Non-state targeted funding

Non-state targeted financing includes, for example:

- grants (for activities in the field of education, art, scientific research, culture, environmental protection, etc.);

- investments received during investment competitions;

- investments received from foreign investors to finance capital investments;

- funds of shareholders and investors accumulated in the accounts of the developer;

- funds received from the founders to finance certain events and pay for certain needs (for example, payment of bonuses, financing of participation in an exhibition, etc.).

1. Availability of conditions for the provision of funds. In some cases, in order to attract non-state targeted funding, an organization must fulfill certain requirements. For example, to receive a grant, an organization must submit a research project.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

2. Direction of use of funds. In order for property (including cash) to be recognized as received as part of targeted financing, its purpose must be directly stated in the agreement with the investor (see, for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated November 8, 2005 No. F04 -7853/2005(16557-A46-3)).

The Civil Code of the Russian Federation does not contain the concept of “agreement on targeted financing”. Therefore, the receipt of non-state targeted financing can be formalized by an agreement drawn up in an arbitrary manner (clauses 2 and 4 of Article 421 of the Civil Code of the Russian Federation). For example, if an organization receives targeted funds from the founder, it is possible to conclude an agreement on targeted financing (see, for example, letter of the Federal Tax Service of Russia for Moscow dated October 19, 2005 No. 20-12/75307).

General rules for postings

Targeted funds received for the implementation of certain programs are shown under the credit of the above item. She corresponds with account. 76, summarizing data on settlements with various creditors and debtors. The use of targeted financing is shown by debit. At the same time, the article in question corresponds with the account. 20 and 26. They reflect the main production and general business expenses.

Such an entry is made if the receipts are spent by a commercial organization. In the record, account 86 corresponds with account. 83 if the amounts are received as an investment. If money from the budget is sent to a commercial organization, then an account is involved in the posting. 98. Analytical accounting of targeted financing is carried out depending on the direction of spending the amounts in the context of the sources of their receipt.

Postings to reflect target financing on account 86

In general, accounting entries for account 86 in commercial organizations look like this:

- Dt76 – Kt86 – reflects the receipt of targeted funds;

- Dt86 – Kt98 – target money is reflected as prospective income;

- Dt60 – Kt51 – payment has been made to the supplier for materials or goods;

- Dt10 – Kt60 – materials or goods delivered to the receipt;

- Dt20 – Kt10 – materials are written off;

- Dt91 – Kt20 – expense account is closed;

- Dt98 – Kt91 – targeted funds are reflected in the line of other income.

Records of the movement of received amounts depend on the nature of the activity of the economic entity. Thus, non-profit organizations can directly reflect the receipt of materials by posting Dt86 - Kt20 .

Accounting

In accounting, reflect funds for targeted financing in account 86 “Targeted financing”. What kind of property the investor provides is determined by the contract (Article 421 of the Civil Code of the Russian Federation). This can be either money or material assets (for example, fixed assets, inventories).

Situation: how to determine in accounting the value of property (for example, fixed assets) acquired by an organization as a property within the framework of non-state targeted financing?

Account 86 - transactions for target financing

Many modern commercial companies, manufacturing enterprises and non-profit organizations face the challenge of targeted financing. The source of receiving targeted funds can be both government bodies and specialized funds and even individuals.

Account 86 is used to reflect such transactions. In the article we will talk in detail about what targeted financing is and how to reflect targeted funds in transactions.

Receiving funds

Debit 76 Credit 86 – reflects the debt of the financing source (investor) to provide funds within the framework of targeted financing (based on the agreement);

Debit 51 (50, 08, 10...) Credit 76 – reflects the receipt of property within the framework of targeted financing from the source of financing (investor) (based on documents related to the transfer of funds, for example, when transferring funds to the organization’s account - bank statement).

This procedure is provided for in the Instructions for the chart of accounts.

Examples of using account 86 in an organization

In reality, postings to account 86 will depend on the type of activity of the organization - commercial (profit-making) or non-commercial. Let's look at accounting for targeted financing using specific examples.

Example:

JSC Mir received funds from Zarya LLC for the purchase of construction equipment in the amount of 250,000 rubles. Also, as part of the agreement, the company is transferred construction materials in the amount of 45,000 rubles.

- Dt 76 Kt 86 — 295,000 rub. — funds have been accrued within the TF.

- Dt 51 Kt 76 - 250,000 rub. — funds are credited to the current account.

- Dt 10 Kt 76 - 45,000 rub. — construction materials were received under the CF agreement.

The procedure for writing off TF funds from the balance sheet will depend on the ultimate purpose of their allocation. If this is a commercial company, then further transactions (after the equipment has been received and put into operation) will be as follows:

- Dt 86 Kt 98 — 250,000 rub. — TF funds are taken into account as future income.

When calculating monthly depreciation, the following entries will be generated:

- Dt 20 Kt 02 — 1,000 rub. — depreciation was charged on construction equipment.

Read more about the calculation of depreciation in accounting in the article “Postings Dt 02 and Kt 02.01 (nuances).”

- Dt 98 Kt 91-1 — 1,000 rub. — TF funds are reflected in other income and expenses of the organization.

