There is hardly a company that does not require printing out any document, putting a signature on it or making a note - all of these actions require the presence of stationery at the enterprise. Sometimes you need a lot of them, sometimes very little, but in any case you need to be able to properly conduct accounting in relation to them. In this article we will talk about postings for writing off paper and stationery, and give an example of drawing up a write-off act.

Stationery supplies are purchased through an accountable person of the company or directly from the supplier. They are accounted for as inventories (inventories) and are reflected in accounts at the purchase price plus delivery costs, VAT is excluded. You also need to write off office supplies according to the rules.

What is considered office supplies?

Office supplies include all devices used for writing, document preparation (pens, pencils, felt-tip pens, markers, paper, etc.), as well as some types of simple office equipment (typewriters, calculators). This also includes fastening materials (folders, paper clips, staples, stamps, etc.), drawing products (for example, preparation boards), pencil cases, briefcases (but only school ones) and other types of goods.

All of them belong to the category of the enterprise’s material reserves and are part of fixed assets, which, if necessary, should be written off in the manner prescribed by law.

It is also worth noting that promotional stationery products intended for external promotions, but issued to employees for internal use (for example, notepads, calendars, pens with logos, etc.) are also subject to write-off.

Answers to common questions

Question No. 1. In the company, office supplies are purchased by employees, who often present sales receipts without decoding with the entry “office supplies” and the number of units purchased. How to process these documents?

It is allowed to accept office supplies for accounting as a unit, without breaking them down into separate items. However, there is a risk that the tax office will challenge the inclusion of such expenses in the list of expenses.

Question No. 2. Is it necessary to write off office supplies that employees use at work, but which were issued for the purpose of a promotion and contain company logos and slogans?

Yes, such office supplies are also written off in the general manner.

Why draw up an act for writing off office supplies?

A common mistake many companies make is that the regular purchase of office supplies is considered an expense at the time of purchase. This is incorrect, because in the event of a sudden tax audit, the inspector of the supervisory service will not recognize expenses for office supplies issued in this way, which in turn will lead to additional income tax. The correct basis for writing off this category of inventory items would be the execution of a special act.

Thus, the act of writing off office supplies allows you to legally classify the funds spent on the purchase of “stationery” as expenses of the enterprise and justify the removal of material assets from the register. It also allows you to reduce the tax base of the organization by the entire amount of expenses incurred on office supplies.

Colleagues found four ways to conveniently record office supplies

Almost all companies are faced with such an unpleasant thing as the posting and write-off of office supplies. This is painstaking work that requires special patience. A reader of our magazine, chief accountant Oksana Kostyleva, told us what ways can help colleagues take into account “officework” without unnecessary problems.

Accounting for office supplies is a different story for accounting. Not only do you have to spend a lot of time on this, but the end result is not particularly impressive. Still, this is not defending a multimillion-dollar VAT deduction. You can simplify your accounting work with the “stationery” by using one of four methods. I will describe what the conveniences are and the possible consequences of each of them.

METHOD No. 1.

Homogeneous groups.

For small batches of office supplies, the accountant, as a rule, keeps records for each unit of goods. But this method is cumbersome and time-consuming, although it provides complete and reliable information about stocks and control over availability and movement.

I see the most correct and optimal solution to the problem of accounting for “officework” being dividing them into homogeneous groups. On account 10 “Materials” the group “Stationery” is formed separately. In the 1C program, I create the “Stationery” group on account 10.6. The elements of a subgroup are already homogeneous goods. For example, “Ballpoint pen”, “Note block”, “A-4 paper”, “Binder”, “General notebook” and so on.

This method is also convenient to use in cases where office supplies are written off not on the day they are registered, but according to employee needs. Every week, the secretary forms a paper demand invoice according to form No. M-11, according to which a “stationary” is issued. The invoice is sent to the accounting department, where it is written off (you can read about the rules for working with different types of invoices on page 47).

Thus, complete and reliable information about stocks of office supplies and control over their availability and movement will be provided, as required by PBU 5/01, approved by Order of the Ministry of Finance of Russia dated June 9, 2001 No. 44n.

For the head of the company, everything is clear and transparent: the number of shipments has increased and, accordingly, the costs of paper and printer ink have increased. Suppose the number of documents issued has increased or the reporting period in the accounting department has begun. This means that the demand for certain groups of stationery products has increased. And when using this method, there is no unnecessary reason for conflict with inspectors.

