Financial consultant Aziz Alimov writes about how VAT can affect the price level in Uzbekistan and what needs to be done to reduce the negative inflationary effect of the transition to this tax.

Aziz Alimov

Economist, financial consultant, certified public accountant, auditor

With the introduction of the new taxation system from January 1, 2021, many questions have arisen regarding the calculation of taxes that are new for many business entities.

Particularly heated discussions are taking place around the value added tax. How is VAT calculated? Why does the Tax Code indicate the taxable base of sales turnover (i.e., revenue), and not added value?

To understand how VAT is calculated, let’s look at what the cost of a product or service consists of when creating a value chain. Let's take a company that previously paid 5% of turnover, but now must pay 20% VAT.

The cost formula for everyone is as follows:

Cost (Price) = Intermediate consumption + Wages + Other expenses + Markup

Intermediate consumption is the value of goods and services consumed during an accounting period for the purpose of producing other goods and services. In other words, this is the cost of all purchased inventory and services under business contracts.

The added value can be expressed by the following formula:

Value added = Wages + Other expenses + Markup = Cost (Price) − Intermediate consumption

VAT calculation looks like this:

VAT = Value Added * 20% = Cost (Price) * 20% − Intermediate Consumption * 20%

Thus, VAT, unlike sales tax (SST), is not charged on the entire cost of production, but on the cost minus intermediate consumption, that is, on value added. Its full amount will be transferred to the state budget in parts at different times from different participants in the chain.

In the case of calculating sales tax, the formula looks like this:

Cost * 5% = Intermediate consumption 5% + Wages 5% + Other expenses 5% + Markup * 5%

That is, in addition to added value, intermediate consumption is also taxed.

What is VAT

VAT is a value added tax on goods. It is withdrawn from the state budget and is necessary for all enterprises that sell services and goods, while being legal entities.

To put it simply, the tax is the difference between the revenue from the total sales of the product and the costs that were allocated to raw materials. Often it is purchased from third-party manufacturers. However, even so, some areas of activity may not be subject to VAT. And this despite the fact that the entire amount is collected long before the goods are sold.

Organizations on OSN or simplified tax system without VAT

An organization has the right not to pay VAT in two cases:

- if it applies the general taxation system and has revenue of less than 2 million rubles for the three previous consecutive calendar months, by virtue of Article 145 of the Tax Code of the Russian Federation;

- if it applies special tax regimes: simplified tax system, UTII, unified tax system or patent system in relation to activities falling under these regimes.

The first option is voluntary, that is, an LLC can operate without VAT at will, but under simplified regimes there is no VAT due to the norms of the Tax Code. At the same time, exemption from VAT does not apply to transactions involving foreign economic activity, namely the import of goods into the territory of Russia. Operations involving the sale of excisable goods are also not exempt from paying value added tax. In addition, an organization can act as a tax agent in relation to other VAT payers.

Working with VAT and without VAT, first of all, depends on the type of activity of the taxpayer. Obviously, when selling goods at retail, a businessman can purchase them from other entrepreneurs or organizations under preferential tax regimes, and then it does not matter to him whether his invoices contain an allocated tax. A sample invoice without VAT may upset wholesale buyers, since it is important for them to have input tax in order to receive a deduction.

If an organization on the general taxation system has decided to operate without VAT, then it must collect and submit to the Federal Tax Service all the documents that are necessary to obtain an exemption from VAT. These include:

notification of the established form on the use of the right to exemption from VAT; extract from the balance sheet (for organizations on the OSN and organizations that have switched from the Unified Agricultural Tax to the OSN); an extract from the sales book, copies of the journal of received and issued invoices for the previous reporting period (for organizations on the OSN); extract from KUDiR (when switching from the simplified tax system to the OSN).

All documents must be submitted to the Federal Tax Service no later than the 20th day of the month from which the organization wants to operate without VAT. At the same time, the tax inspectorate does not send any decision in response, since such an exemption, by virtue of the Tax Code of the Russian Federation, is not permissive, but notifying in nature.

The appearance of the tax

The indicator is an evolutionary version of the sales tax that was used several decades ago. His main problem at that time was that the tax was collected on revenue. This caused a lot of problems, including the lack of normal reporting and the initial basis on the same revenue, and not actual profit. For any volume of production and sales, this significantly reduced the net profit for the entrepreneur, who actually worked on self-sufficiency.