In a non-profit organization, the wiring will be different. When transferring purchased equipment to account 01 “Fixed assets”, the following entry will appear in the accounting:

- Dt 86 Kt 83 - TF funds spent on the purchase of fixed assets are taken into account on the balance sheet as part of additional capital.

IMPORTANT! According to clause 17 of PBU 6/01, non-profit organizations DO NOT charge depreciation. In accounting, depreciation, calculated using the straight-line method, accumulates in the off-balance sheet account.

Now let’s correctly write off the received building materials.

In a commercial organization, these will be the following postings:

- Dt 20 Kt 10 - 45,000 rub. — received building materials are written off as expenses.

For more information about accounting for materials, see the article “Posting debit 10 and credit 10, 60, 91 (nuances)”

- Dt 86 Kt 98 — 45,000 rub. — TF funds are included on the balance sheet as part of future income.

- Dt 98 Kt 91-1 — 45,000 rub. — TF funds are reflected as part of the company’s other income and expenses.

In a non-profit organization, materials will be written off immediately from account 86:

- Dt 86 Kt 20 - CF funds spent on the purchase of materials are written off.

Categories

Account 86 reflects information about receipts and expenditures:

- State assistance and amounts provided in a similar manner by other persons in the form of subsidies and subventions.

- Non-repayable loans.

- Amounts for events.

- Various resources.

Subventions are cash receipts intended for strictly defined purposes. If they are not realized, then the amounts must be returned. Subsidies can be either in-kind or cash payments. If they are not used for the intended purpose, they are usually not returned.

State assistance should be understood as direct actions of an economic nature aimed at increasing benefits for the enterprise. They involve issuing subsidies to the company, subventions, direct financing of certain activities, as well as providing non-repayable loans. The latter represent loan amounts from which the company is exempt from repayment if it spends them on the implementation of programs for which, in fact, they were allocated.

What does the balance show and how is account 86 closed?

The credit part of account 86 displays the amount of funds allocated to the company under the terms of targeted financing. Its debit part reflects the unused balance, which will be spent in the future or returned to the investor.

In a standard situation, when the funds received under the contract were spent on the implementation of contractual goals in full, no additional entries are required to close the account. If the funds remain, then the accountant will have to reflect their further movement:

- if the balance can be used by the company at its own discretion, then posting Dt86 - Kt90 (sales) or Dt86 - Kt91 (other income) will be required;

- if the balance must be returned to the “sponsor”, then the posting looks different - Dt86 - Kt51 (non-cash payment), Dt86 - Kt50 (cash payment), Dt86 - Kt52 (payments in foreign currency).

Saving money

Debit 86 Credit 90-1 (91-1) – reflects the savings of the recipient of targeted financing.

Debit 76 subaccount “Settlements with equity holders” Credit 90-1 – the amount of savings recognized as the developer’s remuneration is reflected in income.

This procedure is provided for by the Instructions for the chart of accounts, paragraph 7 of PBU 9/99, paragraph 3.1.1 of the Regulations approved by letter of the Ministry of Finance of Russia dated December 30, 1993 No. 160, and recommended by the Ministry of Finance of Russia in letter dated October 9, 2006 No. 07-05 -06/245.

Debit 86 (76) Credit 51 (50, 52) – the amount of savings from targeted financing was transferred to the investor.

In a number of cases, as part of the receipt and expenditure of targeted financing, a situation is possible when the recipient spends less on the provided programs than is stipulated in the agreement. In this case, two options are possible:

- the amount of savings remains with the recipient of the targeted financing;

- The recipient of targeted financing returns the resulting savings to investors.

Situation: is it necessary to reflect in income when calculating income tax the amount of savings from non-state targeted financing that remains with the recipient of the funds?

Yes need.

Targeted financing funds received on the grounds and under the conditions provided for in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation are not taken into account when calculating income tax if two conditions are met:

- the organization that receives the funds must organize separate accounting of income (expenses) received (produced) within the framework of non-state targeted financing;

- funds received must be used strictly for their intended purpose.

We suggest that you familiarize yourself with: Other settlements with creditors posting reduction

This rule follows from paragraph 1 of subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

If, as a result of carrying out targeted activities, the organization receives savings from targeted funds, which remains at its disposal, then such funds are recognized as being used for purposes other than their intended purpose. This means that they need to be included in non-operating income (clause 14 of Article 250 of the Tax Code of the Russian Federation).

This position is also shared by the Russian Ministry of Finance in letters dated April 28, 2009 No. 03-11-06/2/71, dated October 10, 2006 No. 03-11-04/2/201. Although these letters apply to organizations using the simplified tax system, they can also be used by organizations using the general taxation system (Articles 346.15, 251, 250 of the Tax Code of the Russian Federation).

Postings to account 86 using an example

Let’s say that Stromex LLC received subventions in March 2021 in the amount of:

- 1,200,000 rub. — for the purchase of production equipment;

- 2,000,000 rub. — for current expenses (targeted work according to the approved estimate).

Until the end of 2021, funds from the state budget went to:

- equipment, RUB 1,500,000, useful life 10 years;

- purchase of materials, 250,000 rubles;

- remuneration for employees involved in targeted activities, RUB 150,000;

- social insurance, 39,000 rubles;

- materials released into production (in fact), 170,000 rubles.

