Refunding income tax when purchasing real estate is a procedure that is complicated at first glance. Most residents of our microdistricts “Lermontovsky Park”, “Nikolskaya Sloboda” or “Novokiselevo” compensate for part of the funds spent.

Specialists of Garant-Zhile LLC tell you everything about the necessary documents, methods and terms of return.

DEADLINES FOR SUBMISSION OF DOCUMENTS AND SUBMISSION OF DECLARATION

The return to the property deduction is 13%, calculated from the value of the property, with a limit of 2,000,000 rubles, and is provided to taxpayers of the Russian Federation once. Regulated by the norms of Articles 220, 222 of the Tax Code of the Russian Federation. Tax Code of the Russian Federation Article 222. The powers of the legislative (representative) bodies of the constituent entities of the Russian Federation to establish social and property deductions provide two options for where to submit papers for deduction when purchasing your home:

- Through the local branch of the Federal Tax Service, at the registration and residence address of the owner of the purchased apartment.

- Through an employer for whom the owner works full-time, with an official execution of an employment contract.

The timing of submitting documents for a tax deduction when purchasing an apartment depends on the choice of one of the two options. In the first case, registration is carried out one year after the purchase of housing, that is, in the tax period following the purchase of the apartment. The next tax period for registering 13 percent of the purchase of an apartment closes on April 30 of the current calendar year. The list of documents for income tax refund for the purchase of an apartment must include an application from the owner and a tax return in form 3-NDFL. So, when can you apply for 13% interest when buying a home through an employer? In this case, there is no need to wait for a year to pass, and you can apply for the deduction immediately through the employer, after receiving documents from Rosreestr regarding the registration of the real estate transaction. In addition to reducing the deadline for submitting documents for a tax refund when purchasing an apartment, there is no need to fill out and submit a 3-NDFL declaration.

Receiving income:

In accordance with Art. 226 of the Tax Code, the obligation to calculate, withhold and pay the amount of tax in respect of income paid to an individual is assigned to the tax agent, usually the employer. However, in some cases, individuals need to independently calculate the amount of tax by submitting a tax return on personal income tax to the tax authority, in which the amount of tax payable to the budget is calculated. A declaration regarding income received from the sale of property owned for less than 3 years is submitted by the taxpayer no later than April 30 of the year following the year in which the relevant income was received.

2.1. Sale of property

Sale of property, for example, an apartment, house, land, car, etc., owned for less than 3 or 5 years.

Income of an individual from the sale of real estate is exempt from personal income tax if the property has been owned for more than 5 years, and for more than 3 years, provided that the ownership is registered before 2021.

The exemption conditions will remain the same for the following types of housing:

- Acquired through an inheritance agreement or gift from a close relative;

- Received as a result of privatization;

- The right of ownership that arose after the conclusion of a lifelong maintenance agreement with a dependent.

Documents required for filing a tax deduction:

- Passport (passport translation if necessary)

- TIN

- Agreement for the sale of property, shares, rooms. Car, garage, boat, etc.

- Certificate of ownership, PTS (when a car)

- Contract for the purchase of sold property (confirmed expenses)

Instead of applying a property deduction, the taxpayer has the right to reduce the amount of income received from the sale of property by actually incurred and documented expenses directly related to the acquisition of this property. In certain situations, this may be more profitable than using a property deduction.

- Receipt cash orders, sales and cash receipts, bank statements, payment orders, receipts from the seller for receipt of funds, etc.)

- Birth certificate of children (up to 14 years of age, the responsibility for paying tax is assumed by the parent or legal representative)

- Child’s passport (tax applies from the age of 14, a declaration must be filled out separately for the child)

IMPORTANT! If the taxpayer sold several pieces of property in one year, the specified limits are applied in the aggregate for all sold objects, and not for each object separately.

2.2. Rental

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Lease agreement for residential and non-residential premises

- Confirmation of payment of personal income tax of 13%, when leasing to organizations that pay tax for the lessor (certificate 2NDFL)

2.3. Agreements for the provision of services, others (with foreign companies), work abroad

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Treaty

- Confirmation of payment of personal income tax of 13%, when leasing to organizations that pay tax for the lessor (certificate 2NDFL)

2.4. Gift agreements

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Gift agreements

- Degree of relationship – birth certificate of the donor, recipient, passport, marriage certificate, etc.

2.5. In the form of various kinds of winnings

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Agreements, documents confirming winnings

- Confirmation of personal income tax payment when paying tax

2.6. Sales in authorized capital, securities

From 2021, funds received by the founder or participant of the company when reducing the authorized capital will be income subject to personal income tax. The taxpayer has the right to receive a property tax deduction not only upon the sale of a share (part thereof) in the authorized capital of the company, but also:

- upon leaving the company's membership;

- when transferring funds (property) to a company participant in the event of liquidation of the company;

- when the nominal value of a share in the authorized capital of the company decreases.

