Each company must keep records of the income it pays to individuals, records of tax deductions provided, and the amounts of personal income tax withheld and paid. Such records must be kept in the personal income tax registers. The formation of such registers allows us to assess the correctness of tax calculation and transfer.

Previously, such a tax accounting register was the 1-NDFL tax card. In 2021, companies must develop tax accounting registers for personal income tax on their own, as well as determine the procedure for reflecting data in them.

Amendments regarding tax accounting registers for personal income tax were introduced into paragraph 1 of Article 230 of the Tax Code of the Russian Federation by Federal Law No. 229-FZ of July 27, 2010.

Only tax agents should maintain tax accounting registers , i.e. only those organizations and individual entrepreneurs that make payments to individuals from whom it is necessary to withhold personal income tax and transfer it to the budget.

If a company is not a tax agent for certain types of income, then it does not need to maintain a tax register for such payments.

There are no personal income tax registers maintained for income received by entrepreneurs, notaries and lawyers.

The organization must develop the tax register form independently, and it is advisable for the company to rely on the 2-NDFL certificate when developing it. Take from it the information that will be necessary and include it in the personal income tax register. In this way, you can “kill two birds with one stone”; all the information that will then automatically be included in the 2-NDFL certificate will be concentrated in the personal income tax register.

Tax registers for personal income tax must be maintained monthly for each employee, summing up cumulative results from the beginning of the year. Article 230 of the Tax Code of the Russian Federation lists the mandatory details that a tax register must contain:

- information about the employee, he is in this case a taxpayer;

- taxpayer status, since the personal income tax rate that applies to income depends on this status;

- type, amount and date of payment of income;

- tax deductions that are applied when calculating personal income tax;

- personal income tax amounts, dates of withholding and transfer, details of payment orders.

This document is taken as a basis and then used not only for the 2-NDFL certificate, but also for calculating 6-NDFL.

Setting up and applying personal income tax deductions

The calculation of personal income tax depends on the settings of the types of calculation (accruals) assigned to the employee (menu: “Salary - Information about accruals”). In addition, if any employees are entitled to deductions for personal income tax, it is necessary to enter data for them to calculate personal income tax.

This can be done from the “Individuals” directory (menu or “Personnel” tab) by clicking the “Personal Income Tax” button. In the personal income tax data entry form that opens, there are three tabs.

On the “Deductions” tab, enter data on standard deductions. The personal standard deduction has not been applied since 2012, so the section “Eligibility for a personal standard deduction” does not need to be completed (however, if payroll is calculated for past periods, this section will have to be completed).

If an employee has children for whom he is provided with standard deductions, the section “Eligibility for standard deductions for children” is filled out. A line is added to it, indicating the start date of the deduction, the end date (optional), the deduction code and the number of children. When you select a deduction code, the “Personal Income Tax Deductions” directory opens, from which you should select the one you need. Deductions for the 1st, 2nd, 3rd and subsequent children are different, so if there are several children, several lines may be required.

Also, in the case of applying deductions, the section “Application of deductions” (below) must be completed, which indicates the organization and start date of application. This is due to the possibility of keeping records for several organizations in the program: for the same employee, one organization can be the main place of work (deductions are provided in it), and another can be a place of part-time work (deductions are not provided in it).

Directory “Personal Tax Deductions”, from which the desired deduction is selected (the directory complies with the law):

On the “Taxpayer Status” tab of the personal income tax data entry form, the status (resident, non-resident, etc.) is indicated, on which the personal income tax rate depends. The default is “Resident”:

On the “Income from previous places of work” tab, you enter data on income from the beginning of the current year, necessary for applying deductions for personal income tax. That is, this tab is filled out for employees entitled to standard deductions who came to this place of work not from the beginning of the year and provided a certificate of income for the previous months.

If any employees have the right to a property deduction, enter the document “Confirmation of the right to a property deduction” (menu: “Salary - Accounting for personal income tax and taxes (contributions) from the payroll” or the “Salary” tab). The document indicates the tax period (year), employees, expenses that give them the right to deduction, and other data from the notification submitted by the employee to the Federal Tax Service (for example, interest on loans). Let’s register a deduction of 2,000,000 rubles for employee Ponomarev:

When calculating personal income tax to an employee, the tax base will be reduced by the specified deduction amount.

Calculation of personal income tax

Personal income tax is calculated automatically in accrual documents.

