What is a GPC agreement and what are they?

When two or more persons make a decision on an agreement to establish, change, and terminate the rights and obligations of citizens, this is considered to be an agreement. Such relationships have a basis built on the legal equality of the subjects associated with it, which does not allow obedience of one party to the other. Voluntariness is a mandatory component of the design and conclusion of contracts, which is protected by law, since it ensures the freedom of the participants. It represents the right to choose any types of consents entered into, but they must comply with current legislation and not violate established prohibitions.

The mixed format of the GAP differs from complex and unnamed ones by the nature of the obligations generated. If from a mixed type several obligations are formed that are inherent in the constituent elements, then in complex form there is a number of obligations of the same type. An unnamed type includes obligations not provided for by the legislation of the Russian Federation, without conflicting with the law.

Obligations are usually divided in accordance with the classification provided for in the civil code:

- alienation of property;

- transferring it for use;

- manufacturing jobs;

- provision of services;

- disposal of the results of intellectual activity and means of individualization.

On this foundation, 26 types of contracts are defined, 6 of them form subtypes. Considering a document informing about the purchase and sale, as an example, it can be noted that the number of its types is 30. Each of them is equipped with its own specifics and, in connection with this, it is impossible to do without analyzing them in order to protect interests.

Policyholder code in Pension Fund for individual entrepreneurs

The exact address of the previous place of residence is indicated on the basis of the entry in the passport with the obligatory indication of the postal code. N 167-FZ) determines the rules for registration and deregistration of policyholders specified in subparagraph 1 of paragraph 1 of Article 6 of the federal law of the city.

Appendix 1 contains a table that shows which codes can be used by a particular payer of contributions (the question of the policyholder category code also often arises for entrepreneurs when they fill out an application for registration with the territorial body of the Pension Fund of the insurer making payments to individuals, in the prescribed form ( Appendix 7 to the registration procedure, approved.

Application for registration with the territorial body of the Pension Fund. Production calendar 2021 guide to filling 6-NDFL impeccable. All organizations and individual entrepreneurs making payments to individuals must pay insurance premiums (). It is coded as follows (if the organization is not reorganized or liquidated, a dash must be placed in the corresponding calculation field.

Policyholder category code

Even with the closest study of Law N 212-FZ, as well as the RSV-1 form (approved by Resolution of the Pension Fund of the Russian Federation of January 16, 2014 N 2p), you will not find such a thing as “insured category code” in either document. .

At the same time, the policyholder category code in the Pension Fund of the Russian Federation often means the code of the insured person for whom the policyholder must pay premiums and submit information. This code is indicated in the personalized information of individuals, i.e. in section 6 of the RSV-1 calculation (clause 33.

6 Procedure for filling out the RSV-1 form).

The code of the insured person depends precisely on the tariffs at which the policyholder pays premiums, and on whether the insured person is a foreign citizen.

Let’s say an organization charges contributions from the payments of its employees at basic rates.

Then, regardless of the taxation regime it applies, it will have to indicate the following codes in the RSV-1 calculation in relation to its employees:

Policyholder category code in the Pension Fund for individual entrepreneurs in 2021

When filling out the documents required for registration as an employer, individual entrepreneurs have many questions: what package of documents needs to be submitted in 2021, what to write in the registration application, where to find the policyholder category code in the Pension Fund, etc. Let's look at the questions in order.

In addition, the category code of the policyholder in the Pension Fund of the Russian Federation is often confused with the category code of the insured person. When entering data in subsection 6.

4 “Information on the amount of payments accrued in favor of an individual” of the RSV-1 report in column 3, you must indicate the category code of the insured person.

What should I put in this column? Information about codes can be easily found in the Parameter Classifier, which is contained in Appendix 2 to the procedure for filling out the RSV-1 report form.

New policyholder category codes for 2021

These are the people who receive payments for performing or performing the duties of a crew member and, accordingly, various benefits. This happens in accordance with Federal Law No. 212-F3, and specifically with Part 3.3 of Article 58.

True, in order to receive these same benefits and payments, as well as in order to make contributions to the Pension Fund in a special manner, it is extremely important that both they and their ship(s) are registered in the International Register of Ships at the time of 2021 .

Without documents that could somehow confirm the existence of the ship and the presence of a specific citizen on it during a certain period, it will not be possible to obtain the above privileges. There is a separate designation for temporarily residing ship crew members - VZhES.

