Intangible assets (IMA) are objects that do not have a tangible form, isolated from other assets, with a useful life of more than 12 months, which can bring benefits to the organization in the future.

In accounting, intangible assets can be accepted if they fall into the following categories:

- If the object is intended for use at the enterprise for a long time, that is, more than 12 months.

- If the property is not sold within 12 months.

- If an object does not have a material form. And so on.

In tax accounting, intangible assets with a validity period of more than 12 months are recognized as depreciable property. Its cost is repaid by calculating depreciation; at the end of its useful life, the value of the intangible asset will be fully included in expenses.

Possible reasons for writing off intangible assets

As the most common reasons for writing off intangible assets, the main document dedicated to these assets (PBU 14/2007, approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n), names their disposal (clause 34) due to:

- expiration of the validity period of the right to the asset;

- transfer of rights to it;

- obsolescence of intangible assets;

- his contribution to the management company or mutual fund;

- transfers by exchange or gift;

- contribution to property united for joint activities;

- shortages identified during inventory.

For whatever reason, the disposal of intangible assets occurs, as of the date of this event the following must be written off from accounting (clause 34 of PBU 14/2007):

- book value of the asset;

- the amount of depreciation accrued on an asset over its useful life.

The following circumstances deserve special attention here:

- For an asset that implies mandatory registration of the right to use, recognition of disposal will occur on the date of registration of this right for the person to whom such an asset is transferred (clause 36 of PBU 14//2007, subparagraph “d”, clause 12 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n, clause 19 PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n).

- The difference between the values related to an intangible asset and subject to write-off upon its disposal (accounting value minus depreciation) constitutes its residual value, which may be revalued during the accounting period (clauses 16–19 of PBU 14/2007). When a revalued asset is disposed of, the amount of its revaluation, which is included in additional capital, should be removed from accounting at the same time (clause 21 of PBU 14/2007).

Read more about revaluation in the material “Revaluation of non-current assets on the balance sheet is...”.

- Depreciation for the month of asset disposal must be accrued in an amount corresponding to a full month (clause 32 of PBU 14/2007).

- An acceptance and transfer certificate signed by the head of the organization or a person authorized by him for this purpose, upon sale, exchange, donation, contribution to a management company (mutual fund) or joint activity.

- A write-off act, drawn up and signed by a commission appointed by the head of the legal entity, upon disposal at the end of the validity period, due to obsolescence or as a result of a shortage. In the latter case, the act must be preceded by an inventory list and a matching sheet, for which it is possible to use forms INV-1a and INV-18, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

Acceptance of intangible assets for registration

Before accepting our intangible asset, we will create it in the necessary directory. This directory will be called “Intangible Assets” and is located in the “Directories” menu item.

Having created an asset in the “Nomenclature” directory, the program will not accept it as intangible assets, but will accept it as a product or service and, accordingly, will automatically assign an incorrect account to it.

Go to the “Assets and intangible assets” tab and create a new document “Receipt of intangible assets”.

Posting a document

After we have processed the receipt of intangible assets, we now move on to accepting it. To do this, we will use the document “Acceptance for accounting of intangible assets”, which is also located in the menu item “Assets and intangible assets”

In the new document, the user has three tabs available: “Non-current assets”, “Accounting” and “Tax accounting”

On the “Non-current assets” tab, the user needs to fill in the type of accounting object, the method of receipt (indicated from the available list), intangible assets and indicate its value.

On the “Accounting” tab, the user fills in the following data: the method of calculating depreciation, the method of reflecting depreciation expenses (account 20.01 was indicated in the example) and the useful life.

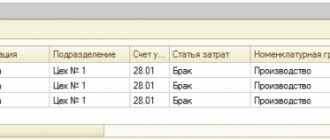

After posting the document, the program generates the next movement of the document.

Documents required for write-off

To reflect the disposal of intangible assets, the following primary documents are required:

The organization develops the forms of both acts independently. A common mandatory requirement for them is to indicate the reason for disposal of the asset.

Read about the rules for completing forms INV-1a and INV-18 in the articles:

- “Unified form No. INV-1a - form and sample”;

- “Unified form No. INV-18 - form and sample.”

Reasons for removing intangible assets from the balance sheet

If the intangible asset cannot be further used to obtain economic benefit (benefit) or is removed from the enterprise for any reason (grounds), its value is written off in accounting.

