How to reflect a loss in 1C 8.3? Before the release of “1C:ERP Enterprise Management” version 2.4.2, in which the developer introduced automation of the procedure to reflect last year’s losses, users had to resort to accounting for them and reflecting operations in the operational management loop to items in the directory of deferred expenses (abbreviated as RBP) . Even with the release of update 2.2, where the possibility of independently entering accounting, management, and tax accounting amounts debuted in the distribution documentation of the BPR, the ability to specify a distribution item for the BPR with the posting of account 99 and calculating the offset amounts from the proceeds in automatic mode remained unrealized.

Because of this, up to version 2.4.2, in order to reflect losses in regulated accounting for enterprises maintaining registration records in the general taxation system, the “Operations” document was used, where users had to manually fill in the distribution amount for VR and NU.

Reflection of losses in 1C:ERP

The main innovation of update 2.4.2 is the ability to maintain records within tax accounting, as well as reflect losses when preparing an income tax return, without the need to carry out manual operations.

For these tasks, the following were introduced into the system: account 97.11 and a directory with the same name. At the same time, the added directory is the only subaccount available for the added account.

As a rule, filling out the directory of past losses is carried out automatically: when closing the calendar year and before the balance sheet is reformed, the system checks for the presence in the directory of an entry with a year that would correspond to the period being closed. If there is no date, a new element for the current year will be added automatically.

To account for time differences in financial losses, in accordance with the requirements of the accounting standard of the Russian Federation 18/02, an asset of the same name is added to the list of types of tax liabilities/assets (ONO/ONA).

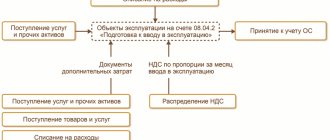

Closing the month for enterprises on the OSN (general taxation system) in terms of calculation and accounting of losses is carried out as follows:

- According to account 99.01.1 (Losses and income from activities with special tax purposes), the balance in tax accounting is calculated.

- If the balance presented in the paragraph above corresponds to financial losses, the amount of the latter is written off from this account, transferred to account 97.11 (Dt 97.11 - Kt 99.01.1), at the same time filling in the NU amount in the account assignment. Already on this account, in the account assignment of the analytical account of past losses, the element of the directory of the same name is filled in in accordance with the year being closed. If such an element does not exist, the system will create it automatically.

- If at the enterprise for which the year is closed, a flag appears in the accounting policy, accounting provision 18/02 is required, and the amount of the transferred loss is entered into the “Amount Kt BP” and “Amount Dt BP” with a negative value. The balance in the debit of account 09 “Deferred tax assets” at the time of closing the calendar year in the analytical account “Loss of the current period” is transferred to the debit of account 09 to the analytical account “Losses of previous years” (account assignment creation is required Dt 09 “Losses of previous years” - Kt 09 "Loss of the current period"). The existing balance on the above account 09 according to the analytical account “Loss of the current period” at the end of the last year and at the beginning of the current year is taken as an error that must be corrected, followed by repeating the registration procedure for closing it.

Answer Profbukh8

Elena Baranova Profbuh8.ru

In accounting, the balance on accounts 09 and 77 should be collapsed, and the resulting balance should be reflected on the corresponding side of account 99: if deferred assets exceed the amount of deferred liabilities, debit 99 (decrease in balance sheet profit), and vice versa.

Tatiana

Elena, good morning, that is, before reforming the balance, it is necessary to enter a manual operation?

- Dt09 51273.81

- Kt 99.01.1 51273.81

- Dt77 873.19

- Kt 99.01.1 873.19?

Closing last year's losses in 1C 8.3

Closing of recorded losses from last year is carried out by performing the regulatory process of closing the month, if there is a profit for the current period. For these purposes, in the program updated to version 2.4.2, the list of month-closing procedures includes the “Write-off of losses from previous years” procedure, carried out automatically if there is a balance on the debit of account 97.11. When performing this step, the system calculates the amount of losses for previous years (up to ten years) and, if there is a profit for the current period, writes off the loss to the amount of previously recorded profit, as a result of which account assignments Dt 99.01.1 - Kt 97.11 of the amount according to NU are formed .

If a flag is set in the enterprise’s accounting policy indicating that the organization maintains accounting in accordance with accounting regulations 18/02, then the amount of financial losses written off from account 97.11 is expressed in the amount of time differences with a negative value.

The write-off is carried out before the calculation of the direct state tax, which comes from the profit of the enterprise. The result of the procedure is taken into account in the process of calculating income tax at the subsequent stage of closing the month.

