Form SZV-6-2 “Register of information on accrued and paid insurance contributions for compulsory pension insurance and the insurance experience of insured persons” (replacing SZV-4-2).

If the insured person did not have special working conditions or conditions for the early assignment of a labor pension during the billing period, information about him was entered into the information register - form SZV-6-2.

Form SZV-6-2 contains the following information about each insured person:

- personal data;

- the amount of accrued and paid insurance premiums;

- work period.

(doc, 40 Kb)

Procedure for filling out form SZV-6-2 (doc, 60 kb)

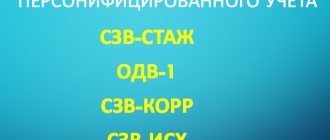

Personalized reporting to the Pension Fund for the first quarter of 2013

Starting from the 1st quarter of 2013, new forms of personalized accounting are used. The corresponding changes to the Resolution of the Board of the Pension Fund of July 31, 2006 No. 192p “On the forms of documents for individual (personalized) registration in the compulsory pension insurance system and Instructions for filling them out” were made by Resolution of the Board of the Pension Fund of 01.28.2013 No. 17p dated 28.01.2013, registered with the Ministry of Justice of Russia on 18.03.2013 No. 27739* (see table 1).

Note:

* The document comes into force 10 days after the day of official publication, published on March 29, 2013 in Rossiyskaya Gazeta (No. 68).

Table 1

| Form name | Symbol | Note |

| Information on the amount of payments and other remuneration, on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of the insured person | SZV-6-4 | Submitted for each insured person for whom insurance contributions for compulsory pension insurance were accrued (paid) during the reporting period and/or who had insurance experience |

| List of documents containing information on the amount of payments and other remuneration, on accrued and paid insurance premiums and the insurance length of the insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation | ADV-6-5 | List of documents containing information on the amount of payments and other remuneration, on accrued and paid insurance premiums and the insurance length of the insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation, starting from 2013. Accompanies a bundle of documents in the form SZV-6-4 (no more than 200 pieces) |

| List of information transmitted by the policyholder to the Pension Fund of Russia (form is not new) | ADV-6-2 | Contains data in general for the policyholder, accompanies packs of documents of incoming initial information SZV-6-4, ADV-6-5, as well as corrective (cancelling) packs of documents SZV-6-1, ADV-6-3 and registers of information SZV-6 -2 for the periods from 2010 to 2012 |

Form SZV-6-4, issued for one insured person, combines information from forms SZV-6-1 and SZV-6-3 and supplements with information on the amounts of payments taxed at the additional tariff, which was introduced on January 1, 2013 by Federal Law dated December 3, 2012 No. 243-FZ.

Just like the SZV-6-1 forms, the SZV-6-4 forms differ by category of insured persons and types of information (initial, corrective and canceling). Just like the SZV-6-3 form, the SZV-6-4 form is prepared separately according to the type of contract (labor or civil law).

Due to the abolition of the Pension Fund's distribution of information letters on the status of personal accounts of insured persons since 2013, the SZV-6-4 form does not include address information for informing the insured person.

There is no longer an analogue for the SZV-6-2 registry.

The inventory of information accompanying the package, form ADV-6-2, does not change. In addition to the SZV-6-4 packs for the 1st quarter of 2013, it, as before, may contain the SZV-6-1 and SZV-6-2 packs if corrective or canceling information is submitted for the reporting periods 2010 - 2012.

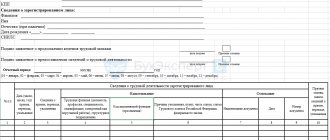

According to the policyholder's records, which are kept in the Individual Accounting Cards recommended by the Pension Fund for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums (hereinafter referred to as individual cards, Fig. 1), the indicators of the following sections of the SZV-6-4 form are filled in:

- Information on the amount of payments and other remuneration accrued in favor of an individual;

- Information on the amount of payments and other remunerations of the insured person employed in the relevant types of work for which insurance premiums are calculated at an additional rate;

- Information on accrued and paid insurance contributions for compulsory pension insurance for the last three months of the reporting period.

Rice. 1. Individual accounting card for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums. The section “Period of work for the last three months of the reporting period” of the SZV-6-4 form is filled out according to the policyholder’s personnel records

Form ADV-6-1

When submitting to the Pension Fund the following personalized accounting forms: ADV-1, ADV-2, ADV-3, as well as forms containing information about payments and contributions accrued to extra-budgetary funds: SZV-1, SZV-3, SZV-4- 1, SZV-4-2, the insurer, that is, the employer, is obliged to provide them along with the accompanying inventory in the ADV-6-1 form.

Form ADV-6-1 is a list of documents that is compiled when the employer transfers a set of documents to the Pension Fund of the Russian Federation, containing information about its employees. ADV-6-1 has been changed in 2021.