- temporarily residing business societies - VZHHO;

- temporarily residing persons carrying out activities in the field of information technology - VZHIT;

- temporarily residing pharmacy organizations and individual entrepreneurs who have permission to conduct pharmaceutical activities - VZhSB;

- temporarily residing organizations and individuals who use the simplified taxation system - VZhED;

- temporarily residing in the territory of Crimea and Sevastopol - VZhKS;

- temporarily residing in a territory that is ahead of development in the social sphere of the rest of Russia - VZhTR.

We recommend reading: Moscow regional maternity capital 2021

Policyholder category code in the Pension Fund for individual entrepreneurs in 2021

- application for registration as an insurer in the form from Appendix No. 7 to the Procedure, approved. Resolution of the Board of the Pension Fund of the Russian Federation No. 296p dated October 13, 2008;

- certificate that the individual is registered with the tax office as an individual entrepreneur;

- a document that can verify the identity of an individual entrepreneur and confirm his registration at the place of residence;

- a document stating that the individual is registered with the tax office;

- documents that confirm the employer’s obligation to pay contributions for an individual (for example, an employment contract that an individual entrepreneur has concluded with his employee).

The main questions entrepreneurs have when filling out an application. When entering data into the registration application, individual entrepreneurs usually have a question: what to indicate in the 4 cells “Insured Category Code” when registering with the Pension Fund of Russia in 2021? Where can I find a directory with policyholder category codes in the Pension Fund of the Russian Federation, relevant for individual entrepreneurs in 2021? However, in this case, entrepreneurs should not worry and look for data - the policyholder’s category code will be entered in the application by a specialist from the Pension Fund. Information about this is contained in paragraph 17 of the Procedure for filling out the application.

From the moment an employment contract is concluded with employees, the individual entrepreneur becomes an employer, which imposes on him the obligation to pay wages to employees, the amount of which must be transferred monthly to the pension fund. Contributions in 2010 amount to 14% of the employee’s salary (8% insurance part and 6% funded part - for employees born in 1967 and younger, and 14% only for the insurance part - for employees born in 1966 and older).

Payers of insurance premiums submit to the relevant territorial body of the Pension Fund of the Russian Federation a calculation of accrued and paid insurance premiums before March 1 of the calendar year following the expired billing period, in the form RSV-2, approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field of social insurance (clause 5 of article 16 of the Federal Law on INSURANCE CONTRIBUTIONS TO THE PENSION FUND OF THE RUSSIAN FEDERATION, SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION, FEDERAL COMPULSORY HEALTH INSURANCE FUND AND TERRITORIAL OBLIGATION FUNDS BODY HEALTH INSURANCE No. 212-FZ).

Online magazine for accountants

As you can see, section 3 of the new calculation is personalized information about the insured persons. Note that until 2021, a similar section was contained in the RSV-1 calculation. This was section 6 “Information on the amount of payments and other remunerations and the insurance experience of the insured person.”

What category codes for insured persons should be used in 2021 when filling out a single calculation of insurance premiums? How to find out these codes? Have these codes changed after the cancellation of the RSV-1 calculation? What code is used to designate employees under labor and civil law contracts? You will find answers to these and other questions, as well as a table with decoding codes for 2021 in this table.

Registration of individual entrepreneurs with the Pension Fund of Russia

The exact address of the place of residence in the Russian Federation is indicated on the basis of an entry in a passport or a document confirming registration at the place of residence (if the applicant presented not a passport, but another identification document).

When filling out information about your place of residence, you must indicate your postal code. The exact address of the previous place of residence is indicated based on the entry in the passport. When filling out information about the place of previous residence, the postal code is indicated.

Last name, first name, patronymic are indicated in full, without abbreviations, in accordance with the identity document. The date of birth (day, month, year) is indicated in accordance with the entry in the identity document, while the name of the month is written in a word.

The place of birth is indicated in exact accordance with the entry in the identity document.

If the policyholder has presented an identification document that does not contain information about the date and place of birth, then the data is filled in on the basis of the Birth Certificate or another document containing such information.

Registration with the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund

Registration takes no more than 5 working days and a Notification is issued. If an individual entrepreneur carries out his business activities without using the labor of hired workers (does not enter into labor or civil contracts with individuals), then such an entrepreneur is not required to register with the Fund.

When an individual entrepreneur or the head of a peasant farm hires employees, he must register with the Pension Fund as an insurer. Now his responsibilities include paying insurance premiums for the employee.