Note that value added tax has always been classified as indirect taxes. For them, as a rule, only the fiscal function is applicable, and their appearance is completely provoked by the state’s need to increase the basic budget.

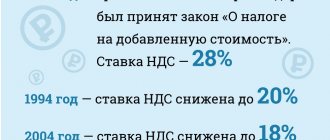

The first adapted and universal version of the VAT has become widespread since 1957. The reason for this was the signing of the EEC Treaty in Rome, the terms of which included mandatory harmonization by all countries of their taxes in order to create a balanced common market. And already in 1967, the tax became an official indirect tax, the introduction of which into each system became mandatory until 1972. The official consolidation of this tax was carried out in 1977, and the last critical adjustments were made in 1991.

It appeared on Russian territory in 1992. This happened immediately after the collapse of the USSR and the tenth directive revised the main provisions on the payment of the indicator.

From January 1, 2021, its value reached 20%.

However, all medical drugs, as well as a number of food items and children's products may be subject to VAT of 10%. In the case of exported goods, there is no indicator as such at all, since its rate is 0%.

Definition on video:

What is better: paying 5% of the total cost or 20% of the added cost?

Here the main role is played by the size of intermediate consumption. If it makes up the majority of the cost, it is of course advantageous to apply VAT. Otherwise, a sales tax at a low rate is beneficial because, with low intermediate consumption and high value added, a tax at 20% will effectively be equal to a sales tax at a higher rate.

I note that the above formulas are relevant provided that all participants in intermediate consumption are VAT payers . Otherwise, the cost of intermediate consumption will be included in value added, which will cause an increase in the tax base.

Which sectors of the economy benefit from working with VAT?

- Product manufacturing

- Wholesale and retail trade

- Construction

For enterprises in these areas, VAT is beneficial, since the share of intermediate consumption in the total cost is high and there is the possibility of a large VAT offset on goods and services consumed, even imported (naturally, if all participants in intermediate consumption are VAT payers).

Which industries are not profitable to work with VAT?

- Services sector

- Public catering

Basically, for enterprises providing services, the main share in the cost of the final product is wages, which is part of the added value. Accordingly, this increases the tax base.

Although for some service businesses, perhaps the bulk of the value comes from investments or investments in fixed assets and intangible assets. According to the adopted Tax Reform Concept, VAT on purchased fixed assets and intangible assets is also subject to offset. In this case, service sector enterprises have a great advantage.

In catering, the main share in the cost of the final product is made up of agricultural products, the cost of which is exempt from VAT. Thus, VAT crediting on intermediate consumption is not possible.

Is work allowed without paying VAT?

The legislation also allows for the sale of products without paying tax. However, only those entrepreneurs and companies that operate under a simplified taxation system receive this right.

Registration of the simplified tax system in order to avoid paying VAT is often carried out either by LLCs or individual entrepreneurs.

Advantages

So, here are the benefits an entrepreneur gets when he uses VAT:

- Possibility of tax deduction and refund. However, this can only be done in the amount that has already been paid to the supplier of materials. As a result, this is an advantage only in those circumstances when the cost of the supplier with VAT will be lower than without it. And although this happens extremely rarely, it should not be ruled out.

- Opportunity to attract serious counterparties. They are often the ones paying this tax. And considering that they do not cooperate with entrepreneurs without VAT, this provides a strategic advantage.

This is where the main advantages of working with VAT end. And although they do not provide short-term financial benefits, their main goal is to provide an advantage in the long term.

Are services subject to VAT?

In order for services to be subject to VAT, the place of their sale, firstly, must be recognized as the territory of the Russian Federation (Article 148 of the Tax Code of the Russian Federation). And secondly, they should not be named in clauses 2, 3 of Art. 149 of the Tax Code of the Russian Federation, which lists transactions not subject to VAT. In accordance with these paragraphs, the following services are exempt from taxation:

- medical services by organizations and individual entrepreneurs conducting medical activities (clause 2, clause 2, article 149 of the Tax Code of the Russian Federation);

- services for supervision and care of children in preschool education organizations, for conducting classes in clubs, sections, studios (clause 4, clause 2, article 149 of the Tax Code of the Russian Federation);

- services for repair and maintenance of goods and household appliances within the warranty period of their operation without charging a fee (clause 13, clause 2, article 149 of the Tax Code of the Russian Federation);

- funeral services (clause 8, clause 2, article 149 of the Tax Code of the Russian Federation);

- services of pharmacy organizations for the manufacture of medicines, production and repair of spectacle optics (clause 24, clause 2, article 149 of the Tax Code of the Russian Federation);

- services of sanatorium-resort, health-improving organizations, recreational and health-improving organizations for children located on the territory of the Russian Federation (clause 18, clause 3, article 149 of the Tax Code of the Russian Federation).

