calculated in the same way as in previous periods. But the deadline for paying personal income tax has changed in favor of taxpayers - starting from 2021, individuals can notify the tax authority about their income until May 2.

Dear Clients! From January 1, 2021, changes to tax legislation will come into force regarding an increase in the personal income tax rate in relation to the income of individuals exceeding 5 million rubles.

What changes in the calculation of personal income tax

According to Law No. 372-FZ of November 23, 2020 (hereinafter referred to as the Law), the personal income tax rate is established depending on the amount and type of income.

13% - if the amount of relevant income for the tax period is less than 5 million rubles or equal to 5 million rubles

650 thousand rubles and 15% from the amount of income exceeding 5 million rubles - if the amount of the corresponding income for the tax period exceeds 5 million rubles.

For some types of income, tax rates will remain unchanged:

— For residents of the Russian Federation - income taxed at other rates (35%, 9%) and income from the sale/donation of real estate.

— For non-residents of the Russian Federation, the rates have not changed, except for income that falls within the exception of paragraph 3 of Article 224 of the Tax Code of the Russian Federation. For example, from the work of a highly qualified specialist, income from interest on bank deposits, etc., a progressive scale will also be applied to them.

Attention bondholders!

According to the new standards, from 01/01/2021 it is necessary to pay personal income tax:

from the amount of income in the form of interest (coupon, discount) received on circulating bonds of Russian organizations denominated in rubles and issued after January 1, 2017.

amounts of interest on state treasury obligations, bonds and other government securities of the former USSR, member states of the Union State and constituent entities of the Russian Federation, as well as on bonds and securities issued by decision of representative bodies of local self-government.

Until 01/01/2021, the specified income was not subject to personal income tax.

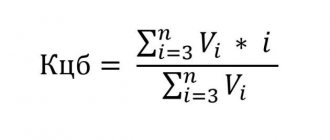

When the issuer pays the coupon, the tax agent withholds tax from the full amount of income received[ii]. The tax rate[iii] when paying coupons for residents of the Russian Federation depends on the amount of the tax base (TB) for income from transactions with securities (CB) and on transactions with derivative financial instruments (DF), calculated from the beginning of the tax period (01.01) to the date coupon payments:

If the National Bank for the Central Bank and Pension Funds is less than 5 million rubles, the tax rate is 13%.

If the National Bank for the Central Bank and Pension Funds is more than 5 million, the tax rate is 15%.

For non-residents of the Russian Federation, the tax rate is 30%.

The coupon paid by an individual when purchasing bonds is included in expenses upon sale/redemption of the bond.

IT IS IMPORTANT TO KNOW!

The law establishes a transition period in relation to income received in 2021 or 2022, for which the calculation and payment is carried out by the tax agent: in 2021-2022, the tax agent, when calculating personal income tax, applies a progressive tax rate to each tax base separately.

How are tax bases determined?

Tax bases for transactions of the Broker's clients are determined as the monetary expression of the corresponding income subject to taxation and taken into account when determining the tax base, taking into account the specifics established by Articles 214.1, 214.3, 214.4, 214.9 of the Tax Code of the Russian Federation, applied in calculating the corresponding tax bases.

The tax base for income from equity participation is determined taking into account the specifics established by Article 275 of the Tax Code of the Russian Federation

When determining the tax base for the Central Bank and Pension Funds, income is reduced by the amount of tax deductions provided for in subparagraph 1 of paragraph 1 of Article 219.1 of the Tax Code of the Russian Federation

When determining the tax base for IIS, income is reduced by the amount of tax deductions provided for in subparagraph 3 of paragraph 1 of Article 219.1 of the Tax Code of the Russian Federation

To determine the tax base, the tax agent calculates the financial result in accordance with Articles 214.1, 214.3 and 214.4 of the Tax Code of the Russian Federation for the taxpayer to whom funds are paid (income in kind) on the date of payment of income.

If the amount of tax calculated on an accrual basis exceeds the amount of the current payment of funds (income in kind), the tax is calculated and paid by the tax agent from the amount of the current payment.

If the amount of tax calculated on an accrual basis does not exceed the amount of the current payment of funds (income in kind), the tax is calculated and paid by the tax agent from the amount of the financial result calculated on an accrual basis.