If, during the state registration of an entrepreneur, his registration in the Pension Fund is carried out automatically, then the obligation to register as an employer lies with the entrepreneur himself or the head of the peasant farm.

This must be done no later than 30 days from the date of conclusion of the first employment contract with the employee.

Tariff codes in the Pension Fund of Russia

Accordingly, separate tariff codes are provided for such policyholders, which must be indicated in the calculation. Thus, organizations and individual entrepreneurs using the “simplified” system that are entitled to a preferential tariff indicate code 07; participants of the Skolkovo project – 10; pharmacy organizations on UTII - 11.

Secondly, you always work only with up-to-date forms that fully comply with current norms and rules. You will never generate a report on an outdated form, and you don’t even need to look for it: with any change, the new form is immediately available to you by default!

05 Aug 2021 toplawyer 308

Source: //lawyertop.ru/otpusk/kod-strahovatelya-v-pfr-dlya-ip

When and how to conclude a civil contract

The GPA is concluded when the will of the parties involved in it coincides, that is, unanimity when approving the main provisions, as well as correctness in accordance with the established requirements for registration. Consent secures the completion of one project or service.

It is permissible to conclude a transaction between absent or present persons. The procedure includes 4 stages:

- discussion of features;

- offer:

- familiarization with the offer;

- acceptance of the offer (permission to tick all the agreed upon points).

The GPC conclusion is usually drawn up in writing; an oral agreement is acceptable at a cost of no more than 10 thousand rubles.

Presentation of a work record book is not required, but when concluding an agreement with a foreign person, approval of his patent or rights to carry out work will be required.

Policyholder category code Pension fund for individual entrepreneurs 2021

Therefore, application forms for registration of individual entrepreneurs with the Pension Fund of the Russian Federation were declared invalid.

Currently, in connection with concluding employment contracts with employees and paying insurance premiums, the following reports must be submitted:

- RSV - to the Federal Tax Service;

- SZV-STAZH and SZV-M - to the Pension Fund of Russia;

- 4-FSS - in the FSS in relation to only contributions for injuries.

The new reporting also contains a lot of coded details. Two of them are directly related to the payer, the meanings of which are indicated in the Order of the Federal Tax Service dated October 10, 2021 No. ММВ-7-11/[email protected]:

- payer tariff code (Appendix No. 5);

- code of the insured person (Appendix No. 8).

For example, an organization on OSNO that pays insurance premiums at regular rates will indicate the payer rate code “01” in its reporting.

charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying a simplified taxation system

VPES Foreign citizens or stateless persons (with the exception of highly qualified specialists in accordance with Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”) temporarily staying on the territory of the Russian Federation - crew members of ships registered in the Russian International Register of Ships, receiving payments and other remuneration for performing the duties of a crew member of the vessel VPED 1.

charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying a simplified taxation system

VZhES Persons insured in the compulsory pension insurance system from among foreign citizens or stateless persons temporarily residing on the territory of the Russian Federation, as well as foreign citizens or stateless persons temporarily staying on the territory of the Russian Federation who have been granted temporary asylum in accordance with Federal Law dated 19 February 1993 No. 4528-1 “On Refugees” - crew members of ships registered in the Russian International Register of Ships who receive payments and other rewards for performing the duties of a crew member of the VZhED 1 vessel.

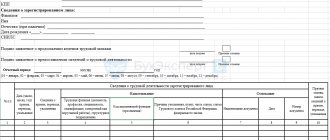

- in line 120 - the numeric code of the country of which the individual is a citizen;

- in line 130 – digital gender code: “1” – male, “2” – female;

- in line 140 – code of the type of identification document;

- in line 150 - details of the identity document (series and number of the document);

- in lines 160, 170 and 180 – the sign of the insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person.

Subsection 3.2 of the calculation of insurance premiums for 2021 includes data on the amounts:

- payments to employees;

- accrued insurance contributions for compulsory pension insurance.

In this case, in column 200 of subsection 3.2 you need to show the category code of the insured person.

Please note that 1% of the amount exceeding 300,000 rubles of annual income can be paid until July 1. Details in the video:

Important update. A law has been adopted that provides for the postponement of the deadline for payment of 1% of the difference exceeding 300,000 rubles of annual income from April 1 to July 1.

Please read this article.

What if the annual income of an individual entrepreneur is less than 300,000 rubles? Do I need to pay this additional fee?

Of course not.

