Violation of tax laws leads to fines and penalties. You can receive a sanction for underestimating the taxable base or late submission of declarations. If payment is not made, penalties will be calculated automatically. Fines and penalties according to 1C 8.3 are calculated manually. There are no separate templates created for them. You can make them yourself. It is important to correctly select the account to which fines and penalties will be transferred and make entries in the process of accruing them. Thus, a fine for violating the provisions of tax legislation can be classified as tax sanctions. They do not reduce the amount of taxable profit.

Fine: essence and types

Definition 1

A fine is a monetary penalty that is imposed on an organization due to a violation of a contract or legal requirements. The monetary penalty can be expressed either as a percentage or as a lump sum.

Types of fines:

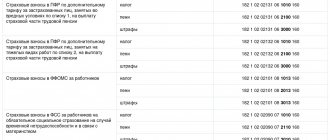

- The tax penalty is displayed in the account: Dt 99 “Profits and losses” Kt 68 “Calculations for taxes and fees”;

- Fine for violation of contractual terms - Dt 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims” - Kt 91 “Other income and expenses”

- Administrative fine – Dt 91 Kt 76

- Payment of administrative bills - DT 76 - Kt 50 “Cash”, 51 “Cash accounts”, etc.

Note 1

Fines are accepted for accounting purposes in the amounts that were awarded by the court during the period when the decision on their collection was made.

Finished works on a similar topic

- Course work Posting fines in 1C 400 rubles.

- Abstract Posting fines in 1C 240 rub.

- Test work Posting fines in 1C 200 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

Insurance premiums accrued posting

Contents Do you want me to challenge the weight of your legal nonsense.

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law.

Administrative fine 1998: 50 rubles.

In 2014, for the same act, a fine of 5,000 rubles. That is, the state, while punishing me, does not want to admit its mistakes. The ruble depreciated. The National Bank of Russia and the country's top leaders are to blame. I have the right to pay 50 rubles, and let the National Bank of Russia pay the rest, as a tortfeasor.

4950 rubles. In court they wanted to apply a refinancing rate to me.

I began to figure out what kind of nonsense this was. It turns out that the reference rate is the inflation rate.

That is, the culprit of inflation is the National Bank of Russia, if your money depreciates, what does that have to do with you.

Legality of levying penalties. Penalty is considered a penalty for failure to fulfill obligations. If you fail to repay the loan on time, a penalty will be imposed.

But again the problem is to impose punishment, and neither the bank nor the pension fund has the right to impose a fine.

Only the court can impose punishment. And neither the pension fund nor the bank has the right to act as a court. The authorities are simply fooling the population with these pension savings.

There is no problem proving it. Information on the amount of debt, the amount of penalties and fines that were accrued on the day the request was sent. In connection with this, the Pension Fund considered that it is enough to indicate only the amount of penalties in the request. Law 212-FZ does not disclose what is meant by detailed data. The fines are not significant; it is better to go to the Pension Fund now and offer to pay off the debts on contributions.

You can agree on an installment plan. And if you wait until the trial, you will also have to pay court costs and communicate with the bailiffs. And this is another story... To calculate penalties, you need to indicate the amount of debt and two dates, the established deadline for paying the tax and the date of repayment of the arrears. For the period from the date of payment of insurance contributions to the Pension Fund to 04/30/14, I accrued penalties according to the simplified tax system, considering that we have arrears according to The simplified tax system for the amount paid in... If possible, it is better to pay off the debt.

The local branch of the Pension Fund of Russia can take the case to court and bailiffs will deal with the debts. They already have their own penalties. Why do you also need to feed the bailiffs?

There are not only fines but also pension contributions. 17600 for each year and now from this new year 36 thousand per year + penalties. There will be no fines, only a small amount of penalties. Calculate it yourself.

As for registration with the Pension Fund of Russia, when registering an individual entrepreneur with the tax office, everything else is done automatically. You simply have not received the registration certificate, which you can obtain from the Pension Fund.

Maxim, you cannot offset fines, penalties and debt for 2010 and 2011 to reduce the 2012 tax. You just need to pay off the contributions and penalties.

