The reflection of income and expenses from the write-off of fixed assets when calculating income tax depends on the reasons for which they are disposed of: sale or liquidation, for example, due to moral or physical depreciation. When writing off an asset due to liquidation, the residual value and expenses associated with its liquidation may be included in costs that reduce taxable profit. The procedure for accounting for residual value depends on the depreciation method used. If the asset being liquidated requires dismantling, then the costs of its implementation can be taken into account as part of non-operating expenses. The cost of materials or other property received in this case is taken into account as part of non-operating income.

Fixed assets on balance sheet

Fixed assets are those elements of a company's property that have served it, that is, are listed on the balance sheet for at least a year at a cost exceeding 40,000 rubles. Accounting clearly defines the procedure for their reflection on the balance sheet in the corresponding paragraph of PBU 6/01 “Accounting for fixed assets”:

- On the balance sheet, fixed assets are listed at their original cost, which is the amount spent on their acquisition or creation.

- During the useful life period assigned by the company, the initial cost of the asset is regularly reduced by the amount of depreciation.

NOTE! If a fixed asset was acquired before January 1, 2002, its useful life cannot be changed, with the exception of an increase in the cases provided for by letter of the Ministry of Finance of Russia No. 16-00-14/80.

Tax accounting

As you remember, depreciable property is considered to be property that:

- are owned by the organization,

- used by it to generate income,

- with a useful life of more than 12 months,

- the cost of which is repaid through depreciation.

From 01/01/2016, the limit on the value of depreciable property in tax accounting was increased from 40,000 rubles to 100,000 rubles (clause 1 of article 256 of the Tax Code of the Russian Federation). Now the cost of objects that are more expensive than 100,000 rubles, including fixed assets, cannot be taken into account as expenses at a time, but should be expensed by calculating depreciation during their useful life (clause 1 of Article 257, clause 1 of Article 258 , paragraphs 1, 2 of Article 259, paragraph 5 of Article 270 of the Tax Code of the Russian Federation). In addition, a depreciation premium can be applied to such fixed assets (clause 9 of Article 258 of the Tax Code of the Russian Federation).

If property with a useful life costs no more than 100,000 rubles, then it is not depreciable. Its cost can be included in expenses (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation):

- or in full as it is put into operation;

- or in parts - over several reporting periods.

The organization must independently choose one of the options, taking into account the period of use of the property or other economically feasible indicators. She needs to consolidate her choice in her accounting policy for tax purposes.

Transfer of fixed assets to non-current assets

An organization cannot simply sell a fixed asset. First, you need to perform an important accounting operation: transfer the OS being sold to the appropriate section of the balance sheet, that is, to non-current assets intended for sale.

The PBU provides conditions, each of which must be met in order to make a transfer:

- profit is planned to be received precisely from the sale, and not from the use of the operating system;

- the fixed asset is fully prepared for sale, there is no need for any additional operations with it;

- The OS will be sold after the transfer no later than within a year, unless otherwise provided by the sales plan;

- the terms of sale do not contradict current regulations;

- the transfer is carried out under a specific sales contract or within the framework of a sales plan adopted by the company.

Valuation of non-current assets

Fixed assets transferred for sale must be valued at a certain balance sheet date. For evaluation, the value that is the lowest is selected:

- or residual book value (original minus depreciation);

- or the cost at which the asset will be sold (also called “net realizable value” or NVR).

FOR YOUR INFORMATION! Net realizable value is the contractual selling price less costs to sell.

Reflection of the sale of fixed assets on the balance sheet

When any fixed asset is sold, it naturally must be removed from the balance sheet of the selling firm. To do this you need to write:

- its original cost;

- accrued depreciation.

Postings for write-off of fixed assets

The accounting entries for the write-off operation will be as follows:

- debit 91.2 “Other expenses”, credit 01 “Fixed assets” - the initial cost of the fixed asset is written off;

- debit 02 “Depreciation of fixed assets”, credit 91.1 “Other income” - the amount of depreciation on sold fixed assets is written off.

ATTENTION! If the implementation of fixed assets does not take place simultaneously, but lasts, as happens, for example, if long-term dismantling is necessary, it is advisable to open a sub-account “Disposal of fixed assets” to account 01. Its debit reflects the original cost, and its credit reflects accrued depreciation. The residual value after the sale of the fixed assets is written off to 91.2 “Other expenses”.

Postings to revenue from fixed assets

The proceeds received from the sale of fixed assets must be credited to the balance sheet as a result of the following transactions:

- debit 76 “Settlements with various debtors and creditors”, credit 91.1 “Other income” - revenue from the sale of fixed assets is accrued;

- debit 91.2 “Other expenses”, credit 68 “Calculations for VAT” - VAT is charged on the sale of fixed assets.

Cost entries for fixed assets

The costs of selling this fixed asset must also be posted on the balance sheet. These may include:

- dismantler salaries;

- funds spent on dismantling (tools, materials, etc.);

- packaging cost;

- expenses for loading and delivery, etc.

The postings will look like this:

- debit 91.2 “Other expenses”, credit 10 “Materials” (or 20 “Main production”, or 23 “Auxiliary production”, or 29 “Service production”, or other necessary) - expenses for the sale of fixed assets are written off.

Acceptance for accounting of fixed assets up to 100,000 rubles.

Let's consider the first example, where we will take into account an asset costing less than 100,000 rubles. enterprise on the general taxation system (OSNO).

Let’s say the organization Trading House “Complex” purchased an HP LaserJet Pro 500 color MFP M570dw laser color MFP for 67,956 rubles. We are faced with the task of taking this OS into account in the 1C 8.3 database.

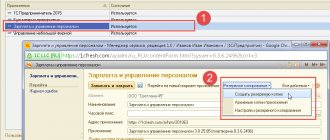

First, let’s create the document Acceptance for accounting of fixed assets: in the menu OS and intangible assets, open the section Acceptance for accounting of fixed assets:

Click the Create button:

Fill in the date of acceptance for accounting of the fixed assets; we select a financially responsible party (MOL) and the location of the property.

In the Non-current assets section, we record the method of receipt of fixed assets, select the multifunctional device from the product group, and indicate the storage warehouse:

Go to the Fixed Assets tab and click the Add button:

Select the desired OS object. If the required OS is not in the nomenclature list, then we create a new one. Fill in the name and asset accounting group by selecting the OKOF code. The depreciation group in 1C 8.3 will be filled in automatically:

Let's go to the Accounting tab: enter an account where the fixed assets and accounting procedure will be taken into account. The fixed asset has a cost of more than 40,000 rubles, so it is necessary to calculate depreciation in accounting. Check the Accrue depreciation box and indicate the accrual account. Let for this enterprise the depreciation costs of fixed assets be charged to account 20.01 - main production in a straight-line manner for 5 years:

For tax accounting, property worth 100,000 rubles. and less purchased after 01/01/2016 are taken into account as part of fixed assets and are not considered depreciable. The costs of purchasing such property are taken into account immediately as part of material costs.

On the Tax Accounting tab, in the line Procedure for including costs in expenses, select Inclusion in expenses when accepted for accounting:

We post the document and analyze its movement using the Dt/Kt button. In our case, the enterprise does not apply PBU 18/02 “Accounting for calculations of corporate income tax.” Therefore, the wiring will look like this:

- In accounting, acceptance of fixed assets for accounting – Dt 01.01/Kt 08.04;

- In tax accounting, it is also included in expenses - Dt 20.01/Kt 01.01:

If an organization applies PBU 18/02, then permanent differences in the value of an object accepted for accounting will be reflected in tax accounting entries with a minus. Thus, entries Dt 20.01/Kt 01.01 reflect the cost of fixed assets not recognized as depreciable, removed from tax accounting:

How to set depreciation parameters for accounting and tax accounting in 1C 8.2 (8.3) under OSNO, when depreciation for tax accounting is calculated according to the provisions of Chapter 25 of the Tax Code of the Russian Federation, see our video lesson:

Accounting for profit or loss from the sale of fixed assets

For a long time, the profit from the sale of fixed assets was considered to be the difference between the NSR and the residual book value, to which was added the inflation index (IRI), published by the State Statistics Committee of the Russian Federation. However, since this index is not applied to profits from the sale of assets, Goskomstat no longer publishes it.