Table of entries for accounting for subventions in account 86:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 76 | 86 | 3 200 000 | Subventions are recognized in accounting (as approved in budget expenditures) | Targeted financing agreement |

| 51 | 76 | 3 200 000 | Subventions received are recognized in accounting | Bank statement |

| 08.04 | 60 | 1 500 000 | Equipment (cost) included | Packing list |

| 01 | 08.04 | 1 500 000 | Equipment put into operation | OS commissioning certificate |

| 86 | 98 | 1 000 000 | The amount of the subvention is recognized as part of deferred income (upon commissioning of equipment) | Targeted financing agreement, Consignment note, OS commissioning certificate |

| 20,23,25,26,44 | 02 | 12 500 | Depreciation reflected (monthly deduction) | Depreciation statement |

| 98 | 91.01 | 12 500 | Recognition of other income from the received subvention | |

| 10 | 60 | 250 000 | Materials (cost) included | Receipt order (Form No. M-4)/Act of acceptance of materials (Form No. M-7) |

| 86 | 98 | 250 000 | The amount of the subvention is recognized as part of deferred income | Targeted financing agreement, Consignment note, M-4/M-7 |

| 20,23,25,26,44 | 70 | 150 000 | Payments have been accrued to employees of Stromex LLC | Certificate-calculation/ Salary slip (form No. T-53) |

| 20,23,25,26,44 | 69 | 39 000 | Social insurance contributions (including accidents and occupational diseases) | Payroll (form T-51) |

| 86 | 98 | 189 000,00 | The amount of the subvention is recognized as part of deferred income | Targeted financing agreement, certificate of calculation, T-53 and T-51 |

| 98 | 91.01 | 189 000 | Recognition of a subvention as part of the income of the reporting period of Stromex LLC | Targeted financing agreement, certificate of calculation |

| 20,23,25,26 | 10 | 170 000 | Materials released into production (cost) are taken into account | Packing list |

| 98 | 91.01 | 170 000 | Recognition of a subvention as part of the income of the reporting period of Stromex LLC | Targeted financing agreement, Consignment note |

Add a comment Cancel reply

You must be logged in to post a comment.

Key spending areas

Targeted funding is used for:

- Paying off costs or covering losses.

- Maintaining the financial position of the company, replenishing its capital.

- Asset acquisitions.

The income category under consideration does not include:

- Help received in the form of benefits, tax credits, exemptions and holidays.

- Acceptance of loans and other repayable loans.

- Expenses on operations related to the management of state property and state participation in the company’s assets.

The indicated amounts are not included in account 86.

Insurance premiums

Situation: is it necessary to charge insurance premiums to the salaries of employees, the source of financing of which is non-state targeted funding?

Yes need.

The legislation does not link the obligation to calculate insurance premiums with sources of financing payments in favor of employees.

Insurance premiums are calculated on payments that employees receive within the framework of labor relations (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Part 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ) .

Payments that are financed from non-state targeted funding are no exception; they are subject to insurance premiums in the general manner (Article 9 of the Law of July 24, 2009 No. 212-FZ and Article 20.2 of the Law of July 24, 1998 No. 125- Federal Law).

Situation: is it necessary to withhold personal income tax from payments to employees under employment contracts (salaries), the source of financing of which is grants received by the organization?

Yes need.

Amounts received by citizens in the form of grants are excluded from the personal income tax tax base if they are provided:

- to support science and education, culture and art in Russia;

- international, foreign and (or) Russian organizations included in special lists approved by the Government of the Russian Federation (in particular, the list approved by Decree of the Government of the Russian Federation of June 28, 2008 No. 485).

This is stated in paragraph 6 of Article 217 of the Tax Code of the Russian Federation.

However, this benefit applies only to cases where the recipient of the grant is the citizen himself (personal income tax payer) (clause 6 of article 217, clause 1 of article 207 of the Tax Code of the Russian Federation).

Therefore, if the recipient of the grant is an organization, then you cannot take advantage of the benefit provided for in paragraph 6 of Article 217 of the Tax Code of the Russian Federation. This means that the organization must withhold personal income tax from payments to employees whose funding source is grants received by the organization.

The tax service adheres to a similar position (see, for example, letter of the Federal Tax Service of Russia for Moscow dated July 30, 2007 No. 28-11/072801).

Partial financing from targeted funds

Now let’s consider a situation where a fixed asset or intangible asset is acquired partly at the expense of targeted funds, and partly at the expense of one’s own. There are no special features in accounting regarding the reflection of an asset and the calculation of depreciation, so the object is accounted for and depreciated in the generally established manner, i.e., in the amount of the costs of its acquisition.

But there are still features that should be taken into account when reflecting transactions in accounting. They relate not to the formation and accounting of the cost of an object and its depreciation, but to the generation of income. In accounting, the entire “target” amount, as in the standard situation, will be credited to account 98 at the time the fixed asset or intangible asset is accepted for accounting. This amount will also be written off to account 91 gradually - as depreciation is calculated. However, the amount written off will not correspond to the amount of depreciation accrued. It will be less, and it must be calculated separately - proportionally, i.e., based on the share of “target participation”.

