A newly created LLC quite often does not have its own or rented office and is listed only at its legal address. This may be the home address of the manager (founder) or an address with postal and secretarial services. While no real activity is being carried out yet, and correspondence intended for the LLC, especially from official bodies, arrives in a timely manner, this situation is normal. But, sooner or later, the LLC begins to work, which means it must “materialize” somewhere in space.

You can get answers to any questions about registering LLCs and individual entrepreneurs using the free business registration consultation :

Free consultation on business registration

Sometimes the nature of the activity allows you to conduct business from home or with the help of remote workers, but if an LLC opens a store, warehouse, office, production facility, or in some other way begins to operate at an address other than its legal address, then it is necessary to create and register a separate division .

There is an important condition here - the criterion for creating a separate unit is the presence of at least one stationary workplace , and it is recognized as such if it is created for a period of more than one month. The concept of a workplace is in the Labor Code (Article 209), from which we can conclude that:

- an employment contract must be concluded with the employee;

- the workplace is under the control of the employer;

- the employee is constantly in this place in accordance with his job duties.

Based on this, a storage warehouse that does not have a permanent employee will not be considered a separate unit. Vending machines, payment terminals, ATMs, etc. are not considered as such. Remote (remote) workers also do not fall under the concept of a “stationary workplace”, therefore concluding employment contracts with them does not require the creation of a separate unit.

Please note that individual entrepreneurs should not create and register separate divisions . Individual entrepreneurs can operate throughout the Russian Federation, regardless of the place of state registration. If they work under the UTII regime or have purchased a patent, they only have to additionally register for taxation at the place of business.

What should a separate division be like for an organization to have the right to the simplified tax system?

Article 346.12 of the Tax Code of the Russian Federation prohibits the use of a preferential simplified taxation system for organizations that have branches (the requirement for the absence of a representative office has already been abolished). Of course, the question arises - how to register a separate division so that it is not recognized as a branch, and at the same time the organization retains the right to the simplified tax system? To understand this, you will have to refer to the provisions of three codes: Tax, Civil and Labor:

- The Tax Code (Article 11) gives the concept of a separate division of an organization as “... any territorially separate division from it, at the location of which stationary workplaces are equipped.” However, the Tax Code of the Russian Federation does not provide a description of the types of separate divisions.

- The Civil Code (Article 55) characterizes a separate division only in the form of a representative office and a branch . That is, from these provisions it is also unclear what other separate divisions, besides a representative office and a branch, can be.

- The Labor Code (Article 40) indicates that “... a collective agreement can be concluded in the organization as a whole, in its branches, representative offices and other separate structural units .” Thus, only here can one see that separate divisions can be something other than a branch and representative office.

As a result, we are dealing with some elusive concept of another separate division, therefore, when creating such a division, we must simply avoid the criteria that characterize it as a branch or representative office. These characteristics in the law are more than meager:

- a representative office is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them;

- a branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of representative offices;

- representative offices and branches are not legal entities, and information about them must be indicated in the Unified State Register of Legal Entities, and therefore in the organization’s charter.

It is no coincidence that we understand this issue in such detail, because non-compliance with these requirements (sometimes implicit) can deprive an organization of the opportunity to work on the simplified tax system, and unexpectedly. For example, the manager believes that the created separate division is not a branch, so the organization continues to work on a simplified system, although it no longer has the right to do so.

In such cases, the organization will be recognized as operating under the general taxation system from the beginning of the quarter in which a separate division with the characteristics of a branch was created. And the loss of the right to simplification leads to the need to charge all general taxes: profit tax, property tax, VAT, and it is with the latter that the most problems can arise. VAT must be charged on the cost of all goods, works and services sold for the current quarter, and if the buyer or customer refuses to pay it additionally, then the tax will have to be paid at their own expense.

Availability of an employment contract

Since the workplace in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation is applied as a category of labor law, the conclusion of a civil contract with an individual, for example a work contract, excludes the possibility of recognizing his place of work as a workplace for tax purposes (Resolution of the Federal Antimonopoly Service of the North Caucasus Region dated December 13, 2005 N F08-5920/05-2345A) .

Thus, the creation of a workplace is evidenced by the conclusion of employment contracts, the signing by the manager of orders for appointment to a position, the drawing up of a staffing table, etc.

In practice, labor relations with employees are often formalized by contract agreements. If a dispute arises related to the qualification of an agreement, one should proceed from its content, and not the name of the agreement. Therefore, if it is established that an employment relationship actually exists between the parties to the contract, the existence of a workplace should be recognized.