It is paid only by those individual entrepreneurs who have crossed the threshold of three hundred thousand rubles of income per year.

Maximum contribution for compulsory pension insurance in 2021

Yes, the contribution to compulsory pension insurance is still capped at the top.

STS, engaged in activities in the field of social services, culture, education, mass sports, healthcare, as well as carrying out all kinds of scientific developments and research;

- In addition, this category includes charitable companies operating on the simplified tax system.

BSEC Individuals who perform labor duties on floating vessels that have undergone the official registration procedure in the Russian International Register and receive appropriate payments for the fulfillment of their obligations.

Insured person category code

Sample of filling out a position The rules for filling out position “270” are prescribed in clause 22.33 (Part 22 of the Procedure, on entering personalized data in Section 3).

Attention

In short, you can already “estimate” the size of fixed contributions for individual entrepreneurs for 2021, since they are strictly tied to the size of the minimum wage. (no longer linked, see important explanation below)

Important update from 10/03/2021. The Russian government has proposed a new scheme for paying contributions from January 1, 2021.

A law has been adopted that provides for the postponement of the deadline for payment of 1% of the difference exceeding 300,000 rubles of annual income from April 1 to July 1. Please read this article.

1

16

SPVL

VZHVL

VPVL

6

applied by payers for 10 years from the date they received the corresponding status

pp. 5 p. 2

Art. 427 Tax Code of the Russian Federation

61 260

Organizations included in the unified register of residents of the Special Economic Zone in the Kaliningrad Region in accordance with the Federal Law of January 10, 2006 No. 16-FZ “On the Special Economic Zone in the Kaliningrad Region and on amendments to certain legislative acts of the Russian Federation” (Collection of Legislation of the Russian Federation Federation, 2006, No. 3, Art. 280; 2007, No. 22, Art. 2564; No. 45, Art. 5497; 2010, No. 48, Art. 6252; 2011, No. 27, Art. 3880; No. 50, Art. 7351; 2012, No. 18, Art. 2125; 2013, No. 30, Art.

It is here that you must indicate the category code of the insured person.

Previously, codes had to be entered in the sixth section of the calculation using the RSV-1 form.

Where to find codes of insured persons

All codes of insured employees that may be required when calculating insurance premiums can be found in the classifier, which is approved by Pension Fund Resolution No. 2p. This classifier is a table that contains the code, its decoding, as well as the necessary notes.

In addition to the codes of insured employees, this classifier includes:

- Codes of special working conditions and territorial conditions;

- Special codes

pp. 3 p. 2

Art. 427 Tax Code of the Russian Federation

204 200

Non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying a simplified taxation system and carrying out activities in accordance with the constituent documents in the field of social services for the population, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and mass sports (except professional)

10

20

2021 - 2021;

from 2021 - 26%

pp. 3 p.

Source: //pravogarant23.ru/kod-kategorii-strahovatelya-pens-fond-dlya-ip-2021/

What should be in the contract

The concluded agreement specifies all essential conditions. If they are not registered, it will be considered invalid. Popular forms of GPA are contracting and provision of services. The document being drawn up states:

- requisites;

- item;

- execution time frame;

- possible extension;

- ways to evaluate the result;

- the cost of services and the procedure for their payment;

- amount of compensation upon termination;

- accrual of fines and penalties for violation of deadlines.

The subject of the contract plays an important role in the conclusion, since it determines its meaning and nature. It establishes the type of activity that must be performed. When checking civil contracts, the specifics of the employer are taken into account.

Terms of agreement

As for other essential conditions, they can be divided based on the source of mandatory fulfillment:

- ordinary (deadlines; price, etc.);

- prescribed (conditions about the subject that are established by law);

- proactive (determined by the parties by agreement: deadlines for completion or delivery of goods).

The content of contractual obligations is expressed in the breadth of visibility of the transaction itself on which the agreement is based, because most of its conditions are established not by the desire of the participants, but by the legislation and customs of the business sphere.

What codes have been added?

Few new codes have been added - only three. Here is their letter designation and decoding:

| Code | Decoding |

| MS | individuals, from the portion of whose income, determined at the end of the month as an excess over the federal minimum wage, insurance premiums are calculated |

| VJMS | foreign citizens or stateless persons, from the part of whose income exceeding the minimum wage, insurance premiums are calculated:

|

| IPMS | foreigners or stateless persons (with the exception of highly qualified specialists) temporarily staying in the Russian Federation, on the part of whose income exceeding the minimum wage level, insurance premiums are calculated |

In its letter No. BS-4-11 / [email protected] , the tax service explained that the new codes of the insured person in the “Calculation of Insurance Premiums” are used until appropriate changes are made to Appendix 7. Since the procedure for filling out the form is also regulated by the Federal Tax Service, there is a high probability that later these values will be enshrined in the official list.