See also personal income tax: review of the main legislative innovations of 2021 (from the recording of the broadcast on December 26, 2021)

Calculation of personal income tax in interpayment documents

Personal income tax is calculated in interpayment documents, such as Vacation , Sick Leave , Bonus , etc. In some documents, to automatically calculate personal income tax, you will need to set the Payment to With advance or During the interpayment period .

For example, in the Vacation , the amount of calculated personal income tax is displayed on the Main vacation in the Tax :

You can view the details of tax calculation by clicking the More details about personal income tax calculation (green pencil icon next to the tax amount):

In interpayment documents in which it is possible to accrue to several employees at once, such as Bonus , One-time accrual of the amount of calculated tax is displayed in the personal income tax .

Employee Romashkina M.L. provided sick leave from 01/17/2019 to 01/23/2019. It is necessary to calculate the amount of benefits for sick leave and personal income tax from it. The employee is provided with a standard deduction for the first child.

Let's enter the document Sick leave :

The amount of accrued benefits was RUB 3,291.47. There have been no other incomes in 2021 yet; personal income tax will be automatically calculated:

Taxable base:

- 3,291.47 (Amount of income) – 1,400 (Standard deduction for a child) = 1,891.47 rubles.

Personal income tax:

- 1,891.47 (Taxable base) * 13% (Tax rate) = 245.89 = 246 rubles.

Final personal income tax calculation

The final calculation of personal income tax is made by the documents Calculation of salaries and contributions to and Dismissal .

In the documents Calculation of salaries and contributions and Dismissal, automatic calculation of personal income tax is performed on the personal income tax tab .

By double-clicking on the personal income tax amount, you can open the detailed personal income tax calculation form for the employee:

Features of personal income tax calculation stipulated by law

Personal income tax is calculated in 1C 8.3 ZUP in accordance with current legislation:

- rounded to the nearest whole ruble;

- in the context of individuals;

- cumulative total since the beginning of the year.

Calculation of personal income tax by individuals

This means that if an employee has several jobs in the organization, for example, at the main place of work and at an internal part-time job, then personal income tax will be calculated taking into account income from two places of work. In the program, both elements of the Employees must be associated with one element of the Individuals .

Employee Vasilkov V.V. has been working at his main place of work at Romashka LLC as an accountant in the “Main Division” division since 10.25.2017. From 01/09/2019, he is also hired at Romashka LLC on an internal part-time basis as a HR specialist, also in the “Main Division”. The work will be carried out on a part-time basis, 2 working hours a day, five days a week. It is necessary to calculate wages and personal income tax for V.V. Vasilkov. for January 2021.

Let's enter the document Calculation of salaries and contributions for January 2021 and fill it out. The document included both workplaces of employee V.V. Vasilkov. On the Accruals , payroll was calculated:

He was accrued 20,000 rubles for his main place of work, and 7,500 rubles for his part-time job.

On the personal income tax , the tax was calculated in the total amount for an individual.

Let's check the calculation:

Total income of Vasilkov V.V.:

- 20,000 (income from the main place of work) + 7,500 (income from a part-time job) = 27,500 rubles.

Personal income tax Vasilkova V.V.:

- 27,500 (total income) * 13% = 3,575 rubles.

Calculation of personal income tax on an accrual basis from the beginning of the year

This means that when calculating personal income tax, accrued income and calculated personal income tax from the beginning of the year are always analyzed.

Employee Cheremukhin N.P. works at Romashka LLC with a salary equal to 12,780 rubles for a full month worked. It is necessary to calculate the employee’s personal income tax for January and February 2021. Both months were fully worked.

Let's enter the document Calculation of salaries and contributions for January 2021. On the Accruals , the salary of N.P. Cheremukhin was calculated. in the amount of 12,780 rubles.

On the personal income tax , the tax was calculated in the amount of 1,661 rubles:

Personal income tax for January 2021:

- 12,780 (income) * 13% = 1,661.4 = 1,661 rubles. (after rounding);

Let's enter the document Calculation of salaries and contributions for February 2021. On the Accruals , the salary of N.P. Cheremukhin was also calculated. in the amount of 12,780 rubles.

On the personal income tax , the calculated tax amount is 1,662 rubles:

The amount of personal income tax calculated in February 2021 was 1 ruble more than the personal income tax amount calculated in January 2021, with equal amounts of income, because the calculation took place on a cumulative basis from the beginning of the year.

Income since the beginning of the year:

- 12,780 (income for January 2019) + 12,780 (income for February 2019) = 25,560 rubles.