Form ADV-6-1 consists of three sections:

- The first section contains information about the employer;

- In the second, it is necessary to reflect the name of the transferred forms and their number;

- The third section is completed if the above SZV forms are submitted to the Pension Fund. Here you fill in information about the amount of contributions, the amount of payments and the period for which they were accrued.

ADV-6-1 sample filling

Form ADV-6-1 in 2021 and rules for filling it out.

- Information about the employer who transfers documents to the Pension Fund: TIN, registration number of the organization, checkpoint, abbreviated name of the employer.

- Other incoming documents that are not included in the list proposed in the form are indicated;

- The paragraph “number of documents in the package” indicates the number of documents that make up the complete package;

- The number of specified employees in the SZV-4-2 form is entered in the next paragraph. This number is indicated only in the inventory where this form is available;

- An internal package number is assigned; this is the serial number of the transferred set of documents entered by the employer. Filled out if documents are accompanied by electronic submission;

- The next paragraph is filled in by the Pension Fund employee when accepting the package. The employee enters the registration number in the Pension Fund, indicates the incoming serial number and the current year.

- The following paragraphs are filled out if the package of documents contains SZV-4-1 or SZV-4-2:

- The period for which the form data was filled out. It is written only if the reporting period is earlier than 01/01/2002;

- Registration code for insured persons. This is done in accordance with the code data classifier;

- The “additional tariff code” is entered from the classifier of the same name. Filled out for those persons on whose account insurance premiums are made at an additional tariff;

- Information type. Only one of the following items is marked with an “X”:

“initial” – put “X” if information about the employee for the specified period is submitted for the first time, “assignment of pension” is noted in the case of providing information at the request of the employee for the assignment or recalculation of an already assigned pension;

The next item is filled out only if it is necessary to make an adjustment - again necessary about: “corrective” - to make changes to previously submitted information about the employee, in this case the entire volume of data is filled in, and not just the corrected ones, or “cancelling” - is filled in for a complete cancellation earlier transmitted data about the employee.

The “territorial conditions” item is filled out in strictly regulated cases according to the classifier and only if the package contains the SZV-4-2 form.

Information on the accrued amounts of insurance premiums is entered according to the rules of the SZV-4-1 form, in rubles in total for the entire package of documents, broken down by: additional tariff (if used), insurance and funded pensions.

- Filled out for the inventory of forms SZV-1 and SZV-3 with a billing period until 01/01/2002.

- It is necessary to indicate the reporting period: year, select “X” quarter of the year;

- Enter information about your total income in rubles and kopecks for the reporting period provided, which will subsequently be taken into account when assigning a pension.

Form ADV-6-1 sample filling

After the inventory in form ADV-6-1 has been prepared together with all documents and a package of forms in the specified order: SZV-1, SZV-3, SZV-4-1, SZV-4-2, SZV-K, the package is needed sew and number.

Attach to it a list of insured persons for whom data is provided. The list is compiled in any form.

The entire package is certified by a seal (if any) and the signature of the appointed executor (personnel employee or accountant), as well as the signature of the manager.

On ADV-6-1 it is written: “I assure that the contents of all documents included in the package consisting of the above number of forms are correct.”

Form ADV-6-1 can be found here:

Source: https://spmag.ru/articles/forma-adv-6-1

Recommendations on the procedure for determining the category of an insured person

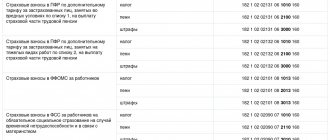

The category of the insured person (IP) indicated in the SZV-6-4 form is determined on the basis of the insurance premium rate applied by the policyholder when calculating contributions from payments to a specific insured person (see Table 2).

table 2

| Insurance premium rate applied by the policyholder | Categories of APs | Tariff code in RSV-1 |

| Basic tariff, including for organizations paying UTII and using the simplified tax system | NR, VZHNR, VPNR | 01, 52, 53 |

| For agricultural producers meeting the criteria specified in Article 346.2 of the Tax Code of the Russian Federation | SKH, VZHSKH, VPSH | 18 |

| For organizations and individual entrepreneurs applying the single agricultural tax | ESKHN, VZHEN, VPEN | 04 |

| For organizations of folk arts and crafts, family (tribal) communities of indigenous peoples of the North, Siberia and the Far East | HMN, VZHMN, VPMN | 19, 20 |

| For public organizations of disabled people; organizations making payments and other remuneration to individuals who are disabled people of group I, II or III - in relation to the specified payments and remuneration | OOI, VZHOI, VPOI | 03 |

| For organizations operating in the field of information technology | ODIT, VZHIT, VZIT | 06 |

| For organizations and individual entrepreneurs using a simplified taxation system, the main type of economic activity of which is specified in paragraph 8 of part 1 of article 58 of the Federal Law of July 24, 2009 No. 212-FZ | PNED, VZhED, VPED, | 07 |

