Salary payment deadlines in 2021 and 2021

In accordance with Art. 136 of the Labor Code of the Russian Federation, salaries are paid no less than every half month and no later than 15 calendar days from the end of the period for which they were accrued. Specific deadlines are not established in the legislation: they must be specified in the employer’s local regulations: collective agreement, employment contract, internal labor regulations. Taking into account the requirements of the code, you need to pay:

- salary for the first half of the month - no later than the 30th (31st) day of the current month;

- for the second half of the month - no later than the 15th day of the next month.

Paying salaries every half month and twice a month is not the same thing.

For example, by paying wages on the 5th and 18th, you pay wages twice a month, but violate the permissible interval between payments - 15 days. Correct option: salary for the first half of the month is paid on the 25th, and for the second half of the month - on the 10th of the next month. In the table we have collected the ratio of advance and salary dates.

| Advance this month | Salary next month |

| 16 | 1 |

| 17 | 2 |

| 18 | 3 |

| 19 | 4 |

| 20 | 5 |

| 21 | 6 |

| 22 | 7 |

| 23 | 8 |

| 24 | 9 |

| 25 | 10 |

| 26 | 11 |

| 27 | 12 |

| 28 | 13 |

| 29 | 14 |

| 30 | 15 |

| 31 | 16 |

If an organization has separate divisions or a large staff of employees, then in each of the divisions or departments you can approve different salary payment dates. The main thing is not to violate the interval of 15 days.

It is unacceptable to set a salary payment period instead of indicating the exact day (letter of the Ministry of Labor of the Russian Federation dated November 28, 2013 No. 14-2-242). The wording “salaries are paid no later than the 10th and 25th of each month” is similarly unsafe.

If the salary payment date falls on a weekend, it is paid on the day preceding the weekend. In other cases, it is impossible to pay wages before the due date. Although the rights of workers are not violated, the labor inspectorate may, with a small probability, impose a fine for this. The problem is that a violation of the 15-day period may occur, and in addition, local regulations will not correspond to the actual procedures of the company.

The rules of Article 136 of the Labor Code are mandatory for everyone. They cannot be violated even at the written request of an employee who wants to receive a salary once a month in full.

The Labor Code establishes the obligation to pay wages at least every half month. This means that you cannot pay less often, but you can please your employees with weekly or even daily payments without restrictions. The main thing is to consolidate this in local documents: internal regulations, collective or employment agreement.

In this case, it is not necessary to fix the salary payment period in the employment contract. It is enough to fix the payment schedule in the internal regulations, which each employee is familiar with upon signature. This was stated in the letter of Rostrud dated March 6, 2012 No. PG/1004-6-1.

Salaries can be paid by transfer to a bank card or in cash. When paying in cash, the employee may not collect the salary on time. For example, due to illness. In this case, it must be deposited. Therefore, the non-cash method of paying salaries is becoming increasingly widespread.

Procedure for payment of wages

Salaries are paid at least every half month.

The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.

Action 1. Approval of the payslip

According to Art. 136 of the Labor Code of the Russian Federation, the form of the pay slip is approved by the employer, taking into account the opinion of the workers’ trade union body.

In order to comply with the procedure for paying wages, the form of the pay slip must comply with Art. 136 Labor Code of the Russian Federation. Therefore, the payslip must contain the following information:

- on the components of wages due to him for the relevant period;

- on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee;

- about the amounts and grounds for deductions made;

- about the total amount of money to be paid.

If an employer uses an unapproved form of pay slip, this is a violation of labor legislation, which may entail administrative liability under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- warning,

- fine on officials in the amount of 1-5 thousand rubles,

- for individual entrepreneurs - 1-5 thousand rubles,

- for legal entities – from 30-50 thousand rubles,

and if such a violation is committed repeatedly – clause 2 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- fine on officials in the amount of 10-20 thousand rubles. or disqualification for a period of one to three years;

- for persons carrying out entrepreneurial activities without forming a legal entity - from 10-20 thousand rubles;

- for legal entities - from 50-70 thousand rubles.