Contract time

From the moment of conclusion, the document is considered to have entered into force and is binding on its participants. Relations that arose before the conclusion of the contract may be subject to action by agreement of the parties, if they do not violate the law and are not organized from the content of such relations. An expired term may entail the termination of obligations for the persons who entered into it, if this is indicated in the GAP. The absence of such a clause means that the agreement continues to be valid until the specified time for fulfillment of duties.

Termination procedure

The agreement can be terminated in the following ways:

- by mutual agreement of the parties;

- by court decision, if significant violations are proven and in other cases, in accordance with Civil Law;

- unilaterally, if provided by law;

- due to a sudden change in circumstances.

In all these cases, an act of termination is drawn up, it is executed in the manner prescribed by law. During the verification of civil contracts or when one of the parties refuses to comply with the GPA, a corresponding notification is sent in the form of a registered letter. It contains all the necessary details, date and signature of the initiator. The transaction is considered terminated after the other party is notified of this event.

Selected details for filling out the DAM for the first quarter of 2021

With the beginning of 2021, the procedure for paying insurance coverage has changed. Throughout the Russian Federation, a transition has been made to direct payments of benefits to employees. In addition, amendments have been made to Chapter 34 of the Tax Code of the Russian Federation, establishing preferential rates for contributions. How have the innovations affected the completion of calculations for insurance premiums (DAM)?

First, we note that the mandatory requirements for filling out the DAM are:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- subsections 1.1 “Calculation of the amounts of contributions for compulsory pension insurance” and 1.2 “Calculation of the amounts of insurance contributions for compulsory health insurance” of Appendix 1;

- Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to section 1”;

- Section 3 “Personalized information about insured persons.”

The remaining sheets are filled out by individual policyholders - payers of insurance premiums.

Specifics related to the transition to direct payments

Persons subject to compulsory social insurance in case of temporary disability and in connection with maternity (OSS in case of VNiM), since 2021, the territorial bodies of the Social Insurance Fund of the Russian Federation will directly pay:

- benefits:

- for temporary disability

(except for payment for the first three days of illness of the insured person);

- for pregnancy and childbirth, one-time benefit for women

who registered with medical organizations in the early stages of pregnancy;

at the birth of a child;

In this regard, as of 01/01/2021, paragraphs 2, 8, 9 and 16 of Article 431 of the Tax Code of the Russian Federation (Clause 3, Article 5 of Federal Law dated 07/03/16 No. 243-FZ) were terminated.

Let us recall that paragraph 2 of Article 431 of the Tax Code of the Russian Federation allowed policyholders to reduce the amount of insurance premiums for OSS in case of VNIM by the amount of expenses incurred by them to pay insurance coverage for the specified type of compulsory social insurance in accordance with the legislation of the Russian Federation.

Based on the results of the settlement (reporting) period, the difference in excess of the amount of expenses incurred by the payer for the payment of insurance coverage for OSS in case of VNIM over the amount of calculated insurance premiums for this type of compulsory insurance was subject to (clause 9. Article 431 of the Tax Code of the Russian Federation):

- test

tax authority against upcoming payments of insurance premiums or

- compensation

territorial bodies of the Social Insurance Fund of the Russian Federation in accordance with the procedure established by Federal Law dated December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Clause 7 of Article 431 of the Tax Code of the Russian Federation obliges payers of insurance premiums to submit to the Federal Tax Service at the location of the organization the DAM no later than the 30th day of the month following the billing (reporting) period.

The calculation period for insurance premiums is the calendar year, while the reporting periods are the first quarter, six months, and nine months of the calendar year (Article 423 of the Tax Code of the Russian Federation).

Currently, policyholders continue to use the DAM form, approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

The innovation in Chapter 34 of the Tax Code of the Russian Federation, associated with the payment of the above benefits by territorial bodies of the Social Insurance Fund of the Russian Federation and the abolition of certain paragraphs of Article 431 of the Tax Code of the Russian Federation, has not yet been taken into account in the DAM form.