The list of non-taxable services is quite large, so only some of them are listed above.

Flaws

The disadvantages of working with this tax are somewhat greater than the advantages. These include:

- Obligation to pay 20% tax. And although it is included in the final cost of the product, and the tax itself is paid by the buyer, its presence often reduces the customer base.

- VAT is quite complex within the framework of document flow, which imposes additional difficulties when maintaining accounting records. Departments are required to maintain registers, regularly submit declarations and inspect additional facilities.

- Purchase, being on a simplified taxation system, from suppliers who pay VAT. Thus, it will not be possible to make a deduction even if an invoice is used.

As a result, working with VAT is ideal for large enterprises. This allows you to get more partners who already have enormous resources so that VAT is not a problem for them. This tax is a hindrance only when it is imposed on small enterprises.

What is not subject to VAT?

Those operations that are not recognized as sales are not subject to VAT taxation (clause 1, clause 2, article 146, clause 3, article 39 of the Tax Code of the Russian Federation). This is, for example:

- operations related to the circulation of currency, except for numismatic purposes (clause 1, clause 3, article 39 of the Tax Code of the Russian Federation);

- transfer of fixed assets, intangible assets, other property to the legal successor during the reorganization of the company (clause 2, clause 3, article 39 of the Tax Code of the Russian Federation);

- transfer of property to a participant in a business company within the limits of his initial contribution upon his withdrawal from the company, as well as upon liquidation of the company (clause 5, clause 3, article 39 of the Tax Code of the Russian Federation).

Other transactions that are not subject to VAT due to the fact that they are not recognized as an object of taxation are listed in clause 2 of Art. 146 of the Tax Code of the Russian Federation. Among them:

- transfer of residential buildings, kindergartens, roads, electrical networks and other facilities to state authorities and local self-government (clause 2, clause 2, article 146 of the Tax Code of the Russian Federation);

- transfer of property of state and municipal enterprises during privatization (clause 3, clause 2, article 146 of the Tax Code of the Russian Federation);

- sale of land plots and shares in them (clause 6, clause 2, article 146 of the Tax Code of the Russian Federation);

- transfer of property rights to the legal successor of the organization (clause 7, clause 2, article 146 of the Tax Code of the Russian Federation);

- sale of property, property rights of debtors declared bankrupt (clause 15, clause 2, article 146 of the Tax Code of the Russian Federation).

In addition, there are transactions that are considered subject to VAT, but at the same time are not subject to VAT taxation (exempt from taxation). They are directly named in paragraphs 1-3 of Art. 149 of the Tax Code of the Russian Federation and their list is closed.

VAT calculation

The first thing that needs to be done during calculations is to determine the tax base. It represents the sum of all funds received within the billing period. Its volume is determined using Art. 154 Tax Code of the Russian Federation. After this, the accrued tax is calculated.

It must be remembered that if there are products that are subject to different rates, VAT is calculated separately for each category.

What is the difference between the rate without VAT and VAT 0%

There are two types of VAT exemption: the 0% VAT rate and the “excluding VAT” rate. Is there a difference without VAT and 0% VAT? Yes, and big. Companies that apply a zero rate are recognized as VAT payers. And the rate without VAT means that the company is not a payer.

What is the difference between the VAT rate 0% and without VAT

Let's figure out what the difference is between the 0% rate, without VAT and with VAT. In the first two cases, ultimately there is no budget revenue from the company, but in the third, the organization will have to pay tax. In addition, a 0% rate is used for transactions that are subject to taxation. But those who are exempt from tax apply without VAT. For example, simplified companies.

When does the 0% VAT rate apply?

