Selection of codes

49.41.1 Transportation of goods by specialized vehicles

49.41.2 Transportation of goods by non-specialized vehicles

49.41.3 Rental of freight vehicles with driver

52.21 Support activities related to land transport

52.21.1 Auxiliary activities related to railway transport

52.21.2 Auxiliary activities related to road transport

52.24 Cargo handling

52.24.1 Transport handling of containers

52.24.2 Transport handling of other cargo

52.29 Other auxiliary activities related to transportation

53.20.3 Courier activities

53.20.31 Activities for courier delivery by various modes of transport

53.20.32 Activities for home delivery of food

53.20.39 Other courier activities

Selection of related codes from the OK 029–2014 classifier

In addition to the main activity code, you may need auxiliary ones. If you plan to open a transport company for individuals and store goods in your own warehouses, enter OKVED 52.10 “Warehouse and Storage” into the application. It includes work on the arrangement of warehouses, granaries, bunkers, refrigeration chambers and other infrastructure facilities for storing any cargo.

You will find a detailed description of auxiliary codes for organizing warehouses and infrastructure facilities in the OK 029–2014 classifier: section H, paragraph 52

Code 52.21 is useful for providing related services and technical assistance to land transport on the roads. By entering such an OKVED, you can open a bus station or a loading and unloading point on the highway - of course, having previously received permission from the road services. Code 52.22 allows the provision of similar services to water vessels, and 52.23 - to air transport.

Mandatory codes for cargo transportation:

- 52.24 - for loading and unloading work, and it does not matter what type of transport you use for transportation;

- 52.29 - for preparing goods for shipment, issuing waybills, and performing services for delivering goods to your home.

For organizing postal or courier services, OKVED 53.10 and 53.20 are useful.

If you plan to transport liquids and gases, and part of the way they will pass through a pipeline, be sure to add code 49.50 - “Pipeline transport activities.”

Explanations and clarifications

Cargo movement is an integral part of almost any business flow, regardless of its scale. The most valuable cargo includes human passengers. Organizing a business related to transportation means ensuring movement using various types of transport and organizing related conditions, such as parking, cargo storage, terminals, etc. You don’t have to deal with all this directly, but rent a vehicle with a driver or operator: such activities are also within this business area.

Mail is also a type of transport service, including the activities of couriers. The delivery items are:

- letters;

- periodicals;

- parcels, parcels;

- goods;

- products;

- funds sent by transfer;

- paid benefits and pensions.

This type of service includes transportation and home delivery of the listed objects.

But some forms of business are not included in transport services , although they are directly related to them:

- renting vehicles as is (without driver);

- repair and maintenance of any type of transport;

- activities related to the construction and maintenance of communication routes (roads, ports, stations, railway tracks, etc.).

Enterprises can organize the transportation of passengers and cargo by any type of land transport in any format, from taxis to international transport.

If an entrepreneur owns a funicular, cable car, or ski lift that does not belong to the municipal transport system, this can also be a transport service.

The movement of cargo (oil, petroleum products, gas, water, other liquids) through pipelines is included in a separate subgroup

The organization of transportation by water transport, in addition to the movement of goods and passengers, includes the activities of tugs and ferries. The OKVED group depends on the type of vessel - marine or other, regardless of the body of water in which it sails.

Air transport is limited to the transportation of people and cargo: this type of service does not include aerial pollination, aircraft repair, aerial photography and airport management.

Providing drivers with or without a car

Providing drivers with or without a car Price from RUR/hour

The need of transport companies for reliable drivers is constantly growing. Especially during the “hot” season, with an increase in the number of transportations. What way out can be found from this situation? There are several options:

The main specialization is the provision of services for the formation and filling of the staff of an enterprise. In addition to standard recruiting, the company offers outsourcing of drivers. If you are looking for versatile professionals, we will select qualified employees for your company who are fluent in driving skills. Today, the driver is, one might say, the face of the organization. He is entrusted with many responsible tasks. For example, loading materials and delivering goods. Therefore, it is important that the driver’s vacancy is filled by a responsible, reliable employee who you can safely rely on. And it can take a lot of time and effort to find just such an employee for the company. ready to take on all the troubles. You don't have to monitor resumes on job sites, answer hundreds of calls and conduct dozens of interviews. For more than 5 years, our company has been outsourcing drivers, helping its customers find the right specialists as quickly as possible.

