In almost every organization, at least once an accountant had to send an employee on a business trip. In this article we will look at how to arrange a business trip in 1C 8.3 Accounting.

You will learn:

- Is it possible to make a business trip order in 1C 8.3 Accounting;

- how to post travel expenses in 1C 8.3;

- how to calculate daily allowances and travel allowances in 1C 8.3 Accounting.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Ticket accounting in 1C

Let's start with the main news - now a special accounting account 76.14 “Purchase of tickets for business trips” has been created in 1C. Those of you who have already worked with Smartway are familiar with this tool, since it was to this account that tickets were transferred from Smartway, so that they did not need to be entered into expense reports manually.

Now (starting with version 3.0.81 of 1C: Accounting 8), all 1C users can:

- independently enter tickets purchased from different agents into the accounting system;

- carry out transactions with tickets (exchange, additional payment, refund);

- reflect travel expenses in the advance report.

To account for a trip, an accountant needs tickets, and in the case of air travel, boarding passes.

Separately, e-tickets . This is a document used to certify a contract for the carriage of a passenger, in which information about the carriage of passengers and baggage is presented in electronic digital form. It can also be printed on paper.

A boarding pass is a document issued on the basis of a passenger's check-in for a flight, which is required to confirm the fact of the flight. Order No. 7 of the Ministry of Transport of Russia dated January 14, 2019 allowed the use of not only paper, but also electronic versions of the coupon.

It is not uncommon for employees to lose their boarding passes. In this case, you will have to order a certificate from the carrier to confirm the fact of the business trip. Smartway has the ability to issue such a certificate directly through the service.

Payment rates

The seconded group can also report expenses upon arrival at their current workplaces. That is, they provide reporting documents and the accountant makes calculations based on them. All amounts spent must be documented, otherwise they are not subject to reimbursement. However, some companies consider cases of exceeding limits and may cover the costs incurred by order of management.

The company's premium reporting reflects all travel expenses. Following the norms of the Tax Code of the Russian Federation, personal income tax is not charged on the following types of expenses:

- when they are no more than 2,500 rubles for each business trip day abroad;

- no more than 700 rubles for each day of a business trip within the country.

As we see, the stipulated daily allowances are very limited and large reputable companies can afford to take care of their subordinates, creating comfortable conditions for them outside of their usual working environment. Management pays increased daily allowances.

When your company issues daily allowances in excess of the generally accepted norm, calculate the amount of the excess and calculate insurance premiums and income tax on it.

The calculation of the business trip is made in the field of income in kind, and the calculation of the excess amount, against which taxes will be calculated, is carried out in the calculation of salaries and contributions.

How to carry out operations with tickets in 1C?

Accounting looked like this: to account for tickets, you could use one of two methods, the main thing was to register the chosen option in the accounting policy:

- Tickets as cash documents (BSO) on account 50.03;

- As an advance payment (advance payment) to the carrier on accounts 60 or 76.

Accounting for tickets as monetary documents:

- Enter information about the purchase of a ticket through the document “Receipt of monetary documents”, filling out all the details;

- Record the transfer of the ticket to the posted employee with the document “Issue of monetary documents”;

- After receiving the advance report, enter the corresponding document in 1C and indicate the cost of the ticket as an advance issued to the accountable person;

- To write off expenses in a tax report, fill in all the data on the Other tab in the “Advance report” document. In particular, the amount of VAT must be reflected there.

Is the business trip organized by an intermediary? The program will also have to reflect settlements with it, as separate transactions.

The second option - reflecting tickets as advances - seems simpler. In this case, tickets are reflected through the “Receipt” document with the “Services” operation type.

But this is not enough to recognize expenses in tax and accounting; you also need to receive an advance report from the posted employee . And already on the date of approval of the report, expenses can be recognized.

The downside is that we will not be able to link an advance report to the receipt document and vice versa. How can an accountant then understand which ticket applies to which employee and when can its cost be written off as an expense? You will have to do it manually.

How to calculate travel allowances in 1C 8.3 Accounting

Settings in 1C for calculating payment during a business trip

To calculate average earnings during a business trip, create an accrual type of the same name in the Accruals , which can be opened from the section Salaries and personnel - Directories and settings - Salary settings - Payroll calculation - Accruals.

Please pay attention to filling out the fields:

Personal income tax section :

- switch taxed ;

- income code - 2000 - remuneration for performing labor or other duties; salary and other taxable payments to military personnel and equivalent persons;

- Income category - Salary .

Section Insurance premiums :

- Type of income - Income that is entirely subject to insurance premiums .