Personal income tax calculated for 2021:

- 25,560 (income since the beginning of the year) * 13% = 3,322.8 = 3,323 rubles. (after rounding)

Personal income tax for February 2021:

- 3,323 (personal income tax calculated for 2021) - 1,661 (personal income tax calculated in January 2019) = 1,662 rubles.

Registers used in the program for personal income tax accounting

Data on income, calculated and withheld tax are stored in the database in accumulation registers.

Let's list the main registers:

- Income accounting for personal income tax calculation - this register stores data on income received by employees for personal income tax accounting purposes.

- Calculations of taxpayers with the budget for personal income tax - the register contains information about the calculated tax (records with the type Income ) and withheld tax (records with the type Expense ).

- Calculations of tax agents with the budget for personal income tax - this register collects information about withheld personal income tax for transfer to the budget (records with the type Income ) and the transferred tax (records with the type Expense ).

- Provided standard and social deductions (NDFL) - contains information about the provided deductions.

You can view register records directly by opening the register through the Main menu – All functions – Accumulation registers, then select the desired register.

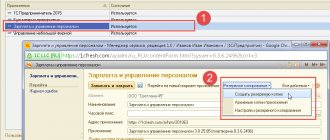

You can view the movements of a specific document by register directly from the form of this document. To do this, open the document and go to the menu Main menu - View - Setting up the form navigation panel. The Navigation Panel Settings window will open :

On the left side of the form there are Available Commands - a list of all registers in which the document can move. On the right side, Selected commands is a list displayed in the document navigation panel (by default, this list is empty and is not displayed in the panel). You can move commands between lists using the buttons located between them, or simply by double-clicking on the name of the register.

If the Selected Commands the Navigation Pane becomes available at the top of the document .

By clicking on the link with the name of the register, you can see the movement of the document in this register:

Personal income tax accrual

Personal income tax is calculated monthly using the same document that calculates wages: “Accrual of wages to employees.” It calculates personal income tax for each employee, according to the entered data, and generates posting Dt 68.01 Kt 70, as well as movements in the personal income tax registers.

Result of the implementation: It is possible to manually adjust personal income tax and property deductions in the document “Calculation of salaries to employees” itself. To do this, you need to set the “Adjustment of personal income tax calculation” flag in it. On the “Accruals” tab, you can edit the accrual amounts, codes and deduction amounts. Let's register a deduction of 5,000 rubles for employee Klimenko associated with a loss on transactions with securities:

If accruals or deductions have been edited, you must go to the “Personal Income Tax” tab and click “Calculate”. In our example, when calculating Klimenko’s personal income tax, the tax base decreased by the amount of the deduction, and the tax was calculated based on this. In addition, it is clear that personal income tax has not been accrued to Ponomarev, since previously a property deduction was registered for him in an amount exceeding his monthly income. Also on this tab you can directly edit the amounts of accrued tax:

If necessary, in the program you can register the recalculation of personal income tax and the return of personal income tax using documents of the same name (available through the menu: “Salary - Accounting for personal income tax and taxes (contributions) from the payroll”).

Account 68 in accounting: postings, subaccounts, examples for dummies

Account 68 of accounting is an active-passive account “Calculations for taxes and duties”, which represents general information on settlements with budgets for taxes and duties paid by the enterprise and the taxes of its employees.

Account 68 in accounting

Account 68 is credited for amounts according to tax returns or calculations in correspondence:

- Account 99 - for the amount of accrued income tax;

- Invoice 70 - for the amount of personal income tax;

- Accounts 20, 25, 26, 44 - for the amount of local taxes, transport tax, property tax, etc.;

- Accounts 90.3, 91.2, 76.AV - when calculating VAT for the reporting quarter;

- Invoice 51 - upon receipt of overpaid tax from the budget.

The debit of the account records the amounts of taxes actually transferred to the budget, including the amounts of VAT written off from account 19.

Subaccounts 68 “Calculations for taxes and fees”

Subaccounts under account 68 are used for taxes and fees paid by the company, depending on its chosen field of activity and tax regime. In this case, a separate sub-account is opened for each type of tax:

Additional sub-accounts can also be opened under account 68:

- 68.11 - UTII;

- 68.12 – simplified tax system;

- 68.13 – Trade fee.