OKVED cargo transportation services 2021

49.4 — Activities of road freight transport and transportation services

This grouping includes:

- all types of cargo transportation by land transport, except for transportation by rail

49.41 — Activities of road freight transport

This grouping includes:

- all types of cargo transportation by road on roads: dangerous goods, large and/or heavy cargo, cargo in containers and transport packages, perishable goods, bulk bulk cargo, agricultural cargo, construction industry cargo, industrial cargo, other cargo

This group also includes:

- rental of trucks with driver;

- activity of transporting goods by vehicles driven by people or animals as draft power.

49.41.1 — Transportation of goods by specialized vehicles

49.41.2 — Transportation of goods by non-specialized vehicles

49.41.3 — Rental of cargo vehicles with driver

49.42 — Providing transportation services

This grouping includes:

- transportation services by road transport provided when moving to individuals and legal entities

What kind of cargo transportation can an individual entrepreneur organize?

The legislation defines cargo transportation as the movement of goods from one point to another by means of transport: land, air or water.

When registering an individual entrepreneur in this area, you must select the main OKVED code corresponding to the type of cargo transportation and the type of transport used. You can specify additional codes at your discretion - the main thing is that they complement the main one.

Cargo transportation can be carried out not only by roads, but also by waterways, as well as by air and rail transport

Types of cargo transportation by routes:

- international - associated with traveling outside the country, so their implementation requires many permits;

- interregional - the most common type of cargo transportation between different settlements within the country;

- intracity - transportation without leaving the city.

Types of cargo transportation by type of transport:

- automobile – the best option in terms of costs;

- railway - used when cargo cannot be delivered by car;

- air transportation - for express delivery;

- by water transport.

Cargoes are divided into types according to a number of characteristics: properties, dimensions, space occupied, material, shelf life.

Types of cargo:

- piece - take up one place in transport;

- bulk - they can be laid in bulk;

- dangerous - occupy a special position in the classification of goods, their transportation is associated with risk;

- ordinary - their weight does not exceed the value specified by the manufacturer for a particular vehicle;

- large and heavy - their dimensions and weight are higher than those permitted for transportation in a particular vehicle;

- perishable - require special conditions of transportation and storage.

The choice of mode of transport for transportation depends on the type of cargo

OKVED cargo transportation 2021: which one to choose

Articles on the topic

To register a business related to cargo transportation in 2021, you will need the OKVED 2 reference book. We will tell you which code to choose for this type of activity step by step. After all, mistakes will lead to registration being denied.

OKVED 2 is a new directory of types of economic activities encrypted in digital codes. Its official name is OK 029–2014. It has been in effect since 2021 and has not lost force in 2021. The old OKVED (with codes until 2021) is invalid in 2021.

We will now look at how to determine which code to choose according to OKVED for cargo transportation.

Specifics of choosing an OKVED identifier: how to avoid making a mistake?

When asked which code to choose for your commercial activity, in a situation where a potential individual entrepreneur has doubts about the correctness of his decision, a legal consultant will help you find the answer and understand the problematic issues, whose services experts recommend using when preparing documents. As for the legislative framework, no changes were made to OKVED in 2021; the version of the document dated January 1, 2021 is valid.

During the process of registering documents, the individual entrepreneur must be prepared for the need to provide license certificates to the tax authorities for the vehicles that will be operated. A situation in which a business entity does not have licensing documentation threatens it with significant penalties. Any cargo transportation, repair service and vehicle maintenance are subject to licensing. Accordingly, having decided on the main, as well as additional ciphers, they should be compared with the list of categories of activities that require a license or special permissions, so as not to violate the law, with all the ensuing consequences.

