From 2021, all employers who hire workers under labor and civil contracts must submit a monthly report to the Pension Fund in the SZV-M form. As for control over the payment of insurance premiums, this function is assigned to tax authorities who accept reports on the payment of pension, medical and social benefits.

Despite such changes, personalized accounting remains under the control of pensioners. The tax service is not interested in this type of reporting and its representatives will not accept it, no matter how much employers would like to make the reporting process more convenient for themselves.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When preparing SZV-M in 2021, policyholders may encounter a number of difficulties and ambiguous situations. The most common problem that accountants encounter during the preparation of a report is that the employee has not been assigned an INN or SNILS.

What is the SZV-M report?

In accordance with Art. 3 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” the goals of individual (personalized) accounting are:

- creating conditions for the appointment of insurance and funded pensions in accordance with the labor results of each insured person;

- ensuring the reliability of information about length of service and earnings (income), which determine the size of insurance and funded pensions when they are assigned;

- creation of an information base for the implementation and improvement of the pension legislation of the Russian Federation, for the appointment of insurance and funded pensions based on the insurance length of the insured persons and their insurance contributions, as well as for the assessment of obligations to the insured persons for the payment of insurance and funded pensions, urgent pension payments, lump sum payments pension savings funds;

- developing the interest of insured persons in paying insurance contributions to the Pension Fund of the Russian Federation;

- creating conditions for monitoring the payment of insurance premiums by insured persons;

- information support for forecasting the costs of paying insurance and funded pensions, determining the tariff of insurance contributions to the Pension Fund of the Russian Federation, calculating macroeconomic indicators related to compulsory pension insurance;

- simplification of the procedure and acceleration of the procedure for assigning insurance and funded pensions to insured persons.

The SZV-M form was approved by Resolution of the Board of the Russian Pension Fund dated February 1, 2021 No. 83p “On approval of the form “Information about insured persons.” In the section “Information about insured persons”, information about insured persons is indicated - employees with whom employment contracts, civil law contracts, the subject of which is the performance of work, the provision of services, author's order contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use works of science, literature, art

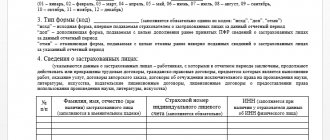

| № p/p | Last name, first name, patronymic (if any) of the insured person (filled out in the nominative case) | Insurance number of an individual personal account (required to be filled in) | TIN (filled in if the policyholder has data on the individual’s TIN) |

Main nuances

On April 1, 2021, Resolution of the Board of the Pension Fund of Russia No. 83p On approval of the form “Information about insured persons” came into force. The abbreviation SZV stands for “incoming information about the insured.” The letter M indicates that the form must be submitted monthly.

In an organization, a dispute often arises about who should prepare this report: accounting or representatives of the human resources department who accept the employee into the organization, and where copies of all his documents are stored. The answer to this is simple: the person responsible for a given segment of work is appointed directly by the manager. One thing is clear - the person in charge must have access to current contracts concluded with employees.

The first report had to be submitted for April 2021, starting from this period, reports must be submitted by each employer on a monthly basis. The document must include information about each employee, even if he worked under a contract for only 1 day.

SZV-M must be submitted even if the organization is temporarily not operating, for example, all employees are on unpaid leave, but they have valid employment agreements. This is due to the fact that the submission of this type of report is not related to any payments and accruals. The only thing that matters is the presence of an employment contract or a GPC contract.

When filling out the form, do not forget about those employees who are on maternity leave. If there are no employees in the organization, and therefore no valid contracts, you do not need to submit this form.

To prepare the report and check it, special programs have been created, which can be found on the website of the Pension Fund of the Russian Federation.

As for the form for submitting the report, it can be prepared and submitted on paper. This is only allowed for employers with no more than 25 employees. However, even in this case, it is better to accompany the report with the corresponding file on a flash drive. If there are more employees, the form is submitted exclusively in electronic format, and it must have an electronic signature.