Typical wiring

The main transactions for this account are presented in the table:

Get 267 video lessons on 1C for free:

| Account Dt | Kt account | Wiring Description | A document base |

| 68 | 19 | Amounts of taxes actually transferred to the budget + VAT | Payment order |

| 68 | 50/51,52,55 | Payment of tax debts in cash or through a bank | Payment order |

| 70/75 | 68 | Personal income tax withheld from the income of employees or founders | Payslip |

| Based on settlement amounts for contributions to budgets | |||

| 99 | 68 | Income tax is reflected | Help-calculation |

| 70 | 68 | We reflect the amount of accrued personal income tax | Payslip |

| 90 | 68 | We reflect VAT, excise taxes, indirect taxes | Accounting information |

| 91 | 68 | We reflect financial results (operating expenses) | Certificate of calculation/Acceptance and transfer certificate |

Example 1. Postings to subaccount 68.01 “NDFL”

Let’s say that at the end of the month, at Osen LLC, an accountant assessed personal income tax on employee salaries in the amount of 107,256 rubles. Dividends were also paid to the founders, the tax amount was 65,123 rubles.

Postings for calculating personal income tax on account 68:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 70 | 68.01 | 107 256 | Personal income tax accrued on salary | Payslip |

| 75.02 | 68.01 | 65 123 | Personal income tax accrued on dividends | Tax card for personal income tax, accounting certificate |

| 68.01 | 51 | 107 256 | Personal income tax on wages transferred to the budget | Payment order |

| 68.01 | 51 | 65 123 | Personal income tax on dividends transferred to the budget | Payment order |

Example 2. Postings to subaccount 68.02 “VAT”

At Leto LLC based on the results of the 2nd quarter (core activities):

- VAT was charged in the amount of RUB 78,958;

- VAT accepted for deduction (advance) in the previous quarter in the amount of RUB 36,695 was restored;

- VAT on the sale of fixed assets amounted to RUB 7,959.

The accountant of Leto LLC reflected the accrual of VAT with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 90.03 | 68.02 | 78 958 | VAT charged (sales) | Accounting information |

| 76 advance | 68.02 | 36 695 | VAT restored | Sales book |

| 91.02 | 68.02 | 7 959 | VAT charged (VAT) | Certificate of acceptance and transfer |

| 68.02 | 51 | 123 612 | The tax is transferred to the budget | Payment order |

Example 3. Postings to subaccount 68.04 “Income Tax”

To account for income tax calculations with the budget, subaccount 68.04.01 is used, and for tax calculations, a balance-free subaccount 68.04.02 is used, which is closed on account 68.04.01 at the end of the period.

//www.youtube.com/watch?v=n7vq_Z5fbHs

Income tax is calculated on an accrual basis, taking into account advances of the reporting periods: quarter, 06 and 09 months and based on the results of the tax period - calendar year.

Let’s say that at the end of the reporting period, quarter, Vesna LLC made a profit, the tax on which amounted to 310,000 rubles. and was transferred to the budget.

The accountant of Vesna LLC generated the following entries for subaccount 68.04 “Income Tax”:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 99 | 68.04.02 | 310 000 | The amount of income tax accrued | Help-calculation |

| 68.04.01 | 51 | 310 000 | The tax amount is transferred to the budget | Payment order |

Source: //BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-68-v-buhgalterskom-uchete-provodki-subscheta-primeryi-dlya-chaynikov.html

Personal income tax payment

Payment of personal income tax, like any other transfer of funds through a bank, is reflected in the program by the document “Debit from the current account.”

If we want the amounts of transferred personal income tax to be reflected in Certificates 2-NDFL and in the tax accounting register, it is necessary to enter the document “Transfer of personal income tax to the budget of the Russian Federation” (menu: “Salary”).

In this document, payment information (date, amount, payment order details) is filled in manually. Then the “Fill” button automatically fills in the physical information. persons who received income and distribution of the payment amount between them. To automatically fill it out, it is necessary that “Personal income tax transfer to the budget” occurs in time after the salary payment document. In addition, physical persons must be filled in with TIN, addresses, and passport details. The document forms movements according to the register of settlements of tax agents with the personal income tax budget, and has a printed form “Register of transferred amounts”.

Withholding personal income tax

Withholding of personal income tax in the ZUP 3.1 program is carried out when paying income using the documents Statement: Statement to the bank , Statement to the cashier , Statement to accounts and Statement through the distributor .

The amounts of withheld personal income tax are reflected in the personal income tax column for transfer :

Personal income tax for transfer is filled in with the amounts of calculated but not yet withheld personal income tax according to the documents on which the payment is made.