The VAT rate of 0% is applied when selling goods for export (subclause 1, clause 1, article 164 of the Tax Code of the Russian Federation). At the same time, the zero VAT rate requires documentary confirmation: the company needs contracts with foreign counterparties, customs declarations, documents for the transportation of goods abroad. These papers are sent to the tax authorities within 180 calendar days from the moment the goods are placed under the customs export procedure (clause 9 of Article 165 of the Tax Code of the Russian Federation). The 0% VAT rate applies to only confirmed transactions, otherwise you will have to use the usual rates - 18% and 10%.

- A 0% VAT rate is established for the sale of services related to the international transportation of goods (subclause 2.1, clause 1, article 164 of the Tax Code of the Russian Federation).

- There is a special list of goods subject to 0 percent VAT. These are rare goods. For example, products from the field of space activities, precious metals, goods for the 2021 FIFA World Cup. But, for example, jewelry with a 0% VAT rate does not exist: a general rate of 18% is applied to their sales.

- The zero VAT rate is used in the following cases: transit transportation of goods through Russia by air and transportation of passengers and luggage from Russia or to Russia (subclause 2.10 and subclause 4, clause 1, article 164 of the Tax Code of the Russian Federation).

This is a list of basic transactions in which cases a 0% VAT rate is applied. The general conclusion is this: to get a zero rate, you need to engage in specific activities. There are many more companies that operate without VAT than those that apply a zero rate.

Without VAT and 0% VAT - what's the difference?

Payment without VAT means that there is no added value in the amount for which the company sells the product. Can an LLC operate without VAT? Yes, but this is possible in two cases:

First case. An organization operates without VAT if it applies special tax regimes - simplified tax system, UTII or unified agricultural tax.

Second case. Sales without VAT are carried out by companies that comply with the revenue limit and have received tax exemption. Article 145 of the Tax Code explains how to operate an LLC without VAT under the general regime. It is necessary that the company’s revenue for the three previous consecutive calendar months does not exceed a total of two million rubles. VAT is not taken into account when calculating revenue. But care must be taken to ensure that revenue for three months does not exceed this limit, otherwise the company will lose the right to exemption. If the amount of revenue falls under the limit, then the organization submits to the tax authorities a notification to receive an exemption and supporting documents (clause 3 of Article 145 of the Tax Code of the Russian Federation).

What does this mean in documents, the rate “Excluding VAT”

In practice, working without VAT is not always profitable. After all, the difference between an agreement with VAT and without VAT is that in the latter option, buyers do not have the right to apply deductions for goods purchased from non-payers. Therefore, not everyone agrees to purchases for which deductions are not possible.

How to find out if an organization is a VAT payer

It is important to know about your counterparties whether they pay VAT. That is, are deductions possible for purchases from such partners? The answer to the question of how to find out whether an organization works with VAT or not is in the agreement with the counterparty itself. Therefore, there will be no difficulties here. But it is important that the counterparty is conscientious. If he is a VAT payer, but does not actually pay the tax, claiming deductions for such purchases is risky. Tax authorities can remove them and recalculate the tax, add additional penalties and fines. You can check whether your counterparty has tax debts on the Federal Tax Service website.

Calculation formulas

There are only two calculation methods (see Table 1).

| Index | Formula |

| Determination of tax base (Y) | Y = price of goods sold + advances |

| VAT rate amount (X) | X = tax base * tax rate percentage |

You should use either the one you like the most, or the one that is acceptable for a specific area.

Pros and cons of video tax:

Tax stages

The tax amount is fully paid by the consumer, although initially it may seem otherwise, because the entrepreneur makes the payment directly. And to better understand how this happens, let’s consider the stages of VAT payment:

- Initially, an order is made for the material that is necessary to create the product. The entrepreneur pays the full cost of the raw materials, which will subsequently be subject to VAT.

Then the raw materials are used, the product is created, and it is time to determine the price of the final product. The cost of goods, production costs, operating expenses, advertising, etc. are taken into account. The full amount of VAT is also taken into account, but it is sent to the “tax credit” item.- A price is set and the product is put up for sale. The final cost already includes all production costs, including markup for the brand and other aspects for making a profit.

- The product is sold, the entrepreneur receives money. From this amount he automatically deducts 20%, which is sent to the state.

It is this large percentage of VAT that is responsible for the rise in prices of all goods on the domestic market. After all, you need to take into account that 20% goes to the state, not the organization. Consequently, about 10-30% of the products sold constitute net profit.

Submitting a report

A VAT return must be generated for each quarterly period. This is if we talk about those cases when OSNO is used.

