A series is an additional warehouse analytics for item accounting, the use of which is determined by the accounting policy. The series accounting mechanism is universal and, depending on the settings, can be used to solve various applied problems, in particular:

- accounting for complaints based on product serial numbers;

- accounting of goods by expiration dates;

- accounting for the balance of goods in rolls, coils, sections, etc.;

- accounting for the cost of goods with different series.

The use of series in 1C:ERP is determined by the functional option Master data and administration – Setting up master data and sections – Nomenclature – Accounting sections – Product series .

Figure 1 - Nomenclature. Accounting sections

If accounting by series is enabled for the configuration as a whole, then it must be configured separately for each type of item by indicating the appropriate checkbox in the form of the reference book for the type of item. The checkbox is available if the Item Type is set to Product or Container :

Figure 2 - Type of nomenclature. Product

Series can be configured for a type of item ( Configured for this type of item ) or used uniformly for several types of item - to do this, you need to configure the use of series for one type of item, and in another view (other types) specify the value Used in the same way as in other types and a link to the first type of nomenclature.

To set up accounting by series, you need to clarify what the series will be. The following values are available (change the hyperlink in the attribute nomenclature type card Series identifies):

- A copy of a product that has a unique serial number (the Batch number and/or Expiration date details are used, accurate to ) – with this setting, the series will represent a unique serial number of a specific product (for example, the serial number of a specific mobile phone or other piece of household appliances);

- Batch of goods (Number) (the Batch number ) – with this setting, the series can characterize minor differences in product characteristics that are associated with production features. For example, a batch (series) of wallpaper. As a rule, different batches (series) of wallpaper differ in color shade.

- Batch of goods (Expiration date with accuracy up to) (use the Expiration date with accuracy up to ) – with this setting, the series will represent the shelf life of a batch of goods, for example a batch of milk;

- Batch of goods (Number, Expiration date accurate to Batch number and Expiration date accurate to are used – with this setting, the series will both characterize the shelf life of the batch and reflect minor differences in product characteristics that are associated with production features. For example, batches of paint.

The expiration date for batches of goods can be specified with an accuracy of days or hours.

Figure 3 — Series props settings

To formulate various rules for keeping records of batches and shelf life of items, a Batch Accounting Policy . Rules must be formed for all types of items for which it is necessary to keep records of batches or expiration dates.

Information about which batch accounting policy is applied to the item type is specified in the Accounting Policy in the item type card.

How the system will take into account goods is determined by the type of batch accounting policy (the Policy type in the Batch accounting policy ): whether a full accounting of the balances of goods by series will be kept or information about the batches of goods will be recorded in documents for reference.

The following policy types are available:

- Reference indication of series - there is no accounting of balances by series and expiration dates, but information on series or expiration dates is recorded in turnover documents.

- Automatic calculation of batch balances using FEFO - upon acceptance of goods, as well as during internal trade turnover, information on batches or expiration dates is recorded. When selling, the batch and expiration date are not indicated. In the reports, balances by batch and expiration date are calculated using the FEFO (first expire first out) principle.

- Management of batch balances – records of balances by batch and expiration date are kept.

- FEFO management of batch balances - records of balances by batch and expiration date are kept. Unlike the previous option, in shipping documents the program will offer to write off goods with expiring dates first (first expire first out).

- Cost accounting by series - a rule with this type of policy is created for goods for which it is necessary to maintain end-to-end cost accounting by series.

Figure 4 — Creating a batch accounting policy

The series accounting policy specifies for which operations a series must be specified. In general, you can independently configure the indication of series during acceptance, shipment, reflection of surpluses, shortages, etc., however, individual settings may be limited by the selected type of accounting policy. For shipment, it is additionally indicated, as well as at what stage (in which document) it is necessary to enter data on the series of goods:

- When planning shipments , series are indicated at the time of placing an order (sales order, order for internal consumption, etc.) or an invoice.

