Let's study how to correctly reflect VAT for deduction upon receipt of goods and materials in 1C 8.2 using an example.

Let’s say that JSC “PK Shtorkin Dom” buys goods. If the supplier is a VAT payer, then he must submit an “input” invoice in the set of documents. Then the organization, subject to all conditions, receives the right to claim such “input” VAT for deduction. Therefore, it is necessary to calculate VAT for deduction, check the VAT transactions, and also check the entries in the VAT accumulation registers in 1C 8.2, create a purchase book and check the VAT calculation. To do this, in 1C 8.2 you need to perform the following operations:

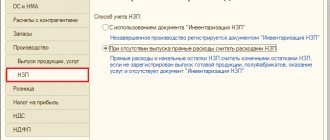

- Materials receipt operation. Acceptance of VAT for deduction must be reflected using the document “Creating purchase ledger entries.”

- Operation – monthly reflection of services for January, February, March. The acceptance of VAT for deduction should be reflected directly when creating the “Invoice received” document.

- Create a purchase book and check its completion.

For example, we use counterparties:

It is proposed to carry out a VAT audit in the following order:

- Check the reflection in the receipt documents of the amount of “input” VAT and the completeness of the reflection of invoices from suppliers.

- Analysis of account balance 19.

- Check the amount of VAT to be deducted upon receipt of goods and services according to accounting records and according to NU.

- Check the correctness of VAT reflection in the purchase book with VAT included in accounting.

Features of filling out documents for receipt of materials in 1C 8.2

Features of filling out the document “Receipt of goods and services”

- In the % VAT – the VAT rate established for each item.

- In the VAT Amount – the calculated VAT amount. Calculated automatically if a bet is set. It is necessary to control the filling of this column;

- In the VAT Invoice – invoice 19.03. Set automatically if a VAT account is defined for an item item in the Item Accounts register in the Enterprise – Goods (materials, products, services):

Features of filling out the document “Invoice received”

register an “input” Invoice by clicking on the hyperlink Enter an invoice in the document Receipt of goods and services ;

In the Invoice window that appears, the received document fields are automatically filled in with information from the Receipt of goods and services . Therefore, you should check and supplement them:

- Invoice type – set to “For receipt”;

- lines Input number and from – enter the number, day, month and year of the received invoice from the supplier;

- Operation type code – “01” is entered, this value is used incl. upon receipt of materials;

- The Issuance method checkbox is placed depending on the method of issuing the invoice - in paper form or in the form of an electronic document;

- Reflect VAT deduction checkbox is placed when VAT is accepted for deduction during the posting of the Invoice received , if all the conditions for this are met:

If the invoice in 1C 8.2 is not registered properly, then an entry in the purchase book will not be generated. The document Invoice

received

does not create postings, but only creates an entry in the information register 1C

Invoice Log

.

Postings generated upon receipt of goods and services in 1C 8.2

Postings generated by the document receipt of goods and services for accounting

Postings for accounting for “input” VAT in 1C 8.2 are created by the document Receipt of goods and services:

Postings generated by the document receipt of goods and services for tax accounting

The following entries were created in the VAT accumulation register:

- An entry with the type of movement Receipt in the VAT register presented – event Presented by VAT by the supplier. This entry is a potential purchase ledger entry:

- Entry with the type of movement Receipt in the VAT register for acquired values , type of value Materials - for tax amounts accepted for accounting related to a specific batch of goods and materials:

How to fill out a purchase book to accept VAT for deduction in 1C 8.2

Creating and filling out the document “Creating purchase ledger entries”

- The document is created through the menu section: Purchase – then select Maintaining a purchase book – Generating purchase book entries ;

- When reflecting received invoices for goods (work, services) received from suppliers in the purchase book, the tab VAT deduction on purchased values . To refill only one bookmark, you can click the <Fill> directly on the bookmark, then the data in other bookmarks will not be changed:

Postings for “input” VAT for deduction in accounting

When you include in the document Formation of purchase book entries records of “input” VAT for deduction on transactions of receipt of goods (work, services), entries are created for debit 68.02: Dt 68.02 Kt 19 – for the amount of “input” VAT accepted for deduction:

Postings for “input” VAT for tax accounting deduction

The following entries were created in the VAT accumulation registers:

- in the VAT register presented with the type of movement Expense. The “input” VAT is written off from the register at the time it is included in the purchase book:

- in the VAT Purchases , which generates the lines of the Purchase Book report:

Document movement report

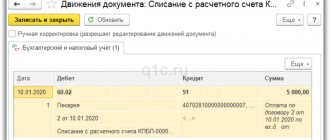

Let's carry out the adjustment document and check what postings we have as a result.

Fig. 10 Document movements

We see that, having reflected the adjustment in the document, the program generated the necessary transactions. The document also made entries in the “Purchase VAT” accumulation register.

Fig. 11 VAT purchases

If the “Generate transactions” checkbox is not checked by the user, then when posting, entries will be made only in the “Purchase VAT” accumulation register.