GLAVBUKH-INFO

Organizations and autonomous institutions that apply the simplification and pay a single tax on the difference between income and expenses have the right to include losses from previous years in the calculation of the tax base.Conditions for carrying forward losses

The loss can be written off only based on the results of the tax period, that is, when calculating the annual amount of the single tax (clause 7 of article 346.18, clause 1 of article 346.19 of the Tax Code of the Russian Federation). When calculating advance payments, the tax base for the amount of losses from previous years is not reduced. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated July 14, 2010 No. ШС-37-3/6701 (brought to the tax inspectorates for use in their work).

Loss carry forward rules

The amount of the loss can be carried forward to the future, but no more than 10 years in advance (for example, if the loss was received in 2009, then the last year for its write-off is 2019). In this case, the size of the loss and its amount, which reduces the tax base in each tax period, must be documented (for example, primary documentation (acts, invoices, etc.), copies of tax returns, a book of income and expenses). You must keep documents confirming the amount of loss incurred and the amount accepted for reduction for each year for the entire period of using the right to transfer it.

The loss of previous years can be written off in the current tax period in full. The balance of the unwritten loss can be carried forward (in whole or in part) to any year out of the next nine years. If a taxpayer received losses in more than one tax period, such losses are carried forward to future tax periods in the order in which they were received.

Upon termination of activities in connection with reorganization, the successor organization has the right to reduce the tax base by the amount of losses received by the reorganized organizations before the moment of reorganization.

This procedure is provided for in paragraphs 2–7 of clause 7 of Article 346.18 of the Tax Code of the Russian Federation.

Change of tax regimes

Losses received when applying other taxation regimes are not taken into account when calculating the single tax. Conversely, losses incurred during the period of application of the simplification are not recognized if the taxpayer switched to other taxation regimes. When changing tax regimes, existing losses are taken into account as follows: – a loss that was not taken into account when calculating income tax (was carried forward) before the transition to the simplified system, the taxpayer will be able to take into account only after returning to the general taxation system; – a loss that was not taken into account when calculating the single tax (was carried forward) before the transition to the general tax system, the taxpayer will be able to take into account only after returning to the simplified tax system.

This procedure is provided for in paragraph 8 of paragraph 7 of Article 346.18 of the Tax Code of the Russian Federation and is explained in letters of the Ministry of Finance of Russia dated January 28, 2011 No. 03-11-11/18, dated October 25, 2010 No. 03-03-06/1/657.

Situation: is it possible to write off a loss from previous years if the organization (autonomous institution) applying the simplification has changed the object of taxation

The answer to this question depends on what object of taxation the organization applies in the period in which it plans to write off the loss.

When simplified, a loss can accrue to an organization only based on the results of those periods in which it paid a single tax on the difference between income and expenses. In those periods when the organization paid a single tax on income, losses cannot arise. Since such an object of taxation does not take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation), the result of the organization’s activities will always be positive.

The right to reduce the tax base of the current period by the amount of losses from previous years is granted only to those organizations that pay a single tax on the difference between income and expenses (clause 7 of Article 346.18 of the Tax Code of the Russian Federation). After an organization switches to paying a single income tax, it is deprived of this right. Consequently, in those periods when an organization applies the object of taxation “income”, it cannot write off losses that arose before the change in the object of taxation.

If an organization changed the object of taxation to “income” and then again began to pay a single tax on the difference between income and expenses, the tax base of the current period can be reduced by the amount of losses from previous years. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 16, 2010 No. 03-11-06/2/35.

Minimum tax

If at the end of the year the taxpayer’s expenses exceeded taxable income, then instead of a single tax, the minimum tax must be transferred to the budget. It is 1 percent of taxable income for the year. This is stated in paragraphs 1–3 of clause 6 of Article 346.18 of the Tax Code of the Russian Federation.

Minimum tax write-off

If you receive a loss, the amount of minimum tax paid can be written off as expenses over the next 10 years. This procedure applies even if the organization or autonomous institution again ends the next year with a negative financial result. In this case, a new loss will be formed, carried forward to the future.

If the taxpayer changed the object of taxation and began to pay a single tax on income, the amount of the minimum tax paid is not applied to expenses, does not reduce the tax base and is not counted against current (upcoming) payments for the single tax.

This follows from the provisions of paragraph 4 of paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 27, 2011 No. 03-11-11/106.