- When planning selection , series are indicated in the issue note in the status For selection . At a non-order warehouse, the series are indicated in the invoice.

- Upon selection - series are indicated after the selection task is completed. At the address warehouse, the series are indicated in the document Task for selection (placement) of goods in the statuses Completed without errors, Completed with errors . In the expenditure order and transfer order, the series are indicated starting with the To check .

Depending on the selected type of batch accounting policy, the checkboxes for operations for which batches are specified, as well as the choice of the stage for specifying batches during shipment, may be automatically checked and cannot be changed.

The batch accounting policy specified for the item type is shown in the warehouse/production department card using the Batch accounting settings .

If you need to set your own series accounting policy for each warehouse and division, then in this case, by default, it is recommended to set the predefined value Series are not used .

Figure 5 — Managing batch balances

Series reference

If you do not need to keep track of balances by series and expiration dates, but you need to use series as reference information, then it is recommended to use the policy type Reference indication of series .

With this type of accounting policy, a choice of operations (reception/shipment) is available, the registration of which requires a reference indication of series (form Series accounting policy ). The choice of operations depends on the scenario for using the series.

For example, if you want to control which product serial number was shipped to a customer, you can only select the When shipped to customer .

With this accounting policy, series are indicated based on the result of the actual selection of goods in the warehouse; The default value is set to Upon selection .

When accepting goods to a batch warehouse, you must indicate:

- in an unordered warehouse - in invoices;

- at the order warehouse - in the documents Receipt order for goods (required - in the Accepted , in previous statuses - possible, but not required).

Figure 6 - Purchase of goods and services

When shipping goods, series are indicated in the document status corresponding to the actual selection of goods in the warehouse (that is, those series that were removed from the shelf are indicated).

When shipping goods in a series, the following must be indicated:

- in an order warehouse - in the documents Issue order for goods with the status Checked and higher;

- in an unordered warehouse – document Sales of goods and services :

Figure 7 — Series registration

To analyze the movements of product series, use the report Warehouse and delivery – Warehouse reports – Inventory analysis – List of item series . Using this report, you can obtain information about which series of goods were accepted/shipped and what documents were drawn up.

Automatic calculation of batch balances using FEFO

If it is necessary to evaluate balances by expiration dates when generating a report, then a batch accounting policy with the type Auto-calculation by FEFO of batch balances . A rule with this type of policy is recommended to be used in cases where for goods there is no need to keep records of balances by series and expiration dates, but when accepting goods and internal trade turnover it is necessary to record information by series or expiration dates.

If the policy type is Automatic calculation of series balances using FEFO, the system automatically sets the series indication flags, and they cannot be changed. Series are specified in all receipt transactions and are not specified in shipment transactions.

An example of using FEFO auto-calculation of batch balances is the retail sale of goods with different expiration dates.

When accepting goods, it is mandatory to indicate information about batches (expiration dates) in all delivery documents. When receiving a batch of goods, the expiration date will be indicated as a series:

- in the order warehouse - in the document Receipt order for goods (required - in the Accepted , in previous statuses - possible, but not required);

- in an unordered warehouse - in invoices.

Information about expiration dates is specified in general for the product item (the expiration date of a specific batch of goods is indicated when preparing documents for the delivery of goods).

When registering a shipment transaction, expiration dates for goods are not indicated. To evaluate stock balances by expiration dates, use the report Product balances by expiration dates .

FEFO management of batch balances

If expiration dates need to be adjusted/selected manually (that is, goods that need to be written off by expiration date are manually selected), then the batch accounting policy with the type Management by FEFO for batch balances . A rule with this type of policy is created for goods for which it is necessary to keep track of balances by series and expiration dates. When accepting and shipping goods, information on series or expiration dates must be indicated. This is possible in distribution center warehouses.

Rule with policy type Management of series balances using FEFO is similar to the previous one. The difference is that in shipping documents the system will offer to write off goods with expiring dates first (first expire first out).