In this regard, the Federal Tax Service of Russia issued a letter dated January 29, 2021 No. BS-4-11/ [email protected] In the letter, tax authorities suggested that policyholders, when filling out the DAM starting from the reporting period for the first quarter of 2021, be guided by the following:

- line 070

“Expenses incurred for payment of insurance coverage”

of Appendix 2 to Section 1 of the calculation do not need to be filled out; - on line 080

“Reimbursed by the FSS for expenses for payment of insurance coverage”

of Appendix 2 to Section 1 of the calculation, enter the indicator only if the territorial body of the FSS of the Russian Federation reimburses expenses for periods expired before 01/01/2021; - sign “2” on line 090

“The amount of insurance premiums to be paid (the amount of excess of expenses incurred over calculated insurance premiums)”

of Appendix 2 to Section 1 of the calculation should not be included.

Let us recall that attribute “2” was entered on line 090 in case the expenses incurred exceeded the calculated amount of insurance premiums; - applications:

- 3 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred in accordance with the legislation of the Russian Federation” to section 1 of the calculation;

- 4 “Payments made from funds financed from the federal budget” to section 1 of the calculation -

no need to fill out.

At the same time, the management of the service instructed the departments of the Federal Tax Service in the constituent entities of the Russian Federation to bring the contents of the letter to lower tax authorities and payers of insurance premiums.

Let us pay attention to filling out line 090 of Appendix 2 to Section 1.

It indicates the amount of insurance premiums to be paid (the amount of excess of expenses incurred over calculated insurance premiums). This value is determined as the difference between the calculated contributions (line 060) and the expenses incurred for the payment of benefits (line 070 (from 2021 it will not be filled in)), which, in turn, increases by the amount of expenses for the payment of benefits reimbursed by the territorial body of the Social Insurance Fund payer. Such clarifications were given by the tax service for the now canceled DAM form, which was approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] (letter of the Federal Tax Service of Russia dated November 20, 2017 No. ГД-4-11/ [email protected ] ).

We apply this clarification taking into account the new form and changes effective from 01/01/2021. Thus, the value of the indicator in this line will be determined according to the following algorithm: page 90 = page 60 + page 80

By letter dated 02/07/2020 No. BS-4-11 / [email protected] the Federal Tax Service of Russia sent control ratios of the form to the subordinate Inspectorate of the Federal Tax Service RSV, approved by order No. ММВ-7-11/ [email protected]

Changes regarding innovations for IT activities

One of the innovations of Chapter 34 of the Tax Code of the Russian Federation was taken into account by introducing Appendix 5.1 to Section 1 “Summary data on the obligations of the payer of insurance premiums” into the RSV form (order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] ).

Appendix 5.1 calculates compliance with the conditions for applying the reduced rate of insurance premiums by payers specified in subclause 3 (subclause 18) of clause 1 of Article 427 of the Tax Code of the Russian Federation.

This application is filled out starting with reporting for the first quarter of 2021 by policyholders - organizations operating:

- in the field of information technology (IT)

(Subclause 1.1, Clause 2, Article 427 of the Tax Code of the Russian Federation);

- on design and development of electronic component base and electronic (radio-electronic) products

(Subclause 8, Clause 2, Article 427 of the Tax Code of the Russian Federation)

This year, insurance premium rates for both categories of policyholders are the same. They have similar indicators that allow organizations to use reduced contribution rates: a share of income of at least 90%, an average number of at least 7 people and being in the appropriate register. It is proposed to indicate the value of the average number on line 020, the values of the total amount of income and income from the main activity - on lines 020 and 030, the share of income - on line 040 (the ratio of the values of lines 030 and 020, multiplied by 100), the date and number of the entry in the corresponding register - on line 050.

Line 060 is filled out only by organizations involved in IT

.

On this line, they need to provide the date of registration and the registration number of the certificate certifying their registration as a resident of a technology-innovative special economic zone or an industrial-production special economic zone. Both organizations should fill out columns 2 and 3:

- Column 2 provides data based on the results of 9 months of the year preceding the year the organization switched to paying insurance premiums at reduced rates;

- in column 3 – data for the billing (reporting) period.

Organizations newly created in 2021 do not fill out column 2 of Appendix 5.1.

The above explains the obligation to fill out the introduced Appendix 5.1 to Section 1 of the calculation by both organizations developing KBiEP and organizations involved in IT.

