What is account 10 used for in accounting “materials”

The chart of accounts establishes that account 10 takes into account objects that are defined in accounting in accordance with PBU 5 as materials.

Materials include material assets that are used in the form of inventory, raw materials for the production of finished products, provision of services, performance of work, for resale if necessary, for the implementation of the management process of a business entity.

If material assets are acquired for the purpose of resale on an ongoing basis, then they are goods and a different account is used to account for them.

Materials are accounted for on account 10 at the actual costs incurred for their acquisition or at accounting prices, depending on the methods chosen in the organization’s accounting policy.

Accounting can be maintained for each unit of materials, batch, or group. The company independently determines how to record them based on the characteristics of its activities, as well as in order to ensure control over their availability and movement.

Attention! Materials located in the company may not belong to it by right of ownership, then they are recorded on off-balance sheet accounts (002 and 003).

Account 21 in accounting: Semi-finished products of own production

Accounting account 21 is the active account “Semi-finished products of own production”, used to record expenses associated with the production and processing of semi-finished products. Using standard postings and practical examples, we will consider the specifics of using account 21 and the features of reflecting transactions for accounting for semi-finished products of our own production

Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

Account 21 in accounting

Semi-finished products of own production are accounted for on account 21 in correspondence with account 20 - when semi-finished products are used in own production, and with account 90 - when semi-finished products are sold to a counterparty:

The debit of account 21 reflects the receipt of semi-finished products and their surpluses discovered during inventory. The account credit takes into account the consumption of semi-finished products during transfer for subsequent processing, their sale or identification of shortages in the warehouse.

On account 21, analytical accounting can be maintained by storage location, by name, type, grade, and so on.

Get 267 video lessons on 1C for free:

Typical postings for 21 accounts “Semi-finished products of own production”

The main entries for 21 accounts used in accounting are shown in the table below:

| Account debit | Account credit | Operation description |

| 21 | 20 | Receipt of semi-finished products of own production |

| 21 | 23 | Receipt of semi-finished products manufactured by auxiliary production |

| 21 | 40 | Receipt of finished products for subsequent use as semi-finished products |

| 21 | 91.01 | Surplus semi-finished products identified during inventory were capitalized |

| 20 | 21 | Semi-finished products are sent to production for subsequent processing |

| 23 (25;26) | 21 | The cost of semi-finished products is included in the costs of auxiliary production (overall production costs; general business expenses) |

| 28 | 21 | Write-off of defective semi-finished products of own production |

| 91.02 | 21 | The cost of semi-finished products of own production, written off or sold, is reflected in other expenses |

| 94 | 21 | The identified shortage of semi-finished products is reflected |

Example 1. The cost of semi-finished products includes only the cost of raw materials and materials

Let's say VESNA LLC produces parts that are used in its own production. In January 2021, 150 parts were manufactured. The costs included:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products are valued at the cost of raw materials and materials. Generated postings:

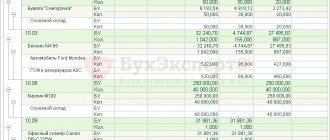

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69); 02 | 1 430 000 | Costs (wages, social contributions, depreciation) for the production of finished products are reflected | Payroll. Depreciation calculation |

| 21 | 20 | 1 200 000 | Semi-finished products are received into the warehouse | Shift production report |

| 20 | 21 | 1 200 000 | Semi-finished products transferred to production | Requirement invoice |

Example 2: Semi-finished products are valued at direct costs

Let's look at the previous example: VESNA LLC produces parts that are used in its own production. In January 2021, 150 parts were manufactured. Costs include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products of own production are valued at direct costs: raw materials and materials; salary; social contributions; accrued depreciation and so on, according to accounting policies. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69) | 980 000 | The amount of salary and social contributions is reflected | Payroll. |

| 20 | 02 | 450 000 | Accrued depreciation reflected | Depreciation calculation. |

| 21 | 20 | 2 630 000 | Receipt of semi-finished products of own production to the warehouse (1,200,000 + 980,000 + 450,000) | Shift production report |

Example 3. The cost of semi-finished products of own production additionally includes indirect costs

Let's assume that VESNA LLC produces part 1 and part 2, which are used in its own production.