The amount of tax calculated and withheld by the tax agent from the taxpayer, in respect of whom it is recognized as a source of income, is paid to the budget in the following order:

- if at the time of payment of the tax to the budget, the amount of tax calculated and withheld by the tax agent from the taxpayer, calculated on an accrual basis from the beginning of the tax period, exceeded 650 thousand rubles, the amount of tax is paid separately in the part missing up to 650 thousand rubles, relating to the part of the tax base up to 5 million rubles inclusive;

— the part of the tax amount exceeding 650 thousand rubles, relating to the part of the tax base exceeding 5 million rubles, is paid separately.

If the total amount of tax calculated by the tax authority on the income of an individual received from different sources of payment of income exceeds the total amount of tax withheld by tax agents and the amount of tax calculated by taxpayers based on the tax return, tax payment is carried out before 01.12 on the basis of the sent tax authority notification of tax payment.

102-FZ dated 04/01/2020

[ii] with the exception of coupons credited to the IIS account

[iii] 372-FZ dated November 23, 2020.

Changes in personal income tax 2018: table

Editor's note:In calculating 6-personal income tax they offer:

— enter the details for the legal successor:

1) “form of reorganization (liquidation) (code)”, where one of the values is indicated: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

2) “TIN/KPP of the reorganized organization”, where the legal successor puts down his TIN and KPP (the rest put dashes);

— set codes for the legal successor (215 or 216, if he is the largest taxpayer), entered in the details “at the location (accounting) (code)”;

— in the “tax agent” field, indicate the name of the reorganized organization or its separate division;

— establish the opportunity for the successor to confirm the accuracy of the information.

They also propose to change the codes for legal entities that are not major taxpayers: instead of code 212 in the details “at location (accounting) (code)” they will have to indicate 214.

To confirm the authority of the representative, you will need to indicate not only the name of the document, but also its details.

In addition, the barcode will change.

Similar innovations will be introduced into the calculation format.

It is assumed that the amendments will take effect starting with the calculation for 2017, but not earlier than two months after the publication of the order.

In the 2-NDFL certificate they plan:

— by analogy with the previous form, enter the fields to be filled out by the legal successor: “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” (other legal entities do not fill out these fields).

— clarify the “Tax Agent” fields of Section 5: the successor of the tax agent will have to enter number 1 in this field, and the representative of the successor will have to enter number 2;

— to confirm the authority of the representative, indicate the name of the document and its details;

— enter a new barcode;

- from section 2 remove the fields “Address of residence in the Russian Federation”, “Code of country of residence” and “Address”, and from Sect. 4 - mention of investment deductions.

The procedure for filling out the form will also change, so the assignee:

— in the “Sign” field, enter the number “3” if submitting a regular certificate, and the number “4” if reporting unwithheld tax;

— indicates the OKTMO code at the location of the reorganized company or its separate division;

— in the “Tax Agent” field reflects the name of the reorganized company or its separate division;

— indicates the form of reorganization, TIN/KPP in the appropriate fields.

The assignee will also have to report to its inspectorate about the tax not withheld by the reorganized company, if it itself has not done so. The new procedure will eliminate the possibility of submitting such information on electronic media.

The format of the certificate will also be clarified.

The amended certificate will be useful starting with reporting for 2017

Commentary on changes to part two of the Tax Code of the Russian Federation

Corporate income tax

Depreciable property

From January 1, 2011

Depreciable property will be recognized as property with a useful life of more than 12 months and

an original cost of more than 40,000 rubles

.

To recognize property as fixed assets, their initial cost must also be more than 40,000 rubles.

Corresponding amendments have been made to Art. 256, 257 Tax Code of the Russian Federation

.

Thus, the cost limit of depreciable property is increased by 2 times

.

Law No. 229-FZ does not provide for transitional provisions for depreciable property.

Therefore, the change in the cost limit of depreciable property applies only to fixed assets put into operation after January 1, 2011.

For depreciable property, the cost of which is up to 40,000 rubles.

and which was put into operation before January 1, 2011, depreciation should continue to be charged until the original cost of the object is fully repaid.

Similar explanations were provided by the Ministry of Finance of the Russian Federation in letter dated 04/25/2008 No. 03-03-06/1/296, when from 01/01/2008, in order to recognize the object as depreciable property, the original cost was increased from 10,000 to 20,000 rubles.

In addition, officials indicate that property acquired by the organization is taken into account

for the purposes of taxing the profits of organizations

in accordance with the procedure in force at the time of putting this property into operation

(letter of the Ministry of Finance of the Russian Federation dated November 3, 2007 No. 03-03-06/1/767).