This principle is regulated by PBU14/2007 (clause 34).

The depreciation accumulated in account 05 is subject to simultaneous write-off (if, of course, this account was used by the enterprise to accumulate reimbursed depreciation).

Disposal and, accordingly, write-off of intangible assets can be carried out by the organization-right holder on the following possible grounds:

- the audit established the fact of shortage (absence) of the property;

- the object is included in the authorized/share fund of another organization as a contribution;

- Intangible assets are made by the copyright holder enterprise as a contribution under a joint activity agreement;

- the asset is transferred to another entity under an exchange/donation agreement;

- obsolescence of an intangible asset has made it impossible to further use it for its intended purpose;

- the rights formalized by the organization in relation to intangible assets are transferred to third parties on the basis of succession or imposed foreclosure;

- the asset is transferred to another person due to the alienation of the corresponding right;

- the exclusive rights to the object ceased to be valid due to the expiration of the appointed period;

- other circumstances, reasons, grounds.

Accounting entries for write-offs

The financial result from the disposal of intangible assets is formed through the reflection of data related to it in other income and expenses (clause 35 of PBU 14/2007). This reflection is preceded by the formation of the residual value of the disposal asset:

Dt 05 Kt 04.

This cost is written off as expenses by posting:

Dt 91 Kt 04.

By a similar entry, expenses associated with the disposal of intangible assets will be debited to account 91 from the credit of accounts for accounting for settlements with counterparties:

Dt 91 Kt 60 (76).

If the identified shortage is the fault of a certain employee, then the following may occur:

Dt 73 Kt 04.

The resulting income from the transfer (which may occur during a sale or exchange) will be reflected by posting:

Dt 62 Kt 91.

The amount of accrued income will include VAT, the amount of which will be highlighted by posting:

Dt 91 Kt 68.

The same VAT entry will arise when donating an asset (based on the market value of this asset), despite the absence of an income accrual entry.

In relation to the revalued object, for which at the time of disposal the revaluation amount was present in the accounting records, the following entry will be made:

Dt 83 Kt 91.

Setting up the program

In the 1C Enterprise Accounting 3.0 program, it is necessary to make the following settings in order to be able to carry out operations with OS and intangible assets. If this setting is not in the configuration, then the user needs to go to the “Main” menu item and select “Functionality”, then go to the “OS and Intangible Materials” tab and activate the following items.

Accounting for intangible assets can be done to benefit the company

The beginning of 2008 was marked by numerous changes regarding intangible assets. Thus, the fourth part of the Civil Code, regulating legal relations in the field of intellectual property, came into force, a new PBU 14/2007 was adopted (approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n), changes were also made to the Tax Code (for example, paragraph 1 Article 256, paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation). Despite the activity of legislators, the existing provisions of the Tax Code allow saving on taxes.

If a company acquires an asset that costs a little more than 20 thousand rubles, it can try to reduce its cost by splitting the price

FIVE WAYS NOT TO DEPRECIATE AN INTANGIBLE ASSET

According to paragraph 1 of Article 256 of the Tax Code of the Russian Federation, intangible assets have a useful life of more than 12 months and an initial cost of more than 20 thousand. rub. are recognized as depreciable property. To speed up this write-off, you can use one of the following methods.

Reduce initial cost.

If a company acquires an asset that costs a little more than 20 thousand rubles.

(for example, exclusive rights to a website), it may try to reduce the cost in tax accounting. For example, agree with the seller to divide the price into two parts (possibly even under different agreements): the price of the asset itself, not exceeding 20 thousand rubles, and the price of other services, for example, website promotion. in detail WHAT IS AN INTANGIBLE ASSET

Intangible assets are recognized as the exclusive rights of the taxpayer to intellectual property objects used in the production of products or for management needs (clause 3 of Article 257 of the Tax Code of the Russian Federation). For example, exclusive rights to a trademark, service mark, business name, to use a computer program, database, website, to own know-how, etc.

To recognize an intangible asset, two conditions must be met: the ability to generate income and properly executed documents that confirm the existence of the intangible asset itself and/or the taxpayer’s exclusive right to it. Such documents may be patents, certificates, other documents of protection, an agreement for the assignment or acquisition of a patent, trademark, etc.