To send a form with an electronic signature, you must be a subscriber to the electronic document management system with the Pension Fund. For this purpose, an agreement is concluded with this government agency. The next step is to obtain a CEP certificate and purchase reporting software. For example, a similar opportunity is provided by the Kontur.Extern system.

Who should fill out the SZV-M?

According to clause 2.2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, the policyholder, on a monthly basis, no later than the 15th day of the month following the reporting period - month, submits information about each person working for the person, (including persons who have entered into civil law agreements, the subject of which is the performance of work, the provision of services, copyright contracts, agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use a work of science, literature, art, including agreements on the transfer of rights management powers concluded with a rights management organization on a collective basis) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- taxpayer identification number (if the policyholder has data on the taxpayer identification number of the insured person).

It is not necessary to provide information about individual contractors only in exceptional cases:

| Contractor | A comment | Normative act |

| Individual entrepreneur | Individual entrepreneurs are recognized as payers of insurance premiums | clause 1 art. 419 Tax Code of the Russian Federation |

| Foreign citizens and stateless persons | Payments and other remuneration in favor of individuals who are foreign citizens or stateless persons under employment contracts concluded with a Russian organization for work in its separate division, the location of which is located outside the territory of the Russian Federation, are not recognized as subject to insurance premiums for payers. . | Art. 420 Tax Code of the Russian Federation |

| Full-time students | The base for calculating insurance benefits does not include remunerations made in favor of students in professional educational organizations, educational institutions of higher education in full-time education for activities carried out in student groups (included in the federal or regional register of youth and children's associations receiving state support) under employment contracts or under civil law contracts, the subject of which is the performance of work and (or) the provision of services. | clause 3 art. 422 Tax Code of the Russian Federation |

Changes from 2021

From the beginning of 2021, new rules for submitting the SZV-M form have come into force.

There are five of them:

- The term for filing SZV-M has been changed. If previously the report was submitted by the 10th day of each month following the reporting month (in some cases a fluctuation of one or two days was allowed), then starting in January of this year a new deadline has been established, which is set for the 15th. That is, now the employer is given 5 more days to prepare the report.

- The pension fund will impose a fine if a company with more than 25 employees submits a paper report instead of an electronic form. Last year, such sanctions were not applied to employers.

- Making a mistake in the TIN has become more dangerous than before. Starting from 2020, a tax identification number is a mandatory element when maintaining personalized records. It is not necessary to reflect it in the SZV-M, but in the new calculation of contributions it must be recorded without fail. If last year it was more difficult for pensioners to track the TIN of each employee, then since the new year the fund has additional opportunities for this, and, accordingly, the likelihood of receiving a fine is higher.

- If an error is detected in the SZV-M form, not only the company, but also its manager and the chief accountant will face penalties.

- The Pension Fund has approved the updated electronic format of the SZV-M form.

Is the TIN a mandatory document?

According to Art. 65 of the Labor Code of the Russian Federation, when concluding an employment contract, a person applying for work presents to the employer:

- passport or other identity document;

- work book, with the exception of cases when an employment contract is concluded for the first time or the employee starts working on a part-time basis;

- insurance certificate of compulsory pension insurance;

- military registration documents - for those liable for military service and persons subject to conscription for military service;

- a document on education and (or) qualifications or the presence of special knowledge - when applying for a job that requires special knowledge or special training;

- a certificate of the presence (absence) of a criminal record and (or) the fact of criminal prosecution or the termination of criminal prosecution on rehabilitative grounds;

- a certificate stating whether or not the person is subject to administrative punishment for the consumption of narcotic drugs or psychotropic substances without a doctor’s prescription or new potentially dangerous psychoactive substances.

The labor legislation of the Russian Federation prohibits requiring other documents from a potential employee during employment.