METHOD No. 2.

The whole party is like a unit.

You can issue a special order that will establish the provision that purchased stationery is immediately put into operation. In this case, all the “stationery” is accounted for as one unit and written off, accordingly, in the same way.

To make it clear what this unit is formed from, a copy of the supplier’s invoice is attached to the receipt order of form No. M-4. When writing off, employee requests for the provision of stationery are filed with the invoice form No. M-11. The method is really simple and fast. But at the same time, it is fraught with criticism from tax inspectors.

METHOD No. 3.

Capitalization by piece.

You can capitalize all office supplies by piece, and not by name. That is, the invoice will show the total number of pieces for all items. For example, it will say “Office supplies – 255 pieces.”

It cannot be said that the company provides false information in the documents: after all, the total number of “stationery” is really 255 units. But the nomenclature of the office is quite wide. And it’s easy to assume that this method will raise questions among tax authorities. They may claim that the thing is a fairly vague thing in this case. The cabinet is also a thing, only its price is clearly different from the price of the handle.

The company management may have questions for the accounting department. A huge number of pieces of office supplies can cause confusion and lead to long and tedious explanations on the part of accountants. And in the end, it is possible that you will still have to create groups of office supplies and display the cost for them.

METHOD No. 4.

Without using count 10.

I heard from colleagues that someone is using a method in which the account 10 “Materials” does not appear at all. This accounting method is chosen when office supplies are immediately transferred to company employees who need them. The range of purchased stationery products is not listed; they are written off as services. Or, if there are no supplies of office supplies, they are immediately written off to account 26 “General business expenses”.

But I consider accounting for office supplies bypassing count 10 to be extremely risky. This leads to a violation of the accounting methodology. And if these costs are large and permanent in nature, then the error can be significant. For management analysis, the method that some of my colleagues use is also, in my opinion, completely unacceptable.

More tips.

When arithmetic errors and problems with VAT deductions may arise

Victoria TsIRULNIKOVA, chief accountant of Nisa LLC:

— I agree that purchased stationery can be capitalized in the total quantity and in the total amount. Moreover, in the documents upon acquisition, for example in No. TORG-12, this is what is written. If office supplies are purchased in the quantity required, then I think it is quite acceptable to take these materials into account as a unit for the entire invoice. The quantity and amount will be immediately written off as expenses, and the materials will be put into operation.

But accounting for stationery by groups, as I see it, is quite labor-intensive. The accountant needs to divide materials into groups, determine the total quantity in each group, and calculate the average unit price in each group. In this case, arithmetic errors may occur.

Tamara SUDAREVA, lecturer, senior financial legal consultant:

– The method that is closest to me is bypassing account 10. The method allows you to write off office supplies as expenses in one entry DEBIT 26 (44) CREDIT 60 (71). This really makes keeping track of your office supplies costs as simple as possible. So, there is no need to regroup anything. At the same time, problems may arise with VAT deductions in relation to “stationery” purchased and written off as expenses. After all, one of the conditions for applying the deduction—acceptance for accounting—will not be met.

Difficulties may arise when rationing costs for office supplies.

It will be impossible to analyze the monthly consumption of one or another type of office supplies. This will be labor-intensive, as will monitoring compliance with the established norm. After all, the procedure for writing off pens and paper into production assumes that each unit of inventories is accounted for at the place of its operation. The article was published in the magazine “Seminar for Accountants” No. 2, 2011

Stages of the process of registering the purchase of office supplies

The procedure for registering expenses for office supplies consists of several stages.

- First, a purchase, in which a cash and sales receipt, as well as a receipt order, must be received.

- Next, the office supplies are sent to those departments that need them (here the requirement is an invoice, without indicating the purpose of the inventory items).

- The final stage is the act of writing off office supplies.

Legislative acts on the topic

It is recommended to study the following documents:

| Document | Name |

| clause 93 of the Guidelines for accounting for inventories | On the write-off of office supplies upon transfer to employees based on the invoice requirement in form No. M-11 |

| clause 13.3 PBU 5/01, Information message of the Ministry of Finance dated June 24, 2016 No. IS-accounting | On the write-off of office supplies as expenses for ordinary activities at the time of purchase without accounting entries (with simplified accounting) |

| paragraph 73 of the Guidelines | On consolidating the chosen method of writing off office supplies in the company’s accounting policy |

Rules for drawing up a document

There is no single unified, mandatory sample of a write-off act. Businesses and organizations can choose one of two options:

- every time, if necessary, draw up an act in free form (which is not entirely convenient),

- develop a document template yourself and based on your needs (in this case, it must be approved in the company’s accounting policies).