| For business entities created after August 13, 2009 by budgetary scientific institutions and educational institutions of higher professional education | HO, VZHHO, VPHO | 08 |

| For the media | Media, VZHSI, VPSI | 09 |

| For organizations that have received the status of participants in the Skolkovo project | ICS, VZhTS, VPTS | 10 |

| For pharmacies, non-profit, charitable organizations, individual entrepreneurs using the patent tax system | ASB, VZHSB, VPSB | 11, 12, 13, 16 |

| For organizations providing engineering services | INZHU, VZHIZH, VPIZH | 14 |

| For organizations and individual entrepreneurs who have entered into agreements with the management bodies of special economic zones on the implementation of technical innovation activities | TVEZ, VZhTZ, VPTZ | 36 |

For Russian citizens and foreign citizens and stateless persons permanently residing in the Russian Federation, the first of each group of AP categories is used.

For foreign citizens and stateless persons temporarily residing in the territory of the Russian Federation, the categories of AP with the prefix “VZh” are used.

For foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation who have entered into an employment contract for an indefinite period or a fixed-term employment contract (contracts) lasting at least six months in total during a calendar year, the categories of AP with the prefix “VP” are used.

To determine whether the amounts of payments and other remuneration belong to a specific category of APs, separate pages are filled out in individual cards for each tariff applied by the policyholder, and the status of foreign citizens from the point of view of paying contributions to compulsory pension insurance is noted.

Information on the amount of payments and other remuneration accrued in favor of an individual

In the column “Amount of payments and other remuneration” of forms SZV-6-4 with the type of contract “employment”, payments reflected in the line “Payments in accordance with Part 1-2 of Art. 7 212-FZ" individual card, with the exception of:

- payments under civil law and copyright contracts, reflected in the line “Art. 9 h. 3 p. 2";

- “uninsured” payments reflected in the line “Art. 9 h. 3 p. 1";

- monetary allowances for military personnel.

In the column “Amount of payments and other remuneration” of the SZV-6-4 forms with the type of contract “civil”, payments reflected in the line “Art. 9 h. 3 p. 2.”

The column “included in the base for calculating insurance premiums, not exceeding the maximum” shows payments reflected in the line “Base for calculating insurance premiums for compulsory health insurance” of the individual card.

In the column “included in the base for calculating insurance premiums exceeding the limit”, payments reflected in the line “Amount of payments exceeding the established part 4 of Art. 8 212-FZ, on the OPS” individual card.

If two forms SZV-6-4 with different types of agreement are generated for one insured person for one category of AP, then the amounts included in the bases for calculating insurance premiums, not exceeding the maximum and exceeding the maximum, are distributed in proportion to the total taxable base for each type of agreement for every month of the reporting period.

Note! Insureds applying preferential rates of insurance premiums who do not pay premiums on amounts of the base for calculating insurance premiums exceeding the maximum do not fill out the column “included in the base for calculating insurance premiums exceeding the maximum.”

Work period for the last three months of the reporting period

Periods of work are determined on the basis of orders for hiring and dismissal, transfers to jobs with special working conditions, certificates of incapacity for work, orders for parental leave and other documents defining the features of the insurance period.

The “Operation period” section may contain several lines in the following cases:

- if the employee quit and was rehired by the same insurer during the reporting period;

— if working conditions changed and the changes were documented with appropriate documents;

- if the insured person has different working conditions due to the type of work, and it is impossible to allocate a calendar period of work in special or harmful working conditions. In this case, the columns “Beginning of period” and “End of period” are indicated only in the first line related to this calendar period.

The column “Territorial conditions” is filled out in accordance with the parameter classifier of the same name, approved. by resolution of the Board of the Pension Fund of July 31, 2006 No. 192p, if the insurer has workplaces that are located in an area included in the list of regions of the Far North, areas equated to regions of the Far North, exclusion zones, resettlement zones, residential zones with the right to resettlement, zones residence with preferential socio-economic status.

The column “Special working conditions (code)” is filled in in accordance with the parameter classifier of the same name only for special working conditions. When an employee performs types of work that give the insured person the right to early assignment of an old-age labor pension, types of work in accordance with Lists No. 1 and 2 of production, work, professions, positions and indicators that give the right to preferential benefits, the code of the corresponding List item is indicated in the next line, starting from the “Special working conditions” column.

The columns “Calculation of the insurance period” and “Conditions for the early assignment of a labor pension” are filled out in accordance with the parameter classifiers of the same name for certain categories of workers.

Note! In accordance with the rules for filling out the “Period of Work” section of the SZV-6-4 form, codes of special working conditions and (or) grounds for early assignment of a labor pension are indicated in individual information for insured persons employed in the jobs specified in subparagraphs 1-18 of paragraph 1 Article 27 of the Federal Law of December 17, 2001 No. 173-FZ only in the case of accrual (payment) of insurance premiums at additional tariffs. In the absence of accrual (payment) of insurance premiums at the additional tariff, codes of special working conditions and (or) grounds for early assignment of a labor pension (hereinafter referred to as codes of special working conditions) are not indicated.