Action 2. Securing in a collective or employment agreement the conditions on the form, procedure and place of payment of wages

The employer must accept a collective agreement, which specifies information about the conditions on the form, procedure and place of payment of wages.

FOR EXAMPLE: 2.1. The employer undertakes:

2.1.2. Pay wages in cash (rubles).

2.2. The employer has established the following remuneration systems: ___________________________ (time-based, time-based-bonus, piece-rate, piece-rate-bonus, progressive).

(Options: The work of ___________________ Employees is paid on a time-based basis based on official salaries, and they are also paid bonuses for ______________ in accordance with the staffing table (Appendix No. _______ to the Collective Agreement).

The work of ___________________ workers is paid based on the tariff rates specified in Appendix N _______ to the Collective Agreement and the categories of work performed.)

The law does not establish the amount of wages for half a month. When calculating wages, it is necessary to take into account the time actually worked by the employee. These acts allow you to calculate the amount of advance payments to employees.

Forms of payment of wages

According to Art. 131 of the Labor Code of the Russian Federation, wages are paid in the currency of the Russian Federation (in rubles).

Non-monetary wages can be paid no more than 20% of the total wages.

The procedure for paying wages in bonds, coupons, in the form of promissory notes, receipts, as well as in the form of alcoholic beverages, narcotic, poisonous, harmful and other toxic substances, weapons, ammunition and other items in respect of which prohibitions or restrictions on their free use are established turnover is not allowed.

Place of payment of wages

Wages are paid at the place where the employee performs the work or paid through the bank, that is, to a salary card.

Before paying wages through the bank, the employee must submit an application indicating the opportunity to receive remuneration for work directly through the bank.

An employer does not have the right to force an employee to receive wages through a bank , that is, in non-cash form.

The employee has the right to change the bank where he will receive his salary, but to do this he will first need to inform the employer about this.

That is, the employee sends the details of his new account to the employer no later than five working days before his salary is paid.

Action 3. Issuing (receiving) wages

Every time the employer pays wages, the employer is obliged to issue the employee a payslip (Article 136 of the Labor Code of the Russian Federation).

If the employer does not issue a pay slip, it is considered that he has violated labor laws.

This means that the employer may be subject to administrative liability, which we discussed above.

According to Art. 136 of the Labor Code of the Russian Federation, the employer is obliged to pay wages at least 2 times a month.

In an employment or collective agreement, the frequency of payments can be increased, but not reduced in any way.

ATTENTION! Methods of collecting compensation from an employer for delayed wages.

In accordance with the clarification of the letter from the Ministry of Labor of the Russian Federation, wages for the first half of the month must be paid from the 15th to the 30th (31st) of the current month, for the second - from the 1st to the 15th of the next month.

If the procedure for paying wages is carried out with a delay or in violation of other payments, the employer is held accountable in the manner established by the Labor Code of the Russian Federation and other federal laws.

If wages are not paid to an employee for more than 15 days, he has the right to suspend work for the period until the delayed amount is paid.

But at the same time, the employee must notify the employer about this in writing.

Salary for the first half of the month

The Labor Code does not contain the concept of “advance”. In accordance with the position of Rostrud (letter of Rostrud dated 09/08/2006 N 1557-6), when paying wages for the first half of the month, you must be guided by the information in the time sheet and pay wages according to the time actually worked.

This payment procedure causes difficulties, because... in accordance with the Tax Code and the position of the Ministry of Finance, personal income tax must be calculated based on monthly results, taking into account the provision of standard deductions. In addition, other deductions (for example, alimony) are also calculated from the salary for the entire month. Therefore, it turns out that if you make payments for the first half of the month according to the time actually worked, but without taking into account deductions from your salary, then the salary for the second half of the month will be less, because when calculating, you will need to take into account deductions from your salary for the entire month .

Therefore, most accountants calculate salaries for the first half of the month in the form of an advance: they set each employee an amount that is approximately half of the amount payable for the month (including deductions) and pay it without dividing it into specific additional payments, allowances and without withholding income tax. And after the end of the month, all types of accruals and deductions are calculated, the total amount payable for the month is determined and the advance payment already paid is subtracted from it. This is the salary for the second half.

Approach each employee individually. If an employee was on vacation for the entire first half of the month, he does not need to pay an advance, because he has already received vacation pay for this period. If the employee did not work for some reason or worked less time, then the amount of the advance must be reduced.

You won't miss anything in payroll

“Accounting is a convenient program. Thanks to the developers. I have been working with Kontur for a long time. And it’s convenient to manage personnel; you’ll never miss anything in payroll. Taxes are calculated on their own. All reports reach the recipient on time. Everything is updated with the times. I really like it, everything is convenient. And when something is unclear, you can call - and they will always come to your aid. Thanks again to the developers."

Natalia Abbasova, accountant, senior Veshenskaya, Rostov region.

Checking employment contracts

The situation is similar with labor and collective agreements. They should reflect the timing of salary payments in 2021. It is possible that their content already fully complies with the requirements of the new law. But it is possible that the contract allows for payment of wages later than the 15th of the next month, for example, the 20th. It may also turn out that the gap between the payment of the advance and the payment of wages is more than 15 days.

According to the changes in legislation being considered, these are violations.

Notifying employees about changes

To make appropriate changes to the employment contract, it is necessary to send the employee a written notice of changes to the terms of the employment contract. The notice must list the changes to the contract, indicating specific reasons and grounds. In this case, the notification must contain new deadlines for payment of wages according to the Labor Code of the Russian Federation.

Moreover, in accordance with Part 2 of Art. 74 of the Labor Code of the Russian Federation, notification must be sent to the employee no later than two months before the changes are made.

Additional agreement to the contract

In addition to editing the contract itself, it is necessary to conclude an additional document. agreement, which will also fix new terms for payment of wages.

Making changes to the contract and concluding a new additional agreement to it is enough to change the terms of payment of wages. There is no need to issue an order to postpone the payment of wages.

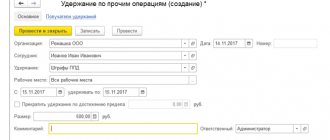

Responsibility for violation of terms of payment of advance payment and salary

Late payment

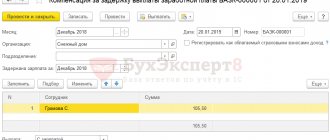

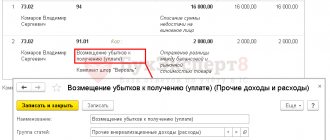

Article 236 of the Labor Code of the Russian Federation provides for financial liability for non-payment of wages on time. Interest is accrued daily on the amount that has been withheld. From October 3, 2021, their size was increased to 1/150 of the discount rate of the Central Bank of the Russian Federation per day, including the day after the established payment deadline and the day of actual settlement. This is the minimum amount of compensation, but the employer can increase it on its own initiative. Compensation is paid along with payment of the delayed amount.

Compensation is awarded regardless of whether the employer is at fault for violating payment deadlines.

In addition to financial liability, there is administrative liability for late wages - a warning or a fine.

| Who will be fined | Primary penalty | Repeated fine |

| Executive | 1,000 - 5,000 rubles | 10,000 - 20,000 rubles |

| Guilty IP | 1,000 - 5,000 rubles | 10,000 - 20,000 rubles |

| Guilty legal entity | 30,000 - 50,000 rubles | 50,000 - 70,000 rubles |

A repeated violation is considered non-payment of wages within a year from the date of entry into force of the decision on the first fine. In addition, the official may be subject to disqualification for a period of 1 to 3 years. All fines are listed in Art. 5.27 Code of Administrative Offenses of the Russian Federation.

An employee has every right to boycott a negligent employer. Article 142 of the Labor Code of the Russian Federation, if wages are delayed by more than 15 days, the employee may stop performing his job duties, for example, stop going to work or idle at the workplace. The only condition is that the employee must notify the employer about this in writing.

You must return to work no later than the next working day after the employer informs you in writing that it is ready to pay wages on the day the employee returns.

Not every employee can afford such behavior. There are situations when suspension of work is not allowed:

- You cannot stop working during periods of emergency;

- employees of the Armed Forces of the Russian Federation, civil servants, employees of defense enterprises, and law enforcement agencies cannot stop fulfilling their duties;

- you cannot refuse to work in organizations serving particularly hazardous types of production;

- Employees whose activities are related to ensuring the livelihoods of the population (energy supply, heating, water supply, etc.) cannot stop working.

According to Art. 142 of the Labor Code of the Russian Federation, during the suspension of work the employee retains his average earnings. Therefore, the manager must also pay the worker for downtime.

Payment ahead of schedule

If an employer unreasonably pays wages ahead of schedule, then he violates Article 142 of the Labor Code of the Russian Federation. This can be assessed as a violation of labor legislation and punished in accordance with Part 1 of Art. 5.27 of the Labor Code of the Russian Federation, similar to salary delays.

| Who will be fined | Primary penalty | Repeated fine |

| Executive | 1,000 - 5,000 rubles | 10,000 - 20,000 rubles |

| Guilty IP | 1,000 - 5,000 rubles | 10,000 - 20,000 rubles |

| Guilty legal entity | 30,000 - 50,000 rubles | 50,000 - 70,000 rubles |

The likelihood of being held accountable for such a violation is extremely low, because no one’s rights are violated. If your employees don't hate you, they certainly won't complain. But in order to avoid violating the provisions of the Labor Code of the Russian Federation, we recommend that salaries be transferred strictly on the dates established by local regulations.

Salary and advance

In accordance with the law, the break between the issuance of an advance and a salary should be no more than fifteen days.

For example, if an organization or individual entrepreneur gives employees an advance on the 20th, then the salary should be issued no later than the 5th of the next month. If the advance is issued on the 30th, then the salary is paid no later than the 15th. Violation of labor legislation by enterprises in this part, in accordance with Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, entails a fine of up to 50,000 rubles.

At the same time, issuing wages earlier than the deadline established by local regulations is not a violation.

Comments

Vadim Vasilyevich 09.24.2016 at 18:33 # Reply

Essentially nothing has changed

It seems like nothing has changed. For example, we paid salaries until the 15th. And this was reflected in all relevant documents. The only thing is that the fines have increased. But we are already accustomed to growing fines.

Sergey 04/25/2017 at 15:05 # Reply

“In accordance with the law, the break between the issuance of an advance and a salary should be no more than fifteen days.” And how is this requirement literally spelled out in the law? Or is this a loose interpretation of the absurdly formulated phrase “Wages must be paid to employees at least every half month.” Which, in my opinion, is absurd. The fact is that the words “rarely” and “often” characterize the frequency of events. And frequency is determined by the number of events per unit of time. Those. it would have to be “at least once every half month.” And “once every half month” does not mean that events should occur exactly 15 days later. It seems to me that once every half month is once in the period from 01 to 15, and once in the period from 16 to 30 (31).

Natalia 04/29/2017 at 14:32 # Reply

Sergey, hello. This requirement is specified in the Labor Code of the Russian Federation as amended by ed. Federal Law of July 3, 2016 N 272-FZ, verbatim: “Wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.” Those. the law says precisely no less than every half month, and not once every half month. Half a month is 15 days.

Kostya 02/19/2020 at 11:12 am # Reply

Our salaries are not paid on time

Our salary is paid on the 25th of the next month. That is, I worked in November and they pay me an advance on December 15, and the main part of my salary for November is paid on December 25. And nothing can be done, it is clear that no one will complain, otherwise there will be a new job. I’ve been working for three months now, and the delay is making it very difficult mentally.