The direct costs for production of the part1 include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Direct costs for the production of parts2 include:

- Raw materials and materials - 1,050,000 rubles;

- Salary and social contributions - 950,000 rubles;

- Depreciation charges - 380,000 rubles.

General business expenses (G&C) for the production of semi-finished products, parts 1 and parts 2, amounted to 870,000 rubles. According to the accounting policy, VESNA distributes general business expenses relative to the cost of raw materials.

Posting table:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 02; 10; 69; 70 | 2 630 000 | The cost of direct costs for manufacturing the part1 is taken into account (450,000 + 1,200,000 + 980,000) | Requirement invoice |

| 20 | 02; 10; 69; 70 | 2 380 000 | The cost of direct costs for manufacturing the part2 is taken into account (1,050,000 + 950,000 + 380,000) | Payroll. Depreciation calculation |

| 2 250 000 | Total costs for raw materials and supplies (1,200,000 + 1,050,000) | Accounting information | ||

| 20 | 26 | 464 000 | The share of OCR coming to part 1 is reflected (870,000 * (1,200,000 / 2,250,000)) | |

| 20 | 26 | 406 000 | The share of OCR coming to part 1 is reflected (870,000 * (1,050,000 / 2,250,000)) | |

| 21 | 20 | 3 094 000 | Semi-finished products part 1 (2,630,000 + 464,000) were credited to the warehouse | Shift production report |

| 21 | 20 | 2 786 000 | Semi-finished products part 2 (2,380,000 + 406,000) were credited to the warehouse |

It is important to note that the standard cost accounting method is advisable to use in the mass production of semi-finished products.

Source: //BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-21-v-buhgalterskom-uchete-provodki-po-uchetu-polufabrikatov-sobstvennogo-proizvodstva.html

The concept of raw materials and supplies in accounting

Materials are recognized as objects of human activity that are used mainly in one production process and fully transfer their value to the manufactured object.

Their useful life is less than one year. In accordance with the law, they are included in the working capital of the enterprise.

Raw materials are objects that are products of the mining industry or agriculture. They undergo a processing process and are fully used in the manufacture of finished products.

Materials are a product of the manufacturing industry, which is subsequently used to produce products, provide services, and perform work.

Materials are divided into the following groups:

- Raw materials and basic materials are the basis for the manufacture of finished products

- Semi-finished products of own production are an integral part of work in progress; they are not taken into account in account 10.

- Purchased semi-finished products are materials that have undergone pre-processing at other enterprises.

- Auxiliary materials - lubricants, containers, returnable waste, etc.

- Fuel is used as one of the sources of energy in economic activities.

- Spare parts are used for timely repair of equipment and other fixed assets.

- Construction materials - used in construction work and repair of buildings and structures.

- Household inventory - objects used in several production processes or in the management of an organization, classified as materials due to cost or short lifespan.

Account 21 in accounting: semi-finished products of own production

In the course of production activities, it may happen that there is a need to take into account semi-finished products of own production. In this situation, everything depends on the specifics of the activity of a particular enterprise.

Today’s topic will be devoted to questions about who uses 21 accounts, how accounting and evaluation of this category of goods is carried out, what are the features of their accounting, what typical accounting entries are recorded for such operations, and we will also analyze practical situations of this kind from life.

Who uses accounting account 21?

21 accounts, called “Semi-finished products of own manufacture,” are actively used by industrial enterprises to summarize data on the availability and movement of manufactured inventories that will be used in the manufacture of final products. It is also used to reflect the movement of workpieces between different workshops of an industrial company.

Thus, the designated position of the Chart of Accounts is intended to summarize data on incoming, available and further intermediate products for the further production process.

If we talk about what should be classified as semi-products of our own production, then we mean those blanks that were obtained as a result of the technological process, but did not go through all the stages of the production cycle necessary to obtain the final product.

Accounting and evaluation of semi-products of own production

To begin with, it should be noted that the designated account is active, i.e. its debit part of the organization reflects the receipt of the specified category of goods, and the credit part reflects the decrease in the balance, for example, as a result of its transfer to the production process.

All costs related to the preparation of semi-products are recorded in the debit of item 21. As for the credit part, it should show the sale of this category of products to third organizations or their transfer for further processing.

The overwhelming number of organizations engaged in production activities prefer to display blanks that are classified as inventories at actual cost.