The SZV-6-4 forms submitted to the Pension Fund of Russia are combined into bundles in which no more than 200 documents are allowed. Wherein:

- forms SZV-6-4, submitted to various categories of insured persons, are formed in separate batches;

- forms SZV-6-4, submitted for insured persons working in different territorial conditions, are formed in separate batches;

- forms SZV-6-4, submitted to insured persons working under an employment contract or under a civil law contract, are formed in different packs.

Each bundle of documents SZV-6-4 is accompanied by an inventory in the form ADV-6-5, which is an integral part of the bundle of documents.

The ADV-6-5 inventory indicates the total values for all documents in the stack (in rubles and kopecks) of the following indicators:

- the amount of payments and other remuneration;

- the amount of payments and other remuneration for which insurance contributions for compulsory pension insurance are calculated, included in the base for calculating insurance contributions, not exceeding the maximum;

- the amount of payments and other remuneration for which insurance premiums for compulsory pension insurance are calculated, included in the base for calculating insurance premiums, exceeding the maximum;

- accrued and paid insurance premiums for the insurance part of the labor pension;

- accrued and paid insurance contributions for the funded part of the labor pension.

Each package of SZV-6-4 documents, accompanied by an electronic submission, is assigned a serial number, which is also indicated in the ADV-6-5 inventory. The batch number within the reporting period must be unique. The batch number within the calendar year must be unique.

The generated packs of initial forms SZV-6-4 are included in the ADV-6-2 inventory, which indicates the amounts (in rubles and kopecks) of accrued and paid insurance premiums for the insurance and funded parts of the labor pension for each pack and for the policyholder as a whole, and also, if necessary, packs of corrective (cancelling) forms SZV-6-1, SZV-6-2, which indicate the amounts (in rubles and kopecks) of additional accrued and paid insurance contributions for the insurance and funded parts of the labor pension for each pack and in general for to the policyholder

The prepared personalized accounting information is accompanied by the PFR form RSV-1, approved. by order of the Ministry of Labor of Russia dated December 28, 2012 No. 639n, and are submitted to the Pension Fund of the Russian Federation in a single set.

Insureds, when submitting information on 50 or more insured persons working for them (including those who have entered into contracts of a civil law nature, for remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) for the previous reporting period

submit to the Pension Fund a single set of reports in the form of electronic documents in formats approved by the Pension Fund. Electronic documents are signed in accordance with the requirements of Federal Law dated April 6, 2011 No. 63-FZ “On Electronic Signatures”.

In addition to format and logical control of the files submitted by the insured, the so-called “pre-basic check” from the 1st quarter of 2013 provides for checking the basis for reflecting codes of special working conditions in individual information in the SZV-6-4 form. This check consists of two stages:

— checking the indicators of the form itself (for each insured person);

— reconciliation of data for the policyholder as a whole with data from the RSV-1 form.

The rules for checking forms SZV-6-4 for the insured person and for the policyholder as a whole are posted on the Pension Fund website.

Verification of the completeness of the accrual and payment of insurance premiums at the additional tariff is carried out as part of a desk audit of the RSV-1 form.

New reporting forms for personalized accounting

On June 21, 2010, the draft Resolution of the Board of the Pension Fund “On Amendments to the Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p” was posted on the official website of the Pension Fund . At the same time, the closing date for receiving expert opinions from independent experts was determined - June 29, 2010.

In this article we will talk about what the new forms look like and what to pay attention to when filling out personalized accounting information. It should be noted that at the time of publication of the material in the journal, the new forms had not been officially approved, despite the fact that there was very little time left for submitting reports - until August 1.

As part of the reporting on personalized accounting, the following forms must be submitted to the Pension Fund:

– SZV-6-1 “Information on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of the insured person” (submitted if in the reporting period it is necessary to indicate leave without pay, and (or) receipt of temporary disability benefits, and (or) the work of the insured person with the need to fill in the details “Territorial working conditions (code)”, “Special working conditions (code)”, “Calculation of the insurance period”, “Conditions for the early assignment of a labor pension”) (see page 39 );

– SZV-6-2 “Register of information on accrued and paid insurance contributions for compulsory pension insurance and the insurance experience of insured persons” (formed for insured persons who do not have special features of accounting for their experience in the reporting period) (see page 40);

– ADV-6-3 “Inventory of documents on accrued and paid insurance premiums and the insurance experience of insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation” (submitted by the insured (employer) as part of a bundle of incoming initial (corrective, canceling) documents containing information on accrued and paid insurance premiums for compulsory pension insurance and the insurance period of the insured person, submitted starting from 2010) (see page 41);

– ADV-6-2 “Inventory of information transmitted by the policyholder to the Pension Fund of the Russian Federation” (contains data in general on the policyholder and accompanies packs of documents and registers of incoming initial and corrective (cancelling) information ADV-6-3, SZV-6-1, SZV- 6-2) (see page 42). Individual information for assigning a pension must be submitted in the SPV-1 form. A pack of SPV-1 must be accompanied by an inventory in the form ADV-6-3.

It should be noted that the forms SZV-6-1, SZV-6-2, ADV-6-3, ADV-6-2 replaced the usual forms SZV-4-1, SZV-4-2, ADV-6-1 , ADV-11. The main difference between the new forms is that they must indicate not only the accrued amount of insurance premiums of the insured person, but also the amount paid in the reporting period.

The SZV-6-1 form is similar to the SZV-4-1 form, the SZV-6-2 form is similar to the SZV-4-2 form. The difference is that in forms SZV-6-1 and SZV-6-2 there is no column to indicate the number of days of leave without pay and temporary disability. Now these periods should be reflected in the SZV-6-1 form as a separate line indicating the dates (from which to which) and the corresponding code in the column “Calculation of insurance experience/Additional information”: – VRNETRUD – period of temporary disability; – ADMINISTR – leave without pay. Particular attention should be paid to working in territorial conditions. Previously, for employees who worked in the regions of the Far North and localities equivalent to them (or in other special territorial conditions), and who had one period of service, it was possible to submit information on the form SZV-4-2, indicating in the accompanying inventory ADV-6- 1 corresponding detail “Territorial conditions” (RKS, ISS and additionally details for radioactive contamination zones). In the new reporting forms, it is necessary to create a separate pack of SZV-6-1. In addition, according to territorial conditions, in addition to the details, it is required to indicate when working in part-time mode the share of the rate (in the electronic file for this it is proposed to use the “Coefficient” parameter, which was used in old forms for some time to indicate the regional coefficient), and when working in the mode part-time work week – reflect periods of work based on actual time worked. Another difference that should be noted is that the new reporting provides that, due to the emergence of new tariffs, an organization may have more than one category code of the insured person. Let us recall that from 2002 to 2009, the HP or CX codes were used for all employees. Now the classifier of codes for categories of insured persons contains the following positions:

– NR – general category of workers; – Farmers – employees of agricultural producers (in accordance with the criteria of Article 346.2 of the Tax Code of the Russian Federation), organizations of folk arts and crafts and family (tribal) communities of indigenous peoples of the North, applying a reduced tariff in accordance with clause 1, part 2 of art. 57 and paragraph 1, part 1, art. 58 of Federal Law No. 212-FZ (valid until December 31, 2014); – OZOI – employees of employers who have the status of residents of technology-innovative SEZs and make payments to individuals working in the territory of the technology-innovation SEZ; workers - disabled people of groups I, II, III, etc. (reduced tariff in accordance with clause 2, part 2, article 57 and clause 2, 4, part 1, article 58 of Federal Law No. 212-FZ is valid until 31.12 .2014); – Unified Agricultural Tax – employees of organizations and individual entrepreneurs on Unified Agricultural Tax, applying a reduced tariff in accordance with clause 3, part 2 of Art. 57 and paragraph 3, part 1, art. 58 of Federal Law No. 212-FZ (until December 31, 2014); – USEN – employees of organizations and individual entrepreneurs on the simplified tax system and special regime in the form of UTII (clause 2, part 2, article 57 of Federal Law No. 212-FZ); – FL – indicated for payers of insurance premiums who do not make payments to individuals (for example, individual entrepreneurs without employees). The need to use different codes arises if an organization uses several tariffs for calculating insurance premiums. Please note that when submitting a report on insurance premiums for the first quarter of 2010, organizations applying different insurance premium rates filled out not only section 2, but also section 3 in the RSV-1 form, or filled out two tables in section 2. For employees, when filling out individual information, you must use the category code of the insured person corresponding to the tariff. Moreover, one insured person may have two forms of information with different codes in the reporting period, for example, if his disability was removed during the reporting period.

Please note: Information with different codes must be formatted in different packs.

Form ADV-6-3 (similar to form ADV-6-1) is attached to the package of documents of form SZV-6-1, but it is not attached to SZV-6-2. Form ADV-6-2 contains amounts for the entire organization and is similar to form ADV-11. However, the content of the new form is different: it lists by name all the bundles of information submitted to the Pension Fund of the Russian Federation, indicating the number of insured persons and the amounts of accrued and paid insurance premiums in the bundle. The total amounts for all packages must coincide with the amounts of accrued and paid insurance premiums indicated for the corresponding period in the RSV-1 form.

Question: How can I determine the total amount of contributions paid? For what period should transfers be indicated: until June 30 or until July 15?

Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p stipulates that the forms of documents for individual (personalized) accounting in the compulsory pension insurance system must indicate the amount of paid insurance contributions for the insurance part and the funded part of the labor pension for the last three months (for 2010 - six months) of the reporting period. When presenting information for the reporting period (1st half of the year) of 2010 (from 01/01/2010 to 06/30/2010), the “Paid” indicator includes the amount of insurance premiums paid for 2010 to 06/30/2010. In this case, the total amount of insurance premiums for all insured persons of the organization, indicated in individual information, must be equal to the amount entered in line 140 of the RSV-1 calculation.

Question: What amount for employees should be reflected in the “Paid” column of the SZV-6-2 form? How to calculate the premiums paid for each insured person if the organization transfers the contributions in one payment?

Employees have equal rights to the contributions paid for them, therefore the amount paid must be divided in proportion to the accrued amounts among all employees. The calculation of the amounts paid for each insured person is carried out using the payment coefficient, which is calculated as the ratio of the amount paid in the reporting period for the organization as a whole to the amount accrued for the organization as a whole. Since the amount to be transferred must be rounded to the nearest whole ruble, there may be inconsistencies with the accrual amounts, which are made in kopecks. When admitted to the Pension Fund of Russia, such a discrepancy will be considered an error. In this regard, the kopecks resulting from rounding will have to be added by one of the employees. Let us note that today there are no regulatory documents regulating personal accounting of insurance premiums paid by an organization. You can refer to the Decree of the Government of the Russian Federation dated June 12, 2002 No. 407 , which states that the received amounts of current payments for insurance premiums, as well as payments for insurance premiums for past periods, are distributed to individual personal accounts of insured persons in proportion to the amounts of accrued insurance premiums. This resolution approved the forms of individual information.

Question: During the reporting period, the employee had leave without pay, and he belonged to two categories (general taxation system and UTII). How to correctly reflect leave without pay in the SZV-6-1 form? What category code of insured persons should he be assigned to?

Vacation without pay must be reflected in form SZV-6-1 both according to the general taxation system (code NR) and according to UTII (code USEN).

Question: How does the organization’s report (general taxation system) reflect information about disabled people for whom reduced insurance premium rates are applied?

In the form SZV-6-1 (or SZV-6-2 - depending on length of service) for disabled people working on the general taxation system, you should use the insured person category code OZOI and the amount of contributions calculated at a reduced rate. For all other employees, the insured person category code HP is used.

Question: Which category code of insured persons should be used for disabled people working under the simplified tax system or special regime in the form of UTII: OZOI or USEN?

If sections 3 and 4.1 are completed in the RSV-1 form, then the OZOI code must be used. If tariff code 05 is indicated in the RSV-1 (when applying the simplified tax system or paying UTII), sections 3 and 4.1 of the said form are not filled out and the code will be the same as for all employees - USEN.

Question: When filling out form SZV-6-1, is it necessary to break down the length of service of employees who are granted additional unpaid days of rest for working on weekends?

If work on a day off is paid and, therefore, insurance premiums are calculated on the payment amount, then there is no need to show an additional unpaid day of rest, since it is provided in exchange for a worked day off. It is mandatory to highlight leave without pay as a separate line in the length of service in the case of special working conditions or if there are grounds for early assignment of a pension. Question: What should I do if a dismissed employee brought a certificate of incapacity for work within 30 days after dismissal?

In this situation, it is necessary to fill out form SZV-6-1. In this case, the period of temporary disability must be highlighted as a separate line indicating the code VRNETRUD in the column “Calculation of length of service/Additional information”. The end date of the last line of service must correspond to the date of dismissal.

Question: How to reflect data on individuals working under contract agreements in reporting forms?

When filling out the SZV-6-2 form, in the “Work period” column, you should reflect the dates of the contract. If there were several contracts, then for this individual it is necessary to fill in the lines for the number of concluded contracts, indicating the validity dates of these contracts in the column “Work period”.

Question: Are there any special features when filling out reporting forms if an enterprise operates on a shortened work week?

In the absence of the need to calculate preferential length of service and the presence of accrued insurance contributions, it does not matter whether the working week was full or shortened. If for employees it is not required to reflect information in the columns “Territorial conditions”, “Special working conditions”, “Calculation of length of service” or “Conditions for early assignment of a pension”, when filling out the SZV-6-2 form, the period from 01.01 is indicated. 2010 to 06/30/2010 or the period with the dates of hiring and dismissal of employees.

Question: How can I include in the report employees who were on sick leave while the organization was operating on reduced working hours?

For such employees, when filling out the SZV-6-1 form, the period of temporary disability must be highlighted as a separate line indicating the code VRNETRUD in the column “Calculation of insurance length/Additional information”.

Question: Is it necessary to submit personalized accounting information if the organization has only a director, who is the only founder, with whom an employment contract was not concluded and to whom wages were not paid?