In this case, the proportion must also be calculated in the case when, by the time the funds are received, the object has already begun to depreciate, and the accountant divides the “target amount” into two components (one part goes to account 91, the other to account 98).

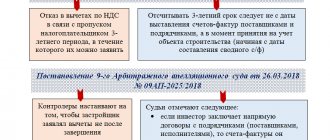

As for tax accounting, the order of reflection depends on which specific targeted funds were used to partially purchase the object. If at the expense of “taxable” earmarked funds, i.e., those that do not fall under subclause. 14 clause 1 art. 251 of the Tax Code of the Russian Federation, then everything is quite simple: the object is subject to depreciation in tax accounting. In other words, there is income, which means there is also expense (in the form of depreciation charges). In this case, the entire cost of fixed assets or intangible assets is subject to depreciation, that is, regardless of the fact that part of the object was paid for at the expense of “taxable” target amounts. This conclusion has been confirmed by departments (letters from the Ministry of Finance of the Russian Federation dated April 2, 2010 No. 03-03-06/1/222, Federal Tax Service of Russia for Moscow dated December 29, 2011 No. 16-15 / [email protected] ).

But if the targeted funds, from which the object is partially paid for, are “non-taxable”, that is, they fall under subclause. 14 clause 1 art. 251 of the Tax Code of the Russian Federation, the situation is ambiguous. In this case, it is not clear whether the provisions of sub-clause apply. 7 paragraph 2 art. 256 of the Tax Code of the Russian Federation, according to which property acquired at the expense of “non-taxable” target amounts is not subject to depreciation.

In our case, property is acquired not only at the expense of “non-taxable” target amounts, but also at the expense of our own funds. But there is no established procedure in this regard in the Tax Code of the Russian Federation.

There is only a procedure established for another situation - when property is acquired partially from budget funds of targeted financing. It is stated in paragraph. 18 clause 1 art. 257 of the Tax Code of the Russian Federation and is as follows: the initial cost of property created using budgetary funds of targeted financing is determined as the sum of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, excluding VAT and excise taxes , reduced by the amount of expenses incurred from budgetary funds of targeted financing. In fact, this means that only that part of the cost of the property that was paid from own funds will be depreciated.

We believe that this approach can also be applied in the case when part of the property is acquired at the expense of “non-taxable” target amounts specified in subparagraph. 14 clause 1 art. 251 Tax Code of the Russian Federation. Indeed, to a certain extent, the company still bears expenses (its own) when purchasing fixed assets or intangible assets.

However, the fact that para. 18 clause 1 art. 257 of the Tax Code of the Russian Federation considers the situation exclusively with “budget funds of targeted financing”, which may lead to the risk that tax authorities will not agree with the use of this approach in other cases (for example, when an object is purchased partly with grant funds, and partly with their own funds). Therefore, companies that decide to depreciate an object in such situations should be prepared to defend their position in court. There are very few such disputes in judicial practice. But those decisions that we found in situations similar to the one under consideration were made in favor of the taxpayer.

So, for example, in the decision of the Ninth Arbitration Court of Appeal dated June 29, 2007 No. 09AP-8600/2007-AK in case No. A40-22339/06-143-165, the court noted the following: “The absence of a sign of gratuitousness of the transaction excludes the possibility of applying the provisions of clause p. 7 paragraph 2 art. 256 Tax Code of the Russian Federation, pp. 6 clause 1 art. 251 of the Tax Code of the Russian Federation when determining the procedure for calculating depreciation during the operation of purchased equipment. The specified provisions of the law establish a ban on the accrual of depreciation charges on equipment received free of charge. Establishing the fact of payment (even partial) is the basis for concluding that the taxpayer has the right to charge depreciation in the generally established manner.”

Thus, in the event of litigation, the company has a chance of winning.

Conditions

Accounting for targeted financing is carried out in the following cases:

- There is reasonable confidence that the procedure for providing assistance will be followed by the enterprise.

- The company has every reason to believe that the amounts will be received.

The fulfillment of the first condition will depend on the capabilities and intentions of the company's management to use assistance. Confidence in compliance with the procedure for its provision is determined in the process of analyzing relevant public decisions, contracts, design estimates and technical and economic documents. Reasons to believe that amounts will actually be received depend on receiving reliable information about the transfer of assets, repayment of debts, notifications of appropriations, and so on.

Typical entries for accounting for designated funds

To summarize information about funds and operations for designated purposes, account 86 is used. We will consider the main operations for accounting for target financing using examples.

Targeted funding for a non-profit organization

NPO "Grace" received office equipment to automate work and simplify document flow. According to the assessment report, the market value of the received office equipment was 174,500 rubles.

In the accounting of NPO "Grace" the following entries were made to account 86:

| Dt | CT | Description | Sum | Document |

| 10 | 83 | NPO "Blagodat" received construction materials free of charge | RUB 294,800 | Transfer and Acceptance Certificate |

Income tax

Targeted financing funds received on the grounds provided for in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation should not be included in income when calculating income tax. This rule applies in particular to:

- grants allocated in favor of the organization;

- investments received during investment competitions;

- investments received from foreign investors to finance capital investments;

- funds of shareholders and investors accumulated in the accounts of the developer.

Exchange rate differences on targeted financing in foreign currency relate to income (expenses) within the framework of targeted financing and are not taken into account when calculating income tax (letter of the Ministry of Finance of Russia dated May 21, 2013 No. 03-03-06/1/17924).

At the same time, in order for the funds received to be recognized as targeted financing for the purpose of calculating income tax, a number of conditions must be met. In particular, funds from foreign investors received to finance capital investments are recognized as targeted financing only if the organization used them within one calendar year from the date of receipt (paragraph 9, subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

A complete list of funds and the conditions for their recognition as target financing when calculating income tax is given in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

In order not to take into account the received amounts of targeted financing when calculating income tax, two mandatory conditions must be met:

- the organization that receives the funds must keep separate records of income (expenses) received (produced) within the framework of non-state targeted financing;

In the absence of separate accounting, received funds are considered as subject to taxation from the date of their receipt.

This is stated in paragraph 1 of subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

Situation: how to document the maintenance of separate accounting of income (expenses) received (produced) within the framework of non-state targeted financing for the purpose of calculating income tax?

Keep separate records in independently developed registers, the forms and application of which are fixed in the accounting policy for tax purposes.

An organization that has received targeted financing is required to keep separate records of income (expenses) received (produced) within the framework of targeted financing (paragraph 1, subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

However, the legislation does not say how such accounting should be organized. Therefore, an organization has the right to develop registers for maintaining separate accounting of income (expenses) independently. It is necessary to consolidate the use of the developed forms in the accounting policy for tax purposes. This position is also confirmed by the Russian Ministry of Finance in a letter dated March 13, 2006.

Advice: when compiling registers for maintaining separate records of income (expenses) received (produced) within the framework of non-state targeted financing, you can take as a basis the ready-made forms recommended by the tax service for non-profit organizations.

The Tax Code of the Russian Federation contains a list of funds that relate to targeted financing (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

We invite you to read: Appeal regarding debt under a loan agreement

Here are some of them:

- budgetary allocations to government institutions, including in the form of subsidies to budgetary organizations;

- grants (cash or other property) that are provided on a gratuitous and irrevocable basis for the implementation of programs in the fields of education, art, culture, science, physical culture, health and the environment;

- investments provided as a result of investment competitions;

- funds received from funds to support scientific and innovative activities.

Let us note that the bulk of targeted funding is, as a rule, state aid, the accounting features of which are regulated by PBU 13/2000 “Accounting for State Aid.”

1) subventions are budget funds provided on a gratuitous and non-refundable basis for the implementation of certain targeted expenses;

2) subsidies are budget funds provided on the basis of shared financing of targeted expenses;

3) budget loans (excluding tax credits, deferments in payment of payments, etc.) are resources not only in the form of provided funds, but also in the form of other property (land plots, natural resources).

PBU 13/2000 “Accounting for state aid” is used to reflect in the accounting records received budget funds in the following areas of expenditure:

- financing of capital expenses associated with the purchase, construction or other acquisition of non-current assets (fixed assets, intangible assets);

- to cover the organization’s current expenses (purchase of inventories, remuneration of employees and other expenses of a similar nature);

- as compensation for expenses already incurred by the organization, including losses, in particular in the housing and communal services, agro-industrial complex (in terms of compensation for losses of enterprises of municipal housing and communal services, urban services, providing social facilities of municipal property with heat and energy resources (differences between tariffs for services and costs) etc.;

- to provide immediate financial support to the organization in the form of emergency assistance without connection with future expenses, etc.

As a rule, government support is provided primarily to enterprises in the agro-industrial sector.

The expenditure of targeted funds is strictly controlled by government and other regulatory authorities.

An organization reflects budget funds for accounting if the organization is confident that they have been received (this can be confirmed by a budget statement, a notice of budget allocations, limits on budget obligations, etc.) and that the conditions for the provision of these funds will be fulfilled by it, then there are funds that will be spent on certain needs (confirmation of this is the agreements concluded by the organization, publicly announced decisions, approved design and estimate documentation, etc.).

Targeted financing does not include receiving assistance in the form of benefits; obtaining loans; participation of the state in the capital of the organization.

Basic accounting entries

At the end of each reporting period, entries must be made in the accounting department of the enterprise. This simplifies the process of understanding multiple transactions and contributes to the ease of doing business. Typical entries for account 86 look like this:

- Dt 51 Kt 86. This is how cash receipts are reflected. To simplify this process, you can skip the intermediate section. 76 and start from here.

- Dt 08 (4) Kt 51. This entry indicates payment for purchased fixed assets - one of the most common areas of financing.

- Dt 01 Kt 08 (4). This entry reflects the capitalization of this resource.

- Dt 26 Kt 02. This indicates the fact of accrual of depreciation during the operation of certain objects. Only after all these records can you begin to reflect financial receipts for the intended use.

- Dt 86 Kt 91 (1). As part of such an operation, the assistance received is reflected.

- Dt 10 Kt 86. Since financial assistance can be provided not only in the form of money, but also in the form of natural elements, such an entry can be recorded.

- Dt 20 Kt 10. The chart of accounts line in question is not used in this entry. It states that the materials have been written off.

- Dt 86 Kt 91 (1). In this case, the accountant must draw up the main directions for the development of the products that have been received.

As you can see, the funds are reflected in the credit of the item listed above. There is correspondence with a large number of other summary accounts.

The values that contribute to the generalization of this account, in case of violation of the conditions for dissipation of assistance, can be withdrawn, and the investor will no longer be willing to provide any support. Therefore, any deviations and all other operations must be strictly reflected within the reporting document.

Thus, line 86 plays a special role in the accounting activities of any enterprise. It reflects the receipt of financial assistance and the directions of its expenditure. Since it is targeted, the company must monitor costs strictly according to goals.

Additional information regarding account 86 is provided below.

Reporting on the use of targeted funding

At the end of the year in which funds for targeted financing were received, the organization must submit to the tax inspectorate a Report on the intended use of property (sheet 07 of the income tax return, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600 ). That is, the specified report must be submitted as part of the annual income tax return no later than March 28 of the year following the expired one (clause 4 of Article 289 of the Tax Code of the Russian Federation). There is no need to submit Sheet 07 as part of the declaration submitted at the end of the reporting periods.

simplified tax system

Targeted financing funds received on the grounds and under the conditions provided for in subclause 14 of clause 1 of Article 251 of the Tax Code of the Russian Federation should not be included in income when calculating the single tax (subclause 1, clause 1.1, article 346.15, subclause 14, clause 1, art. 251 Tax Code of the Russian Federation). This rule applies to both organizations that pay a single tax on income and organizations that use income reduced by expenses as an object of taxation.

In this case, the organization that received targeted funding must:

- keep separate records of income (expenses) received (produced) within the framework of targeted financing;

- use the funds received strictly for their intended purpose.

In the absence of separate accounting, received funds for targeted financing must be included in income on the date of their receipt (subclause 14, clause 1, article 251, clause 1, 1.1, article 346.15 of the Tax Code of the Russian Federation).

Situation: how can an organization using the simplification organize separate accounting of income and expenses received (produced) within the framework of non-state targeted financing?

Targeted financing funds received on the grounds and under the conditions provided for in subclause 14 of clause 1 of Article 251 of the Tax Code of the Russian Federation are not taken into account as part of income when calculating the single tax (subclause 1, clause 1.1, article 346.15, subclause 14, clause 1, art. 251 Tax Code of the Russian Federation). This rule applies to both organizations that pay a single tax on income and organizations that use income reduced by expenses as an object of taxation.

We invite you to familiarize yourself with: Bank Vozrozhdenie account closure

At the same time, the organization that received targeted financing is required to keep separate records of income (expenses) received (produced) within the framework of non-state targeted financing. Otherwise, the received funds must be included in income on the date of their receipt (subclause 14, clause 1, article 251, clause 1, 1.1, article 346.15 of the Tax Code of the Russian Federation).

To maintain separate accounting of income and expenses within the framework of targeted financing, an organization can independently develop the necessary registers and approve their forms in the accounting policy for tax purposes.

Such recommendations were given in the letter of the Ministry of Finance of Russia dated March 13, 2006 No. 03-11-04/2/59.

Advice: when compiling registers for maintaining separate records of income (expenses) received (produced) within the framework of non-state targeted financing, you can take as a basis the ready-made forms that the tax service recommends for non-profit organizations (recommendations of the Ministry of Taxes of Russia).

The organization must use the funds received for targeted funding strictly for their intended purpose. If this condition is violated, the received property must be included in non-operating income on the date when the organization did not use it for its intended purpose (violated the conditions for the provision of funds) (clause 1 of Article 346.15, clause 14 of Article 250 of the Tax Code of the Russian Federation).

The benefits provided for by this subclause do not apply to targeted financing funds that are not listed in subclause 14 of clause 1 of Article 251 of the Tax Code of the Russian Federation. Such property (including cash) should be taken into account as part of income when calculating the single tax (in the absence of other benefits that exempt these amounts from taxation) (Article 346.15, paragraph 8 of Article 250 of the Tax Code of the Russian Federation).

Attention: it is necessary to distinguish between targeted financing, which is exempt from taxation under subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, from targeted revenues.

The list of targeted revenues is given in paragraph 2 of Article 251 of the Tax Code of the Russian Federation. These funds, subject to certain conditions, also may not be taken into account for tax purposes. However, these provisions apply only to non-profit organizations.

Situation: does the management organization need to include in income when calculating the single tax funds received from the owners of residential premises to finance the capital repairs of an apartment building? The organization applies simplification.

No no need.

Funds received by the management company from the owners of premises for the purpose of carrying out repairs (including capital repairs) of the common property of an apartment building are not taken into account when calculating income tax (paragraph 21, subparagraph 14, paragraph 1, article 251 of the Tax Code of the Russian Federation).

This is stated in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation and confirmed by letter of the Ministry of Finance of Russia dated February 20, 2012 No. 03-11-06/2/28.

Situation: is it possible for an organization to take into account expenses paid using non-state targeted funding (for example, staff salaries) in a simplified manner?