EXPERT COMMENT Igor NEVSKY,

leading specialist of the consulting department of the audit department of AKG “SV-Audit”: - According to the Ministry of Finance of Russia, until 2009, exclusive rights to computer programs worth from 10 thousand to 20 thousand rubles. are recognized as depreciable property and their cost is included in expenses by calculating depreciation (letter of the Ministry of Finance of Russia dated February 13, 2008 No. 03-03-06/1/91, dated November 13, 2007 No. 03-03-06/2/211). This is due to the fact that subparagraph 26 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation classifies as other expenses only expenses for the acquisition of exclusive rights worth less than 10 thousand rubles. Amendments to the Tax Code that eliminate this discrepancy are introduced by Federal Law No. 158-FZ of July 22, 2008 only from January 1, 2009.

EXPERT COMMENT Sergey GOROKHOV,

Leading Legal Advisor at FBK-Pravo: - Despite dividing the price into two parts, tax authorities may consider that the so-called other services should be included in the initial cost of the asset. A similar thing happened in one of the episodes of the YUKOS case, when the court supported the position of the tax authority regarding the unlawful inclusion as expenses of the cost of related services for the development of banking computer programs.

If the company is obliged to pay a nominal fee to the seller annually, then the asset will not be considered depreciable property

Reduce useful life.

If a company can prove that the use of an intangible asset to generate income is possible only within a year, this object will not be recognized as depreciable property. However, proving this for most types of assets will be difficult and fraught with a dispute with the tax authorities. Indeed, in accordance with the Tax Code, the useful life of an intangible asset is determined based on the validity period of a patent, certificate or other restrictions in accordance with the Civil Code. If it is impossible to determine the useful life of an asset, depreciation rates are set for 10 years (clause 2 of Article 258 of the Tax Code of the Russian Federation).

However, in the same paragraph 2 of Article 258 of the Tax Code of the Russian Federation there is a clause that the useful life of intangible assets may be stipulated by relevant contracts. That is, if a company acquires the exclusive right to an invention for a period of one year, then the next year, etc., then there is no need to amortize such an intangible asset.

EXPERT COMMENT Sergey GOROKHOV,

Leading Legal Advisor at FBK-Pravo: “There is a minimal risk that when conducting an audit, tax authorities will discover the existence of two or more agreements over several years stipulating the use of the same intangible asset. After which, based on the testimony of witnesses or from other sources, they will establish the relationship between the contracts, on the basis of which they will consider such contracts to be feigned, concluded in order to cover up the use of the asset for a long period of time.

Note that there are types of intangible assets whose validity period is not regulated by law, and tax authorities will not be able to check how long they are actually used by the company. This is, for example, know-how, a secret formula or process, information regarding industrial, commercial or scientific experience.

EXPERT COMMENT Sergey GOROKHOV,

Leading Legal Advisor at FBK-Pravo: - This method is not applicable in all cases, since there are productions whose technological process is impossible without the use of these intangible assets.

Pay the value of an asset in periodic payments.

According to subparagraph 8 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation, acquired rights to the results of intellectual activity and other objects of intellectual property are not subject to amortization if, in accordance with the agreement, their payment is made in periodic payments during the term of the agreement. Such expenses relate to other expenses associated with production and sales (subclause 37, paragraph 1, article 264 of the NKRF).

Thus, if the contract establishes a long period for which exclusive rights are acquired and stipulates the company’s obligation to annually pay the seller of these rights a nominal fee (in addition to the amount paid immediately), then the acquired intangible asset will not be considered depreciable property.

EXPERT COMMENT Igor NEVSKY,

Leading specialist of the consulting department of the audit department of AKG "SV-Audit": - In this case, disputes with tax authorities are not excluded. Surveyors may recognize a one-time payment that represents the majority of the transaction amount as the cost of the intangible asset.

Do not register rights to an asset created on your own.

If a company does not have properly executed documents confirming the existence of an intangible asset (for example, a patent, registration certificate, etc.), then its expenses for creating such an object will be considered for tax purposes as R&D, and will not form the initial cost of the object. The cost of R&D is written off as tax expenses evenly over one year (clause 2 of Article 262 of the Tax Code of the Russian Federation), while depreciation of an intangible asset protected by a patent can take 10 years.

In addition, obtaining a patent is a lengthy process in itself. It may take more than a year. And during this period, the company will not be able to reduce taxable profit by the amount of material costs, labor costs, services of third-party organizations and other costs. If the company does not protect its copyrights, then expenses will be recognized much faster.