With this type of policy, the system automatically sets the batch specification flags during receiving and shipping and cannot be changed.

With this type of accounting policy, batches are indicated in shipment documents when planning selection, that is, at the stage of issuing selection tasks (the default value is set when planning selection in the form of batch accounting policy).

Series are indicated in all operations of receipt and shipment of goods.

To control the status of indicating series according to FEFO, special icons are provided in shipping documents, indicating that series can be filled in automatically based on balance data according to FEFO:

- – it is necessary to indicate the series or there is an error in indicating the series according to FEFO: more or less is indicated than the quantity for the goods;

- – series are indicated correctly according to FEFO balances: the quantity for series coincides with the quantity for goods.

When accepting goods in a series, the following must be indicated:

- at the order warehouse - in the documents Receipt order for goods (required - in the Accepted , in previous statuses - possible, but not required);

- in an unordered warehouse - in invoices.

Figure 8 - Registration of series. Best before date

When shipping goods, information about the series (expiration date) is indicated:

- in an order-based warehouse - in the document Issue order for goods with the status For selection ;

- in a non-order warehouse – document Sales of goods and services .

Figure 9 - Registration of series. Best before date. FEFO

Series (expiration dates) can be filled in automatically based on FEFO balances (button Fill - Series by FEFO in the goods receipt or in the invoice). It is recommended to use in cases of refilling series (for example, an issue note for goods on an invoice).

To control the balance of goods by expiration dates, the report Warehouse and delivery – Warehouse reports – Inventory analysis – Remaining goods by expiration dates .

Managing batch balances

If you need to keep individual records of balances (for example, by bobbins, rolls, pieces, etc.), it is recommended to use series with the accounting policy type Manage series balances . Moreover, each roll, reel, etc. must have their own individual number. If there is no number initially, then it can be generated and printed upon admission. This type of policy is also used to identify batches of goods with the same properties.

With this type of accounting policy, series are indicated in all receipt, shipment and internal merchandise flow documents.

When accepting goods in a series, the following must be indicated:

- in an unordered warehouse - in invoices;

- order warehouse - in the document Receipt order for goods .

Figure 10 — Managing batch balances

In the accounting policy settings, indicating series in all possible documents is mandatory. It is only possible to select one of three options for specifying series in shipment documents: when planning shipment, when planning selection, or upon selection.

Updates:

PRO version:

New in version 1.0.67.6:

Chart of accounts

New accounts added:

- 01.22 “Especially valuable movable property for use under lease agreements”;

- 01.32 “Other movable property for use under lease agreements”;

- 02.5 “Fixed assets that make up the treasury, not recognized as an asset”;

- 02.6 “Material reserves that make up the treasury, not recognized as an asset.”

Documents on accounting for Ministry of Health on off-balance sheet accounts have been improved to make it possible to work with account 02.6.

Note:

Accounts 01.22 and 01.32 have been added as new (valid from 01/01/2021). Balances from old accounts can be transferred to new ones during the inter-reporting period using the document “Transition to the application of order 198n (NFA)” or the processing “Assistant for transferring balances between accounts.”

The names of accounts 02.21, 02.22, 02.31, 02.32 have been clarified.

Quantitative accounting has been added for accounts 106.60, 111.60, 114.80, 114.87, 114.88.

When updating the configuration for new accounts 104.60, 114.40, 114.60, the “Agreements...” subaccount will be deleted, because was added by mistake.

Payment document subsystem

The Budget Code made changes to the treasury service system (Chapter 24.2). Now the territorial bodies of the federal treasury (TOFK) have their own BIC, like credit organizations, and are part of the classifier of banks (BIC classifier).

Processing "Loading Banks"

The processing includes loading the BIC classifier, both directly from the 1C service and from an external file containing TOFK data.

Note:

The file is a zip archive containing a classifier file in JSON format. The classifier file can be downloaded from the BGU 1 or BGU 2 support pages containing classifiers. On the support page it is called “BIK Directory”.