Individual information with dashes is not submitted to the Pension Fund. Since wages were not accrued, therefore, insurance premiums were not accrued or paid. Consequently, there is nothing to reflect on the personal account of the insured person. Let us remind you that you can submit form RSV-1 with dashes.

Question: How do I fill out a report for an employee fired in 2009 who was awarded a bonus based on the year’s performance in 2010?

For a dismissed employee, you must fill out form SZV-6-2, in which you should indicate only the amounts of accrued and paid insurance premiums, while the column “Period of work” does not need to be filled out, since in 2010 such an employee does not have work experience.

Question: How will periods of temporary disability be reflected in the new reporting?

Let us remind you that previously, when submitting personal information, it was necessary to indicate the total number of days on sick leave. In the new forms, a special code is introduced to reflect information about periods of temporary disability.

For an employee who was on sick leave during the reporting period, fill out form SZV-6-1, which indicates the period (from dd.mm.yyyy to dd.mm.yyyy) of sick leave and enters it in the column “Calculation of insurance length/Additional information” code VRNETRUD.

Is it possible to submit the report for the first quarter of 2010 before August 2, since July 31 is a day off? Federal Law No. 213-FZ stipulates that policyholders for the first reporting period of 2010 (half-year) provide information provided for by the Federal Law “On individual (personalized) registration in the compulsory pension insurance system” by August 1, 2010, for the second reporting period of 2010 year (calendar year) – until February 1, 2011. The law does not clearly state the transfer of the reporting deadline from a weekend to the first working day, as is done, for example, in Federal Law No. 212-FZ for the RSV-1 form. To avoid disagreements with regulatory authorities, we recommend submitting the report before August 1.

Checking the SZV-6-4 form for the insured person

1. If in the SZV-6-4 form there are non-zero values in the section “Information on the amount of payments and other remunerations of the insured person employed in the relevant types of work for which insurance premiums are calculated at the additional rate”, then in the section “Period of work” of the form SZV-6-4 one of the corresponding codes of special working conditions must be indicated (and vice versa).

2. The number of months of work in the section of the SZV-6-4 form “Period of work for the last three months of the reporting period” with the code of special working conditions must correspond to the number of months (with non-zero values) in the section “Information on the amount of payments and other remunerations of the insured person, employed in the relevant types of work for which insurance premiums are calculated at an additional rate.”

3. If non-zero values are indicated in the column “Amount of payments and other remuneration accrued to the insured person engaged in the types of work specified in subparagraph 1 of paragraph 1 of Article 27 of Federal Law No. 173-FZ” (List No. 1) of the section “Information on the amount of payments and other remunerations of the insured person engaged in the relevant types of work for which insurance premiums are calculated at an additional rate" of the SZV-6-4 form, then in the section "Period of work for the last three months of the reporting period" of the SZV-6-4 form there should be the code of special working conditions and (or) grounds for early assignment of a labor pension is indicated, corresponding to the work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law of December 17, 2001 No. 173-FZ (code 27-1).

4. If non-zero values are indicated in the column “Amount of payments and other remunerations accrued to the insured person engaged in the types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of Federal Law No. 173-FZ” section “Information on the amount of payments and other remunerations” the insured person engaged in the relevant types of work for which insurance premiums are calculated at an additional rate" of the form, then in the section "Period of work for the last three months of the reporting period" of the SZV-6-4 form the code of special working conditions and (or ) grounds for the early assignment of a labor pension, corresponding to the work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law of December 17, 2001 No. 173-FZ (for example, code 27-5).

SZV-6-4: Individual information since 2013

Here you can see the list of Insured Persons who have Individual Information for 2013. You can set a filter to view the list by selecting predefined display modes (All employees are displayed by default)

The top List displays a list of employees for the selected Policyholder. In the lower list are Individual information (forms SZV-6-4) related to the selected employee.

The buttons to the right of the list of employees are used to add, change or delete employee data.

The buttons to the right of the list of SZV-6-4 forms are used to add, change or delete the Individual Information for a specific employee.

Adding/changing forms SZV-6-4

Main On this tab you enter the so-called “header” information on the SZV-6-4 form itself: Reporting period, Payer Category, Adjusted/cancelled Reporting period, Type of information, Type of agreement, Date of filling out the form.

Reg. No. of the Pension Fund of the Russian Federation during the adjusted period: in case of re-registration of the policyholder when submitting the corrective form, this detail is required to be filled out

For one insured person, the policyholder, due to different working conditions in the organization, submits more than one form.

For example: work under employment and civil law contracts, or the insured person has different categories in the reporting period.

If more than one civil law contract is concluded with the insured person during the reporting period, one SZV-6-4 form is submitted for the insured person.

Contributions, payment On this tab you must make accrued/paid contributions for the Insurance/Savings part

For KORR and OTMN forms, you enter the amounts of additional accrued/additional contributions.