For tax purposes, profit from the sale of fixed assets represents capital expenditure, from which the following are sequentially subtracted: the residual book value of the fixed asset and sales costs.

Sometimes it happens that the implementation of an OS is carried out to the detriment of the company.

A loss from the sale of fixed assets is recognized if the residual value, together with sales costs, exceeds the NSR, that is, the revenue received.

Such a loss cannot be taken into account on the balance sheet immediately after sale, so that its amount reduces the income tax base. The lost funds will have to be distributed in equal parts over the months that remain from the moment of the transaction until the end of the useful life of the sold OS. This is reflected in the tax register “Accounting for deferred expenses”.

Example of transactions when selling a fixed asset

Titania LLC sells equipment (machine) for the amount of 500,000 rubles. (VAT is 90,000 rubles.) Initially, the machine was listed on the balance sheet at a cost of 650,000 rubles. Depreciation was charged on it in the amount of RUB 350,000. It was necessary to spend 20,000 rubles to dismantle the machine. What notes should the accountant of Titania LLC make?

- Debit 76, credit 91.1 – 500,000 rubles. – revenue from the sale of equipment is reflected.

- Debit 51, credit 76 – 500,000 rub. – receipt of funds from the buyer of the machine.

- Debit 91-2, credit 68, subaccount “Calculations for VAT” – 90,000 rubles. — VAT calculation.

- Debit 01, subaccount “Disposal of fixed assets”, credit 01 – 650,000 rubles. — the original cost of the machine has been written off.

- Debit 02, credit 01, subaccount “Disposal of fixed assets” – 350,000 rubles. — the amount of depreciation accrued on the machine is written off.

- Debit 91-2, credit 01, subaccount “Disposal of fixed assets” – 300,000 rubles. (650,000 - 350,000) - the residual value of the machine is written off.

- Debit 91-2, credit 10 (20, 23...) – 20,000 rubles. – the costs of dismantling the machine have been written off.

- Debit 91-9, credit 99 – 90,000 rub. (500,000 – 90,000 – 300,000 – 20,000) - the profit from the sale of the machine is determined.

How to capitalize fixed assets worth more than 100,000 rubles.

Let's look at the second example.

Let’s say that the organization Trading House “Complex” under OSNO accepts for accounting a Toyota Camry passenger car for 600,000 rubles, VAT 18%.

We fill out the document Acceptance for accounting of fixed assets in the same way as the first example considered:

On the Tax Accounting tab, in the line Order of inclusion in expenses, select Accrual of depreciation. We check the Accrue depreciation checkbox and indicate the useful life of the OS - 84 months:

We post the document and analyze its movement using the Dt/Kt button. In accounting and tax accounting, the entries will have the following form: accounting for fixed assets - Dt 01.01/Kt 08.04 for the amount net of VAT - 508,474.58 rubles:

Changes

Legislative changes in the order of displaying fixed assets and business transactions with them on the balance sheet concern mainly small companies:

- Depreciation should be calculated as regularly as possible; it is important to do this at least annually. The accrual procedure must be reflected in the accounting policy.

- The company that purchased the fixed assets takes them onto its balance sheet at the NSR, to which it adds its own installation costs. The costs of transport delivery, consultations, if any, payments to intermediaries and other purchase costs can be written off immediately, without stretching them to future periods.

- If the acquired fixed assets belong to inventory (according to the classifier of fixed assets OK 013-2014), depreciation on it can be calculated immediately upon placement on the balance sheet.