Synchronization purpose

If you configure the synchronization of two applications in the 1C:Enterprise 8 over the Internet service, then documents and directory entries that are entered or changed in one application will be automatically transferred to another application during periodic data synchronization sessions.

Synchronization of applications 1C:Accounting 8 and 1C:Salaries and personnel management 8 allows you to provide:

- automatic transfer of information on payroll and insurance contributions from application 1C: Salaries and personnel management 8 to application 1C: Accounting 8 for the generation and submission of regulated reporting;

- convenience for employees: accountants work in the 1C: Accounting 8 , and payroll clerks and HR specialists work in the 1C: Salaries and Personnel Management 8 application;

- consistency (synchronization) of directories used in these applications, eliminating the need for manual re-entry of data.

Shifts, teams and workers in “1C: Trade Management + Production”

If fixed teams of workers are working on the production, then in the 1C: Trade Management + Production you can maintain a register of teams with a description of the composition.

In the document “Production Report” you can select the element of the directory “Brigades/Shifts”

.

This way we indicate which team worked on this release. In this case, in the document on the “Payment to employees” , you can click the “Fill in by shift”

- filling and calculation will be made according to the composition of the team.

Moreover, if in some cases the actual composition of the team differed from the planned one (for example, someone did not show up for work, employees were replaced), then after filling out the list of employees, they can be changed by selecting from the list as in the first case.

When posting the “Production Report” “Reflect in production accounting” checkbox must be checked .

Setting up salary display in accounting

Before enabling the data synchronization mechanism between applications 1C: Salaries and HR Management 8 and 1C: Accounting 8, you must configure the reflection of salaries in accounting in these applications.

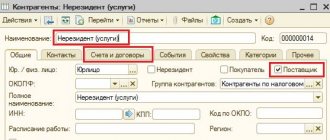

- In the application 1C: Accounting 8:

- in the menu section Salaries and personnel - Salary settings In an external program must be enabled ;

In the menu section Salaries and Personnel - Salary Settings , you need to set the wage accounting settings - menu items Salary Accounting Procedure, Salary Accounting Methods and Cost Items for Insurance Contributions.

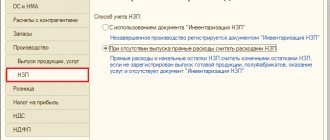

- In the application 1C: Salaries and personnel management 8:

- you need to set up data preparation rules for accounting and tax accounting, as described in the documentation for this application (see the link);

in the organization cards, on the Accounting policies and other settings , select the menu item Estimated liabilities (reserves) for vacations and select the method used in the accounting policies of the organization for forming estimated liabilities (reserves) for vacation payments (for more details, see the link).

Comment. If setting up the reflection of salaries in accounting causes difficulties, we recommend that you contact your partner service organization.

Sequence of entering documents when calculating salaries

Let's look at the documents and reference books used in payroll calculations and personnel records.

- Fill in the settings as described in the section.

- We add a new employee to the “Employees” directory (“Salaries and Personnel – Employees”).

- Personnel records (documents are located in the menu “Salaries and Personnel – Personnel – Personnel Documents”):

- To hire an employee, we use the “Hiring” document.

- To change salary, position, or transfer to another department, we use the “Personnel Transfer” document.

- To dismiss an employee, we use the “Dismissal” document.

- automatically with the documents “Vacation” and “Vacation without pay” (menu “Salaries and Personnel - All Accruals” - click on the “Create” button). This method is available if the database contains up to 60 employees.

- automatically with the document “Sick Leave” (menu “Salaries and Personnel – All Accruals” - click on the “Create” button). This method is available if the database contains up to 60 employees.

- through the cash register - create a document “Statement to the cash register”, then “Cash withdrawal”.

Backing up applications

Before setting up synchronization of applications 1C: Accounting 8 and 1C: Salary and HR 8 , it is recommended to save backup copies of these applications.