The Pension Fund itself, after paying contributions and penalties, must inform the bank about the repayment of the debt. In total, fixed payments for 2011 need to be paid 16,159.56 rubles. The Pension Fund pays RUB 13,509.60. , If you were born in 1967 and younger, then contributions to the Pension Fund for the insurance part will be 10,392 rubles (4,330 (this is the minimum wage) x 20% x 12 months), for accumulated.

part 3117.60 (4330x6%x12). In the event that you are older than 1967. , then the entire amount is paid for the insurance part in the FFOMS - 1610.76 rubles (4330x3.1%x12 months), TFOMS - 1039.20 (4330x2%x12 months) In your case, you need to multiply the amounts not by 12 months, but by 5 months ( from August) Posting debt to the Pension Fund.

Reflection of an administrative fine in the program

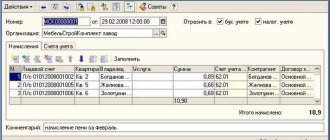

A fine can be entered into the 1C program as follows. Go to the “Operations” menu and select the “Operations entered manually” view. Click on the “Create” button and a form will open for you to fill out. You need to enter information about the name, date of the document, correspondence of accounts (debit and credit of accounts), the amount of the transaction and subaccount. Debit subconto is the counterparty, credit subconto is an item of other income and expenses from the directory “Directory of Items of Income and Expenses”. In this directory, select the article “Fines, penalties and penalties for receipt (payment)”. The amount of the fine is indicated in the document “Receipt to the current account” indicating the type of transaction “Other receipt”. Now you can post the document and the 1C program will display the transactions.

The operation for accounting for a fine is carried out through the operation “Operation entered manually”, but when filling out changes in the corresponding account and analytics appear. The changes occur due to the fact that fines and penalties are accepted for tax accounting. Therefore, the amount when posting a document will be reflected in both accounting and tax accounting.

Do you need to select scientific articles for your academic work? Specify a topic and receive a response in 15 minutes get help

As in “1C: Accounting 8” edition 3

Please note that from 01/01/2021 the value of the refinancing rate is equal to the value of the key rate of the Bank of Russia (Information of the Central Bank of the Russian Federation dated 12/11/2021). The independent value of the refinancing rate is not established from 01/01/2021.

- Tax penalties payable to the budget are reflected in the same manner as sanctions for non-compliance with tax legislation, that is, they are reflected in the debit of account 99 in correspondence with account 68 (see Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations , approved by order of the Ministry of Finance of Russia dated October 31, 2021 No. 94n; clause 83 of the Regulations on accounting and financial reporting, approved by order of the Ministry of Finance of Russia dated July 29, 2021 No. 34n).

- Penalties are a way of ensuring the fulfillment of the obligation to pay taxes and fees and are not a tax sanction (clause 1 of Article 75, clauses 1, 2 of Article 114 of the Tax Code of the Russian Federation). The amounts of penalties accrued by the organization in connection with incomplete payment of tax on time satisfy the definition of expense given in paragraph 2 of PBU 10/99, approved. by order of the Ministry of Finance of Russia dated 05/06/2021 No. 33n. Accrued penalties are reflected in the debit of account 91.2, in correspondence with account 68.

Payment of the penalty

You can enter information about paying a fine into the 1C program using the “Receipt of Goods” document. When creating a document, select the type of transaction “Write-off from current account”. In the open window, fill in the information about the date, number, contract, DDS article. Post the document. Now you can generate a document for payment of penalties. This payment can be made in the “Bank and cash desk” menu, in the “Bank” section, “Bank statements” item. When you click on the “Bank Statements” hyperlink, click on the “Write-off” button and fill out the document “Write-off from the current account” indicating the type of transaction “Payment to the supplier.” You also need to fill out information about the date, recipient, amount of the fine, agreement and settlement account 76.02.

How to additionally charge insurance premiums for the previous period

Contents Important

In other words, if in the period for which additional insurance premiums are calculated, the tax base for the income tax was unprofitable and the tax was not paid at all, then paragraph 1 of Article 54 of the Tax Code of the Russian Federation cannot be applied.