By clicking the Change tax in the header of the tabular section, you can view details about the withheld personal income tax: Date of receipt of income , Rate , Basis document , etc.

You can also open this form by double-clicking on the personal income tax amount column.

If the amount of income paid is adjusted, for example, with a partial release of accrued amounts, then an amount of tax must be withheld in proportion to the amount of income paid. After adjusting the amounts in the To be paid , click the Update tax .

When paying wages for January 2021, Romashka LLC did not have enough funds to pay wages in full. It was decided to pay 50% of the salary. It is necessary to reflect in the ZUP the payment of 50% of wages, as well as the withholding of personal income tax in proportion to the amounts paid.

We will manually adjust the amounts in the To be paid . At the same time, it is advisable to make adjustments within the breakdown of the amount to be paid according to the supporting documents. The transcript opens by clicking the Change salary or by clicking on the cell to the right of the amount.

Let's adjust the amount in the line where Document basis is Payroll and contributions :

We will similarly adjust the amounts for other employees. column for transfer will not be automatically recalculated.

In order for personal income tax amounts to be recalculated, you must click the Update tax . Update tax button updates the tax only for the selected document lines. To update the tax on all lines of the document at once, you can select all lines using the key combination < Ctrl + A >, and then click the Update tax .

Personal income tax reporting

The document “Certificate 2-NDFL for transfer to the Federal Tax Service” is available through the menu: “Salary - Accounting for personal income tax and taxes (contributions) from the payroll” or the “Salary” tab.

By clicking the “Fill” button, the document is automatically filled in by individuals who received income. For each physical the person is shown the amounts of income received and calculated, withheld, and transferred taxes. Amounts can be changed manually. On the “Taxpayer’s personal data” tab, you can edit your passport data and physical address. faces. The document has a printed form “2-NDFL”, and also allows you to save the data as a file on disk for transmission to the Federal Tax Service in electronic form. It is necessary that all individuals fill in the TIN codes, registration addresses and information about the identity document, only then will it be possible to print 2-NDFL and record the data as a file on disk.

Checklist: 9 steps to check accounting in “1C: Salary and HR Management”, ed. 3.1

Even the most attentive and careful accountant may encounter inconsistencies in the database. Consultation line specialist Anastasia Cheremnykh has prepared a checklist for checking accounting in ZUP 3.1, which will help you avoid mistakes or correct them in advance.

Anastasia outlined the main points that are worth paying attention to. Correction of identified inconsistencies is decided on a case-by-case basis.

During the reporting period, data on ongoing events is entered into the database - personnel changes, absences, accruals and payments. We check their correctness immediately at the time of registration.

Be sure to make a copy of the database. Changing the following settings can have a significant impact on program accounting. Be careful!

Organization card

1) Section “Settings” – “Organizations” (or “Organization details”). Check that all tabs are complete. Please note “Month of registration with the tax authority” - the field must be filled out.

Rice. 1 (click to enlarge)

2) “Regional coefficient”, if it is used, both fields with RK must be filled in.

Rice. 2 (click to enlarge)

3) “Accounting policy” - check whether all marks are correct.

Rice. 3 (click to enlarge)

Filling out data on individuals

“Personnel” – “Personnel reports” – “Personal data of employees”. Check the completion of the employee’s data (SNILS, Taxpayer Identification Number, residential address, etc.). The same data can be viewed in the individual’s card.

Rice. 4 (click to enlarge)

It is also worth checking data on length of service for calculating sick leave and vacation balances. Check the completeness and correctness of filling out employee work schedules. This data has more influence at the time of calculating accruals than generating reports, but is a common cause of errors.

Staffing table

If a staffing table is maintained, then we check its correctness:

1) “Personnel” – “Personnel reports” – “Staffing table (T-3)”. Check whether the data corresponds to the actual state of affairs in the organization.

2) “Personnel” – “Personnel reports” – “Staffing arrangement”, “Compliance with staffing schedule”. Check the correspondence of open and filled positions.

Rice. 5 (click to enlarge)

For positions in the staffing table corresponding to hazardous professions, check that the data on hazardousness is filled out. If the staffing table is not maintained (disabled in the settings), then we check the information about harmfulness in the position directory.

Rice. 6 (click to enlarge)

Charge settings

Attention!

Corrections to accruals already in use are not recommended. “Settings” – “Accruals” – “Setting up personal income tax, average earnings, etc.” 1) Check what accruals are and are not included in your average earnings. Do not forget that bonuses can be included in the average earnings in whole or in part.