To create a backup copy, the user-owner of the subscriber must log into the service manager ( Personal Account on the My Applications , double-click the application name in the list and select the menu item Backup - Create backup . Created backup copy of the application will be stored in the service.

Note. If desired, you can obtain the created backup file. To do this, you need to wait for the backup to be created, select the menu item Backup - Archive copies of applications , select the desired backup copy from the displayed list and click the Get file . The resulting file can be used to create a new application in the service, as well as to switch to the local version of the application.

How to check if synchronization is correct

If synchronization is enabled, you should check on the Synchronizing data with my applications (it is displayed when you select the menu items Administration | Data synchronization ) to see if there are any problems synchronizing data. If problems occur, a message will be displayed about this.

In such cases, you should follow the Warnings hyperlink. Data Synchronization Warning form will be displayed :

There are 4 tabs on this form:

- Unposted documents - here you can see documents received during synchronization from another program, which for one reason or another could not be automatically posted;

- Unfilled details - here you can see documents received during synchronization from another program that could not be processed because one or more document attributes were filled in;

- Conflicts - here documents and directory entries are shown that were changed in two programs between synchronizations. As a result, two versions of one directory element or one document appeared. Such conflicts are resolved automatically - but you can view the list of such situations and confirm or revise automatically made conflict resolution decisions;

- Not accepted by ban date - shows documents whose information was not entered into the application database because the dates of these documents are earlier than the ban date Data synchronization

Each tab's label shows the number of warnings in that tab in parentheses.

It is recommended that you review all warnings and correct the causes of errors.

Attention. Problems with data transferred during synchronization are shown in the application to which the data was transferred. That is, in Appendix 1C: Accounting 8 problems with data obtained from Appendix 1C: Salary and HR Management 8 (if such problems arise). And in application 1C: Salaries and personnel management 8 - problems with data obtained from application 1C: Accounting 8 (if such problems arise). Therefore, it is necessary to check whether problems have arisen during synchronization, both in application 1C: Accounting 8 , and in application 1C: Salary and personnel management 8 .

Payroll in "1C: Trade Management + Production"

After calculating wages based on the results of production in “1C: Trade Management + Production”, it is necessary to make a payment to the employee.

Payroll in “1C: Trade Management + Production” is carried out using the documents “Cash receipt order” and “Write-off of non-cash funds” .

In these documents, when selecting the operation “Payment of salary to employee”, “Employee” field

“Accrual month”

field appears . In this field we indicate the month for which the income is paid.

The statement and status of mutual settlements with employees in “1C: Trade Management + Production” can be viewed in the report “Analysis of accrued salaries”

, which is located in the

“Production Accounting” section, subsection “Reports”.

Read more about the program “1C: Trade Management + Production” at this link

How to start app synchronization manually

If the 1C:Enterprise 8 over the Internet service is configured to synchronize a pair of applications, then the service automatically synchronizes these applications according to a specified schedule (by default, every 15 minutes).

However, if necessary, you can manually start synchronizing applications at any time.

- Log in to the service and launch the application 1C: Salaries and personnel management 8 or application 1C: Accounting 8.

- Administration - Data synchronization settings in the application menu .

- In the Data synchronization settings , click the Data synchronization hyperlink.

- In the opened form Syncing data with my apps click the button Sync everything. The 1C:Enterprise 8 over the Internet service will begin synchronizing the application with all other service applications for which synchronization has been configured:

Accountant checking payroll

After synchronizing data from applications 1C: Accounting 8 and 1C: Salary and HR Management 8, in application 1C: Accounting 8, entries can be automatically generated that reflect in accounting information about payroll, insurance premiums, and other payments. But it is often required that transactions be generated only with the permission of the accountant.

To select the desired mode for generating transactions in the document Reflection of salaries in accounting, there is a checkbox called Salaries reflected in accounting by user .

If the payroll clerk sets this checkbox 1C: Salaries and Personnel Management 8 Reflection of Salaries in Accounting , then after synchronization in Appendix 1C: Accounting 8 , based on the transmitted document Reflection of Salaries in Accounting, transactions will be generated that reflect in accounting information on payroll, insurance premiums and other payments.

If this checkbox was not checked by the payroll processor, then:

- After synchronization is completed, the document Reflection of salaries in accounting will appear in application 1C: Accounting 8 , but postings for it will not be automatically created.

- An accountant, working in application 1C:Accounting 8, will see in the list of documents that the document has not been posted (in the left column of the list the document is not marked with a “checkmark”).

- To post a document, an accountant can open this document, check it, possibly correct something, and check the box Salaries are reflected in the accounting by the user, as if he signed this document.

- After this, the document is accepted for accounting in Appendix 1C: Accounting 8 , that is, postings are generated based on it.

- When performing the next synchronization, this document, with the Salary reflected in accounting checkbox selected, is transferred by the user to application 1C: Salary and personnel management 8 . And the payroll processor will no longer be able to change this flag (since the document has already been “signed” by the accountant).

LECTURE No. 6. Accounting for labor and wages

- 1. Forms and systems of remuneration

- 2. Classification and accounting of enterprise personnel, recording of working time use

- 3. Payroll

- 4. Salary deductions

Accounting for labor and wages is a complex and very time-consuming accounting task.

The right to work is enshrined in the Constitution of the Russian Federation in Art. 37, which determines that every citizen has the right to freely dispose of his ability to work.

Labor relations of all employees are regulated by the Labor Code of the Russian Federation.

Remuneration under employment agreements.

In accordance with Art. 15 of the Labor Code of the Russian Federation, labor relations are relations based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function (work in a certain specialty, qualification or position), the employee’s subordination to internal labor regulations while the employer provides working conditions provided for by labor legislation, collective agreement, agreements, employment contract.

The basis of labor relations is an employment agreement (contract), concluded in writing. The labor income of each employee is not limited to maximum amounts. The minimum monthly wage is established by the government and is widely used in calculating tariff rates, official salaries, and when imposing fines.

Currently, among the most important tasks of labor and wage accounting are:

1) promptly and within the established deadlines make payments to personnel for wages;

2) timely and correctly attribute the amount of accrued wages and taxes to the cost of production;

3) collect and group indicators on labor and wages for the purposes of operational management and tax calculations.

According to Article 20 of the Labor Code of the Russian Federation, the parties to labor relations are the employee and the employer.

Worker

– an individual who has entered into an employment relationship with an employer.

Employer

– an individual or legal entity (organization) that has entered into an employment relationship with an employee. In cases established by federal laws, another entity entitled to enter into employment contracts may act as an employer.

The rights and obligations of the employer in labor relations are exercised by: an individual who is an employer; management bodies of a legal entity (organization) or persons authorized by them in the manner established by laws, other regulatory legal acts, constituent documents of a legal entity (organization) and local regulations.

For the obligations of institutions financed in whole or in part by the owner (founder), arising from labor relations, the owner (founder) bears additional responsibility in the manner prescribed by law.

Labor relations may arise between an employee and an employer on the basis of a collective agreement. In accordance with Art. 41 of the Labor Code of the Russian Federation, the content and structure of the collective agreement are determined by the parties.

The collective agreement may include mutual obligations of employees and employers on the following issues:

1) forms, systems and amounts of remuneration;

2) payment of benefits, compensation;

3) a mechanism for regulating wages taking into account rising prices, inflation levels, and the fulfillment of indicators determined by the collective agreement;

4) employment, retraining, conditions for releasing workers;

5) working time and rest time, including issues of granting and duration of vacations;

6) improving the working conditions and safety of workers, including women and youth;

7) respect for the interests of employees during the privatization of organizations and departmental housing;

environmental safety and health protection of workers at work;

environmental safety and health protection of workers at work;

9) guarantees and benefits for employees combining work with training;

10) health improvement and recreation of employees and members of their families;

11) control over the implementation of the collective agreement, the procedure for making changes and additions to it, the responsibility of the parties, ensuring normal conditions for the activities of employee representatives;

12) refusal to strike if the relevant conditions of the collective agreement are met;

13) other issues determined by the parties.

A collective agreement, taking into account the financial and economic situation of the employer, may establish benefits and advantages for employees, working conditions that are more favorable in comparison with those established by laws, other regulatory legal acts, and agreements.

The collective agreement includes regulatory provisions if laws and other regulatory legal acts contain a direct requirement for the mandatory enshrinement of these provisions in the collective agreement.

Payment for night work hours.

Night work time is considered to be the time from 10 pm to 6 am. It is recorded in the report card as the total quantity for the month. All work at night is documented and calculated at a certain (increased) rate. This increased amount cannot be lower than 40% of the tariff rate.

According to Art. 96 of the Labor Code of the Russian Federation, the following are not allowed to work at night: pregnant women; workers under the age of 18, with the exception of persons involved in the creation and (or) performance of artistic works, and other categories of workers in accordance with this Code and other federal laws. Women with children under 3 years of age, disabled people, workers with disabled children, as well as workers caring for sick members of their families in accordance with a medical report, mothers and fathers raising children under the age of 5 years old, as well as guardians of children of this age, may be involved in night work only with their written consent and provided that such work is not prohibited for them for health reasons in accordance with a medical report. In this case, these employees must be informed in writing of their right to refuse to work at night.

Payment for overtime hours.

Overtime is work that is carried out by employees after the main shift. Overtime work is allowed in exceptional cases with the permission of the head of the enterprise.

In accordance with Art. 99 of the Labor Code of the Russian Federation, involvement in overtime work is carried out by the employer with the written consent of the employee in the following cases:

1) when carrying out work necessary for the defense of the country, as well as to prevent an industrial accident or eliminate the consequences of an industrial accident or natural disaster;

2) when carrying out socially necessary work on water supply, gas supply, heating, lighting, sewerage, transport, communications - to eliminate unforeseen circumstances that disrupt their normal functioning;

3) if necessary, perform (finish) work that has begun, which, due to an unforeseen delay due to technical production conditions, could not be performed (finished) within the normal number of working hours, if failure to perform (non-complete) this work may result in damage or destruction of the employer’s property, state or municipal property or create a threat to the life and health of people;

4) when carrying out temporary work on the repair and restoration of mechanisms or structures in cases where their malfunction may cause the cessation of work for a significant number of workers;

5) to continue work if the replacement employee fails to appear, if the work does not allow a break. In these cases, the employer is obliged to immediately take measures to replace the shift worker with another employee.

In other cases, involvement in overtime work is permitted with the written consent of the employee and taking into account the opinion of the elected trade union body of the organization.

Pregnant women, workers under the age of 18, and other categories of workers are not allowed to work overtime in accordance with federal law. Involving disabled people and women with children under 3 years of age in overtime work is permitted with their written consent and provided that such work is not prohibited for them due to health reasons in accordance with a medical report. At the same time, disabled people and women with children under 3 years of age must be informed in writing of their right to refuse overtime work.

Overtime work should not exceed 4 hours for each employee for 2 consecutive days and 120 hours per year.

The employer is required to ensure accurate records of overtime work performed by each employee.

Payment for products that turned out to be defective.

Complete defects due to the fault of the employee are not paid in full, and partial defects are paid depending on the degree of suitability of the manufactured products at reduced prices or at cost.

Defects that are not the fault of the employee are paid at reduced rates. A defect that occurred not through the fault of the employee, but due to a hidden defect in the processed material (raw materials), is paid to the employee on the same basis as good products.

Payment for downtime.

Downtime caused by the employee is not subject to payment. Downtime not caused by the employee, if he warned the administration about the start of downtime, is paid at the rate of not less than 2/3 of the tariff rate of the category or salary established for the employee.

Remuneration for combining professions.

If an employee, along with the main work stipulated by the employment contract, performs additional work in another profession or the duties of a temporarily absent employee without being released from his main job, then he is paid extra for combining professions or performing the duties of a temporarily absent employee.

The amount of these additional payments is determined by the administration by agreement of the parties.

Remuneration during the development of production (new types of products).

For the period of development of new production (products), employees may be given an additional payment up to their previous average earnings in the manner and on the terms determined by the collective agreement.

Remuneration for part-time work.

In addition to their main job, many employees perform additional work (combined) in the same organization. When combining professions, it is necessary to draw up an employment agreement, which stipulates the duration of the combined profession and, accordingly, the payment for it. The amount of payment is set by the administration (manager) of the enterprise.

Vacation and severance pay.

The right to leave arises for employees six calendar months after joining the organization. Vacation must be provided to employees annually within the period provided for by the vacation schedule approved by the enterprise. In exceptional cases and with the consent of the employee, it is allowed to transfer his established leave to the next calendar year. Currently, at many enterprises, the vacation schedule is noticeably different from the vacation schedules of enterprises twenty years ago, since many employees are on vacation not for a month, but for less than 1–3 weeks.

In large and medium-sized enterprises, the development and calculation of all necessary indicators in the field of labor and wages is carried out by the human resources department.

The staff is divided into:

1) permanent personnel - employees hired without specifying a period;

2) seasonal personnel - employees hired for the period of seasonal work;

3) temporary personnel - employees hired for a period of no more than 2 months.

In accordance with the Labor Code of the Russian Federation, working hours

– the time during which the employee, in accordance with the internal labor regulations of the organization and the terms of the employment contract, must perform labor duties, as well as other periods of time that, in accordance with laws and other regulatory legal acts, relate to working time.

Normal working hours cannot exceed 40 hours per week.

The employer must keep records of the time actually worked by each employee.

When working part-time, the employee is paid in proportion to the time he worked or depending on the amount of work he performed.

Part-time work does not entail for employees any restrictions on the duration of annual basic paid leave, calculation of length of service and other labor rights.

The duration of daily work (shift) cannot exceed:

1) for workers aged 15–16 years – 5 hours, for workers aged 16–18 years – 7 hours;

2) for students of general education institutions, educational institutions of primary and secondary vocational education, combining study with work during the academic year, at the age of 14 to 16 years - 2.5 hours, at the age of 16-18 years - 3.5 hours;

3) for disabled people - in accordance with a medical report.

For workers engaged in work with harmful and (or) dangerous working conditions, where reduced working hours are established, the maximum permissible duration of daily work (shift) cannot exceed:

1) with a 36-hour work week – 8 hours;

2) with a 30-hour work week or less – 6 hours

For creative workers of cinematography organizations, television and video filming groups, theaters, theatrical and concert organizations, circuses, media, professional athletes in accordance with the lists of categories of these workers approved by the Government of the Russian Federation, the duration of daily work (shift) can be established in accordance with laws and other regulatory legal acts, local regulations, a collective agreement or an employment contract (Article 94 of the Labor Code of the Russian Federation).

Synthetic accounting

Organizations maintain payments for wages on account 70 “Settlements with personnel for wages.”

On account credit 70

reflect the amounts of accrued wages for hours worked and bonuses due to members of the labor collective and persons working under an employment agreement (contract) (debit of accounts 08, 10, 15, 20, 23, 25, 26, 28, 29, 43, 96), amounts temporary disability benefits and other payments from extra-budgetary social funds. The basis for calculating wages are time sheets, work orders (work orders) for work, and other documents.

On the debit of account 70

payments of wages from the cash register are taken into account (account credit 50), the amount of income tax withheld to the budget (account credit 68), amounts not returned to accountable persons in a timely manner (account credit 71), amounts for material damage caused (account credit 73), for marriage (account credit account 28), in repayment of debt on issued loans (account credit 73), according to executive documents in favor of various legal entities and individuals (account credit 76).

Analytical accounting

account 70 is led to in the personal accounts of workers and employees (forms No. T-54 and No. T-55), which are created at the beginning of the year for each member of the workforce and persons working under an employment agreement (contract). During the year, data on accrued wages, bonuses, year-end payments, for length of service, benefits for disability certificates, deductions, indicating the amounts to be issued are entered into personal accounts. The shelf life of personal accounts is 75 years.

In accounting, payroll is reflected in the following entries:

1) wages are accrued to employees for loading, unloading, moving equipment requiring installation:

Debit account 07 “Equipment for installation”, Credit account 70 “Settlements with personnel for wages”;

2) wages accrued to employees engaged in capital construction:

Debit of account 08 “Investments in non-current assets”, Credit of account 70 “Settlements with personnel for wages”;

3) wages were accrued to employees for loading, unloading, moving inventory: Debit account 10 “Materials”,

Credit to account 70 “Settlements with personnel for wages”;

4) wages are accrued for manufactured products, works, services to the personnel of the main production:

Debit account 20 “Main production”,

Credit to account 70 “Settlements with personnel for wages”;

5) wages accrued to personnel of auxiliary production:

Debit of account 23 “Auxiliary production”, Credit of account 70 “Settlements with personnel for wages”;

6) wages accrued to general production personnel: Debit of account 25 “General production expenses”,

Credit to account 70 “Settlements with personnel for wages”;

7) wages for general business personnel are accrued: Debit account 26 “General business expenses”,

Credit to account 70 “Settlements with personnel for wages”;

wages were accrued to personnel for correcting defects: Debit of account 28 “Defects in production”,

wages were accrued to personnel for correcting defects: Debit of account 28 “Defects in production”,

Credit to account 70 “Settlements with personnel for wages”;

9) wages accrued to employees of service industries:

Debit of account 29 “Service production and facilities”, Credit of account 70 “Settlements with personnel for wages”;

10) wages have been accrued to employees for work attributed to deferred expenses:

Debit account 97 “Deferred expenses”,

Credit to account 70 “Settlements with personnel for wages”;

11) wages accrued to personnel involved in product sales:

Debit account 43 “Finished products”,

Credit to account 70 “Settlements with personnel for wages”;

12) wages were accrued to personnel for the dismantling of fixed assets:

Debit account 46 “Completed stages of work in progress”, Credit account 70 “Settlements with personnel for wages”. Accounting for the reserve for vacation pay

Organizations may have expenses that were not incurred in the reporting period, but will occur in the future. These expenses are called pending expenses or pending payments. These are reserves formed by the organization: to pay for vacations.

Formation of a reserve for vacation pay. Most organizations include accrued vacation pay in production costs (debit accounts 20, 23, 25, 26, 29, 43, credit account 70). Members of the workforce are granted vacations unevenly throughout the year, which leads to a distortion of the cost of products (works, services) in different reporting periods. To avoid this, organizations can, when adopting an accounting policy, provide for the formation of a reserve for payment of vacations, and write off the amounts actually accrued for vacations against this reserve. The vacation reserve is calculated from wages for the time actually worked.

The question of how to reflect vacation pay in the accounting accounts is determined by the organization itself, adopting an accounting policy for the coming year.

The mechanism for reserving amounts for vacation pay is mainly used by large commercial organizations (for example, JSC), as well as organizations located in the Far North and similar areas. Small businesses do not have such a need.

Contributions to the reserve can be made either in a fixed amount monthly or as a percentage of wages.