Added the ability to track changes in the name of banks when loading banks, and when it changes, change the name in the “Banks” directory.

The algorithm for generating bank names in payment details has been improved if the payment is made through the treasury.

Directory "Banks"

New details have been added to the directory.

Note:

The details are filled in automatically when loading the BIC directory.

Document “Decoding of unused cash deposited through an ATM”

A new edition of printed form 0531251 has been added to the document, in accordance with the order of the Treasury of Russia dated May 15, 2020 N22n “On approval of the Rules for providing cash and funds intended for settlements on transactions made using payment cards for participants in the treasury payment system.”

New editions of printed forms of payment documents “Application for cash expense”, “Application for cash expense (abbreviated)”, “Consolidated application for cash expense”, “Application for return”, “Application for cash”, “Application for cash (bank card) )":

New editions of payment document forms have been added in accordance with the order of the Federal Treasury dated May 14, 2020 No. 21n:

- Appendix No. 15. Application for cash expenses (Form according to KFD 0531801 (daily));

- Appendix No. 16. Application for cash expenses (abbreviated) (Form according to KFD 0531851);

- Appendix No. 17. Consolidated application for cash expenses (for payment of taxes) (Form according to KFD 0531860);

- Appendix No. 18. Application for return (Form according to KFD 0531803 (daily));

- Appendix No. 19. Application for receipt of cash (Form according to KFD 0531802);

- Appendix No. 20. Application for receiving funds transferred to the card (Form according to KFD 0531243).

Accounting for liabilities

Printed forms of the documents “Application for amendments to the budget obligation”, “Information on the accepted budget obligation” and “Accepted monetary obligation” are brought into compliance with the letter of the Ministry of Finance of Russia dated January 12, 2021 N 09-01-09/563 “On sending recommended samples of Information on the budget obligation and Information on the monetary obligation containing information constituting a state secret.”

Correcting mistakes from previous years

By Order of the Ministry of Finance of Russia dated September 14, 2020 No. 198n, from 2021 special accounts for correcting errors of previous years were added in order to isolate errors identified as a result of control activities: 304.66, 304.76, 401.16, 401.17, 401.26, 401.27. In addition, as of January 1, 2021, accounts 304.84 and 304.94 have been excluded.

To automatically generate postings for correcting errors from previous years, a parameter has been added to the setup form indicating who identified the error - independently or by the control body.

The algorithm for converting accounting records when reflecting corrections of errors from previous years in accounting has been improved.

When generating transactions for correcting errors from previous years manually in the form of editing the accounting register, pre-filling with converted transactions has been improved depending on the source of the error detection (the error was detected independently or by the control body).

Accounting for rights to use intangible assets

In accordance with Order of the Ministry of Finance of Russia dated November 15, 2019 No. 181n “On approval of the federal accounting standard for public finance “Intangible assets””, accounting operations for the rights to use intangible assets, including non-exclusive rights to the results of intellectual activity, have been implemented.

In the directory of fixed assets, intangible assets, legal acts, for objects of rights to use intangible assets, the Type of intangible assets is used - Intangible assets.

The document “Capitalization of fixed assets (intangible assets) to account 101 (102)” has been renamed to “Capitalization of fixed assets (intangible assets) to account 101 (102, 111.60)”.

To reflect accounting entries for the rights to use intangible assets, new operations have been added to the documents:

Document “Purchase of fixed assets, intangible assets”

- Purchase of rights to use intangible assets from a supplier (106.60 – 302.26)

- Acquisition of rights to use intangible assets through an accountable entity (106.60 – 208.26)

Document “Acceptance for accounting of fixed assets and intangible assets”

- Acceptance of acquired rights to use intangible assets into accounting (111.60 – 106.60)

Document “Free receipt of fixed assets and intangible assets”

- Free receipt of rights to use intangible assets (111.60 – 401.10.195-199)

Document “Capitalization of fixed assets (intangible assets) to account 101 (102, 111.60)”

- Capitalization of intangible assets based on inventory results (102 – 401.10.199)

Document “Internal movement of fixed assets and intangible assets”

- Internal movement of rights to use intangible assets - intended for moving rights of use between central medical centers

The document Calculation of depreciation of fixed assets and intangible assets for calculating depreciation on objects of rights to use intangible assets has been finalized.