But there are still some shortcomings in this matter.

According to paragraphs 26 clause 1 art. 264 Tax Code of the Russian Federation

other costs associated with production and sales include the costs of acquiring

exclusive rights to computer programs

worth less than 20,000 rubles.

And although since 2011 the minimum amount of the initial cost at which property ( including intangible assets

) is recognized as depreciable, increased to 40,000 rubles,

pp.

26 clause 1 art. 264 of the Tax Code of the Russian Federation, Law No. 229-FZ did not make any changes.

The situation of 2008 repeated itself.

Then, too, having increased the minimum amount of the initial cost of depreciable property since 2008 from 10,000 to 20,000 rubles, the legislator forgot to make the appropriate amendments to paragraphs. 26 clause 1 art. 264 Tax Code of the Russian Federation

.

The error was corrected only in 2009.

And the Ministry of Finance of the Russian Federation insisted in 2008 that the cost of acquiring exclusive rights to use a computer program worth less than 10,000 rubles. can be taken into account for tax purposes of corporate profits as part of other expenses associated with production and sales, based on paragraphs. 26 clause 1 art. 264 Tax Code of the Russian Federation

.

If the specified expenses exceed 10,000 rubles, then according to paragraphs. 2 p. 3 art. 257 Tax Code of the Russian Federation

they are recognized as an intangible asset (if their useful life exceeds 12 months), which is included in the depreciation group in accordance with its useful life, and are repaid by calculating depreciation (see, for example, letter dated February 13, 2008 No. 03- 03-06/1/91).

And this despite the fact that exclusive rights to computer programs worth up to 20,000 rubles. could no longer be recognized as depreciable property.

It is likely that in the current situation (since 2011), the Ministry of Finance will insist that the taxpayer amortize exclusive rights to computer programs worth up to 20,000 rubles.

Until legislators correct their oversight.

Advance tax payments

According to paragraph 3 of Art. 286 Tax Code of the Russian Federation

organizations whose

sales income over the previous four quarters did not exceed an average of three million rubles for each quarter

pay only quarterly advance payments

based on the results of the reporting period

.

Since 2011

A much larger number of taxpayers will be able to take advantage of the right not to make monthly advance payments of income tax.

The maximum amount of income from sales for the transition to paying only quarterly advance payments has been increased to 10 million rubles for each quarter

.

Activities related to the use of facilities of service industries and farms

Currently, according to Art. 275.1 Tax Code of the Russian Federation

in the event that

a division of the taxpayer carrying out activities related to the use of facilities of service industries and farms receives a loss

while carrying out activities related to the use of facilities of service industries and farms, and there are no specialized organizations carrying out similar activities on the territory of the municipality at the location of the taxpayer associated with the use of such objects, for tax purposes, actual expenses incurred for the maintenance of these objects are accepted within the limits of standards approved by the executive authorities of the constituent entities of the Russian Federation at the location of the taxpayer.

From January 1, 2011

this provision is cancelled.

Consequently, from 2011

losses

from the use of service industries and farms

will be accepted

for tax purposes

subject to the following conditions

:

– if the cost of goods, works, services sold by a taxpayer carrying out activities related to the use of these objects corresponds to the cost of similar services provided by specialized organizations carrying out similar activities related to the use of such objects.

In this case, there is no need to compare the conditions of the taxpayer’s activities and precisely

a specialized organization located on the territory of the municipality at the location of the taxpayer;

– if maintenance costs

objects of housing and communal services, social and cultural sphere, as well as subsidiary farming and other similar farms, production and services do not exceed the usual costs of servicing similar objects, carried out by specialized organizations for which this activity is the main one;

– if the conditions for the provision of services, performance of work by the taxpayer do not differ significantly from the conditions for the provision of services, performance of work by specialized organizations for which this activity is the main one.

Currently Art. 275.1 Tax Code of the Russian Federation

determines city-forming organizations in accordance with the legislation of the Russian Federation.

According to Art. 169 of the Federal Law of the Russian Federation of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”,

city-forming organizations

are legal entities

whose number of employees is at least twenty-five percent

of the working population of the corresponding locality.

The provisions on bankruptcy of city-forming organizations also apply to other organizations whose number of employees exceeds five thousand people

.

However, 5,000 workers may represent less than 25% of the working population of a locality.

This uncertainty caused a lot of controversy, including litigation.

From January 1, 2011

these disputes will end.

Part seven of Art. 275.1 Tax Code of the Russian Federation

the new edition establishes that taxpayers

whose number of employees is at least 25 percent of the working population

of the relevant locality and which includes structural units for the operation of housing facilities, as well as housing and communal services and social and cultural sphere facilities,

have the right to accept for tax purposes actual expenses incurred for the maintenance of these facilities

.

In addition, actual expenses of city-forming organizations will be accepted for tax purposes without taking into account standards

.

The rule on recognizing costs within the limits of standards is excluded

.

Tax payment deadlines

According to paragraph 2 of Art. 287 Tax Code of the Russian Federation

a Russian organization or a foreign organization operating in the Russian Federation through a permanent representative office (tax agents) paying income to a foreign organization withholds the amount of tax from the income of this foreign organization.

The tax agent is obliged to transfer the appropriate amount of tax within three days

after the day of payment (transfer) of funds to a foreign organization or other receipt of income by a foreign organization.

For income paid to taxpayers in the form of dividends, as well as interest on state and municipal securities, the tax withheld upon payment of income is transferred to the budget by the tax agent who made the payment within 10 days

from the date of payment of income.

A Art. 310 Tax Code of the Russian Federation

It has been established that the amount of tax withheld from the income of foreign organizations is transferred by the tax agent to the federal budget

simultaneously with the payment of income in Russian currency

.

From January 1, 2011

this

contradiction has been eliminated

.

Tax withheld from the income of foreign organizations, including in the form of dividends, must be transferred by the tax agent to the budget no later than the day following the day of payment (transfer)

.

Carrying forward losses

In accordance with paragraph 1 of Art. 283 Tax Code of the Russian Federation

taxpayers who suffered a loss (losses) calculated in the previous tax period or in previous tax periods have the right to reduce the tax base of the current tax period by the entire amount of the loss they received or by a part of this amount (carry forward the loss to the future).

Since 2011

This provision

does not apply

to losses received by the taxpayer during the period of taxation of his income

at a rate of 0 percent

.

Personal income tax

Property tax deductions

In accordance with Art. 220 Tax Code of the Russian Federation

property tax deduction in the amount of expenses actually incurred by the taxpayer

for new construction or acquisition

on the territory of the Russian Federation

of a residential building, apartment, room or share

(s) in them,

land plots

provided for individual housing construction, and land plots on which the purchased residential buildings are located , or shares (shares) in them can be

provided to the taxpayer before the end of the tax period when he contacts the employer - tax agent,

subject to confirmation of the taxpayer's right to a property tax deduction by the tax authority.

And the tax agent is obliged to provide a property tax deduction

upon receipt from the taxpayer of confirmation of the right to a property tax deduction issued by the tax authority.

From January 1, 2011

if, after the taxpayer has submitted in the prescribed manner an application to the tax agent to receive the specified property tax deduction,

the tax agent has unlawfully withheld the tax without taking into account this property tax deduction, the amount of excess tax withheld after receipt of the application shall be returned to the taxpayer

in the manner established

by Art.

231 Tax Code of the Russian Federation .

Accounting for income by tax agents

Currently, in accordance with paragraph 1 of Art. 230 Tax Code of the Russian Federation

tax agents keep records of income received from them by individuals during the tax period,

in a form

established by the Ministry of Finance of the Russian Federation.

can use an independently developed form to record income received from them by individuals in the tax period

or the relevant sections of Form 1-NDFL “Tax card for accounting of income and personal income tax for 2003”, approved by order of the Ministry of Taxes of the Russian Federation dated October 31, 2003 No. BG-3-04/583.

From January 1, 2011

directly in

Art.

230 of the Tax Code of the Russian Federation stipulates that tax agents keep records of income received from them by individuals during the tax period, tax deductions provided to individuals, calculated and withheld taxes

in tax accounting registers

.

Forms of tax accounting registers and procedures

the reflection in them of analytical tax accounting data and data from primary accounting documents

is developed by the tax agent independently

.

These forms must contain the following information

:

– information allowing identification of the taxpayer;

– the type of income paid to the taxpayer and tax deductions provided in accordance with the codes approved by the Federal Tax Service of the Russian Federation;

– the amount of income and the date of their payment;

- taxpayer status;

– dates of tax withholding and transfer to the budget system of the Russian Federation;

– details of the corresponding payment document.

In form 2-NDFL since 2011

You will need to provide information about the amounts not only of taxes accrued and withheld, but also

transferred

to the budget.

Currently, the Federal Tax Service of the Russian Federation only approves form 2-NDFL.

And directly in Art. 230 Tax Code of the Russian Federation

it is stated that tax agents submit information to the tax authorities at the place of their registration

on magnetic media or using telecommunications

.

If the number of individuals who received income in the tax period is up to 10 people

tax agents can submit such information

on paper

.

Since 2011

in

Art.

230 of the Tax Code of the Russian Federation will not contain these norms.

Form, format and order of presentation of information

will be approved by the Federal Tax Service of the Russian Federation.

Now, according to paragraph 2 of Art.

230 of the Tax Code of the Russian Federation, information on income paid to individual entrepreneurs

for goods, products or work performed (services provided) purchased from them is not provided if these individual entrepreneurs have presented to the tax agent documents confirming their state registration as entrepreneurs without forming a legal entity and registration with the tax authorities.

Since 2011

this provision in

Art.

230 of the Tax Code of the Russian Federation will not exist.

On the one hand, Art. 226 Tax Code of the Russian Federation

The specifics of calculating personal income tax by tax agents have been established.

From paragraph 2 of this article it follows that the provisions of Art.

226 of the Tax Code of the Russian Federation do not apply to income received by individual entrepreneurs

from carrying out entrepreneurial activities, the calculation and payment of tax on which is carried out in accordance with

Art.

227 Tax Code of the Russian Federation .

That is, since in relation to an individual entrepreneur the source of payment of income is not recognized as a tax agent, he is not required to provide information about the income paid.

On the other hand, it may be that the Federal Tax Service of the Russian Federation, which has the right to approve the procedure for submitting information, will explain the presentation (failure to provide) information about income paid to the entrepreneur.

Procedure for collection and refund of tax

Currently Art. 231 Tax Code of the Russian Federation

It has been established that

excessively withheld

by a tax agent from a taxpayer’s income

are subject to refund by the tax agent

upon submission of a corresponding

application

.

Specific order

the implementation of the return of withheld personal income tax of the Tax Code

of the Russian Federation is not established

.

The Ministry of Finance of the Russian Federation indicated that the refund to the taxpayer of the amount of overpaid personal income tax is made based on the provisions of Articles 78 and 231 of the Tax Code of the Russian Federation

.

In accordance with paragraph 2 of Art. 78 Tax Code of the Russian Federation

offset or refund of the amount of overpaid tax

is carried out by the tax authority

at the place of registration of the taxpayer, unless otherwise provided by the Tax Code of the Russian Federation.

A refund of the amount of tax over-withheld by a tax agent may be made to the taxpayer by a tax agent on the basis of an application from an individual submitted to the tax agent, and to the tax agent by the tax authority.

on the basis of the corresponding application of the tax agent for a refund (offset) submitted to the tax authority.

The Ministry of Finance is convinced that the return to the taxpayer of excessively withheld tax by reducing

amounts of tax to be transferred on income received from this tax agent by other individuals,

Art. 78 of the Tax Code of the Russian Federation is not provided for

(letters dated January 14, 2009 No. 03-04-05-01/5, dated April 3, 2009 No. 03-04-06-01/76, dated April 12, 2010 No. 03- 04-06/9-72).

The Federal Tax Service of the Russian Federation has a different opinion on this issue.

The Federal Tax Service rightfully points out that the provisions

of Art.

78 of the Tax Code of the Russian Federation , when an employee contacts a tax agent with a written application for the return of tax amounts excessively withheld by this tax agent,

do not apply

, since this article regulates relations arising directly

between the taxpayer and the tax authority

.

The tax agent has the right to make a refund

excessively withheld from the employee and amounts of taxes transferred to the budget

at the expense of amounts of taxes to be transferred, withheld from other employees of the organization

(letter of the Federal Tax Service of the Russian Federation dated August 19, 2009 No. 3-5-01/1289).

The position of the tax authorities was reinforced in the new version of Art. 231 Tax Code of the Russian Federation

.

From January 1, 2011

as before, the amount of tax overdeducted from the taxpayer’s income by the tax agent is subject to refund by the tax agent

based on a written application from the taxpayer

.

The tax agent will have an obligation to inform the taxpayer

about each fact of excessive tax withholding that has become known to him and the amount of excessive tax withheld

within 10 days from the date of discovery of such a fact

.

Note!

Return

to the taxpayer, the excess withheld amount of tax

is made by the tax agent at the expense of the amounts

of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and

for other taxpayers from whose income the tax agent withholds such tax

.