However, it is quite acceptable to use initial or planned prices, and their further adjustment to the actual cost value by including transport costs associated with moving products between different workshops.

Along with this, there are also methods for valuing semi-products, such as valuation based on the price of raw materials and materials, as well as on direct cost items.

Warehouse workers, who are financially responsible persons, are responsible for the quantitative accounting of semi-finished products. In this case, quantitative accounting is carried out according to such nomenclature characteristics as, for example, size, type, etc. If the movement of semi-finished products occurs between workshops, bypassing the warehouse, then control over the movement of these products is carried out by the workers of the workshops.

Specifics of the non-semi-finished accounting method

The specificity of the indicated cost accounting method is that the price of semi-finished products that are moved from one workshop to another is not taken into account. In this case, the cost of a finished product includes all the costs of its production at all stages, i.e. in this case, only the cost of the finished product is calculated.

Typical accounting entries

Basic transactions for 21 accounts look like this:

1) Dt 21

Kt 20 – accounting of received semi-finished products produced independently;

2) Dt 21

Kt 23 - accounting for the designated category of products produced in auxiliary workshops;

3) Dt 21

Kt 40 – reflection of received products for their subsequent use as a semi-finished product;

4) Dt 21

Kt 91.01 - capitalization of surplus semi-finished products that were identified during the inventory process;

5) Dt 20

Kt 21 – products transferred to production;

6) Dt 28

Kt 21 – write-off of defective products of own production;

7) Dt 94

Kt 21 - a reflection of the identified shortage of products, etc.

Case studies

Let's imagine a situation where a certain company produces certain parts, which are then used in its own production. At the beginning of the reporting year, 170 units of parts were produced. In this case, the following costs were incurred in the manufacture of 1 type of parts:

- materials and raw materials – 1,370,000 rubles;

- expenses for wages and social contributions - 927,000 rubles;

- depreciation charges - 570,000 rubles.

At the same time, the following costs were taken into account in the direct costs of production of type 2 parts:

- materials and raw materials – 1,230,000 rubles;

- expenses for wages and social contributions - 873,000 rubles;

- depreciation charges - 340,000 rubles.

The amount of general business expenses for the production of these parts amounted to 930,000 rubles. In accordance with the company's accounting policy, the distribution of general business expenses is carried out relative to the price of raw materials.

In this situation, the accounting entries will be as follows:

1) Dt 20

Kt 02, 10, 69 and 70 – 2,867,000, direct costs for the manufacture of parts of type 1;

2) Dt 20

Kt 02, 10, 69 and 70 – 2,443,000, direct costs for the manufacture of type 2 parts;

3) Dt 20

Kt 26 – 490,038.46, share of chemical and chemical work for part 1 type (930,000 * (1,370,000 / 2,600,000);

4) Dt 20

Kt 26 – 439,961.54, share of chemical and chemical work for part 2 of type (930,000 * (1,230,000 / 2,600,000);

5) Dt 21

Kt 20 – 3,357,038.46, posting semi-finished products of type 1 to the warehouse;

6) 5) Dt 21

Kt 20 – 2,882,961.54, posting of type 2 semi-finished products to the warehouse.

Account characteristics

To record information about the availability and movement of materials, account 10 is used in accounting.

This is an active account that has a debit balance characterizing the availability of materials on certain dates.

The receipt of materials is reflected in the debit of the account based on the primary documents received by the organization, and their disposal, including write-off to production, is reflected in the credit of the account. At the same time, the company prepares primary expenditure documents for disposal.

The final account balance is determined by adding the opening balance with the turnover on the debit of account 10, and subtracting from the resulting result on the credit of account 10.

Attention! In the balance sheet, information on account 10 is reflected in line 1210.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

What subaccounts are used?

The following subaccounts can be created for account 10:

- 10/1 “Raw materials and materials” - it records raw materials and the main types of materials that form the basis for the production of main products. Here you can also keep records of materials for auxiliary and technological purposes, as well as agricultural products intended for processing.

- 10/2 “Purchased semi-finished products and components, structures and parts” - this takes into account the cost of semi-finished products and components that are purchased for the production of products and require further refinement.

- 10/3 “Fuel” – this takes into account the availability and movement of fuel and lubricants for the company’s vehicles and equipment.