The document Impairment of fixed assets, intangible assets and legal assets has been finalized for the accrual and recovery of impairment losses on objects of the rights to use intangible assets. To reflect transactions on accounts 111.60, you should select NFA Type – Intangible Assets, and in the balance selection form (Selection – by balances) manually change the NFA account “102.00” to “111.60”.

Support for operations in tax accounting for income tax has also been added.

Materials accounting

In the documents “Transfer of materials to third parties”, “Write-off of materials” and “Sale of materials”, accounting for reserves for reducing the cost of goods and products is implemented, in accordance with the order of the Ministry of Finance of Russia dated December 7, 2021 N 256n “On approval of the federal accounting standard for state-owned organizations "Reserves" sector.

The formation of entries to create a reserve for reducing the cost of products and goods is reflected by entry D-t 401.20.274, K-t 114.87 (114.88) and is documented in the document “Operation (accounting)”.

Postings for the use of the reserve are generated when posting the documents “Transfer of materials to third parties”, “Write-off of materials” and “Sale of materials” with the flag “Take into account the reserve for reduction in value” checked, if any.

Postings are generated only when goods or products are written off from accounts 105.27, 105.37, 105.A8, 105.B8. When writing off from other 105.xx accounts, the reserve is not analyzed and is not written off, even if it exists.

When selling goods, products for which a reserve was formed to reduce the value of them, the following entries are created: D-t 114.8Х, K-t 105.ХХ for the amount of the reserve. Those. part of the cost is written off against the reserve.

When writing off goods or products for which a reserve was formed for a reduction in value, the following entries are generated: D-t 114.8Х, K-t 401.20.274 for the amount of the reserve.

Document “Transfer of materials to third parties”

For operations “Free interbudgetary transfer (401.20.250 – 105.00)” and “Free interbudgetary transfer of investments (401.20.250 – 106.30)” of the document, 4,5,6,7 have been added to the list of available KFOs.

Document “Receipt of materials other”

The operation “Restore to balance (105 – 401.10.172, from off-balance sheet accounts 02, 07)” has been added to the document;

The operation for returning property from personal use has been renamed “Return from personal use (105.00 – 401.10, off-balance sheet account 27).” For the 401.10 account, KEC 172 and 199 are now available.

Document "Internal movement of materials"

Two new types of transfers have been added to the document: “Movement of investments in purchases between CMOs” and “Movement of investments in manufacturing between CMOs” for registration of operations for moving investments in inventories in accounts 106.2I, 106.2P, 106.3I, 106.3P.

Note

New types of movements can only be used in documents with a date after 01/01/2021.

Document “Acceptance of materials for accounting”

The ability to enter a document based on the document “Internal movement of materials” has been implemented. Entry based on this makes sense only for the operations “Move purchase investments between DMOs” and “Move manufacturing investments between DMSs”.

Other changes

Document “Act of reconciliation of mutual settlements”

In the document, the length of the attribute “Operation (primary document)” of the tabular parts “According to the institution” and “According to the counterparty” has been increased to 150 characters.

In the column “Operation (primary document)” of the tabular part of the document at the end of the presentation, the amount was displayed in parentheses. If payments are made in rubles, then this amount duplicated the amount in the “Debit” or “Credit” column. Now, if the settlement amount for a document is in rubles, then the amount will not be displayed in the view.

Documents “Purchase of fixed assets, intangible assets”, “Acceptance for accounting of fixed assets and intangible assets”, “Purchase of legal acts”, “Acceptance for accounting of legal acts”, “Free receipt of legal acts”

Accounts 106.90 have been added to document transactions to account for investments in the grantor's property.