Section Income tax, type of expense under Art. 255 Tax Code of the Russian Federation :

- the switch is taken into account in labor costs under article : pp. 6, Art. 255 of the Tax Code of the Russian Federation - the amount of average earnings accrued to employees, retained while they perform state and (or) public duties and in other cases provided for by the labor legislation of the Russian Federation;

- flag Included in the basic accruals for calculating accruals “Regional coefficient” and “Northern allowance” do not need to be set for the Accrual Payment for time on a business trip , since these accruals have already been taken into account to calculate the payment.

Section Reflection in accounting :

- The method of reflection is not established.

In 1C, the accrued amount will be reflected in the salary account with the BU and NU settings specified in the Employees in the Expense Accounting .

Calculation of payment for time on a business trip

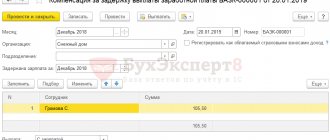

Accrual of travel allowances in 1C 8.3 Accounting does not have a special standard document. Therefore, the accrual of average earnings during a business trip is calculated manually and documented in the Payroll in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll accrual.

In the document please indicate:

- Salary for —the month for which the employee’s salary is calculated;

- from - last day of the month.

Click the Add to select the employee who will be paid for the time on a business trip. Accrue button to select:

- Accrual Payment based on salary - indicate the number of days worked at the workplace, minus days on a business trip (calculate manually). The program will automatically calculate the amount.

- Accrual Payment for time on a business trip - fill in the manually calculated amount of payment for the business trip.

Check all amounts accrued to the employee and, if necessary, adjust them in the form using the Accrued .

- personal income tax column - the amount of calculated personal income tax.

Using the personal income tax in the personal income tax , check the cumulative tax calculation for the employee for the current tax period.

Postings

Test yourself! Take the test:

- Test No. 18. Salary settings in 1C

Integration of 1C and Smartway: how tickets are accounted for

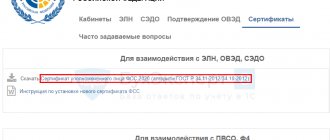

We create a receipt document. Purchases - Receipt of tickets.

Ticket data is downloaded from the Smartway service; just select the one you need from the list and its details will be filled in automatically.

The Ticket Receipt document generates the following transactions:

Debit 60.01 Credit 60.02 - prepayment credited;

Debit 76.14 Credit 60.01 - the cost of the ticket is reflected.

On account 76.14 “Purchase of tickets for business trips,” analytics are carried out on business travelers and tickets.

When creating a Ticket Receipt document, you can select other types of operations - Additional payment, Exchange, Refund.

The surcharge is used when additional services are purchased in addition to an existing ticket - baggage, seat selection, and others. The cost of additional services is included in the total ticket price.

The exchange is intended to reflect the situation when one ticket is exchanged for another, the electronic ticket number changes. Using this operation, the previous ticket is written off and a new one is issued.

With the help of Refund, a trip can be canceled

All transactions with tickets, if they go through the Smartway service, including surcharges, exchanges or refunds, are reflected in the 1C program automatically.

After the employee returns from a business trip, he provides an advance report. As a rule, an accountant forms it in 1C, then prints it out and gives it to an employee to sign. As we said above, expenses can be taken into account only after the expense report has been approved.

To account for tickets, a separate Tickets tab has appeared in the Advance Report document.

To download data from Smartway, just click the Fill button, and the program will automatically select tickets in accordance with the business trip period.

If you selected the trip report type, the form will look like this:

The advantage of the special form is that it will automatically calculate the amount of daily allowance. 1C will analyze the last 5 business trips and substitute the appropriate value; if it does not find the necessary data, it will indicate the “standard” amount of daily allowance, non-personal income tax - 700 rubles / day for business trips in Russia and 2,500 rubles/day for business trips abroad.

All that remains is to fill in the data on advances for travel expenses (selected from the list) and the document is ready. Thanks to the integration of Smartway and 1C, filling out requires minimal user interaction.

Try Smartway for free

Business trip of one employee to 1C ZUP

I suggest you familiarize yourself with the process of traveling on official matters for one person. As a result, all actions regarding group trips in one way or another intersect with the process of booking a trip for one. I have presented the information in a table to display the essence more clearly.

