Individual entrepreneurs have the right to apply a simplified taxation system along with other tax regimes (Article 346.11 of the Tax Code of the Russian Federation). Businessmen who have chosen “Income” as the object of taxation pay tax at a rate of 6 percent.

If since the beginning of the year, an individual entrepreneur has earned more than 150 million rubles, but less than 200 million rubles, using the simplified tax system of 6 percent, then he will pay tax at an increased rate - 8 percent. The same rate will begin to apply if the average number of individual entrepreneurs’ personnel is more than 100 people, but less than 130 (Article 346.20 of the Tax Code of the Russian Federation). If these limits are exceeded, the right to this special regime is lost.

We will discuss in our article whether an individual entrepreneur should keep accounting records using the simplified tax system “Income”, on what income the tax is paid, how to calculate mandatory payments, where and when to transfer them.

Why you need to think about accounting in advance

- The final tax amount depends on the chosen taxation system. In some cases, it can vary significantly. In addition, different systems require different amounts of reporting. This is an extremely important issue when an entrepreneur conducts his or her own accounting. After all, not all reporting forms are easy to understand. At the same time, for late submission of documentation, you may incur additional costs in the form of fines. Also, a properly selected tax system can give you the right to receive certain benefits or a comfortable payment schedule. Therefore, when choosing a taxation system, you need to turn to specialists.

- An ill-conceived accounting system for entrepreneurs can contribute to various errors. This could be a violation of deadlines for paying various taxes and fees, salaries to employees, and so on. Among the consequences of such force majeure are disputes with the Federal Tax Service, counterparties, personnel, fines and lawsuits.

- After registering an individual entrepreneur, you are given only 30 days to choose the appropriate tax regime. Those who did not manage to decide on it in advance and register it on time will work according to the general taxation system (OSNO). This is usually the most problematic option with many reporting forms.

Software to simplify accounting

Automated data accounting is a convenient form of entering income, expenses and generating reports. When using the program:

- ensuring the relevance of legal requirements;

- data is grouped according to analytical criteria to obtain reports and internal reporting;

- automatic calculation of taxes for advance payments and final settlement with the budget is carried out;

- KUDiR and reporting are generated automatically based on the entered data;

- Data is downloaded for further transmission to control authorities.

A program to help keep records of individual entrepreneurs allows you not to have a staff of special workers or reduce the complexity of data processing. The product is adapted to individual operating conditions.

Read about the characteristics of the software in the material “Review of free accounting programs for the simplified tax system.”

What does accounting for an individual entrepreneur look like?

Law No. 402-FZ dated December 6, 2011 misleads some business founders. It states that individual entrepreneurs do not have to keep accounting records. But this does not relieve entrepreneurs from the need to report to supervisory authorities. After all, there is tax accounting. This is the accumulation of data with the help of which payments and the tax base are calculated. Entrepreneurs are required to keep tax records. To do this you need to have special knowledge. Individual entrepreneurs are also required to work with primary and bank documents, maintain reports on employees, etc.

Typically, entrepreneurs do not notice the difference between types of accounting, using one general concept of “accounting.” Therefore, confusion can often arise in communication with specialists and supervisory authorities.

How can an individual entrepreneur claim his right to accounting?

If an individual entrepreneur decides to conduct accounting, he must follow the requirements of Federal Law dated December 6, 2011 No. 402-FZ and by-laws on accounting (PBU, Chart of Accounts and other regulatory documents of the Russian Ministry of Finance on accounting).

First you need to decide who exactly will do the accounting for the individual entrepreneur. If an individual entrepreneur decides to conduct accounting, he is equal in status to the head of the organization. This means that he organizes accounting and storage of primary records (Part 2 of Article 7 of Federal Law No. 402-FZ of December 6, 2011). Accordingly, IP:

- or hires a chief accountant (and perhaps creates an accounting service for him),

- or entrusts the duties of an accountant to another employee,

- or entrusts accounting to a third-party company or a civil contract specialist;

- or performs the duties of an accountant personally.

However, when an individual entrepreneur exceeds the level of a medium-sized business entity, he no longer has the right to conduct accounting personally and must delegate this function to other persons (Part 3 of Article 7 of the Federal Law of December 6, 2011 No. 402-FZ). An individual entrepreneur is large if for the previous year the average number of its employees is more than 250 people and (or) income exceeds 2 billion rubles. (Clause 2 and 3 Part 1.1, Part 3 Article 4 of the Federal Law dated July 24, 2007 No. 209-FZ, Decree of the Government of the Russian Federation dated April 4, 2016 No. 265).

In order to initially express its decision to introduce accounting, the individual entrepreneur must approve its accounting policy. An accounting policy is a document in which an individual entrepreneur selects the methods of accounting and reporting he needs from the totality of all the methods proposed in PBU and other regulatory documents on accounting (Article 8 of the Federal Law of December 6, 2011 No. 402-FZ). Further, when maintaining accounting, you will need to follow the established accounting policies.

The first point of the accounting policy may just be a statement about maintaining accounting records from such and such a date in accordance with Federal Law dated December 6, 2011 No. 402-FZ.

In order to declare accounting to the state and counterparties (existing and potential), an individual entrepreneur must prepare annual financial statements and submit a copy of it to the territorial statistics body (part 2 of article 13, part 1 of article 18 of the Federal Law of December 6, 2011 No. 402 -FZ).

Who to entrust accounting for individual entrepreneurs to?

The complexity of accounting for an individual entrepreneur depends mainly on the taxation system, the number of employees and turnover. Therefore, when choosing an accountant, there are four options:

- Independent reporting by the entrepreneur. This option certainly helps save money, but it requires time. Today, to independently conduct accounting for individual entrepreneurs, a minimum of knowledge is required. After all, there are many online services that have everything you need, including up-to-date reporting templates, Help Desk, tax calendars for each tax system, etc. And yet, before using such services, it is worth familiarizing yourself with the basics of accounting so as not to get confused in concepts and to understand the main principles.

- Accountant in the office. An excellent option for those who have suitable premises. For the position of accountant, a specialist must be selected especially carefully. If you find a qualified accountant, you need to provide him with a workplace, which also entails some expenses. It is necessary to hire a specialist for the office only if there is enough work for him. If the business is small and there are few business transactions, some of the accountants will sit at their workplace in vain. In this case, the entrepreneur will have to pay for these downtime hours.

- Freelancer. This option allows you to avoid the cost of a workplace and registration of an employee on staff. But here you need to choose a specialist doubly carefully. It is best to hire him by recommendation. After all, when communicating online, it is not always possible to determine how qualified an employee is.

- Outsourcing company. This is the most expensive option for maintaining accounting and income/expense books. But doubts about the qualifications of specialists disappear. And damage from any possible errors will be compensated. This is often specified in contracts with outsourcers. In addition, you can transfer to the company all powers for maintaining the accounting of individual entrepreneurs and devote all your time to more important business tasks. The cost of such services can also be adjusted by choosing the optimal tariff or list of required work.

Since any option has its pros and cons, in each case the decision will have to be made individually.

Step-by-step instruction

Most beginning entrepreneurs associate all their reporting with accounting issues, which is divided into three types:

- tax (declarations, calculations);

- accounting (financial condition reports);

- reporting on employees (to funds and calculations of insurance premiums).

Attention! Of these types of reporting, only the first and third are mandatory for individual entrepreneurs, since Law No. 402-FZ dated December 6, 2011 “On Accounting” established that they have the right not to maintain it, subject to strict accounting of income and expenses and other physical indicators.

As for tax accounting, it is important to correctly collect and summarize the information necessary to calculate the tax base. To generate reporting on employees, you also need to maintain personnel records. If the workforce is large, a businessman will not be able to cope with all this without his own accountant; if the enterprise is small, then you can order accounting services from a specialized company.

Those who want to independently organize accounting from scratch in 2018 need to follow these step-by-step instructions:

- Draw up a business plan, study the experience of competitors, determine the approximate ratio of income and expenses.

- Consider all possible tax regimes to select the lowest possible tax burden.

- Study the mandatory reporting under the chosen tax regime, pay attention to the deadlines and procedure for submitting declarations.

- If there is a need to attract hired labor, then a businessman must thoroughly study the issues of personnel records, the responsibilities of a tax agent and the forms of reports to funds.

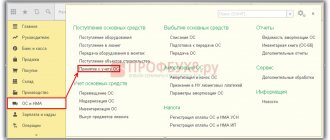

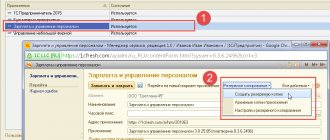

- Study the rules for maintaining a book of income and expenses, familiarize yourself with the software with which an individual entrepreneur can easily master accounting on his own, for example, “1C Entrepreneur”.

- Organize office work in such a way that documents are kept in order: create separate files for filing contracts, banking, personnel and cash documents, correspondence.

A successful business begins with well-thought-out accounting, and accounting requires order in the documents. All papers must be kept for at least the previous three years; they will be needed during a tax audit. In general, it is better not to destroy personnel documents, especially orders; their storage period for such cases varies from 50 to 75 years.

Next, we will consider how accounting for individual entrepreneurs will differ in different taxation systems.

Accounting for individual entrepreneurs on UTII

A businessman who has chosen the UTII regime pays tax on imputed income. Oddly enough, the amount of this tax does not directly depend on the amount of profit received. The tax base is determined by basic profitability, which, in turn, depends on physical performance indicators. The entire accounting of an entrepreneur on UTII consists of taking into account these physical indicators.

For each type of activity, different criteria are used as physical indicators, for example:

- in retail trade, the individual entrepreneur must take into account the area of the trade pavilion;

- when transporting passengers by taxi and route transport, the owner of the taxi fleet must keep records of the number of cars or the number of passenger seats;

- When providing services to the population, a businessman must take into account the number of hired workers, and when working alone, only himself.

Important! For a businessman on imputation, it is necessary to keep accounting records of fixed assets and intangible assets; the amount of real income can not be taken into account. It is necessary to do reporting on employees, especially since the tax base can be reduced by the amount of insurance premiums paid.

If a businessman combines several types of activities, one of which is taxed under the UTII regime, he must keep separate records of property, liabilities and business transactions for each type of work.

Accounting for individual entrepreneurs on PSN

The taxation system associated with a patent, or more precisely, with the purchase of it for a certain period of time from 1 to 12 months, is considered the most acceptable for businessmen starting their work in 2021. Everything is very simple here: you pay an amount for a patent, it is usually taken for a year or six months, and a tax return is not needed.

The price of a patent depends on the potential profit per year. Its size is established annually by regional authorities in their decree. Under PSN, the same concessions apply to entrepreneurs: financial statements do not need to be generated, but income must be taken into account, and expenses should not be recorded, since their amounts are not taken into account anywhere and do not affect the tax base. Gross revenue is reflected in the book approved by Order No. 135n dated 10.22.12.

Attention! A businessman who has no more than 15 employees on staff can switch to PSN. He must keep reports on employees in full.

How to conduct accounting for individual entrepreneurs using two simplified taxation systems?

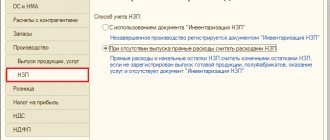

A mandatory condition for abolishing accounting for entrepreneurs and private practitioners using the simplified tax system is maintaining an Income and Expense Accounting Book (KUDiR). Such accounting is carried out for the purpose of correct calculation of the tax base, which, under this special regime, directly depends on the amount of income received under the simplified tax system of 6%, and is reduced by the amount of funds spent on the simplified tax system “income-expense” at a rate of 15%.

The first tax regime in terms of accounting is much simpler than the second, since only income is recorded in the Book. However, do not forget that you need to pay advances under the simplified tax system at a rate of 6% quarterly. To do this, based on the results of the quarter, the amount of income is calculated, the payment is calculated and paid according to the necessary details. There is no need to submit interim reports to the tax office. The declaration is submitted at the end of the year.

The second option is more difficult, since you also need to record expenses. Simply writing them down is not enough; you also need to keep supporting documents for them: supplier agreements and payment receipts. Moreover, not every type of expense is considered legal for reducing the tax base, since a closed list of expenses of the simplified tax system is prescribed in Art. 346.16 of the Tax Code of the Russian Federation, for example:

- purchase, manufacture, construction, repair, rental of fixed assets;

- acquisition of intangible assets;

- employee-related expenses: salaries, contributions to funds, sick leave, travel allowances;

- payment for legal, notary, accounting, auditing, advertising, expert services;

- payment of utilities, office expenses, purchase of software.

All these expenses have one common feature: they must be economically feasible and justified.

Important! In addition to KUDiR, a businessman using the simplified tax system is recommended to keep records of the residual value of fixed assets. The conclusion follows from the letter of the Ministry of Finance of Russia dated August 29, 2017 No. 03-11-11/55403. According to it, all taxpayers (both legal entities and individual entrepreneurs) using the simplified tax system must switch to OSNO if the residual value of their fixed assets exceeds 150 million rubles. But this figure can only be calculated if they are included in accounting, which, in principle, individual entrepreneurs should not maintain. From the point of view of the Ministry of Finance, in this case, entrepreneurs must rely on the rules for accounting for fixed assets for legal entities.

If a businessman considers it necessary to organize more complete accounting to track his financial condition, then he, as a small business entity, can create accounting records using a simplified system in accordance with paragraph 4 of Art. 6 of Law No. 402-FZ. The abbreviated forms were approved by order of the Ministry of Finance of the Russian Federation “On forms of financial reporting of organizations” dated July 2, 2010 No. 66n:

- balance sheet;

- income statement.

The remaining forms of reports: a statement of changes in capital and a statement of cash flows are filled out if they contain important information, in the absence of which it would be impossible to fully assess the financial condition of the business entity and the results of its activities.

Note! The formation of a balance sheet by an entrepreneur causes criticism from lawyers. When registering an individual entrepreneur, the formation of an authorized capital does not occur. It is extremely difficult to distinguish between personal property and business assets. The data in such reporting will be more than conditional.

What to consider on OSNO?

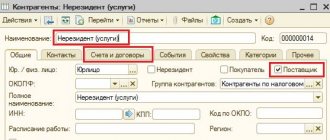

The general tax regime increases the tax burden on a businessman and complicates his tax accounting. This system is suitable for a beginning individual entrepreneur if he is immediately planning a large-scale business and is confident of making a good profit. Large suppliers are more interested in cooperation with entrepreneurs using OSNO.

Despite the fact that a businessman under the general taxation regime pays several types of taxes: personal income tax 13%, VAT, property tax, the rules of simplified accounting for individual entrepreneurs also apply to him. The only mandatory accounting attribute for him is also KUDiR.

Based on data on accounting for income and expenses of all business transactions during the month when the first income was received, the entrepreneur submits a 4-NDFL declaration to the tax authority about his estimated income for the coming year. After that, he pays advance payments quarterly, and at the end of the year, by April 30, submits a 3-NDFL declaration, where the final amount of personal income tax of 13% is calculated, taking into account advance payments.

Independent accounting for individual entrepreneurs in 2021

In order for an individual entrepreneur to manage document flow as efficiently as possible, it is enough to follow some simple tips. This will help you avoid common mistakes and unnecessary expenses. If you decide to register an individual entrepreneur, take the following steps:

- Determine the income and expenses of your business in advance. The resulting figures will be useful in determining the amount of taxes.

- Be sure to decide on the tax regime. There are several options here. OSNO and special modes: simplified taxation system, unified agricultural tax, PSN. There is also UTII. We remind you that the tax burden on the business depends on the chosen option. To make the right choice in each specific case, it is best to consult specialists for advice.

- Study tax reporting for your regime. This will make it easier to fill out paperwork in the future. Current samples can be found on the Federal Tax Service website.

- Decide if you need employees. With the advent of employees, the individual entrepreneur becomes a tax agent. From now on, you will need to maintain personnel documentation. In addition, you will have to calculate wages and deductions from them. Afterwards, you still need to make contributions to the Pension Fund and the Social Insurance Fund. All this will definitely require a specialist.

- Check your regime's tax calendar. If reporting deadlines are not met, this will result in fines and penalties that will have to be paid. Your current account may also be blocked.

- Choose who will do the accounting for the individual entrepreneur. If the regime is simple, for example, PSN or USN Income, the entrepreneur himself can do accounting. There are many online services for this. But if you have employees, or if you have chosen a regime like the simplified tax system Income minus expenses, OSNO, it is best to turn to professionals. After all, apparent savings can lead to large unexpected expenses. The same applies if the business has a large number of business transactions. Without experience and special knowledge, it is very easy to get confused in them.

- Collect all documents during the activity. These are all kinds of checks, bank statements, contracts, cash register reports, personnel and primary documentation. All this and other papers must be carefully stored. After all, the Federal Tax Service can check them within 3 years from the date of termination of the individual entrepreneur’s activities and its removal from the Unified State Register of Individual Entrepreneurs.

Thanks to these tips, you can quickly get up to speed and understand the essence of document flow in practice.

Comments: 5

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Polina Kruglova

05/27/2021 at 07:17 pm I have been collaborating remotely with for a long time, it is much more profitable and reliable than a regular full-time employee

Reply ↓ - Eugene

04/30/2021 at 13:07Good afternoon Tell me how to do it right. Example: I receive a salary/advance payment within a month, I record all cash receipts in the financial accounting application, but I receive bonuses and other allowances for this month only in the next month. The question is, for which month should the received bonus and allowances be recorded? (Perhaps such a rule does not exist, but I would like to hear your advice)

Reply ↓

Anna Popovich

05/01/2021 at 01:16Dear Evgeniy, for the calculation to be correct, we believe that the receipt should be entered upon receipt of it.

Reply ↓

04/12/2021 at 22:57

Hello! The question is: how to keep loans and borrowings in home accounting? It is possible using the accounting method, where receiving a loan is not income, and repaying the loan is not an expense. But then there will be no complete picture. For example, on January 31, I borrowed 10,000 rubles from a friend. In February I received a salary of 100,000, expenses amounted to 80,000. Nominal savings amounted to 20,000. But in the same February I repaid the debt. In this case, according to the February cash flow, I have 10,000 left. Inconsistency. On the other hand, you can count the receipt of a loan as income, and repayment of the debt as an expense. In terms of cash flow, everything will be fine, but for example, I spent the borrowed 10,000 on groceries, and then repaid the debt from my salary in the same month. It turns out that expenses are doubled, as well as income is doubled when you receive 10,000.

Reply ↓

- Anna Popovich

04/13/2021 at 00:38

Dear Dmitry, there are no universal rules for ideal accounting of personal finances. Your home accounting should reflect solely your convenience in counting. If you borrowed funds, for example, take them into account immediately as an expense, since in essence these funds are your guaranteed expenditure.

Reply ↓

Individual entrepreneur reporting calendar for 2021

Tax returns and reports for employees in 2021, regardless of the regime, must be submitted in the following order:

- Inspectorate of the Federal Tax Service. Form 2-NDFL must be submitted by March 1, 6-NDFL - within 30 days after the reporting quarter and before March 1 for the past year. The DAM must be submitted no later than 30 days after the reporting quarter.