- 10/4 “Containers and packaging materials” - here all types of containers are recorded, as well as materials for their manufacture or repair.

- 10/5 “Spare parts” - here the accounting of spare parts intended for the repair of existing equipment, vehicles and other mechanical means is made;

- 10/6 “Other materials” - production waste, trimmings, shavings, etc. are taken into account here. Materials that were formed during the liquidation of the OS can also be taken into account here. The main thing is that the materials accounted for in this subaccount are not used as basic materials, fuel, spare parts, etc.

- 10/7 “Materials transferred for processing to third parties” - this takes into account materials that were transferred to third parties for the manufacture of products from them;

- 10/8 “Building materials” - the subaccount is used in developer organizations to account for materials used during construction and installation;

- 10/9 “Inventory and household supplies” – the account records the cost of tools, inventory, and household supplies;

- 10/10 “Special equipment and special clothing in the warehouse” - is intended to account for special equipment, equipment, special clothing, etc., which are stored in the warehouse.

- 10/11 “Special equipment and special clothing in operation, etc.” – designed to account for special equipment, equipment, workwear, etc., which are used in production.

Attention! An organization can open other sub-accounts necessary for proper accounting. Analytical accounting can be carried out by types, types, sizes, grades of materials, etc.

Chart of accounts 2021 (table)

Accounting in organizations is maintained in accordance with the Chart of Accounts approved by the Ministry of Finance. In this material, you have access to the Chart of Accounts for Accounting 2021 (table) and instructions for use.

The chart of accounts for 2021 was approved by order of the Ministry of Finance dated October 31, 2000 No. 94n. All organizations maintain accounting records in accordance with this plan (with the exception of credit and state (municipal) organizations). It has eight sections. Such a plan ensures compliance with accounting and reporting indicators.

Important

They plan to change the chart of accounts. The Ministry of Finance reported this to the UNP newspaper.

More about the changes

Chart of accounts for accounting 2021 with explanations and entries

Next, consider the chart of accounts with subaccounts (see table below). Explanations and explanations can be found by clicking on the links in the table.

Chart of accounts: table

Account number and name Sub-account number and name

| Section I. NON-CURRENT ASSETS: accounts for summarizing information on the presence and movement of the organization’s assets, which, according to accounting rules, relate to fixed assets, intangible assets and other non-current assets, as well as operations related to their construction, acquisition and disposal | |

| Account 01 “Fixed Assets” | By type of fixed assets |

| Account 02 “Depreciation of fixed assets” | |

| Account 03 “Profitable investments in material assets” | By type of material assets |

| Account 04 “Intangible assets” | By type of intangible assets and by expenses for research, development and technological work |

| Account 05 “Amortization of intangible assets” | |

| Account 06……………….. | |

| Account 07 “Equipment for installation” | |

| Account 08 “Investments in non-current assets” | 1. Acquisition of land2. Acquisition of environmental management facilities3. Construction of fixed assets4. Acquisition of fixed assets5. Acquisition of intangible assets6. Transfer of young animals to the main herd7. Purchase of adult animals8. Carrying out research, development and technological work |

| Account 09 “Deferred tax assets” | |

| Section II. PRODUCTION INVENTORIES: accounts for summarizing information on the availability and movement of objects of labor intended for processing, processing or use in production/for economic needs, means of labor, which are included in the assets in circulation, as well as operations related to their procurement (purchase) | |

| Account 10 “Materials” | 1. Raw materials and materials2. Purchased semi-finished products and components, structures and parts3. Fuel4. Containers and packaging materials5. Spare parts6. Other materials7. Materials outsourced for processing8. Construction materials9. Inventory and household supplies10. Special equipment and special clothing in stock |

| Account 11 “Animals for growing and fattening” | |

| Count 12……………….. | |

| Count 13……………….. | |

| Account 14 “Reserves for reduction in the value of material assets” | |

| Account 15 “Procurement and acquisition of material assets” | |

| Account 16 “Deviation in the cost of material assets” | |

| Account 19 “Value added tax on acquired assets” | 1. Value added tax on the acquisition of fixed assets2. Value added tax on acquired intangible assets3. Value added tax on purchased inventories |

| Section III. PRODUCTION COSTS: accounts for summarizing information about expenses for an organization's normal activities (except selling expenses) | |