The courts recognize the fact of creation of a job due to the fact that there is actual admission to work. For example, in the case when an organization sets up workplaces outside its location, but invites to these places not its own employees, but employees hired under a personnel supply agreement with a third-party organization. As a rule, under such an agreement, employees are in an employment relationship with the providing organization, and the organization receiving the personnel undertakes to provide such employees with jobs and pay a certain amount to the providing organization. And the courts recognize such places as workplaces for tax purposes, based on the fact that the basis for the emergence of labor relations is the actual admission to work with the knowledge or on behalf of the employer or his representative, regardless of whether the employment contract was properly drawn up (Resolution of the Federal Antimonopoly Service of the North-Western Territory dated 04/14/2004 N A66-6278-03).

Tax authorities quite often recognize the places of work of employees who live and work separately from the parent organization (in other cities) as separate divisions. In this case, the tax authorities directly indicate that the conclusion of civil, rather than employment, contracts with them was made in order to avoid recognition of the places of work of such employees as separate divisions, which may entail the collection of sanctions under Art. 116 of the Tax Code of the Russian Federation.

The conclusion between the parties of a civil law rather than an employment contract (for example, a work contract) allows the organization to claim that the job was not created. The tax authorities will be forced to additionally prove in court that an employment relationship actually took place between the parties to the contract, and if a dispute arises related to the qualification of the contract, one should proceed from its content, not its name. Tax authorities are not vested with the right to independently reclassify this type of agreement from a civil law agreement to a labor agreement.

Thus, if a company decides to conclude civil contracts with individuals hired to perform work, then it should pay serious attention to the compliance of the wording of the concluded contracts with the norms of the Civil Code of the Russian Federation, as well as the absence in such contracts of features inherent exclusively to employment contracts.

In our opinion, the relationship between an organization and an individual involved in the systematic performance of certain functions over a long period, not depending on the specific (stipulated by contract) result accepted by the organization (customer), should be considered as an employment relationship (in this case, the result is understood identifiable result of actions carried out by an individual during the performance of his obligations under the contract). In this case, we proceed not so much from the possible form of the concluded contract, but from the actual relationship between the parties (performance of a labor function by the employee and payment by the employer of the employee’s labor in accordance).

Signs of a branch and representative office

Considering what unpleasant consequences recognition of a separate division as a branch can lead to for the simplified tax system payer, you need to know what its signs may be:

- The fact of the creation and commencement of activities of a branch or representative office is reflected in the charter of the LLC (from 2021 this is not necessary).

- The parent organization approved the regulations on the branch or representative office.

- A head of a separate division has been appointed, who acts by proxy.

- Internal regulatory documents have been developed to regulate the activities of a separate division, as a branch or representative office.

- A branch or representative office represents the interests of the parent organization before third parties and protects its interests, for example, in court.

Thus, in order to retain the right to the simplified tax system, it is necessary to ensure that the created separate division does not have the indicated characteristics of a branch. In addition, it is necessary to indicate in the Regulations on a separate division that it does not have the status of a branch or representative office and does not conduct the business activities of the organization in full (for example, a store is engaged only in the storage, sale and delivery of goods). The creation of a separate division is within the competence of the head of the LLC; it is not necessary to include information about this in the charter.

Where does it appear?

The checkpoint must be indicated as part of the details of the legal entity in all official papers and forms of the organization. It must be reflected in the texts of contracts, various letters and powers of attorney.

There are a number of forms in which checkpoints are a mandatory element. For example, checkpoint in the invoice of a separate division . It is indicated when the OP sells something through himself.

EXAMPLE The sale of goods produced by the parent organization is carried out by its separate division. Then the checkpoint is written on the invoice not of the main office, but of the OP that makes the transaction. The same rule applies if goods are purchased by a separate division.

But the TIN is indicated to the parent organization, since the OP does not have its own.

We inform the tax office about the opening of a separate division

According to Article 83(1) of the Tax Code of the Russian Federation, organizations must register for tax purposes at the location of each of their separate divisions. An additional requirement to report to the tax inspectorate about all separate divisions (within a month) and changes in information about them (within three days) is established by Article 23(3) of the Tax Code of the Russian Federation.

Thus, when creating a separate division (that is not a branch or representative office), the LLC must:

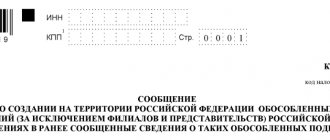

- report this to your tax office using form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] ;

- register with the tax authorities at the location of this unit, if it was created in a territory under the jurisdiction of a tax office other than the one in which the head office is registered.

The tax inspectorate at the place of registration of the head office, to which message No. S-09-3-1 was submitted, itself reports this fact to the Federal Tax Service at the location of the created separate division (Article 83(4) of the Tax Code of the Russian Federation), that is, from the LLC you do not need to register yourself.