- FSS. The paper form 4-FSS must be submitted every quarter: before the 20th of April, July, October, January. It is submitted electronically until the 25th, respectively. Confirmation of the main type of work must be provided by April 15.

- Pension Fund. The SZV-Experience form for the year must be submitted by March 1. SZV-M – until the 15th of each month.

Tax reporting and payment of taxes for individual entrepreneurs in 2021 are carried out as follows:

- BASIC. 1st quarter: VAT declaration – until April 24, tax – until June 25. 2nd quarter: VAT declaration - until July 25, tax - until September 25, advance payment of personal income tax - until July 15. 3rd quarter: VAT return – until October 25, tax – until December 25. Advance payment for personal income tax – until October 15. 4th quarter: VAT declaration – until January 25, tax – until March 25. Personal income tax declaration - until April 25, tax for the past year - until July 15, 2022.

- USN. Advance payments – until April 25, July, October. Payment of taxes and submission of a return for the past year is carried out until April 30, 2022.

- Unified Agricultural Sciences. Advance payment must be made by July 25th. The declaration and tax for the past year are submitted until March 31, 2022. If there is no VAT exemption, then you also need to report on it.

- UTII. Reporting is submitted every quarter, before the 20th day of the month following the reporting period. The tax must also be transferred every quarter, until the 25th of the month, respectively.

Individual entrepreneurs on PSN do not need to submit a declaration. The cost of a patent must be paid in accordance with its validity period.

Where to pay taxes for individual entrepreneurs using the simplified tax system 6 percent

Tax according to the simplified tax system “Income”

By virtue of paragraph 6 of Art. 346.21 of the Tax Code of the Russian Federation, tax according to the simplified tax system and advances are paid at the place of residence of the entrepreneur.

Taking into account the rules for indicating information in the details of payment slips for state payments, approved by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, payment slips for tax payments according to the simplified tax system with the object “Income” should be filled out, taking into account the following features:

- in field 101, code 09 is indicated, corresponding to the payer - individual entrepreneur;

- field 8 reflects full name. and in brackets the status is “IP”, the sign “//” is indicated before and after the information about the registration address;

- the TIN is entered in field 60;

- in field 102 - 0 due to the absence of a checkpoint;

- in field 104 - KBK.

Advance payments and tax for the year are transferred to one BCC - 182 1 0500 110.

Insurance premiums for yourself

According to paragraph 2 of Art. 432 of the Tax Code of the Russian Federation, contributions for oneself for compulsory health insurance and compulsory medical insurance are calculated separately. Deductions are made to the inspectorate at the place of residence (clauses 1, 3, Article 83 of the Tax Code of the Russian Federation).

The following BCCs are indicated in the payments:

- contributions to compulsory pension insurance (fixed and one percent) - 182 1 0210 160;

- contributions for compulsory medical insurance - 182 1 0213 160.

Insurance premiums for employees

Deductions for mandatory medical insurance, compulsory medical insurance and VNIM are made to the Federal Tax Service at the place of residence (clauses 1, 3, article 83 of the Tax Code of the Russian Federation). Contributions for injuries are also transferred at the place of residence, but to the territorial branch of the Social Insurance Fund of the Russian Federation (clauses 3, 4, clause 1, article 6 of Law No. 125-FZ).

The following BCCs are indicated in the payments:

- for OPS - 182 1 0210 160;

- for compulsory medical insurance - 182 1 0213 160;

- at VNiM - 182 1 0210 160;

- for injuries - 393 1 0200 160.

Accounting using the simplified tax system

The simplest option is to maintain an individual entrepreneur on the simplified tax system. After all, it is enough to submit one return for the year and pay the tax contribution on the same day. True, there are two accounting options for individual entrepreneurs using simplified language:

- Income accounting – tax 6%. This rate remains unchanged throughout the entire period. It is enough to make an advance payment before the 25th month following the reporting month.