You should also not get carried away with the admissibility of entering any number of additional codes into documents, since when registering a code according to which the activity is not carried out, you will have to provide reporting materials certifying this fact. For aspiring entrepreneurs at the starting stage of a business, choosing one fundamental and two or three additional ciphers is often sufficient. A feature of the selection of auxiliary encodings, in contrast to the main code, is the fact that they can be added to the system after the main documentation has been completed, therefore, even if the individual entrepreneur “forgot” or “did not foresee” the need to enter a certain code, it can be registered through the appropriate structures in any time. This procedure takes no more than five working days. Additionally, legislation authorizes the addition of an accompanying cipher if it is necessary to expand the scope of activity, if it does not conflict with the main focus of the company.

Another important nuance associated with the selection of codes is the emerging issue of choosing a taxation system. Popular among individual entrepreneurs in cargo transportation is the UTII tax system, which is considered the most rational from a financial position, but can only be used in companies that have at their disposal no more than twenty pieces of equipment and a staff of no more than one hundred people. When selecting a taxation scheme, it is worth making a prospective assessment of the relevance and demand for services, the potential scale of financial productivity, which will determine the company’s turnover, annual income, and, accordingly, the possibility of paying state duties.

Transportation of goods by an entrepreneur, why OKVED is needed

An individual entrepreneur has the right to choose any type of cargo transportation, be it air, water, land transport or pipeline. Depending on what will be the basis of the business. And the basis is the type of entrepreneurship that provides 51% of income or more. The businessman will be set the amount of payment of contributions for injuries and the form of taxation.

OKVED may also be taken into account when determining benefits for a businessman and affect obtaining a license.

According to the directory, the entrepreneur must independently find the code not only for the main business, but also for all related ones, if he has any. In this case, there can be only one main type of economic activity.

Main and additional OKVED: what is the difference?

How does the main activity differ from additional activities? Let's find out! So:

The main OKVED is a code for the type of economic activity that most accurately reflects the specifics of your business;

Important! When filling out form P11001 or P21001, you can indicate only one main type of activity.

Additional OKVED are codes that reflect related activities.

Important! The current legislation of the Russian Federation does not limit the number of OKVED codes that you can indicate when registering an LLC or individual entrepreneur.

How to use OKVED cargo transportation in 2021

Despite its large size, the classifier is quite easy to use. The first place to start is to find the section you need. They are grouped according to the Latin alphabet.

If your occupation is the transfer of goods, materials, etc., then the section you need is N.

Section H " TRANSPORTATION AND STORAGE" includes:

- Passenger and freight transportation by any type of transport, both along a specific route and without it.

- Service at stations and terminals, parking, cargo handling and storage, etc.;

- rental of vehicles, their repair and maintenance;

- overhaul or maintenance of vehicles other than automobiles;

- construction, maintenance and repair of roads, railways, ports, airfields;

- postal service activities.

To find the required code, it is worth remembering its structure. It includes a combination of different numbers. They are divided:

For cargo transportation, as the main type of income, it is enough to know the first four digits. For additional earnings 5-6 figures.

Having entered the required section of OKVED, in our case it is N, we first find the required class. Knowing the class, we go to the subclass, and then to the group. Look at what groups exist in Section H.

OKVED cargo transportation 2021 with decoding

It is important to determine the cipher as accurately as possible. For example, pay attention to groups 49.41 and 49.42. In the first case, we are talking about transporting goods and the like, in the second case, personal belongings. Such nuances are not uncommon even within the same group:

- 49.41.1 – transportation by specialized vehicles;

- 49.41.2 – by ordinary trucks.

Therefore, first clearly think about the type of your occupation, and then select the appropriate OKVED for it. How to do this in reality, read the example below.

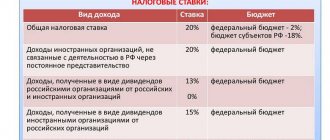

Taxation in the field of cargo transportation

While the registration process is ongoing, the individual entrepreneur must decide which type of taxation to choose. Otherwise, OSNO will be automatically selected. To do this, you should study in more detail the forms of taxation that are available for cargo transportation:

- OSNO – general mode. Accounting documentation is maintained in full and all taxes required by law are paid. An enterprise that does not have access to simplification uses a common system. Individual entrepreneurs for cargo transportation pay absolutely everything, incl. personal income tax persons and added value.

- STS is a simplified system. It examines two tax options. In the first case, the tax rate is 6% and the object of taxation is income. In the second case - the rate is 15%. In this case, the object of taxation is selected independently and can be changed in the future.

- A form of taxation, which is presented in the form of a single tax on imputed income. The most common among individual entrepreneurs involved in cargo transportation. The following restrictions are imposed here: the presence of up to 20 vehicles. The decision to apply this form of taxation is made by municipal authorities.

If the region does not have a permit, then it will not be possible to use such a system.

- Patent form. This form is applicable only to individual entrepreneurs. The tax is calculated not on real income, but on estimated income, which is established at the regional level by regulation. A patent can be taken out not for the whole year at once, but for several months. When calculating the tax, insurance premiums paid for employees and entrepreneurs are not taken into account. For other types, contributions reduce the amount of tax.

An example of how to choose OKVED cargo transportation in 2021

Let us show with an example how to choose an OKVED code depending on what the entrepreneur wants to do. In our case, the business will be related to cargo transportation.

Example. Suppose a certain businessman decided to organize the transportation of various goods from the region to the city. He chose this type of entrepreneurship as his main one. And as an additional income, he also created a parking lot for trucks of farmers coming to the city.

He goes into section N of OKVED 2, runs through the classes and reaches 49.

- Class 49 is land transport activities. Then he goes through the groups of this class;

- Group 49.41 – all types of cargo transportation by road. Let's move on to the subgroup;

- There are three of them:

- 49.41.1 – transportation of goods by special machines;

- 49.41.2 – transportation by non-specialized vehicles;

- 49.41.3 – rental of transport.

Of these three subgroups, 49.41.2 suits our individual entrepreneur. There are no species in this subgroup, so we’ll stop there. In principle, there would be no need to look for a subgroup and species. To fill out form p21001 and submit data to the Unified State Register of Legal Entities, 4 digits of the main activity code are enough. But we also have a side issue - parking.

We repeat the steps, starting with searching for the desired class. In this case it will be 52 - warehousing and auxiliary transport activities.

- Group – 52.21 – auxiliary business related to land vehicles;

- View – 52.21.24 – parking lots, car parking.

What is OKVED

Before sending a package of documents to the specialists of the territorial tax service for registration, future individual entrepreneurs and LLC founders must have a clear idea of what types of commercial activities they are going to engage in. This is important because when entering information about a newly created enterprise into state registers, OKVED codes are of decisive importance for tax authorities.

If you decipher this abbreviation, it will sound like this:

All-Russian Classifier of Types of Economic Activities.

Already from the title it is quite clear what the essence of this document is: each type of commercial work or service in Russia has its own digital code. To enter classification codes into the title package, you do not need to create any special documents; it is enough to list them in the application for registration of an individual entrepreneur or a limited liability company, which is filled out in a strictly established form.

We will select the best drivers for your company

Over the years, we have established ourselves as a reliable and proven partner who provides professional outsourcing and fully fulfills its obligations to customers. We are of the opinion that not every person who knows how to drive a vehicle can be called a driver. The specialists we provide are not only drivers, but also representatives of many other in-demand professions. Therefore, there is no need for long and expensive internships for new employees. The driver we select will meet all the customer’s requirements, having not only a driver’s license of a certain category, but also an impressive driving experience. A new employee will begin to perform his duties in your transport company without lengthy paperwork and resolution of organizational and personnel issues.

What you need to know and how to accurately select OKVED codes

When studying and entering OKVED digital codes into the registration application, many novice entrepreneurs unknowingly make a number of mistakes. In order to help avoid them, we’ll talk in detail about what to rely on and in what order to act when choosing codes from the all-Russian classifier.

- Not all codes are equivalent when entered into the constituent documents of an enterprise or individual entrepreneur. The first code chosen is considered the main one, since it must correspond to the type of activity that is prioritized at the enterprise. All other codes play an additional role and are of a secondary nature. Every organization must have at least one code from OKVED; without it, registration with the state is simply impossible;

- All actually and formally possible types of economic activity carried out on the territory of Russia have their own special digital designation, which is included in OKVED. In turn, OKVED consists of sections and subsections, groups and subgroups. When choosing digital ciphers, you should go from large to small. That is, you need to start by defining the scope of activity, and gradually, through sections and groups, reach any specific type of activity. At the same time, you need to try to select codes so that they correspond as much as possible and reflect the essence of the actual work performed and services provided;

- The digital code from OKVED allowed for registration must consist of at least 3 characters. 3 numbers imply a subclass of the section and, as a rule, they are chosen by those entrepreneurs who do not want to limit their actions within this section in any way. However, it is still preferable to specify four-digit ciphers that are narrower in terms of practical application;

- If suddenly a newly created organization plans to engage in those works or services that, under Russian law, are subject to mandatory licensing or require special permission, it is best not to act at random, but to consult with specialists. They will help you more accurately designate the name of a particular type of activity and select the correct digital code, which will protect you from all sorts of troubles in the future.

Attention! If problems arise in selecting OKVED codes, it is enough to study Appendix “A” to the classifier. It is an excellent assistant and contains quite detailed explanations for all types of activities.

What type of cargo transportation can an individual entrepreneur carry out?

When creating any business, the most important task for a future entrepreneur is to draw up a business plan and officially register documentation that allows the entity to engage in certain activities. To systematize entrepreneurs in government bodies on the territory of the Russian Federation, the OKVED classifier, common for all types of economic activity, is in effect. From the list of codes of the All-Russian Systematizer, during registration activities, the subject must indicate in the documentation a digital code corresponding to the line of business that will be carried out by the individual entrepreneur.

The collection of codes in the latest edition consists of twenty-one sections and about three thousand subsections. Deciding what to indicate for your economic activities so that it is transparent and does not raise questions about the legality of procedures from the relevant structures is actually not so simple.

Freight transportation is defined by law as the delivery of goods from one point to another using vehicles of the land, water or air categories. When submitting documents to conduct a business involving the transportation of goods, you will need to indicate the basic OKVED code for cargo transportation in accordance with the type of activity and category of transport vehicles operated, with the possibility of subsequently supplementing it with codes of secondary importance.

Secondary codes must be selected in such a way that they are in maximum harmony with the fundamental code and allow for legal business activities, taking into account all the procedural nuances of providing services. Legislation for private business entities provides, in accordance with OKVED, transport services of the following categories:

- Depending on the type of transport: water, air and land transportation, which includes the delivery of goods by rail and road.

- Regional, interregional and international transportation are distinguished by route directions.

- According to the type of cargo transported, piece goods, bulk, dangerous, perishable, large-sized and standardized products are differentiated.

In order for the subsequent transportation of goods to be legal, it is worth paying very close attention to the preparation of all accompanying documents, and especially to the choice of the main OKVED code. In the course of business activities, this code will be the main identifier of the individual entrepreneur in the documentation; it is entered into the general database of the state register of entrepreneurs, which will allow consumers of “services” to check the legality of the company’s functioning.

Subtleties of choosing ciphers from OKVED

We talked about the main points that you should pay attention to when choosing codes from OKVED. Now about some of the nuances of choosing types of activities based on digital ciphers from the classifier.