Fig. 12 Generate transactions

Fig. 13 Changing VAT amounts manually

Thus, the program allows the user to make changes to VAT amounts manually. In this case, all changes are reflected in the reporting.

Checking the calculation of “input” VAT claimed for deduction in 1C 8.2

Step 1. Check the reflection of VAT for deduction in 1C 8.2 and the completeness of the reflection of invoices from suppliers

A common mistake is that the VAT amount is not entered in the Receipt of goods and services . This leads to underpayment of income tax and loss of VAT deduction. One of the methods for identifying such an error is to compile a report Report on the availability of invoices in the menu Purchasing - Maintaining a purchase ledger ). If there is no document in the Invoice , this means that the Invoice is not registered properly.

Step 2. Close account 19 “VAT on purchased assets” in 1C 8.2

As a rule, if all the conditions for submitting “input” VAT are met, then there should be no balance left on account 19 at the end of the tax period. To check whether all “input” invoices are included in the purchase book properly, you can generate a balance sheet for each subaccount to account 19 in the context of counterparties and receipt documents.

Let's check the data using our example. There is no balance on account 19 at the end of the period. All conditions for crediting “input” VAT in our case are met:

Step 3. Check the reflection of the amount of VAT to be deducted in 1C 8.2 when purchasing goods and equipment according to accounting records and according to NU

It is advisable to compare the reflection of VAT deductible in accounting with VAT deductible in NU.

Reflection of VAT for deduction in accounting

In accounting entries, the amount of “input” VAT is reflected - Dt 68.02 Kt 19 - for the amount of VAT accepted for deduction. To calculate the amount of VAT accepted for deduction when purchasing goods and services, we will create Account Analysis 68.02 in the Reports - then Account Analysis :

Reflection of the transaction of gratuitous transfer of goods (for charitable purposes)?

- To perform the operation, you need to create a document Reflection of VAT accrual. As a result of this document, the corresponding transactions will be generated.

- Call from the menu: Operations - VAT - Reflection of VAT accrual.

- Create button.

- In the from field, indicate the date of VAT restoration.

- In the Contractor field, select the organization from which the goods were previously purchased.

- In the Contract field, select the appropriate contract.

- In the Payment Document field, the basis document for which the goods were received is indicated. If there is no receipt document in the information base (for example, if property is entered as incoming balances), this field can be left empty.

- To reflect VAT in the sales ledger, the Use as sales ledger entry check box is selected by default.

- To generate VAT transactions, select the Generate transactions checkbox.

- Click the Fill button - Fill according to the settlement document.

- In the Type of value field, select Products from the list. In the case of filling out a document, the type of value is set automatically.

- The Items field displays goods from the settlement document. If necessary, item items can be adjusted.

- The Quantity field indicates the quantity of goods from the settlement document. For our example, it is necessary to adjust the quantity in accordance with the goods donated.

- In the Price field, indicate the cost of the goods from which the amount of restored VAT is calculated.

- In the % VAT field, select the rate of 18%.

- In the VAT Account on Sales field, select account 19.03 “VAT on purchased inventories.”

- In the Event field, select an event, in our case - VAT Restoration.

- Click the Submit button.

- Call from the menu: Operations - Accounting - Operations entered manually.

- Create button.

- To create a new transaction, click the Add button.

- Button Record and close.

This document is intended for calculating VAT manually in certain cases.

Creating a document “Reflection of VAT accrual”:

Filling out the “Main” tab of the document “Reflection of VAT accrual”:

Filling out the “Goods and Reflection of VAT accrual” tab:

The result of the document “Reflection of VAT accrual”:

To view transactions, click the Show transactions and other document movements button.

As a result of posting the document “Reflection of VAT accrual”, a posting was generated to the debit of account 19.03 “VAT on purchased inventories” and the credit of account 68.02 “Value added tax”. Thus, VAT has been restored in an amount calculated in proportion to the value of the goods transferred for charitable purposes.

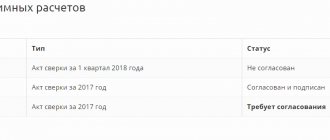

When restoring VAT, an invoice must be registered in the sales book, on which VAT was previously accepted for deduction, and in case of its absence, for example, due to the expiration of the storage period - an accountant’s certificate, which reflects the amount of tax calculated in proportion to the cost property (clause 14 of section II of Appendix No. 5 to Government Decree No. 1137) (menu: Reports - VAT reports - Sales book).

Also, the amount of the restored VAT is reflected in column 5 of line 090 of Section 3 “Calculation of the amount of tax payable to the budget for transactions taxed at the tax rates provided for in paragraphs 2 - 4 of Article 164 of the Tax Code of the Russian Federation” of the VAT tax return (menu: Reports - 1C-Reporting - Regulated reports).

Next, it is necessary to reflect the transactions “Recognition of the amount of recovered VAT as part of other expenses”; “The amount of restored VAT on transferred goods has been written off from tax accounting”; “Recognition of the amount of recovered VAT as part of other expenses”—the Transaction document is created. As a result of this document, the corresponding postings will be generated.

Creating an “Operation” document: