General rules for filing a declaration

As Article 174 of the Tax Code shows, the declaration is submitted after the expiration of the reporting period, no later than the 25th day of the month following it.

If this date falls on a weekend (or holiday), the last day of delivery is transferred to the next working day following it.

Regarding the location, the completed form must be submitted to the tax office where the taxpayer is registered.

As the step-by-step instructions for filling out a VAT return show, the form reflects the following information:

- objects of taxation;

- expenses incurred in the reporting period and income received;

- sources of funds;

- the tax base;

- available tax benefits;

- calculated tax contribution;

- other information affecting the calculation and payment of tax.

In 2021, the declaration will be submitted electronically.

Until the end of 2013, enterprises whose average number of employees did not exceed 100 people could prepare a document in printed form.

From January 1, 2014, this procedure was changed. Now the declaration is submitted electronically, regardless of the number of employees.

Important: taxpayers can also submit documents attached to the declaration electronically.

VAT return for the 3rd quarter of 2021: responsibility for failure to submit

The liability of companies and individual entrepreneurs for late submission of the reporting form or complete disregard of their legislative obligations is established by Art. 119 of the Tax Code of the Russian Federation. They are subject to a fine of 5% of the quarterly budget obligation for each month (full or partial) of delay. The minimum sanction is 1 thousand rubles, the maximum is 30% of the total tax.

To avoid sanctions from regulatory authorities, you need to:

- Submit reports electronically on time.

- If it is discovered that the VAT return form for the 3rd quarter of 2017 contains errors that underestimate the amount of the budget obligation, submit the updated version. It is advisable to do this before the deadline for submitting the initial report.

- If an erroneous tax calculation (downward) is detected, independently transfer the arrears and penalties to the budget.

In addition to imposing a fine, the Federal Tax Service may use another, more effective method - blocking the accounts of a company or individual entrepreneur in servicing banks. The control authority has the right to resort to such a measure 10 days after the expiration of the “deadline” for submitting the document.

VAT declaration for the 3rd quarter of 2021: deadlines, submission procedure and filling out rules are regulated by current legislation. In order to avoid problems with regulatory authorities, you need to comply with existing requirements and not ignore your responsibilities as a taxpayer.

Who is required to submit a declaration

Not all entrepreneurs and organizations are required by law to file a VAT return.

The following lists the tax payers for whom this requirement is relevant.

- IP on OSNO.

- LLC on OSNO.

- Individual entrepreneur on the simplified tax system and UTII when importing products from abroad, when operating in the form of a simple partnership or when issuing an invoice to the consumer with the specified VAT.

The following entrepreneurs and organizations do not pay VAT:

- IP on the simplified tax system.

- IP on UTII.

- IP on Unified Agricultural Sciences.

- IP on PSN.

- Individual entrepreneurs and LLCs on OSNO in the case when their turnover for three months was less than two million rubles. Then they may not remit VAT, but they must notify the tax office in advance.

There is a single simplified declaration. It is provided for cases when, as a result of business activities, the balance of bank accounts does not change, and there are no objects of VAT taxation.

This simplified version is filled out on paper. The requirement to submit a declaration in electronic format does not apply to these cases.

How to check the declaration

Before sending the completed declaration to the Federal Tax Service, you need to check that it is filled out correctly. This can be done using the “Control ratios of declaration indicators”, published in the letter of the Federal Tax Service of the Russian Federation dated 04/06/2017 No. SD-4-3/6467. The ratios are checked not only within the VAT return, but are compared with indicators of other reporting forms and financial statements.

If any control ratio for VAT is violated, the declaration will not pass a desk audit, the tax authorities will consider this an error and send a request for appropriate explanations within 5 days. Taxpayers are required to submit explanations, as well as the declaration, in electronic form according to the TKS (clause 3 of Article 88 of the Tax Code of the Russian Federation). Electronic formats for such explanations were approved by order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/682.

About document structure

Step-by-step instructions for filling out a VAT return show that the entire document consists of 12 sections.

When all the columns are filled out correctly and all the papers required by law are attached, the tax office does not have the right to refuse the taxpayer to accept the reports.

Below is a brief summary of the form.

- Title page. To be completed by all taxpayers.

- Section 1 is also intended for everyone, including those taxpayers who are exempt from VAT, but issued invoices with the indicated tax amount. Such entrepreneurs should submit a document with a completed title page and first section.

- Section 2 is intended to be completed by tax agents.

- Sections 3 to 6 are completed by the taxpayer or agent only in cases where relevant transactions were carried out during the reporting quarter.

- Section 7 contains information about a number of operations. Among them are transactions that are not subject to taxation, related to the sale of products or services in a place outside the territory of the Russian Federation, consisting of receiving an advance or payment for the future supply of goods or provision of services, the preparation of which takes more than 6 months.

- Section 8 specifies tax deductions relating to past reporting periods.

- Section 9 contains information from the sales ledger and accompanying sheets.

- Sections 10, 11 include data entered into the invoice journal in the field of intermediation.

- Section 12 is completed by taxpayers for whom VAT is not provided, but they issued an invoice indicating the tax.

Above is a summary of the declaration by section.

In order to correctly fill out the document in 2021, it is worth understanding all the details of filling it out.

Differences from old forms

In addition to the changes, the new document contains a number of innovations. Taking into account the additions, the VAT declaration form for the 4th quarter of 2017 has the following structure:

- Chapter No. 3 concerns the calculation of taxes required to be paid to local budgets; has a separate application to reflect the amounts of paid and recovered taxes;

- Section 4 shows the procedure for calculating taxes on goods with a zero VAT rate;

- Section 6 reflects the procedure for calculating taxes on goods that do not have documentary grounds for zero rates;

- In section 8, page 00309127 appeared to reflect transactions of the previous period;

- Page 00309858 (9th section). To settle the sales ledger data for the expired period;

- Page 00309196. Reference information on transactions recorded in the sales book of the previous period;

- Appendix No. 1 with the order of operation codes.

- Appendix No. 2 to the Order on filling out VAT forms.

The number of sections in the new form is the same as in the old version - 12. As before, the title page and section No. 1 are mandatory for VAT payers. Sections 2-12 are optional if there have been no transactions under the relevant items.

Since VAT returns are accepted electronically, it is difficult for accountants to fill out sections selectively. Guided by this point of view, representatives of the tax authorities recommend submitting the declaration in full. Lines for which the company did not carry out transactions are left blank.

What data is included in the first section?

The initial section of the return is intended to calculate the total tax amount.

- OKTMO is entered in the line with code 010.

- Under number 020 is placed the KBK for VAT (by analogy with the KBK for the simplified tax system) for that part of services and goods that are sold on the territory of the Russian Federation.

- Under number 030, the amount of the VAT contribution is entered; it does not appear in the third section of the report, and is not shown in subsequent lines of the current section.

- Under numbers 040 and 050, the results for sections 3 to 6 are entered. If there is no tax base, dashes are placed in these lines.

Next there are numbers 060-080. They are issued if the code “227” appears on the title page in the line with the location of the accounting. Otherwise, leave a dash.

Changes to the form

One of the main innovations is the introduction of new 16-digit codes. They will have to be taken into account when drawing up the report. The changes affected the following lines:

- 041 and 042. Transactions with goods subject to VAT during customs procedures (Article 151 of the Tax Code of the Russian Federation);

- Here it is necessary to record expenses in favor of the capital plans account;

- 090 and 060. You can find out more about them if you download the VAT return for the 4th quarter of 2017;

- 070 and 010 from the 6th section. The need to reflect information in them is eliminated.

Information on the third section

In the third section of the declaration, the tax contribution is calculated at rates of 10% and 18%, and tax deductions are indicated.

Lines numbered 010 to 040, columns 3 and 5, describe transactions for the sale of services and the supply of goods subject to VAT.

Line 050 contains information about operations related to the functioning of the object as a property complex.

Line 060 is intended for entering data on construction and installation work carried out, provided for the enterprise itself.

This information is entered only if this type of work was performed in a specific tax period.

Under number 070, information is entered about the tax base and the amount of tax on the amount received as an advance payment or advance for goods or services.

The VAT return shows both the prepayment and subsequent transactions for this payment.

The amount of tax that is taken from this advance is entered in the appropriate field.

Line 080 contains information about the amounts that make up the tax base and on which VAT is calculated.

These are transactions that accompany settlements for payment for services or goods provided.

This includes payments such as fines, late fees and similar charges.

Lines 090-110 contain detailed information about VAT charges that should be restored in the current tax period.

- Under number 090, enter the amount to be restored.

- Number 100 shows the contribution in the case where the amount for deduction was accepted for products or services that are subsequently exported.

- Number 110 shows transactions when a tax deduction was calculated for fixed assets, intangible assets or rights that become a contribution to the authorized capital of a third-party organization.

Line 120 contains the total tax amount, which includes the contribution for transactions for the sale of products and services and the amount of the restored tax.

VAT declaration 2017: filling out the required sections

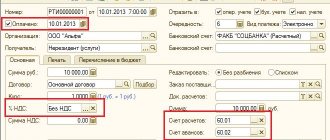

The VAT declaration is filled out based on the following documents:

- Purchase books and sales books,

- Invoices from VAT evaders,

- Invoice journal (intermediaries),

- Accounting registers and tax registers.

The title page of the declaration is quite standard. It contains information about the organization/individual entrepreneur:

- TIN and checkpoint,

- Adjustment number – “0” for the primary declaration, “1”, “2”, etc. for subsequent clarifications,

- Tax period code, according to Appendix No. 3 to the Filling Out Procedure, and year,

- Code of the Federal Tax Service where reports are submitted,

- Name/full name VAT payer, as indicated in the company’s charter, or in the individual’s passport,

- OKVED code, as in the extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs,

- Number of pages of the declaration and attached documents,

- Contact details, signature of the manager/individual entrepreneur.

Section 1 of the VAT return, which is mandatory for everyone, reflects the amount of tax to be paid or reimbursed from the budget. The data is entered into it after calculating the results in other necessary sections of the declaration, and includes:

- Territory code according to OKTMO - it can be found in the territory classifier, or on the websites of Rosstat and the Federal Tax Service;

- KBK, relevant for this period,

- Lines 030-040 reflect the total amount of tax payable, and line 050 - the amount to be reimbursed,

- Lines 060-080 are filled in if the code “227” is indicated in the “At location” line of the title page.

The title page with section 1 is submitted to the Federal Tax Service and in the case where there are no indicators to be reflected in sections 2-12 of the declaration, such VAT reporting will be “zero”.

About tax deductions in section 3

The next part of Section 3 contains information on tax deductions.

Line 130 includes the total amount of tax deductions related to the reporting period.

It should be checked against the final line in the purchase book - the indicators must match.

The invoices on the basis of which the tax base is calculated are indicated there.

Under number 150, VAT amounts are transferred, which are calculated from the advance payment.

This requires documents - contracts and invoices that record the transfer of funds.

Only advances received by bank transfer are taken into account.

Not all taxpayers take tax deductions from prepaid funds. In such a situation, a dash is placed in the line.

Number 160 includes deductions made for VAT, which are levied on construction and installation work for the needs of the enterprise.

The same amount is entered here as in line 060 of the fifth column of the same section.

Information on deductions that are calculated when importing products into the territory of the Russian Federation is reflected in lines 170-190.

- 170 – the total VAT contribution paid during the import of goods into the territory of the Russian Federation.

- 180, 190 – explanations to line 170, number 190 reflects the amount of tax paid when importing products from Belarus and Kazakhstan.

Next comes line 200 with the VAT contribution, accrued on prepayment and accepted for deduction when sending products.

Line 210 indicates the actual amount of VAT transferred.

Lines 220 to 240 serve to summarize. 220 indicates the total amount to be paid.

If the final deduction does not exceed the tax on sales transactions and the contribution subject to restoration, the indicator is entered in line 230.

If, on the contrary, this amount is less, the result is entered in line 240 - this is the amount to be reimbursed.

Procedure for issuing an invoice

From the second half of 2021, a goods traceability system will be in place, which was created to legalize the circulation of goods in the EAEU. Such a system will help prevent the entry of counterfeit products into the Russian market and will contribute to the growth of the competitiveness of domestically produced goods.

The Government of the Russian Federation will develop a list of goods that will participate in the traceability system, as well as the procedure for providing the necessary information to the Federal Tax Service.

What's in Sections 4-9

Sections four to six must be completed only if transactions subject to a zero rate were carried out during the reporting period.

Section 7 is completed if during the reporting period transactions were concluded that are not subject to VAT.

The second case is when an advance payment was made for the supply of goods from the list approved by the Government of the Russian Federation (Resolution No. 468 of July 28, 2006).

Section 8 contains information from the purchase book and accepted invoices, the deduction for which relates to the reporting period.

Section 9 records information from the sales ledger and issued invoices.

Benefits for the IT industry

Starting from January 2021, transactions related to the sale and transfer of exclusive rights to computer programs and databases from the Unified Register are exempt from VAT (see VAT for IT companies for more details).