If, when filling out the main sections, the value “0” appears in them, then this is exactly what needs to be indicated in the documents. Leaving this field blank is unacceptable.

Submission is made electronically. The legislation clearly establishes the rules regarding this, not allowing delivery in any other form. Failure to comply with the established rules will result in a fine - more details in Art. 119 of the Tax Code of the Russian Federation.

It is also worth taking into account that VAT is precisely that tax in which the amount payable is equal to that which can be reimbursed to the entrepreneur from the budget. This often happens with exporters. Indication of this amount, as a rule, provokes an audit by the Federal Tax Service and a number of explanations regarding the information that was indicated in the declaration.

And if exporters always encounter this, then entrepreneurs in the domestic market are advised to take care in advance about the legal change in the scope of the deduction.

Filling out the declaration on video:

What is subject to VAT

When answering the question of what is subject to VAT, it is necessary to pay attention to 2 aspects: is the operation subject to VAT and is it not listed in Art. 149 of the Tax Code of the Russian Federation. The object of taxation includes 4 groups of operations (clause 1 of Article 146 of the Tax Code of the Russian Federation):

- sale on the territory of the Russian Federation of goods (work, services), collateral, transfer of goods (work, services) on the basis of compensation or novation, transfer of property rights. In this case, the sale can be either paid or gratuitous (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- transfer of goods (works, services) for one’s own needs, i.e. not for the purpose of obtaining income from third parties with their help, but for the needs of the organization itself. Such a transfer is subject to VAT if expenses on it are not recognized for profit tax purposes (clause 2, clause 1, article 146 of the Tax Code of the Russian Federation). Because they cannot be considered economically justified (Article 252 of the Tax Code of the Russian Federation), or they are listed among the expenses not taken into account when calculating income tax (Article 270 of the Tax Code of the Russian Federation). In this case, the fact of transfer of goods must be documented (for example, when transferring goods from one division to another, TORG-13 is issued);

- carrying out construction and installation work for own consumption. These are construction and installation works that the payer performs on his own and for himself (clause 3, clause 1, article 146 of the Tax Code of the Russian Federation). If construction is carried out by contractors, and the organization acts as an investor or developer, then there is no VAT subject to taxation (Letter of the Ministry of Finance dated 09.09.2010 N 03-07-10/12);

- import of goods into the territory of the Russian Federation (clause 4, clause 1, article 146 of the Tax Code of the Russian Federation). We are talking about goods crossing the customs border and importing them into the territory of the customs union (clause 3, clause 1, article 2 of the EAEU Labor Code).

Is it possible to be exempt from paying

The Tax Code allows you to be exempt from paying VAT if financial transactions are carried out within the Russian Federation. These are only special provisions that do not represent the same exemption that is provided to subjects when switching to the simplified tax system.

Those who are exempt from tax:

- not obliged to pay it on the domestic market

- has the right not to submit VAT reports

- ignores maintaining a purchase ledger

- issues invoices to its customers excluding 20% VAT

The use of VAT in business is justified from the point of view of the economy and the formation of the state budget. Moreover, it is an improved version of the income tax that existed in the Russian Federation before it. However, this is still a heavy burden for smaller companies. And often it is this 20% that can significantly reduce the flow of clients.

Top

Write your question in the form below

Who will benefit from raising VAT to 20%, and who will lose from it?

While Russians are busy discussing the retirement age, the law on increasing VAT to 20% has already been approved by the State Duma in the first reading. Experts expect prices for all goods to rise and GDP to decline due to slower economic growth. However, for some this will only be to their advantage.

What will change?

Most likely, the bill will continue to pass, given the unanimity in the ranks of our deputies.

The text of the document and the progress of consideration can be found on the State Duma website here. The VAT rate will increase from January 2021 from 18% to 20%. According to officials' calculations, this will increase federal budget revenues by 620 billion rubles annually. In total, VAT is already one of the main taxes in our federal budget. It brings in 5.05 trillion rubles (due to imported and sold goods). Accordingly, after the increase, VAT will generate 5.67 trillion rubles.

It is obvious that the VAT increase will affect every Russian. If only because this will lead to an increase in prices by an average of 10%. Considering the fact that all taxes are ultimately included in the price of goods and services for the consumer.

If we very roughly divide the 620 billion rubles that officials want to earn by 146 million Russians, it turns out that each of us, including babies, will additionally pay about 4.3 thousand rubles to the budget next year.