In this situation, you need to submit an updated tax return for the previous period with the amount of expenses increased by additional accrued insurance premiums. If last year the tax base for income tax was positive and the amount of tax was paid to the budget, then an updated declaration may not be submitted, but an additional assessment may be taken into account in the current year when the audit report was drawn up (or the organization independently identified an error in the calculation of insurance premiums) . At the same time, in the letter of the Federal Tax Service of Russia dated August 17, 2011 No. AS-4-3/13421, a different approach was voiced.

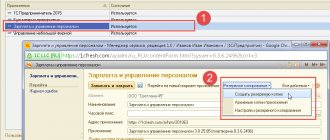

Figure 38 In the second quarter, the organization calculated contributions at this “preferential” tariff and submitted the corresponding reports, while it did not have the right to apply such a tariff. Figure 39 This error was discovered in the third quarter. The corresponding changes are made to the accounting parameters settings - the correct tariff is indicated

“Organizations using the simplified tax system, except for those specified in paragraph 8 of part 1 of article 58 of the Federal Law of July 24, 2009 No. 212-FZ”

, valid since April.

The date when changes were recorded is the date when the error was actually detected. Figure 40 During the next calculation of insurance premiums in July, additional charges for previous periods are made. Figure 41 When generating reports for the 3rd quarter, the recalculation amount will be taken into account in section 4, and also section 2.1 will be additionally formed with the “old” tariff code 07 and filled in indicators “from the beginning of the billing period”.

And the values in completed line 120 in RSV-1 must be equal to the corresponding values in the “Total” line in section 4.

Separately, line 121 indicates contributions to compulsory pension insurance, additionally accrued from payments after exceeding the maximum base value.

How to fill out section 6.6 of RSV-1 Additional accrued amounts of contributions must be reflected not only in section 4 and in line 120 of section 1, but also in sections 6, which are issued separately for each employee. After all, additional charges appeared due to unaccounted payments in favor of specific individuals. Info

This means that unreliable personalized information was also provided on them previously.

We recommend reading: Is a person retiring entitled to 3t of salary?

In this regard, in the calculation of DAM-1, corrective section 6 must be drawn up. In it, in subsection 6.3, the type of adjustment is noted - “corrective” and subsection 6.6 is filled in, which indicates the directly accrued amounts of contributions from payments of this individual (clause 35 of the Procedure for filling out DAM -1).

Since not all operations can be performed with the current date. Some difficulties may arise when making additional charges in 1C 8.2, since there are some peculiarities in performing this operation. What period to take into account? The tax period for contributions to extra-budgetary funds is recognized as one calendar year.

Calculation of penalties for taxes

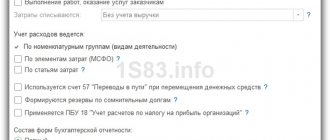

Tax penalties are calculated in the 1C program using the “Other income and expenses” directory element. For business contracts, fines are taken into account in income and expenses to determine the tax base when calculating income tax. Make sure that the “Accepted for tax accounting” checkbox is checked in the directory element.

Fines to government agencies (fines for taxes, for violating traffic rules, etc.) are not accepted in tax accounting. Therefore, the best solution is to create two different elements of the “Other income and expenses” directory. And now for each fine you will choose the appropriate one.

After selecting a directory element, you need to pay the debt to the supplier and the amount of the fine. To do this, you can generate a document “Write-off from the current account” and upload documents from the bank, or you can open the “Purchases” menu, the “Receipts (acts, invoices)” section and find the “Purchases” document.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Reporting when using the simplified tax system

Any business transaction must be reflected by posting. Accounting for different types of taxes in account 68 occurs in accordance with subaccounts. The list of such must be specified in the accounting policy. Account 68 itself can be divided into subaccounts:

However, commercial units are not exempt from preparing primary documentation. In practice, this means that it is mandatory to keep records of intangible assets and fixed assets. Accounting is necessary solely to determine the possibility of applying the simplified tax system. That is, the right to use this regime is lost as soon as the amount of fixed assets and assets exceeds a total of 100 million rubles. Accounting also becomes mandatory in the case of combining regimes, for example, UTII and “simplified”.