| No. | Action taken | Characteristic |

| 1 | Formation in the program | Creating a document involves entering information already known to us regarding the subordinate and the trip itself. It is important to enter the period so that the machine calculates the cash payment and the month in which it will be paid. Of course, do not forget to enter the name of the person who is traveling and to whom the calculations will need to be made. Some companies prescribe exemption of wages for the period of absence of a subordinate, this is also provided for in the program |

| 2 | Information in the main | After entering the requested information, the machine itself will calculate the average income and, based on it, calculate the travel allowance, taking into account income tax |

| 3 | Payment of the money | Don’t forget to write down a clear date for your subordinate to receive money for the trip and choose one of the proposed options for transferring it:

|

| 4 | Calculation of the amount | By default, the machine contains an annual period for calculating average income, but you, in fact, have the right to change most of the initial parameters. For this purpose, in front of the average amount there is a change button that opens a form for entering new data. You check the flag for manually specifying the period and enter the one you need. When you click on recalculate, the average income will be updated based on the presence of new information entered. Next click OK |

| 5 | Adjustment of cash amounts | The Accrued field contains in detail the amount calculated by the machine, but in manual mode you have the right to adjust it. This is only available here, since it is no longer possible to change the amount in the main field |

| 6 | additional information | When filling out the form, you will be faced with additional information that the machine will require from you. Here you enter the budget item from which the money is allocated, on what basis the person is traveling and how long he will be on the road. |

| 7 | Carrying out the operation | The business trip is carried out by machine in a standard way and you will eventually receive printed forms of documents:

|

There are a number of regions in our country where people work in which they retire earlier. So in our situation, when you send a subordinate to such a region, be sure to indicate the desired region in the territorial conditions field, which will be offered to you from the list. This action is performed in the form of Pension Fund experience.

Vouchers - consequences of the pandemic

In 2021, we were faced with the fact that business trips were canceled en masse - borders were closed, bans were in effect. And in return for tickets unused due to flight cancellations, airlines issued vouchers.

Vouchers are SSO (strict reporting forms). They must be stored and accounted for in the same way as tickets.

If an employee quits while the personal voucher has not yet been used, what should I do?

Another employee simply cannot use a personal voucher and has to contact the carrier company to find out what options it offers in this case. Theoretically, you can transfer the voucher to another employee with an additional payment, return it or exchange it. In any case, the future fate of the ticket depends on the capabilities and policies of the carrier.

As with tickets, any manipulations with the voucher (exchange, return, transfer to another employee) will affect accounting and need to be tracked.

An accountant does not have extra time to solve such problems, especially if the organization has a large number of employees sent on business trips. Therefore, here too, the integration of Smartway and 1C allows you to automate accounting, since all manipulations with vouchers will be reflected in the program automatically.

If you have any questions regarding the exchange or return of vouchers issued during the pandemic, Smartway helps its customers.

The air ticket office department will help you get the most comfortable solution from the airline, and the accounting service of Smartway will provide consultation on accounting.

Return of a posted subordinate before the end of the trip

Various unforeseen moments arise that require the subordinate to be immediately at his workplace. It is in the best interests of business to recall people from their trip as quickly as possible. The law does not regulate such issues in any way and management has the right to independently decide how it is more comfortable to organize this return process.

The machine will offer you 2 ways to formalize the return of subordinates to their work:

- Correction of miscalculations for those moments when a full calculation and payment has already been made in an already closed and posted period and a posting has been created to display wages in accounting.

- In the reporting period that has not yet closed, all adjustments are made to the business trip form.

In order to correct information that was affected by the early return of subordinates, you should use the method described below:

- carry out reversal posting. The machine assumes the possibility of reversing miscalculations, and when such a function is necessary, the calculations are reversed, and the corrected document becomes blocked. This is often true when a group of people’s trip is completely cancelled;

- make the correction to the form using the command of the same name. As a result, old data is blocked and a new form appears. However, please note that the new form will inform users that adjustments have been made. Based on the new information, the accountant makes entries and relies on the newly generated information. Basically, this method is preferable for accountants when the team goes on a train with a shift in deadlines.

All recalculated amounts for a group of persons are based on average annual earnings, starting from the day the trip began. The corrected field affects the work schedule of subordinates by entering information into the time sheet regarding the planned working hours for them.

Algorithm for issuing funds

Remember I told you about the procedure for issuing travel allowances. So, when the method of payment in salary or advance is selected, travel allowances for the team of subordinates will also be displayed in the general statement for such payments.

But in the situation of choosing an intersettlement payment period, automatic calculation occurs after you decide on one of the options:

- By generating a new salary slip, a payment window will appear where you should indicate the payment for business trips based on the document of the same name. The machine itself will open the proposed amount for you, and you, in turn, continue to act according to the standard payment scheme.

- The second method requires you to pay from the business trip field. Here the salary payment window is displayed, which already includes travel allowances. The paper on the basis of which such issuance of money is carried out is, as usual, a statement to the cashier or bank. It all depends on how the work on settlements with personnel is organized in your company or for a certain circle of people. It is not surprising that statements are subject to adjustment and after checking it, all you have to do is post it and close it.