EXPERT COMMENT Igor NEVSKY,

leading specialist of the consulting department of the audit department of AKG "SV-Audit": - Firstly, when deciding not to receive the relevant documents, you should assess the risk of losing intellectual property rights (for example, if similar developments are produced and patented by another person). Secondly, in accordance with paragraph 4 of Article 1259 of the Civil Code of the Russian Federation, for the emergence, implementation and protection of certain rights (for example, computer programs and databases), their registration or compliance with any other formalities is not required, and the right itself arises by virtue of their creation.

PRACTITIONER'S OPINION Maxim DOMUKHOVSKY,

chief accountant of SmolCarton LLC: - If the company does not have title documents for intellectual property, any organization (including a competitor) can theoretically use this object for free. Moreover, you can register an intangible asset in your name, spending much less money and effort. For example, by luring developers or through simple data theft. I believe that the proposed method of saving is acceptable only in those areas where there is no fierce competition, or if the use of the asset is very energy and labor intensive.

Register an asset on .

Taxpayers who use the simplified tax system have the right to write off the cost of fixed assets and intangible assets as expenses much faster than others. The initial cost of an intangible asset is included in “simplified” expenses on the basis of “income minus expenses” from the moment the object is registered until the end of the tax period, that is, the year (clause 3 of Article 346.16). Therefore, if an expensive asset is purchased at , then due to the write-off of the initial cost of the asset as an expense at the end of the tax period, it may generate a loss. After which the process of merger with the parent company of the holding is initiated. As a result, the loss will reduce the profit of the main organization, and the fully depreciated intangible asset will go to its balance sheet.

Please note that disputes may arise with tax authorities over whether the loss received during the “simplified procedure” can reduce the taxable profit of the successor. There are no letters or established judicial practice on this issue. We believe that taxpayers have strong arguments to defend their beneficial position. Firstly, there is no direct prohibition on such a reduction in the Tax Code of the Russian Federation. There is only a rule that does not allow taking into account losses from “simplified taxation” when switching to a different taxation regime (clause 7 of Article 346.18 of the Tax Code of the Russian Federation). However, reorganization is not subject to this rule.

Secondly, paragraph 5 of Article 283 of the Tax Code of the Russian Federation, which makes it possible to take into account the losses of the reorganized company, does not specify that this loss must necessarily be formed in accordance with the rules of Chapter 25 of the Tax Code of the Russian Federation.

OFFICIAL POSITION Maria TOKACHEVA,

Adviser to the state civil service, 2nd class: - In my opinion, if a company under the general taxation regime takes into account the losses of the reorganized “simplified” company, then the claims of the tax authorities are guaranteed. Clause 7 of Article 346.18 of the Tax Code of the Russian Federation directly states that the loss received under the “simplified regime” cannot be taken into account when switching to the general regime. And the successor during the reorganization receives not only the rights, but also the obligations of the reorganized persons (Article 50 of the Tax Code of the Russian Federation). Although I agree that this issue is not clearly resolved.

Disputes may arise with tax authorities as to whether the loss received by the “simplified” person before the reorganization can reduce the profit of the successor under the general regime

in detail BUSINESS REPUTATION IS NOT AMORTIZED IN TAX ACCOUNTING

If the founder acquired the company as a property complex at a price exceeding the total residual value of the acquired assets, then this difference in price will be considered goodwill. In accounting, it must be depreciated over 20 years (clauses 42, 44 PBU 14/2007). Tax accounting provisions are more beneficial for the taxpayer.

In particular, the premium to the price of the property complex is recognized as an expense evenly over five years, starting from the month following the month of state registration of the buyer’s ownership of the enterprise as a property complex (subclause 1, clause 3, article 268.1 of the Tax Code of the Russian Federation).

As for the discount, it is recognized as income at a time in the month in which the state registration of the transfer of ownership of the enterprise as a property complex was carried out (subclause 2, clause 3, article 268.1 of the Tax Code of the Russian Federation).

CREATION OF AN ASSET THROUGH A FRIENDLY COMPANY WILL HELP TO REDUCE INCOME TAX

If the holding plans to create an intangible asset on its own, then it is more profitable to do this through a “simplified” method. In this case, you can transfer part of the profit to a preferential tax regime.

So, if an object is created by a company under the general taxation regime that intends to use it, then the accounting will be as follows. Costs directly related to the creation of this object (for example, employee salaries) will form the initial cost of the asset (clause 3 of Article 257 of the Tax Code of the Russian Federation). The remaining expenses will be written off at a time. If such costs are small and the company will still have to depreciate the object, then it is more profitable to do differently.