At the same time, regardless of which method of drawing up the act form for writing off office supplies is chosen, you must adhere to certain standards in filling it out. In particular, it must indicate

- date of compilation,

- name of the company that purchases the office supplies,

- a complete list of write-off goods (indicating quantity and price),

- signatures of the chief accountant and the head of the enterprise.

You should be very careful when filling out the form, you should avoid mistakes, and especially not enter unreliable or deliberately false information into the document, which could lead to punishment from regulatory authorities.

Form

The legislation does not put forward any special requirements for the preparation of this document. The act may be drawn up on A4 paper. You can also use a letterhead for these purposes. Naturally, it must first be drawn up and approved. In addition, it does not matter whether the information is entered on the computer or by hand. The main thing to remember here is that all available autographs must be affixed “live”. Regardless of the chosen filling option, the following information is required:

- Company name;

- commission members;

- Date of preparation;

- information about the manager and the company;

- information about stationery, their quantity, cost and other information;

- signatures of responsible persons.

As for the organization's seal, you can do without it. It is this act that indicates the company's expenses associated with office supplies. Therefore, the document must be kept in the company’s archives for three years.

What is considered office supplies?

It is unlikely that anyone here will have questions about the correct wording.

As you might guess, stationery supplies are those that are necessary for preparing and writing documents. This includes pens, markers, paper, pencils and more. In addition, simple devices, such as calculators and typewriters, are also considered office equipment. This includes various fastening and drawing materials: pencil cases, staples, staplers, binders, etc. All of the above products ensure the functionality of the company’s accounting department. The organization usually purchases office supplies in reserve. All this applies to the company’s fixed assets, which are subject to strict accounting. When it becomes necessary to write them off, this procedure must be carried out in accordance with the requirements prescribed by law. It must be said that this also applies to stationery products that are intended for advertising. This can be either internal promotions, for example, pens and calendars with logos, or external banners.

( Video : “Writing off office supplies in 1C 8.3 - step-by-step instructions”)

Rules for drawing up an act for write-off of stationery

The act can be drawn up on the organization’s letterhead or on an ordinary A4 sheet - it doesn’t matter, nor does it matter whether it is handwritten or printed on a computer.

The only condition: it must contain “live signatures” of the persons responsible for the write-off.

It is not necessary to put a stamp, since from 2021 legal entities are exempt from the need to use them in their activities.

After drawing up the act and recognizing the expenses for office supplies in the company’s accounting and tax records, the document is transferred for storage to the archive of the enterprise, where it must be kept for at least three years.

Receipt of office supplies: accounting entries

Like other materials, office supplies will be accounted for in account 10, and the subaccount is chosen at the discretion of the accountant. Read also the article: → “Accounting for account 10: postings, examples. Receipt and write-off of materials." The choice of Credit depends on the method of purchase:

| Purchasing through a supplier | Purchase by reporting employee |

| D 10 K 60 | D 10 K 71 |

Sample act for write-off of stationery

This act has a completely standard structure.

- First, the full name of the organization, its address are written at the top, and a place is also allocated for approval by the director.

- Then the document records the period for which it is drawn up, as well as the composition of the commission that carries out the write-off.

- After this, a list of write-off inventory items is entered into the act.

This information is best presented in table form. It must indicate

- Name of product,

- quantity (for all positions),

- cost of one piece,

- the total amount for a batch of one or another category of stationery,

- the account through which these inventory items are held

- The final figures for the quantity and cost of stationery are entered in the “Total” line.

- At the end, the document is signed on behalf of the commission members, indicating their positions and transcripts of signatures.

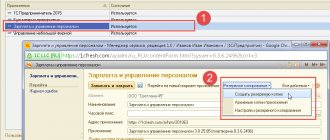

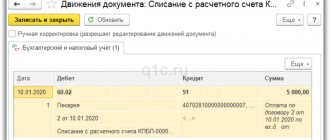

Postings for office supplies in 1C

- “Pass” button ;

- Button “Result of document posting”.

Rice. 135

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?