Calculation of insurance premiums from 2021 is provided to the Federal Tax Service. It displays accrued taxes on compulsory pension, health insurance and social insurance (for cases of temporary disability and in connection with maternity). The new form for calculating insurance premiums and recommendations for filling it out were approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected]

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is the purpose of calculating insurance premiums?

Based on the calculated amounts for employee insurance, these funds are transferred to the employee’s appropriate insurance account. The report indicates how much money the employer must contribute to each employee's retirement account, as well as medical contributions to the city budget. Insurance premiums are calculated from the amount of accrued wages, which is reflected in the payroll (form T-51). An accountant handles these calculations.

Calculation of insurance premiums, starting with reporting for 2021

Calculation of insurance premiums to the Federal Tax Service, form according to KND 1151111. The form is applied starting from the submission of the calculation of insurance premiums for the first settlement (reporting) period of 2021. The calculation of insurance premiums is filled out by the payers of insurance premiums or their representatives:

- persons making payments and other remuneration to individuals (organizations, individual entrepreneurs, individuals who are not individual entrepreneurs);

- heads of peasant (farm) households.

Persons making payments to individuals submit a calculation of insurance premiums to the tax authority:

- organizations - at their location and at the location of separate divisions that pay payments to individuals. If a separate division is located outside the Russian Federation, then the organization submits the calculation for such division to the tax authority at its location (clauses 7, 11, 14 of Article 431 of the Tax Code of the Russian Federation);

- individuals (including individual entrepreneurs) - at the place of residence (Clause 7, Article 431 of the Tax Code of the Russian Federation).

The heads of peasant farms submit calculations for insurance premiums to the tax authority at the place of their registration (clause 3 of Article 432 of the Tax Code of the Russian Federation).

Deadline for submitting calculations for insurance premiums:

- persons making payments to individuals - no later than the 30th day of the month following the billing (reporting) period (clause 1, clause 1, article 419, clause 7, article 431 of the Tax Code of the Russian Federation);

- heads of peasant farms - until January 30 of the calendar year following the expired billing period (clause 3 of Article 432 of the Tax Code of the Russian Federation). Since in paragraph 3 of Art. 432 of the Tax Code of the Russian Federation does not contain a clause stating that the deadline includes January 30; we recommend submitting the calculation no later than January 29.

When the last day of the period falls on a weekend and (or) a non-working holiday, the end of the period is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If the deadline for submitting insurance premium calculations is missed, this may result in liability and other negative consequences.

The procedure for submitting calculations for insurance premiums

When determining the method of submitting the Calculation of insurance premiums, persons making payments to individuals must take into account the average number of such individuals for the previous billing (reporting) period.

Calculation of insurance premiums in electronic form according to TKS must be submitted if this figure exceeds 25 people. This also applies to newly created organizations whose number of named individuals exceeds the specified limit (clause 10 of Article 431 of the Tax Code of the Russian Federation).

For failure to comply with the procedure for submitting the Calculation in electronic form, a fine is provided in accordance with Art. 119.1 Tax Code of the Russian Federation.

If the indicator is 25 or less people, then payers (including newly created organizations) decide for themselves how to submit the payment: in electronic form or on paper (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Filling algorithm

Let's make a calculation of insurance premiums using the example of NAUKA LLC. Let it be a payer of insurance premiums under the simplified tax system and apply the basic tariff of insurance premiums (22% pension insurance; 5.1% medical insurance; 2.9% social insurance). NAUKA LLC has two employees on its staff. The report was compiled for the 4th quarter of 2017.

Title page

On the title page we fill out the TIN, KPP and number the page. If you are submitting a report for this period for the first time, the adjustment number is set to 0.

Next, fill in the reporting period code, in this case annual (code 34), year 2021.

The following information must also be filled out on the title page:

- Tax authority code,

- code of the location of the organization of the Russian Federation,

- name of company,

- OKVED code,

- contact phone number of the manager or accountant.

We recommend recording the number of pages on which the report was published after completing the report.

Below, only the left part is filled in - information about the payer of insurance premiums. Date and signature are added.

Note! The insurance premium payer or his representative must put the date and signature not only on the title page, but also on several others where space is provided for this.

For our LLC, we include the following pages in the report:

- Section 1. Summary data of the payer of insurance premiums (on two pages)

- Appendix 1 to Section 1 (Subsection 1.1)

- Appendix 1 to Section 1 (Subsection 1.2)

- Appendix 1 to Section 1 (Subsection 1.1)

- Appendix 2 to section 1 (two pages)

- Appendix 3 to section 1

- Appendix 4 to section 1 (end)

- Section 3 (on two pages) – to be filled out for each employee.

Next pages

We recommend that you start filling out the data by determining the base for calculating insurance premiums. It is calculated as follows: the total amount of payroll for all employees is taken and non-taxable amounts (sick leave payments, benefits, financial assistance, etc.) are subtracted from it.

Now we calculate the amount of insurance premiums from the calculated base. For an LLC using the simplified tax system and the basic tax rate, this is 22% pension insurance; 5.1% health insurance; 2.9% social insurance.

Enter the calculated values into the report. On the sheet “Appendix 1 to Section 1” Subsection 1.1 refers to compulsory pension insurance, Subsection 1.2 to compulsory medical insurance.

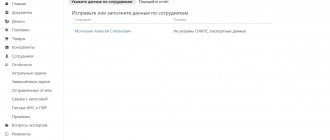

In the picture in line 060

- amounts 4761.12 rubles, 5707.46 rubles, 5566 rubles. – monthly calculated insurance premiums;

- amount 16034.58 rub. – addition of the calculated contributions indicated above;

- the amount 66128.58 is an annual amount with an increase, that is, calculated from January to December.