- Accounting for income and expenses – tax 15%. All business expenses must be accounted for and documented correctly. This is the only way they will be taken into account when reducing the tax base. Therefore, it is necessary to save all bank statements, checks, invoices, etc. It is also necessary to keep KUDiR - a book of income and expenses.

On what income should individual entrepreneurs pay tax on the simplified tax system at 6 percent?

The Tax Code does not establish a special list of income taken into account by simplifiers. According to Article 346.15 of the Code, within the framework of the simplified tax system, income is determined according to the rules of paragraphs 1 and 2 of Art. 248 of the Tax Code of the Russian Federation, that is, the same as for paying income tax. Thus, individual entrepreneurs on the simplified tax system of 6 percent take into account sales and non-sales income.

Sales revenue is income from the sale of goods of own production and purchased for resale (property rights), income from the provision of services, and performance of work. Sales revenue is recognized as all money or payment in kind received in the settlement of goods (work, services) sold.

Non-operating revenue is:

- revenue from exchange rate differences;

- amounts of damages, losses, fines, and other sanctions recognized by the debtor or won in court for violation of contracts;

- rental payments, if this is non-operating income;

- interest on loans, bank deposits;

- other income.

According to paragraph 1 of Art. 250 of the Tax Code of the Russian Federation, non-operating income is revenue not included in the sales article. 249 of the Tax Code of the Russian Federation. Accordingly, the list of non-operating income is open.

It should be taken into account that certain income is not subject to inclusion in the base under the simplified regime. In accordance with paragraph 1.1 of Art. 346.15 of the Tax Code of the Russian Federation these include:

- income from the list of Art. 251 of the Tax Code of the Russian Federation, not taken into account in the income tax base. Despite the fact that advances in Art. 251 of the Tax Code of the Russian Federation are given, they still need to be taken into account in the database according to the simplified tax system. This is due to the fact that in the income tax base, advances are not taken into account by taxpayers who determine income using the accrual method, while under the simplified tax system, income is determined using the cash method;

- income subject to personal income tax at rates of 9 and 35 percent;

- dividends - according to clause 3 of Art. 346.11 of the Tax Code of the Russian Federation, personal income tax is paid from them;

- income on which tax is paid under the patent system.

Revenue accounting under the simplified system is carried out using the cash method (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). This means that money is counted on the date it is credited to a bank account, received at the cash register, or the debt is repaid in another way (receiving goods as payment, signing an offset act).

In letter dated 02/10/2020 No. 03-11-11/8398, the Ministry of Finance of the Russian Federation explained that when paying for goods with a plastic card, income is accounted for precisely at the moment the money is credited to the current account. Accordingly, if the moment of direct payment for goods by card does not coincide with the moment the money arrives in the account, the payment must be taken into account only when the money is credited.

Regarding the commission that the bank can withhold from the buyer’s payment, in letter dated September 19, 2016 No. 03-11-11/54526, the Ministry of Finance reported that when paying for goods through the terminal, the seller’s income will be the entire amount received, without reducing it for any expenses , including bank commission.

All income, including those received in kind, must be expressed in money. This requirement is enshrined in paragraph 1 of Art. 346.18 Tax Code of the Russian Federation. Revenue in kind is converted into money based on market prices (clause 4 of article 346.18 of the Tax Code of the Russian Federation).

Accounting for Unified Agricultural Tax

Reports on the unified agricultural taxation system must be submitted twice a year. The situation is complicated by the fact that every month you need to submit reports for employees with whom employment contracts have been concluded. Unified agricultural tax is a special regime that was created for producers of agricultural goods, as well as for companies and individual entrepreneurs that provide services to manufacturers of agricultural products. Its essence is to provide this category of entrepreneurs with preferential conditions for conducting activities. Companies and individual entrepreneurs that are not producers of agricultural products cannot apply the unified agricultural tax.