The following cases are exceptions:

- distribution of advertising information on the Internet

- publication on the Internet of commercial offers for the purchase and sale of goods, services, property rights

- searching for information about possible participants in a purchase and sale transaction

According to the new rules, transactions for the purchase of foreign computer programs are always subject to VAT .

Please note that only IT companies that meet the following conditions can apply for benefits:

- More than 90% of revenue comes from software production

- the company is included in the Register of Domestic Software

Latest changes

VAT rate

A large number of organizations will be able to pay VAT at a rate of 10%.

Companies selling periodicals (magazines, newsletters, collections, etc.) pay a 10% tax, with the exception of advertising publications in which advertising constitutes more than 45% of the volume of one issue. Previously, this criterion was equal to 40% (clause 2 of Article 165 of the Tax Code). From 2021, long-distance passenger and baggage transportation across Russia by rail is subject to a 0% VAT rate (referring to paragraph 1 of Article 164, paragraph 5.3 of Article 165 of the Tax Code). Previously they were taxed at a rate of 10% . To confirm the zero rate, carriers must submit to the inspection the data from the register of unified transportation documents, indicating:

- transportation document numbers;

- destinations and departure points;

- dates of service provision;

- the cost of such services.

If company employees went on a business trip by train in 2021, but the ticket was purchased in 2021, the carrier allocated VAT at a rate of 10%.

The Tax Service takes the position that in this case the company can exercise the right to claim a deduction.

Explanations in electronic form

From 2021, organizations that report electronically must provide explanations in the same form upon request (in accordance with paragraph 3 of Article 88 of the Tax Code).

The tax service may send a notification to provide explanations on reporting in connection with:

- an updated declaration, the result of which was a reduction in tax payable;

- errors or discrepancies in the declaration.

In most cases, explanations on paper are automatically considered not provided. However, there are a number of exceptions:

- the tax service has not approved the format of the electronic response;

- the organization received a request for clarification in December 2021, and the response deadline is 2017;

- The inspection requested clarification on VAT benefits.

For ignoring the request for explanations or untimely submission of them, the inspection has the right to impose penalties (clause 1 of Article 129.1 of the Tax Code). The fine for the first violation is 5,000 rubles, for repeated and subsequent violations - 20,000 rubles.

Other VAT changes

- An organization cannot charge VAT on remuneration for issuing a guarantee or surety.

Previously, this was subject to VAT, but since during court proceedings organizations proved that the guarantor did not provide any services, by decision of the Ministry of Finance such transactions have not been subject to taxation since 2017.

- It is necessary to restore VAT if the organization received subsidies.

Previously, companies restored the tax if the costs of purchasing goods were reimbursed from the state budget. Since 2017, when receiving local and regional subsidies, it is also necessary to pay the tax that the organization set for deduction earlier.

- Companies and individual entrepreneurs purchasing electronic services from foreign companies pay VAT as tax agents.

These will also be intermediaries who conduct settlements with customers on the basis of an agreement with a foreign company for the purchase of services related to online advertising, provision of access to databases, hosting, access to mobile applications, etc. For each payment, the customer must withhold VAT at a rate of 18/118.

- Fewer controlled transactions.

Providing guarantees and interest-free loans to Russian organizations is no longer a controlled matter; there is no need to report them to the tax office. At the same time, inspectors do not have the right to check whether their contract prices correspond to market prices.

- Inspectors have the right to fine an individual who fails to report real estate and vehicles for which tax notices were not received.

The penalty amount is 20% of the unpaid tax on time. Such property must be reported in writing by December 31 of the year following the expired tax period.

Changes since July 2017

From July 1, a small company can exercise the right to refund VAT until the end of the desk audit (clauses and subclauses 2, 4 of Article 176.1 of the Tax Code).

To do this, it is necessary to submit a guarantee agreement with a Russian company that:

- not being liquidated or reorganized, not on the verge of bankruptcy;

- paid more than 7 billion rubles in taxes, including excise taxes, over 3 years;

- has no debts on taxes, fines and penalties;

- has guarantee obligations of no more than 20% of assets.

The guarantee agreement must expire no earlier than 10 months after the organization submits the return.

From October 2021, the penalty for late tax payment for more than one month will increase. From 1 to 30 days the penalty is calculated based on the rate of 1/300, and from 31 days at the rate of 1/150. The penalty will not increase for individuals and individual entrepreneurs.

You can download transaction codes relevant for 2021 here.

tax return for 2021 can be found here.