“Appendix 2 to Section 1” refers to compulsory social insurance in case of temporary disability and in connection with maternity.

Filling out sick leave payments

Sick leave payments are completed quarterly (last 3 months). During this reporting period, one of the employees of NAUKA LLC was on sick leave for 7 days. We take this information and the amount of hospital payments from the payroll (form T-51) and enter it into our report in “Appendix 3 to Section 1” in the table.

The first column of the table indicates the total number of sick leaves taken into account, even if they were all brought by the same person. The second column contains the amount of sick days (for all employees). The third column reflects the total amount paid for all sick leave. In the fourth - the amount that is reimbursed to the organization from the federal budget. Since the first three days of sick leave are paid to the employee by the organization, and the subsequent days - from the federation. budget.

The table below reveals specific types of sick leave.

“Appendix 4 to Section 1” indicates the total amounts of compensation from the federal budget with the number of sick leaves and the sum of days for them in the corresponding paragraph of the appendix.

Completing Section 1. Summary data of the payer of insurance premiums

After we have calculated the insurance premiums, we must enter them nicely into “Section 1”. We have the calculated amounts in the Subsections, all that remains is to transfer them here.

In our case, this is Subsection 1.1, Subsection 1.2

and continuation of Appendix 2 to section 1.

Calculation of insurance premiums (DAM), starting with reporting for 2021

Calculation of insurance premiums to the Federal Tax Service, form according to KND 1151111. The form is applied starting from the submission of the calculation of insurance premiums for the first settlement (reporting) period of 2021.

The calculation of insurance premiums is filled out by the payers of insurance premiums or their representatives:

- persons making payments and other remuneration to individuals (organizations, individual entrepreneurs, individuals who are not individual entrepreneurs);

- heads of peasant (farm) households.

Persons making payments to individuals submit a calculation of insurance premiums to the tax authority:

- organizations - at their location and at the location of separate divisions that pay payments to individuals. If a separate division is located outside the Russian Federation, then the organization submits the calculation for such division to the tax authority at its location;

- individuals (including individual entrepreneurs) - at their place of residence.

The heads of peasant farms submit calculations of insurance premiums to the tax authority at the place of their registration.

Deadlines for submitting calculations for insurance premiums

The following deadlines for submitting the report have been established:

- persons making payments to individuals - no later than the 30th day of the month following the billing (reporting) period;

- heads of peasant farms - before January 30 of the calendar year following the expired billing period, it is recommended to submit the calculation no later than January 29.

When the last day of the term falls on a weekend and (or) a non-working holiday, the end of the term is postponed to the next working day.

If the deadline for submitting insurance premium calculations is missed, this may result in liability and other negative consequences.

The procedure for submitting calculations for insurance premiums

When determining the method of submitting the Calculation of insurance premiums, persons making payments to individuals must take into account the average number of such individuals for the previous billing (reporting) period.

Calculation of insurance premiums in electronic form according to TKS must be submitted if this figure exceeds 25 people. This also applies to newly created organizations whose number of named individuals exceeds the specified limit.

Failure to comply with the procedure for submitting the Calculation in electronic form will result in a fine.

If the indicator is 25 or fewer people, then payers (including newly created organizations) decide for themselves how to submit the payment: electronically or on paper.

Form for KND 1151111 (form for calculating insurance premiums)

Source/official document: Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ Where to submit: Federal Tax Service Penalty for late submission: for late submission a fine of five percent of the amount of contributions that must be paid or additionally paid based on calculation is charged

Document name: Calculation of insurance premiums (form according to KND 1151111) new form Format: .xls Size: 552 kb

Print Preview Bookmark

Save to yourself:

Submit the KND form 1151111 correctly and online

Attention, the material has been updated. A new form KND 1151111 has been uploaded. The new form for calculating insurance premiums under KND 1151111 is a report that is required to be submitted to the tax office. The report was approved in the Order of the Russian Tax Service dated September 18, 2019 No. ММВ-7-11/ The order discusses in detail how to correctly fill out the form; tables are attached along with codes to enter them into the calculation fields. You can download the free form for KND 1151111 below.

The order became effective in the country on January 1, 2017. The new report replaced the previous forms 4-FSS and RSV-1. As a result, the new form is larger in volume than the previous ones - it has twenty-four sheets.

The form is clear and uncomplicated. It contains sheets that reflect various information: about the income of individuals; about compulsory medical insurance, compulsory health insurance, compulsory health insurance contributions; about the possibility of using reduced rates to accrued contributions, and so on.

The deadline for requiring forms under KND 1151111 and submitting the form is the 30th day of the month following the reporting period, regardless of the method according to which the calculation is submitted. According to the law, the report must be provided for the third, sixth and ninth months (billing periods) and for twelve months (reporting period).

Heads of farm (peasant) households need to download the KND 1151111 form in Excel and submit a report to the tax office at their place of registration every year before January 30 of the calendar year that follows the expired reporting period.

Inspectors may impose a fine for errors in the report - five percent of the amount of insurance premiums payable. For late payments, a fine of five percent of the amount of contributions that must be paid or additionally paid based on calculation will also be charged. In this case, the total amount of penalties cannot be more than thirty percent of the amount of contributions and less than a thousand rubles.

Submit the KND form 1151111 correctly and online

Preview

Full screen preview