These amounts can also be calculated using the appropriate buttons [Calculate additionally accrued amounts] and [Calculate additionally paid amounts].

In this case, these amounts are calculated as the difference between the form available in the ISHD Database and the current CORR/OTMN form.

The added additional accrued/additional paid amounts fall into the ADV-6-2 form when generating batches of documents for transfer to the Pension Fund of the Russian Federation. The amount of overpaid (collected) insurance premiums in the “paid” requisite for the insured person in the SZV-6-4 form is not taken into account.

Important! Form SZV-6-4 does not contain data on the amounts of accrued and paid insurance premiums for additional tariffs, because

this indicator is absent in the legislation on personalized accounting (Article 6 of Federal Law No. 27), concerning additional tariffs. In addition, the amounts of additional insurance premiums.

tariffs are not taken into account when forming the estimated pension capital

Payments The amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual for the last three months of the Reporting Period with a monthly breakdown in rubles and kopecks is indicated. If you do not have the flag checked: [ ] Refusal of automatic calculation of accrued contributions

then the accrued contributions will be automatically calculated. Will be calculated based on the amount in the column: Included in the base for calculating contributions not exceeding the limit.

To be able to calculate the amount of Insurance contributions based on the contributed income, the employee must have a Date of Birth entered.

Payments under Additional

tariff Indicates the amount of payments and other remunerations accrued by payers of insurance premiums in favor of an individual, for which insurance premiums payers - policyholders have accrued insurance premiums at an additional tariff in subparagraph 1 of paragraph 1 of Article 27 and subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law "On labor pensions in the Russian Federation"

Notes on entering Reporting Periods and Adjusted/Canceled Reporting Periods Since 2010, the concept of Adjustable Reporting Period has appeared in the Individual Information forms. Those. for correcting/cancelling Individual Information forms, you need to select two Reporting Periods:

- Reporting period - indicate the period in which you submit the adjustment/cancellation form.

- Corrected/cancelled Reporting period - indicate the period for which you submit the corrected/cancelled form.

For example, you submit an adjustment form for the first quarter of 2013 on May 20, 2013. For this case: Reporting period - second quarter of 2013

Adjusted/cancelled reporting period - first quarter of 2013

Important! To correctly calculate additional accrued/additional amounts in the ADV-6-2 form, your database must also contain incorrect ISHD forms for the corresponding reporting period. For example: Incorrect ISHD form Reporting period - first quarter of 2013 Accrued - 1000 rubles. Disbursed - 1000 rubles.

Corrective form

Reporting period—second quarter of 2013

Adjusted/cancelled reporting period: first quarter of 2013

Accrued - 1000 rubles. Disbursed - 900 rubles.

The following amounts will be reflected in ADV-6-2

Additional accrued - 0 rub.

Additional payment - 100 rubles.

For additional information, see here: Corrective information on forms SZV-6/SPV-1, because the principle is the same for forms SZV-6-4.

Important! If it is necessary to make changes to the reporting on personalized accounting in the reporting periods 2010-2012, the composition of the report from 01.01.

2013, in addition to packs with forms SZV-6-4, ADV-6-2, packs with forms SZV-6-1(2) containing corrective (cancelling) information should also be included. Those.

KORR/OTMN forms SZV-6-1(2) are formed from the formation mode of packs SZV-6-4

Paid contributions You can make paid contributions either independently or by calculating them in accordance with the logic laid down in the program. The calculation of paid contributions is carried out in the left Task Panel: [Calculation of paid contributions to the Pension Fund]

For additional information, see here: Amounts of accrued and paid contributions

Information accepted Information is displayed about the employee who added/changed the SZV-6-4 form, as well as the date and time of adding/changing the SZV-6-4 form

Sending to the Pension Fund Displays information about the employee who uploaded the SZV-6-4 form for transmission to the Pension Fund, as well as the date the form was sent. These details are automatically filled in if the following flag is selected in the window for recording batches on magnetic media:

Set the flag on the SZV-6-4 forms [Sent to the Pension Fund of Russia]

You can also manually set/uncheck the flag for sending form SZV-6-4 to the Pension Fund on this tab.

Calculation of paid contributions for forms SZV-6-4

The calculation of paid contributions is made using algorithms similar to those for forms SZV-6-1(2) with a number of minor changes.

Current period On this tab, the amounts accrued/paid by contribution in the current calculated reporting period are entered, and the Payer Category is selected for which the debt will be repaid, if the employee does not have the SZV-6-4 form for the current Reporting period (the employee was dismissed in the previous reporting period and he does not have accrued contributions and work experience)

Source: https://dokumenty-pu-6.ru/instrukciya-po-rabote-s-programmoj/individualnye-svedeniya/szv-6-4-individualnye-svedeniya-s-2013-goda/