Documents “Disposal of fixed assets (off-balance sheet)” and “Write-off of fixed assets in operational accounting”

In documents in transactions for writing off fixed assets from off-balance sheet accounts, the ability to restore fixed assets on the balance sheet is implemented (the Restore on balance sheet flag).

Document "Notice"

A new type of transfer has been added to the document “Transfer of settlements for IBT, subsidies (founder)” for generating transactions for accepting the amounts of transferred subsidies, IBT, as expenses, and generating a notice in form 0504805 for transfer to the recipient of subsidies, IBT. In essence, it is the founder’s response to the notice received from the recipient of subsidies, the ILO, regarding the accepted income of the current period from the subsidies received, the ILO.

Document "Application for food"

The frequency of numbers “Within a year” is included for the document. Before this, the number was non-periodic.

Document “Reflection of salaries in accounting”

New accounts 106.xx have been added for document transactions.

For the operation “Calculation of benefits and other payments at the expense of state social insurance funds”, KEC 266 has been added for calculating payment for additional days off per month to a parent, guardian, trustee for the care of disabled children.

Document “Service of loans and loans”

The operation “Accrual of claims for non-exchange transactions (207.44 – 401.10.190)” has been added to the document.

Document “Currency revaluation”

In the document for the operation “Currency revaluation on settlement accounts”, when selecting an exchange rate difference account, the substitution of KOSGU 176 is implemented.

Document “Transition to the application of order 198n (NFA)”

The document has added the operation “Property received for use | rent (01)”, to transfer balances from outdated accounts 01.22 and 01.32 to new accounts with the same code.

Added check for compliance of the selected contract with the counterparty.

Improved filling of the table section.

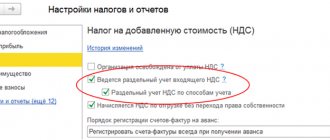

Tax accounting

In the documents working with accounts 111.60 and new 106.60, the procedure for generating income tax entries and registers under the simplified tax system has been improved.

Non-exclusive rights to use the results of intellectual activity for the purposes of tax accounting for income tax do not apply to depreciable property, regardless of the cost and useful life (clause 1 of Article 256 of the Tax Code of the Russian Federation). Expenses for the acquisition of such rights are classified as other expenses associated with production and sales (clauses 26, 37, clause 1, Article 264 of the Tax Code of the Russian Federation), and are included in the tax base evenly in those reporting (tax) periods to which they relate (clause 1 Article 272 of the Tax Code of the Russian Federation).

If an institution applies the general tax regime and maintains tax records for income tax, when acquiring non-exclusive rights to use the results of intellectual activity, these expenses are charged to account N97 “Deferred expenses”.

Non-exclusive rights to use the results of intellectual activity for tax accounting purposes under the simplified taxation system (Chapter 26.2 of the Tax Code of the Russian Federation) do not apply to intangible assets (clause 4 of Article 346.16 of the Tax Code of the Russian Federation). In 2021, these expenses are included in Section I of the “Book of Accounting for Income and Expenses of Organizations and Individual Entrepreneurs Using the Simplified Taxation System” as they are actually paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Directory "Magazines"

In the reference book, the 8-mo journal is renamed “Journal of Inter-Reporting Period Operations.”

Report Statement of OS, intangible assets

The report has added information about the objects of rights to use intangible assets accounted for in accounts 111.6Х.

Report Depreciation Statement

The report has added information on the depreciation of objects of the rights to use intangible assets recorded in accounts 111.6Х.

Report Calculation of average annual cost

A selection and grouping field “Tax Authority” has been added to the report, and the name of the field “Code by OK) has been clarified.

Attached files

The directory “Incoming Notice” and the document “Accounting Operation” are attached to the “Attached Files” mechanism. Now you can attach external files to them.