- When choosing OKVED codes, future businessmen, in particular the founders of an LLC, should remember that there must be a 100% coincidence of the types of activities specified in the application and those indicated in the charter, otherwise tax officials can easily refuse registration. But even if the initial stage of registration with the tax service is completed successfully, problems may well arise when opening a bank account, since bank employees check documents no less carefully;

- The law does not in any way limit the number of OKVED codes included in the application for registration of an enterprise. Therefore, businessmen often enter not only those specific types of activities that they actually plan to engage in, but also those that they envision only in theory. The accumulation of codes from the classifier included in title documents entails a number of dangers. Let's give just one fairly common example: some types of activities may be subject to a special UTII tax regime, and in such cases, tax authorities may require an entrepreneur or organization to submit separate reports on them. Thus, experts advise holding back and not adding more than two dozen OKVED codes to the constituent documents and, when choosing them, carefully study the features of each type of activity, including from the point of view of tax legislation;

- It is extremely important to correctly understand and interpret the names of the types of activities listed in OKVED. Otherwise, an incident may arise in which the most necessary and relevant type of activity will not be included in the state register for a given organization or individual entrepreneur. The consequences of such an incident are unpleasant. Firstly, if necessary, it will be impossible to obtain a license, and secondly, it will be impossible to switch to UTII, which operates for strictly defined types of activities at the local and municipal level.

Important! Entering the correct codes from OKVED into the registration documents at the stage of registering an enterprise with state registration is of great importance. If tax specialists discover an error, they will certainly issue an automatic refusal to register. At the same time, the inaccuracy can be corrected, but this will entail new financial and time costs.

How to open an individual entrepreneur for cargo transportation in 2021

Freight transportation refers to the delivery of cargo from the sender to the recipient. To start doing this, you need to have your own or rented transport.

To officially open a cargo transportation business, you must go through the registration procedure. Licenses and permits are not required if the type of activity does not involve the transportation of hazardous substances. To begin registration, you need to obtain a TIN. To do this, an application is drawn up and submitted to the tax service.

You can deal with issues of registration of TIN and IP online through the website of the Federal Tax Service.

The procedure consists of the following steps:

- Collect documents.

- Submit the documents to the tax service by registered mail with an inventory. This can be done electronically, but an electronic signature and an account are required. Documents can be submitted in person or by a trusted person.

- The stage of checking documents for correctness and completeness.

- The registration itself. It is considered completed if information about this is entered into the Unified State Register of Entrepreneurs.

How to change OKVED codes during the work of the organization

Sometimes, at various stages of an enterprise’s activity, due to the expansion of business interests, it becomes necessary to change or add new OKVED codes to the constituent package. It's not that difficult to do. It is enough just to submit an application for amendments to the Unified State Register of Individual Entrepreneurs to the territorial tax service. It is necessary to indicate new codes and within a few days, tax inspectorate specialists will make these amendments to the organization’s title documents and state registers of individuals and legal entities.

The article was written based on materials from the sites: aae.su, www.rnk.ru, assistentus.ru.

«

OKVED code for individual entrepreneurs to provide driver services with their own car (not a taxi)

- The following situation happened: after training to become a hairdresser, I was offered a job in a salon. However, most of the time I just sit, 1-2 clients a day is the maximum. (1 answer)

- The following situation happened: after training to become a hairdresser, I was offered a job in a salon. However, most of the time I just sit, 1-2 clients a day is the maximum. (1 answer)

- Should a person (without forming an individual entrepreneur) have a license to carry out legal activities with whom the HOA has entered into an agreement for the provision of legal services for a fee? (4 answers)

- The chairman of the garage cooperative enters into a contract for the provision of paid services with the individual entrepreneur. He does not have the authority to do this according to the Charter, (2 answers)

- Please tell me: 1. If the charter of the PGK states that the chairman is obliged to represent the interests of the cooperative, including in the courts, (2 answers)

- Contract between individual entrepreneurs and individual entrepreneurs for the provision of services

- Service agreement between individual entrepreneur and individual entrepreneur

- Contract for paid services

- Contract of paid services with individual entrepreneur