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Agreements for the sale of management companies, shares, securities, etc.

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

- Documents confirming actual expenses incurred

2.7. Income upon assignment of the right of claim

(other income during the construction of a house, apartment, during the assignment of the right of claim, before receiving ownership of the apartment, is subject to a rate of 13%)

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Treaty

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

2.8. Income from the exchange of real estate, exchange agreement

When exchanging apartments, “there is a paid transfer of ownership,” therefore this operation is recognized as a sale of property.

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Contracts of exchange, purchase and sale

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

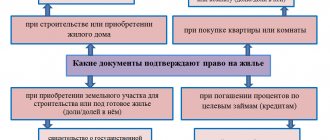

WHAT DOCUMENTS ARE NEEDED FOR A REFUND OF 13 PERCENT FROM THE PURCHASE OF AN APARTMENT?

A property transaction must undergo mandatory registration at the cadastral chamber or multifunctional center (MFC) at the location of the property. Registration is regulated by the norms of Federal Law No. 218-FZ of July 13, 2015 and Article 131 of the Civil Code of the Russian Federation. According to the indicated sources, the owner receives a package of papers for the tax refund declaration when purchasing housing, which must be presented to the Federal Tax Service. The following documents are provided to the tax office:

- A civil law agreement for the purchase and sale of an apartment certified by Rosreestr. This is the main document establishing the eligibility of individuals to receive the legal 13%.

- Certificate of ownership of the apartment issued by Rosreestr upon registration. It is allowed to certify a property transaction at a notary’s office, which has the same authority as certification by Rosreestr.

This list of documents is attached to the following:

- owner's statement;

- receipt or bank receipt for payment of money;

- the applicant's civil passport.

The entire list of papers listed must be presented in the form of originals and photocopies.

Additionally, originals are provided:

- certificates from the accounting department at the place of work in form 2-NDFL;

- completed tax return in form 3-NDFL.

Option 2. For buyers of an apartment in a building under construction for cash

The peculiarity of this purchase is that you will be able to apply for a property tax deduction only after the acceptance certificate for the transfer of the apartment is signed between the developer and you. If, for example, the house will be commissioned in 2021, then the transfer and acceptance certificate will be signed in 2021. Thus, you will be able to submit documents for a personal income tax refund only in 2021.

Accordingly, to the list of documents that must be submitted to the Federal Tax Service (see Step 1 of Option 1)), it is necessary to add such a document as the apartment acceptance certificate. And instead of a purchase and sale agreement, you enclose an agreement on participation in shared construction.

The following steps are similar to option No. 1.

PERSONAL RECEIPT OF DEDUCTION

What papers are needed to receive 13% when purchasing a home and how to apply for the benefit through the Federal Tax Service? In this case, you need to contact the Federal Tax Service office during the tax period established by law to submit a 3-NDFL declaration. Fill out a tax return and attach the list of documents listed above. The documents are submitted as an attachment to the application for the calculation of a refund of previously withheld tax. When submitting 3-NDFL, the application can be drawn up in free form and requires handwriting, with identification by a personal signature. It is also possible to register it on a standard form received from the tax authority. Mostly, inspection departments offer samples for drawing up applications.

Other documents

In some cases, additional documents may be required. For example, in order to provide a deduction to a spouse who is not the parent or guardian of the child, a statement from the mother or father of the child is required that the spouse is involved in providing for him (letter of the Ministry of Finance of Russia dated February 21, 2012 No. 03-04-05/8-209 ).

A detailed list of documents required to provide standard tax deductions in various situations is given in the table.

Situation: is it possible to provide a standard deduction for personal income tax to a disabled person if the disability is confirmed by documents of a foreign state (for example, Ukraine)?

No you can not.

In order to receive the standard deduction due to a disabled person, a citizen whose disability is confirmed by documents of a foreign state (including Ukraine) must undergo re-examination at the relevant bureau of medical and social examination of Russia. An exception is made for disabled people living in the Republic of Crimea and the city of Sevastopol. They can confirm their disability with documents drawn up in accordance with Ukrainian legislation. In Crimea and Sevastopol, such documents are used without limiting their validity period and without any additional confirmation. This follows from the provisions of Article 12 of the Law of March 21, 2014 No. 6-FKZ.