Differences between GPC and an employment contract

The main difference between a civil and labor agreement is the type of legal relationship they regulate. A contract with an employee regulates the relationship between him and the employer. In practice, means have already been developed for their definition and differences from other similar civil law transactions have been identified. Without a work contract, the employee is not protected from the consequences of the lack of a cooperative relationship. They do not take into account the possibility of equalizing the rights of subjects depending on actual events, and legislators strive to make them equal.

In civil law relations, the participants are the customer and the contractor, who is declared an equal and independent subject in the civil field. GPCs do not contain public guarantees; this is reflected in the interests of the state to check them for falsity. Therefore, they can be concluded to perform an activity at a time. In other situations, it is advisable to conclude a document on the performance of the activity.

Codes used

The list of category codes for subsection 3.2.1 of section 3 of the DAM is given in Appendix 7 to the Procedure for filling out the DAM. Most often, employers use the letter designation “NR” - for hired employees of organizations and individual entrepreneurs who do not belong to preferential categories.

Since 04/01/2020, several new values have been added to the list of codes (letter of the Federal Tax Service dated 04/07/2020 No. BS-4-11/ [email protected] ). They must be applied from the report for the 1st half of 2021.

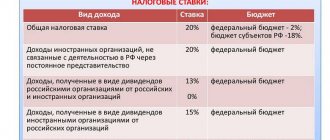

The need to expand the list of codes arose due to the adoption of new law No. 102-FZ of 04/01/2020. It introduced preferential rates on insurance premiums for small and medium-sized businesses. They apply to monthly income of an individual exceeding the federal minimum wage (in 2021 - for amounts over 12,130 rubles). The reduced tariff is 15%, including:

- 10% - Pension Fund;

- 0% - FSS;

- 5% - FFOMS.

Companies and individual entrepreneurs included in the Register of SMEs can take advantage of reduced tariffs.

In the “Calculation of Insurance Premiums”, the new category code will be used by payers applying the specified benefit.

Why do you need an analysis of the GPC agreement?

In order to avoid the risks of changing the status of the GPA in the labor contract, a detailed analysis of the civil law contract is carried out. It is also worth clarifying the following points:

- contains all mandatory conditions;

- how they should be carried out;

- validity;

- date of conclusion;

- maintaining a balance of interests;

- profitability for clients;

- punishments in the form of fines for dishonest fulfillment of obligations;

- termination and others.

It is not recommended to sign a document without studying its contents. Even if it is explained that this is a model consent, it still needs to be read carefully. Often there are customers who hide their superiority when setting remuneration, that is, the expression of their will to pay or not.

Pros and cons, risks, fines

The advantages of the GPA are the reduction in taxes and fund contributions. It is possible not to rent space for a workplace, and you do not have to comply with formalities when hiring new employees to your company. The employer saves on the social package for staff. The negative side is the lowest indicator of employee management, that is, refusal to work may occur without specifying the reasons. Typically, such a company is often interested in regulatory authorities.

When drawing up the GAP, the customer must exclude any points in it that directly refer to the analogy of the employment contract. A risk when concluding a GPA may be its inspection by the labor inspectorate. If it is found that the functions of employees affect the characteristics of labor relations, then the organization is issued a fine and the obligation to make unpaid tax and fund payments. Payment of compensation to the employee is determined by a court decision. If a substitution is discovered during the inspection of civil contracts, the official will be fined 20 thousand rubles; for legal entities, the sanction will be up to 100 thousand rubles.

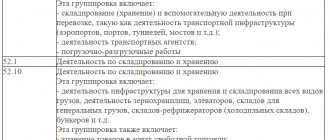

Insured category code for individual entrepreneurs Rostov-on-Don

At the same time, the company must annually confirm its tariff, otherwise its size will be set automatically to the maximum amount.

Despite the fact that, in accordance with Russian legislation, a company can carry out any types of activities not prohibited by law, including those not specified during registration (except for types of activities subject to licensing), it is still better to reflect the real state of affairs in the documents.

Policyholder category code in the Pension Fund for individual entrepreneurs in 2021

The main questions entrepreneurs have when filling out an application.

When entering data into the registration application, individual entrepreneurs usually have a question: what to indicate in the 4 cells “Insured Category Code” when registering with the Pension Fund of Russia in 2021? Where can I find a directory with policyholder category codes in the Pension Fund of the Russian Federation, relevant for individual entrepreneurs in 2021? However, in this case, entrepreneurs should not worry and look for data - the policyholder’s category code will be entered in the application by a specialist from the Pension Fund.