You can read about the consequences of the reform in the article - What will happen if VAT is increased from 18 to 20%?

But let's see who, on the contrary, will benefit from this and even gain a competitive advantage.

VAT: more complicated than it seems!

First, it’s worth saying that VAT is far from being as simple a tax as it seems at first glance. It is paid by all companies and even many individual entrepreneurs who have chosen the general OSNO tax system. They pay it for any product sold or service provided. However, no product just appears out of thin air.

For example, to bake and sell buns you need flour. But the flour manufacturer has already included its VAT in its price. You also need yeast, salt, water - their suppliers also included tax in the price. The factory baked a bun and sold it to the store, and also paid VAT on its products. To deliver finished bread to the store, road transportation is required. The carrier, having provided the delivery service, also included VAT in the price of the bun. The store owner sold the bread to the buyer, and he also has to pay VAT.

So, the more intermediaries there are in the chain, the more complex the production cycle, the more different VAT is ultimately included in the price of the product.

But, there is one very important nuance. According to current legislation, there is a principle of one-time taxation. This means that a product or service should only be subject to VAT once. But it is being implemented very poorly.

To try to reduce the VAT pile, as in the bun example, Russia has a VAT refund system. This is the statutory right of a taxpayer to reduce the amount of tax charged to its customers on their invoices by the amount of that tax paid to suppliers or at customs (apply tax deductions to recover VAT). However, getting the tax paid back is very, very difficult and time consuming. Often the time frame for returning and carrying out all procedures and checks exceeds one year. In addition, the state, having studied the documentation and conducted inspections of the company, can simply refuse this. Often the matter ends up in court.

Who benefits from the VAT increase anyway?

An increase in VAT will be beneficial for large Russian businesses ; this will become another competitive advantage for them. The fact is that the largest taxpayers reimburse themselves for VAT in an accelerated and simplified manner. But it is worth adding that the threshold for the accelerated method of VAT refund will decrease from 7 billion to 2 billion rubles. (companies can count on a tax refund when they buy goods including VAT; now the Tax Code gives a company the right to an accelerated method of refund if it has paid at least 7 billion rubles of VAT, excise taxes, income tax and mineral extraction tax in total for the previous three years).

The VAT increase will be beneficial for exporters , especially for large companies. Let me remind you that when exporting, VAT is reimbursed from the federal budget, and in large amounts.

“Some industries, especially those that are export-oriented, according to our estimates, will even benefit from this increase, since this tax is now reimbursed to them from the federal budget. For example, the chemical industry. At the same time, the increase in VAT will act as an additional motivation for enterprises to export more, because when exporting, VAT is returned,” noted the Head of the Ministry of Industry and Trade Denis Manturov in a commentary for RIA Novosti.

In turn, enterprises focused on the domestic market will suffer much more. And mainly those who create more expensive and technologically advanced goods - mechanical engineering, instrument making, as well as construction and trade.

who do not pay VAT will receive a slight competitive advantage . These are individual entrepreneurs using the simplified tax system, patent and other forms of taxation that do not require payment of VAT. In addition, there are certain sectors that are not subject to VAT or taxed at a zero rate - medical services, child care services, charity. Products include the sale of food, medical products, scrap ferrous and non-ferrous metals, ore, etc. All of them are listed in detail in the Tax Code. However, since a general rise in prices will in any case affect the raw materials or services for their activities, they are unlikely to expect an economic breakthrough.

Even if not directly, but indirectly, banks . The Ministry of Industry and Trade expects that enterprises will increasingly apply for loans and subsidies to cover increased costs.

The informal sector will benefit from the VAT increase . There is one rating for Russia where we are at the top, and have been for a long time. This is a rating of the shadow economy. Last year, Russia took fourth place in the top 5 largest shadow economies in the world, according to experts from the Association of Chartered Certified Accountants (ACCA). And now, drum roll: its volume is 33.6 trillion rubles, or 39% of the country’s GDP! One could say that the experts were mistaken, but there are many similar ratings from influential international organizations, and the essence is approximately the same everywhere - Russia is confidently in the forefront. The higher the tax burden, the more citizens and companies go into shadow employment and do not pay taxes. With the VAT increase, this sector will continue to grow, and prices for their goods and services may even be cheaper compared to others.