To return excessively withheld personal income tax, the tax agent is given 3 months

from the date the tax agent receives the corresponding application from the taxpayer.

Excess amounts of personal income tax withheld should be returned to the taxpayer only in non-cash form

by transferring funds to the taxpayer's bank account specified in his application.

In case the return

the amount of tax withheld in excess

is carried out by the tax agent in violation of the three-month deadline

; the tax agent

accrues interest

payable to the taxpayer for each calendar day of violation of the deadline for the return.

The interest rate is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation

, which was in effect on the days of violation of the return deadline.

If the amount of personal income tax to be transferred

by a tax agent to the budget system of the Russian Federation,

is not enough

to refund the amount of tax that was excessively withheld and transferred to the taxpayer within a three-month period; the tax agent,

within 10 days

from the date the taxpayer submits the corresponding application to him, must send to the tax authority at the place of his registration

an application for a refund to the tax agent of the excess the amount of tax withheld by him

.

And in this case, the return of the tax amount transferred to the budget system of the Russian Federation to the tax agent will be carried out by the tax authority in the manner established by Art. 78 Tax Code of the Russian Federation

.

Along with the application

In order to return the excessively withheld and transferred tax amount, the tax agent must

submit

to the tax authority

an extract from the tax accounting register

for the corresponding tax period and

documents confirming

the excessive withholding and transfer of the tax amount.

According to the general rule established by paragraph 9 of Art. 226 Tax Code of the Russian Federation

, payment of tax at the expense of tax agents is not allowed.

However, from January 1, 2011

before the return from the budget system of the Russian Federation to the tax agent of the amount of tax withheld and transferred to the budget system of the Russian Federation from the taxpayer,

Art.

231 of the Tax Code of the Russian Federation gives

the tax agent the right to refund such an amount of tax at his own expense

.

If there is no tax agent

, then the taxpayer has the right to submit an application to the tax authority for the return of the amount of tax that was excessively withheld from him and transferred to the budget system of the Russian Federation earlier by the tax agent.

The application is submitted simultaneously with the submission of the tax return

at the end of the tax period.

Non-residents

Clause 2 art. 207 Tax Code of the Russian Federation

It has been established that

tax residents

are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months.

Until the time an employee stays in the Russian Federation for the 12 months preceding the date of payment of income is less than 183 days, he will not be a tax resident of the Russian Federation

and his remuneration for performing labor duties on the territory of the Russian Federation is subject to personal income tax

at a rate of 30%

.

If on the date of receipt of income the employee is recognized as a tax resident of the Russian Federation, then his income from sources in the Russian Federation is subject to taxation at a rate of 13%

.

According to the Ministry of Finance of the Russian Federation, the final tax status

of an individual

for a tax period is established based on its results

, and, accordingly, the procedure for taxing the income of this person received for a given tax period is determined.

When the tax status of an employee of an organization is finally determined, tax amounts are recalculated in connection with a change in his tax status from the beginning of the tax period in which such a change occurred.

If at the end of the tax period

An employee of the organization will be recognized as a tax resident of the Russian Federation; based on his income from sources in the Russian Federation

the amount of tax

previously calculated at a rate of 30% as for a non-resident of the Russian Federation

should be recalculated at a rate of 13%

.

The offset or refund of the amounts of overpaid tax based on the results of the above recalculation is carried out in the manner established by Art. 78 and 231 of the Tax Code of the Russian Federation

(letter of the Ministry of Finance of the Russian Federation dated March 26, 2010 No. 03-04-06/51).

That is, return

, the tax agent

is currently required to withhold personal income tax in excess .

From January 1, 2011,

the refund of the tax amount

to the taxpayer in connection with the recalculation at the end of the tax period in accordance with his acquired status of tax resident of the Russian Federation

is carried out by the tax authority

in which he was registered at the place of residence (place of stay).

To do this, the taxpayer must submit a tax return to the tax authority at the end of the tax period.

, as well as

documents

confirming the status of a tax resident of the Russian Federation in this tax period, in the manner established by

Art.

78 Tax Code of the Russian Federation .

Uncollected personal income tax amounts

Now, according to paragraph 3 of Art. 231 Tax Code of the Russian Federation

tax amounts not collected as a result of tax evasion by the taxpayer are collected

for the entire period of tax evasion

.

From January 1, 2011

this provision

is no longer in force

.

Please note that the statute of limitations is three years.

.