Distribution of labor costs and related mandatory payments

All primary documents for recording production (work orders, additional payment sheets, downtime sheets, route sheets, time sheets, etc.) go to the organization’s accounting department. There they are grouped by workshops, services, departments, and in the context of these divisions - by cost centers for production (by types of products manufactured, work performed, services provided, for general production and general economic purposes, commercial expenses, etc.) and non-production (capital construction , maintenance and operation of social facilities, work financed from special sources) purposes. Grouped primary documents are the basis for including the amounts of accrued wages (credit account 70) in production costs (debit accounts 20, 23, 25, 26, 28, 29, 43), in other areas (debit accounts 07, 08, 10, 80, 96). At the same time, the organization debits the same accounts where the accrued wages were written off, assigns in the established amount (%) to wages:

1) from the credit of account 68 – transport tax accrued to the budget (1%);

2) from the credit of account 69 - deductions to extra-budgetary social funds: to the Social Insurance Fund (account 69.1), to the Pension Fund (account 69.2), to the Mandatory Medical Insurance Fund (account 69.3), to the Employment Fund (account 69.4).

Accruals are made for the remuneration of the organization's employees: full-time (including working pensioners), non-staff, part-time, seasonal, one-time and casual workers.

Payments from net profit to be included in comprehensive income for tax purposes

The list of such payments is quite long. There are payments that are fully included in total income, while others are provided with benefits by law (for tax purposes, such payments are included in the calculation in amounts exceeding the benefit amount).

The first group, in particular, includes material and social benefits provided by the organization to employees:

1) payment for housing, communal and personal services;

2) individual subscription to periodicals (newspapers, magazines) and books; telephone subscription fee;

3) one-time benefits in connection with retirement;

4) free or discounted food coupons, purchase of travel tickets, personal passes for visiting sports facilities;

5) payment of fees for parents for the maintenance of children in preschool institutions, as well as tuition fees in educational institutions;

6) issuing tourist and excursion vouchers to employees free of charge or at a discount;

7) contributions to non-state pension funds, etc. The second group includes, in particular, amounts of material assistance and the cost of clothing gifts and prizes, for which a benefit is provided in the amount of 12 times the monthly minimum wage.

Taxation of persons who are not members of the organization

The taxation procedure for such persons does not differ from that established for those on the staff of the organization, with the exception of income tax benefits established for developers and for the maintenance of children and dependents - they are not provided to persons who are not on the staff of the organization.

Currently, many individuals do not have main jobs, so they are forced to work under one-time labor agreements. When calculating tax, income is reduced by all deductions provided by law. The accounting department must require from these persons personal statements, documents confirming the right to benefits and deductions, as well as a work record book.

The organization, at least once a quarter within the period agreed upon with the tax authority, submits certificates of income paid to the indicated persons.

Deduction based on writs of execution

The basis for withholding alimony is writs of execution, and if they are lost, duplicates; written statements from citizens about voluntary payment of alimony; marks (records) of internal affairs bodies in the passports of persons about that. In accordance with the decision of the courts, these persons are required to pay alimony.

Organizations record settlements with legal entities and individuals for deductions in their favor on account 76 “Settlements with various debtors and creditors.” Open subaccount 1 “Deductions under writs of execution” for it.

Amounts of employee income from which alimony is withheld:

1) wages at tariff rates, official salaries, at piece rates or as a percentage of revenue from sales of products (performance of work, provision of services), etc.;

2) additional payments and allowances to tariff rates and official salaries (for work in harmful and dangerous working conditions, at night; for those employed in underground work; for qualifications, combining professions and positions, temporary substitution, access to state secrets, academic degrees and academic title, length of service, work experience, etc.);

3) bonuses (remunerations), which are of a regular or periodic nature, as well as based on the results of work for the year;

4) payment for overtime work, work on weekends and holidays;

5) the sum of regional coefficients and wage supplements;

6) wages during vacation, monetary compensation for unused vacation, in the case of combining vacations for several years;

7) additional payments established by the employer in excess of the amounts accrued when providing annual leave in accordance with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation;

the amount for the period of performance of state and public duties and in other cases provided for by the Labor Code of the Russian Federation (except for severance pay upon dismissal);

the amount for the period of performance of state and public duties and in other cases provided for by the Labor Code of the Russian Federation (except for severance pay upon dismissal);

9) an amount equal to the cost of the issued (paid) food, except for therapeutic and preventive food;

10) commission (for full-time insurance agents, full-time brokers, etc.);

11) payment for work performed under civil contracts;

12) the amount of royalties, including those paid to full-time employees of editorial offices of newspapers, magazines and other media;

13) the amount of executive remuneration;

14) income of individuals engaged in mining activities;

15) income from engaging in entrepreneurial activities without forming a legal entity;

16) income from the lease of property;

17) income from shares and other income from participation in the management of the organization’s property (dividends, payments on equity shares, etc.);

18) material assistance provided to citizens in connection with a natural disaster, fire, theft of property, injury, as well as the death of a person obligated to pay alimony or his close relatives.

Retention for marriage

Products that, due to defects in them, cannot be used for their intended purpose are considered defective. A distinction is made between correctable defects (the defects are removable and this is economically expedient) and irreparable defects (the defects are irreparable, or, although correctable, it is not economically expedient); internal (identified within the organization) and external (identified by consumers).

If the defect is correctable, then the amount of losses (debit of account 28) will be the sum of the costs associated with its correction:

1) materials (account credit 10);

2) wages accrued for correcting the defect (account credit 70);

3) payments to off-budget social funds (account credit 69);

4) the amount of transport tax (account credit 68) and part of general production expenses (account credit 25). The accounting amount of losses will either be immediately withheld in full

amount (debit of account 70, credit of account 28), or previously written off to account 73.3 (debit of account 73.3, credit of account 28) and subsequently repaid (credit of account 73.3) by deduction from wages (debit of account 70), depositing cash in the cash register (debit of account 50) or transfers to the current account (debit of account 51).

Table of contents

About the transfer of salary and personnel accounting data from the 1C: Accounting 8 application

Currently, synchronization of applications 1C: Accounting 8 and 1C: Salary and Personnel Management 8 is implemented on the assumption that salary and personnel records are maintained in application 1C: Salary and Personnel Management 8 .

However, some users first keep track of salaries and personnel in the 1C: Accounting 8 , and then decide to switch to using the 1C: Salary and Personnel Management 8 . In this case it is necessary:

- When creating the 1C: Salary and HR Management 8 , use the “Initial Filling Assistant” to transfer data from the 1C: Accounting 8 .

- In application 1C: Accounting 8, in the Salaries and Personnel , enable the In an external program .

- Configure the display of wages in accounting in applications 1C: Accounting 8 and 1C: Salary and HR 8 and enable synchronization of these applications, as described at the beginning of this article.

Tariff rates for piecework payment for production

Entering information about employee output in 1C:UT + Production within the framework of a specific product output occurs in the document “Production Report” .

But in order for the “Production” module in 1C: Trade Management to calculate the total amounts, it is necessary to indicate the tariff rates of employees for production.

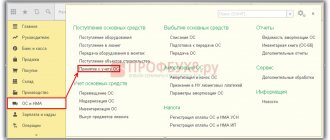

Setting the tariff rates for production workers is carried out in the “Production Accounting” in the menu item “Tariffs for employee remuneration”

A list opens with payment rates for employees in 1C:UT + Production .

To enter a new tariff, click the “Create”

. The information entry window opens

In this window you must provide the following information

- Period

. We determine from what date this tariff is valid. It is convenient, for example, when tariffs change over time and you need to save the history of tariff rates in 1C. - Employee

. Selecting a value from the “Individuals” directory in “1C: Trade Management” - Division

. Selection from the directory “Enterprise Structure”. The document “Production Report” indicates the division. Therefore, the automatic selection of tariffs for calculation is carried out taking into account the division. - Tariff subject

. In this field, we select for what the employee is accrued output - for what products. In this field, you can select a specific item, or specify the “Type of item” from the corresponding directory. This is convenient when an employee has a single payment rate for an entire group of items that corresponds to a certain type of item. - Tariff

. The actual tariff rate per unit of the specified product

After the tariffs are filled out in the “Production Report” , you can select employees.