Added processing for transferring attached files to disk volumes.

Processing is intended for transferring external files already stored in the database, i.e. saved before switching to storing external files in volumes.

You can call processing from the program settings form from the “Attached files” tab.

Note

Processing can be called from the program settings form from the “Attached files” tab (hyperlink “Transfer files to volumes”).

Enumeration “Types of NFA”

The type of NFA “Rights to use property” has been renamed to “Rights to use fixed assets, legal acts”.

Production calendar

The production calendar for 2021 has been updated.

Barcode image generation component

The barcode image generation component has been updated to version 9.0.12.13.

Exchange with treasury systems and bank institutions

Added the ability to display the data of the confirming document “Order for transfer to account” from settlement and payment documents of disposals and receipts to the l/s (data is loaded during Statement import).

Updated formats:

- exchange with treasury systems version 32.0 (OFK.xml file);

Attention!

When updating the configuration, the formats are not updated. Files of supplied formats should be uploaded to the “Types of exchange formats” directory (the “Load formats” button on the “Exchange formats” tab of the “Exchange with treasury and banking systems” form). In the “Format Download and Update Assistant” window that opens, specify the download source – “Folder on this computer or a computer on the local network” and then follow the program’s instructions.

Regulated accounting reporting

The ability to fill out forms 0503169, 0503769 by institutional unit codes has been added to the mechanisms for filling out regulated reporting.

The multi-page form allows you to switch pages with one click.

Queries for filling out forms 0503175, 0503775 have been optimized.

The procedure for filling out column 3 of the final line of the expenses section of form 0503164 has been improved. When selecting the option “Fill in column 5 if column 4 = 0,” column 3 is filled in as the sum of column 4 or 5 detailed lines of form 0503127. Previously, when choosing this option, data was taken only from columns 5.

The sets of accounting reporting forms established by orders of the Russian Ministry of Finance have been updated:

- dated December 28, 2010 No. 191n – files statrep191K.repx, forep.repx;

- dated March 25, 2011 No. 33n – file statrep33B.repx;

- dated 04.12.2014 No. 143н – file statrep143N.repx;

Attention!

When updating the configuration, the accounting reporting sets (files statrep191K.repx, statrep33B.repx, statrep143N.repx, DataFEA.repx, forep.repx) are not updated. The sets should be loaded into the “Types of reports” directory (the “Download reporting sets” button).

Descriptions of changes are included in the kits. Information about the version of the set of financial statements and changes in the version can be obtained by clicking on the “i” button in the “Regulated financial statements” form.

Processing for uploading accounting and budget reporting has been updated – file extrp.zip.

Note

An archive of outdated sets can be downloaded from the configuration support page in the section “Outdated reporting sets of government, budgetary, autonomous institutions, financial institutions.” organ".

Regulated tax reporting

Regulated report “Form 11 (short)”

The report was completed in accordance with Rosstat order No. 384 dated July 15, 2020.

Regulated report “Property”

The property tax declaration as amended by Order of the Federal Tax Service of Russia dated July 28, 2020 No. ED-7-21/ [email protected] has been amended, approved by Order of the Federal Tax Service of Russia dated December 9, 2020 No. KCh-7-21/ [email protected]

Section 4 of the declaration can be filled out manually with data from the report “Calculation of the average annual value of property” with selection by accounts in the group from the list 101.20 and 101.30 to display information about movable property objects and the group fields “OK code for identifying objects that can be taken into account on the balance sheet of an institution or a separate unit in another subject of the Russian Federation.

Expanding the range of regulated reporting forms

The following have been added to the regulated reporting forms:

- declaration of tax paid in connection with the application of the simplified taxation system (approved by order of the Federal Tax Service of Russia dated December 25, 2020 No. ED-7-3 / [email protected] ). The declaration applies from March 20, 2021, starting with the 2021 report.