Reflection of loss in the accounting book

To calculate the amount of loss that reduces the tax base of the current period and is carried forward to the future, Section III of the book of accounting for income and expenses is intended. When filling it out, follow Section IV of Appendix 2 to Order No. 154n of the Ministry of Finance of Russia dated December 31, 2008.

Reflection of loss in the declaration

When reflecting losses from previous years in your single tax return, follow the following algorithm.

Indicate the amount of taxable income for the reporting year on line 210 of section 2 of the declaration, approved by order of the Ministry of Finance of Russia dated June 22, 2009 No. 58n. The amount of taxable expenses is according to line 220 of the same section. In the indicator reflected on this line, include the difference (if any) between the amount of the minimum tax paid and the calculated single tax for the previous year. If a loss was incurred in the previous year, the difference will be equal to the amount of the minimum tax paid (since the amount of the calculated single tax will be zero).

If the tax base of the reporting year is positive (there are more incomes than expenses), indicate the amount of losses of previous years in an amount not exceeding the tax base of the reporting year on line 230. If the amount of losses of previous years exceeds the tax base of the reporting year, the difference between these indicators in line 230 is not reflected. Calculate the total amount of income (line 240) for the reporting year as the difference between lines 210, 220 and 230. Thus, the tax base of the reporting year will be reduced by the amount of losses from previous years.

If the tax base of the reporting year is negative (there is less income than expenses), line 250 reflects the loss of the current tax period. In this case, the organization does not have a source to cover losses from previous years, so their amount does not need to be indicated in the declaration.

This follows from Section V of the Procedure, approved by order of the Ministry of Finance of Russia dated June 22, 2009 No. 58n.

An example of accounting for losses from previous years when calculating a single tax under simplification. The organization pays a single tax on the difference between income and expenses

At the end of 2008, Alpha received income in the amount of 1,400,000 rubles. and incurred expenses of 1,800,000 rubles. Thus, at the end of the tax period, the organization received a loss in the amount of 400,000 rubles. (RUB 1,400,000 – RUB 1,800,000). The budget includes a minimum tax of 14,000 rubles. (RUB 1,400,000 × 1%).

At the end of 2009, Alpha received income of 1,300,000 rubles. and incurred expenses of RUB 1,290,000. The tax base for 2009 was reduced by the amount of the minimum tax paid for 2008 in the amount of 14,000 rubles. Thus, at the end of 2009, the organization received a loss in the amount of 4,000 rubles. (RUB 1,300,000 – RUB 1,290,000 – RUB 14,000). The budget includes a minimum tax of 13,000 rubles.

At the end of 2010, Alpha received income of 1,730,000 rubles. and incurred expenses of RUB 1,160,000. The tax base for 2010 was reduced by the amount of the minimum tax paid for 2009 in the amount of 13,000 rubles. The tax base for the single tax for 2010 amounted to 557,000 rubles. (RUB 1,730,000 – RUB 1,160,000 – RUB 13,000). At the beginning of 2010, the amount of outstanding losses from previous years amounted to 404,000 rubles. (400,000 rub. + 4,000 rub.). The single tax payable at the end of 2010 will be 22,950 rubles. ((RUB 557,000 – RUB 404,000) × 15%).

The calculation of the tax base for 2010 in connection with the write-off of losses for 2008 and 2009 was reflected by the Alpha accountant in the book of income and expenses.

| Next > |

Transfer of last year's losses when updating 1C ERP settings to the latest version

All of the above applies to new systems that do not provide information on losses for previous years, which remain after the system is updated from previous versions. But what to do if the system has already accounted for account 97.21 and the losses were closed manually?

In this case, after updating the settings, the balance will need to be manually assigned to the beginning of the current year from account 97.21 to account 97.11, using the “Operation (reg.)” document. Since after updating the settings, the directory of last year’s losses will be empty, you will need to manually prepare elements for those years for which there are unclosed losses, and when transferring from the account, fill out analytical account 97 yourself and correctly.

It is important not to forget the fact that the write-off of last year's losses (up to ten years) is not carried out automatically. In this case, a notification will appear about the presence of such amounts when closing regulated accounting for the last month of the year.

In order to write off last year's losses for a period of ten years or more from the current moment, you will need to use the document “Operation (reg.)”, starting from the decision made and filling out the following entries:

- Dt 91.02 PR – Kt 97.11 NU for a loss that is subject to write-off;

- Dt 91.02 VR – Kt 97.11 VR for a loss with a negative value that is subject to write-off.

Answer Profbukh8

Elena Baranova Profbuh8.ru

It turns out that yes.

Please rate this question:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?