| Account 20 “Main production” | |

| Account 21 “Semi-finished products of own production” | |

| Count 22……………….. | |

| Account 23 “Auxiliary proceedings” | |

| Count 24……………….. | |

| Account 25 “General production expenses” | |

| Account 26 General business expenses | |

| Account 27……………….. | |

| Account 28 Defects in production | |

| Account 29 Service industries and farms | |

| Count 30……………….. | |

| Account 31……………….. | |

| Count 32……………….. | |

| Account 33……………….. | |

| Account 34……………….. | |

| Count 35……………….. | |

| Count 36……………….. | |

| Account 37……………….. | |

| Count 38……………….. | |

| Account 39……………….. | |

| Section IV. FINISHED PRODUCTS AND GOODS: accounts for summarizing information on the availability and movement of finished products (manufactured products) and goods | |

| Account 40 “Release of products (works, services)” | |

| Account 41 “Goods” | 1. Goods in warehouses2. Products in retail trade3. The container is under the goods and empty4. Purchased products |

| Account 42 “Trade margin” | |

| Account 43 “Finished products” | |

| Account 44 “Sales expenses” | |

| Account 45 “Goods shipped” | |

| Account 46 “Completed stages of unfinished work” | |

| Account 47……………….. | |

| Count 48……………….. | |

| Score 49……………….. | |

| Section V. CASH: accounts for summarizing information on the availability and movement of funds in Russian and foreign currencies held at the cash desk, in settlement, currency and other accounts opened with credit institutions in the country and abroad, as well as securities , payment and monetary documents | |

| Account 50 “Cashier” | 1. Cash desk of the organization2. Operating cash desk3. Money documents |

| Account 51 “Current accounts” | |

| Account 52 “Currency accounts” | |

| Account 53……………….. | |

| Score 54……………….. | |

| Account 55 “Special bank accounts” | 1. Letters of credit2. Check books3. Deposit accounts |

| Score 56……………….. | |

| Account 57 “Transfers on the way” | |

| Account 58 “Financial investments” | 1. Units and shares2. Debt securities3. Loans provided4. Deposits under a simple partnership agreement |

| Account 59 “Provisions for impairment of financial investments” | |

| Section VI. SETTLEMENTS: accounts for summarizing information on all types of settlements with various organizations and individuals, as well as intra-business settlements | |

| Account 60 “Settlements with suppliers and contractors” | |

| Account 61……………….. | |

| Account 62 “Settlements with buyers and customers” | |

| Account 63 “Provisions for doubtful debts” | |

| Score 64……………….. | |

| Score 65……………….. | |

| Account 66 “Settlements for short-term loans and borrowings” | By type of credits and loans |

| Account 67 “Settlements for long-term loans and borrowings” | By type of credits and loans |

| Account 68 “Calculations for taxes and fees” | By type of taxes and fees |

| Account 69 “Calculations for social insurance and security” | 1. Social insurance calculations2. Pension calculations3. Calculations for compulsory health insurance |

| Account 70 “Settlements with personnel for wages” | |

| Account 71 “Settlements with accountable persons” | |

| Score 72……………….. | |

| Account 73 “Settlements with personnel for other operations” | 1. Calculations for loans provided2. Calculations for compensation for material damage |

| Score 74……………….. | |

| Account 75 “Settlements with founders” | 1. Calculations for contributions to the authorized (share) capital2. Calculations for payment of income |

| Account 76 “Settlements with various debtors and creditors” | 1. Calculations for property and personal insurance2. Claim settlements3. Calculations of dividends due and other income4. Calculations on deposited amounts |

| Account 77 “Deferred tax liabilities” | |

| Score 78……………….. | |

| Account 79 “Intra-business settlements” | 1. Calculations for allocated property2. Settlements for current transactions3. Settlements under a property trust management agreement |

| Section VII. CAPITAL: accounts for summarizing information about the state and movement of capital of an organization | |

| Account 80 “Authorized capital” | |

| Account 81 “Own shares (shares)” | |

| Account 82 “Reserve capital” | |

| Account 83 “Additional capital” | |

| Account 84 “Retained earnings (uncovered loss)” | |

| Score 85……………….. | |

| Account 86 “Targeted financing” | By type of financing |

| Score 87……………….. | |

| Score 88……………….. | |

| Score 89……………….. | |

| Section VIII. FINANCIAL RESULTS: accounts for summarizing information about the organization’s income and expenses, as well as identifying the final financial result of activities for the reporting period | |