- statistics form No. 2-science “Information on the implementation of scientific research and development” (OKUD 0604011) (approved by Rosstat order No. 424 dated July 30, 2020). The form applies starting with the 2021 report.

- statistics form No. 6-oil “Information on the cost of oil production, production of petroleum products” (OKUD 0610066) (approved by Rosstat order No. 411 dated July 24, 2020). The form is used starting from the report for the 1st quarter of 2021.

- statistics form No. 1-conjuncture (wholesale) “Survey of market conditions and business activity in wholesale trade” (OKUD 0607002) (approved by Rosstat order No. 410 dated July 24, 2020). The form is used starting from the report for the 1st quarter of 2021.

Methodological changes

Checking the control ratios Calculation of insurance premiums as amended by the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] , introduced by the letter of the Federal Tax Service of Russia dated February 7, 2020 No. BS-4-11 / [email protected] , finalized in in accordance with the letter of the Federal Tax Service of Russia dated February 19, 2021 No. BS-4-11/ [email protected]

The form and electronic download of the corporate income tax declaration as amended by Order No. ED-7-3/ [email protected] have been amended in accordance with the letter of the Federal Tax Service of Russia dated 02.19.2021 No. SD-4- 3/ [email protected]

Cost accounting by series

If it is necessary to maintain quantitative and end-to-end accounting of cost by product series, then it is recommended to use the accounting policy type Cost accounting by series .

Applying the series accounting policy Series costing allows you to use series as a financial accounting section. This allows you to calculate a unique cost of goods for each batch of goods that have different serial numbers.

If a series accounting policy with the type Cost accounting by series type, then in individual warehouses and production departments it is necessary to specify a series accounting policy with the type Series not used. In this case, batches are recorded by type of item.

If you need to set your own series accounting policy for each warehouse and production unit, then in this case, by default, it is recommended to set the series accounting policy for the item type to Series not used . To clarify the batch accounting policy settings for individual warehouses and departments, you must select the There are individual batch accounting policy settings in the item type card.

Figure 11 — Cost accounting by series

With the accounting policy Accounting for cost by series, series are indicated when registering acceptance, shipment and internal trade transactions.

The selection of a series affects the financial result, in particular, the assessment of the profitability of the transaction, therefore the selection of the series is performed when planning shipments (in the series accounting policy form, the default value is set when planning shipments ).

When accepting goods, series are indicated in the invoice both at the non-order and at the order warehouse, since series affect financial accounting.

Indicating series accounted for financial accounting in a goods receipt order is similar to indicating series for other types of accounting policies.

When planning shipments at non-ordered and ordered warehouses, series are indicated in the order or invoice issued without an order.

At the time of placing an order, the stock reserve in the warehouse can be detailed down to the series. The series from the order will be automatically added to the invoice.

Figure 12 - Purchase of goods and services. Sales of goods and services

If the series are not specified in the order or the orders are not used, then the series must be indicated in the invoice.

Receipt rules

So, when registering a company with the tax authorities, they are simply required to issue it with the appropriate form. Certificate of registration - this is the document that tax authorities must send after the subject is included in the ranks of taxpayers.

If an organization is created for the first time, then form 1-1-Accounting is sent to the enterprise along with an extract from the Unified State Register of Legal Entities. Let us remind you that the Federal Tax Service is obliged to carry out registration within 3 working days from the date of receipt of the relevant application. Another day is allowed for the issuance of completed documentation to the applicant.

You need to obtain a new certificate in the following cases:

- Change of location of the company when the checkpoint changes. In this case, it will be unlawful to use the old certificate.

- When changing the name of the organization. If the subject changes its name (if even one character is changed), a new certificate will have to be issued.

- In case of physical loss of a valid document. For example, if the certificate was lost or destroyed.

IMPORTANT!

When registering a separate division of a company, the Federal Tax Service does not issue Form 1-1-Accounting. In this situation, the company must receive a special notification about registering a Russian organization with the Federal Tax Service. Such a document has a unified form 1-3-Accounting.