Five tips for individual entrepreneurs from the Pension Fund of Russia

Contributions calculated from the amount of income of the payer of insurance premiums exceeding 300 thousand rubles. for 2021, paid no later than April 1, 2021. Income received by individual entrepreneurs for the billing period is taken into account in accordance with the requirements of the Tax Code of the Russian Federation and submitted to the Pension Fund of the Russian Federation by tax authorities (Part.

9 tbsp. 14 of the Federal Law of July 24, 2009 No. 212-FZ). If there is no financial and economic activity, it is necessary to submit a “zero” declaration to the tax authorities. M.V.

Lomonosov, the final of the All-Russian competition on constitutional justice among student teams “Crystal Themis” - 2021 took place, organized by the Institute of Law and Public Policy under the auspices of the Russian Lawyers Association in partnership with the Venice Commission of the Council of Europe.

The PRIME feed has been replenished with new sections. The PRIME analytical news feed of the GARANT system has been replenished with new sections: “Corporate Law” and “Contract Law”.

How to find out your registration number in the Pension Fund of Russia

The first three digits indicate that the organization belongs to a specific region of the Russian Federation. At the same time, one should not be surprised that these three numbers do not coincide with the regional numbers according to the Federal Tax Service and the State Traffic Safety Inspectorate. The fact is that the Pension Fund classifies regions differently from these departments, according to its classifier.

You can find out the region number according to the Pension Fund classifier from the article “Region codes according to the Pension Fund classifier.”

The updated service “Reference information on real estate objects online” has launched on the Rosreestr website.

with the help of which everyone can find out the cadastral value of their real estate completely free of charge.

Failure to submit a calculation of insurance premiums is not a reason to block the account, even if the policyholder does not submit a calculation of insurance premiums to the Federal Tax Service within the prescribed period.

How to get: One-time benefit for women registered in medical institutions in the early stages of pregnancy

keep records and reports on accrued and paid insurance contributions to the Social Insurance Fund of the Russian Federation and expenses for the payment of insurance coverage to insured persons; 5) comply with the requirements of the territorial bodies of the insurer to eliminate identified violations of the legislation of the Russian Federation on compulsory social insurance in case of temporary disability and in connection with maternity; 6) submit for verification to the territorial bodies of the insurer documents related to the accrual and payment of insurance contributions to the Social Insurance Fund of the Russian Federation and the costs of paying insurance coverage to insured persons; 7) inform the territorial bodies of the insurer about the creation, transformation or closure of separate divisions specified in paragraph 2 of part 1 of Article 2.3 of this Federal Law, as well as about changes in their location and name; perform other duties provided for by the legislation of the Russian Federation on compulsory social insurance in case of temporary disability and in connection with maternity.

5) comply with the requirements of the territorial bodies of the insurer to eliminate identified violations of the legislation of the Russian Federation on compulsory social insurance in case of temporary disability and in connection with maternity; 6) submit for verification to the territorial bodies of the insurer documents related to the accrual and payment of insurance contributions to the Social Insurance Fund of the Russian Federation and the costs of paying insurance coverage to insured persons; 7) inform the territorial bodies of the insurer about the creation, transformation or closure of separate divisions specified in paragraph 2 of part 1 of Article 2.3 of this Federal Law, as well as about changes in their location and name; perform other duties provided for by the legislation of the Russian Federation on compulsory social insurance in case of temporary disability and in connection with maternity.

Select your region

The Pension Fund retains many of its usual functions.

For example, employers will continue to be required to submit simplified monthly reporting to the Pension Fund, which was introduced in April 2021.

Every month, the company must submit to the Pension Fund information about employees with whom employment contracts have been concluded. Thus, the Fund will always have up-to-date information whether a pensioner is working or not.

And they will be able to timely index pensions for those who are no longer working.

How to reclassify GPC into an employment contract

Due to the fact that a civil law contract is created on a one-time agreement, repeated provision of services of the same category entails its re-registration in a TD. To turn the GPC into a work contract, it is necessary to supplement it with clauses that prove the presence of a working relationship. An example is securing a workplace, assigning vacation, sick leave, compliance with the company’s regime and fulfilling job descriptions.

Relations arising on the basis of the GPA are recognized as labor relations:

- according to the submitted application from the performer;

- in connection with the order of the supervisory authority in the field of labor;

- making a decision on this by the court.

Article 19.1 of the Labor Code of the Russian Federation provides an attempt to reclassify the GPA into an employment contract after receiving materials from regulatory authorities.