| Account 90 “Sales” | 1. Revenue2. Cost of sales3. Value added tax4. Excise taxes9. Profit/loss from sales |

| Account 91 “Other income and expenses” | 1. Other income2. Other expenses9. Balance of other income and expenses |

| Score 92……………….. | |

| Account 93……………….. | |

| Account 94 “Shortages and losses from damage to valuables” | |

| Score 95……………….. | |

| Account 96 “Reserves for future expenses” | By type of reserves |

| Account 97 “Deferred expenses” | By type of expense |

| Account 98 “Deferred income” | 1. Income received for future periods2. Gratuitous receipts3. Upcoming debt receipts for shortfalls identified in previous years4. The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables |

| Account 99 “Profits and losses” | |

| OFF-BALANCE ACCOUNTS: accounts for summarizing information about the availability and movement of valuables temporarily in the use or disposal of the organization, contingent rights and obligations, as well as for monitoring individual transactions | |

| Account 001 Leased fixed assets | |

| Account 002 Inventory assets accepted for safekeeping | |

| Account 003 Materials accepted for processing | |

| Account 004 Goods accepted for commission | |

| Invoice 005 Equipment accepted for installation | |

| Account 006 Strict reporting forms | |

| Account 007 Debt of insolvent debtors written off at a loss | |

| Account 008 Security for obligations and payments received | |

| Account 009 Security for obligations and payments issued | |

| Account 010 Depreciation of fixed assets | |

| Account 011 Fixed assets leased |

Chart of Accounts for 2021

Based on the chart of accounts, the organization approves the working chart of accounts.

, containing a complete list of synthetic and analytical (including subaccounts) accounts necessary for accounting.

An accounting chart of accounts is a scheme for recording and grouping assets, liabilities, financial, business and other operations of an organization in accounting. It contains the names and numbers of synthetic accounts (first-order accounts) and sub-accounts (second-order accounts).

The new chart of accounts for accounting 2021 (Russia) is presented above. It contains all the accounts.

To account for specific transactions, an organization can, in agreement with the Ministry of Finance, introduce additional synthetic accounts into the plan using free numbers.

The subaccounts provided for in the chart of accounts are used based on the requirements of the organization's management, including the needs of analysis, control and reporting. The organization can clarify the content of the subaccounts given in the plan, exclude and combine them, and introduce additional ones.

The procedure for maintaining analytical accounting is established taking into account PBU and other regulations, guidelines on accounting issues.

Each synthetic account has a standard pattern of its correspondence with other accounts. If some correspondence is not provided for in the standard scheme, the organization can supplement it.

Appendix to accounting policies for accounting purposes. Working chart of accounts for 2021 (fragment)

Source: //www.gazeta-unp.ru/articles/3914-plan-schetov-buhgalterskogo-ucheta-2021

Which accounts does account 10 correspond to?

Account 10 can correspond with the following accounts:

From the debit of account 10 to the credit of accounts:

- Account 10 - when transferring materials between warehouses;

- Account 15 - when purchasing materials using accounts 15, 16 in accounting;

- Account 20 - when registering materials from the main production;

- Account 23 - when registering materials from auxiliary production;

- Account 25 - when recording materials that arose during the implementation of general production expenses;

- Account 26 - when recording materials that arose during the implementation of general business expenses;

- Cch. 28 – when registering irreparable defects as materials;

- sch. 29 - when receiving materials from service farms;

- sch. 40 - when adjusting the actual cost;

- sch. 41 - when converting goods purchased for resale into materials;

- sch. 43 - when converting finished products into materials;

- sch. 44 - when recording material that arose when incurring sales expenses;

- sch. 60 - upon receipt of materials from suppliers;

- sch. 66 - upon receipt of materials in the form of short-term trade credits or loans;

- sch. 67 - upon receipt of materials in the form of long-term trade credits or loans;

- sch. 68 - regarding fees or taxes attributable to the cost of materials;

- sch. 71 - upon receipt of materials from accountable persons;

- sch. 75 - when the founders contribute shares with materials;

- sch. 76 - upon receipt of materials from other suppliers, inclusion of the cost of services in the price of materials, etc.