If several separate divisions are located in the same municipality, but in territories under the jurisdiction of different tax inspectorates, registration can be carried out at the location of one of the separate divisions, at the choice of the organization. For example, if in one city an LLC has several stores open in the territories of different Federal Tax Service, you do not need to register with each of them, you can select one inspection, indicating this choice in the message.

If the address of a separate division changes, it does not need to be closed and re-opened (such an obligation existed until September 2010), but only to submit a message in form No. S-09-3-1 to the tax office at the place of registration of the division indicating the new address.

Workplace equipment

A workplace should be considered equipped if it is functionally adapted to carry out the type of activity for which it is created and suitable for an employee to be in this place.

The equipment of the workplace can be confirmed, incl. documents on financial responsibility containing indications of specific property entrusted to the employee. Property necessary for work can be transferred under the employee’s report and according to an inventory report.

If special requirements are imposed on the equipment of workplaces, without which compliance with activities is impossible (prohibited), in the absence of documents established by law, the presence of equipped stationary workplaces does not in itself lead to the formation of a separate division of the organization.

At the same time, some courts continue to insist on the following: the equipment of stationary workplaces in a separate unit means not only the creation of all the conditions necessary for the performance of labor duties, but also the very performance of such (labor) duties (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 20.06. 2007 N F08-3590/2007-1449A in case N A63-9693/2006-C4, Ninth Arbitration Court of Appeal dated 10/08/2007 N 09AP-10255/07-AK in case N A40-10267/07-141-57).

Registration with funds

Previously, registration with the Pension Fund when opening a separate division was carried out on the basis of an application from the LLC; now this data is automatically transmitted by the tax office. However, the obligation to independently register with the Social Insurance Fund remains.

To register with the FSS, notarized copies are submitted:

- tax registration certificates;

- certificate of state registration of a legal entity or Unified State Register of Legal Entities;

- notice of registration as an insurer of the parent organization, issued by the regional branch of the Social Insurance Fund;

- information letter from the State Statistics Service (Rosstat);

- notifications about tax registration of a separate division;

- opening order, Regulations on a separate division, documents confirming that the separate division has a separate balance sheet and current account;

- original registration application.

A single simplified tax and insurance premiums for employees employed in a separate division must be paid at the place of registration of the parent organization, and personal income tax from these employees must be withheld at the location of the separate division.

Basic codes

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

A TIN can only be assigned to the organization itself. None of its divisions, including separate ones, have the right to receive their own TIN. Only upon initial registration with the Federal Tax Service does the organization receive its TIN at the place of registration.

Responsibility for violation of the procedure for registering a separate subdivision

Violation of the deadlines for submitting messages and applications for registration of a separate division entails the following fines:

- violation of the deadline for filing an application for registration - 10 thousand rubles (Article 116 of the Tax Code of the Russian Federation);

- Conducting activities as a separate division without registration - a fine of 10 percent of the income received as a result of such activities, but not less than 40 thousand rubles (Article 116 of the Tax Code of the Russian Federation);

- violation of the deadline for registration with the Social Insurance Fund - 5 thousand rubles or 10 thousand rubles if the violation lasts more than 90 calendar days (Article 19 No. 125-FZ of July 24, 1998).

Action plan for creating a separate unit

- Determine that the organization is creating a separate division that is not a branch or representative office (since they have a different registration procedure).

- Make sure that the created workplace is stationary, that is, created for a period of more than a month, the employee is present at it constantly, and this is related to the performance of his official duties. If the employee is remote, there is no need to create a separate unit.

- Within a month after creating a permanent workplace, inform the tax office where the LLC is registered about the creation of a separate division using form No. S-09-3-1.

- Register with the social insurance fund within 30 days.

- If necessary, report a change in the address or name of a separate division to the Federal Tax Service at the place of registration of the division within three days using Form No. S-09-3-1.

How to find out

Before you understand the decoding of the assigned checkpoints in order to obtain information about the EP, you need to understand how you can find out including by TIN

Information about such structural divisions as branches and representative offices is displayed in the Unified State Register of Legal Entities (other types of EP do not appear in it). Tax officers transmit all checkpoint numbers of existing separate divisions to the inspectorate at the head office address.

Many people believe that to obtain information about the checkpoint of a separate unit, it is enough to go to the official website of the Federal Tax Service of Russia and request an extract from the Unified State Register of Legal Entities. The exact link is www.egrul.nalog.ru.

However, this won't help. The fact is that by order of the Ministry of Finance dated December 5, 2013 No. 115n, the exact composition of the information in the extract from the Unified State Register of Legal Entities was approved. And the checkpoint of the separate unit is not mentioned in it. Therefore, such an extract will not help to recognize the checkpoint of a separate unit by TIN .

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

Therefore, there are two options left:

- send a request to the tax office (or to the counterparty you are interested in);

- use various databases (but no one is responsible for their reliability).