In accordance with Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 No. 114n “On approval of the Procedure for registering and deregistering with the tax authorities of Russian organizations at the location of their separate divisions, real estate and (or) vehicles owned by them, individuals - citizens of the Russian Federation, as well as individual entrepreneurs applying a simplified taxation system based on a patent" an individual registered with the tax authority at his place of residence on the basis of information reported by the authorities, who has not received a Certificate, has the right to contact the appropriate tax authority for the purpose of obtaining a Certificate.

According to Art. 11 of the Labor Code of the Russian Federation, labor legislation and other acts containing labor law norms do not apply to persons working on the basis of civil law contracts.

If a GPC agreement is concluded, the presence of a TIN may be indicated in the agreement.

Is it possible to pass the SZV-M without a TIN?

In accordance with clause 2.2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system,” the policyholder is obliged to provide information about the taxpayer identification number, but only if the policyholder has data about the taxpayer identification number of the insured person.

If necessary, the employer can find out the TIN on the website of the Federal Tax Service in the Find out TIN service, where in order to obtain information it is necessary to indicate certain information about the insured person:

- last name, first name, patronymic (if available);

- Date of Birth;

- type of identification document;

- series and document number.

After sending the request, information about the taxpayer’s TIN appears.

How can I pass the SZV-M?

According to Art. 8 of the Federal Law of April 1, 1996 No. 27-FZ, information for individual (personalized) accounting submitted in accordance with this Federal Law to the bodies of the Pension Fund of the Russian Federation is presented in accordance with the procedure and instructions established by the Pension Fund of the Russian Federation.

This information may be presented as follows:

| Method of reporting | Conditions |

| In the form of written documents | Provided that the number of insured persons (including those who have entered into civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) does not exceed 25 people |

| In electronic form (on magnetic media or using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services) with guarantees of their accuracy and protection from unauthorized access and distortion | The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into civil contracts) for the previous reporting period in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation. |

When submitting information in electronic form, the relevant body of the Pension Fund of the Russian Federation sends to the policyholder confirmation of receipt of the specified information in the form of an electronic document.

Responsibility for failure to provide SZV-M

For violation of the submission of the SZV-M form, the insurer is held liable:

| Offense | Penalties | Normative act |

| SZV-M is not represented for individual contractors | Fine 500 rubles for each insured contractor | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

| Failure of the policyholder to comply with the procedure for submitting information in the form of electronic documents | Fine 1000 rubles | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

If the employee does not have SNILS

When an employer hires new employees, he requests a certain package of documents from them. The insurance number of an individual personal account (SNILS) must be present among the papers. A person may not have such a document. This is possible if this place of work, for example, is the first. In such a situation, the employer is responsible for preparing the document.

There may be another reason why a person does not have such a document: he simply could have lost it. Whatever the reason, it will take some time to restore or register SNILS, which can reach three weeks. Given this fact, it may happen that at the time when it is necessary to submit the SZV-M report, the employee will not yet have his insurance number on hand.

This field in the report form cannot be left blank; it must be filled out. If you provide incorrect details, an error will be identified when checking the provided data by Pension Fund employees. As a result, the employer will be held accountable in accordance with Article 17 of Federal Law No. 27. The amount of the fine that will have to be paid will be 500 rubles for each SNILS that was indicated incorrectly.

If the report is submitted using a telecommunications channel, the policyholder will be refused to accept the report, since the document will not pass the program’s verification. You must not miss the deadline for submitting the report, since this will also entail penalties: in this case, you will have to pay 500 rubles for each employee for whom information was not submitted in a timely manner.

In this case, the only acceptable option is not to include in the form the data of an employee who does not have SNILS. After the insurance certificate has been issued, you can send a supplementary report, which will include all employees who were not previously included in the reporting.

It is best to submit such a report with a cover letter indicating the reason why the employee was not included in the initial report form. As a basis for such actions, it should be noted that it was not physically possible to submit data on the SNILS of some employees in a timely manner, since at the time of submitting the report such a document had not yet been issued for them.

In such a situation, there is a possibility that no penalties will be applied to the employer. But if possible, it is better to avoid this and ask employees in advance for information about their SNILS.