All others (including disabled people who moved from Crimea and Sevastopol to other regions of Russia) can receive standard deductions only if they have certificates in the form approved by order of the Ministry of Health and Social Development of Russia dated November 24, 2010 No. 1031n. And such a certificate is issued based on the results of a medical and social examination in accordance with the Administrative Regulations approved by Order of the Ministry of Labor of Russia dated January 29, 2014 No. 59n, and according to the Rules approved by Decree of the Government of the Russian Federation dated February 20, 2006 No. 95.

This follows from the provisions of paragraphs 2, 7, 36, 37 of the Rules approved by Decree of the Government of the Russian Federation of February 20, 2006 No. 95, paragraph 3 of Article 218 of the Tax Code of the Russian Federation, as well as from letters of the Ministry of Finance of Russia dated March 26, 2013 No. 03- 04-05/8-284, dated April 24, 2009 No. 03-04-07-01/127.

Thus, citizens whose disability is confirmed by documents of a foreign state (including Ukraine) must first undergo re-examination at the bureau of medical and social examination. Having received confirmation of disability in the Russian form, the citizen has the right to apply for a deduction.

Let us tell you that for citizens who were forced to leave the territory of Ukraine, hotlines have been opened on issues of conducting a medical and social examination. For example, in the Moscow region, such a line was opened in the Main Bureau of Medical and Social Expertise for the Moscow Region.

In addition, the Department for Disabled People of the Ministry of Labor of Russia, the Federal Bureau of Medical and Social Expertise, and the main bureau of medical and social expertise of the relevant constituent entity of the Russian Federation are obliged to ensure prompt re-examination of these citizens. Such instructions are contained in the order of the Ministry of Labor of Russia dated June 23, 2014 No. 406.

BUYING AN APARTMENT UNDER CONSTRUCTION

Let's find out what documents are needed to get a tax refund after purchasing an apartment under the DDU. If the full cost of housing has been paid under a shared participation agreement (DPA), it is permissible to issue a deduction on the basis of this agreement, but before the housing is put into operation. A payment document is considered to be a receipt for the transfer of money to the developer in the amount provided for by the DDU. The same applies to the acquisition of an apartment under an assignment of rights agreement, but here the payment document will be a receipt for the transfer of money to the assignee.

Option 3. For buyers of any type of real estate using mortgage funds

In this case, the mortgage loan agreement is added to the list of documents ( copy

). Then, when you repay the loan, in the following years of submitting documents for personal income tax refund, you must attach copies of payment documents for payment of interest.

Regardless of how much you repaid the principal debt, when taking out mortgage lending you immediately have the right to a deduction of up to 2 million rubles. from the cost of the apartment plus the amount of interest actually paid in the year for which you will file a declaration.

For example, at the beginning of 2021 you bought an apartment with a mortgage for 2,500 thousand rubles and have already paid interest on the loan in the amount of 60 thousand rubles in 2021. Then for 2021 you have the right to a deduction in the amount of 2060 thousand rubles. (“maximum” 2 million rubles + 60 thousand rubles amount of interest). Then, every year you can apply for a deduction from the amount of interest paid on the mortgage until the amount of interest reaches 3 million rubles.

So, these are the main steps to get your legal personal income tax back.

Good luck to you in this useful endeavor! And if you have more questions, you can probably find the answer to them here.

ARE DOCUMENTS AND APPLICATIONS REQUIRED?

The application must be certified by the personal signature of the owner. No other identification is required. The submitted application is certified by the authorized person responsible for completing the procedure - the head of the Federal Tax Service department or the employer, after which it comes into legal force. The purchase and sale agreement is certified by a notary or Rosreestr. A receipt for receipt of money is signed by the parties to the agreement and can be certified by a notary. A tax certificate from the accounting department in form 2-NDFL is an official document. It must be signed by the chief accountant and the head of the organization. Certificates from the guardianship authorities are certified by the head of the local branch. The remaining necessary papers for processing a tax deduction when purchasing an apartment, submitted in the form of photocopies, are certified directly upon acceptance by the tax inspector, while simultaneously submitting their originals.

Documents for the child

Provide the standard child tax deduction after you receive a copy of the child’s birth certificate from the employee. If the child lives or was born abroad, then provide the deduction on the basis of documents certified by the competent authorities of that state. To accept a document issued in a foreign country for accounting, it must be translated line by line. To do this, the employee can contact a translator. There is no need to certify such documents with an apostille.

Typically, deductions are provided for children under 18 years of age. An exception is provided only for children under the age of 24 who are studying full-time at an educational institution. Parents are also entitled to a deduction for such adult children. To confirm the right to a deduction, ask the employee for a certificate from the place of education of his child. If a child studies abroad, the certificate of education must be translated into Russian.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated October 27, 2011 No. 03-04-06/8-289.