If the target funds received are included in the list given in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, then expenses paid from such funds cannot be taken into account when calculating the single tax.

An organization that has received targeted financing is required to keep separate records of income (expenses) received (produced) within the framework of targeted financing (subclause 1, clause 1.1, article 346.15, subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation). This condition is due to the fact that for activities financed from targeted financing, the organization does not form a tax base for a single tax.

The Ministry of Finance of Russia adheres to a similar position regarding the formation of the tax base within the framework of targeted financing in letters dated November 10, 2009 No. 03-03-06/1/739, dated February 12, 2004 No. 04-04-04/19. Despite the fact that these clarifications concern the determination of the tax base when calculating income tax, this position is also applicable when calculating the single tax under simplification.

In addition, the point of view about the impossibility of accounting for expenses paid from targeted financing is also confirmed by the tax service (see, for example, letter of the Federal Tax Service of Russia for Moscow dated June 23, 2008 No. 18-11/3/059130).

A different situation will arise if the funds received for targeted financing are not recognized as such for the purposes of calculating the single tax. In this case, the benefit provided for by subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation does not apply to them. This means that such property (including cash) must be taken into account in income when calculating the single tax (in the absence of other benefits that exempt these amounts from taxation) (Article 346.15, paragraph 8 of Article 250 of the Tax Code of the Russian Federation).

- The recipient of targeted financing returns to investors the resulting amount of savings from targeted funds.

Situation: is it necessary to reflect in income when calculating the single tax the amount of savings from non-state targeted financing that remains with the recipient of the funds? The organization that receives the funds applies a simplification.

Yes need.

This rule is contained in subparagraph 14 of paragraph 1 of Article 251 and subparagraph 1 of paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation.

If, as a result of carrying out targeted activities, the organization receives savings from targeted funds, which remains at its disposal, then such funds are recognized as being used for purposes other than their intended purpose. This means that they need to be included in non-operating income (clause 14 of article 250, clause 1 of article 346.15 of the Tax Code of the Russian Federation).

This position is also shared by the Russian Ministry of Finance in letters dated April 28, 2009 No. 03-11-06/2/71, dated October 10, 2006 No. 03-11-04/2/201.

How an 86 account is closed in a homeowners' association

Overspending on account 86 during the year.

Hello, how is this possible? Account 86 “Targeted financing” reflects funds for targeted financing (Instructions for the chart of accounts)

D 76 K 86 funds received

D 86 K 98.2 funds used.

How can you use more than what you receive?

An NPO cannot have a profit in principle, that’s why it is an NPO. It is allowed to conduct business activities to achieve the purposes for which it was created. Thus, profits, i.e. There cannot be 84 accounts at the end of the year; all funds must be accounted for in 86 (in the corresponding sub-account, since target funds are maintained separately and there is a separate sub-account for them). Something like this, correct me if I'm wrong)

A non-profit organization does not have the right to reduce income associated with the production and sale of goods, work, services, and non-operating income by the amount of expenses associated with the statutory non-profit activities of the organization.

These expenses must be covered from targeted revenues, and if they are insufficient or absent, from the profits remaining at the disposal of the organization after paying corporate income tax.

For non-profit organizations receiving targeted funding and targeted revenues, in accordance with subparagraph. 14 clause 1 and clause 2 art. 251 of the Tax Code of the Russian Federation establishes the obligation to maintain separate records of income (expenses) received (produced) within the framework of targeted financing and within the framework of targeted revenues.

Non-profit organizations: legal regulation, accounting and taxation. Elvira Mityukova

Therefore, account 86 should have subaccounts.

Here's how expert Garant explains:

According to the terms of the accounting policy of a non-profit organization, income (financial assistance, donations) is recorded according to CT account 86. Expenses (cash method) for statutory activities are written off to DT account 86. As a result of the activities of a non-profit organization at the expense of funds raised (loans), accounts receivable were formed in account 86, expenses for statutory activities exceeded revenues for statutory activities.

How to reflect excess expenses (DT account 86) in the balance sheet?

There are two opinions of experts on the issue of reflecting “overspending” in account 86 “Targeted financing”. We believe that an organization can use any of the selected methods, having approved it in its accounting policies.

In accordance with the Instructions for the application of the chart of accounts for accounting the financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions), designated funds received as sources of financing for certain activities are reflected in the account credit 86 “Targeted financing” in correspondence with account 76 “Settlements with various debtors and creditors.”

The use of targeted financing is reflected when funds from targeted financing are directed to the maintenance of a non-profit organization by debiting account 86 in correspondence with accounts 20 “Main production” or 26 “General expenses”.

On the issue of the possibility of a debit balance on account 86, there are two positions of specialists.

Some of them believe that a non-profit organization should not reflect in Form No. 6 expenses incurred in excess of the funds received (receivable) from targeted financing.

In this case, the costs reflected in accounts 20, 26 are written off to the debit of account 86 only within the limits of available target revenues.

In this case, account 86 is closed without a balance, and the expense account (account 20) has a balance as of the reporting date, which will be reflected in the balance sheet asset in the “Inventories” line. We believe that in the absence of entrepreneurial activity in this case, the estimate for the next reporting period should include funds to cover the balance on account 20.