2) Check the income codes of the additional ones used. accruals. Do not forget that different income codes are recorded on different dates of receipt of income, and the income code “2002” can be taken into account both by the date of payment and by the last day of the month of accrual.

Rice. 7 (click to enlarge)

Taxes and fees

1) “Taxes” – “Reports on taxes and contributions” – “Analysis of contributions to funds”, “Analysis of personal income tax”.

Check the compliance of the base for contributions and for personal income tax with what actually happened. 2) Check the compliance of the bases for personal income tax - “Analysis of personal income tax by month”, for contributions - “Analysis of contributions to funds” and the amounts of income in the report - “Full set of accruals and deductions”.

The difference between these amounts is often not an error, but the peculiarities of filling out reports. But it is useful to understand the reason for the difference, because... After sending the regulated reports, you will probably need to send explanations on such differences to the Federal Tax Service. When comparing the reports “Full set of accruals, deductions and payments” and “Analysis of contributions to funds”, it is necessary to take into account that in the full set the data falls by the registration period when accrual or recalculation occurs, and in the “Analysis of contributions to funds” the data falls by period actions, i.e. for which month the accrual or recalculation occurs. Thus, the recalculation of vacation in May, accrued in April, will be included in the full summary in May, and in the analysis of contributions to the funds - will be included in April.

3) To compare the base for contributions and for personal income tax, the report “Analysis of personal income tax by month of the tax period and months of mutual settlements with employees” will help; it has the ability to select both by the date of receipt of income and by the month of accrual. Also, decoding the fields of the “Registrator” report will help you understand the situation - double click on the amount of interest.

Rice. 8 (click to enlarge)

4) “Taxes” – “Reports on taxes and contributions” – “Checking the calculation of contributions”. Check whether contributions have been accrued to the entire base.

5) “Analysis of personal income tax by month” - check the compliance of the calculated, withheld and transferred tax with each other and with the tax base. Check the number of applicable deductions. Check whether the amounts of income and taxes belong to the same tax authorities.

Rice. 9 (click to enlarge)

6) “Personal income tax analysis by dates of receipt of income” - check the tax by date of receipt of income. Check the accuracy of the dates of receipt of income. Calculating documents out of order may result in tax without income on some dates and other inconsistencies.

7) “Checking section. 2 6-NDFL” – check the withholding dates and tax remittance dates as they appear in the second section of 6-NDFL.

“Taxes and contributions” – “Payment of insurance contributions to funds.” Have all payments been made to the Social Insurance Fund?

“Taxes and contributions” – “Payment of insurance contributions to funds.” Have all payments been made to the Social Insurance Fund?

Calculations for deductions and loans

“Salary” – “Salary reports” – “Loans to employees”, “Writs of execution, agreements on payment of alimony, etc.” Check whether deductions are made on those documents, whether the amount withheld on a particular document corresponds to what it should actually be.

Rice. 10 (click to enlarge)

Balances on mutual settlements with employees

“Payments” – “Payment reports” – “Salary arrears”. Check the debt owed by the employees or organization and the correctness of the amounts.

Rice. 11 (click to enlarge)

Correspondence between the data in ZUP 3.1 and the data sent to BP 3.0

If data synchronization with the BP 3.0 program is used and it is regularly launched correctly, then it is necessary to check whether the sent information corresponds to what is currently indicated in the BP 3.1 database. To do this, you need to compare the “Salary Accounting” report with the “Full summary of accruals and payments” or “Salary analysis by employee” reports. The reports are located in the “Salary” – “Salary Reports” section. A discrepancy may occur if accruals are refilled in the ZUP 3.1 database after sending the data to BP 3.0.

Generation of regulated reports for the next reporting period and assessment of their correctness

For example: 6-NDFL, Calculation of insurance premiums, 4-FSS, 2-NDFL, SZV-Experience. In the program we do this in the “Reporting, certificates” section – “1C-Reporting”.

Rice. 12 (click to enlarge)

This checklist includes the most common possible mistakes when keeping records. The article does not discuss the search for errors that arise during the monthly calculation of amounts and their payments. There are a lot of accrual options and each organization has its own characteristics.

Still have questions? –

Contact our specialists for help

Order a consultation

Along with this read:

- Checklist: checking accounting in “1C: Trade Management 8”, ed. eleven

- Checklist: 16 steps to check accounting in “1C: Accounting 8”, ed. 3.0

- Transition to 1C:ZUP, edition 3