First, a friendly “simplifier” creates an object of intellectual property as a product. Next, the exclusive rights to it at a significant premium are acquired by the company that will use it. As a result, this organization gets the opportunity to inflate the amount of depreciation (due to a markup), and transfers part of the profit to a preferential tax regime.

Note that the buyer in this situation will not be able to deduct VAT, since the “simplified” does not pay this tax. However, this should not be considered a loss. If she created the asset on her own, then, given that in the cost structure a large share is occupied by wages (not subject to VAT), the situation with VAT would be approximately the same.

As for possible claims by tax authorities related to transfer pricing, each object of intellectual property is unique, and it is almost impossible to determine its market price for the purposes of Article 40 of the Tax Code of the Russian Federation.

EXPERT COMMENT Igor NEVSKY,

leading specialist of the consulting department of the audit department of AKG "SV-Audit": - Reducing income tax by shifting the tax base to a hidden affiliated "simplified" may carry a significant tax risk. After all, the development of a new intangible asset requires certain skills and knowledge and can often be performed only by certain employees. If the “simplified” performer has employees of the parent company on staff, the tax authorities’ chances of proving the “scheme” only increase: they will be able to insist that the use of the “simplified” was due to the sole purpose of obtaining a tax benefit, which should be considered unfounded.

If an asset has already ceased to generate income, then writing it off may result in tax losses for the company

IT IS MORE PROFITABLE TO SELL AN UNNEEDED ASSET

In practice, the easiest way to write off the cost of a fixed asset as a tax expense at a time is to liquidate it. In this case, the residual value of the fixed asset reduces taxable profit on the basis of the provisions of subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. However, this is not possible when writing off an intangible asset. The specified subclause of the Tax Code of the Russian Federation does not contain norms that allow the residual value of intangible assets to be written off as expenses (letter of the Ministry of Finance of Russia dated February 21, 2007 No. 03-03-06/4/17).

It turns out that if there are still many years left before the end of the useful life of an asset, but it has already ceased to generate income, has lost its relevance and is not used in business activities, then the company is forced to incur tax losses. If an item is written off, its residual value will not reduce taxable income. If the write-off is not formalized, then tax authorities may make claims regarding the validity of further depreciation. Allegedly, since the object is no longer used in activities, then the expenses in the form of depreciation are not justified. The solution to this problem is to sell the intellectual property that has become unnecessary. For example, to the director of a company as an individual for a nominal fee. In this case, the company will be able to write off the residual value of the asset as tax expenses (subclause 1, clause 1, article 268 of the Tax Code of the Russian Federation).

PRACTITIONER'S OPINION Maxim DOMUKHOVSKY,

chief accountant of SmolCarton LLC: - When using this method, I recommend that you still justify the sale of an intangible asset at such a low price, for example, by acts of obsolescence of the asset and the need for its replacement.

EXPERT COMMENT Igor NEVSKY,

leading specialist of the consulting department of the audit department of AKG “SV-Audit”: - In this case, there is a risk of filing claims under Article 40 of the Tax Code of the Russian Federation. Therefore, it is better to sell an under-depreciated asset to the director at least at its residual value, and then reimburse him for the money spent with a bonus, financial assistance or other means.

Accounting and postings

The financial result of the procedure for removing an intangible asset from the balance sheet is reflected in account 91. Transactions are recorded in accounting in the period in which income/expenses arise.

Typical correspondence is shown in the table.

| Operation | Debit | Credit |

| Intangible assets are written off through accumulated depreciation | 05 | 04 |

| The residual value is written off (account 05 was used) | 91/2 | 05 |

| The residual value of the object is written off (the 05-account was not used) | 91/2 | 04 |

| Additional costs of the enterprise for write-off are taken into account | 91/2 | 69,10,76,60,others |

Depreciation

If the 05-account was used to accumulate depreciation (accrual of depreciation), the amount of accumulated depreciation will be written off by correspondence of debit 05 with credit 04, and the residual value of the intangible asset, determined by 04-account, is transferred to other costs by correspondence of debit 91/2 with credit 04.

If the 05 account was not opened to accumulate depreciation, depreciation was written off directly from credit 04. In this case, the residual value is identified and transferred to other costs.