Other experts believe that this accounting option does not provide users of financial statements with clear information about cost overruns.

At the same time, neither the Instructions nor other accounting regulations indicate the impossibility of having a debit balance on account 86.

In accordance with clause 34 of the Peculiarities of the Formation of Accounting Reports of Nonprofit Organizations (Information of the Department for Regulation of State Financial Control, Auditing, Accounting and Reporting of the Ministry of Finance of Russia dated December 24, 2007), the balances of funds by item at the beginning and end of the reporting year of the Report on the intended use of funds received ( form N 6) should be equal to the item “Targeted funds” of the corresponding columns of section III “Targeted financing” of the balance sheet.

Let us note that, according to clause 6 of the Notes to the balance sheet form, approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, the non-profit organization is referred to as Section III “Targeted Financing”. Instead of the indicators “Authorized capital (share capital, authorized capital, contributions of partners)”, “Own shares purchased from shareholders”, “Additional capital”, “Reserve capital” and “Retained earnings (uncovered loss)”, a non-profit organization includes indicators “Share fund”, “Target capital”, “Target funds”, “Fund for real estate and especially valuable movable property”, “Reserve and other target funds” (depending on the form of the non-profit organization and the sources of property formation).

Thus, a non-profit organization in the balance sheet under the item “Targeted financing” indicates the balance at the end of the reporting period in account 86.

According to paragraph 7 of the Notes to the balance sheet form, in the balance sheet form and in other forms of reports, the deductible or negative indicator is shown in parentheses.

Therefore, given that in the case under consideration the balance is debit, it should be reflected in the “Targeted financing” item in parentheses. “Overexpenditure” on account 86 is not reflected in the balance sheet asset.

In addition, this amount must also be given in parentheses and in the line “Balance of funds at the end of the reporting year” of Form No. 6.

The explanatory note to the annual reports must explain the reasons for this result.

The negative balance of funds at the end of the reporting period is transferred to the line “Balance of funds at the beginning of the reporting period” of Form No. 6 of the next year and will be covered by target revenues.

This means that there is a balance on the debit of account 86 in a non-profit organization

How to close an 86 account.

Wiring alone is unlikely to work. It depends on what kind of analytics is in account 20. There will probably be wages, depreciation, and materials. well, etc. otherwise it will turn red and something won’t close. Well, in account 86, it seems to me that you need to separate the grants in order to track whether everything was closed correctly. By the way, the OS is closed through depreciation.

If I understood the question correctly, then account 20 is closed monthly on account 86, account 86 is closed at the end of the year.

Account 86 “Targeted financing” is intended to summarize information on the movement of funds intended for the implementation of targeted activities, funds received from other organizations and individuals, budget funds, etc.

Targeted funds received as sources of financing for certain activities are reflected in the credit of account 86 “Targeted financing” in correspondence with account 76 “Settlements with various debtors and creditors.”

The use of targeted financing is reflected in the debit of account 86 “Targeted financing” in correspondence with accounts: 20 “Main production” or 26 “General expenses” - when directing funds from targeted financing for the maintenance of a non-profit organization; 83 “Additional capital” - when using targeted financing received in the form of investment funds; 98 “Future income” - when a commercial organization sends budget funds to finance expenses, etc.

Analytical accounting for account 86 “Targeted financing” is carried out according to the purpose of the targeted funds and in the context of their sources of receipt.

Here are the typical wiring for you:

Dt 76 Kt 86 Amount of targeted financing to be received Dt 08 Kt 76 The sum of the cost of fixed assets and intangible assets received as part of targeted financing Dt 10 Kt 76 Amount of the actual cost of materials received as part of targeted financing Dt 51 (50) Kt 76 Amount of funds received for targeted financing Dt 26 Kt 70 Amount of accrued wages (including allowances, additional payments and additional payments) to employees of a non-profit organization engaged in management or economic activities Dt 26 Kt 69 Amount of insurance premiums accrued on the amount of wages of employees engaged in managerial or economic activities Dt 26 Kt 10 Sum of the cost of materials used in management or economic activities Dt 26 Kt 60 Sum of the cost of work and services paid for and used in the implementation of managerial or economic activities and performed or provided by third parties Dt 20 Kt 70 Amount wages of employees directly involved in work on the implementation of specific programs Dt 20 Kt 69 Amount of accruals on the wages of employees Dt 20 Kt 10 Amount of the cost of materials used in performing work under specific programs Dt 20 Kt 60 Amount of cost of work and services of third-party organizations

The choice of write-off scheme must be determined in advance and fixed in the accounting policy of the non-profit organization Dt 86 Kt 26 For the amount of monthly write-off of general business expenses incurred in the reporting month. Dt 20 Kt 26 Dt 86 Kt 20 For the amount of expenses incurred during the implementation of funded programs or activities

I also have a non-Korchesk organization - a trade union. I charge all costs to 29 accounts. and then I close 86 accounts according to items, only not once a year, but immediately, at the time of the operation. then you can quickly see how 86 accounts are changing, how much money is still left and on what item. For convenience, I entered it at 86 hours. expense items for which I receive targeted funds. I don’t have a salary, only sports events.

How to close an 86 account.