- sch. 79 - upon receipt of materials from branches or head offices;

- sch. 80 - when making contributions from partnership participants in materials;

- sch. 86 - upon receipt of materials as targeted funding;

- sch. 91 - upon receipt of materials during the disassembly of OS objects;

- sch. 97 - adjustment of the cost of materials charged to deferred expenses;

- sch. 99 - when registering materials arising due to emergency circumstances.

You might be interested in:

Account 28 in accounting: how defects in production are taken into account, characteristics of the account, postings

According to the credit of the account, it corresponds with the debit of the following accounts:

- sch. 08 - when writing off materials for preparation for operation of non-current assets, capital construction, etc.;

- sch. 10 – when transferring materials between warehouses;

- sch. 20 - when releasing materials to main production;

- sch. 23 – when releasing materials to auxiliary production;

- sch. 25 – when releasing materials for general production needs;

- sch. 26 – when releasing materials for general business needs;

- sch. 28 - when releasing materials to correct defects;

- sch. 29 – when releasing materials to subsidiary farms;

- sch. 44 - when releasing materials for sales expenses;

- sch. 45 - for the amount of shipped materials, the revenue for which has not yet been recognized in accounting;

- sch. 76 - upon disposal of materials to another counterparty;

- sch. 79 - when transferring materials to branches or head offices;

- sch. 80 - when paying off a partner’s share with materials;

- sch. 91 - when writing off the cost of materials upon their disposal;

- sch. 94 - when a shortage of materials is detected;

- sch. 97 - when assigning the cost of materials to future expenses;

- sch. 99 - when writing off materials for emergency circumstances.

Accounting entries for the account

With a score of 10 the following entries can be made:

| Debit | Credit | Description |

| Materials receipt transactions | ||

| 10 | 10 | Transfer of materials from warehouse to warehouse |

| 10 | 15 | Materials accepted at discount prices |

| 10 | 20 | Accepted materials manufactured by the main production facilities |

| 10 | 20 | Return of unused materials to the warehouse |

| 10 | 23 | Materials manufactured by auxiliary production forces have been accepted into the warehouse |

| 10 | 28 | Accepted irreparable marriage |

| 10 | 29 | Materials produced by subsidiary farms have been accepted for accounting |

| 10 | 41 | Goods purchased for resale are used as materials |

| 10 | 43 | Finished products are transferred to the warehouse for use as materials |

| 10 | 44 | Return of materials issued for sales support |

| 10 | 60 | Receipt of materials from the supplier to the warehouse |

| 10 | 66 | Receipt of materials for short-term trade credit or loan |

| 10 | 67 | Receipt of materials for long-term trade credit or loan |

| 10 | 71 | Receipt of materials from an accountable person |

| 10 | 73 | Receipt of materials from personnel |

| 10 | 76 | Receipt of materials from other creditors |

| 10 | 79 | Receipt of materials from the head office or branch |

| 10 | 75 | Receipt of materials as a contribution to the authorized capital |

| 10 | 86 | Receipt of materials in the form of targeted financing |

| 10 | 97 | Receipt of materials from deferred expenses funds |

| 10 | 99 | Receipt of materials due to emergency or force majeure circumstances |

| 10 | 91 | Additional valuation of materials, proceeds from the sale or dismantling of an asset |

| Material write-off operations | ||

| 08 | 10 | Write-off of materials for preparing non-current assets for operation |

| 14 | 10 | Materials have been marked down |

| 20 | 10 | Materials transferred to main production |

| 23 | 10 | Materials transferred to auxiliary production |

| 28 | 10 | Materials transferred for correction of defects |

| 29 | 10 | Materials were donated to the needs of subsidiary farms |

| 44 | 10 | Materials were transferred for the needs of preparing main products for sale |

| 79 | 10 | Materials transferred to the head office or branch |

| 91 | 10 | Write-off of the cost of materials upon disposal or sale |

| 94 | 10 | Shortage of materials identified |

| 97 | 10 | The cost of materials is charged to deferred expenses. |

| 99 | 10 | Loss of materials written off due to emergency or force majeure circumstances |